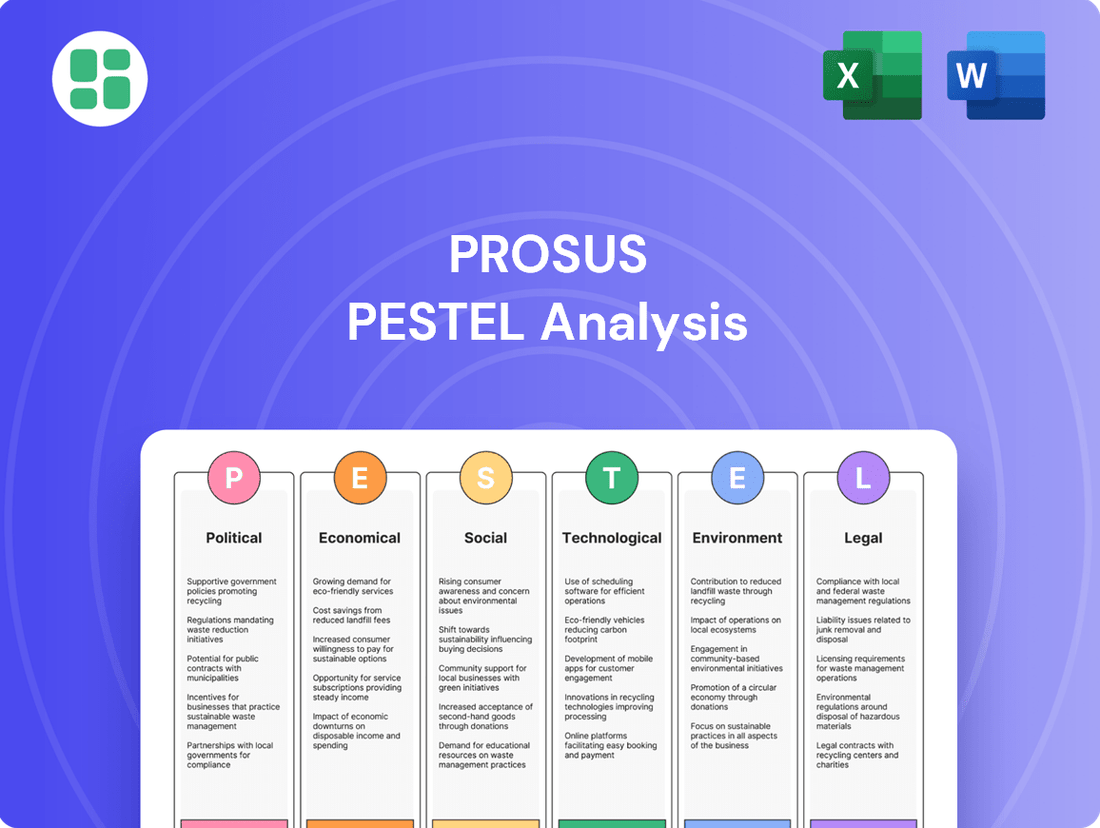

Prosus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prosus Bundle

Unlock the strategic advantages Prosus holds by understanding the intricate web of political, economic, social, technological, legal, and environmental factors impacting its operations. Our PESTLE analysis provides a critical overview of these external forces, equipping you with the foresight to anticipate market shifts and capitalize on emerging opportunities. Don't just react to change—lead it. Download the full PESTLE analysis now for actionable intelligence that will refine your strategic planning and sharpen your competitive edge.

Political factors

Prosus's extensive operations in high-growth emerging markets mean it's particularly sensitive to political stability and shifts in government policies. For instance, in 2024, several key markets for Prosus, such as India and Brazil, have seen elections or are anticipating significant policy reviews, which could alter the operating landscape.

A stable political climate is vital for Prosus, as it underpins investor confidence and ensures predictable regulatory environments, essential for the long-term capital deployment characteristic of its investments in sectors like e-commerce and fintech. Countries with consistent governance tend to offer more reliable frameworks for business operations and growth.

Conversely, political volatility or sudden policy changes, such as unexpected regulatory crackdowns or changes in foreign investment rules, can pose substantial risks. These disruptions can affect Prosus's ability to access markets, maintain operational continuity, and ultimately impact the valuation of its diverse portfolio companies, as seen with past regulatory shifts in the tech sector globally.

Global trade relations and the increasing trend of protectionism present significant challenges for Prosus. For instance, the US-China trade tensions, which saw tariffs imposed on billions of dollars worth of goods, could impact Prosus's investments and operations in both regions, particularly affecting its e-commerce ventures like Tencent.

Trade barriers and restrictions on foreign investment directly influence Prosus's ability to expand its diverse portfolio, which spans e-commerce, fintech, and food delivery services across various continents. Navigating these complexities is crucial for maintaining cost-efficiency and market access.

The World Trade Organization (WTO) reported a notable increase in trade-restrictive measures by its members in 2023, a trend that continued into early 2024, potentially increasing operational costs for Prosus's international subsidiaries and impacting its profitability.

Governments globally are tightening their grip on the digital realm, emphasizing digital sovereignty. This translates into more stringent rules concerning where data must be stored (data localization), what content is permissible (content censorship), and how online platforms are managed. For Prosus, which holds substantial investments in online marketplaces and social media, navigating these diverse national digital policies is a critical challenge.

Recent regulatory actions, like China's intensified oversight of its tech sector or the European Union's Digital Markets Act (DMA) which came into effect in phases starting in 2023, directly impact companies like Prosus. The DMA, for instance, aims to ensure fairer competition in digital markets and could alter how Prosus's portfolio companies operate and access markets within the EU, potentially affecting revenue streams and business models.

Antitrust and Competition Policy

Antitrust and competition policy presents a significant political headwind for Prosus. Increased global regulatory attention on large technology firms, including scrutiny of mergers and market dominance, directly impacts Prosus's investment and expansion strategies. For example, the European Union's Digital Markets Act (DMA), enacted in 2024, specifically targets "gatekeeper" platforms, aiming to foster fairer competition. This legislation could influence the operational landscape for Prosus's significant online marketplace holdings, such as its stake in Delivery Hero or its e-commerce ventures in emerging markets.

The ongoing investigations and potential enforcement actions by bodies like the U.S. Federal Trade Commission (FTC) and the European Commission underscore this risk. These regulatory bodies are actively examining market concentration and alleged anti-competitive behaviors within the digital economy. Prosus, with its diverse portfolio of internet and technology investments, is inherently exposed to these evolving policy shifts. The potential for fines, divestitures, or restrictions on business practices could materially affect future profitability and strategic flexibility.

Prosus's exposure is particularly pronounced in sectors where market consolidation is high and digital platforms play a dominant role. The company's significant investments in areas like food delivery, e-commerce, and fintech are all subject to this intensified regulatory oversight. For instance, a hypothetical antitrust challenge to a major acquisition by one of Prosus's portfolio companies could lead to significant delays, costly legal battles, or even the blocking of the deal altogether, impacting its growth trajectory.

Geopolitical Tensions and International Relations

Geopolitical tensions, such as the ongoing conflicts and trade disputes observed globally through 2024 and projected into 2025, directly impact Prosus's international operations. These tensions can cause significant disruptions to global supply chains, affecting the delivery and cost of goods and services Prosus relies on. For instance, increased trade barriers or sanctions imposed between major economic blocs could limit market access or increase operational costs for Prosus's e-commerce and fintech ventures.

Prosus's diversified portfolio, spanning emerging markets and established economies, necessitates constant vigilance regarding evolving geopolitical landscapes. As of early 2025, the global political climate remains volatile, with several regions experiencing heightened instability. This instability can negatively influence investor sentiment towards emerging markets, where Prosus has substantial investments, potentially impacting valuations and future growth prospects. The company must therefore remain agile, ready to adapt its strategies to mitigate risks arising from these international relations shifts.

- Supply Chain Vulnerability: Geopolitical flashpoints in 2024-2025 have highlighted the fragility of global supply chains, impacting technology hardware and logistics, critical for Prosus's e-commerce segments.

- Market Sentiment Volatility: International disputes, like those involving major tech-producing nations, can create unpredictable swings in market sentiment, affecting Prosus's publicly traded assets.

- Sanctions and Restrictions: The threat or imposition of sanctions can directly hinder cross-border transactions and investments, a key component of Prosus's growth strategy in diverse markets.

- Emerging Market Exposure: Prosus's significant presence in high-growth, yet sometimes politically sensitive, emerging markets means it is particularly susceptible to the fallout from regional geopolitical instability.

Prosus operates in a dynamic political landscape, with elections and policy shifts in key markets like India and Brazil during 2024 potentially altering its operating environment. Political stability is crucial for investor confidence and predictable regulatory frameworks, essential for Prosus's long-term capital deployment in sectors such as e-commerce and fintech.

Global trade relations and rising protectionism pose risks, with US-China trade tensions impacting Prosus's investments and operations. The World Trade Organization noted an increase in trade-restrictive measures in 2023-2024, potentially increasing operational costs for Prosus's subsidiaries.

Governments are increasing digital sovereignty, leading to stricter data localization and content rules. Regulations like the EU's Digital Markets Act (DMA), effective from 2024, directly impact Prosus's portfolio companies by aiming for fairer competition in digital markets.

Antitrust scrutiny is a significant headwind, with bodies like the European Commission examining market concentration. Prosus's diverse internet and technology investments expose it to evolving policy shifts, with potential fines or restrictions affecting profitability.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Prosus, offering a comprehensive view of its operating landscape.

Provides a clear, actionable framework that helps Prosus proactively identify and mitigate external threats, thereby relieving the pain of unexpected market disruptions and informing strategic decision-making.

Economic factors

Rising inflation and fluctuating interest rates present a dual challenge for Prosus. As of early 2025, persistent inflation continues to pressure consumer spending, potentially dampening demand for Prosus's diverse online services. This economic backdrop is further complicated by central banks maintaining higher interest rates than initially anticipated for 2024, a trend expected to carry into the new year.

The elevated interest rate environment directly impacts Prosus's cost of capital, making new investments and acquisitions more expensive. For its portfolio companies, higher borrowing costs can strain profitability and hinder expansion plans. This is particularly relevant as tech investors navigate a landscape where rate cut delays, influenced by ongoing inflation concerns, have become a significant factor in investment decisions throughout 2024 and into 2025.

Prosus's investment strategy hinges on robust economic expansion in its core markets. For instance, India, a significant market for Prosus through its stake in Swiggy and Byju's, projected a GDP growth rate of 6.5% for the fiscal year 2024-25. This growth fuels consumer spending, directly benefiting Prosus's e-commerce and food delivery ventures.

Similarly, Brazil, where Prosus holds investments in iFood, is expected to see its GDP grow by approximately 2.0% in 2024. While lower than India's, this growth still signifies a positive economic environment conducive to increased digital service adoption. A sustained economic upturn in these regions directly correlates with higher user engagement and revenue for Prosus's portfolio companies.

Operating globally, Prosus faces substantial currency exchange rate volatility. This can significantly sway its reported earnings, profits, and the value of its assets. For instance, a weakening of currencies in key markets like Brazil or India against the Euro, Prosus's reporting currency, directly reduces the Euro-denominated value of its income and investments.

In 2024, emerging markets, which are significant for Prosus, experienced varied currency movements. The Brazilian Real saw some depreciation against the Euro, impacting the reported performance of Prosus's holdings like iFood. Similarly, while the Indian Rupee remained relatively stable for much of 2024, any future depreciation could affect the reported value of its stake in Swiggy.

Effective management of this currency risk is therefore paramount. Prosus likely employs hedging strategies and makes strategic investment decisions to mitigate the adverse effects of currency fluctuations on its financial statements and overall business performance.

Consumer Spending Power and Disposable Income

Consumer spending power is a critical driver for Prosus's diverse portfolio. In 2024, global disposable income trends will shape demand for online services. For instance, in markets where Prosus operates, such as India, e-commerce growth is closely tied to rising middle-class incomes.

Economic downturns directly impact discretionary spending. If unemployment rises, consumers are less likely to spend on services like food delivery or online entertainment, which are core to Prosus's business. For example, a slowdown in the European economy in late 2023 and early 2024 could temper growth in its food delivery segment.

Prosus aims to mitigate these economic sensitivities by focusing on value creation. This strategy is evident in its e-commerce platforms, which often offer competitive pricing and promotions to attract and retain customers even during periods of economic uncertainty.

- Disposable Income Trends: Global disposable income is projected to see moderate growth in 2024, but regional disparities persist, influencing Prosus's market penetration strategies.

- Impact of Inflation: Rising inflation rates in key markets can erode consumer purchasing power, potentially leading to reduced spending on non-essential online services.

- Unemployment Rates: Higher unemployment figures in regions like parts of Eastern Europe could directly curb consumer demand for Prosus's food delivery and e-commerce offerings.

- Value Proposition: Prosus's emphasis on offering value through its platforms is a key strategy to maintain consumer engagement amid fluctuating economic conditions.

Venture Capital and Investment Climate

The venture capital and investment climate significantly influences Prosus's ability to fund its ventures. A challenging funding environment, marked by higher interest rates and cautious investor sentiment, can impede follow-on funding for portfolio companies and depress valuations. For instance, in early 2024, global venture capital funding saw a notable slowdown compared to previous years, with deal volumes and values contracting, impacting the growth trajectory of many tech startups.

Prosus, as a significant investor in growth-stage technology companies, is directly affected by these trends. The ability to raise capital for new initiatives or to support existing investments hinges on the overall health of the investment market. As we look towards 2025, the tech investment landscape is expected to pivot towards sustainable value creation, demanding clearer paths to profitability and robust unit economics from startups.

- Global VC funding in Q1 2024 reached approximately $70 billion, a decrease from the $100 billion recorded in Q1 2023.

- The cost of capital is rising, with benchmark interest rates in major economies remaining elevated.

- Investor focus is shifting from hyper-growth to profitability and sustainable business models.

- The valuation multiples for tech companies have compressed compared to the peaks seen in 2021.

Economic factors present a mixed outlook for Prosus. Persistent inflation and elevated interest rates, expected to continue into 2025, challenge consumer spending and increase capital costs for investments and acquisitions. However, growth in key markets like India, with a projected GDP growth of 6.5% for FY2024-25, and Brazil, with an estimated 2.0% GDP growth for 2024, offer opportunities for Prosus's digital service businesses.

Currency fluctuations, particularly the depreciation of currencies in emerging markets against the Euro, impact Prosus's reported earnings. For example, the Brazilian Real's performance in 2024 directly affected iFood's reported value. Prosus must strategically manage these currency risks through hedging and investment decisions to maintain financial stability.

Consumer spending power, driven by disposable income trends, remains a critical factor. While global disposable income is expected to grow moderately in 2024, regional variations and potential economic downturns, leading to higher unemployment, could reduce demand for non-essential online services. Prosus counters this by emphasizing value and competitive pricing on its platforms.

The investment climate, marked by a slowdown in venture capital funding in early 2024, with Q1 funding at approximately $70 billion, affects Prosus's ability to fund ventures. Investors are increasingly prioritizing profitability and sustainable models, leading to compressed valuation multiples for tech companies compared to 2021 peaks.

| Economic Factor | Impact on Prosus | Data/Trend (2024-2025) |

| Inflation | Reduces consumer spending power | Persistent inflation in key markets |

| Interest Rates | Increases cost of capital | Elevated rates expected into 2025 |

| GDP Growth (India) | Drives demand for digital services | Projected 6.5% for FY2024-25 |

| GDP Growth (Brazil) | Supports digital service adoption | Estimated 2.0% for 2024 |

| Currency Volatility | Affects reported earnings | Brazilian Real depreciation noted in 2024 |

| VC Funding | Impacts investment capacity | Q1 2024 funding ~ $70 billion |

Same Document Delivered

Prosus PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Prosus PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview essential for informed decision-making.

Sociological factors

The surge in digital adoption and internet penetration, particularly in emerging economies, directly fuels Prosus's growth. As of early 2024, global internet penetration reached approximately 66%, with significant growth observed in regions where Prosus actively invests, like Asia and Africa. This expanding digital footprint means a larger customer base for Prosus's diverse portfolio, encompassing everything from e-commerce to online education.

This increasing connectivity, driven by more affordable smartphones and data plans, expands the addressable market for Prosus's core businesses. For instance, mobile internet penetration in India, a key market for Prosus's investments like Swiggy and Byju's, has been steadily climbing, exceeding 70% by late 2023. This trend is crucial for scaling online marketplaces and delivery services, directly impacting revenue potential.

Prosus's growth is significantly influenced by evolving consumer behaviors, particularly the strong preference for online shopping, on-demand services, and digital payments. These shifts directly fuel the demand for Prosus's diverse platforms, from e-commerce to food delivery.

The increasing emphasis on convenience, personalization, and digital-first interactions is a key driver. For instance, the global e-commerce market was projected to reach over $6.3 trillion in 2024, a testament to these changing lifestyle trends that Prosus is well-positioned to capitalize on.

Businesses like Prosus must adapt to these lifestyle trends, including the notable rise of social commerce, where consumers discover and purchase products directly through social media. This integration of social interaction with shopping presents a substantial opportunity for engagement and sales.

Prosus benefits from rapid urbanization in emerging markets, as denser populations often translate to higher demand for its e-commerce and food delivery services. For instance, by the end of 2024, it's projected that over 60% of the world's population will reside in urban areas, a trend that directly supports the growth of platforms like Delivery Hero and iFood, which Prosus has significant investments in.

Demographic shifts, particularly the expansion of a young, digitally native consumer base, are crucial for Prosus. By 2025, the global youth population (ages 15-24) is expected to exceed 1.2 billion, representing a massive potential user pool for Prosus's diverse digital ecosystem, including online learning platforms like Udemy and gaming ventures.

Recognizing these evolving demographics allows Prosus to refine its investment thesis and product development. By focusing on markets with a high proportion of young, urban dwellers, Prosus can more effectively tailor its digital offerings, ensuring continued engagement and growth for its portfolio companies in the coming years.

Education and Digital Literacy

The evolving landscape of education and digital literacy directly impacts the success of edtech and fintech ventures. As more individuals gain access to and proficiency with digital tools, the adoption of online learning and digital financial services naturally increases. This trend is crucial for Prosus, whose portfolio heavily relies on these growing digital ecosystems.

Societal improvements in digital literacy are a strong indicator of future market potential for Prosus's investments. For instance, in 2024, global internet penetration reached approximately 66%, with significant growth in emerging markets where Prosus has a strong presence. This increasing digital savviness translates to a greater openness to digital solutions.

- Growing Digital Proficiency: Increased internet access and smartphone adoption, projected to exceed 70% globally by 2025, fuel digital literacy.

- Edtech Adoption: The global edtech market was valued at over $120 billion in 2023 and is expected to continue its upward trajectory, driven by demand for accessible learning.

- Fintech Engagement: Digital financial services are becoming mainstream, with mobile money transactions alone reaching trillions of dollars annually, demonstrating a societal shift.

- Investment Alignment: Prosus's focus on sectors like online education (e.g., Udemy) and digital payments (e.g., PayU) directly benefits from these positive societal trends.

Social Influence and Community Building

Social networks and online communities are profoundly shaping consumer choices, with platforms like those operated by Prosus, such as OLX and Avito, seeing significant user engagement. In 2024, the influence of user-generated content and peer recommendations on these platforms is a critical driver for both new user acquisition and keeping existing users active. Prosus's strategy to foster strong, localized communities around its services, like the recent focus on community events and user forums for its e-commerce and classifieds businesses, directly taps into consumers' growing demand for authentic brand interactions and a sense of belonging.

Building these vibrant communities is key to Prosus's long-term success. For instance, Bykea, a ride-hailing and delivery service in Pakistan where Prosus holds a stake, has actively cultivated local user groups, contributing to its substantial growth. This approach not only enhances user loyalty but also provides valuable insights into local market needs, a crucial advantage in the diverse global markets Prosus operates in.

The emphasis on authenticity resonates deeply with today's consumers. Prosus's platforms can amplify this by facilitating genuine connections between buyers and sellers, and by empowering users to share their experiences. This organic growth, driven by community trust and positive social influence, is a powerful engine for sustained engagement and market penetration, particularly in emerging economies where digital communities often serve as primary information hubs.

Societal shifts towards digital communities and peer influence are paramount for Prosus. Platforms like OLX and Avito thrive on user-generated content, with strong community engagement driving acquisition and retention. Prosus's strategy to foster localized communities, evident in its support for user forums and events, directly capitalizes on the desire for authentic brand interactions.

The growing emphasis on authenticity and trust within online interactions is a significant societal trend benefiting Prosus. By facilitating genuine connections and empowering user experiences, Prosus cultivates organic growth. This community-driven trust is especially vital in emerging markets, where digital communities often act as primary information sources.

Prosus's investments, such as in ride-hailing and delivery services like Bykea in Pakistan, demonstrate the success of cultivating local user groups. This approach not only builds user loyalty but also provides critical local market insights, a key differentiator for Prosus across its diverse global operations.

The increasing reliance on social networks for purchasing decisions, amplified by user reviews and recommendations, directly impacts Prosus's e-commerce and classifieds businesses. By 2025, it's estimated that over 50% of online purchases will be influenced by social media, highlighting the critical role of community building for Prosus.

Technological factors

Artificial Intelligence and Machine Learning are fundamentally reshaping Prosus's operations. For instance, in their food delivery segment, AI algorithms are optimizing delivery routes, leading to faster service and reduced operational costs. In 2024, Prosus's portfolio companies reported substantial efficiency gains attributed to AI implementation, with some seeing a 15% improvement in delivery times.

Furthermore, AI is crucial for personalizing user experiences across Prosus's diverse platforms, from e-commerce to edtech. This personalization drives customer engagement and retention. The fintech arm leverages machine learning for advanced fraud detection, significantly reducing financial losses. Prosus's investment in AI technologies is projected to unlock new revenue streams and enhance competitive advantage through 2025.

As a global internet group handling extensive user data and financial transactions, Prosus places immense importance on cybersecurity and data protection. The escalating sophistication of cyber threats and the potential for data breaches present substantial risks to both customer trust and ongoing business operations.

In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the immense financial incentive for malicious actors. Prosus's commitment to investing in advanced security measures, such as AI-powered threat detection and robust encryption protocols, is therefore crucial for safeguarding its diverse portfolio of businesses, including Tencent, Delivery Hero, and OLX, from these pervasive risks.

The relentless expansion of mobile technology and the increasing availability of high-speed internet, particularly with the rollout of 5G, are crucial for Prosus. These advancements directly support its mobile-first approach, making it easier for users in emerging markets to access its diverse online platforms. This improved connectivity fuels user engagement and boosts transaction numbers across Prosus's portfolio, from e-commerce to fintech.

Platform Innovation and Ecosystem Development

Prosus is heavily invested in platform innovation, constantly refining its user interfaces and backend systems to stay ahead. This commitment is crucial for retaining users in competitive digital markets. For instance, their investment in expanding food delivery platforms into grocery and convenience services demonstrates a strategic move to deepen customer engagement and create a more comprehensive ecosystem.

The development of integrated ecosystems around its key businesses is a core technological strategy for Prosus. By broadening fintech platforms and linking them with e-commerce offerings, Prosus aims to unlock new revenue streams and enhance customer loyalty. This approach is exemplified by their focus on creating synergistic value across their portfolio companies, fostering a network effect that benefits both consumers and merchants.

- Platform Innovation: Prosus prioritizes continuous updates to its digital platforms, enhancing user experience and operational efficiency.

- Ecosystem Development: The company actively builds interconnected services, such as integrating grocery delivery with existing food delivery platforms.

- Fintech Expansion: Prosus is broadening its fintech capabilities, aiming to create a seamless financial experience within its broader digital ecosystems.

- Strategic Integration: By linking various services, Prosus seeks to increase customer stickiness and unlock cross-selling opportunities.

Emerging Technologies (e.g., Blockchain, AR/VR)

Emerging technologies like blockchain and augmented/virtual reality (AR/VR) offer significant future opportunities for Prosus. Blockchain can enhance security and efficiency in fintech, a sector where Prosus has substantial investments. For instance, the global blockchain in fintech market was projected to reach USD 1.77 billion in 2024, with expectations to grow substantially in the coming years.

AR/VR technologies can revolutionize online experiences, benefiting Prosus's edtech and e-commerce ventures. Imagine immersive learning environments or virtual shopping malls; these innovations could create new engagement models and revenue streams. The global AR/VR market is anticipated to expand rapidly, with some forecasts suggesting it could reach hundreds of billions of dollars by the early 2030s, highlighting the potential for early adopters.

Prosus's strategic approach to monitoring and integrating these nascent technologies is crucial for maintaining a competitive edge. Early adoption and thoughtful implementation can unlock new markets and differentiate its portfolio companies.

- Blockchain in Fintech: Expected to drive secure and efficient transactions, a key area for Prosus's investment in financial services.

- AR/VR in Edtech and E-commerce: Promises immersive user experiences, potentially transforming how Prosus's education and online marketplace businesses operate.

- Market Growth Potential: Both blockchain and AR/VR markets are poised for significant expansion, offering substantial future revenue opportunities.

- Competitive Advantage: Strategic integration of these technologies can provide Prosus with a distinct edge in its diverse operational sectors.

Prosus is heavily leveraging Artificial Intelligence and Machine Learning to enhance its operations, particularly in optimizing delivery routes for its food delivery segment, leading to improved efficiency and reduced costs. In 2024, portfolio companies reported significant gains from AI, with some experiencing up to a 15% reduction in delivery times.

AI is also pivotal in personalizing user experiences across Prosus's platforms, boosting engagement and retention, while machine learning in its fintech arm strengthens fraud detection. The company's continued investment in AI is expected to create new revenue streams and solidify its competitive standing through 2025.

The rapid expansion of mobile technology and high-speed internet, including the ongoing 5G rollout, directly supports Prosus's mobile-first strategy, facilitating access to its diverse online services, especially in emerging markets. This enhanced connectivity fuels user engagement and transaction growth across its e-commerce, edtech, and fintech ventures.

Prosus is actively developing integrated ecosystems by linking services like fintech with e-commerce to foster customer loyalty and unlock new revenue opportunities. This strategy aims to create synergistic value across its portfolio, building a network effect that benefits both users and businesses.

Legal factors

Prosus operates in a landscape shaped by increasingly stringent data privacy and protection regulations. Laws like the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018 and has seen ongoing enforcement actions, alongside similar frameworks like California's CCPA/CPRA, mandate careful handling of user data. For instance, in 2023, Meta (a company with significant overlap in digital advertising and platform operations) faced substantial fines under GDPR, highlighting the financial risks of non-compliance. Prosus must navigate these complex rules to ensure lawful data collection, storage, and processing across its diverse portfolio, from e-commerce to food delivery services.

Prosus faces growing antitrust scrutiny globally. In 2024, the European Commission continued its focus on digital markets, investigating several large platforms where Prosus holds significant investments, potentially impacting future M&A and strategic partnerships.

Navigating these regulations is crucial as Prosus aims to maintain its strong positions in e-commerce and fintech. For instance, competition authorities in various regions are examining the market power of dominant players, which could lead to stricter oversight of Prosus's operational strategies and investment opportunities.

Consumer protection laws are a significant legal factor for Prosus, particularly impacting its e-commerce and food delivery segments. These regulations, which govern fair trading, product safety, and advertising, are crucial for building and maintaining consumer trust across its global operations. Failure to comply can lead to substantial fines and reputational damage, directly affecting Prosus's ability to operate smoothly.

The evolving legislative landscape, such as the UK's Digital Markets, Competition and Consumers Act 2024, highlights the increasing focus on consumer rights in the digital sphere. This act aims to provide greater protection against unfair practices and misleading information, requiring companies like Prosus to adapt their business models and ensure transparency in their dealings with consumers.

Intellectual Property Rights (IPR)

Prosus places significant emphasis on safeguarding its intellectual property, encompassing software, brand identities, and the vast array of content hosted across its diverse platforms. This protection is fundamental to maintaining its competitive edge and revenue streams, especially in digital-first markets.

The legal framework surrounding intellectual property is constantly shifting, particularly with the rise of AI-generated content and the increasing value of digital assets. Prosus must remain acutely aware of these changes to adapt its protection strategies effectively.

Navigating global regulations and actively defending against intellectual property infringement are persistent challenges for a company with Prosus's international reach. For instance, in 2024, the digital content market continued to see a rise in piracy cases, requiring proactive legal measures.

- Software Protection: Ensuring robust copyright and patent protection for its proprietary software is crucial for Prosus's technology-driven businesses.

- Brand Enforcement: Protecting its well-known brand names and trademarks across various jurisdictions is vital for consumer trust and market recognition.

- Content Licensing: Managing content rights and licensing agreements across its platforms, including gaming and e-commerce, involves complex legal frameworks.

- Emerging Digital Assets: Adapting legal strategies to cover new forms of digital assets and intellectual property generated through evolving technologies is a key focus.

Labor Laws and Gig Economy Regulations

Evolving labor laws and regulations surrounding the gig economy present a significant challenge for Prosus's food delivery operations. Changes in how platform workers are classified, for instance, could directly affect employment costs. As of early 2024, many jurisdictions are still debating or implementing new rules, with some proposals suggesting benefits akin to traditional employment for gig workers, which could increase Prosus's operational expenses by a considerable margin.

Minimum wage adjustments and requirements for social benefits for independent contractors are also critical factors. For example, if minimum wage laws are applied to delivery drivers, it could substantially alter the cost structure of services like Delivery Hero. Prosus needs to remain agile, adapting its business models to comply with these shifting legal landscapes to ensure continued operational viability.

- Worker Classification: Ongoing legal battles and legislative changes in key markets (e.g., California's AB5, EU directives) are redefining the employment status of gig workers, impacting Prosus's cost base.

- Minimum Wage Impact: Potential increases in minimum wage requirements for delivery personnel could add millions to Prosus's annual operating costs across its portfolio companies.

- Social Benefit Mandates: Regulations requiring contributions to social security, health insurance, or retirement funds for gig workers will directly increase overhead for Prosus's delivery platforms.

Prosus must navigate evolving data privacy laws, such as the GDPR, which has seen significant enforcement actions in 2023 and 2024, impacting how it handles user information across its diverse digital platforms. Antitrust scrutiny from bodies like the European Commission in 2024 continues to shape the competitive landscape, potentially influencing Prosus's investment and partnership strategies in key digital markets. Furthermore, consumer protection regulations, exemplified by the UK's 2024 Digital Markets, Competition and Consumers Act, necessitate transparency and fair practices in its e-commerce and food delivery segments.

Intellectual property protection remains paramount, with Prosus actively defending its software, brands, and digital content against infringement, a challenge amplified by the rise of AI-generated content and piracy in 2024. The company also faces significant legal hurdles related to labor laws and the gig economy, particularly concerning worker classification and minimum wage requirements for delivery personnel, which could substantially increase operational costs as regulations solidify in 2024 and 2025.

| Legal Factor | Impact on Prosus | Example/Data Point (2023-2025) |

|---|---|---|

| Data Privacy & Protection | Compliance costs, potential fines, customer trust | Meta fined €1.2 billion under GDPR in 2023; ongoing regulatory reviews of data handling practices. |

| Antitrust & Competition | Restrictions on M&A, operational adjustments, market access | EU Commission investigations into digital platforms with significant market power, impacting potential acquisitions. |

| Consumer Protection | Reputational risk, need for transparent practices, advertising compliance | UK's Digital Markets, Competition and Consumers Act 2024 emphasizes consumer rights in digital transactions. |

| Intellectual Property | Maintaining competitive advantage, revenue protection, litigation risk | Increased digital content piracy cases in 2024 require proactive legal defense strategies. |

| Gig Economy Labor Laws | Increased operational costs, potential shifts in business models | Ongoing debates and implementation of worker classification laws in various jurisdictions could add millions to annual operating costs. |

Environmental factors

Prosus, as a significant technology investor, faces indirect impacts from evolving e-waste regulations. These rules are increasingly holding manufacturers responsible for the full lifecycle of electronic goods, pushing for more sustainable design and disposal practices across the industry.

Stricter recycling mandates and the growing emphasis on circular economy principles are compelling companies to prioritize product repairability and recyclability. This trend shapes the technological landscape where Prosus's diverse portfolio companies operate, influencing product development and supply chain strategies.

For instance, the European Union's Extended Producer Responsibility (EPR) schemes, like those implemented in 2024 for electronic waste, place financial and operational burdens on producers. This can affect the cost of goods and the investment required for compliance by companies within Prosus's investment sphere.

The intensifying global drive to shrink carbon footprints and meet stricter emissions standards directly impacts Prosus's diverse portfolio. This is particularly relevant for its food delivery operations, where transportation is a core component, necessitating a shift towards more eco-friendly logistics. For instance, in 2024, many European cities are implementing low-emission zones, potentially increasing operational costs for delivery fleets if they don't transition to electric vehicles.

Prosus faces increasing pressure to ensure sustainability across its extensive supply chains, particularly for its e-commerce and food delivery operations. This is driven by both consumer expectations and evolving regulations. For instance, in 2024, the European Union's proposed directive on corporate sustainability due diligence will require companies like Prosus to identify, prevent, and mitigate adverse environmental and human rights impacts in their supply chains, potentially impacting sourcing, packaging, and logistics.

The focus extends to minimizing environmental harm and promoting ethical practices. This includes scrutinizing the origins of products sold on its platforms and the materials used in packaging for its food delivery services. For example, a growing trend in 2024 is the demand for reduced plastic packaging, pushing companies to explore biodegradable or reusable alternatives, a challenge Prosus must navigate across its diverse markets.

Transparency in the supply chain is also a critical environmental factor. Consumers are increasingly demanding to know where and how products are made. Prosus's ability to provide clear and verifiable information about its supply chain practices, from raw material sourcing to last-mile delivery, will be a key differentiator and a significant aspect of its environmental performance in the coming years.

Climate Change Impact and Adaptation

Climate change presents indirect risks for Prosus, potentially disrupting supply chains and logistics through extreme weather events. For instance, a severe hurricane impacting a key e-commerce fulfillment center in 2024 could delay deliveries and increase operational costs. Prosus's investments in digital platforms are less susceptible to physical climate impacts than traditional brick-and-mortar businesses, but the broader economic and societal effects remain relevant.

Consumer behavior shifts towards sustainability, a trend amplified by climate awareness, could influence the performance of Prosus's portfolio companies. Brands perceived as environmentally irresponsible may see declining demand. Prosus's strategic focus on growth-stage technology companies means it must consider how these businesses are positioning themselves to address evolving consumer expectations and regulatory landscapes related to climate action.

Adapting to and mitigating climate-related risks is becoming a crucial element of long-term business resilience for companies like Prosus. This includes assessing the vulnerability of their digital infrastructure and the operational resilience of their investee companies. By 2025, many companies are expected to have more robust climate risk disclosure frameworks in place, influencing investor sentiment and capital allocation.

- Infrastructure Vulnerability: Extreme weather events, such as floods or heatwaves, can impact the physical infrastructure supporting digital services, potentially leading to service disruptions for Prosus's e-commerce and gaming platforms.

- Supply Chain Disruptions: Climate-related natural disasters can affect global supply chains, impacting the availability and cost of hardware for tech companies within Prosus's portfolio.

- Consumer Preference Shifts: Growing environmental consciousness among consumers may favor brands and services with strong sustainability credentials, potentially impacting the market share of Prosus's investee companies if they lag in this area.

- Regulatory and Policy Changes: Governments worldwide are implementing policies to address climate change, which could create new compliance burdens or opportunities for Prosus's diverse range of businesses.

Corporate Social Responsibility (CSR) and ESG Reporting

Prosus faces increasing pressure from investors and the public to enhance its Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting. This trend is significantly shaping its strategic direction and public image.

Demonstrating genuine commitment to environmental sustainability, going beyond basic regulatory requirements, is crucial for Prosus. This can boost its brand value, attract investors focused on social impact, and strengthen relationships with all stakeholders.

- Investor Focus: In 2024, sustainable investing continued its upward trajectory, with global ESG assets projected to exceed $37 trillion by the end of the year, according to Morningstar data. This highlights the financial imperative for Prosus to align with ESG principles.

- Reputational Impact: A strong ESG performance can mitigate reputational risks. For instance, a 2025 survey by Edelman found that 60% of consumers globally are more likely to buy from brands they trust to do the right thing.

- Strategic Alignment: Prosus's investments in areas like e-commerce and fintech must increasingly incorporate ESG considerations to align with evolving market expectations and regulatory landscapes.

Environmental factors are increasingly shaping Prosus's operational and investment strategies. Stricter e-waste regulations, like the EU's Extended Producer Responsibility schemes implemented in 2024, directly impact companies in Prosus's portfolio, necessitating sustainable product design and disposal. The global push to reduce carbon footprints is also a significant driver, particularly for Prosus's food delivery operations, where transitioning to electric vehicles is becoming essential to navigate low-emission zones in European cities by 2025.

Prosus must also address growing consumer demand for reduced plastic packaging, pushing for biodegradable alternatives in its e-commerce and food delivery services. Climate change poses indirect risks, with extreme weather events potentially disrupting supply chains and impacting infrastructure. For instance, a severe weather event in 2024 could delay deliveries and increase operational costs. By 2025, robust climate risk disclosure frameworks are expected to influence investor sentiment and capital allocation, making ESG performance a critical factor for Prosus.

| Environmental Factor | Impact on Prosus | 2024/2025 Data/Trend |

| E-waste Regulations | Increased compliance costs for portfolio companies, focus on product lifecycle management. | EU EPR schemes for electronics expanded in 2024. |

| Carbon Footprint Reduction | Pressure to adopt eco-friendly logistics, especially for food delivery. | Implementation of low-emission zones in European cities by 2025. |

| Sustainable Packaging | Demand for reduced plastic use, exploration of biodegradable alternatives. | Growing consumer preference for environmentally friendly packaging. |

| Climate Change Risks | Potential supply chain disruptions, infrastructure vulnerability. | Increased frequency of extreme weather events globally. |

| ESG Reporting & Investor Focus | Need for enhanced CSR and ESG reporting, attracting sustainable investors. | Global ESG assets projected to exceed $37 trillion by end of 2024 (Morningstar). |

PESTLE Analysis Data Sources

Our Prosus PESTLE Analysis is meticulously constructed using a diverse range of data sources, including reports from leading financial institutions like the IMF and World Bank, government publications detailing regulatory frameworks, and industry-specific market research from firms such as Statista. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Prosus's global operations.