Prosus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prosus Bundle

Prosus navigates a dynamic digital landscape, facing intense competition from established tech giants and agile startups. Understanding the bargaining power of its suppliers and the constant threat of new entrants is crucial for its sustained growth.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Prosus’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Prosus's reliance on a concentrated group of key technology providers, such as major cloud service platforms like AWS, Azure, or Google Cloud, presents a significant supplier bargaining power. These providers often hold a dominant position in critical infrastructure, enabling them to influence pricing and service terms. For instance, the global cloud computing market, dominated by these three players, saw substantial growth in 2024, with AWS, Azure, and Google Cloud collectively holding over 65% of the market share by the end of Q1 2024.

The global technology sector, a key area for Prosus, faces a significant challenge with the availability of specialized talent. Think about fields like artificial intelligence, fintech, and sophisticated logistics; these demand very specific technical and managerial skills. In 2024, the demand for AI specialists, for instance, continued to outstrip supply. For example, LinkedIn reported a 74% increase in AI-related job postings in the first half of 2024 compared to the same period in 2023, highlighting this scarcity.

This scarcity, especially in rapidly expanding markets where Prosus has a strong presence, directly boosts the bargaining power of employees and recruitment agencies. Consequently, businesses like Prosus can expect increased labor costs and face more complex recruitment processes. The ability to attract and keep the best people is not just a nice-to-have; it's fundamental to Prosus's strategy for fostering innovation and driving growth in its diverse portfolio.

Prosus's reliance on proprietary software and unique data sets from third parties can significantly amplify supplier bargaining power. If these providers offer highly differentiated or exclusive solutions, particularly in specialized areas like advanced analytics or critical payment infrastructure, they can command higher prices or more favorable terms. For instance, a unique API for a core payment processing function, if not easily replicable, gives that supplier considerable leverage.

Content and Media Suppliers for Marketplaces

Prosus's online marketplaces, like OLX or Avito, depend on content from various suppliers such as real estate agents, car dealerships, and recruiters to fill their platforms. If these suppliers are dominant players with strong brand recognition or substantial market influence, they gain leverage. This leverage allows them to negotiate for higher listing fees or more favorable terms, potentially impacting Prosus's revenue and its ability to attract a broad user base. The quality and quantity of listings directly influence the marketplace's value proposition to consumers.

For instance, in 2024, the real estate sector saw continued digital transformation, with many agencies investing in sophisticated online marketing. This trend could empower larger agencies to demand premium placement or reduced commission structures on platforms like OLX Brazil, which reported strong growth in its real estate vertical. Similarly, in the automotive sector, major dealership groups might leverage their sales volume to negotiate better advertising packages, affecting the profitability of platforms like AutoTrader in South Africa.

- Supplier Concentration: The bargaining power of suppliers increases if only a few dominant real estate agencies, auto dealerships, or recruitment firms provide content to Prosus's marketplaces.

- Differentiation of Suppliers: If suppliers offer unique or high-demand inventory, their ability to dictate terms to Prosus is amplified.

- Switching Costs for Prosus: High costs or significant disruption associated with finding and integrating new content suppliers can strengthen the position of existing suppliers.

- Importance of Supplier Content: The extent to which the marketplace's value relies on the specific content provided by these suppliers directly correlates with their bargaining power.

Logistics and Payment Infrastructure for Food Delivery and Fintech

Prosus's food delivery and fintech businesses rely heavily on specialized logistics and payment infrastructure. The availability of numerous high-quality delivery partners and efficient payment gateways is crucial for their operations. For instance, in 2024, the global food delivery market continued to see consolidation, potentially increasing the bargaining power of remaining logistics providers.

The concentration of dominant payment network providers, such as Visa and Mastercard, can also grant suppliers significant leverage. These networks are essential for processing transactions in both food delivery and fintech sectors. Any shifts in their fee structures or service availability directly impact Prosus's cost base and operational flexibility.

- Logistics Dependence: Prosus's portfolio companies, like Delivery Hero and iFood, depend on a vast network of delivery riders and fleet management systems.

- Payment Processing Reliance: Fintech ventures and food delivery platforms require seamless integration with payment processors for transaction completion.

- Supplier Concentration Risk: A limited number of high-quality logistics providers or dominant payment networks can exert considerable influence.

- Regulatory Impact: Evolving regulations in logistics and fintech can alter the bargaining power of suppliers, affecting operational costs and strategies.

Prosus faces supplier bargaining power through its reliance on critical technology infrastructure, such as cloud service providers, where a few dominant players control a significant market share. This concentration allows them to influence pricing and terms, impacting Prosus's operational costs. For example, the global cloud market, dominated by AWS, Azure, and Google Cloud, saw these providers collectively hold over 65% of market share by Q1 2024.

The demand for specialized talent in areas like AI and fintech, crucial for Prosus's ventures, outstrips supply, empowering employees and recruitment agencies. This scarcity, evident in the 74% increase in AI job postings on LinkedIn in H1 2024, leads to higher labor costs for Prosus.

Prosus's dependence on unique third-party software and data, like specialized APIs for payment processing, grants suppliers leverage. If these solutions are not easily replicable, suppliers can command higher prices, directly affecting Prosus's expenses.

Marketplaces within Prosus's portfolio, such as OLX and Avito, are vulnerable to supplier bargaining power from dominant real estate agencies or car dealerships. These entities can leverage their influence to negotiate better terms or higher listing fees, impacting platform revenue and user engagement. For instance, larger real estate agencies in 2024 increasingly sought premium placement on platforms like OLX Brazil.

| Factor | Impact on Prosus | 2024 Data/Trend |

| Supplier Concentration (Cloud Providers) | Increased pricing power for suppliers | AWS, Azure, Google Cloud held >65% market share in Q1 2024 |

| Talent Scarcity (AI/Fintech) | Higher labor costs, recruitment challenges | 74% rise in AI job postings (H1 2024) |

| Proprietary Software/Data | Leverage for suppliers of unique solutions | Ongoing demand for specialized fintech APIs |

| Marketplace Content Providers | Negotiation power for dominant agencies/dealerships | Real estate agencies seeking premium placement on OLX Brazil |

What is included in the product

This analysis unpacks the competitive forces shaping Prosus's operating environment, from buyer and supplier power to the threat of new entrants and substitutes, offering strategic insights into its market position.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

In Prosus's consumer internet businesses like food delivery and online marketplaces, customers can easily switch between platforms. For instance, a user might switch from one food delivery app to another for a better discount or faster delivery. This low barrier to switching means customers have considerable power.

This power translates into pressure on Prosus's portfolio companies to keep prices competitive and user experiences top-notch. In 2024, the average customer acquisition cost across the digital advertising industry, which many of Prosus's businesses tap into, remained a significant factor, highlighting the need for customer retention strategies driven by value.

Prosus's multi-sided platforms present a unique challenge regarding customer bargaining power. While individual end-users, like app downloaders or food delivery recipients, often have minimal switching costs, the businesses integrated into these platforms—such as restaurants on Delivery Hero or merchants on e-commerce sites—can face significant hurdles. These hurdles include established customer relationships, the cost of integrating new systems, and prior marketing investments, potentially giving these business customers more leverage.

The dynamic is further complicated by the need to maintain strong network effects. For instance, in 2023, Prosus's e-commerce segment, particularly through its investment in Mercado Libre, saw robust growth, indicating the value of its integrated ecosystems. Prosus must carefully manage pricing and service offerings to retain both user groups, as the defection of either can weaken the overall platform's appeal and profitability.

Prosus operates significantly in high-growth markets where consumers are often more sensitive to price. This means its food delivery, fintech, and e-commerce platforms frequently face pressure to offer aggressive pricing, discounts, and promotions to attract and retain customers. For instance, in many emerging economies, a small price difference can significantly sway purchasing decisions.

This heightened price sensitivity directly impacts Prosus's profitability. Even with increasing transaction volumes, the need for constant discounting can squeeze profit margins. In 2023, the food delivery sector, a key area for Prosus, saw many companies battling for market share through promotional activities, impacting overall industry profitability.

To counter this, Prosus must continually focus on achieving operational efficiencies and building scale across its diverse portfolio. Achieving scale allows for better cost absorption and potentially stronger negotiation leverage with suppliers, which can help mitigate the impact of customer price sensitivity and maintain profitability in competitive landscapes.

Access to Information and Comparison Tools

The internet's widespread reach grants customers unprecedented access to information and comparison tools. Before committing to a purchase or service, consumers can effortlessly compare pricing, read reviews, and scrutinize features across a multitude of platforms, including those operated by Prosus. This heightened transparency directly translates into increased customer bargaining power, as they can readily identify and demand superior value and service, putting pressure on Prosus's market position.

- Increased Price Sensitivity: With easy access to competitor pricing, customers are more likely to switch to providers offering better deals, forcing companies like Prosus to maintain competitive pricing structures.

- Demand for Enhanced Features: Customers can compare feature sets across different services, leading to a demand for more robust and user-friendly offerings, pushing Prosus to continuously innovate.

- Influence of Online Reviews: User-generated content and online reviews significantly impact purchasing decisions, giving customers collective power to influence demand for Prosus's products and services.

Regulatory and Data Privacy Concerns

Increasing regulatory scrutiny, particularly concerning data privacy, significantly bolsters customer bargaining power. Regulations similar to GDPR, now prevalent in numerous markets, empower consumers by granting them greater control over their personal information.

As awareness of data rights grows, customers are increasingly demanding transparency and control. For instance, by mid-2024, over 150 countries had enacted some form of data protection legislation, reflecting this global trend.

Companies that fail to comply with these regulations or are perceived to misuse data face substantial risks. This can manifest as customer backlash, hefty fines, and severe reputational damage, all of which indirectly amplify customer leverage.

- Regulatory Landscape: Over 150 countries have data protection laws as of mid-2024.

- Customer Awareness: Consumers are increasingly demanding transparency and control over their data.

- Non-Compliance Impact: Fines and reputational damage for data misuse empower customers.

- Data Control: GDPR-like regulations give customers more power over personal information.

Customers wield significant bargaining power within Prosus's diverse digital platforms, largely due to low switching costs and readily available information. This forces companies to compete on price and service quality, impacting profitability. For instance, in 2023, the food delivery sector, a key area for Prosus, saw intense promotional activity impacting industry margins.

The dual nature of Prosus's platforms, serving both end-consumers and businesses, creates a complex power dynamic. While individual users have little leverage, integrated businesses like restaurants or merchants may possess greater bargaining power due to established relationships and integration costs.

Heightened customer price sensitivity, especially in emerging markets where Prosus has a strong presence, further amplifies this power. This necessitates a continuous focus on operational efficiencies and scale to maintain profitability amidst aggressive pricing strategies.

| Factor | Impact on Prosus | Example/Data Point (2023-2024) |

|---|---|---|

| Low Switching Costs (End-Users) | Pressure on pricing and user experience | Users easily switch food delivery apps for discounts. |

| Business Customer Leverage | Potential for negotiation on platform fees | Restaurants on Delivery Hero may have leverage due to customer base. |

| Price Sensitivity (Emerging Markets) | Need for aggressive discounting | Small price differences drive purchasing decisions in many regions. |

| Information Transparency | Demand for better value and service | Online reviews and comparison tools empower consumers. |

What You See Is What You Get

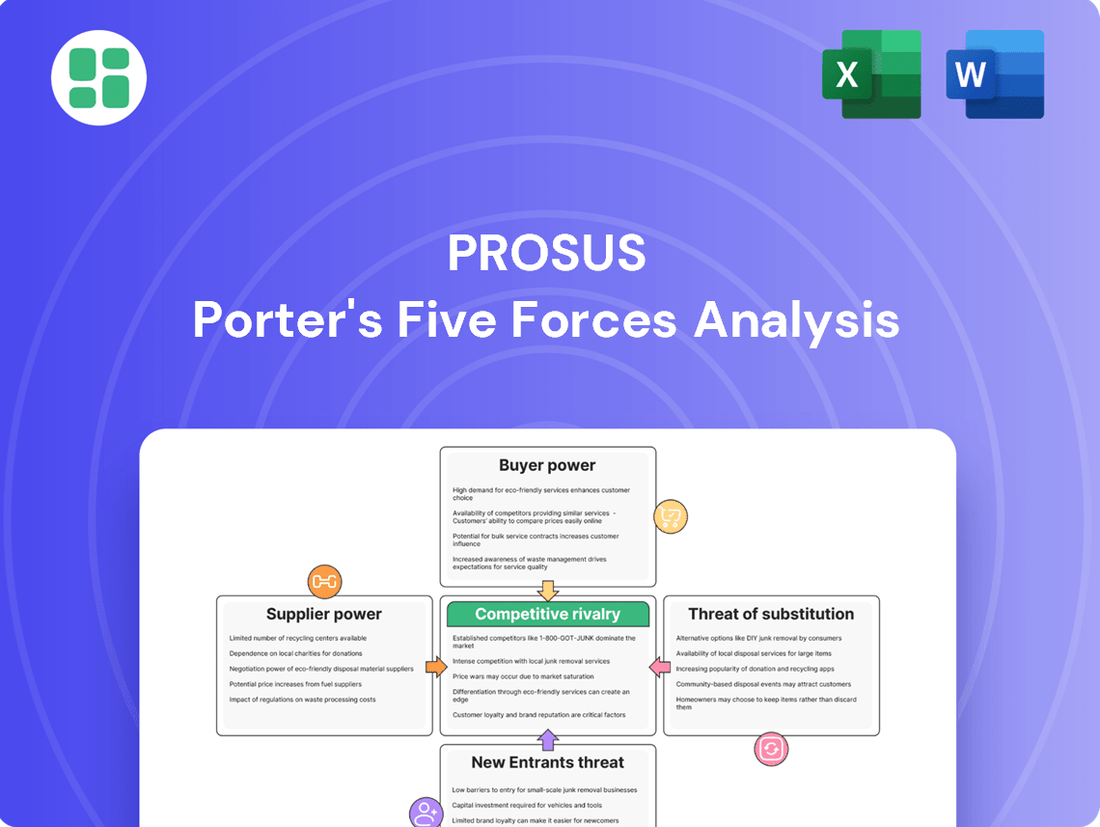

Prosus Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Prosus, offering an in-depth examination of competitive forces within its operating environment. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into industry attractiveness and strategic positioning. You can trust that the detailed analysis of threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry among existing competitors is precisely what you will receive. This is the complete, ready-to-use analysis file, ensuring you gain immediate access to the same professionally formatted and insightful report.

Rivalry Among Competitors

Prosus navigates fiercely competitive landscapes across food delivery, online classifieds, payments, and edtech. In 2024, the global food delivery market alone was projected to reach over $200 billion, highlighting the sheer scale and intensity of rivalry. This necessitates constant innovation and aggressive user acquisition strategies.

Prosus contends with formidable competition from global tech titans like Google, Amazon, and Meta, alongside powerful local players such as Swiggy in India and Meituan in China. These rivals possess substantial financial resources, robust brand loyalty, and extensive customer networks, creating significant hurdles for Prosus's ventures to secure and sustain market leadership.

The drive towards 'super apps' intensifies competition, as firms like Prosus aim to bundle diverse services. This strategy, evident in their Latin American and Indian ventures, creates integrated ecosystems, but also pits them against rivals building similar interconnected platforms.

Companies are increasingly focused on creating comprehensive digital ecosystems, where users can access a wide array of services through a single application. This trend is exemplified by the growth of platforms that offer everything from e-commerce and payments to social networking and food delivery.

Prosus’s investment in businesses like iFood in Brazil and its stake in Swiggy in India highlight this push towards building lifestyle e-commerce ecosystems. These integrated platforms aim to leverage network effects and cross-selling opportunities, making them formidable competitors.

The ability to seamlessly integrate and offer multiple services within a single platform is becoming a key differentiator, leading to a more intense battle for customer loyalty and market share among digital service providers.

Price Wars and Aggressive Marketing

In the fiercely competitive food delivery sector, particularly within mature markets, price wars and aggressive marketing are standard strategies to capture and hold onto customers. This often translates to significant pressure on profit margins, especially for businesses operating on high volumes with inherently lower margins. Prosus's portfolio companies, such as Delivery Hero and iFood, must navigate this challenging landscape by meticulously balancing the pursuit of user growth with the imperative of achieving sustainable profitability.

The intensity of this rivalry is evident in the substantial marketing spend by major players. For instance, in 2023, the food delivery market saw continued heavy investment in promotions and discounts aimed at customer acquisition and retention. Companies like Delivery Hero reported significant marketing expenses as a percentage of gross merchandise value (GMV) to maintain market share against rivals who are equally aggressive in their promotional efforts.

- Intense Competition: The food delivery market is characterized by a crowded field of competitors vying for market share.

- Margin Pressure: Aggressive pricing and promotional campaigns directly impact the profitability of food delivery platforms.

- Strategic Balancing Act: Prosus's companies need to carefully manage growth objectives against the need for financial sustainability.

- Marketing Investment: Significant resources are allocated to marketing and user acquisition, a trend observed throughout 2023 and expected to continue.

Rapid Pace of Technological Innovation

The internet sector is a hotbed of rapid technological change, with advancements in areas like artificial intelligence significantly impacting the competitive landscape. Prosus, through its strategic investments, is actively engaging with these innovations, recognizing that staying ahead requires constant adaptation.

Companies that fail to keep pace with emerging technologies risk becoming obsolete, a critical factor that intensifies rivalry for Prosus's portfolio companies. For instance, the global AI market was valued at approximately $196.6 billion in 2023 and is projected to reach $1,815.7 billion by 2030, demonstrating the speed and scale of innovation. This necessitates continuous investment in R&D and agile business models.

- Constant Innovation is Key: The rapid evolution of technologies like AI demands that Prosus's portfolio companies consistently innovate to maintain their competitive edge.

- Risk of Obsolescence: Failing to adopt new technologies quickly can lead to a loss of market relevance and competitive disadvantage.

- AI as a Driver: Prosus's active embrace of AI, a sector experiencing exponential growth, highlights the importance of technological adoption in mitigating competitive pressures.

Prosus faces intense competition across its diverse portfolio, particularly in food delivery and online classifieds. The global food delivery market, projected to exceed $200 billion in 2024, exemplifies this fierce rivalry, pushing companies towards aggressive user acquisition and constant innovation. This competitive pressure necessitates a delicate balance between growth and profitability, as seen in significant marketing expenditures by industry players throughout 2023.

| Sector | Key Competitors | Competitive Intensity | Impact on Prosus |

|---|---|---|---|

| Food Delivery | Swiggy, Meituan, Uber Eats | Very High (Price wars, heavy marketing) | Margin pressure, need for differentiation |

| Online Classifieds | eBay, Craigslist, local players | High (Network effects, user experience) | Requires continuous platform improvement |

| Edtech | Coursera, Udemy, local platforms | Growing (Content quality, accessibility) | Demands investment in curriculum and technology |

SSubstitutes Threaten

For online marketplaces like those Prosus invests in, traditional brick-and-mortar retail and direct-to-consumer (DTC) sales channels represent significant substitutes. Consumers can still opt to visit physical stores or purchase directly from brands, bypassing the marketplace entirely. In 2024, while e-commerce continues its growth, physical retail still captures a substantial share of consumer spending, highlighting the persistent threat of these established channels.

In the food delivery sector, where Prosus has notable investments, the threat of substitutes is also pronounced. Consumers have long-standing alternatives such as cooking meals at home, dining out at restaurants, or opting for direct restaurant pick-up services. Despite the convenience of digital platforms, these traditional methods remain popular and cost-effective for many, particularly given rising inflation concerns in 2024 that might push consumers towards more budget-friendly options.

In sectors like classifieds, users might bypass dedicated platforms for social media groups, direct networking, or even simple word-of-mouth referrals. This trend was evident in 2024 as many users sought free or more personalized connections, potentially impacting the user acquisition and retention rates of platforms like OLX. Prosus needs to ensure its offerings provide a clear advantage over these readily available alternatives.

For Prosus’s education technology ventures, traditional schooling, private tutoring, physical textbooks, and even self-directed learning through free online resources remain potent substitutes. For instance, the continued accessibility of university open courseware and readily available study guides in 2024 presented a cost-effective alternative for many learners. The perceived value and convenience of Prosus’s digital learning solutions must consistently surpass these established methods to maintain market share.

The rapid evolution of technology frequently introduces novel substitutes that can disrupt established markets. For example, advancements in augmented reality (AR) are creating new ways for consumers to experience shopping, potentially bypassing traditional e-commerce platforms. Similarly, the rise of highly localized, community-based service models offers alternative fulfillment for consumer needs, challenging the reach of larger, centralized players.

Prosus must proactively monitor and adapt to these emerging technological trends to effectively mitigate future substitution threats. The company's strategic investments in areas like fintech and e-commerce, where it holds significant stakes in companies like Tencent and Delivery Hero, position it to potentially leverage or counter these shifts. By staying agile, Prosus can better navigate the evolving landscape where new digital solutions can emerge as potent substitutes for existing offerings.

Shifting Consumer Preferences and Lifestyles

Changes in consumer behavior, economic conditions, or lifestyle trends can significantly alter the appeal of existing products and services, thereby increasing the threat of substitutes. For instance, a growing preference for sustainable living could diminish demand for single-use plastics, while a rise in digital nomadism might impact the need for traditional office spaces. Prosus's diversified business model, spanning e-commerce, fintech, and edtech, helps buffer against these shifts by not being overly reliant on any single consumer trend.

For example, in 2024, global consumer spending on sustainable products was projected to reach over $150 billion, indicating a clear shift that could affect businesses not adapting to these preferences. Similarly, the continued expansion of remote work arrangements, with an estimated 37% of US employees working from home at least part-time in early 2024, reshapes demand for services and goods previously tied to physical locations. Prosus's strategic investments in areas like online learning platforms and digital payment solutions position it to capitalize on these evolving consumer needs rather than be threatened by them.

- Shifting Consumer Preferences: A move towards healthier eating could reduce demand for traditional fast food delivery services.

- Economic Influence: Economic downturns might push consumers towards more affordable substitute goods or services.

- Lifestyle Trends: Increased adoption of remote work can decrease reliance on public transportation or office-centric services.

- Prosus's Mitigation: Diversification across e-commerce, fintech, and edtech allows Prosus to benefit from various evolving consumer trends.

Regulatory Environment and Offline Market Support

Government policies can significantly influence the threat of substitutes by either bolstering traditional offline businesses or erecting hurdles for digital competitors. For example, regulations that champion local brick-and-mortar establishments or introduce stringent requirements for gig economy participants can inadvertently enhance the competitiveness of offline alternatives.

Prosus must remain adept at navigating these evolving regulatory terrains. In 2024, many regions saw increased scrutiny on digital platform operations, with some governments introducing new tax frameworks or labor regulations impacting online service providers. This can make it more attractive for consumers to opt for established, offline services that may be less affected by these new digital-specific mandates.

- Regulatory Favoritism: Policies supporting small, local businesses can make offline options more appealing and cost-effective compared to digital platforms.

- Gig Economy Regulations: Stricter rules on gig workers can increase operational costs for digital platforms, potentially raising prices and making traditional employment models more competitive.

- Market Access Barriers: Certain regulations might limit the reach or operational scope of digital services, indirectly strengthening the position of existing offline substitutes.

The threat of substitutes for Prosus's diverse portfolio remains a critical consideration. In online marketplaces, traditional retail and direct-to-consumer sales are persistent substitutes, with physical retail still holding a significant market share in 2024. For food delivery, home cooking and dining out are enduring alternatives, especially as inflation in 2024 pressures consumer spending towards more economical choices.

In classifieds, social media groups and direct networking offer free or personalized alternatives to platforms like OLX, a trend observed in 2024 as users sought cost-effective connections. For Prosus's edtech ventures, traditional schooling and free online resources are strong substitutes, with university open courseware remaining a budget-friendly option in 2024. Emerging technologies like AR also present new ways for consumers to shop, potentially bypassing traditional e-commerce.

| Sector | Key Substitutes | 2024 Context/Data |

|---|---|---|

| Online Marketplaces | Brick-and-mortar retail, Direct-to-Consumer (DTC) | Physical retail still captures substantial consumer spending. |

| Food Delivery | Home cooking, Dining out, Restaurant pick-up | Inflation concerns may drive consumers to more budget-friendly options. |

| Classifieds | Social media groups, Direct networking, Word-of-mouth | Users sought free or personalized connections in 2024. |

| Edtech | Traditional schooling, Private tutoring, Textbooks, Free online resources | University open courseware remains a cost-effective alternative. |

Entrants Threaten

While digital ventures can begin with minimal investment, building the scale and network effects needed to challenge Prosus's dominant platforms in areas like food delivery, classifieds, and payments demands significant capital. New players face considerable hurdles in marketing, technology, and user acquisition, especially in the rapidly expanding markets Prosus operates within.

Prosus's portfolio, particularly in e-commerce and food delivery, thrives on powerful network effects. For instance, on platforms like OLX, a larger user base of buyers naturally attracts more sellers, and vice versa, creating a self-reinforcing cycle. This dynamic makes it significantly harder for newcomers to gain traction against established players.

Brand loyalty is another formidable barrier. Companies such as iFood and Swiggy have cultivated strong brand recognition and user trust, built over years of operation and investment. In 2023, iFood maintained its dominant position in Brazil's food delivery market, demonstrating this loyalty. This deep-rooted loyalty means new entrants must not only offer a comparable service but also invest heavily in marketing and incentives to even begin chipping away at Prosus's market share.

Entering sectors where Prosus operates, such as fintech and food delivery, frequently means confronting substantial regulatory hurdles and compliance costs. These can include obtaining specific licenses, adhering to data privacy laws like GDPR, and meeting capital requirements. For instance, in 2024, the European Union continued to refine its digital market regulations, potentially increasing compliance burdens for large tech platforms.

Access to Talent and Technology Infrastructure

New entrants into the digital platform space, like those Prosus operates in, often struggle to attract top-tier talent. The demand for specialists in areas such as artificial intelligence, machine learning, and data analytics is exceptionally high, driving up compensation and making it difficult for new players to compete with established tech giants for the best minds. For instance, in 2024, the average salary for a senior AI engineer in the US could easily exceed $200,000 annually, a significant barrier for startups.

Furthermore, building and maintaining robust technology infrastructure presents a substantial challenge. This includes securing reliable cloud computing resources, efficient payment processing systems, and scalable data storage solutions. Without significant capital investment or strategic partnerships, new entrants may find it difficult to match the operational efficiency and reliability that incumbent firms, often leveraging economies of scale with providers like Amazon Web Services or Microsoft Azure, already possess.

- Talent Acquisition Costs: High demand for AI and data science talent in 2024 significantly inflates recruitment and retention expenses for new entrants.

- Infrastructure Investment: Securing scalable cloud services and payment gateways requires substantial upfront capital, often exceeding the initial funding of new ventures.

- Partnership Dependencies: Lack of established relationships with key technology providers can leave new entrants reliant on less favorable terms or limited service offerings.

Prosus's Investment and Acquisition Strategy

Prosus, through its active investment arm Prosus Ventures, consistently injects capital into emerging technology sectors. This proactive approach, coupled with a track record of strategic acquisitions, allows Prosus to scout and integrate potential new entrants or disruptive technologies early on, thereby mitigating future competitive pressures.

For instance, Prosus Ventures’ significant investments in areas like fintech and edtech demonstrate a clear strategy to either partner with or acquire innovative startups that could otherwise emerge as formidable competitors. In 2023 alone, Prosus Ventures reported investments totaling billions of dollars across various growth-stage companies, reinforcing its commitment to shaping the competitive landscape.

- Prosus Ventures actively invests in high-growth technology sectors, identifying potential threats and opportunities.

- The company has a history of strategic acquisitions, integrating innovative businesses to neutralize competitive threats.

- This strategy allows Prosus to preemptively address the threat of new entrants by acquiring or partnering with them.

- In 2023, Prosus Ventures continued its aggressive investment pace, deploying significant capital into promising startups globally.

The threat of new entrants for Prosus is generally low due to high capital requirements for scaling digital platforms and establishing network effects, which are crucial for success in e-commerce and food delivery. New players must overcome significant marketing, technology, and user acquisition costs to compete with established entities like Prosus's investments in iFood and Swiggy.

Prosus benefits from strong brand loyalty and entrenched network effects on its platforms, such as OLX, making it difficult for newcomers to gain market share. For example, iFood's continued dominance in Brazil's food delivery market in 2023 highlights the power of established user trust and loyalty.

Regulatory hurdles and the need for substantial technology infrastructure investment also act as significant barriers. In 2024, evolving EU digital market regulations could further complicate entry. Moreover, attracting top talent, with senior AI engineers commanding salaries over $200,000 in 2024, presents another considerable challenge for startups aiming to compete with Prosus.

Porter's Five Forces Analysis Data Sources

Our Prosus Porter's Five Forces analysis is built upon a robust foundation of data, including Prosus's annual reports, filings with regulatory bodies like the SEC, and insights from reputable financial news outlets and industry analysis firms.