Prosus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prosus Bundle

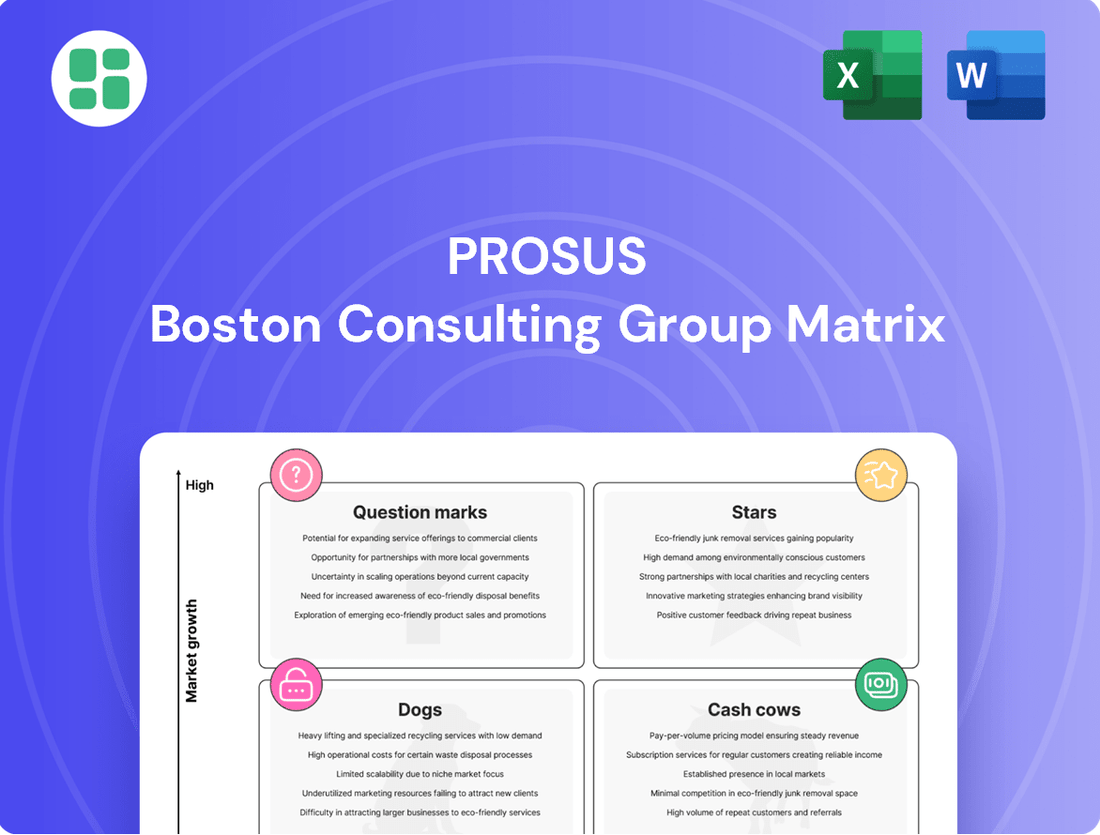

Curious about Prosus's strategic positioning? Our BCG Matrix analysis offers a glimpse into how their diverse portfolio, from established giants to emerging ventures, stacks up in terms of market share and growth potential. Understand where their "Stars" shine, their "Cash Cows" sustain, and which "Question Marks" warrant further investigation.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

iFood stands out as a Star in the Prosus portfolio due to its commanding leadership in Latin America's booming food delivery market. The company consistently shows impressive revenue growth and a healthy trading profit, underscoring its strong market position.

As Prosus's sole consolidated food delivery operation, iFood is actively expanding its reach beyond restaurant delivery into groceries and financial services, further solidifying its ecosystem. This strategic expansion, coupled with its dominant regional presence in a high-growth sector, firmly places iFood in the Star category.

Swiggy is a definite star in the Prosus portfolio, dominating India's rapidly expanding food and grocery delivery sector. The company has consistently shown impressive double-digit growth in its gross order value. This strong performance positions it as a key player with significant future potential.

Even after Prosus reduced its stake following Swiggy's late 2024 IPO, the remaining 25% ownership is substantial. This investment is in a business that is not only growing but also achieving strong operational profitability, a crucial indicator of its health and market strength.

Swiggy's strategic move into quick-commerce further solidifies its high-growth trajectory. This expansion diversifies its revenue streams and reinforces its leading position in the competitive Indian market, making it a valuable asset for Prosus.

eMAG stands as a prominent e-commerce player in Central and Eastern Europe, particularly in Romania where it holds a dominant market position. Its strategic focus on expanding into Hungary and Bulgaria, coupled with achieving profitability in its core business, highlights its strong growth trajectory.

The company's approach centers on increasing its Gross Merchandise Value (GMV) and diversifying into logistics and food delivery services. This expansion leverages its established local market share and aims to capitalize on the growing e-commerce landscape in these developing markets, solidifying its status as a Star in the BCG matrix.

PayU India (Payments & Fintech)

PayU India is a significant player in India's rapidly expanding digital payments sector, demonstrating impressive revenue growth and a clear path toward greater profitability. This strong performance in a high-growth market positions it favorably within the BCG matrix.

The company's market share is substantial, further bolstered by its recent in-principle authorization to operate as a payment aggregator in India. This regulatory approval is a key enabler for future expansion and solidifies its competitive standing.

Considering its robust market position and consistent growth trajectory in a crucial emerging market, PayU India is categorized as a Star.

- Market Growth: India's digital payments market is projected to reach $3 trillion by 2026, according to various industry reports.

- Revenue Performance: PayU India has consistently reported strong double-digit revenue growth in recent fiscal years.

- Profitability Improvement: The company has shown a steady improvement in its operating margins, indicating enhanced efficiency.

- Regulatory Advantage: The payment aggregator license allows PayU to onboard merchants more effectively, expanding its reach.

Strategic AI-native Startups (Prosus Ventures)

Prosus Ventures is strategically focusing on AI-native startups, viewing them as crucial for future expansion. This aligns with their broader portfolio strategy, aiming to integrate AI for enhanced performance and market leadership.

These AI-centric investments, though often in early stages, represent a significant bet on the transformative power of artificial intelligence across various high-growth industries. Prosus Ventures seeks to harness these emerging technologies to bolster its existing ventures and cultivate new market disruptors.

- AI Integration: Prosus is actively embedding AI capabilities into its portfolio companies.

- Future Growth Drivers: AI-native startups are identified as key contributors to long-term value creation.

- Market Leadership: The strategy aims to leverage AI to establish new leaders in emerging markets.

- Portfolio Synergy: Prosus seeks to create synergies by applying AI across its diverse range of investments.

iFood, Swiggy, and eMAG are prime examples of Stars within the Prosus portfolio, showcasing strong market positions and consistent growth. PayU India also demonstrates significant potential in the burgeoning digital payments sector.

| Company | Market Position | Growth Trajectory | Key Data Point |

|---|---|---|---|

| iFood | Dominant in Latin America food delivery | High revenue growth, expanding into groceries and financial services | Leading market share in a high-growth sector |

| Swiggy | Dominant in India's food and grocery delivery | Double-digit Gross Order Value growth, expanding into quick-commerce | 25% stake held by Prosus post-IPO, achieving operational profitability |

| eMAG | Dominant e-commerce player in Central and Eastern Europe | Expanding into new markets, achieving profitability in core business | Focus on increasing GMV and diversifying into logistics |

| PayU India | Significant player in India's digital payments | Strong double-digit revenue growth, improving operating margins | In-principle authorization as a payment aggregator |

What is included in the product

The Prosus BCG Matrix offers a strategic overview of its diverse portfolio, categorizing ventures into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides Prosus in making informed decisions about investing in high-growth Stars, milking Cash Cows, developing Question Marks, or divesting Dogs.

Strategic clarity by visualizing each business unit's market position and growth potential.

Cash Cows

Prosus maintains a significant, though gradually decreasing, stake in Tencent Holdings. This investment consistently generates substantial dividend income and remains a key contributor to Prosus's overall net asset value.

Tencent, while a growth company in its own right, represents a mature profitability source for Prosus. Prosus's involvement here is more about reaping the rewards of Tencent's established success rather than actively driving its growth.

The steady cash flow from Tencent, coupled with Prosus's strategic approach to gradually monetize this holding to fund other ventures, firmly positions it as a Cash Cow within the Prosus portfolio.

The OLX Group's classifieds business, a significant part of Prosus's portfolio, operates as a classic Cash Cow. It has achieved consolidated profitability, a testament to its strong market position in established online classifieds markets.

While the classifieds sector might not see the explosive growth of newer tech ventures, OLX's focus on operational efficiency and cost management allows it to generate reliable and consistent cash flow. This stable, cash-generating performance in a mature market segment firmly places it in the Cash Cow quadrant of the BCG matrix.

PayU's established Payment Service Provider (PSP) business, particularly in mature global markets outside of India, functions as a significant Cash Cow for Prosus. These operations benefit from a substantial existing merchant base and high transaction volumes, leading to stable and predictable cash generation.

While growth may be slower in these regions, the need for extensive reinvestment is reduced, allowing these segments to consistently contribute to profitability. For instance, in 2023, Prosus reported that PayU's total payment volumes reached $136 billion, with a significant portion stemming from these established markets, underscoring their role as reliable cash generators.

Delivery Hero (Remaining Stake)

Prosus holds a substantial stake in Delivery Hero, a company that has historically been a significant contributor to its food delivery segment. This investment has been a cash-generating asset, providing financial returns and market influence within the evolving food delivery landscape.

While Prosus's stake in Delivery Hero is subject to potential divestment, influenced by regulatory considerations surrounding its acquisition of Just Eat Takeaway.com, it has functioned as a cash cow. This means it generates more cash than it consumes, supporting other ventures within Prosus's portfolio.

- Prosus's stake in Delivery Hero has been a key part of its food delivery business.

- The investment has historically generated significant cash flow for Prosus.

- Potential divestment is linked to regulatory scrutiny of Prosus's other food delivery assets.

eMAG's Core Romanian Etail

eMAG's core Romanian etail operations, a business it has led since 2001, represent a significant cash generator for Prosus. This segment benefits from a dominant market share and highly efficient operations, enabling it to finance growth into new regions and related service areas.

The established customer loyalty and mature operational framework of eMAG Romania ensure consistent profitability, solidifying its position as a dependable Cash Cow within Prosus's portfolio.

- Market Leadership: eMAG has been the leading online retailer in Romania since 2001.

- Profitability Driver: Its high market share and operational efficiency generate consistent profits.

- Funding Growth: Profits from eMAG Romania are reinvested to support expansion into new markets and services.

- Customer Base: A mature operation with a loyal customer base contributes to its reliable cash flow.

Cash Cows in Prosus's portfolio are assets that generate more cash than they consume, requiring minimal investment to maintain their market position. These entities are crucial for funding growth in other areas of the business.

Tencent, despite its ongoing growth, acts as a mature cash cow for Prosus, providing substantial dividend income. Similarly, the OLX Group's classifieds business, with its strong market presence and focus on efficiency, consistently delivers reliable cash flow.

PayU's established payment services in mature markets, alongside Delivery Hero's historical contribution and eMAG's dominant Romanian e-tail operations, further exemplify these dependable cash-generating assets within Prosus.

| Asset | Business Segment | Role | Key Metric/Observation |

|---|---|---|---|

| Tencent Holdings | Internet & Technology | Cash Cow | Significant dividend income contributor. |

| OLX Group | Classifieds | Cash Cow | Achieved consolidated profitability, strong market position. |

| PayU | Payments (Mature Markets) | Cash Cow | High transaction volumes, stable cash generation. 2023 TPV: $136 billion. |

| Delivery Hero | Food Delivery | Cash Cow | Historically generated significant cash flow. |

| eMAG | E-commerce (Romania) | Cash Cow | Dominant market share, funds expansion. Leading online retailer in Romania since 2001. |

Preview = Final Product

Prosus BCG Matrix

The Prosus BCG Matrix preview you're viewing is the complete, unwatermarked document you will receive immediately after purchase. This meticulously crafted analysis, designed for strategic insight, will be yours to use without any alterations or demo content. It's ready for immediate integration into your business planning and presentations.

Dogs

Prosus has formally written off its substantial investment in BYJU's, the Indian edtech giant. This significant write-down, announced in early 2024, reflects a drastic reassessment of BYJU's valuation, which has plummeted from its peak. The decision signals that Prosus no longer anticipates a positive return on this particular asset.

This write-off firmly places BYJU's in the 'Dog' category of the BCG matrix from Prosus's perspective. It indicates that BYJU's holds a low market share within Prosus's portfolio and faces bleak growth prospects. The company's struggles, including significant financial challenges and operational hurdles, have led to this reclassification.

Prosus has largely divested its OLX Autos business, marking a strategic exit from the automotive transaction segment. This move signals that OLX Autos was an underperforming asset, likely characterized by a low market share and a failure to contribute significantly to Prosus's overall growth or profitability. The divestment firmly places it in the Dogs category of the BCG matrix.

Stack Overflow, an edtech firm within Prosus's investment portfolio, has seen its revenue growth fall short of expectations. This is partly due to the increasing use of generative AI tools and a tougher economic climate. For instance, while the edtech sector saw significant investment in prior years, 2023 and early 2024 have been marked by a more cautious approach from investors, impacting growth trajectories for many companies.

The company has faced difficulties in capturing a larger slice of the market and achieving robust expansion. Its positioning within the competitive edtech landscape, coupled with the aforementioned headwinds, firmly places it in the Dog category of the BCG matrix. This classification suggests it requires careful consideration regarding future investment or potential divestment.

Trip.com & Tazz (Sold Stakes)

Prosus's strategic divestment of stakes in Trip.com and Tazz in late 2024 and early 2025 signals a portfolio rebalancing. These moves likely indicate that these ventures were not meeting Prosus's growth expectations or were deemed less strategic for its future direction.

The decision to sell these stakes suggests Trip.com and Tazz were potentially classified as Dogs within the BCG matrix, characterized by low market share and low market growth. Prosus's action reflects a proactive approach to shedding underperforming or non-core assets to focus capital on more promising opportunities.

While specific financial performance data for these divestments will become clearer post-transaction, Prosus's overall strategy in 2024 has focused on optimizing its portfolio. For instance, Prosus reported a substantial increase in its e-commerce segment revenue in the first half of 2024, highlighting its commitment to investing in high-growth areas.

- Divestment Rationale: Trip.com and Tazz likely represented low-growth, low-market-share businesses within Prosus's portfolio, fitting the 'Dog' category in the BCG matrix.

- Portfolio Optimization: These sales are part of Prosus's ongoing strategy to refine its investment holdings and allocate resources more effectively towards higher-potential ventures.

- Market Context: The travel and food delivery sectors, where Trip.com and Tazz operate, have experienced significant shifts, potentially impacting their growth trajectories and Prosus's strategic outlook.

- Financial Impact: While exact figures are pending, the divestments are expected to free up capital for reinvestment in Prosus's core and emerging technology businesses.

Underperforming Early-Stage Ventures

Within Prosus Ventures' extensive portfolio, which boasts over 100 early-stage investments, a portion inevitably struggles to gain market traction or achieve desired growth. These ventures, initially classified as Question Marks, can evolve into Dogs if they fail to demonstrate significant progress.

These underperforming early-stage ventures often represent a challenge for venture capital firms like Prosus. They consume valuable resources, including capital and management attention, without delivering the anticipated returns or market share. By 2024, the landscape of venture capital continues to highlight the inherent risks in early-stage investing, with a notable percentage of startups failing to reach profitability or secure subsequent funding rounds.

- High Failure Rate: Statistics from various venture capital reports in 2023 and early 2024 indicate that a significant percentage of early-stage startups, often cited between 70% and 90%, do not achieve a successful exit or sustainable growth.

- Resource Drain: These ventures, even if not formally written off, can tie up capital and human resources that could be allocated to more promising investments within the portfolio.

- Quiet Exits: Often, these underperforming early-stage companies are quietly exited through small asset sales or simply deprioritized, rather than undergoing high-profile liquidations. This allows the firm to redeploy capital and focus on its Stars and Cash Cows.

- Strategic Re-evaluation: Prosus Ventures, like other major investors, continuously re-evaluates its portfolio. Investments that consistently miss key performance indicators and fail to show a path to market leadership are candidates for being categorized as Dogs.

The 'Dog' category in the BCG matrix represents investments with low market share and low growth prospects. Prosus has identified several of its holdings as fitting this description, often leading to strategic divestments or write-offs. This classification is a critical part of portfolio management, allowing the company to reallocate resources to more promising ventures.

BYJU's, a significant investment in the edtech sector, was formally written down by Prosus in early 2024, signaling its move into the Dog category due to diminished valuation and bleak growth outlook. Similarly, OLX Autos was divested, indicating it was an underperforming asset with low market share and growth. Stack Overflow, another edtech investment, has also faced challenges in market capture and expansion, placing it in the Dog quadrant.

Prosus's strategic exits from Trip.com and Tazz in late 2024 and early 2025 further illustrate the application of the Dog classification. These divestments suggest that these ventures were not meeting growth expectations or were deemed less strategic, fitting the profile of low market share and low market growth. This proactive portfolio optimization aims to free up capital for reinvestment in higher-potential areas.

Early-stage investments that fail to gain market traction or achieve desired growth also fall into the Dog category. Venture capital reports from 2023 and early 2024 highlight a high failure rate for startups, with a significant percentage not achieving profitability or securing further funding. These underperforming ventures consume resources without delivering anticipated returns, prompting continuous re-evaluation by firms like Prosus Ventures.

Question Marks

Prosus's proposed €4.1 billion acquisition of Just Eat Takeaway.com positions it to become a significant player in Europe's burgeoning food delivery sector. This strategic move, aimed at creating an AI-powered food delivery leader, is currently awaiting regulatory approval, making its direct market share contribution still in its infancy.

The success of Just Eat Takeaway.com as a potential Star in the BCG matrix hinges on Prosus's ability to navigate the regulatory landscape and effectively integrate the acquired business. Its future growth trajectory and market dominance will be determined by how well it captures market share and achieves operational synergies post-acquisition, with the food delivery market in Europe showing robust growth, projected to reach over €30 billion by 2025.

Prosus is strategically channeling significant investments into cutting-edge AI and Generative AI applications across its diverse portfolio. These advancements aim to revolutionize customer experiences and accelerate growth, particularly within its e-commerce ventures. For instance, by July 2025, many of Prosus's platforms are expected to integrate AI-powered personalization engines, potentially boosting conversion rates by an estimated 15-20% based on industry trends observed in early 2024.

These innovative AI-driven solutions represent a high-potential growth area, but their market penetration and widespread adoption are still in nascent stages as of mid-2024. The ultimate success of these applications hinges on their ability to capture substantial market share and transition into the 'Star' category within the BCG framework. Early indicators from 2024 suggest a strong demand for AI-enhanced services, with companies reporting a 10% increase in user engagement when AI features are prominently displayed.

Prosus views companies like Brainly, a leading AI learning platform, as potential stars within its portfolio, despite past edtech sector volatility. This strategic positioning acknowledges the broader edtech market's high growth trajectory, fueled by increasing global demand for digital learning solutions. While the overall market is expanding, individual platforms like Brainly are still actively competing to capture significant market share, making them prime candidates for future success.

iFood's Expansion into Grocery, Fintech & Credit

iFood, a recognized Star in the food delivery sector, is strategically diversifying into promising new areas like online grocery delivery, fintech with iFood Pago, and credit services. These ventures are designed to capitalize on iFood's established user base and logistical infrastructure, but they represent newer endeavors in crowded markets where iFood is still establishing a strong presence.

The expansion into grocery and fintech is a calculated move to capture a larger share of the digital consumer wallet. For instance, by 2024, the online grocery market in Brazil, iFood's primary market, was projected to reach significant growth, with iFood aiming to capture a substantial portion of this. iFood Pago, its fintech arm, is also building momentum, offering payment solutions that integrate seamlessly with its delivery services.

- Grocery Delivery: iFood's grocery segment saw substantial growth in 2023, with a reported 40% increase in orders year-over-year, indicating strong adoption.

- Fintech Services (iFood Pago): By the end of 2023, iFood Pago processed over 10 million transactions, demonstrating its growing utility for both consumers and merchants.

- Credit Offerings: Pilot programs for credit services launched in late 2023 targeted delivery partners, with early results showing a 15% uptake among eligible individuals.

Despegar.com (Latin America Online Travel)

Despegar.com, acquired by Prosus in May 2025, is positioned as a Star within the BCG matrix for Prosus's portfolio. This classification stems from its operation in the high-growth Latin American online travel market, a sector demonstrating significant expansion potential. For instance, the Latin American online travel market was projected to reach approximately $40 billion in 2024, reflecting robust consumer adoption of digital booking platforms.

While Despegar operates in a promising market, its position as a Star is contingent on its ability to solidify a dominant market share amidst intense competition. Prosus's strategic integration of Despegar into its wider digital ecosystem is key to unlocking this potential. The company's performance will be closely watched as it navigates this dynamic environment, aiming to leverage its existing customer base and technological capabilities.

- Market Growth: Latin America's online travel market shows strong growth, with projections indicating continued upward trends through 2025.

- Competitive Landscape: Despegar faces established and emerging competitors, making market share capture a critical factor for Star status.

- Strategic Integration: Prosus's success hinges on effectively integrating Despegar into its broader digital offerings to enhance customer value and operational synergies.

- Future Potential: Despegar represents a high-growth opportunity, but its path to market leadership requires sustained execution and innovation.

Question Marks in Prosus's portfolio represent ventures with high growth potential but uncertain market positions. These are typically new investments or businesses in rapidly evolving sectors where market share capture is still a significant challenge. Prosus aims to nurture these into Stars through strategic investment and operational improvements.

Many of Prosus's emerging AI initiatives and newer ventures within established companies like iFood fall into the Question Mark category. Their success depends on gaining traction in competitive markets and demonstrating clear value propositions to customers. For example, iFood's expansion into grocery and fintech, while promising, operates in established, competitive sectors.

The key for Prosus is to identify which Question Marks have the strongest potential to become Stars. This involves rigorous analysis of market dynamics, competitive landscapes, and the inherent scalability of the business model. For instance, while Brainly operates in the growing edtech sector, its ability to secure a dominant market share will determine its trajectory.

Prosus's investment in Despegar.com, acquired in May 2025, places it in the Question Mark category initially, despite operating in the high-growth Latin American online travel market. While the market is projected to reach approximately $40 billion in 2024, Despegar's success hinges on its ability to consolidate market share against strong competition.

| Venture | Sector | Growth Potential | Market Position Uncertainty | Prosus Strategy |

|---|---|---|---|---|

| Just Eat Takeaway.com (Post-Acquisition) | Food Delivery | High (Europe) | Uncertain (Regulatory, Integration) | AI integration, operational synergies |

| Emerging AI Applications | Technology/E-commerce | Very High | High (Nascent adoption) | Investment in R&D, platform integration |

| iFood (Grocery, Fintech) | Food Delivery, E-commerce, Fintech | High (Brazil) | Moderate (Competitive markets) | Leverage user base, expand services |

| Brainly | EdTech | High (Global) | Moderate (EdTech volatility, competition) | Strategic positioning, market share capture |

| Despegar.com | Online Travel | High (Latin America) | Moderate (Intense competition) | Strategic integration, customer value enhancement |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial statements, market research reports, and industry growth forecasts, to provide accurate strategic insights.