Power Corporation of Canada SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Power Corporation of Canada Bundle

Power Corporation of Canada boasts a diversified portfolio, but understanding its competitive advantages and potential market threats is crucial for strategic decision-making. Our comprehensive SWOT analysis delves into these critical areas, offering a clear view of their operational strengths and potential vulnerabilities.

Want the full story behind Power Corporation of Canada's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Power Corporation of Canada's diversified portfolio and global presence are significant strengths, with substantial operations across North America, Europe, and Asia. This broad geographical and sectoral reach, especially in financial services like insurance and wealth management, creates a resilient revenue stream and reduces dependence on any single market or industry. For instance, in the first quarter of 2024, Power Corp reported a net earnings attributable to shareholders of $927 million, a testament to the stability provided by its diverse holdings.

Power Corporation of Canada consistently showcases robust financial performance, highlighted by its Q1 2025 adjusted net earnings of $1.05 billion and a 5% increase in net asset value per share. This financial strength underpins its ability to reward investors.

The company's commitment to shareholder returns is evident in its March 2025 announcement of a 10% dividend increase, alongside ongoing share repurchase programs. Such consistent value delivery fosters strong investor confidence and attracts further capital investment.

Power Corporation's strength lies in its active shareholder approach, driving long-term value by focusing on organic growth and strategic M&A within its core businesses. This hands-on management, combined with robust governance, allows for effective subsidiary guidance and market adaptability.

In 2024, Power Corporation continued to demonstrate this by actively participating in the strategic direction of its key holdings, such as Great-West Lifeco and IGM Financial, aiming to enhance operational efficiencies and explore synergistic opportunities. This proactive stance is crucial for navigating the evolving financial services landscape.

Commitment to Sustainability and ESG Initiatives

Power Corporation of Canada demonstrates a strong commitment to sustainability, embedding Environmental, Social, and Governance (ESG) principles into its core business strategies. This dedication is evident in its active support for initiatives addressing climate change and promoting environmental stewardship.

The company's proactive approach to environmental governance was recognized with a leadership score of A- from the CDP for its 2024 climate change response. This rating highlights Power Corporation's robust disclosure and management of climate-related risks and opportunities.

- ESG Integration: Sustainability is a key consideration in Power Corporation's decision-making processes.

- Climate Action: The company actively supports initiatives focused on mitigating climate change and enhancing environmental responsibility.

- CDP Recognition: Achieved an A- leadership score from CDP for its 2024 climate change disclosure, underscoring its strong environmental performance and transparency.

Investments in Alternative Assets and Fintech

Power Corporation's strategic investments in alternative assets, through platforms like Sagard and Power Sustainable, are a significant strength. As of late 2024, these ventures have been actively expanding their reach, aiming to capture growth in private equity, credit, and infrastructure, thereby diversifying Power Corp's earnings base away from more traditional insurance and wealth management sectors.

The company's proactive approach to fintech is another key strength, highlighted by its substantial investment in Wealthsimple. This Canadian-based fintech company experienced significant user growth through 2024, reaching over 3 million clients by year-end. This positions Power Corporation to benefit from the ongoing digital transformation within financial services, tapping into new customer segments and innovative product offerings.

- Diversified Revenue Streams: Alternative assets and fintech investments reduce reliance on traditional financial services.

- Capitalizing on Trends: Active fintech strategy allows Power Corp to embrace digital innovation and emerging market opportunities.

- Growth Platforms: Sagard and Power Sustainable are actively deploying capital, enhancing Power Corp's long-term growth potential.

- Strategic Partnerships: Investments like Wealthsimple provide access to a rapidly growing digital customer base.

Power Corporation of Canada benefits from a diversified business model, encompassing insurance, wealth management, and investments in alternative assets and fintech. This broad operational scope, with significant presence in North America, Europe, and Asia, provides resilience against market downturns in any single sector or region. The company's robust financial health is consistently demonstrated, with Q1 2025 adjusted net earnings reaching $1.05 billion, reflecting the stability and profitability of its varied holdings.

The company's strategic focus on shareholder value is a core strength, evidenced by a 10% dividend increase announced in March 2025 and ongoing share repurchase programs. This commitment, combined with an active shareholder approach that guides its subsidiaries like Great-West Lifeco and IGM Financial, enhances operational efficiencies and market adaptability. Furthermore, Power Corporation's significant investment in Wealthsimple, which surpassed 3 million clients by the end of 2024, positions it to capitalize on the digital transformation in financial services.

Power Corporation of Canada demonstrates strong ESG integration, actively supporting climate change mitigation and environmental stewardship, earning an A- leadership score from CDP for its 2024 climate change response. Its strategic investments in alternative assets through Sagard and Power Sustainable are also key strengths, actively deploying capital to diversify earnings away from traditional sectors.

What is included in the product

Analyzes Power Corporation of Canada’s competitive position through key internal and external factors, highlighting its diversified financial services portfolio and strong market presence, while also considering potential regulatory shifts and economic uncertainties.

Offers a clear breakdown of Power Corporation of Canada's strategic landscape, highlighting areas for growth and mitigating potential risks.

Weaknesses

Power Corporation of Canada's extensive involvement in financial services makes it highly susceptible to market volatility. Fluctuations in interest rates, inflation, and foreign exchange rates directly impact its investment portfolio and the profitability of its insurance and wealth management segments. For instance, rising interest rates in 2024 could pressure the value of existing fixed-income assets within its holdings.

Economic downturns pose a significant risk, potentially leading to reduced asset values and lower fee income from wealth management operations. A prolonged period of market instability, such as that seen in parts of 2022 and early 2023, can erode the value of its substantial investment holdings, impacting overall financial performance.

Power Corporation of Canada's diversified international management and holding company structure, while strategically advantageous, introduces inherent complexities. Managing oversight, ensuring consistent regulatory compliance, and optimizing operations across a multitude of subsidiaries and joint ventures can strain resources and create administrative burdens. This intricate web of businesses may also hinder the realization of full operational synergies, potentially obscuring performance issues within individual segments.

A significant portion of Power Corporation's earnings is tied to its major subsidiaries, notably Great-West Lifeco and IGM Financial. For instance, as of the first quarter of 2024, Great-West Lifeco contributed substantially to Power Corporation's consolidated net earnings, highlighting this dependency.

This concentration means that any substantial underperformance or unexpected difficulties faced by these key operating companies, such as regulatory changes impacting their insurance or wealth management operations, could disproportionately affect Power Corporation's overall financial health and profitability.

Transition Risk from Fossil Fuel Exposure

Power Corporation of Canada faces a significant weakness due to its substantial investment in fossil fuels through subsidiaries like IGM Financial and Great-West Lifeco. This exposure to emissions-intensive assets creates a transition risk as the global economy moves towards decarbonization. For instance, as of late 2024, these subsidiaries collectively hold billions in investments tied to the energy sector, making them vulnerable to regulatory changes and shifts in investor sentiment favoring greener portfolios.

This heavy reliance on fossil fuel-related assets could deter environmentally conscious investors, potentially impacting the company's valuation and access to capital. Furthermore, increased scrutiny from ESG-focused investors and potential regulatory pressures related to climate change pose a direct threat to shareholder value. The company's reported sustainability initiatives, while present, may not fully offset concerns regarding its core fossil fuel holdings.

- Significant Fossil Fuel Exposure: Power Corporation's subsidiaries, particularly IGM and Great-West Lifeco, maintain substantial investments in the fossil fuel industry, representing a key weakness.

- Transition Risk: The global shift towards decarbonization poses a material risk to these investments, potentially leading to asset devaluation and stranded assets.

- Investor Scrutiny: Increased focus on Environmental, Social, and Governance (ESG) factors by investors can lead to divestment and negative sentiment towards companies with high fossil fuel exposure.

- Potential Regulatory Impact: Evolving climate policies and regulations could further impact the profitability and valuation of Power Corporation's fossil fuel-dependent assets.

Inconsistent Emissions Disclosure Across Subsidiaries

Power Corporation of Canada has faced scrutiny for a lack of uniformity in reporting financed emissions across its various subsidiaries. Notably, major entities like IGM Financial and Great-West Lifeco (GBL) have not always been fully integrated into the consolidated disclosures, even when they maintain their own detailed reporting frameworks.

This inconsistency creates a gap, as a substantial portion of the company's assets under management are not comprehensively reflected in its transition risk assessments. For instance, as of the end of 2023, Power Corporation’s total assets under management were over CAD 1.7 trillion, and the exclusion of certain subsidiaries’ emissions data could obscure the true scope of its climate-related financial exposure.

- Incomplete Coverage: Key subsidiaries like IGM and GBL, with significant AUM, are not always included in consolidated financed emissions reporting.

- Reputational Risk: This inconsistency can impact investor perception of the company's commitment to transparent climate action and transition risk management.

- Data Gaps: A significant portion of the company's overall financial assets are not fully accounted for in its transition risk disclosures, potentially leading to an incomplete understanding of its climate footprint.

Power Corporation's substantial investment in fossil fuels, particularly through Great-West Lifeco and IGM Financial, presents a significant weakness. As of late 2024, these subsidiaries held billions in energy sector investments, exposing the company to transition risks associated with decarbonization efforts and potential asset devaluation.

This reliance on carbon-intensive assets can deter ESG-focused investors, potentially affecting valuation and capital access. The lack of consolidated reporting for financed emissions across all subsidiaries, including major ones like IGM Financial and Great-West Lifeco, creates data gaps, obscuring the full scope of its climate-related financial exposure, impacting over CAD 1.7 trillion in assets under management as of end-2023.

The complexity of managing a diversified international structure can strain resources and create administrative burdens, potentially hindering operational synergies and obscuring segment-specific performance issues.

Preview Before You Purchase

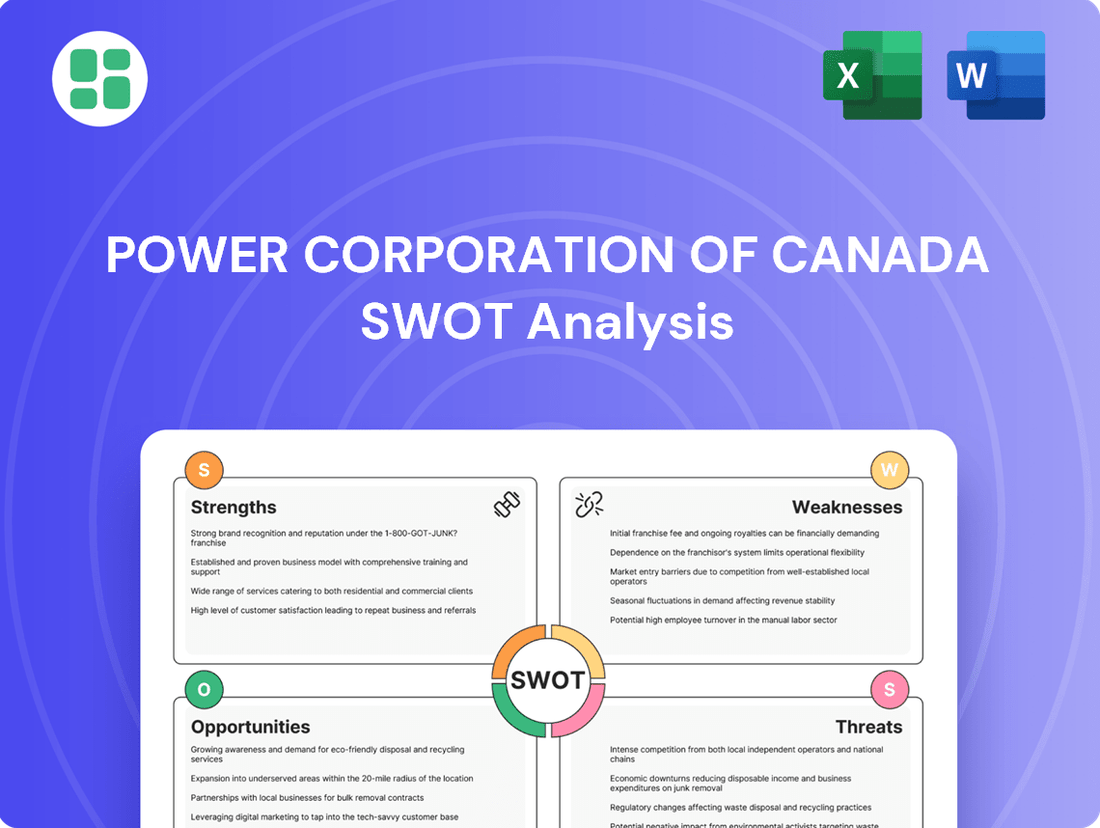

Power Corporation of Canada SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Power Corporation of Canada's Strengths, Weaknesses, Opportunities, and Threats. This detailed analysis is ready for your strategic planning needs.

Opportunities

Power Corporation's strategic investments in renewable energy and sustainable technologies, particularly through Power Sustainable, present a compelling growth avenue. This aligns with the accelerating global transition to a low-carbon economy, a trend showing no signs of slowing down. The company is well-positioned to capitalize on this shift.

The increasing demand for clean electricity, fueled by widespread electrification and ambitious decarbonization targets worldwide, creates a fertile ground for expansion. Power Corporation can leverage its existing infrastructure and expertise to broaden its presence in this vital sector, meeting the growing need for sustainable power solutions.

The global wealth management sector is experiencing robust growth, driven by increasing demand for personalized financial advice and a rising appetite for alternative investments. This trend is particularly evident as investors, both individual and institutional, look to diversify beyond traditional assets and achieve enhanced returns.

Power Corporation of Canada is strategically positioned to capitalize on this opportunity. Through its significant holdings in IGM Financial and Sagard, the company benefits from established platforms adept at providing sophisticated wealth management solutions and accessing alternative asset classes. This allows Power Corporation to expand its product suite and client reach within a burgeoning market.

For instance, IGM Financial reported net inflows of $5.1 billion in its wealth management segment during the first quarter of 2024, highlighting strong client demand. Sagard's growing presence in private equity and credit further strengthens Power Corporation's ability to offer diverse alternative investment options, appealing to a sophisticated investor base seeking uncorrelated returns.

Power Corporation's commitment to digital transformation and fintech integration, exemplified by its significant investment in Wealthsimple, positions it to capitalize on the growing demand for digital financial services. This strategy is crucial for enhancing operational efficiency and creating new avenues for revenue generation in the evolving financial landscape. As of early 2024, Wealthsimple reported a substantial increase in assets under management, underscoring the success of its digital-first approach.

Strategic Mergers and Acquisitions (M&A)

Power Corporation of Canada, as a prominent management and holding company, is well-positioned to leverage strategic mergers and acquisitions (M&A). This inorganic growth strategy allows for market consolidation, geographic expansion, and the acquisition of specialized, high-growth capabilities. For instance, in 2024, Power Corporation continued its active role in M&A, with notable investments and acquisitions contributing to its diversified portfolio, aiming to accelerate expansion and bolster its market presence across various sectors.

The company's financial strength and strategic vision enable it to pursue opportunities that enhance its existing business lines or open new avenues for revenue generation. This approach is critical for maintaining a competitive edge and adapting to evolving market dynamics. Power Corporation's commitment to M&A was evident in its financial activities throughout 2024, where strategic capital allocation towards potential acquisitions underscored this opportunity.

- Market Consolidation: M&A can strengthen Power Corporation's position in its core markets, leading to greater economies of scale and improved profitability.

- Geographic Expansion: Acquiring companies in new regions allows Power Corporation to tap into diverse customer bases and revenue streams.

- Capability Acquisition: Pursuing targets with specialized technologies or expertise can accelerate innovation and entry into emerging, high-growth sectors.

- Portfolio Diversification: Strategic M&A can further diversify Power Corporation's holdings, reducing overall risk and enhancing stability.

Increasing Demand for ESG-aligned Investments

The increasing investor focus on environmental, social, and governance (ESG) criteria presents a significant opportunity for Power Corporation of Canada. By further developing and marketing its ESG-aligned investment offerings, the company can tap into a rapidly growing pool of capital. Power Corporation's established sustainability initiatives and strong CDP (formerly Carbon Disclosure Project) scores, such as its A- score in climate change in 2023, position it well to attract socially responsible investors.

This trend is underscored by market data showing substantial growth in ESG investing. For instance, global sustainable investment assets reached an estimated $37.7 trillion in early 2024, demonstrating a clear investor preference for companies with strong ESG performance. Power Corporation can leverage this by:

- Expanding its range of ESG-focused mutual funds and ETFs.

- Highlighting its corporate sustainability achievements in investor communications.

- Seeking partnerships with asset managers specializing in responsible investing.

Power Corporation's strategic investments in renewable energy, particularly through Power Sustainable, align with the global shift towards a low-carbon economy, offering significant growth potential. The increasing demand for clean electricity, driven by electrification and decarbonization efforts, provides a strong foundation for expanding its presence in this vital sector.

The robust growth in global wealth management, fueled by demand for personalized advice and alternative investments, presents another key opportunity. Power Corporation, through IGM Financial and Sagard, is well-positioned to meet this demand with sophisticated wealth management solutions and access to diverse alternative asset classes.

Furthermore, Power Corporation's commitment to digital transformation, highlighted by its investment in Wealthsimple, capitalizes on the burgeoning digital financial services market. This focus enhances operational efficiency and opens new revenue streams, reflecting the success of digital-first strategies in the financial sector.

Strategic mergers and acquisitions (M&A) offer Power Corporation avenues for market consolidation, geographic expansion, and acquiring specialized capabilities. This inorganic growth strategy is crucial for enhancing its competitive edge and adapting to evolving market dynamics, as demonstrated by its active M&A involvement throughout 2024.

The growing investor focus on ESG criteria is a significant opportunity, allowing Power Corporation to attract capital by expanding its ESG-aligned offerings. Its established sustainability initiatives and strong CDP scores, like its A- score for climate change in 2023, position it favorably with socially responsible investors, tapping into a rapidly expanding pool of capital.

Threats

The financial services landscape is intensely competitive. Power Corporation of Canada contends with established banks, insurers, and agile fintech disruptors, all seeking to capture customer segments and assets. This rivalry, particularly from major Canadian financial institutions and international entities, directly challenges Power Corporation's ability to maintain healthy profit margins and expand its operations across its diverse business lines.

The financial services sector faces a constantly shifting regulatory environment, impacting companies like Power Corporation. New rules or changes to existing ones, such as updated capital requirements or tax laws, can directly affect operational costs and profitability across its diverse subsidiaries.

For instance, in 2024, discussions around enhanced climate-related financial disclosures and evolving consumer protection laws in Canada and Europe could necessitate significant investment in compliance infrastructure for Power Corporation's insurance and wealth management arms. These regulatory shifts might also introduce new restrictions on certain business activities or alter the tax treatment of financial products, potentially impacting net earnings.

A significant economic slowdown, potentially exacerbated by rising interest rates and ongoing geopolitical instability, poses a substantial threat to Power Corporation of Canada. Such an environment could dampen consumer spending and reduce overall investment activity, directly impacting the performance of its financial services divisions. For instance, a prolonged downturn might see a rise in loan defaults across its insurance and wealth management operations.

Furthermore, market instability can negatively affect the valuations of Power Corporation's extensive investment portfolio. As of the first quarter of 2024, the company held substantial investments across various sectors, and a broad market decline could lead to significant unrealized losses, impacting its book value and overall financial health. The company's assets under management, particularly in its Great-West Lifeco subsidiary, are also susceptible to market volatility, potentially leading to outflows and reduced fee income.

Cybersecurity Risks and Data Breaches

Power Corporation, like many large financial institutions, is a prime target for sophisticated cyberattacks. The increasing reliance on digital infrastructure for everything from client transactions to internal operations means that a successful breach could be devastating. For instance, in 2023, the financial services sector globally experienced a significant uptick in ransomware attacks, with some incidents costing companies millions in recovery and lost business.

A major cybersecurity incident for Power Corporation could result in substantial financial penalties, regulatory fines, and the immense cost of remediation. Beyond the direct financial impact, the damage to its reputation and the erosion of client trust are critical threats. Clients entrust Power Corporation with sensitive personal and financial data, and a breach would severely undermine this confidence, potentially leading to client attrition and difficulty attracting new business.

- Financial Losses: Costs associated with incident response, system recovery, and potential legal liabilities can run into the millions.

- Reputational Damage: A data breach can severely tarnish a company's image, leading to loss of customer trust and market share.

- Operational Disruption: Cyberattacks can halt critical business operations, impacting service delivery and revenue generation.

- Regulatory Fines: Non-compliance with data protection regulations, such as GDPR or PIPEDA, can result in significant financial penalties.

Failure to Adapt to Climate Transition Risks

Power Corporation faces significant threats if it fails to adequately address climate transition risks. Despite ongoing sustainability initiatives, a failure to comprehensively mitigate exposure to fossil fuel assets across its diverse holdings could lead to substantial reputational damage. For instance, as of early 2024, many large corporations are facing increased scrutiny on their Scope 3 emissions, which Power Corporation's diverse portfolio would encompass.

Furthermore, not meeting evolving stakeholder expectations regarding climate action and transparent reporting could result in divestment pressures from institutional investors. This is particularly relevant given the growing trend of ESG (Environmental, Social, and Governance) investing; in 2024, global sustainable investment assets were projected to reach trillions, with a significant portion actively avoiding fossil fuel-heavy portfolios.

This inability to adapt could also directly impact Power Corporation's ability to attract capital from these ESG-focused investors. Failure to demonstrate a robust transition strategy might limit access to a crucial and growing pool of capital, potentially increasing the cost of financing for the company.

Potential regulatory penalties are another looming threat. Governments worldwide are strengthening climate-related regulations, and non-compliance or insufficient action could result in fines and stricter operational requirements. For example, new disclosure mandates for climate-related financial risks are becoming more common across major economies.

Power Corporation faces intense competition from established financial institutions and emerging fintech firms, potentially eroding market share and profitability. Evolving regulatory landscapes, including new capital requirements and consumer protection laws, could increase operational costs and restrict business activities. Economic slowdowns and market volatility also threaten investment valuations and asset management performance.

Cybersecurity threats represent a significant risk, with potential for substantial financial losses, reputational damage, and operational disruption. Failure to adequately address climate transition risks and meet stakeholder ESG expectations could lead to divestment pressures and limited access to capital. Regulatory penalties for non-compliance with climate-related financial regulations are also a concern.

SWOT Analysis Data Sources

This analysis draws from a comprehensive blend of data, including Power Corporation of Canada's official financial filings, detailed market research reports, and insights from industry experts to provide a robust strategic overview.