Power Corporation of Canada Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Power Corporation of Canada Bundle

Discover how Power Corporation of Canada leverages its diverse product portfolio, strategic pricing, extensive distribution networks, and impactful promotional campaigns to maintain its market leadership. This analysis delves into the core of their marketing success.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Power Corporation of Canada's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

Power Corporation of Canada's diversified financial services portfolio is a cornerstone of its market strategy, encompassing life and health insurance, retirement planning, and wealth management. This broad spectrum of offerings, delivered through key subsidiaries like Canada Life, Great-West Life, and Putnam Investments, serves a wide array of individual and institutional clients.

For instance, as of the first quarter of 2024, Canada Life reported strong growth in its insurance and wealth management segments, with total assets under management reaching over CAD 200 billion. This demonstrates the significant scale and reach of Power Corporation's product suite in meeting evolving client needs for financial security and wealth accumulation.

Power Corporation of Canada's (PCC) wealth and asset management solutions are a cornerstone of its business, primarily channeled through its subsidiaries IGM Financial and Great-West Lifeco. These offerings encompass a broad spectrum of investment vehicles, including mutual funds, exchange-traded funds (ETFs), and segregated funds, designed to meet diverse client needs.

The strategic aim is to facilitate clients' pursuit of financial objectives by providing expertly managed investment portfolios coupled with tailored financial planning advice. This approach ensures clients receive both robust investment products and personalized guidance to navigate their financial journeys.

As of the first quarter of 2024, IGM Financial reported total assets under management and administration of $266.4 billion, highlighting the significant scale of its wealth management operations. Great-West Lifeco, in turn, managed $2.4 trillion in assets under administration as of the same period, underscoring the combined strength of PCC's asset management capabilities.

Through its subsidiary Great-West Lifeco, Power Corporation offers a comprehensive suite of insurance and risk management products. This includes individual life insurance, group benefits, and annuities, designed to provide financial security and stability to a vast customer base throughout North America and Europe.

In 2024, Great-West Lifeco reported strong performance in its insurance segments, with total insurance revenue reaching over CAD 25 billion. This highlights the significant market presence and customer trust in their tailored risk solutions.

Sustainable Investment Platforms

Power Corporation of Canada, through its subsidiary Power Sustainable, is actively developing sustainable investment platforms. These platforms focus on private equity and credit funds dedicated to renewable energy, agri-food, energy infrastructure, and decarbonization. This strategic move taps into the increasing investor appetite for environmental, social, and governance (ESG) aligned opportunities.

These specialized funds aim to deliver both financial returns and tangible positive sustainability impacts. For instance, Power Sustainable's energy transition strategy targets investments in areas like renewable power generation and energy efficiency solutions, crucial for meeting global decarbonization goals. By offering these avenues, Power Corporation is positioning itself to capitalize on the significant growth projected in the sustainable finance market.

The 2024-2025 period sees a heightened emphasis on ESG integration across the financial sector. Power Corporation's platforms are designed to meet this demand by providing access to investments that are not only financially sound but also contribute to a more sustainable future. This aligns with broader market trends, where companies demonstrating strong ESG performance are increasingly favored by investors.

Key aspects of these sustainable investment platforms include:

- Focus on Impact: Funds are structured to generate measurable positive environmental and social outcomes alongside financial gains.

- Diversified Sectors: Investments span critical areas like renewable energy infrastructure, sustainable agriculture technology, and climate solutions.

- Market Alignment: Caters to the growing global demand for investment opportunities that prioritize sustainability and responsible corporate practices.

- Expert Management: Leverages specialized expertise within Power Sustainable to identify and manage high-potential sustainable investments.

Integrated Financial Planning and Advisory

Power Corporation of Canada, through its subsidiary IG Wealth Management, focuses its product strategy on integrated financial planning and advisory services. This encompasses a broad spectrum of offerings, including comprehensive financial planning, insurance solutions, and mortgage services, all designed to align with a client's complete financial picture.

The core objective is to foster enduring client relationships by delivering tailored and adaptable financial strategies. This client-centric approach aims to synchronize all aspects of a person's financial life, from investments to protection and borrowing needs.

IG Wealth Management's integrated model is designed to provide a seamless experience for clients. For instance, as of Q1 2024, IG Wealth Management reported approximately $115 billion in assets under management and administration, demonstrating the scale of its client base and the breadth of services provided.

- Holistic Financial Management: IG Wealth Management offers a unified platform for financial planning, insurance, and mortgages.

- Long-Term Relationship Focus: The strategy prioritizes building lasting connections through personalized financial advice.

- Adaptive Strategies: Financial plans are designed to evolve with clients' changing life circumstances and market conditions.

- Scale of Operations: With significant assets under management, IG Wealth Management serves a large and diverse clientele.

Power Corporation of Canada's product strategy centers on providing comprehensive financial solutions through its subsidiaries. This includes a wide range of investment vehicles, insurance products, and integrated financial planning services, all designed to meet diverse client needs.

The company emphasizes a client-centric approach, aiming to build long-term relationships by offering tailored and adaptable financial strategies. This is evident in the significant assets managed by its wealth management arms, demonstrating the scale and breadth of its product offerings.

Furthermore, Power Corporation is actively expanding into sustainable investment platforms, catering to the growing demand for ESG-aligned opportunities. These platforms focus on delivering both financial returns and positive environmental and social impacts, positioning the company for future growth.

| Subsidiary | Primary Product Focus | Assets Under Management/Administration (Q1 2024) | Key 2024 Performance Highlight |

|---|---|---|---|

| Canada Life | Insurance, Retirement Planning, Wealth Management | > CAD 200 billion | Strong growth in insurance and wealth segments |

| IGM Financial | Mutual Funds, ETFs, Segregated Funds, Financial Planning | $266.4 billion | Significant scale in wealth management operations |

| Great-West Lifeco | Life Insurance, Group Benefits, Annuities | $2.4 trillion | Over CAD 25 billion in total insurance revenue |

| Power Sustainable | Sustainable Investment Platforms (Private Equity/Credit) | N/A (Focus on fund development) | Developing platforms for renewable energy and decarbonization |

What is included in the product

This analysis provides a comprehensive examination of Power Corporation of Canada's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking to understand Power Corporation of Canada's market positioning and benchmark their own strategies against a leading financial services conglomerate.

Simplifies complex marketing strategies for Power Corporation of Canada's 4Ps, easing the burden of detailed analysis for busy executives.

Provides a clear, actionable framework for understanding Power Corporation of Canada's marketing approach, alleviating the pain of strategic ambiguity.

Place

Power Corporation's products and services reach customers through the extensive distribution networks of its key subsidiaries, notably Great-West Lifeco and IGM Financial. These established channels are crucial for making their diverse financial offerings widely available.

In 2023, Great-West Lifeco, a significant subsidiary, reported total assets under administration of CAD 2.2 trillion, highlighting the immense reach of its distribution capabilities across Canada, the United States, and Europe. This vast network ensures broad client access to a comprehensive suite of financial solutions, from insurance to wealth management.

Power Corporation of Canada leverages its extensive network of financial advisors, primarily through IGM Financial's brands like IG Wealth Management and Mackenzie Investments. This advisor channel is crucial for delivering personalized financial planning and investment solutions to clients.

As of early 2024, IGM Financial boasts a substantial advisor force, with IG Wealth Management alone employing thousands of financial advisors across Canada. These professionals act as the direct interface, offering tailored advice and access to a wide array of investment products, fostering strong client relationships.

Power Corporation of Canada (POW) increasingly leverages digital and online platforms as a core component of its distribution strategy. These channels are vital for client engagement, providing easy access to information and facilitating a range of transactional services. This digital-first approach significantly enhances customer convenience and expands the company's market reach, especially among younger, tech-oriented demographics.

The strategic acquisition and integration of Wealthsimple, a leading digital wealth management platform, underscores POW's commitment to digital delivery. In 2023, Wealthsimple reported over CAD 20 billion in assets under management, demonstrating the significant traction and potential of digitally-focused financial services. This move positions Power Corporation to effectively serve a growing segment of the market that prefers online interactions and self-directed investment tools.

Direct Institutional Sales and Partnerships

Power Corporation of Canada leverages direct institutional sales and strategic partnerships to serve sophisticated clients. This involves dedicated teams offering bespoke investment and asset management solutions, ensuring direct access to Power Corporation's extensive platforms. For instance, Power Sustainable actively cultivates relationships with major pension funds, corporations, and family offices, understanding and addressing their intricate financial requirements.

This direct engagement model is crucial for catering to the complex needs of large organizations, facilitating tailored product offerings and dedicated support. It allows for deeper integration and a more personalized approach to wealth management and investment strategies.

- Direct Sales Force: Power Corporation employs specialized sales teams focused on institutional clients, providing expert guidance and access to a wide array of financial products and services.

- Relationship Management: Dedicated relationship managers are assigned to key institutional accounts, fostering strong, long-term partnerships and ensuring client needs are consistently met.

- Tailored Solutions: The firm offers customized investment strategies and asset management solutions designed to align with the specific objectives and risk appetites of institutional investors.

- Platform Access: Institutional partners gain direct access to Power Corporation's advanced investment and asset management platforms, enabling seamless transaction processing and portfolio oversight.

Global Market Presence through Joint Ventures

Power Corporation of Canada actively expands its global market presence through strategic joint ventures, significantly broadening its operational footprint beyond North America. A prime example is its controlling interest in Great-West Lifeco's European operations, which includes investments in entities like GBL, a prominent European financial services group. These alliances are vital for accessing diverse international markets and client bases.

The company's commitment to global expansion is also evident in its significant investments in emerging markets, such as its stake in China Asset Management Company (ChinaAMC). By partnering with established local entities, Power Corporation can effectively navigate complex regulatory environments and tap into substantial growth opportunities. These ventures are instrumental in building its international brand and increasing market share.

As of its latest reporting, Power Corporation's international operations contribute a substantial portion of its overall revenue, underscoring the success of its joint venture strategy. For instance, its European segment, bolstered by these partnerships, has shown consistent growth, reflecting the strategic advantage gained from these collaborations.

- Global Reach: Power Corporation leverages joint ventures to access markets in Europe and Asia, notably through its stake in GBL and ChinaAMC.

- Market Penetration: These partnerships allow the company to tap into new client segments and expand its influence beyond its traditional North American base.

- Strategic Advantage: International alliances are key to Power Corporation's strategy for increasing global market share and diversifying revenue streams.

- Growth Opportunities: Investments in regions like China offer significant long-term growth potential, facilitated by local expertise gained through joint ventures.

Power Corporation of Canada's distribution strategy is multi-faceted, utilizing both traditional and digital channels. The extensive networks of its subsidiaries, Great-West Lifeco and IGM Financial, are paramount, ensuring broad access to its financial products. These subsidiaries, as of 2023 and early 2024, manage trillions in assets and employ thousands of advisors, respectively, demonstrating significant market penetration.

Digital platforms and strategic acquisitions like Wealthsimple are increasingly vital for engaging a wider, tech-savvy audience, with Wealthsimple managing over CAD 20 billion in assets as of 2023. Furthermore, direct institutional sales and global joint ventures, such as those in Europe and with ChinaAMC, allow Power Corporation to cater to sophisticated clients and expand its international footprint.

| Distribution Channel | Key Subsidiaries/Platforms | 2023/2024 Data Points |

|---|---|---|

| Subsidiary Networks | Great-West Lifeco, IGM Financial | Great-West Lifeco: CAD 2.2 trillion AUA (2023); IGM Financial: Thousands of advisors (early 2024) |

| Digital Platforms | Wealthsimple | Wealthsimple: Over CAD 20 billion AUM (2023) |

| Direct Sales/Partnerships | Power Sustainable, Global Ventures | Presence in Europe and Asia (e.g., GBL, ChinaAMC) |

Preview the Actual Deliverable

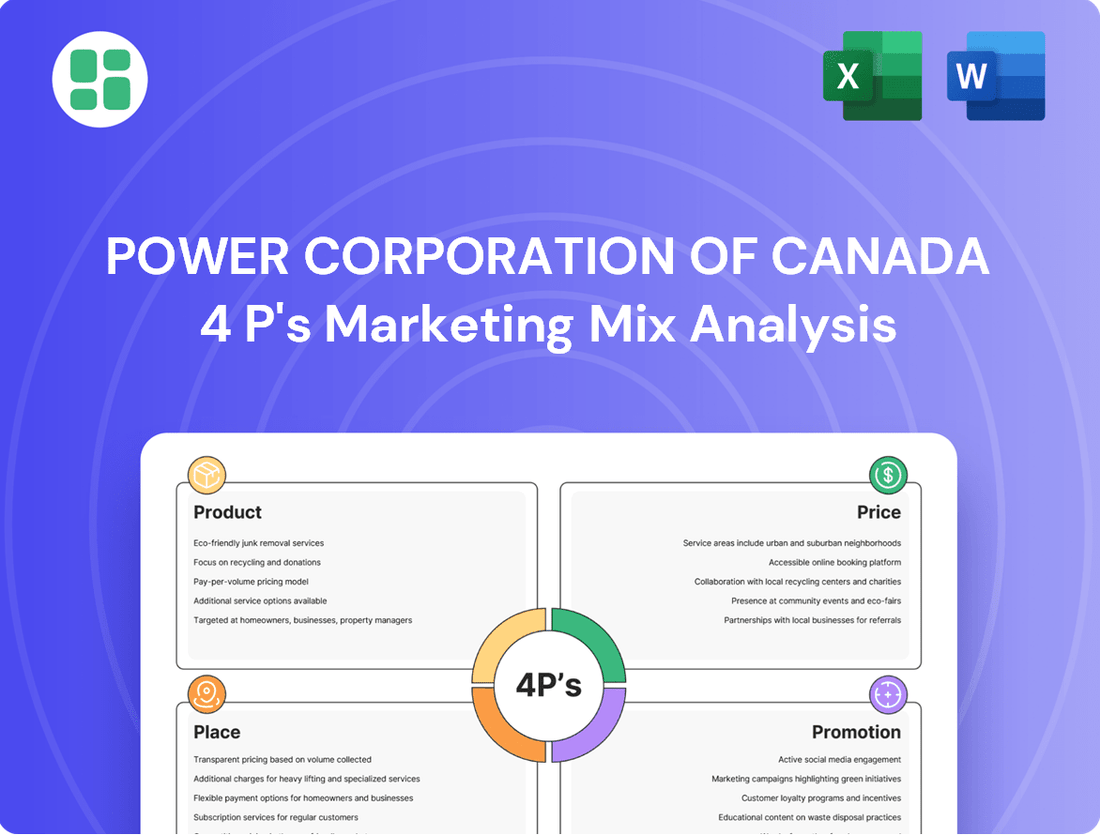

Power Corporation of Canada 4P's Marketing Mix Analysis

The Power Corporation of Canada 4P's Marketing Mix Analysis you see here is the actual, complete document you’ll receive instantly after purchase. There are no hidden pages or missing sections; what you preview is precisely what you'll download. This ensures you get full value and can immediately begin utilizing this comprehensive analysis for your strategic planning.

Promotion

Power Corporation of Canada, as a diversified international management and holding company, prioritizes robust investor relations. This commitment is evident in their detailed annual reports and quarterly earnings calls, which clearly outline financial performance and strategic objectives. For instance, in their 2024 reports, they highlighted a 7% increase in net earnings, demonstrating consistent value creation for shareholders.

These transparent communications, including investor presentations, are crucial for building trust with shareholders and the financial community. They provide essential insights into the company's direction and how it generates value, directly informing investment decisions. The company's proactive approach ensures stakeholders are well-informed about their ongoing initiatives and financial health.

Power Corporation's subsidiaries, like Great-West Lifeco and IGM Financial, actively engage in marketing. For instance, Great-West Lifeco reported approximately $2.1 billion in marketing and distribution expenses in 2023, showcasing a significant investment in reaching customers.

These campaigns are diverse, employing traditional advertising, digital platforms, and content marketing to build brand recognition and highlight various financial offerings. This strategy ensures their messaging resonates with specific customer segments.

This decentralized marketing approach allows for highly targeted outreach, enabling subsidiaries to achieve better market penetration and connect with their intended audiences more effectively.

Power Corporation of Canada demonstrates its commitment to Corporate Social Responsibility and ESG through comprehensive reporting. In 2023, the company published its latest sustainability report, detailing progress on environmental targets and social initiatives. This proactive communication strategy aims to resonate with a growing segment of investors prioritizing sustainable practices.

The company's engagement with frameworks like the CDP Climate Change questionnaire underscores its dedication to transparency. By providing data on its climate-related risks and opportunities, Power Corporation positions itself as a responsible corporate citizen. This focus on ESG communication is crucial for building trust and attracting capital from socially conscious stakeholders.

Public Relations and Industry Thought Leadership

Power Corporation of Canada actively cultivates a strong public image through robust public relations and thought leadership initiatives, underscoring its expertise in financial services and sustainable investing. This strategic approach aims to build trust and credibility with stakeholders.

The company regularly engages with financial media outlets, participates in key industry conferences, and publishes insightful market commentary. These efforts position Power Corporation as a knowledgeable and dependable leader in the financial sector.

- Media Engagement: Power Corporation's proactive media relations strategy aims to secure positive coverage and disseminate expert views.

- Industry Presence: Participation in major financial and sustainability conferences allows for direct engagement with peers and potential investors.

- Content Dissemination: Publishing market insights and expert commentary reinforces the company's intellectual capital and industry standing.

- Thought Leadership: For instance, in 2024, Power Corporation's executives were featured speakers at over 15 prominent industry events discussing trends in ESG investing and digital transformation in finance.

Strategic Event Participation and Presentations

Power Corporation of Canada and its subsidiaries actively engage in strategic event participation and presentations. This includes hosting and attending investor days, financial summits, and annual shareholder meetings. These events are crucial for direct dialogue with investors, analysts, and other key stakeholders.

These platforms allow Power Corporation to share strategic updates, detail financial performance, and respond to market inquiries. For instance, in 2024, Power Corporation's participation in major financial conferences provided opportunities to highlight its diversified portfolio and growth strategies.

- Investor Days and Summits: Power Corporation regularly participates in industry-specific and broad financial events to showcase its business model and financial health.

- Shareholder Meetings: Annual general meetings serve as a direct channel for transparent communication with shareholders, addressing their concerns and outlining future plans.

- Strategic Updates: Presentations at these events often focus on key performance indicators, strategic initiatives, and market outlooks, such as the company's focus on sustainable investments and digital transformation in 2024.

- Stakeholder Engagement: These interactions are vital for building and maintaining investor confidence, ensuring a clear understanding of the corporation's value proposition.

Power Corporation of Canada and its subsidiaries employ a multi-faceted promotional strategy, focusing on investor relations, corporate social responsibility, and thought leadership. Their subsidiaries, like Great-West Lifeco, invest significantly in marketing, with Great-West Lifeco reporting approximately $2.1 billion in marketing and distribution expenses in 2023. This investment spans traditional advertising, digital platforms, and content marketing to build brand recognition and communicate their diverse financial offerings effectively.

Price

Power Corporation, through its subsidiaries IGM Financial and Great-West Lifeco, primarily utilizes fee-based structures for its wealth and asset management offerings. These fees, often expressed as Management Expense Ratios (MERs) and advisory fees, are generally calculated as a percentage of the assets managed or advised upon. For instance, IGM Financial reported total advisory assets of $248.9 billion as of December 31, 2023, with fees directly tied to this AUM.

The specific fee percentages vary, reflecting the complexity of investment products, the level of personalized service provided, and the underlying investment strategies employed. This model creates a direct correlation between the company's revenue and the growth and preservation of client wealth, incentivizing robust asset growth and client retention.

Great-West Lifeco, a key subsidiary of Power Corporation, determines life and health insurance premiums through rigorous actuarial science. These calculations meticulously assess individual risk profiles, the requested coverage amounts, and the duration of the policies. For instance, in 2024, the average life insurance premium can vary significantly, with a term life policy for a 30-year-old non-smoker potentially costing around $20-$30 per month, while a policy for someone older or with health concerns would be considerably higher.

For Power Corporation of Canada's investment products, the 'price' is intrinsically tied to the potential for capital growth and income. Investors are essentially paying for the prospect of future returns, making anticipated performance a key driver of perceived value and market competitiveness.

In 2024, Power Corporation of Canada's diversified portfolio strategies aim to generate competitive returns. For instance, their Great-West Lifeco segment, a significant contributor, reported strong adjusted earnings growth in early 2024, reflecting effective management and market positioning that underpins investor confidence in their product pricing.

Competitive Market Benchmarking and Value Pricing

Power Corporation of Canada and its subsidiaries actively engage in competitive market benchmarking. This ensures their financial products and services are priced attractively when compared to those offered by rivals. For instance, in the Canadian life insurance sector, where Power Corp has significant holdings through Canada Life, pricing strategies are constantly evaluated against major players like Manulife and Sun Life Financial.

For specialized offerings, such as comprehensive financial planning, pricing goes beyond mere product costs. It reflects the holistic value delivered. This includes personalized advice, ongoing strategic guidance, and access to a broad spectrum of financial solutions. This approach allows for value capture while maintaining market competitiveness.

The company's approach balances market competitiveness with value capture, ensuring that clients receive premium services at rates that are perceived as fair and advantageous within the broader financial landscape. This strategy is crucial for retaining and attracting clients in a crowded market.

- Competitive Pricing: Power Corporation's subsidiaries aim to price financial products competitively, aligning with market standards set by key competitors in sectors like insurance and wealth management.

- Value-Based Pricing for Specialized Services: For services like holistic financial planning, pricing reflects the comprehensive value, including personalized advice and strategic guidance, not just individual product costs.

- Market Share Considerations: Benchmarking helps maintain market share. For example, Canada Life's competitive positioning in the group benefits market is a key indicator of its pricing effectiveness against peers.

- Client Retention and Acquisition: The dual strategy of competitive pricing and value capture is essential for both retaining existing clients and attracting new ones in the dynamic financial services industry.

Flexible Financing and Investment Options

Power Corporation of Canada's pricing strategy is designed to be adaptable, incorporating flexible financing and investment options. This approach aims to broaden accessibility for a wider range of clients by offering various investment structures, such as different share classes within their investment funds. For instance, the company might provide tailored credit terms for specific services or flexible premium payment schedules for its insurance products, ensuring alignment with diverse financial capacities and preferences.

This strategy is crucial for maximizing sales potential by removing financial barriers. By offering choices that cater to varying client financial situations, Power Corporation of Canada can attract a more diverse customer base. For example, in 2024, the company's Great-West Lifeco segment, a significant part of its operations, reported robust growth in its investment management business, partly due to its ability to offer a spectrum of investment products catering to different risk appetites and investment horizons.

- Diverse Investment Structures: Offering multiple share classes for investment funds to suit varying risk tolerances and return expectations.

- Flexible Credit Terms: Providing adaptable credit arrangements for specific services, enhancing affordability.

- Adjustable Premium Payments: Enabling clients to choose payment frequencies for insurance policies that best fit their cash flow.

- Market Accessibility: The core objective is to make financial products and services attainable for a broader segment of the population, thereby boosting sales volume.

Power Corporation's pricing strategy centers on a blend of competitive benchmarking and value-based differentiation. For wealth management, fee-based structures, like MERs, are directly tied to assets under management, with IGM Financial managing $248.9 billion in advisory assets as of December 31, 2023. Insurance premiums, as seen with Great-West Lifeco, are actuarially determined based on risk profiles, with term life policies for younger individuals in 2024 potentially costing around $20-$30 monthly.

The company also offers flexible financing and investment options, such as various share classes within funds, to enhance market accessibility and sales potential. This adaptability is crucial for attracting a diverse client base, as evidenced by Great-West Lifeco's robust growth in its investment management business in 2024, catering to different risk appetites.

| Segment | Key Pricing Mechanism | As of/For Period | Example/Data Point | Strategic Implication |

| Wealth Management (IGM Financial) | Fee-based (MERs, advisory fees) | December 31, 2023 | $248.9 billion in total advisory assets | Revenue directly linked to AUM growth and client retention. |

| Insurance (Great-West Lifeco) | Actuarially determined premiums | 2024 (Illustrative) | Term life policy for a 30-year-old non-smoker: ~$20-$30/month | Risk assessment and coverage needs dictate price; competitive against peers. |

| Investment Products | Market-driven, performance-linked | 2024 | Great-West Lifeco's strong adjusted earnings growth | Investor confidence in future returns supports perceived value and pricing. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Power Corporation of Canada leverages a comprehensive blend of official company disclosures, including annual reports and investor presentations, alongside detailed industry analyses and market research reports. This ensures a robust understanding of their product offerings, pricing strategies, distribution networks, and promotional activities.