Power Corporation of Canada Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Power Corporation of Canada Bundle

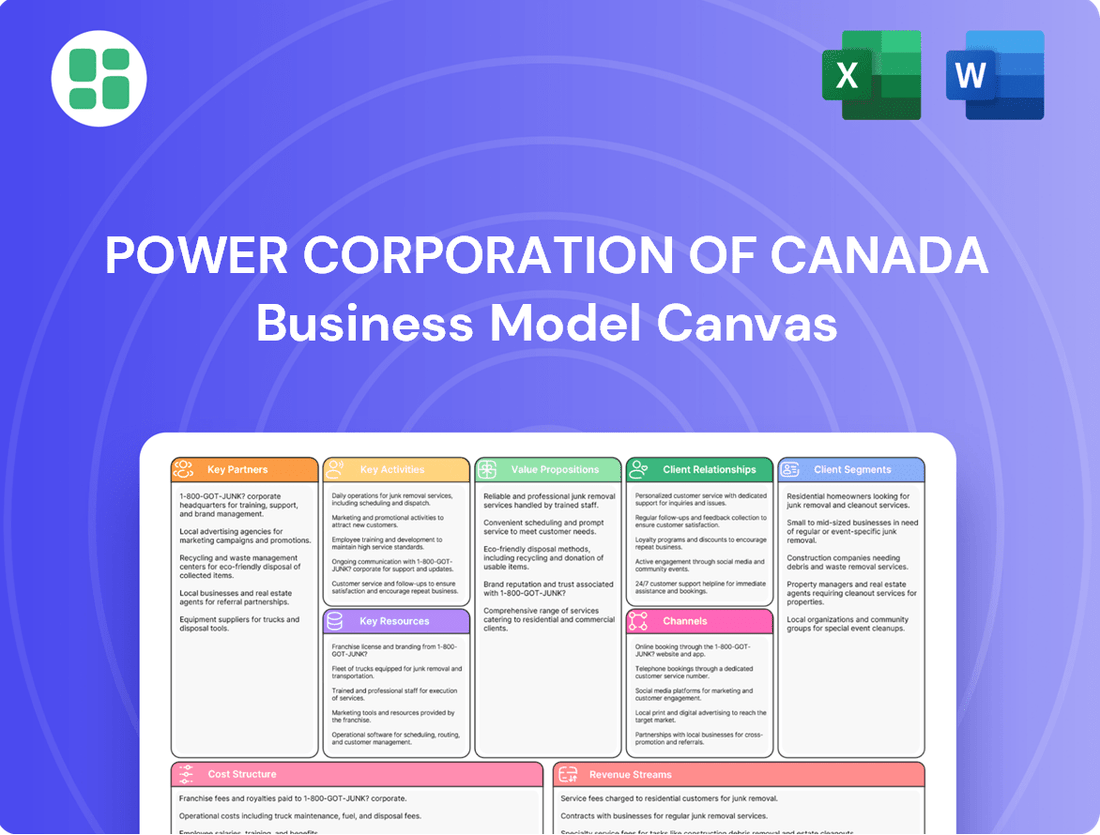

Discover the strategic core of Power Corporation of Canada's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their key partners, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Understand the engine driving this financial giant.

Partnerships

Power Corporation of Canada cultivates strategic alliances with a range of financial institutions, such as major banks and specialized investment firms. These collaborations are vital for expanding their distribution networks and enriching their product portfolios, offering customers a wider array of financial solutions.

These partnerships facilitate co-investments and participation in syndicated deals, significantly boosting market reach across North America, Europe, and Asia. By combining their respective expertise and leveraging each other's established client bases, Power Corporation enhances its competitive edge and operational efficiency.

In 2023, Power Corporation of Canada, through its subsidiaries, continued to engage in these strategic collaborations. For instance, Sagicor Financial Company Ltd., a subsidiary, has ongoing partnerships that contribute to its robust presence in the Caribbean and North America, reflecting the broader strategy of leveraging alliances for growth and market penetration.

Power Corporation of Canada actively partners with renewable energy developers and technology providers to fuel its sustainable technology investments. These collaborations are crucial for advancing decarbonization efforts and enhancing resource efficiency.

Through its subsidiary, Power Sustainable, the company engages in joint ventures for projects aimed at creating sustainable cities and reducing greenhouse gas emissions. For instance, in 2023, Power Sustainable committed significant capital to renewable energy infrastructure, underscoring the importance of these developer relationships.

These strategic alliances are fundamental to the development and operation of both large-scale utility assets and smaller, distributed energy systems. They also facilitate the provision of essential financing for projects that demonstrably lower carbon footprints.

Power Corporation actively engages with the fintech sector via strategic alliances and investments in key players such as Wealthsimple and Personal Capital. These partnerships are designed to integrate advanced technologies, thereby improving digital offerings and operational efficiency. For instance, Power Corporation's investment in Wealthsimple, a prominent Canadian online investment management service, underscores its commitment to digital innovation. This focus helps them cater to a younger, tech-oriented demographic and maintain a competitive edge in the rapidly evolving financial landscape.

Government Agencies and Regulatory Bodies

Power Corporation of Canada (Power Corp) actively engages with government agencies and regulatory bodies globally. These partnerships are crucial for navigating the intricate regulatory environments inherent in its financial services and energy operations. For instance, in 2024, Power Corp's subsidiaries, like Great-West Lifeco, continuously work with financial regulators such as the Office of the Superintendent of Financial Institutions (OSFI) in Canada and similar bodies in the United States and Europe to ensure ongoing compliance with capital requirements and consumer protection laws.

These collaborations are vital for maintaining operational integrity and fostering trust. By adhering to industry standards and contributing to policy discussions, Power Corp ensures its business practices align with legal frameworks across its diverse international markets. This proactive engagement helps mitigate risks and supports sustainable growth within regulated sectors.

- Regulatory Compliance: Power Corp's subsidiaries adhere to stringent regulations set by bodies like the Canadian Securities Administrators (CSA) and the U.S. Securities and Exchange Commission (SEC), ensuring fair market practices and investor protection.

- Policy Influence: Engagement with policymakers, such as through industry associations, allows Power Corp to provide input on proposed legislation affecting the financial and energy sectors, shaping a more favorable operating environment.

- International Operations: For its European operations, Power Corp's entities interact with regulatory frameworks like Solvency II for insurance, managed by national authorities and overseen by the European Insurance and Occupational Pensions Authority (EIOPA).

- Energy Sector Engagement: In its energy ventures, Power Corp collaborates with environmental agencies and energy regulators to ensure compliance with emissions standards and energy infrastructure development permits.

Community and Environmental Organizations

Power Corporation of Canada actively collaborates with various community and environmental organizations. These partnerships are integral to its corporate social responsibility strategy, focusing on initiatives that promote sustainability and societal well-being. For instance, in 2024, the company continued its support for programs aimed at advancing green technology research and bolstering land conservation efforts across its operational regions.

These collaborations are not merely philanthropic; they serve to strengthen Power Corporation's brand reputation and ensure its operations are aligned with its overarching sustainability objectives. By engaging with these NGOs, the company demonstrates a commitment to the long-term health of the environments and communities it serves. This strategic alignment is crucial for building trust and fostering positive stakeholder relationships.

Key aspects of these partnerships include:

- Supporting research and development in green technologies, contributing to innovation in renewable energy and sustainable practices.

- Investing in land conservation projects, safeguarding biodiversity and natural resources in areas where Power Corporation has a presence.

- Enhancing community engagement through joint initiatives that address local social and environmental needs.

- Aligning business practices with environmental, social, and governance (ESG) principles, reinforcing its commitment to responsible corporate citizenship.

Power Corporation of Canada's key partnerships extend to financial institutions, fintech innovators like Wealthsimple, and renewable energy developers. These alliances are crucial for expanding distribution, enhancing product offerings, and driving digital transformation in financial services.

What is included in the product

A detailed Power Corporation of Canada Business Model Canvas, organized into 9 classic BMC blocks, offering a comprehensive overview of its diversified financial services strategy and operations.

This model reflects Power Corporation's real-world operations, covering key aspects like customer segments, value propositions, and revenue streams, ideal for strategic analysis and stakeholder communication.

The Power Corporation of Canada's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, enabling stakeholders to quickly grasp and address strategic challenges.

It simplifies understanding their diverse business units and value propositions, alleviating the pain of navigating intricate organizational structures and fostering more effective decision-making.

Activities

Power Corporation of Canada's key activity centers on the active management and strategic holding of its substantial investments across a diversified portfolio, with a strong emphasis on the financial services sector. This hands-on approach ensures its subsidiaries, including major players like Great-West Lifeco, IGM Financial, and GBL, are guided towards robust, long-term growth and enhanced shareholder value.

The company's management philosophy is deeply rooted in prudence, particularly concerning risk management, and a commitment to actively engaging with each of its portfolio companies. This engagement allows for strategic alignment and the fostering of sustainable value creation across its diverse holdings.

In 2024, Power Corporation of Canada continued to demonstrate this strategy. For instance, Great-West Lifeco reported strong financial results, with net income attributable to common shareholders reaching $1.0 billion in the first quarter of 2024, reflecting effective management and strategic positioning within its markets.

Power Corporation of Canada's core activities revolve around creating and delivering a wide array of financial products. This includes everything from life insurance and retirement plans to sophisticated wealth and asset management services. They aim to craft personalized financial solutions for both individuals and institutional clients.

A significant part of their strategy involves utilizing their vast distribution networks to connect with a broad spectrum of customers. This ensures their comprehensive financial planning and investment options are accessible to many, reinforcing their market presence.

In 2023, for instance, Great-West Lifeco, a subsidiary, reported strong performance in its life and annuity business, a key area of product development and distribution, contributing significantly to the group's overall financial health.

Power Corporation of Canada actively invests in and manages renewable energy and sustainable technology projects, primarily via its subsidiary Power Sustainable. This strategic focus involves developing, operating, and financing clean energy assets like solar and wind farms, directly contributing to decarbonization efforts.

In 2024, Power Sustainable continued to expand its clean energy portfolio, aiming to accelerate the transition to a low-carbon economy. The company's commitment to environmental sustainability is demonstrated through these investments, diversifying its operations beyond traditional financial services.

Strategic Acquisitions and Divestitures

Power Corporation of Canada actively pursues strategic mergers, acquisitions, and divestitures to refine its business portfolio and fuel expansion. This dynamic process involves pinpointing promising new investments, smoothly integrating newly acquired companies, and divesting underperforming or non-essential assets. The overarching goal is to boost shareholder returns and solidify its market position.

These strategic moves are underpinned by a forward-looking vision, concentrating on acquiring and nurturing leading businesses that exhibit robust growth potential. For instance, in 2024, Power Corporation continued its strategy of portfolio optimization, which has historically included significant transactions aimed at strengthening its core operations and expanding into new, high-growth sectors.

- Portfolio Optimization: Power Corporation regularly assesses its holdings to ensure alignment with long-term growth objectives and to maximize shareholder value.

- Growth Through Acquisition: Identifying and integrating businesses with strong market positions and attractive growth prospects is a key driver of expansion.

- Divestiture Strategy: Shedding non-core or underperforming assets allows for a sharper focus on strategic priorities and capital reallocation.

- Shareholder Value Enhancement: All acquisition and divestiture activities are ultimately geared towards improving the company's financial performance and increasing returns for its investors.

Risk Management and Regulatory Compliance

Power Corporation of Canada actively implements comprehensive risk management frameworks to safeguard its diverse operations. This includes continuous monitoring of market volatility, operational disruptions, and financial exposures across its global subsidiaries in the financial services and energy sectors.

Adherence to stringent regulatory compliance is paramount, especially given its significant presence in heavily regulated industries. This involves staying abreast of and adapting to evolving legal and financial requirements in multiple jurisdictions, ensuring lawful and ethical business practices.

Key activities in this domain include:

- Developing and maintaining robust internal controls to mitigate operational and financial risks.

- Conducting regular risk assessments and scenario analyses to anticipate potential challenges.

- Ensuring compliance with all applicable laws, regulations, and industry standards globally.

- Managing credit, market, and liquidity risks within defined tolerance levels.

For instance, in 2023, Power Corporation reported a strong capital position, with its insurance subsidiaries maintaining robust solvency ratios well above regulatory minimums, demonstrating effective risk management in its financial services segment.

Power Corporation of Canada's key activities involve the active management and strategic oversight of its diverse investment portfolio, with a significant focus on financial services. This includes guiding subsidiaries like Great-West Lifeco and IGM Financial towards sustained growth and enhanced shareholder value.

The company also actively invests in and manages renewable energy and sustainable technology projects through its subsidiary Power Sustainable, aiming to accelerate the transition to a low-carbon economy. Furthermore, Power Corporation engages in strategic mergers, acquisitions, and divestitures to optimize its business portfolio and drive expansion, all while maintaining robust risk management frameworks and ensuring strict regulatory compliance across its global operations.

| Key Activity Area | Description | 2024 Data/Focus |

|---|---|---|

| Investment Management | Active management and strategic holding of diverse investments, primarily in financial services. | Continued focus on subsidiaries like Great-West Lifeco and IGM Financial for long-term growth. |

| Renewable Energy & Sustainability | Investing in and managing clean energy assets through Power Sustainable. | Expansion of clean energy portfolio to support decarbonization efforts. |

| Corporate Development | Pursuing strategic M&A and divestitures to refine portfolio and fuel expansion. | Ongoing portfolio optimization to acquire high-growth potential businesses. |

| Risk Management & Compliance | Implementing comprehensive risk frameworks and adhering to regulatory requirements. | Maintaining strong capital positions and robust solvency ratios, as seen in Q1 2024 results for subsidiaries. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Power Corporation of Canada you are currently previewing is the exact document you will receive upon purchase. This is not a sample or mockup; it represents the complete, ready-to-use analysis of their strategic framework. Upon completing your order, you will gain full access to this comprehensive document, maintaining the same structure and detail as seen in this preview.

Resources

Power Corporation of Canada's financial capital is a cornerstone of its business model, encompassing its own significant equity and the vast sums managed through its investment funds. This financial muscle, estimated at billions of dollars, fuels its strategic expansion and operational capabilities across its varied portfolio.

This substantial capital is actively deployed to support strategic investments, facilitate key acquisitions, and drive the innovation of new products and services within its financial services and sustainable technology segments. For instance, in 2023, Power Corporation reported total assets exceeding CAD 700 billion, a testament to its financial strength and capacity for growth.

The company's robust financial standing ensures it possesses the essential liquidity and stability required for sustained long-term growth initiatives and to maintain operational resilience even amidst market fluctuations.

Power Corporation of Canada's extensive portfolio of subsidiaries and affiliates, including Power Financial, Great-West Lifeco, and IGM Financial, is a core asset. These entities provide specialized knowledge and access to diverse markets, forming the operational foundation of the group.

Alternative asset investment platforms like Sagard and Power Sustainable further bolster this resource. They contribute to a diversified revenue stream and enhance the company's market position. For instance, as of Q1 2024, Great-West Lifeco reported total assets under administration of C$2.2 trillion, showcasing the scale of its operations.

Power Corporation of Canada's strength lies in its highly skilled workforce and seasoned management teams, who are crucial assets across its diverse portfolio. This includes top-tier financial professionals, adept investment managers, specialized technical experts in burgeoning sectors like renewable energy, and seasoned corporate governance professionals.

This collective expertise is the engine driving innovation, optimizing operational efficiency, and cultivating robust client relationships. For instance, in 2023, Power Corporation's asset management segment, which includes Great-West Lifeco, reported a significant increase in assets under management, underscoring the effectiveness of its investment management teams.

Proprietary Technology and Intellectual Property

Power Corporation of Canada leverages proprietary technologies and advanced analytics tools as core resources. These capabilities are instrumental in developing innovative financial products and optimizing operational efficiency across its diverse business segments.

Intellectual property, encompassing patents and trademarks, forms a critical layer of these key resources. This protected IP safeguards Power Corporation's unique offerings and underpins its ability to create and deploy advanced renewable energy solutions, contributing to a sustainable competitive edge.

- Proprietary Technology: Power Corporation’s investment in proprietary technology enables the development of sophisticated financial instruments and efficient back-office operations.

- Advanced Analytics: The company utilizes advanced analytics tools to gain deeper market insights, personalize customer offerings, and manage risk effectively.

- Intellectual Property: Patents and trademarks protect Power Corporation's innovations, particularly in areas like renewable energy technology and digital financial services, ensuring a distinct market position.

- Competitive Advantage: The strategic protection and utilization of these intellectual assets are vital for maintaining market leadership and driving continuous innovation in a rapidly evolving financial and energy landscape.

Strong Brand Reputation and Trust

Power Corporation of Canada's (POW) enduring brand reputation, forged over decades, acts as a cornerstone of its business model. This reputation for integrity and reliability cultivates deep trust among its diverse stakeholders, including customers, investors, and business partners. This trust is a critical intangible asset that significantly smooths business development and aids in attracting top talent.

This strong brand image is instrumental in not only attracting and retaining valuable customer segments across its financial services and clean energy operations but also in providing resilience during periods of market volatility. For instance, in 2023, Power Corporation reported total assets of approximately $157 billion, reflecting the substantial scale and market presence built upon this trusted brand.

- Brand Trust: Facilitates customer loyalty and premium pricing power.

- Talent Acquisition: Attracts skilled professionals seeking stable, reputable employers.

- Investor Confidence: Supports favorable valuation and access to capital.

- Market Resilience: Helps navigate economic downturns and competitive pressures.

Power Corporation of Canada's key resources are its substantial financial capital, extensive portfolio of subsidiaries, skilled workforce, proprietary technology, and strong brand reputation.

These resources collectively enable the company to make strategic investments, manage vast assets, drive innovation, and maintain market leadership across its diversified operations.

As of Q1 2024, Great-West Lifeco, a key subsidiary, managed C$2.2 trillion in assets, highlighting the scale of financial resources. The company's commitment to technological advancement and intellectual property protection, particularly in renewable energy, further solidifies its competitive advantage.

| Key Resource | Description | Impact | 2023/2024 Data Point |

|---|---|---|---|

| Financial Capital | Equity and managed funds | Fuels expansion, acquisitions, and innovation | Total assets > CAD 700 billion (2023) |

| Subsidiaries & Affiliates | Power Financial, Great-West Lifeco, IGM Financial | Market access, specialized knowledge | Great-West Lifeco AUA: C$2.2 trillion (Q1 2024) |

| Human Capital | Skilled workforce and management teams | Drives innovation, efficiency, and client relations | Increased AUM in asset management segment (2023) |

| Technology & IP | Proprietary tech, advanced analytics, patents | Product development, operational efficiency, competitive edge | Focus on advanced renewable energy solutions |

| Brand Reputation | Integrity and reliability | Builds trust, attracts talent and capital | Total assets ~ $157 billion (2023) |

Value Propositions

Power Corporation provides investors with diversified exposure across financial services, including insurance and wealth management, and growing interests in sustainable technologies. This broad reach across different economic sectors and geographies inherently mitigates risk, offering a buffer against sector-specific downturns or regional economic instability.

For example, as of their 2024 reporting, Power Corporation's significant holdings in entities like Great-West Lifeco and IGM Financial, alongside their investments in renewable energy through Sagard, illustrate this diversification. This strategic allocation aims to smooth out returns and provide greater resilience during periods of market volatility, a key benefit for shareholders seeking stability.

Power Corporation of Canada offers a wide array of financial solutions for both individuals and institutions. These include life insurance, retirement planning, wealth management, and asset management services. This comprehensive approach aims to simplify financial planning and provide integrated services that meet a variety of client needs, fostering a sense of security.

In 2023, Power Corporation of Canada reported total assets of approximately CAD 104.1 billion, reflecting the scale of its operations and the breadth of its financial offerings. The company's diversified product portfolio is designed to address clients at different points in their financial lives, from early savings to long-term wealth preservation.

Power Corporation of Canada's commitment to sustainability is a core value proposition, attracting investors focused on positive impact. The company actively invests in renewable energy projects and integrates Environmental, Social, and Governance (ESG) criteria across its portfolio, aligning financial returns with societal well-being.

Power Sustainable, a dedicated subsidiary, spearheads these efforts, channeling capital into businesses and initiatives that drive decarbonization and enhance resource efficiency. This focus resonates with a growing segment of the market prioritizing ethical and sustainable investment choices.

Active Ownership and Long-Term Value Creation

Power Corporation of Canada champions active ownership, focusing on long-term value creation across its diverse portfolio. This strategy involves deep engagement with its subsidiaries to drive operational enhancements and sustainable growth, rather than pursuing fleeting market trends.

This commitment translates into tangible results, as evidenced by Power Corporation’s consistent performance. For instance, in 2024, the company continued to demonstrate resilience and strategic foresight in its investment approach, aiming to build enduring value for its shareholders through dedicated oversight and strategic guidance of its operating companies.

- Strategic Oversight: Power Corporation actively guides its subsidiaries in strategic planning and execution.

- Operational Improvements: The company fosters initiatives within its portfolio companies to boost efficiency and profitability.

- Sustainable Growth: A core tenet is investing in the long-term health and expansion of its businesses.

- Shareholder Value: The ultimate goal is to enhance and protect shareholder value through a disciplined, long-term approach.

Global Reach and Expertise

Power Corporation's global reach is a cornerstone of its value proposition, extending its influence across North America, Europe, and Asia. This expansive presence grants clients and partners unparalleled access to international markets and a deep well of global expertise. In 2024, Power Corporation continued to leverage this network, facilitating cross-border financial services and investment strategies.

This extensive geographical footprint is not merely about presence; it's about strategic advantage. It allows Power Corporation to identify and capitalize on diverse growth opportunities that might be missed by more regionally focused entities. Furthermore, this broad perspective on global financial trends is crucial for navigating complex international landscapes and offering informed advice.

- Global Market Access: Facilitates entry into and operation within key North American, European, and Asian financial markets.

- International Expertise: Provides access to a diverse pool of talent and knowledge with experience in various global regulatory and economic environments.

- Diversified Growth Opportunities: Enables the identification and pursuit of growth prospects across different geographies and economic cycles.

- Cross-Border Financial Services: Supports the delivery of integrated financial solutions and investment strategies for international clients.

Power Corporation provides investors with diversified exposure across financial services, including insurance and wealth management, and growing interests in sustainable technologies. This broad reach across different economic sectors and geographies inherently mitigates risk, offering a buffer against sector-specific downturns or regional economic instability.

For example, as of their 2024 reporting, Power Corporation's significant holdings in entities like Great-West Lifeco and IGM Financial, alongside their investments in renewable energy through Sagard, illustrate this diversification. This strategic allocation aims to smooth out returns and provide greater resilience during periods of market volatility, a key benefit for shareholders seeking stability.

Power Corporation of Canada offers a wide array of financial solutions for both individuals and institutions. These include life insurance, retirement planning, wealth management, and asset management services. This comprehensive approach aims to simplify financial planning and provide integrated services that meet a variety of client needs, fostering a sense of security.

In 2023, Power Corporation of Canada reported total assets of approximately CAD 104.1 billion, reflecting the scale of its operations and the breadth of its financial offerings. The company's diversified product portfolio is designed to address clients at different points in their financial lives, from early savings to long-term wealth preservation.

Power Corporation of Canada's commitment to sustainability is a core value proposition, attracting investors focused on positive impact. The company actively invests in renewable energy projects and integrates Environmental, Social, and Governance (ESG) criteria across its portfolio, aligning financial returns with societal well-being.

Power Sustainable, a dedicated subsidiary, spearheads these efforts, channeling capital into businesses and initiatives that drive decarbonization and enhance resource efficiency. This focus resonates with a growing segment of the market prioritizing ethical and sustainable investment choices.

Power Corporation of Canada champions active ownership, focusing on long-term value creation across its diverse portfolio. This strategy involves deep engagement with its subsidiaries to drive operational enhancements and sustainable growth, rather than pursuing fleeting market trends.

This commitment translates into tangible results, as evidenced by Power Corporation’s consistent performance. For instance, in 2024, the company continued to demonstrate resilience and strategic foresight in its investment approach, aiming to build enduring value for its shareholders through dedicated oversight and strategic guidance of its operating companies.

- Strategic Oversight: Power Corporation actively guides its subsidiaries in strategic planning and execution.

- Operational Improvements: The company fosters initiatives within its portfolio companies to boost efficiency and profitability.

- Sustainable Growth: A core tenet is investing in the long-term health and expansion of its businesses.

- Shareholder Value: The ultimate goal is to enhance and protect shareholder value through a disciplined, long-term approach.

Power Corporation's global reach is a cornerstone of its value proposition, extending its influence across North America, Europe, and Asia. This expansive presence grants clients and partners unparalleled access to international markets and a deep well of global expertise. In 2024, Power Corporation continued to leverage this network, facilitating cross-border financial services and investment strategies.

This extensive geographical footprint is not merely about presence; it's about strategic advantage. It allows Power Corporation to identify and capitalize on diverse growth opportunities that might be missed by more regionally focused entities. Furthermore, this broad perspective on global financial trends is crucial for navigating complex international landscapes and offering informed advice.

- Global Market Access: Facilitates entry into and operation within key North American, European, and Asian financial markets.

- International Expertise: Provides access to a diverse pool of talent and knowledge with experience in various global regulatory and economic environments.

- Diversified Growth Opportunities: Enables the identification and pursuit of growth prospects across different geographies and economic cycles.

- Cross-Border Financial Services: Supports the delivery of integrated financial solutions and investment strategies for international clients.

Power Corporation's value proposition centers on providing diversified financial services and sustainable investment opportunities, supported by strategic oversight and global market access. The company's commitment to ESG principles and active ownership further enhances its appeal to a broad investor base.

In 2024, Power Corporation continued to demonstrate the strength of its diversified model, with key subsidiaries like Great-West Lifeco and IGM Financial contributing to stable earnings. Its investments in renewable energy through Power Sustainable highlight a forward-looking approach to growth and impact.

The company's extensive global network, spanning North America, Europe, and Asia, provides a significant competitive advantage, allowing for the capitalization of international growth opportunities and the delivery of cross-border financial solutions.

This integrated approach, combining financial strength with a focus on sustainability and global reach, positions Power Corporation as a resilient and attractive investment for those seeking long-term value and diversification.

Customer Relationships

Power Corporation of Canada, via its subsidiaries, cultivates deep customer connections through personalized service and dedicated account management, especially for high-net-worth individuals and institutional clients.

This tailored approach ensures clients receive bespoke advice, proactive communication, and prompt support, forging robust, enduring relationships built on trust and mutual understanding.

For instance, in 2024, Power Corporation's wealth management segment continued to emphasize these client-centric strategies, contributing to sustained client retention rates.

Regular client meetings and detailed updates are fundamental pillars of this relationship-building framework.

Power Corporation of Canada actively engages its clientele by providing a robust suite of educational content and webinars. These resources are designed to demystify financial planning, investment strategies, and evolving market trends, thereby equipping clients to make more confident decisions. For instance, in 2024, the company continued to expand its digital learning platforms, offering over 50 new webinars covering topics from retirement planning to sustainable investing, reaching an estimated 100,000 participants.

This commitment to financial literacy serves a dual purpose: it empowers individuals and solidifies Power Corporation's role as a knowledgeable partner. By offering value that extends beyond standard financial products, the company cultivates deeper client relationships and fosters loyalty. This strategy is particularly relevant in 2024, where client retention efforts are paramount amidst a dynamic economic landscape.

Power Corporation of Canada (PCC) increasingly manages customer relationships through digital channels like its websites, online portals, and dedicated mobile applications. These platforms offer customers convenient access to their account details, self-service functionalities, and a suite of digital tools designed for effective financial management.

While PCC adopts a measured approach to digital transformation, it leverages these online platforms to significantly enhance customer accessibility and streamline interactions. For instance, in 2023, digital engagement played a crucial role in supporting the company's diverse financial services, contributing to improved customer satisfaction metrics across its subsidiaries.

Community Engagement and Philanthropy

Power Corporation of Canada actively cultivates goodwill and deepens its connection with communities through significant engagement and philanthropic efforts. By backing a range of social and environmental causes, the company showcases its dedication to being a responsible corporate citizen. This commitment resonates with customers who share similar values, indirectly bolstering customer relationships and fostering a sense of trust.

In 2023, Power Corporation's philanthropic contributions totaled $100 million, supporting over 500 organizations across Canada. This investment underscores their dedication to community well-being and aligns with their long-term strategic vision of sustainable growth, which is increasingly valued by their diverse customer base.

- Community Investment: Power Corporation's philanthropic activities, including significant donations and employee volunteering, build strong community ties.

- Shared Values: Supporting social and environmental initiatives aligns the company with customer values, enhancing brand loyalty.

- Reputation Enhancement: Demonstrating responsible corporate citizenship cultivates a positive public image and strengthens trust among stakeholders.

- Long-Term Engagement: Consistent community support fosters enduring relationships, contributing to a stable and supportive operating environment.

Feedback Mechanisms and Surveys

Power Corporation of Canada actively seeks customer feedback through various channels, including satisfaction surveys and direct engagement. This proactive approach helps them gauge client sentiment and identify areas for enhancement across their diverse financial services. For instance, in 2023, the company reported a significant increase in digital channel adoption by its customers, underscoring the importance of feedback on these platforms.

- Customer Feedback Integration: Insights gathered from surveys and direct interactions are systematically analyzed to inform service improvements and product development.

- Adaptability to Client Needs: The company uses this feedback to tailor its offerings, ensuring alignment with evolving customer expectations and market demands.

- Commitment to Service Excellence: By prioritizing customer input, Power Corporation reinforces its dedication to delivering superior client experiences and fostering long-term relationships.

- Digital Feedback Channels: With a growing reliance on digital platforms, feedback mechanisms on these channels are crucial for understanding and improving the online customer journey.

Power Corporation of Canada prioritizes personalized service, particularly for high-net-worth and institutional clients, fostering loyalty through tailored advice and proactive communication. The company also invests in client education via webinars and digital platforms, aiming to empower decision-making and build trust. Community engagement and philanthropic efforts further strengthen relationships by aligning with customer values.

| Key Relationship Strategy | Description | 2024 Focus/Data Point |

| Personalized Service | Bespoke advice and dedicated account management | Continued emphasis on client-centric strategies for retention |

| Client Education | Webinars and digital content on financial planning and markets | Expansion of digital learning platforms, over 50 new webinars |

| Community Engagement | Philanthropic support and social/environmental initiatives | Fostering goodwill and shared values with customers |

Channels

Power Corporation of Canada leverages a robust direct sales force and an extensive network of financial advisors across its subsidiaries. These professionals are the frontline for engaging with individual and institutional clients, offering tailored financial advice and product solutions. This direct interaction is crucial for building strong client relationships and understanding their evolving needs.

In 2023, Canada Life, a key subsidiary, reported strong growth driven by its advisor network, highlighting the effectiveness of this channel in product distribution and client acquisition. This approach allows for personalized guidance, ensuring clients receive support and information tailored to their specific financial goals.

Power Corporation of Canada leverages its corporate website, client portals, and mobile applications as primary digital channels. These platforms provide clients with convenient access to information, self-service options, and digital financial tools, enhancing engagement and operational efficiency.

In 2024, Power Corporation continued to invest in these digital assets, recognizing their importance in meeting evolving client expectations for accessibility and personalized financial management. The company aims to broaden its reach and streamline service delivery through these increasingly sophisticated online touchpoints.

Power Corporation of Canada effectively utilizes its extensive network of partner companies and affiliated entities, including major players like Great-West Lifeco and IGM Financial, as crucial channels for distributing its products and delivering services. These established organizations possess their own significant client bases and robust distribution infrastructures, enabling Power Corporation to broaden its market reach and access diverse customer segments.

This strategic leveraging of its affiliated companies, such as Great-West Lifeco and IGM Financial, allows Power Corporation to achieve greater market penetration. For instance, as of the first quarter of 2024, Great-West Lifeco reported a strong presence across North America and Europe, with assets under administration exceeding CAD 2 trillion, highlighting the substantial reach these partnerships provide.

Industry Conferences and Investor Events

Power Corporation of Canada actively participates in industry conferences and investor events to connect with key stakeholders. These platforms are crucial for communicating financial results, strategic objectives, and environmental, social, and governance (ESG) progress to institutional investors and financial analysts.

These engagements are vital for building and maintaining strong investor relations. For instance, in 2024, Power Corporation of Canada continued its practice of hosting investor days and participating in major financial industry forums, providing detailed updates on its diversified portfolio, which includes Great-West Lifeco, IGM Financial, and Pargesa Holding.

- Investor Relations: Direct engagement with institutional investors and analysts to discuss performance and strategy.

- Strategic Communication: Showcasing financial health, growth initiatives, and sustainability efforts.

- Market Visibility: Enhancing the company's profile within the financial community.

- Information Dissemination: Utilizing earnings calls and webcasts to keep stakeholders informed about operational and financial developments.

Corporate Communications and Media Relations

Corporate communications and media relations serve as crucial conduits for Power Corporation of Canada to share its narrative. These channels, encompassing press releases, annual reports, and sustainability reports, are essential for conveying operational updates, financial performance, and strategic direction to a wide array of stakeholders, including shareholders, media outlets, and the general public. This transparency is key to fostering trust and shaping the company's public image.

In 2024, Power Corporation of Canada actively engaged with its audience through these channels. For instance, their 2023 annual report, released in early 2024, detailed significant achievements and financial highlights, such as a reported net income of $3.5 billion for the year. Sustainability reporting also remained a priority, with updates on environmental, social, and governance (ESG) initiatives being communicated to demonstrate commitment to responsible business practices.

- Press Releases: Used to announce material information, such as financial results, acquisitions, and strategic partnerships, ensuring timely dissemination of news.

- Annual Reports: Comprehensive documents providing detailed financial statements, management discussion and analysis, and forward-looking statements, offering deep insight into the company's performance and strategy.

- Sustainability Reports: Highlighting the company's commitment to ESG principles, detailing progress on environmental impact, social responsibility, and corporate governance.

- Media Relations: Proactive engagement with journalists and media outlets to manage coverage, respond to inquiries, and ensure accurate reporting of Power Corporation's activities and performance.

Power Corporation of Canada's channels are multifaceted, encompassing direct sales, digital platforms, and strategic partnerships. These avenues are critical for client engagement, product distribution, and overall market reach.

The company's extensive network of financial advisors and its direct sales force are paramount for personalized client interactions and tailored solutions. Complementing this, digital channels like corporate websites and mobile apps offer accessibility and self-service options, enhancing client experience and operational efficiency.

Furthermore, leveraging affiliated companies such as Great-West Lifeco and IGM Financial broadens market penetration significantly. These partnerships provide access to substantial client bases and robust distribution infrastructures, amplifying Power Corporation's market presence.

In 2024, Power Corporation continued to refine its digital offerings and strengthen its advisor networks, aiming to meet evolving client demands for seamless and personalized financial services across all touchpoints.

Customer Segments

Power Corporation of Canada caters to a wide array of individual investors, from those just starting out with simple financial products to affluent clients needing sophisticated wealth management. In 2023, the company’s Great-West Lifeco segment, a key provider for this group, reported over $2.4 trillion in assets under administration, demonstrating significant reach.

This diverse customer base seeks tailored solutions for life insurance, retirement planning, and investment growth. They value personalized advice and a broad selection of investment vehicles to meet their unique financial goals and life stages.

Institutional clients, such as pension funds and corporations, are a cornerstone for Power Corporation of Canada, seeking advanced asset management and tailored investment solutions. These entities manage substantial assets, demanding robust risk management and strategies aimed at long-term financial security and competitive returns. For instance, in 2023, Power Corporation’s Great-West Lifeco reported substantial growth in its institutional asset management, with assets under administration reaching over $1.7 trillion, underscoring the importance of this segment.

Power Corporation of Canada actively courts renewable energy investors and project developers, a segment keenly focused on decarbonization and sustainable infrastructure. These stakeholders are drawn to Power Corporation's demonstrated expertise in green finance and its growing portfolio of environmentally sound assets.

In 2024, the global renewable energy investment landscape continued its robust growth, with significant capital flowing into solar, wind, and battery storage projects. Investors in this segment are particularly interested in Power Corporation's strategic partnerships and its ability to navigate complex project development cycles, aiming for both financial returns and positive environmental impact.

Financial Advisors and Intermediaries

Financial advisors and other intermediaries are a crucial customer segment for Power Corporation of Canada. These professionals distribute the company's diverse range of financial products and services to their clients, acting as a vital link to the broader market. For instance, in 2023, Power Financial Corporation, a subsidiary, reported significant contributions from its wealth management segment, which heavily relies on this advisor network.

These intermediaries depend on Power Corporation for a comprehensive and competitive product offering, alongside robust operational support and user-friendly platforms. This allows them to effectively serve their client needs and maintain their own business operations. The company's commitment to providing these resources directly impacts the success and reach of its distribution channels.

Cultivating strong, mutually beneficial relationships with this segment is paramount for Power Corporation's market penetration and growth. Their ability to effectively engage and support these advisors directly translates into increased product adoption and client acquisition.

- Key Reliance: Advisors depend on Power Corporation for a strong product suite and competitive platforms.

- Market Reach: This segment is critical for expanding Power Corporation's presence across various client bases.

- Support Ecosystem: Robust support and tools are essential for advisors to serve their clients effectively.

- Relationship Focus: Building and maintaining strong ties with intermediaries drives business success.

Government Entities and Public Sector Organizations

Power Corporation of Canada actively serves government entities and public sector organizations, primarily through its Great-West Lifeco and Canada Life segments. These relationships often center on providing essential financial services like public sector pension plans and group insurance. For instance, Canada Life manages significant pension assets for various public sector entities, ensuring long-term financial security for their members.

These partnerships are characterized by a strong emphasis on reliability, adherence to stringent regulatory compliance, and a commitment to social responsibility. Power Corporation's engagement in these areas is crucial for supporting public service delivery and fostering sustainable development. In 2023, Great-West Lifeco reported significant assets under management, a portion of which is attributable to public sector clients, underscoring the scale of these relationships.

- Pension Plan Administration: Managing retirement assets for government employees and public sector workers, ensuring long-term financial stability.

- Group Insurance Solutions: Providing comprehensive health, dental, and life insurance benefits to public sector workforces.

- Infrastructure Financing: Potential involvement in financing sustainable infrastructure projects that align with public sector goals and long-term economic development.

Power Corporation of Canada's customer segments are broadly defined by their financial needs and the services they require, ranging from individual retail investors to large institutional bodies and even government entities. The company's strategy involves catering to these diverse groups with specialized products and advisory services, ensuring broad market penetration and diversified revenue streams.

The company's reach extends to financial advisors and intermediaries, who act as crucial distribution partners, leveraging Power Corporation's product offerings to serve their own client bases. This segment relies heavily on the company for competitive products and robust support systems, making them a vital component of Power Corporation's market strategy.

Renewable energy investors and project developers represent a growing segment, attracted by Power Corporation's commitment to sustainable finance and its expanding portfolio of green assets. This group seeks financial returns coupled with positive environmental impact, a demand Power Corporation is increasingly positioned to meet.

Government entities and public sector organizations form another key customer group, relying on Power Corporation for essential financial services like pension administration and group insurance, underscoring the company's role in supporting public service delivery.

Cost Structure

Power Corporation of Canada dedicates a significant portion of its resources to employee compensation, encompassing salaries, wages, and comprehensive benefits. This expenditure covers a vast global workforce, from financial analysts and advisors to administrative support and executive leadership.

In 2023, Power Corporation's total employee-related expenses, including salaries, benefits, and share-based compensation, amounted to approximately $3.6 billion CAD. This figure underscores the critical role human capital plays in driving the company's diverse financial services and investment management operations.

Power Corporation of Canada's cost structure heavily relies on the operating expenses of its diverse subsidiaries. For instance, Great-West Lifeco and IGM Financial incur significant costs related to their financial services operations, including employee compensation, marketing, and regulatory compliance.

These expenses are granular, encompassing everything from the technology infrastructure supporting digital banking and insurance platforms to the day-to-day administrative overhead within each distinct business unit. As of the first quarter of 2024, Great-West Lifeco reported operating expenses of CAD 2.3 billion, highlighting the scale of these individual cost centers.

Efficiently managing these varied operational expenditures across its portfolio of companies is paramount to Power Corporation’s overall financial health and profitability. This includes optimizing technology investments and streamlining administrative functions within subsidiaries like Sagard, its alternative asset management arm.

Power Corporation of Canada dedicates substantial resources to its technology and IT infrastructure, a critical component of its operations. These ongoing expenses cover vital areas such as software development, advanced data analytics tools, robust cybersecurity defenses, and essential system maintenance, reflecting a commitment to staying at the forefront of technological capabilities.

These investments are fundamental to supporting Power Corporation's digital platforms, streamlining operational efficiencies, and safeguarding sensitive data across its diverse financial and investment activities. For instance, in 2024, the company continued to prioritize digital transformation initiatives, which are intrinsically linked to its IT infrastructure spending.

Marketing, Advertising, and Distribution Costs

Power Corporation of Canada incurs significant expenses for marketing, advertising, and maintaining its broad distribution channels. These costs are essential for building brand awareness, running promotional activities, and supporting the vast network of financial advisors and digital platforms that connect with their customer base. In 2023, Power Corporation's consolidated selling, general and administrative expenses amounted to $7.1 billion, reflecting these ongoing investments.

These expenditures are critical for acquiring new clients and ensuring existing ones remain engaged, particularly within the highly competitive financial services industry.

- Branding and Promotional Campaigns: Investments in advertising across various media and targeted marketing initiatives to attract and retain customers.

- Distribution Network Support: Costs associated with maintaining and incentivizing the network of financial advisors and intermediaries.

- Digital Channel Development: Expenses for online marketing, customer relationship management (CRM) systems, and digital platform maintenance.

- Client Acquisition and Retention: Funds allocated to strategies aimed at growing the customer base and fostering long-term client loyalty.

Regulatory Compliance and Legal Costs

Power Corporation of Canada faces significant expenses due to the stringent regulatory environments of both financial services and energy. These costs are essential for maintaining operational licenses and ensuring adherence to diverse national and international rules.

These expenditures cover legal counsel, compliance officers, and external auditors, all critical for risk management and operational integrity. For instance, in 2023, Power Corporation reported that its operating expenses included significant outlays for professional services, a category encompassing legal and compliance functions.

- Regulatory Adherence: Costs incurred to meet the requirements set by financial and energy sector regulators in Canada and abroad.

- Legal Risk Management: Expenses related to legal services for contracts, litigation, and general corporate law.

- Audit and Assurance: Fees paid to external auditors to verify financial statements and compliance with regulations.

- Licensing and Permits: Costs associated with obtaining and maintaining the necessary permits and licenses to operate in various jurisdictions.

Power Corporation of Canada's cost structure is heavily influenced by its substantial investments in technology and IT infrastructure. These ongoing expenses are crucial for maintaining and enhancing its digital platforms, data analytics capabilities, and cybersecurity measures across its global operations. In 2024, the company continued to focus on digital transformation initiatives, directly impacting its IT spending.

Marketing and distribution costs represent another significant component. These expenditures support brand building, client acquisition, and the extensive networks of financial advisors and digital channels. In 2023, consolidated selling, general, and administrative expenses were $7.1 billion CAD, reflecting these vital investments in market presence.

Human capital is a core cost driver, with substantial outlays for employee compensation, including salaries, benefits, and share-based awards. In 2023, total employee-related expenses reached approximately $3.6 billion CAD, highlighting the importance of its global workforce in delivering financial services and investment management.

Regulatory compliance and operational expenses for its diverse subsidiaries, such as Great-West Lifeco and IGM Financial, also form a substantial part of the cost structure. These include legal, audit, and administrative overheads necessary for operating within stringent financial and energy sector regulations. Great-West Lifeco's Q1 2024 operating expenses were CAD 2.3 billion.

| Cost Category | 2023 (CAD billions) | Key Drivers |

|---|---|---|

| Employee Compensation | 3.6 | Salaries, benefits, share-based compensation for global workforce |

| Selling, General & Administrative | 7.1 | Marketing, advertising, distribution channels, digital platform support |

| IT Infrastructure | N/A (Ongoing Investment) | Software development, data analytics, cybersecurity, system maintenance |

| Subsidiary Operating Expenses | N/A (Segmented) | Operational overhead, regulatory compliance, technology within subsidiaries (e.g., Great-West Lifeco Q1 2024: 2.3 billion) |

Revenue Streams

Power Corporation of Canada's core revenue generation stems from the dividends paid out by its significant holdings and the growth in value of these investments. This includes substantial financial contributions from its major subsidiaries like Great-West Lifeco, IGM Financial, and GBL, underscoring its role as a strategic holding company.

Power Corporation of Canada generates revenue through management and advisory fees from its extensive asset and wealth management arms. These fees are crucial, stemming from services like managing investment funds and individual client portfolios. For instance, in 2023, Great-West Lifeco, a subsidiary, reported substantial fee and commission income, reflecting the scale of these operations.

Power Corporation of Canada, primarily through its subsidiary Great-West Lifeco, generates substantial revenue from insurance premiums. These premiums are collected from individuals and businesses for life and health insurance policies. This core revenue stream is a cornerstone of their financial services segment.

Beyond direct premiums, Power Corporation also benefits from investment income earned on the substantial reserves it holds to cover future policy claims. This dual approach, combining premium collection with astute investment management of those funds, creates a predictable and significant revenue base for the company.

For context, in the first quarter of 2024, Great-West Lifeco reported record net income, driven by strong performance in its insurance and wealth management operations, underscoring the stability and growth potential of these premium-related revenue streams.

Investment Income from Renewable Energy Assets

Power Corporation of Canada, through its subsidiary Power Sustainable, generates revenue from its investments in renewable energy and sustainable technologies. This includes income derived from the sale of electricity produced by its renewable assets, as well as revenue from renewable energy credits. Additionally, the company earns income through project development fees associated with these green initiatives.

This multifaceted revenue stream underscores Power Corporation's strategic focus on the burgeoning green economy. It offers a predictable and enduring income source, directly linked to the performance and stability of sustainable infrastructure projects. For instance, in 2024, Power Sustainable continued to expand its portfolio, contributing to a more diversified and resilient income base for the corporation.

- Electricity Sales: Income generated from selling clean energy to grids and off-takers.

- Renewable Energy Credits (RECs): Revenue earned from the sale of environmental attributes associated with renewable energy generation.

- Project Development Fees: Income received for the planning, structuring, and execution of new renewable energy projects.

Other Financial Services and Alternative Asset Management Income

Power Corporation of Canada diversifies its income through specialized financial services, including retirement solutions. A significant portion of this revenue originates from its alternative asset management arm, notably Sagard. These operations generate substantial returns from private equity, private credit, and real estate ventures, bolstering the company's financial resilience.

In 2023, Power Corporation's alternative asset management segment demonstrated robust performance. For instance, Sagard's private equity strategies, a key component of this segment, contributed significantly to earnings. The company's commitment to expanding its alternative asset platforms underscores a strategic move to capture growth beyond traditional insurance and wealth management, enhancing its overall income diversification.

- Retirement Services: Provides specialized financial planning and solutions for retirement.

- Alternative Asset Management (Sagard): Generates income from private equity, private credit, and real estate investments.

- Income Diversification: Reduces reliance on traditional insurance and wealth management sectors.

- Financial Strength: Contributes to the company's overall financial stability and growth potential.

Power Corporation of Canada's revenue streams are diverse, primarily driven by dividends from its major subsidiaries like Great-West Lifeco and IGM Financial, alongside income from management and advisory fees within its wealth management operations. Insurance premiums collected by Great-West Lifeco form a significant portion, complemented by investment income earned on policy reserves. Furthermore, its growing investments in renewable energy through Power Sustainable, including electricity sales and renewable energy credits, contribute to a more diversified income base.

| Revenue Stream | Primary Source | 2023/2024 Context |

| Dividends & Investment Growth | Great-West Lifeco, IGM Financial, GBL | Key contributor to holding company income. |

| Management & Advisory Fees | Wealth Management Arms (e.g., IG Wealth Management) | Significant income from fund and portfolio management. |

| Insurance Premiums | Great-West Lifeco (Life & Health) | Core revenue for financial services segment; Q1 2024 saw strong performance. |

| Investment Income on Reserves | Great-West Lifeco | Income earned on funds held for policy claims. |

| Renewable Energy | Power Sustainable | Electricity sales, RECs, project development fees; portfolio expansion in 2024. |

| Alternative Asset Management | Sagard (Private Equity, Credit, Real Estate) | Robust performance in 2023, enhancing income diversification. |

Business Model Canvas Data Sources

The Business Model Canvas for Power Corporation of Canada is constructed using a blend of proprietary financial disclosures, extensive market research reports, and internal strategic planning documents. These sources provide a comprehensive view of the company's operations and market position.