Power Corporation of Canada Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Power Corporation of Canada Bundle

Power Corporation of Canada navigates a complex landscape shaped by significant buyer power and moderate threat of substitutes, impacting its strategic flexibility. Understanding the intensity of these forces is crucial for any stakeholder.

The complete report reveals the real forces shaping Power Corporation of Canada’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers in the financial services sector, particularly for a company like Power Corporation of Canada, is notably influenced by the critical role of technology and data. Key suppliers provide essential software for financial platforms, robust cybersecurity, and advanced data analytics tools, all of which are foundational to modern financial operations.

These suppliers can wield considerable power when their solutions are highly specialized or proprietary, embedding deeply within Power Corporation's existing infrastructure. For instance, a unique data analytics platform that significantly enhances risk assessment or client segmentation could create substantial switching costs, thereby increasing supplier leverage.

In 2024, the demand for sophisticated AI-driven analytics in wealth management and insurance, areas where Power Corporation is active, has intensified. Companies that can demonstrably improve operational efficiency or customer insights through their technology are in a strong position to negotiate favorable terms, especially if alternative solutions are scarce or less effective.

Human capital, especially skilled finance, tech, and risk management professionals, acts as a crucial supplier for Power Corporation of Canada. In today's competitive job market, the bargaining power of these individuals can significantly impact compensation packages and employee retention efforts. For instance, in 2023, the average salary for financial analysts in Canada saw an increase, reflecting this demand.

Suppliers of regulatory compliance and legal services wield significant power over Power Corporation. This is because navigating the intricate and constantly changing legal frameworks across North America, Europe, and Asia is crucial for a global management and holding company. For instance, adherence to Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) regulations, along with evolving consumer banking rules, remains paramount through 2025, making specialized legal and compliance expertise indispensable.

Supplier Power 4

Providers of specialized financial data and market intelligence are essential for Power Corporation of Canada's investment and asset management activities. The ability of these suppliers to dictate terms or pricing is influenced by the availability of alternatives for unique datasets or analytical models. For instance, in 2023, the global market for financial data and analytics was valued at approximately $32 billion, with a significant portion driven by specialized data providers catering to institutional investors.

Power Corporation's strategic focus on alternative asset investment platforms, such as those managed by Sagard and IGM Financial, heightens its reliance on these specialized data sources. If these data providers offer proprietary or highly sought-after information, their bargaining power increases, potentially impacting Power Corporation's operational costs and strategic flexibility. The concentration of certain niche data providers in the market can exacerbate this dynamic.

- Reliance on Specialized Data: Power Corporation's investment platforms necessitate access to unique financial datasets and analytical tools, making these suppliers critical.

- Limited Alternatives: If few providers offer specific, high-value data or models, their bargaining power is amplified.

- Market Value: The global financial data and analytics market, exceeding $32 billion in 2023, highlights the significant economic importance of these suppliers.

- Impact on Strategy: Strong supplier power can influence Power Corporation's cost structure and its ability to execute investment strategies efficiently.

Supplier Power 5

In the renewable energy and sustainable technologies sector, Power Corporation of Canada (PCC) faces supplier power from manufacturers of wind turbines, solar panels, and providers of specialized engineering services. The increasing global demand for clean energy, projected to see significant investment by 2025, can amplify supplier leverage, particularly for proprietary technologies or components with limited alternatives.

The bargaining power of suppliers is influenced by factors such as the concentration of suppliers, the availability of substitute inputs, and the switching costs for PCC. For instance, a single dominant manufacturer of a critical component for a new solar technology could exert considerable influence over pricing and supply terms.

- Supplier Concentration: The market for certain renewable energy components, like advanced battery storage systems or specialized solar inverters, might be dominated by a few key players, giving them more pricing power.

- Uniqueness of Inputs: Suppliers offering unique, patented technologies or highly specialized engineering expertise for large-scale renewable projects can command higher prices and more favorable contract terms.

- Supply Chain Stability: Global supply chain disruptions, as seen in recent years, can temporarily increase the bargaining power of suppliers who can ensure reliable delivery of essential materials and equipment.

- Investment Trends: With substantial global investments anticipated in clean energy through 2025, suppliers of critical infrastructure and technology are positioned to benefit from increased demand, potentially strengthening their negotiating position.

Power Corporation of Canada's bargaining power of suppliers is significantly shaped by technology and specialized human capital. Key technology providers for financial platforms, cybersecurity, and data analytics hold considerable sway if their solutions are proprietary or deeply integrated, creating high switching costs for Power Corp. The demand for AI-driven analytics in wealth management and insurance, areas where Power Corp operates, further bolsters the position of tech suppliers in 2024.

Skilled finance, tech, and risk management professionals also act as potent suppliers, with their bargaining power evident in compensation trends; for example, financial analyst salaries in Canada saw an increase in 2023. Furthermore, suppliers of regulatory compliance and legal services are critical due to the complex, evolving global regulatory landscape, making their expertise indispensable through 2025.

Providers of specialized financial data and market intelligence are vital for Power Corp's asset management arms, like Sagard and IGM Financial. The uniqueness of their data or models, coupled with the market's reliance on such insights, amplifies their negotiating strength. The global financial data and analytics market, valued around $32 billion in 2023, underscores the economic importance of these data suppliers.

In renewable energy, suppliers of wind turbines, solar panels, and specialized engineering services can exert influence, particularly when offering proprietary technologies or facing high global demand for clean energy solutions, a trend expected to continue through 2025. Supplier concentration, uniqueness of inputs, and supply chain stability are key determinants of their power.

| Supplier Type | Key Factors Influencing Power | 2023/2024 Data Points | Impact on Power Corp |

|---|---|---|---|

| Technology Providers (AI, Cybersecurity, Data Analytics) | Proprietary solutions, deep integration, switching costs, demand for AI in finance | Intensified demand for AI in wealth management and insurance (2024) | Potential for higher pricing, negotiation leverage on terms |

| Skilled Human Capital (Finance, Tech, Risk) | Demand in competitive job market, specialized skills | Increased average salaries for financial analysts (2023) | Impact on compensation packages, talent acquisition costs |

| Regulatory & Legal Services | Complexity of global regulations, need for specialized expertise | Ongoing adherence to AML/ATF and consumer banking rules (through 2025) | Essential service providers with significant leverage on contracts |

| Specialized Financial Data Providers | Uniqueness of data/models, limited alternatives, market reliance | Global financial data market valued ~ $32 billion (2023) | Influence on operational costs and strategic flexibility |

| Renewable Energy Component Manufacturers | Proprietary technology, global demand for clean energy | Projected significant investment in clean energy by 2025 | Potential for price increases and favorable supply terms |

What is included in the product

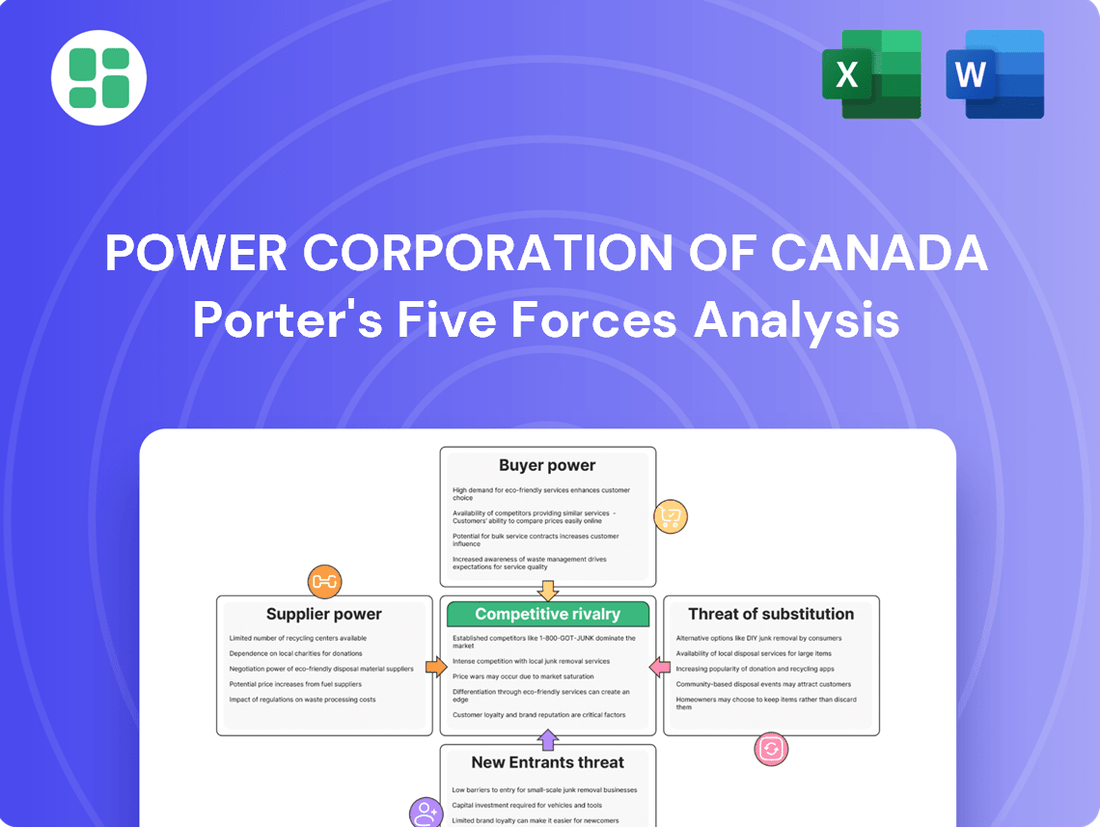

Tailored exclusively for Power Corporation of Canada, this analysis dissects the five competitive forces shaping its operating environment, from buyer and supplier power to the threat of new entrants and substitutes.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Power Corporation of Canada's competitive landscape.

Customers Bargaining Power

Customers of Power Corporation of Canada, encompassing individual investors to large institutions, wield considerable bargaining power. This is largely due to the highly competitive Canadian financial services landscape, where numerous alternatives exist for life and non-life insurance, wealth management, and banking services.

In 2024, the Canadian insurance sector, a key area for Power Corporation, continues to be characterized by intense competition. Major players constantly offer competitive pricing and product innovation to attract and retain customers, directly influencing the bargaining power of consumers who can easily switch providers.

The bargaining power of customers for Power Corporation of Canada is significantly influenced by the growing emphasis on customer experience and digital ease. In Canada, a striking 90% of consumers deem customer experience as crucial as, or even more so than, the actual products and services offered, highlighting a key driver for businesses.

Fintech advancements and the proliferation of digital platforms have dramatically elevated customer expectations. Consumers now anticipate highly personalized and effortlessly integrated services, a trend that directly impacts how utility and financial service providers must operate to retain and attract clients.

The bargaining power of customers in the financial services sector is a significant factor for Power Corporation of Canada. Low switching costs for many financial products, especially with the upcoming open banking legislation in Canada, mean customers can more easily move between institutions. This increased mobility empowers them to seek better rates and services.

While many Canadians maintain long-term relationships with their banks, a notable segment, particularly younger individuals, are increasingly willing to explore alternative financial providers. This openness suggests a growing customer base that is less tied to legacy institutions and more receptive to competitive offerings, potentially pressuring established players like Power Corporation.

Buyer Power 4

The increasing demand for holistic wealth management, integrating investments, financial planning, tax, and insurance, significantly enhances customer bargaining power. Clients now expect a seamless, all-encompassing service, pushing financial institutions to offer bundled solutions.

Firms that can effectively bundle these diverse services and deliver tailored advice are more likely to retain clients, as customers can consolidate their financial needs with a single provider. This integration reduces the effort required by clients to manage multiple financial relationships.

- Holistic Wealth Demand: Clients increasingly seek integrated financial services, encompassing investments, planning, tax, and insurance, giving them more leverage.

- Bundling Advantage: Companies that bundle these services can better retain clients by meeting comprehensive needs.

- Personalized Advice: Tailored financial advice strengthens client loyalty and reduces the likelihood of clients switching providers.

Buyer Power 5

In the renewable energy investment sector, institutional investors and large corporations often wield considerable bargaining power. Their substantial capital commitments allow them to negotiate favorable terms for sustainable technology investments, influencing project financing and deal structures. For instance, in 2024, major infrastructure funds actively seeking green energy assets were able to secure lower yields on their investments due to the sheer volume of capital available and the competitive landscape for acquiring quality renewable projects.

Government incentives for clean energy also play a crucial role in shaping buyer power. These incentives can reduce the overall cost of renewable projects, making them more attractive to investors and potentially increasing their leverage in negotiations. For example, the Inflation Reduction Act in the United States, with its extended tax credits for solar and wind power through 2032, has bolstered demand and provided a stable investment environment, indirectly influencing the bargaining dynamics between project developers and large-scale buyers of renewable energy.

- Large Capital Commitments: Institutional investors and corporations can deploy significant capital, giving them leverage in negotiations for renewable energy projects.

- Dictating Terms: The ability to make large investments allows these buyers to influence project financing, contract terms, and even technology choices.

- Government Incentives: Tax credits, subsidies, and other government programs for clean energy can enhance the attractiveness of renewable investments, potentially increasing buyer power by lowering project costs.

- Demand for Sustainable Assets: Growing investor demand for ESG-compliant and sustainable assets in 2024 means buyers have more options and can be more selective, further strengthening their position.

Customers of Power Corporation of Canada, spanning individual investors to institutional entities, possess substantial bargaining power. This strength stems from the highly competitive Canadian financial services market, offering numerous alternatives for insurance, wealth management, and banking. In 2024, the Canadian insurance sector, a vital segment for Power Corporation, remains intensely competitive, with providers frequently adjusting pricing and innovating products to attract and retain clients, thereby amplifying consumer leverage.

The increasing demand for integrated wealth management, which combines investments, financial planning, tax services, and insurance, significantly bolsters customer bargaining power. Clients now expect a unified, comprehensive service, compelling financial institutions to offer bundled solutions. Firms adept at consolidating these diverse offerings and delivering customized advice are better positioned to retain clients, as customers can centralize their financial needs with a single provider, simplifying management.

| Key Driver | Impact on Bargaining Power | Supporting Data/Trend (2024) |

| Competitive Landscape | High | Numerous alternatives for insurance, wealth management, and banking in Canada. |

| Customer Experience Focus | High | 90% of Canadian consumers prioritize customer experience as much as or more than products/services. |

| Fintech & Digitalization | High | Elevated customer expectations for personalized, integrated services. |

| Switching Costs & Open Banking | Moderate to High | Low switching costs for many financial products; upcoming open banking legislation in Canada facilitates easier client movement. |

| Holistic Wealth Demand | High | Clients seek integrated services (investments, planning, tax, insurance), increasing leverage for bundled solutions. |

Preview the Actual Deliverable

Power Corporation of Canada Porter's Five Forces Analysis

This preview displays the complete Power Corporation of Canada Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. You are viewing the exact document you will receive, fully formatted and ready for immediate use upon purchase, ensuring transparency and no hidden surprises.

Rivalry Among Competitors

Power Corporation of Canada operates in a dynamic Canadian financial services landscape marked by robust competition. Its key subsidiaries, Great-West Lifeco and IGM Financial, face formidable rivals including Manulife, Sun Life, and the banking giants like RBC. This intense rivalry stems from a market that, while moderately concentrated, is fiercely contested across insurance, wealth management, and banking sectors.

The wealth management sector is indeed growing, fueled by technological advancements and an expanding mass affluent demographic. However, this growth is met with increasingly fierce competition. Firms are actively seeking to capture market share by improving their digital platforms, emphasizing environmental, social, and governance (ESG) principles, and offering comprehensive financial planning services.

This competitive landscape drives continuous innovation and puts downward pressure on fees. For instance, in 2024, the global wealth management market was projected to reach over $24 trillion, with a significant portion of new assets flowing into digitally-enabled advisory services and ESG-focused funds, highlighting the strategic importance of these differentiators.

The wealth management sector is experiencing significant consolidation, with mergers and acquisitions becoming more frequent as companies aim for greater scale and operational efficiency. For instance, in 2024, the industry saw continued activity as firms like Equitable Group acquired Home Capital Group, demonstrating this trend toward consolidation.

Major players are channeling substantial investments into technology and expanding their distribution networks. This creates attractive aggregator platforms, drawing in smaller firms and independent advisors, which in turn heightens the competitive intensity across the board.

Competitive Rivalry 4

The renewable energy sector in Canada is experiencing robust growth, but this expansion fuels intense competition among developers vying for lucrative projects. Government incentives and increasing investment are attracting numerous players, intensifying the rivalry. For instance, in 2023, Canada's renewable energy capacity saw significant additions, with solar and wind power leading the charge, creating a dynamic and competitive landscape.

This competitive pressure is further amplified by a strategic push for diversification beyond established hydropower. Companies are actively competing for opportunities in emerging areas like wind, solar, and advanced energy storage solutions. This diversification strategy means that developers must innovate and differentiate themselves to secure market share in these rapidly evolving segments.

- Intensified Competition: Numerous developers are actively seeking projects in Canada's growing renewable energy market.

- Diversification Drive: Competition is increasing in wind, solar, and energy storage as companies move beyond traditional hydropower.

- Investment and Incentives: Increased investment and government incentives are attracting more players, heightening rivalry.

- Market Dynamics: The sector's growth, with significant capacity additions in 2023, reflects a highly competitive environment.

Competitive Rivalry 5

Regulatory shifts significantly heighten competitive rivalry within the financial sector. For instance, the Office of the Superintendent of Financial Institutions (OSFI) B-15 guideline on climate risk management, implemented in 2024, requires Canadian financial institutions to integrate climate-related risks into their governance, risk management, and disclosure frameworks. This necessitates substantial investment in data analytics and reporting capabilities, creating a competitive hurdle for firms less prepared.

Furthermore, evolving anti-money laundering (AML) practices, driven by global efforts to combat financial crime, impose new compliance burdens. In 2024, Canada continued to strengthen its AML/ATF regime, with ongoing efforts to enhance the effectiveness of the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). These regulatory demands increase operational costs and require continuous adaptation, intensifying competition as firms vie for efficiency and compliance leadership.

The need to adapt to these complex regulatory landscapes impacts strategic positioning. Financial institutions must allocate resources to meet new compliance standards, potentially diverting funds from innovation or market expansion. This environment favors larger, well-resourced players who can absorb these costs more readily, thereby increasing competitive pressure on smaller or less agile competitors.

- OSFI B-15 Guideline: Mandates climate risk integration, impacting operational costs and strategic planning for Canadian financial institutions.

- AML/ATF Enhancements: Continued strengthening of Canada's anti-money laundering and anti-terrorist financing regime increases compliance burdens.

- Increased Operational Costs: Adapting to new regulations requires investment in technology, data, and expertise, creating a competitive disadvantage for less prepared firms.

- Strategic Positioning: Firms that effectively navigate regulatory changes gain a competitive edge, while others face pressure to adapt or risk falling behind.

Competitive rivalry within Power Corporation of Canada's operating sectors is intense, driven by a mature market and the presence of well-established players. In financial services, subsidiaries like Great-West Lifeco and IGM Financial compete fiercely with major Canadian banks and other insurance and wealth management firms. This rivalry is further fueled by ongoing consolidation, as seen with Equitable Group's acquisition of Home Capital Group in 2024, and a strong emphasis on digital platforms and ESG offerings to attract and retain clients.

| Key Competitors (Financial Services) | Key Competitors (Renewable Energy) | Market Trend Impacting Rivalry |

| Manulife, Sun Life, RBC, TD Bank | Brookfield Renewable Partners, TransAlta, Northland Power | Digitalization and ESG focus in Wealth Management |

| Market Share Focus | Project Acquisition | Consolidation Activities (e.g., Equitable Group/Home Capital, 2024) |

| Fee Pressure | Innovation in Storage Solutions | Regulatory Compliance Costs (e.g., OSFI B-15, AML) |

SSubstitutes Threaten

Robo-advisors and self-directed platforms are increasingly challenging traditional investment management. These digital solutions, like Wealthsimple and Questrade, offer lower fees and commission-free trading, making them attractive to a growing segment of investors, particularly those new to the market or focused on cost savings.

The appeal of these substitutes lies in their accessibility and user-friendliness, directly competing with the advisory services offered by firms like Power Corporation of Canada. For instance, Wealthsimple reported a significant increase in assets under management, reaching over $15 billion by the end of 2023, demonstrating the growing adoption of these alternative investment platforms.

Fintech innovations, such as digital banking and alternative lending, present a significant threat by offering substitutes for traditional banking products. These agile, customer-experience driven fintechs, while sometimes partnering with incumbents, directly compete in key areas like payment processing and mobile banking, challenging established players.

For instance, in 2024, the Canadian fintech sector continued its robust growth, with transaction volumes in digital payments and alternative financing reaching new heights, indicating a clear shift in consumer preference towards these more convenient and often faster digital solutions.

Alternative asset classes and direct private market investments, increasingly accessible through specialized platforms, pose a significant threat of substitution to traditional investment products offered by Power Corporation's asset management arms like Sagard and IGM Financial. For instance, the global private equity market size was estimated to be around $12.1 trillion in 2023, demonstrating a substantial pool of capital that could be diverted from public markets.

Investors are actively seeking diversification beyond conventional stocks and bonds, a trend that directly impacts the demand for Power Corporation's core offerings. Data from 2024 indicates a growing investor appetite for alternative investments, with surveys showing a significant percentage of institutional investors planning to increase their allocations to private equity, venture capital, and real estate, potentially reducing their exposure to traditional asset management services.

Threat of Substitution 4

In the insurance sector, evolving consumer preferences and the rise of insurtech present a growing threat of substitutes for Power Corporation of Canada's traditional life and non-life insurance products. Digital-first insurance offerings and tailored, on-demand policies could disrupt conventional models by offering greater convenience or cost-effectiveness.

Insurtech startups are increasingly offering specialized products that bypass traditional channels. For instance, by mid-2024, several platforms are expected to offer parametric insurance for specific events, like travel disruptions or crop failures, directly to consumers, bypassing the need for a full life or property policy.

- Insurtech Growth: The global insurtech market size was valued at approximately $11.4 billion in 2023 and is projected to grow significantly, indicating a strong trend towards digital alternatives.

- Customer Demand: A 2024 survey revealed that over 60% of consumers aged 18-35 are open to purchasing insurance directly from technology-focused companies, highlighting a shift in purchasing behavior.

- Product Innovation: The availability of usage-based insurance (UBI) for auto and home, which offers premiums based on actual behavior rather than broad risk pools, provides a compelling substitute for traditional policies.

- Cost Sensitivity: Many of these digital substitutes are positioned as more affordable due to lower overheads and streamlined processes, directly challenging the pricing of established insurers.

Threat of Substitution 5

The threat of substitutes for Power Corporation of Canada is particularly relevant in its renewable energy segment. While the global push for decarbonization is strong, continued reliance on traditional fossil fuels, even with climate goals in place, can act as a substitute. This is often due to the high initial costs associated with new renewable energy infrastructure or existing limitations in grid integration. For instance, in 2024, many regions are still heavily dependent on natural gas for baseload power, which can displace the need for new renewable capacity in the short to medium term.

Government policies and investment incentives are critical in mitigating this substitution threat. Subsidies, tax credits, and regulatory mandates that favor renewable energy deployment can significantly alter the economic viability of alternatives. For example, federal and provincial incentives in Canada, such as those supporting solar and wind projects, aim to make renewables more competitive against fossil fuels. The pace of adoption of cleaner technologies, influenced by these policies, directly impacts the demand for Power Corporation's renewable energy offerings.

- Fossil Fuel Reliance: Despite climate targets, the ongoing use of fossil fuels for energy generation presents a direct substitute threat to renewable energy investments.

- Infrastructure Limitations: Slower development of grid infrastructure capable of handling intermittent renewable sources can hinder adoption and favor traditional energy.

- Initial Cost Barriers: High upfront capital expenditures for renewable projects can make them less attractive compared to established fossil fuel assets, especially without supportive policies.

- Government Policy Impact: The presence and strength of government incentives, such as tax credits and renewable portfolio standards, are crucial in making renewables competitive and reducing the threat of substitutes.

The threat of substitutes for Power Corporation of Canada is significant across its diverse business lines. In wealth management, robo-advisors and fintech platforms offer lower-cost alternatives, attracting a growing number of investors. For instance, by early 2024, digital investment platforms continued to gain market share, with many reporting substantial increases in assets under management.

Alternative investments, such as private equity and venture capital, also pose a substitute threat to traditional asset management services. By mid-2024, investor interest in these less liquid but potentially higher-return assets remained strong, with a notable portion of institutional capital being allocated away from public markets.

In the insurance sector, insurtech companies are providing innovative, digital-first products that challenge traditional offerings. Consumer preference for convenience and tailored solutions, particularly among younger demographics, is driving adoption of these substitutes. By the end of 2023, the insurtech market showed continued robust growth, indicating a sustained shift in consumer behavior.

For Power Corporation's renewable energy segment, the continued reliance on fossil fuels, particularly natural gas for baseload power, acts as a substitute. This is often due to the high initial capital costs of renewable infrastructure and ongoing grid integration challenges. In 2024, many energy markets still demonstrated a significant dependence on these traditional sources.

| Segment | Substitute Threat | Key Drivers | 2023/2024 Data Point |

|---|---|---|---|

| Wealth Management | Robo-advisors, Fintech Platforms | Lower fees, accessibility, user-friendliness | Digital platforms saw continued asset growth, exceeding $15 billion in AUM for some by end of 2023. |

| Asset Management | Private Equity, Venture Capital | Diversification, potential for higher returns | Global private equity market size estimated around $12.1 trillion in 2023. |

| Insurance | Insurtech, Digital-first policies | Convenience, tailored products, cost-effectiveness | Global insurtech market valued at $11.4 billion in 2023; 60%+ of young consumers open to tech-focused insurers. |

| Renewable Energy | Fossil Fuels (Natural Gas) | Initial cost, grid integration, baseload reliability | Continued significant reliance on natural gas for baseload power in many regions in 2024. |

Entrants Threaten

The threat of new entrants in the financial services sector, particularly for a company like Power Corporation of Canada, is generally low due to substantial barriers. Significant capital is required to establish operations, meet regulatory compliance, and build a competitive infrastructure. For instance, in 2024, the average startup capital for a new federally regulated financial institution in Canada could easily run into the hundreds of millions of dollars.

Navigating the complex regulatory landscape is another major hurdle. Bodies like the Office of the Superintendent of Financial Institutions (OSFI) and the Financial Consumer Agency of Canada (FCAC) impose stringent rules on capital adequacy, risk management, and consumer protection. Failure to comply can result in severe penalties, deterring many potential new players.

Furthermore, established players like Power Corporation benefit from decades of brand recognition and customer trust. Acquiring this level of credibility and a loyal customer base is incredibly difficult and time-consuming for newcomers. This intangible asset, built over years, acts as a significant moat against new competition entering the market.

Fintech startups are a significant threat, particularly in areas like digital payments and wealth management. These agile companies can bypass the extensive regulatory hurdles faced by traditional institutions, allowing them to innovate rapidly. For instance, by mid-2024, fintechs had captured a notable share of the Canadian digital payment market, forcing established players like Power Corporation to adapt their offerings.

The evolving landscape of open banking in Canada, with phased implementation beginning in 2025, presents a significant threat of new entrants. This legislation is designed to foster data sharing and increase competition, potentially lowering the hurdles for new fintech companies to enter the market.

These new players could leverage access to customer data, facilitated by open banking, to offer innovative and integrated financial services, directly challenging established institutions like Power Corporation of Canada.

Threat of New Entrants 4

The renewable energy sector, where Power Corporation of Canada operates through its subsidiaries like Great-West Lifeco and IGM Financial, presents a mixed landscape for new entrants. While the global push for clean energy and increasing investment in renewables, reaching over $600 billion in 2023 according to BloombergNEF, can attract new players with novel technologies or business models, significant barriers remain.

These barriers are primarily rooted in the capital-intensive nature of large-scale energy projects. Developing solar farms, wind power installations, or hydroelectric facilities requires substantial upfront investment, often in the hundreds of millions or even billions of dollars. Furthermore, the specialized expertise needed for project development, construction, operation, and regulatory compliance, coupled with lengthy development timelines, can be prohibitive for smaller, less established companies. This high barrier to entry helps to moderate the threat of new competition for established players like Power Corporation of Canada.

- Capital Intensity: Projects in renewable energy, a key focus for Power Corporation's investments, demand significant upfront capital, often exceeding hundreds of millions of dollars, making it difficult for smaller firms to compete.

- Specialized Expertise: The technical, engineering, and regulatory knowledge required for developing and operating renewable energy assets is highly specialized, creating a knowledge barrier for newcomers.

- Long Development Cycles: The time from project conception to operational status can span several years, involving extensive planning, permitting, and construction, which deters agile new entrants.

- Regulatory Hurdles: Navigating complex environmental regulations and obtaining necessary permits for energy projects can be a lengthy and costly process, acting as a deterrent to new market participants.

Threat of New Entrants 5

The threat of new entrants into Canada's financial services sector, particularly for established players like Power Corporation of Canada, is significantly mitigated by deeply entrenched brand loyalty and decades-old customer relationships. These long-standing connections, fostered through consistent service and trust, act as formidable barriers. For instance, in 2024, traditional banks and insurance providers continued to benefit from customer inertia, with many Canadians preferring the familiarity and perceived security of their existing financial institutions.

While customer satisfaction scores can fluctuate, the sheer convenience and established accessibility of incumbent financial institutions remain powerful drivers of loyalty. New entrants often struggle to replicate the widespread branch networks, intuitive digital platforms, and personalized advisory services that Power Corporation and its subsidiaries have cultivated over many years. This makes it challenging for newcomers to attract and retain a significant customer base, even with competitive offerings.

The capital requirements and regulatory hurdles for establishing a new financial institution in Canada are also substantial, further deterring potential entrants. These factors, combined with the difficulty of overcoming existing brand equity, suggest that the threat of new entrants remains relatively low for Power Corporation of Canada.

- Brand Loyalty: Decades of service have built strong customer trust and reliance on established financial institutions.

- Customer Relationships: Long-standing personal and business relationships are difficult for new entrants to replicate.

- Convenience and Access: Existing networks of branches and digital services offer a significant advantage over newcomers.

- Regulatory Barriers: High capital and compliance requirements make it difficult and costly for new financial firms to enter the market.

The threat of new entrants for Power Corporation of Canada is generally low due to significant barriers in both its financial services and renewable energy segments. High capital requirements, stringent regulations, established brand loyalty, and specialized expertise create substantial hurdles for newcomers. For example, in 2024, the cost to establish a new regulated financial institution in Canada could easily reach hundreds of millions of dollars.

While fintech innovation and open banking initiatives, slated for phased implementation from 2025, present potential challenges by lowering some entry barriers in financial services, the overall threat remains moderated. Similarly, the capital-intensive nature and technical demands of renewable energy projects, which saw global investment exceed $600 billion in 2023, also deter new, less-resourced entrants.

| Barrier Type | Financial Services Impact | Renewable Energy Impact |

|---|---|---|

| Capital Requirements | High (e.g., hundreds of millions for new banks) | Very High (e.g., hundreds of millions to billions for projects) |

| Regulatory Compliance | Complex and costly (OSFI, FCAC) | Extensive (environmental, permits) |

| Brand Loyalty & Relationships | Strong, built over decades | Less direct, but established players have market access |

| Specialized Expertise | Financial acumen, risk management | Technical, engineering, project management |

| Technological Innovation | Fintech disruption, open banking (emerging threat) | New energy technologies (potential entry point) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Power Corporation of Canada leverages data from its annual reports, investor presentations, and public filings. We also incorporate industry research from reputable sources and relevant market trend reports to provide a comprehensive view of the competitive landscape.