Power Corporation of Canada Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Power Corporation of Canada Bundle

Curious about Power Corporation of Canada's strategic positioning? This preview offers a glimpse into its BCG Matrix, hinting at its market dynamics.

To truly unlock the company's competitive advantage and understand which segments are fueling growth and which require a strategic rethink, you need the full picture.

Purchase the complete BCG Matrix for a detailed quadrant breakdown, actionable insights, and a clear roadmap to optimize Power Corporation of Canada's portfolio for future success.

Stars

Great-West Lifeco's U.S. retirement and wealth management arm, Empower, is a powerhouse of growth. Its retirement and wealth segments are not just performing well; they're on track to be the biggest earners for Lifeco's core profits. This surge is happening within a global life insurance and annuity market that's expected to see considerable expansion, positioning Empower strongly in a booming industry.

Mackenzie Investments, a significant part of Power Corporation of Canada's asset management arm, is showing impressive growth. In 2024, the company reported substantial increases in assets under management and advisement (AUM&A), driven by strong net sales. This performance highlights investor trust and Mackenzie's success in capturing market share, particularly in fast-growing segments.

The robust AUM&A growth for Mackenzie Investments is fueled by investor demand for specialized products. Funds focused on Environmental, Social, and Governance (ESG) principles and alternative investment strategies are particularly attracting capital within Canada's evolving wealth management sector. This strategic alignment with market trends positions Mackenzie for continued expansion.

Power Corporation of Canada, through its subsidiary Power Sustainable, has launched a significant Decarbonization Private Equity strategy. This initiative has already garnered substantial commitments, signaling strong investor confidence in the clean energy and sustainable technology sectors. The strategy is specifically targeting middle-market companies poised for growth within areas like energy transition, industrials, and transportation.

This move firmly establishes Power Corporation as a key participant in the burgeoning clean energy market. By deploying its considerable capital and leveraging its deep expertise, the company aims to accelerate the growth of businesses focused on decarbonization. This strategic focus aligns with global efforts to combat climate change and capitalize on the economic opportunities presented by the transition to a lower-carbon economy.

Digital Wealth Solutions Leadership

Power Corporation of Canada's subsidiaries are heavily investing in digital wealth solutions, integrating advanced WealthTech platforms to enhance their offerings. This strategic push is designed to capture a larger share of the market, especially by appealing to younger, affluent clients who expect seamless digital experiences and tailored advice.

This focus on digital transformation is crucial for staying competitive. For instance, in 2023, Power Corporation's Great-West Lifeco reported significant progress in its digital strategy, with digital sales channels contributing a growing percentage of new business. They are actively developing and deploying AI-powered tools for client engagement and financial planning.

- Digital Investment: Power Corporation's wealth management arms are channeling substantial resources into advanced digital tools and WealthTech.

- Market Capture: The strategy targets market share growth, particularly from next-generation high-net-worth individuals.

- Client Demand: This focus addresses the increasing demand for sophisticated digital capabilities and personalized financial services.

- Competitive Edge: By embracing digital innovation, Power Corporation aims to maintain and enhance its competitive position in the evolving financial advisory landscape.

Sustainable Agri-Food Private Equity

Power Sustainable Lios, Power Corporation of Canada's dedicated agri-food private equity arm, solidified its commitment to the sector by successfully closing its inaugural fund in 2024. This fund is actively investing in North American companies focused on transforming the food value chain through sustainable practices.

This strategic focus positions Power Corporation within a rapidly expanding market driven by growing consumer preferences and investor interest in environmentally responsible food systems. The firm aims to capitalize on this trend by supporting innovative businesses that contribute to a more sustainable agri-food future.

- Fund Closure: Power Sustainable Lios' inaugural fund successfully closed in 2024.

- Investment Focus: Capital is being deployed into North American agri-food companies promoting sustainability.

- Market Position: This strategy allows Power Corporation to lead in a high-growth sector with increasing demand for sustainable food solutions.

Empower, Great-West Lifeco's U.S. retirement business, is a significant growth driver, projected to be Lifeco's largest profit contributor. Its strong performance is set against a backdrop of global life insurance and annuity market expansion, positioning Empower for continued success.

Mackenzie Investments, Power Corporation's asset management arm, demonstrated robust growth in 2024, with substantial increases in assets under management and advisement (AUM&A) driven by strong net sales. This growth is attributed to rising investor demand for specialized products like ESG and alternative investments, enhancing Mackenzie's market position.

Power Corporation's strategic investments in digital wealth solutions and WealthTech are designed to capture a larger market share, particularly among younger, affluent clients. This digital transformation is crucial for maintaining a competitive edge, as evidenced by Great-West Lifeco's increasing digital sales contributions in 2023.

Power Sustainable's Decarbonization Private Equity strategy has secured significant commitments, reflecting strong investor confidence in clean energy. The strategy targets middle-market companies in energy transition, industrials, and transportation, positioning Power Corporation as a key player in the growing decarbonization market.

Power Sustainable Lios successfully closed its inaugural agri-food private equity fund in 2024, actively investing in North American companies focused on sustainable food value chains. This initiative capitalizes on increasing consumer and investor interest in environmentally responsible food systems.

| Business Unit | BCG Category | Key Growth Drivers | 2024 Performance Highlight | Strategic Focus |

|---|---|---|---|---|

| Empower (Great-West Lifeco) | Star | Global retirement market expansion, strong U.S. retirement and wealth management growth | Projected to be Lifeco's largest profit contributor | Continued expansion in U.S. retirement and wealth services |

| Mackenzie Investments | Star | Investor demand for specialized products (ESG, alternatives), strong net sales | Substantial AUM&A growth in 2024 | Capturing market share through differentiated product offerings |

| Power Sustainable (Decarbonization) | Star | Investor confidence in clean energy, growth in energy transition sectors | Significant commitments to Decarbonization Private Equity strategy | Accelerating growth of decarbonization-focused businesses |

| Power Sustainable Lios (Agri-food) | Star | Growing consumer and investor interest in sustainable food systems | Inaugural fund closure in 2024 | Investing in sustainable agri-food transformation |

What is included in the product

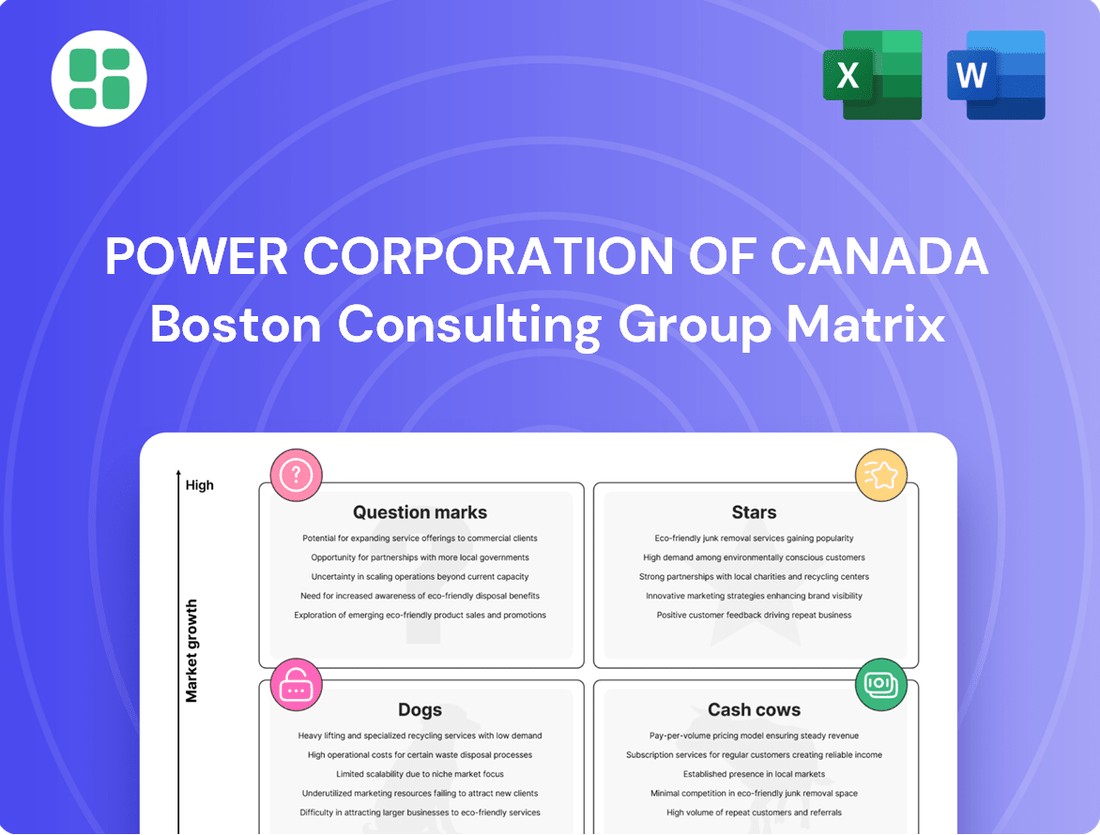

Highlights which of Power Corporation's diverse business units to invest in, hold, or divest based on market growth and share.

A clear Power Corporation of Canada BCG Matrix visually clarifies the portfolio, easing the pain of strategic decision-making.

Cash Cows

Great-West Lifeco's Canadian life insurance business, operating under well-recognized brands such as Canada Life, is a prime example of a cash cow for Power Corporation of Canada. This segment boasts a substantial market share within Canada, indicative of its maturity and established presence.

These operations consistently generate stable and significant cash flows, forming a reliable financial bedrock for the broader Power Corporation group. In 2023, Great-West Lifeco reported total revenues of C$77.9 billion, with its Canadian operations contributing a substantial portion to this figure, underscoring their cash-generating power despite modest global life insurance market growth.

Great-West Lifeco's traditional retirement plan administration, primarily through its Workplace Solutions in Canada and the U.S., is a prime example of a Cash Cow for Power Corporation of Canada. These services benefit from a dominant market share, ensuring a stable and predictable revenue stream.

The consistent fee-based income and substantial assets under administration generated by these plans make them a reliable source of cash. This stability means they require minimal reinvestment to maintain their position, freeing up capital for other strategic initiatives within Power Corporation.

IG Wealth Management, a cornerstone of IGM Financial, exemplifies a mature business with a dominant market share. In 2023, IGM Financial reported total assets under management and advisement of $247.4 billion, with IG Wealth Management being a significant contributor to this figure. This segment consistently delivers high profit margins and predictable cash flows, primarily from its established client base and recurring advisory fees.

As a cash cow, IG Wealth Management requires minimal reinvestment to maintain its position, unlike businesses in other BCG matrix quadrants. Its stable revenue streams and strong profitability allow it to fund other ventures within Power Corporation of Canada's portfolio, such as those in the question mark or star categories.

Diversified Asset Management Offerings

Mackenzie Investments, a key subsidiary of IGM Financial, which is itself controlled by Power Corporation of Canada, benefits from a robust and diversified asset management business. This segment is characterized by established mutual funds and institutional mandates that maintain significant market share, even outside of the highest-growth areas. These mature offerings are crucial for generating stable, recurring revenue streams.

The consistent cash flow generated by these diversified assets directly supports IGM Financial's overall financial health and, consequently, Power Corporation's balance sheet. This stability is a hallmark of Cash Cows in a BCG Matrix analysis.

For instance, as of the first quarter of 2024, IGM Financial reported total assets under management and advisement of approximately CAD 247 billion. A substantial portion of this AUM is derived from these established, income-generating products, underscoring their role as reliable cash generators.

- Diversified Revenue Streams: Mackenzie's broad range of mutual funds and institutional products ensures a steady inflow of management fees.

- Market Share Stability: Established products maintain a strong market presence, providing a predictable revenue base.

- Consistent Cash Flow Contribution: These offerings are vital for the consistent generation of cash flow for IGM Financial and Power Corporation.

- Financial Performance (Q1 2024): IGM Financial's AUM of CAD 247 billion highlights the scale of its asset management operations, with a significant portion attributed to mature, cash-generating products.

Reinsurance Operations

Great-West Lifeco's reinsurance operations are a significant contributor to Power Corporation of Canada's stability, acting as a reliable source of cash. These businesses, while not experiencing rapid expansion, effectively utilize established expertise and strong industry connections to generate consistent income. This steady cash flow is crucial for funding other growth initiatives within the broader Power Corporation portfolio.

The reinsurance segment plays a vital role in risk diversification for Great-West Lifeco. By reinsuring a portion of its own risks, the company reduces its exposure to large, unexpected claims, thereby enhancing its financial resilience. This strategic management of risk translates into more predictable earnings, a hallmark of a cash cow.

- Diversification of Risk: Reinsurance helps spread the financial impact of large claims across multiple entities, stabilizing earnings.

- Consistent Income Generation: These operations provide a steady stream of revenue, contributing to Power Corporation's overall financial health.

- Leveraging Existing Expertise: The business benefits from established knowledge and relationships within the insurance industry.

- Support for Strategic Investments: The reliable cash flows generated enable funding for other, potentially higher-growth, ventures within the corporation.

Power Corporation of Canada's cash cows are its mature, market-leading businesses that generate consistent and substantial cash flows with minimal need for reinvestment. Great-West Lifeco's Canadian life insurance and retirement plan administration, along with IG Wealth Management and Mackenzie Investments, are prime examples. These segments benefit from established client bases and recurring fee income, providing a stable financial foundation for the corporation.

These operations consistently generate predictable earnings, allowing Power Corporation to allocate capital to other strategic areas. For instance, in 2023, Great-West Lifeco's total revenues reached C$77.9 billion, with its Canadian businesses being significant contributors. Similarly, IGM Financial, which includes IG Wealth Management and Mackenzie Investments, reported total assets under management and advisement of CAD 247.4 billion in 2023, highlighting the scale of its stable, cash-generating asset management operations.

| Business Segment | Parent Company | BCG Quadrant | 2023 Revenue/AUM (Approx.) | Key Characteristics |

|---|---|---|---|---|

| Canadian Life Insurance | Great-West Lifeco | Cash Cow | Significant contributor to C$77.9 billion total revenue | High market share, stable cash flows, mature market |

| Retirement Plan Administration (Canada/US) | Great-West Lifeco | Cash Cow | Stable fee-based income | Dominant market share, predictable revenue stream |

| IG Wealth Management | IGM Financial | Cash Cow | CAD 247.4 billion AUM (part of IGM) | Dominant market share, high profit margins, recurring fees |

| Mackenzie Investments | IGM Financial | Cash Cow | CAD 247 billion AUM (part of IGM as of Q1 2024) | Established mutual funds, institutional mandates, stable revenue |

| Reinsurance Operations | Great-West Lifeco | Cash Cow | Consistent income generation | Risk diversification, leverages existing expertise, stable earnings |

What You See Is What You Get

Power Corporation of Canada BCG Matrix

The Power Corporation of Canada BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously prepared by strategy experts, offers an in-depth look at the company's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs. You can confidently expect to download this professional-grade report, ready for immediate integration into your strategic planning, competitive analysis, or executive presentations, without any watermarks or demo content.

Dogs

Power Corporation of Canada's legacy product lines, particularly within its insurance and wealth management arms, are showing signs of declining demand. These older offerings often struggle to compete with newer, more innovative financial solutions, leading to a low market share. For instance, certain annuity products or traditional life insurance policies might be seeing reduced uptake as consumer preferences shift towards more flexible investment vehicles.

These legacy products represent a challenge because they continue to require resources for maintenance and compliance, even as their revenue generation potential diminishes. This situation can tie up valuable capital and management attention that could otherwise be directed towards growth areas, such as digital wealth platforms or specialized insurance products gaining traction in the market. In 2023, while Power Corporation reported strong overall financial performance, segments with these legacy offerings likely contributed less to the company's growth trajectory.

Underperforming minority investments within Power Corporation of Canada's portfolio are those small, non-strategic equity stakes that are failing to generate anticipated returns or are situated in industries experiencing sluggish growth. These positions can consume valuable management attention and capital without contributing significantly to the company's overall strategic objectives or core operations.

As of the first quarter of 2024, Power Corporation of Canada's diverse investment holdings include a variety of minority stakes. While specific details on underperforming minority investments are not publicly itemized, the company's overall strategy involves actively managing its portfolio to optimize performance and align with its long-term vision. For instance, in 2023, Power Corporation reported total assets of approximately $105 billion, reflecting a broad range of investments across different sectors.

Wealth management segments that haven't embraced digital tools or personalized, affordable services are losing ground. For instance, traditional advisory models that rely heavily on in-person meetings and generic advice may struggle to attract younger demographics or clients seeking greater convenience.

These outdated approaches risk becoming irrelevant as client expectations shift towards seamless online platforms and tailored financial planning. A recent report indicated that a significant portion of investors, particularly millennials, prefer digital interaction for managing their investments, highlighting a clear disconnect for legacy firms.

Niche or Geographically Limited Insurance Offerings

Niche or geographically limited insurance offerings within Power Corporation of Canada's portfolio, primarily managed through Great-West Lifeco, might represent potential question marks in a BCG Matrix analysis. These could be specialized products with a small customer base or those concentrated in specific regions where competition is particularly fierce.

For instance, a highly localized property insurance product in a less populated Canadian province might face challenges in achieving significant scale compared to national offerings. In 2024, while specific figures for such niche segments are often embedded within broader reporting, the general trend for smaller, specialized insurers is a constant battle for market share against larger, more diversified players. This can lead to slower revenue growth and potentially lower profitability.

- Limited Scale: Niche products often lack the economies of scale enjoyed by larger insurance lines, impacting cost-efficiency and pricing competitiveness.

- Intense Regional Competition: In geographically constrained markets, smaller players must contend with established regional insurers who may have deeper customer relationships and tailored product knowledge.

- Potential for Divestiture: Operations that consistently struggle to gain traction or achieve profitability due to these limitations could be candidates for strategic review, including potential divestiture to focus resources on more promising areas.

Non-Core, Non-Performing Diversified Holdings

Non-core, non-performing diversified holdings represent investments outside Power Corporation of Canada's main sectors, like financial services and sustainable tech. These are often found in industries with limited growth prospects. For example, if Power Corp had a stake in a legacy manufacturing company that consistently missed earnings targets and operated in a declining market, it would fit this category. Such assets can hinder overall portfolio health.

These holdings may not align with Power Corp's strategic direction and can consume resources without generating adequate returns. For instance, a historical investment in a regional print media company, if it's experiencing declining advertising revenue and readership, would be a classic example. By 2024, many such traditional media assets have struggled to adapt to digital disruption.

The presence of these assets can dilute the impact of stronger performers and mask underlying issues. Consider a situation where Power Corp holds a small, underperforming stake in a niche retail chain that is not scaling effectively. This type of asset can act as a drag on the company's overall financial performance metrics.

- Underperforming Assets: Investments consistently failing to meet financial expectations.

- Low-Growth Industries: Sectors experiencing stagnant or declining market expansion.

- Strategic Mismatch: Holdings that do not align with Power Corp's core business strategy.

- Portfolio Drag: Assets that negatively impact overall portfolio value and returns.

Power Corporation of Canada's legacy products, particularly in insurance and wealth management, represent their "Dogs" in the BCG Matrix. These are offerings with low market share and low growth potential, often struggling against newer, more agile competitors.

For example, certain traditional annuity or life insurance policies may see declining uptake as consumer preferences shift towards flexible digital platforms. These products require ongoing maintenance and compliance, tying up capital that could be invested in high-growth areas.

While Power Corporation of Canada's overall financial performance remains robust, these legacy segments likely contribute less to the company's growth trajectory, as seen in their 2023 results where total assets were approximately $105 billion.

Question Marks

Early-stage sustainable technology ventures within Power Corporation of Canada's BCG matrix are akin to 'Question Marks'. Power Sustainable is actively identifying and funding these nascent clean energy innovations. These companies, while operating in a high-growth sector, are still in their infancy, meaning their market position is undefined and their future profitability is uncertain.

These ventures require substantial capital infusions for research, development, and market penetration, reflecting their high investment needs. For instance, in 2024, venture capital funding for cleantech globally saw significant activity, with early-stage deals representing a substantial portion of the total investment, underscoring the trend Power Sustainable is tapping into.

Emerging fintech innovations, like those focusing on advanced AI for personalized financial advice or blockchain for secure transactions, represent Power Corporation of Canada's question marks. These ventures are in their infancy, demanding significant investment to foster growth and market penetration.

While these digital platforms hold immense potential for disruption, their current market share for Power Corporation is minimal. For instance, the global fintech market size was valued at approximately USD 2.4 trillion in 2023 and is projected to grow substantially, highlighting the opportunity but also the competitive landscape Power Corporation is entering.

Power Corporation of Canada is strategically exploring new geographic markets, particularly within high-growth emerging economies for financial services. These ventures, often in regions like Asia, represent nascent but promising opportunities with significant long-term growth potential.

These new market entries are characterized by substantial investment requirements to build market share and establish a strong presence. For instance, Power Corporation's expansion into Southeast Asia, a region projected to see continued economic growth and increasing demand for financial products, exemplifies this strategy.

Specialized Alternative Investment Fund Launches

Power Corporation of Canada, through its subsidiaries like Sagard and Power Sustainable, is actively launching specialized alternative investment funds. These funds are designed to tap into high-growth, less traditional asset classes, positioning them as potential stars within a BCG matrix framework. For instance, Sagard's recent forays into private credit and venture capital, particularly in areas like fintech and sustainable technology, represent early-stage ventures that require significant capital deployment to establish market presence and build track records.

These emerging funds are characterized by their capital consumption during the initial fundraising and asset deployment phases. They are building portfolios and reputations, aiming to eventually dominate their niche markets. For example, Power Sustainable's focus on renewable energy infrastructure and climate solutions, while a growing sector, involves substantial upfront investment to secure projects and demonstrate value, mirroring the characteristics of a question mark in the BCG matrix.

- Sagard's Private Credit Fund II, launched in 2023, secured $1.2 billion, indicating significant capital deployment for its strategy of investing in middle-market companies.

- Power Sustainable's Global Infrastructure Fund, targeting renewable energy and sustainable infrastructure, is actively deploying capital to build a diversified portfolio of green assets.

- These funds are in the early stages of development, requiring ongoing capital injections to scale operations and gain market traction.

- Their success hinges on identifying and capitalizing on emerging market trends in alternative asset classes.

Advanced Data Analytics and AI Integration

Power Corporation of Canada is strategically investing in advanced data analytics and AI to enhance its financial services operations. This push into technological leadership, while crucial for competitive advantage in a high-growth sector, represents a nascent area for the company. Significant investment in research and development, alongside implementation, is required to solidify its market position in this domain.

In 2023, Power Corporation's focus on digital transformation, which includes AI and data analytics, was evident in its capital allocation. While specific figures for AI investment are not separately disclosed, the broader digital and technology expenditure across its subsidiaries, such as Great-West Lifeco and IGM Financial, underscores this commitment. For instance, Great-West Lifeco reported significant investments in technology and digital capabilities as part of its growth strategy.

- Technological Investment: Power Corporation is channeling resources into AI and data analytics to drive innovation and efficiency across its diverse financial services portfolio.

- Competitive Landscape: This technological advancement is seen as a key differentiator in the rapidly evolving financial services industry, where data-driven insights are paramount.

- R&D Focus: Substantial investment in research and development is necessary to build and integrate these advanced capabilities, aiming to capture future market share in AI-driven financial solutions.

- Nascent Market Position: Despite the strategic importance, Power Corporation's leadership in AI integration is still developing, necessitating ongoing commitment to technological innovation and adoption.

Power Corporation of Canada's 'Question Marks' are its nascent ventures in high-growth, uncertain markets. These require significant investment to establish market share, with their future success being a key question. For example, Power Sustainable's investments in early-stage cleantech and Sagard's emerging alternative asset funds fit this category.

These ventures, like new fintech innovations or expansion into emerging geographic markets, are capital-intensive and have unproven profitability. Global fintech market growth, projected to be substantial, highlights the potential but also the competitive challenge these 'Question Marks' face.

Power Corporation's strategic push into advanced data analytics and AI also represents a 'Question Mark'. While crucial for future competitiveness, these areas demand ongoing R&D and implementation to build market leadership.

| Venture Area | Description | Investment Need | Market Position | Potential |

|---|---|---|---|---|

| Early-Stage Cleantech | Nascent clean energy innovations | High | Undefined | High Growth |

| Emerging Fintech | AI for financial advice, blockchain | Significant | Minimal | Disruptive Potential |

| New Geographic Markets | Financial services in emerging economies | Substantial | Nascent | Long-Term Growth |

| Advanced Data Analytics & AI | Enhancing financial services operations | High R&D | Developing | Competitive Advantage |

BCG Matrix Data Sources

Our BCG Matrix for Power Corporation of Canada is informed by a blend of official financial reports, detailed industry analysis, and market growth projections.