Power Assets Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Power Assets Holdings Bundle

Power Assets Holdings boasts strong operational efficiencies and a diversified portfolio, but faces increasing regulatory scrutiny and the capital demands of renewable energy transitions. Understanding these dynamics is crucial for navigating its future success.

Want the full story behind Power Assets Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Power Assets Holdings Limited's strength lies in its geographically diversified global portfolio. This includes significant investments in Hong Kong, Mainland China, the United Kingdom, and Australia, among other key markets. This spread across different economies helps buffer against localized downturns or regulatory changes, ensuring a more consistent revenue flow.

The company's focus on essential utility services, such as electricity and gas, further bolsters its stability. These sectors typically exhibit resilient demand, even during economic slowdowns. For instance, as of the first half of 2024, Power Assets reported stable contributions from its international operations, underscoring the benefit of this diversified approach in providing predictable returns.

Power Assets Holdings benefits significantly from stable and regulated income streams, with roughly 80% of its business rooted in regulated utility assets. This substantial exposure to regulated operations provides a strong buffer against the unpredictable nature of market fluctuations, inflationary pressures, and the increasing costs associated with borrowing.

The predictable returns generated by these regulated assets are a cornerstone of Power Assets' financial strength, directly contributing to its consistent financial performance and reliable dividend distribution history. This stability is a key advantage in the often-volatile energy sector.

Power Assets Holdings boasts a strong financial foundation, underscored by its 'A/Stable' long-term issuer credit rating from Standard & Poor's, which was reaffirmed in February 2024. This rating reflects the company's consistent performance and sound financial management.

The company's robust balance sheet and disciplined capital structure are key strengths. As of December 31, 2024, Power Assets maintained a net cash position, providing significant financial flexibility. This healthy liquidity enables the company to pursue strategic growth initiatives and investments.

This financial resilience directly supports Power Assets' capacity to fund new acquisitions and maintain its commitment to shareholder returns. Its strong creditworthiness facilitates access to capital markets on favorable terms, further bolstering its investment capabilities.

Commitment to Renewable Energy and Sustainability

Power Assets Holdings demonstrates a strong commitment to renewable energy and sustainability, actively expanding its green energy portfolio. This includes a focus on emerging technologies like hydrogen, aligning with the global shift towards decarbonization. By 2050, the company aims to achieve net-zero carbon emissions, a goal supported by significant investments in innovation and new green projects.

This strategic direction is crucial for future growth. For instance, as of early 2024, the renewable energy sector saw continued robust investment, with global clean energy spending projected to reach new highs. Power Assets' proactive approach in this area positions it favorably to capitalize on these expanding market opportunities and meet increasing demand for sustainable energy solutions.

- Pursuing Hydrogen and Green Projects: Actively investing in and developing new ventures in hydrogen and other green energy initiatives.

- Expanding Renewable Portfolio: Continuously increasing the capacity and diversity of its renewable energy assets.

- Net-Zero Commitment: Targeting net-zero carbon emissions by 2050, demonstrating a long-term environmental strategy.

- Innovation Investment: Allocating resources to technological advancements that support the transition to cleaner energy sources.

Operational Excellence and Reliability

Power Assets Holdings demonstrates exceptional operational excellence, a key strength that underpins its reliability. Its operating companies consistently deliver high performance, translating into strong customer satisfaction.

This commitment to operational efficiency is exemplified by HK Electric, which achieved a remarkable supply reliability rate exceeding 99.9999% in 2024. Such a high standard not only bolsters the company's reputation but also helps secure favorable regulatory treatment.

The company's ability to maintain such superior operational performance is crucial for its extensive customer base, serving approximately 20.1 million customers globally. This ensures the uninterrupted provision of essential energy services, a testament to their robust infrastructure and management practices.

- World-Class Reliability: HK Electric's 2024 supply reliability surpassed 99.9999%.

- Customer Focus: High operational performance drives customer satisfaction across its global operations.

- Regulatory Benefits: Operational excellence often leads to positive regulatory outcomes and incentives.

- Extensive Reach: Serves over 20.1 million customers worldwide, highlighting operational capacity.

Power Assets Holdings' strength is significantly boosted by its geographically diverse asset base, spanning key markets like Hong Kong, Mainland China, the UK, and Australia. This diversification acts as a natural hedge against regional economic volatility and regulatory shifts, ensuring more stable revenue streams. The company's strategic focus on essential utility services, such as electricity and gas, further enhances this stability, as demand for these services remains resilient even during economic downturns. For instance, in the first half of 2024, international operations contributed steadily, validating the benefits of this broad geographical spread in delivering predictable returns.

A substantial portion of Power Assets' business, approximately 80%, is derived from regulated utility assets. This high exposure to regulated operations provides a robust shield against market fluctuations, inflationary pressures, and rising borrowing costs. The predictable income generated from these regulated assets is a fundamental pillar of the company's financial strength, directly supporting its consistent financial performance and a history of reliable dividend distributions, which is a significant advantage in the often-unpredictable energy sector.

The company's financial health is further evidenced by its strong credit rating. Standard & Poor's reaffirmed Power Assets Holdings' 'A/Stable' long-term issuer credit rating in February 2024, a testament to its consistent performance and prudent financial management. This strong financial foundation, coupled with a robust balance sheet and disciplined capital structure, provides significant financial flexibility. As of December 31, 2024, the company held a net cash position, enabling it to pursue strategic growth opportunities and maintain its commitment to shareholder returns through favorable access to capital markets.

Power Assets Holdings demonstrates a forward-looking approach by actively investing in renewable energy and sustainability, including a focus on emerging technologies like hydrogen. This aligns with the global drive towards decarbonization, with a target of achieving net-zero carbon emissions by 2050 supported by substantial investments in green projects and innovation. This strategic positioning is critical for future growth, especially as global clean energy spending continues to rise, with projections indicating new highs in 2024. Power Assets' proactive engagement in this sector allows it to capitalize on expanding market opportunities and meet the growing demand for sustainable energy solutions.

| Strength Area | Key Metric/Fact | Impact |

|---|---|---|

| Geographic Diversification | Investments in Hong Kong, Mainland China, UK, Australia | Mitigates regional economic and regulatory risks, ensures stable revenue. |

| Regulated Asset Base | ~80% of business in regulated utilities | Provides predictable income, shields against market volatility and inflation. |

| Financial Strength | 'A/Stable' S&P rating (Feb 2024), Net Cash (Dec 2024) | Ensures financial flexibility, facilitates growth investments and favorable borrowing. |

| Renewable Energy Focus | Net-zero target by 2050, investment in hydrogen | Positions for future growth in sustainable energy, aligns with global decarbonization trends. |

| Operational Excellence | HK Electric reliability >99.9999% (2024) | Enhances reputation, supports customer satisfaction, and can lead to favorable regulatory treatment. |

What is included in the product

Delivers a strategic overview of Power Assets Holdings’s internal and external business factors, highlighting its strengths in infrastructure, opportunities in renewable energy, potential weaknesses in diversification, and threats from regulatory changes.

Uncovers hidden opportunities and threats in Power Assets Holdings' market, enabling proactive risk mitigation.

Weaknesses

While regulated assets offer a stable revenue base, they also bring the risk of regulatory price controls that can limit profitability. For instance, UK Power Networks (UKPN) is currently navigating the RIIO-ED2 price control period, which features more stringent price caps.

These regulatory resets, such as the upcoming one for SA Power Networks (SAPN) covering 2025-2030, directly influence future returns. Effective management is crucial to ensure sustained profitability within these evolving frameworks.

Operating and expanding energy infrastructure, like that of Power Assets Holdings, demands substantial ongoing investment. This capital intensity means significant funds are continually needed for network upkeep and new development projects.

While Power Assets Holdings maintained a robust financial standing, the sheer scale of capital expenditures required for modernizing its networks, constructing new power generation facilities, and integrating renewable energy sources presents a challenge. Without careful financial management, these necessities could strain the company's cash flow or lead to increased borrowing.

Power Assets Holdings, while benefiting from regulated businesses, faces vulnerability to rising global interest rates. Higher borrowing costs can squeeze margins on new projects and make refinancing existing debt more expensive, impacting the company's bottom line.

This sensitivity is underscored by the increase in net debt from HKD 43.6 billion at the end of 2023 to HKD 45.1 billion by mid-2024, even though the overall debt level remains manageable.

Reliance on Mature Market Growth

A key weakness for Power Assets Holdings is its significant reliance on mature markets for growth. A substantial part of its investment portfolio is concentrated in well-established, regulated territories such as the United Kingdom and Australia. While these regions provide a stable operating environment, they inherently offer more constrained growth prospects when contrasted with rapidly developing economies.

This strategic focus on acquiring premium assets within these mature markets, while ensuring stability, may cap the company's potential for aggressive expansion in terms of market share or overall revenue growth. For instance, in 2023, Power Assets' operations in the UK and Australia contributed a significant portion of its revenue, highlighting this dependency.

The company's approach prioritizes quality and stability over rapid, high-volume expansion, which could be a disadvantage in a competitive global energy sector. This could translate to slower year-over-year revenue increases compared to peers with a stronger presence in emerging markets.

- Mature Market Concentration: Investments heavily weighted towards the UK and Australia limit exposure to higher-growth emerging markets.

- Slower Growth Potential: Mature, regulated markets typically offer less aggressive revenue and market share expansion opportunities.

- Acquisition Strategy Impact: Focus on acquiring high-quality, established assets may inherently restrict the pace of overall company growth.

Geopolitical and Macroeconomic Volatility

Power Assets Holdings operates in a global landscape marked by persistent geopolitical tensions and significant macroeconomic volatility. These external forces, including ongoing inflationary pressures and elevated interest rates, introduce considerable uncertainty into investment environments. For instance, the International Monetary Fund projected global inflation to remain elevated in 2024 before moderating, impacting the cost of capital and project feasibility.

This volatile climate directly affects the company by creating fluctuations in currency exchange rates, which can impact the value of international earnings and assets. Furthermore, supply chain disruptions, often exacerbated by geopolitical events, can delay project timelines and increase operational costs, directly challenging Power Assets Holdings' ability to execute projects efficiently and maintain profitability.

- Geopolitical Instability: Ongoing conflicts and trade disputes create unpredictable operating conditions.

- Inflationary Pressures: Rising costs for materials and labor can erode profit margins on long-term projects.

- High Interest Rates: Increased borrowing costs make new investments less attractive and can strain existing debt.

- Currency Fluctuations: Volatile exchange rates impact the translation of foreign earnings and asset values.

The company's reliance on mature markets like the UK and Australia, which contributed significantly to its 2023 revenue, limits its exposure to potentially higher-growth emerging economies. This concentration means that while stable, the growth trajectory may be slower compared to peers operating in more dynamic regions.

Furthermore, the strategic focus on acquiring established, high-quality assets, while ensuring stability, can cap the pace of overall company expansion and market share gains. This approach prioritizes quality over rapid, high-volume growth, potentially leading to slower year-over-year revenue increases.

The company's significant capital expenditure needs for network modernization and new developments, exemplified by the increase in net debt from HKD 43.6 billion to HKD 45.1 billion between end-2023 and mid-2024, also present a challenge. Without careful financial management, these necessities could strain cash flow or increase borrowing.

Preview Before You Purchase

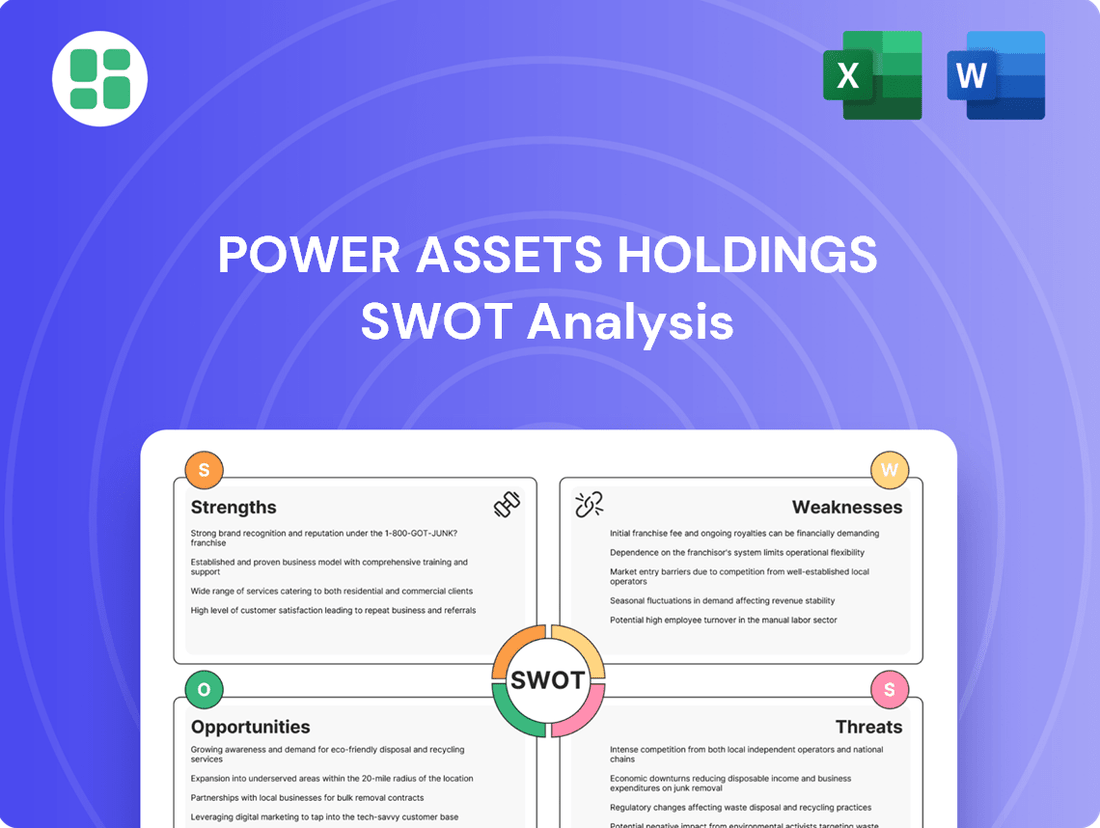

Power Assets Holdings SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Power Assets Holdings' Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing Power Assets Holdings' market position and future growth potential.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Power Assets Holdings SWOT analysis, ready for your strategic decision-making.

Opportunities

The global transition to sustainable energy sources offers substantial growth avenues for Power Assets. The company's proactive engagement in developing new hydrogen and green energy initiatives, alongside its 2050 net-zero emissions goal, positions it to capitalize on strategic investments in solar, wind, and hydrogen infrastructure.

This strategic focus is bolstered by growing governmental support and public preference for cleaner energy alternatives. For instance, in 2024, global renewable energy capacity additions are projected to reach a record 500 GW, driven by supportive policies and technological advancements, presenting a fertile ground for Power Assets' expansion.

Power Assets Holdings actively pursues strategic acquisitions, aligning with its global investment strategy focused on high-quality assets in stable energy markets. For instance, its acquisition of Phoenix Energy and UK Renewables Energy in the UK highlights a successful approach to expanding its portfolio and securing immediate revenue streams. These moves demonstrate a commitment to growth through targeted M&A activity.

Advancements in smart grid technologies, energy storage, and digital infrastructure present significant opportunities for Power Assets Holdings to boost efficiency and reliability. For instance, smart grid deployments globally are expected to reach $100 billion by 2027, offering a vast market for integrated solutions.

By investing in these areas, the company can better integrate distributed renewable energy sources, a trend that saw global renewable energy capacity additions reach a record 510 gigawatts in 2023, according to the International Energy Agency.

These technological upgrades can drive down operational costs, improve customer service through better data management, and unlock new revenue streams, such as grid services or data monetization, thereby enhancing Power Assets Holdings' competitive edge in the evolving energy landscape.

Decarbonization Initiatives and Government Support

Governments globally are actively promoting decarbonization, creating a fertile ground for companies like Power Assets Holdings. These initiatives often involve substantial financial backing and favorable regulations. For instance, the European Union's Green Deal aims to mobilize at least €1 trillion in sustainable investments by 2030, with significant portions earmarked for energy transition projects. This presents a clear opportunity for Power Assets to align its strategic investments with these policy priorities.

The push towards a low-carbon economy includes concrete actions such as the integration of green hydrogen into existing gas infrastructure and the planned phase-out of coal power plants in many regions. In 2024, Germany announced plans to accelerate the phase-out of coal power, aiming for completion by 2030. Power Assets can capitalize on this by expanding its portfolio of renewable energy assets and developing hydrogen-related infrastructure, thereby securing a competitive advantage in a rapidly evolving energy landscape.

These supportive government frameworks translate directly into tangible financial benefits and market expansion potential. Opportunities include:

- Access to Green Financing: Leveraging government-backed green bonds and subsidies for renewable energy projects, potentially lowering the cost of capital for new developments.

- Policy Certainty for Investments: Government commitments to decarbonization provide long-term visibility, de-risking significant capital expenditures in sustainable technologies.

- Market Growth in Renewables: Increased demand for renewable energy sources, driven by policy mandates and consumer preference, creates a larger addressable market for Power Assets' green solutions.

- Partnership Opportunities: Collaborating with government agencies and other stakeholders on pilot projects and large-scale decarbonization initiatives, fostering innovation and market penetration.

Growth in Emerging Markets (Selective)

Power Assets Holdings can strategically target emerging markets with stable regulatory frameworks and predictable demand. For instance, countries in Southeast Asia are experiencing significant infrastructure development, with the renewable energy sector in Vietnam showing robust growth. This selective approach allows for higher growth potential compared to saturated developed markets.

Diversification into these select regions can also mitigate risks associated with over-reliance on a single market. By focusing on opportunities that meet stringent criteria for sustainable returns, Power Assets Holdings can tap into new revenue streams while adhering to its long-term objectives.

- Emerging Market Growth: Asia-Pacific renewable energy capacity is projected to grow significantly, with countries like Vietnam and the Philippines offering attractive investment environments.

- Regulatory Stability: Identifying markets with clear and consistent energy policies is crucial for ensuring predictable returns on investment.

- Diversification Benefits: Expanding into new geographic regions can reduce overall portfolio risk and enhance long-term stability.

Power Assets Holdings is well-positioned to benefit from the global shift towards renewable energy, with significant opportunities in green hydrogen and net-zero initiatives. The company's strategic acquisitions, such as Phoenix Energy and UK Renewables Energy, demonstrate a successful approach to portfolio expansion and immediate revenue generation.

Advancements in smart grid technologies and energy storage offer avenues for improved efficiency and new revenue streams, with the global smart grid market projected to reach $100 billion by 2027. Supportive government policies, like the EU's Green Deal aiming for €1 trillion in sustainable investments by 2030, provide policy certainty and access to green financing, de-risking capital expenditures.

The company can also leverage emerging market growth, particularly in Asia-Pacific, where renewable energy capacity is expanding rapidly, offering diversification benefits and higher growth potential. For instance, Vietnam's renewable energy sector is showing robust growth, presenting attractive investment opportunities.

| Opportunity Area | Key Drivers | 2024/2025 Data/Projections |

|---|---|---|

| Sustainable Energy Transition | Global decarbonization efforts, net-zero targets | Global renewable energy capacity additions projected to reach a record 500 GW in 2024. |

| Strategic Acquisitions & M&A | Portfolio expansion, securing revenue streams | Acquisition of Phoenix Energy and UK Renewables Energy cited as examples. |

| Technological Advancements | Smart grids, energy storage, digital infrastructure | Global smart grid deployments expected to reach $100 billion by 2027. |

| Government Support & Policy | Green Deal initiatives, decarbonization mandates | EU Green Deal aims to mobilize at least €1 trillion in sustainable investments by 2030. |

| Emerging Market Expansion | Infrastructure development, regulatory stability | Asia-Pacific renewable energy capacity growth, Vietnam's robust sector. |

Threats

Power Assets Holdings operates in a landscape of increasingly stringent regulatory oversight and dynamic policy shifts across its global operations. Navigating diverse regulatory frameworks, from price controls to environmental mandates, presents a continuous challenge. For instance, the UK's energy regulator, Ofgem, has implemented stricter price caps and greater transparency demands, directly affecting revenue streams and necessitating operational adjustments.

The company must also contend with evolving government policies concerning energy transition and foreign investment, which can significantly alter the operating environment. For example, shifts in renewable energy incentives or changes to foreign ownership rules in key markets could impact project viability and future investment decisions.

The energy landscape is becoming fiercely competitive, with new entrants in renewables challenging established utilities. These traditional players are also grappling with the rise of decentralized energy sources and innovative business approaches.

Disruptive technologies like advanced energy storage solutions, which saw significant investment growth in 2024, and the development of microgrids pose a substantial threat. These advancements could fundamentally change how energy is generated and distributed, potentially diminishing reliance on centralized power and transmission infrastructure if not proactively integrated.

Ongoing geopolitical tensions, such as the evolving situation in Eastern Europe and trade disputes between major economies, continue to create uncertainty in global markets. This instability can directly affect investment climates and currency exchange rates, impacting Power Assets Holdings' cost of capital and the profitability of its international projects.

Operating across diverse regions means Power Assets Holdings is exposed to these macro-risks, which could lead to project delays, increased operational costs, or downward pressure on asset valuations. For instance, a significant escalation in trade tariffs could raise the cost of imported equipment essential for new power generation facilities, thereby affecting project viability.

Cybersecurity and Infrastructure Vulnerabilities

Power Assets Holdings, as a critical energy infrastructure operator, faces significant threats from cybersecurity vulnerabilities. The potential for disruption to its operations, data breaches, and substantial financial and reputational damage is a constant concern. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the scale of this threat to all industries, including energy.

Maintaining the security and resilience of its vast networks against increasingly sophisticated cyberattacks presents an ongoing and evolving challenge for Power Assets. The interconnected nature of modern energy grids means a single breach could have cascading effects.

- Cyberattack Costs: Global cybercrime costs are expected to hit $10.5 trillion annually by 2025.

- Infrastructure Risk: Critical energy infrastructure is a prime target for state-sponsored and criminal hacking groups.

- Operational Disruption: A successful cyberattack could lead to widespread power outages and service interruptions.

- Data Breach Impact: Compromised sensitive data can result in significant financial penalties and loss of customer trust.

Climate Change Impacts and Environmental Risks

Power Assets Holdings faces significant threats from the physical impacts of climate change. Extreme weather events, such as intensified typhoons and prolonged heatwaves, pose a direct risk to the operational integrity and reliability of its energy infrastructure, potentially leading to service disruptions and increased maintenance costs. For instance, in 2023, the Asia-Pacific region experienced a notable rise in severe weather, impacting utility operations across several markets.

Furthermore, the accelerating pace of environmental regulations and the global push for faster decarbonization present a substantial challenge. These pressures may compel Power Assets Holdings to undertake costly upgrades to existing assets or even divest from carbon-intensive operations sooner than anticipated. This could significantly affect financial performance and necessitate a strategic reallocation of capital, potentially impacting profitability and shareholder returns as the company navigates the transition to a lower-carbon economy.

Key climate-related threats include:

- Increased frequency and intensity of extreme weather events impacting infrastructure reliability.

- Stricter environmental regulations requiring accelerated investment in cleaner technologies or asset retirement.

- Potential for stranded assets due to a faster-than-expected transition away from fossil fuels, impacting valuations.

- Rising operational costs associated with climate adaptation and mitigation measures.

The company faces escalating cybersecurity risks, with global cybercrime costs projected to reach $10.5 trillion annually by 2025, making critical energy infrastructure a prime target. Sophisticated cyberattacks could lead to widespread power outages and significant financial and reputational damage.

Physical impacts from climate change, including more frequent extreme weather events, threaten infrastructure reliability and could increase operational costs for repairs and adaptation measures. Additionally, accelerating decarbonization efforts and stricter environmental regulations may necessitate costly asset upgrades or divestments, potentially creating stranded assets.

| Threat Category | Specific Risk | Impact Example | Data Point/Year |

| Cybersecurity | Sophisticated cyberattacks on critical infrastructure | Potential for widespread power outages, data breaches | Global cybercrime costs to reach $10.5 trillion annually by 2025 |

| Climate Change | Extreme weather events (e.g., intensified typhoons) | Damage to infrastructure, service disruptions, increased maintenance costs | Notable rise in severe weather events in Asia-Pacific in 2023 |

| Regulatory & Policy | Stricter environmental regulations, faster decarbonization | Costly asset upgrades, potential for stranded assets, impact on profitability | Accelerating global push for net-zero emissions by mid-century |

SWOT Analysis Data Sources

This SWOT analysis for Power Assets Holdings is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market research, and insights from industry experts. These sources collectively provide a well-rounded view of the company's operational landscape and future potential.