Power Assets Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Power Assets Holdings Bundle

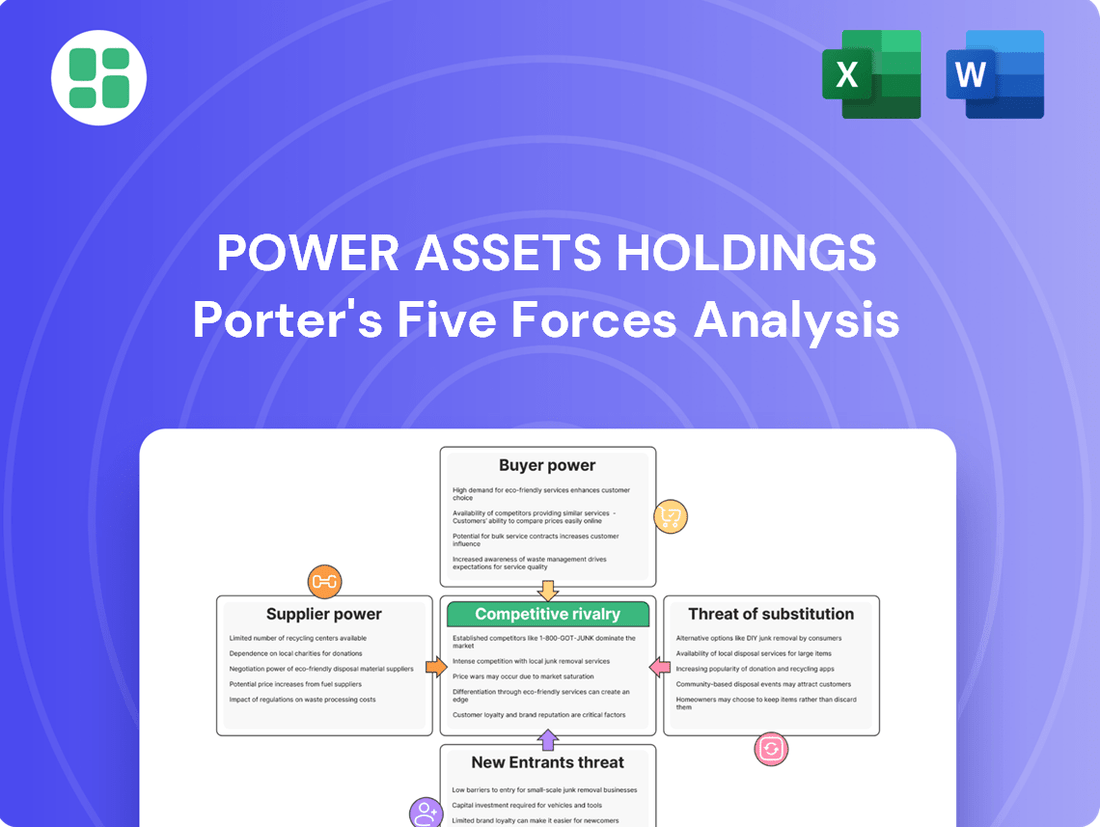

Power Assets Holdings operates in a dynamic energy sector, where understanding the competitive landscape is crucial. Our analysis reveals moderate bargaining power of buyers and suppliers, balanced by a low threat of new entrants due to high capital requirements.

The threat of substitutes is also relatively low, given the essential nature of power. However, intense rivalry among existing players presents a significant challenge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Power Assets Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Power Assets Holdings often finds itself dependent on a small group of specialized manufacturers for crucial infrastructure components such as turbines, transformers, and advanced grid technology. This limited supplier pool is a significant factor in the bargaining power of suppliers.

The substantial financial investment and intricate engineering required for these specialized assets make it both challenging and costly for Power Assets to switch between suppliers. Consequently, these specialized vendors wield considerable influence over pricing and terms.

This concentrated supply chain can directly translate into increased procurement expenses and extended delivery timelines for the essential equipment Power Assets needs to maintain and expand its operations. For instance, major turbine manufacturers in 2024 often had backlogs extending well into 2026, impacting project schedules.

Power Assets Holdings' reliance on thermal generation means its operations are tied to the availability and pricing of fuels like natural gas and coal. The global supply of these essential resources is often concentrated among a limited number of large producers, or secured through long-term agreements. This concentration inherently grants significant leverage to these suppliers.

Geopolitical shifts and disruptions within global supply chains can directly affect the cost and accessibility of these fuels. For instance, in 2024, ongoing international tensions continued to create volatility in energy markets, impacting the cost of natural gas for many utilities. Such external factors amplify the bargaining power of fuel suppliers, allowing them to influence terms and pricing.

As Power Assets strategically moves towards cleaner energy sources, its supplier dependencies are evolving. This transition, while aimed at long-term sustainability, will reshape its relationships with suppliers in the renewable energy sector, potentially introducing new dynamics to supplier bargaining power in the coming years.

Suppliers offering advanced environmental control technologies and renewable energy components are gaining leverage. This is driven by mounting regulatory pressure for decarbonization and increasingly strict environmental standards. For instance, the global renewable energy market was valued at approximately USD 1.1 trillion in 2023 and is projected to grow significantly, indicating substantial investment in these areas.

Power Assets Holdings, like many in the energy sector, must invest in these technologies to align with climate action goals. This necessity empowers suppliers who can demonstrate proven, compliant solutions, particularly as the global shift towards green energy necessitates considerable capital outlay for new technologies and infrastructure.

Skilled Labor and Technology Providers

The bargaining power of suppliers for Power Assets Holdings, particularly concerning skilled labor and technology providers, is significant. Specialized engineering, IT, and maintenance services crucial for complex energy infrastructure, including smart grid technologies and renewable energy integration, are sourced from a select group of highly skilled entities.

The limited availability of this specialized expertise, coupled with the proprietary nature of certain advanced technologies, grants these service providers considerable leverage. This is especially evident in the ongoing maintenance and upgrading of sophisticated digital utility systems, which require niche knowledge and capabilities.

- Limited Pool of Expertise: The demand for highly specialized skills in areas like smart grid development and renewable energy integration outstrips supply, empowering providers.

- Proprietary Technology: Companies offering unique or patented technologies for utility operations possess strong bargaining power due to the lack of alternatives.

- High Switching Costs: For complex digital systems, the cost and disruption associated with changing service providers can be substantial, further strengthening supplier leverage.

Long-Term Contracts and Switching Costs

Power Assets Holdings frequently secures long-term agreements for essential inputs like fuel, critical equipment servicing, and technology access. These contracts are designed to guarantee smooth and predictable operations. For instance, in 2024, a significant portion of their fuel procurement was covered by multi-year agreements, providing a stable cost base.

The financial implications of terminating or altering these long-term commitments are substantial. Power Assets would face considerable penalties, potential interruptions to their power generation, and the expense of integrating new suppliers. This makes it economically challenging to switch, thereby enhancing the leverage of their existing suppliers.

- High Switching Costs: The penalties and operational disruptions associated with changing suppliers create significant barriers.

- Supplier Lock-in: Long-term contracts effectively lock Power Assets into current supplier relationships.

- Operational Stability: These contracts, while increasing supplier power, also ensure a reliable supply chain for critical assets.

- 2024 Fuel Contracts: A substantial percentage of Power Assets' 2024 fuel needs were secured through long-term arrangements, illustrating this strategy.

The bargaining power of suppliers for Power Assets Holdings is considerable, driven by the specialized nature of its infrastructure needs and the concentration within certain supply markets. This leverage is particularly evident in the procurement of critical components like turbines and advanced grid technology, where a limited number of manufacturers exist. Furthermore, the company's reliance on specific fuels, such as natural gas and coal, places it at the mercy of global producers whose supply chains can be influenced by geopolitical events, as seen with energy market volatility in 2024.

| Supplier Category | Key Dependencies | Supplier Bargaining Power Factors | 2024 Impact/Data |

|---|---|---|---|

| Infrastructure Components (Turbines, Transformers) | Specialized manufacturing, high R&D investment | Limited suppliers, high switching costs, proprietary technology | Major turbine manufacturers had backlogs extending into 2026. |

| Fuel (Natural Gas, Coal) | Global production concentration, long-term contracts | Geopolitical risks, supply chain disruptions, price volatility | Ongoing international tensions created energy market volatility. |

| Renewable Energy Technology | Growing market, regulatory pressure for decarbonization | Increasing demand for green solutions, investment in new tech | Global renewable energy market valued at approx. USD 1.1 trillion in 2023. |

| Skilled Labor & Services (Engineering, IT) | Niche expertise, proprietary digital systems | Scarcity of specialized skills, high integration costs for new providers | Ongoing upgrades of sophisticated digital utility systems require niche knowledge. |

What is included in the product

This analysis of Power Assets Holdings dissects the competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly identify competitive advantages and vulnerabilities in the utility sector, enabling proactive strategy development.

Customers Bargaining Power

The bargaining power of customers is significantly influenced by regulatory oversight and price controls in the utility sector. In markets like Hong Kong and the UK, government bodies actively regulate electricity and gas tariffs, essentially acting as a proxy for consumer interests.

These regulators implement price caps and scrutinize tariff adjustments, directly limiting Power Assets' freedom to increase prices at will. For instance, Hong Kong's electricity tariffs saw an annual review in 2025, with approved increases capped below 1%, underscoring the constrained pricing environment.

The residential customer base for power assets is generally vast and highly dispersed. In many regulated markets, individual consumers face minimal switching costs, especially when alternative providers are scarce or unavailable. This fragmentation means individual customers have limited direct bargaining power.

However, their collective influence is significant, often exerted through regulatory bodies and public sentiment. These channels can shape decisions on tariff approvals and service quality standards. For instance, in Australia, residential electricity prices are anticipated to decrease over the next ten years, driven partly by increased electrification efforts.

For Power Assets Holdings, the bargaining power of customers is significantly influenced by the high importance of service reliability across all customer segments. An uninterrupted energy supply is not just a convenience but a critical necessity, making the quality of service a paramount consideration for every user.

While customers might have limited options for energy providers, any lapse in service delivery can trigger substantial public outcry and regulatory scrutiny. This reality compels Power Assets to uphold rigorous service standards and make substantial investments in infrastructure resilience to prevent disruptions.

For instance, HK Electric, a key subsidiary, is actively investing to enhance its reliability, particularly in preparation for and response to extreme weather events. These investments underscore the company's commitment to meeting customer expectations for dependable service.

Potential for Distributed Energy Resources (DERs)

The increasing adoption of distributed energy resources (DERs) significantly bolsters customer bargaining power. Large industrial, commercial, and even residential customers can now generate their own electricity through options like rooftop solar and battery storage.

This shift reduces their dependence on traditional utility providers, giving them more leverage in negotiations. As the cost of DER technologies continues to fall, this trend is expected to accelerate.

For instance, by 2024, the U.S. solar market alone saw continued growth, with residential solar installations projected to reach new heights, demonstrating the tangible impact of DERs on customer choice and power.

- Reduced Grid Reliance: Customers can partially or fully disconnect from the grid, lessening their dependence on a single power source.

- Cost Savings Potential: On-site generation can lead to lower electricity bills, especially for high-consumption users.

- Increased Negotiating Power: The option to self-generate gives customers more leverage when discussing tariffs and service agreements with utility companies.

- Technological Advancements: Falling costs and improved efficiency of solar panels and battery storage make DERs more accessible and attractive to a wider customer base.

Government and Industrial Customers' Leverage

Large industrial consumers and government bodies often wield considerable influence due to their sheer energy demand and strategic significance. In 2024, for instance, major industrial parks or government facilities can negotiate favorable pricing and service agreements, impacting Power Assets Holdings' profitability.

These powerful customers may also explore alternatives like on-site generation or direct sourcing from independent power producers, particularly in markets with evolving deregulation. This can pressure Power Assets to offer customized contracts and potentially reduce its market share.

- Significant Volume Discounts: Large industrial clients can leverage their consumption volumes to demand lower per-unit energy costs.

- Service Level Agreements (SLAs): Government and industrial customers often negotiate strict SLAs, requiring Power Assets to maintain high reliability and uptime.

- Threat of Self-Generation: The potential for these entities to invest in their own power generation capacity acts as a constant leverage point in negotiations.

- Direct Procurement Options: In certain jurisdictions, these customers can bypass traditional utility providers and procure power directly from alternative sources.

The bargaining power of customers for Power Assets Holdings is moderate, influenced by regulatory frameworks and the nature of energy as an essential service. While individual customers have limited direct power due to low switching costs and dispersed demand, their collective voice, amplified through regulators and public opinion, carries significant weight. For instance, in 2025, Hong Kong’s electricity tariffs saw approved increases capped below 1%, illustrating regulatory control over pricing.

The increasing adoption of distributed energy resources (DERs) is a growing factor, empowering customers by reducing their reliance on traditional utility providers. By 2024, residential solar installations continued to grow, offering customers more choice and leverage. Large industrial consumers also exert considerable influence through their high energy demand, potentially negotiating favorable terms or exploring self-generation options.

| Factor | Impact on Power Assets | Example/Data Point (2024-2025) |

|---|---|---|

| Regulatory Price Controls | Limits pricing flexibility | HK Electricity Tariff Cap: <1% increase (2025) |

| Customer Switching Costs | Generally low for residential users | Minimal if alternative providers are scarce |

| Distributed Energy Resources (DERs) | Increases customer leverage | Continued growth in residential solar installations (2024) |

| Large Industrial/Government Consumers | Significant negotiating power | Potential for direct procurement or self-generation |

Same Document Delivered

Power Assets Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Power Assets Holdings' Porter's Five Forces Analysis, covering the bargaining power of buyers, the threat of new entrants, the threat of substitutes, the intensity of rivalry, and the bargaining power of suppliers. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

Power Assets Holdings operates in markets that are significantly shaped by their geographical location and the specific regulations in place. For instance, its operations in Hong Kong, the UK, and Australia are governed by distinct regulatory bodies and policies, influencing the competitive landscape.

In many segments, particularly transmission and distribution, Power Assets often functions within regulated monopolies or oligopolies. This structure inherently limits direct head-to-head competition in these essential infrastructure areas, as market entry is typically controlled. For example, in the UK, the energy market is regulated by Ofgem, which oversees network companies.

However, the competitive intensity increases in the power generation and renewable energy project development sectors. Here, Power Assets contends with other independent power producers and developers vying for new projects and market share. In 2024, the global renewable energy sector saw significant investment, with companies like Power Assets needing to innovate and secure competitive bids to expand their generation portfolios.

Power Assets Holdings is navigating a fiercely competitive landscape as it grows its renewable energy segment. Numerous global and local companies are actively pursuing wind, solar, and other green energy projects, creating a crowded marketplace.

The worldwide shift towards cleaner energy sources is a magnet for substantial investment, intensifying the race for desirable clean energy assets. For example, China's renewable energy capacity has seen a remarkable expansion, with the country adding approximately 190 GW of solar and wind power capacity in 2023 alone, underscoring the global trend.

In mature markets such as Hong Kong and parts of the UK, where energy demand growth is often subdued, competition among established players intensifies. This maturity can lead companies like Power Assets Holdings to focus on operational efficiency, service innovation, and strategic mergers or acquisitions to secure market share and profitable growth, rather than engaging in aggressive price wars.

The United Kingdom, for instance, is actively engaged in reforming its electricity market arrangements. These reviews aim to foster a fair and efficient competitive landscape, influencing how companies like Power Assets Holdings operate and invest within the UK energy sector. Such regulatory shifts can significantly impact competitive dynamics and profitability.

High Fixed Costs and Exit Barriers

Power Assets Holdings operates in an industry where significant upfront investment in infrastructure, such as power plants and transmission networks, results in very high fixed costs. This capital-intensive nature means companies cannot easily divest or exit the market without incurring substantial financial penalties and asset write-downs. For instance, the global energy infrastructure sector saw investments exceeding $1.5 trillion in 2023 alone, highlighting the scale of these fixed costs.

These elevated exit barriers compel existing players, including Power Assets, to engage in intense competition to ensure their assets remain operational and profitable. Even when market demand is sluggish or growth prospects are limited, companies are motivated to maintain utilization rates to cover their substantial fixed expenses. This often leads to price competition or efforts to secure long-term contracts, intensifying rivalry among incumbents.

- High Capital Intensity: The power sector demands massive, long-term investments in generation, transmission, and distribution infrastructure.

- Exit Barriers: Significant sunk costs in specialized, non-fungible assets make exiting the market economically prohibitive.

- Competitive Pressure: To cover fixed costs, companies like Power Assets must strive for high asset utilization, fueling ongoing rivalry.

- Market Stability: Sustained competition can persist even in mature or low-growth markets due to the necessity of operating existing, high-cost assets.

Strategic Acquisitions and Partnerships

Power Assets Holdings actively pursues strategic acquisitions and partnerships to broaden its international reach and diversify its energy portfolio. This approach directly impacts competitive rivalry by creating new market dynamics and intensifying competition for valuable assets.

For instance, Power Assets' acquisition of a stake in the UK's low-carbon energy sector in 2023, valued at approximately $1.7 billion, exemplifies this strategy. This move not only strengthens its position in renewable energy but also escalates competition among utilities and infrastructure funds vying for similar opportunities in the region.

- Strategic Acquisitions: Power Assets' acquisition strategy aims to consolidate market share and gain access to new technologies and geographic regions.

- Partnership Formation: Collaborations with local and international entities allow for risk sharing and accelerated expansion into new markets.

- Competitive Impact: These actions increase the intensity of rivalry, particularly in high-growth sectors like renewables, as players compete for limited acquisition targets and project development rights.

Competitive rivalry within Power Assets Holdings' operational spheres is a dynamic interplay of regulated markets and burgeoning renewable sectors. While transmission and distribution often operate as regulated monopolies, limiting direct competition, the power generation and renewable project development segments are intensely contested. Companies like Power Assets face numerous global and local players vying for new projects, especially as the global renewable energy sector saw substantial investment in 2024, pushing for innovation and competitive bids.

In mature markets like Hong Kong and parts of the UK, where demand growth is modest, competition among established entities intensifies, often focusing on operational efficiencies and service improvements rather than price wars. The UK's ongoing electricity market reforms, aimed at fostering a fair competitive landscape, further influence these dynamics. Power Assets' strategic acquisitions, such as its 2023 investment in the UK's low-carbon energy sector for approximately $1.7 billion, directly escalate this rivalry by consolidating market share and intensifying competition for valuable assets.

| Market Segment | Competitive Intensity | Key Drivers of Rivalry |

|---|---|---|

| Transmission & Distribution | Low to Moderate (Regulated) | Regulatory oversight, high entry barriers, limited direct competition. |

| Power Generation (Conventional) | Moderate to High | Operational efficiency, fuel costs, long-term contracts, existing asset utilization. |

| Renewable Energy Development | High | Project bidding, technological advancements, government incentives, global investment trends. |

| Acquisitions & Partnerships | High | Competition for attractive assets, market consolidation, strategic expansion. |

SSubstitutes Threaten

The rise of distributed generation, especially rooftop solar coupled with battery storage, presents a substantial threat of substitution for traditional power asset providers. As these technologies become more affordable and efficient, customers can increasingly generate their own electricity, lessening their dependence on grid power. For instance, in 2024, the cost of solar panels continued its downward trend, making self-generation a more viable option for a wider range of consumers.

This shift directly impacts companies like Power Assets Holdings by potentially reducing demand for their core services. When homes and businesses can produce their own power, they buy less from the utility. This trend is further amplified as some utilities, through increasing electricity rates, inadvertently encourage customers to explore grid defection as a cost-saving measure.

Improvements in energy efficiency are a significant threat to Power Assets Holdings by reducing the need for grid-supplied electricity. For instance, in 2024, advancements in building insulation and more efficient appliances continued to lower residential energy consumption. This trend directly substitutes for the energy Power Assets generates and distributes.

Smart technologies, like smart thermostats and energy management systems, further empower consumers to control and reduce their usage. In 2024, the adoption rate of these technologies saw a notable increase, particularly in urban areas. This heightened consumer awareness and control directly impacts the demand for Power Assets' core services.

Demand-side management programs implemented by utilities also act as a substitute. These initiatives encourage customers to shift energy usage away from peak hours or reduce it altogether, often through incentives. In 2024, many utilities reported success in these programs, contributing to a more stable, but potentially lower, overall demand profile for traditional power providers.

Alternative heating and cooling technologies present a significant threat to traditional utility providers like Power Assets Holdings. Innovations such as air-source and ground-source heat pumps, alongside expanding district heating and cooling networks, offer consumers increasingly viable options that bypass reliance on grid-supplied electricity or natural gas. For instance, by 2024, the global heat pump market was projected to reach over $100 billion, indicating substantial consumer adoption.

As these substitute technologies improve in efficiency and become more affordable, they directly erode the demand for conventional energy sources. This trend is amplified by the global push for decarbonization, encouraging a shift towards electrification and renewable-based thermal solutions. The increasing prevalence of rooftop solar installations coupled with battery storage further empowers consumers to self-generate and manage their heating and cooling needs, diminishing the utility's role.

Advancements in Energy Storage Solutions

Rapid advancements and significant cost reductions in battery storage technologies are enabling consumers and businesses to store energy from renewables or off-peak grid power. This directly reduces reliance on continuous grid supply and can mitigate peak demand charges.

Energy storage saw substantial investment growth in 2024, with global investment in energy storage systems projected to reach over $150 billion annually by 2030. This surge in investment fuels innovation and drives down the cost of these substitute solutions.

- Technological Advancements: Improved energy density and longer lifespans of batteries make them more attractive alternatives.

- Cost Reductions: Decreasing battery prices make self-generation and storage economically viable for a wider range of users.

- Policy Support: Government incentives and mandates for renewable energy integration further encourage the adoption of storage solutions.

- Grid Independence: The ability to store energy offers a degree of independence from traditional utility providers and grid fluctuations.

Direct Procurement of Renewable Energy

Large corporations and industrial clients are increasingly bypassing traditional utilities by entering into direct power purchase agreements (PPAs) with renewable energy developers. This trend allows them to secure renewable energy for a portion of their needs, directly substituting conventional utility services.

This shift is largely driven by corporate sustainability goals and the desire for more predictable energy pricing. For instance, by 2024, a significant number of Fortune 500 companies have committed to renewable energy targets, often through direct sourcing.

- Corporate Sustainability Initiatives: Companies are actively seeking to reduce their carbon footprint, making direct procurement of renewables a key strategy.

- Price Stability: PPAs can offer long-term, fixed-price contracts, shielding buyers from volatile wholesale energy market fluctuations.

- Market Growth: The corporate PPA market saw substantial growth in 2023, with deal volumes indicating continued investor and corporate interest in direct renewable energy sourcing.

The threat of substitutes for Power Assets Holdings is significant, driven by the increasing viability and adoption of distributed generation, energy efficiency measures, and alternative thermal solutions. These substitutes directly reduce reliance on traditional grid-supplied power and energy. For example, by 2024, the cost of solar photovoltaic systems continued to decline, making self-generation a more attractive option for consumers and businesses alike, directly impacting the demand for Power Assets' services.

Furthermore, advancements in battery storage technology, with global investment in these systems projected to exceed $150 billion annually by 2030, enable greater energy independence and grid defection. This trend is compounded by corporate sustainability goals, leading major companies to pursue direct power purchase agreements for renewable energy, bypassing traditional utility providers.

| Substitute Category | Key Drivers | Impact on Power Assets Holdings | 2024 Data/Projections |

|---|---|---|---|

| Distributed Generation (Solar + Storage) | Falling costs, consumer desire for independence | Reduced demand for grid power | Solar panel costs continued downward trend |

| Energy Efficiency | Technological advancements, smart home adoption | Lower overall energy consumption | Increased adoption of smart thermostats |

| Alternative Thermal Solutions (Heat Pumps) | Decarbonization goals, improved efficiency | Reduced demand for electricity/gas for heating | Global heat pump market projected over $100 billion |

| Direct Power Purchase Agreements (PPAs) | Corporate sustainability, price stability | Bypassing utility services for large clients | Significant growth in corporate PPA market |

Entrants Threaten

The energy sector, particularly transmission and distribution, demands substantial upfront capital for infrastructure, creating a significant barrier for new players. Power Assets Holdings leverages its vast, already-built networks, which would be incredibly costly and time-consuming for newcomers to duplicate.

Utilities are significantly increasing their capital expenditures in transmission and distribution. For instance, in 2024, the US electric utility sector saw capital expenditures projected to reach approximately $150 billion, a notable increase from previous years, highlighting the immense financial commitment required to enter and compete.

The utility sector, including power generation and distribution, is inherently burdened by intricate regulatory and licensing requirements. These include obtaining specific permits, adhering to environmental standards, and securing operational licenses, all of which necessitate substantial investment in time, specialized knowledge, and capital. For instance, in 2024, the UK's ongoing energy market reforms continue to introduce new compliance obligations for all operators.

Navigating these complex legal and administrative landscapes across different jurisdictions, such as Hong Kong, the United Kingdom, and Australia, presents a formidable barrier to entry for any prospective new competitor. The sheer cost and effort involved in understanding and satisfying these diverse regulatory frameworks effectively deter new players from entering the market.

Established players like Power Assets Holdings benefit from substantial economies of scale. This means they can procure equipment, manage operations, and conduct maintenance at a lower cost per unit compared to newer, smaller competitors. For instance, in 2024, Power Assets' extensive global infrastructure allows for bulk purchasing discounts and optimized operational efficiencies that are difficult for new entrants to replicate quickly.

Furthermore, Power Assets leverages decades of operational experience, which translates into enhanced efficiency and reliability in its services. This accumulated know-how, particularly in regulated and mature markets where the company primarily operates, creates a high barrier to entry. Newcomers would struggle to match the established operational expertise and the deep understanding of regulatory frameworks that Power Assets possesses.

Established Brand Reputation and Customer Loyalty

In mature utility markets, established providers like Power Assets Holdings benefit from deeply ingrained customer relationships and a robust reputation for reliability. This makes it challenging for newcomers to gain traction. While some services might see lower loyalty, the fundamental need for a secure and consistent energy supply fosters a strong barrier to entry.

Power Assets Holdings, with its extensive history spanning over 135 years in Hong Kong, has cultivated a significant level of trust. This long-standing presence translates into a formidable competitive advantage.

- Established Brand Reputation: Over a century of operation builds significant trust in service delivery.

- Customer Loyalty: While some aspects may be commoditized, the critical nature of energy supply reinforces loyalty to reliable providers.

- High Switching Costs: For essential services, the perceived risk and effort of switching providers are substantial deterrents.

- Regulatory Hurdles: New entrants often face significant regulatory compliance and licensing requirements, which are already met by incumbents.

Government Support and Incumbent Advantages

Governments frequently prioritize established utilities for energy security, often granting them advantages like subsidies or preferential regulatory treatment. This inherently disadvantages new entrants who haven't built similar trust or operational history. For example, the UK's ongoing reforms to its electricity market arrangements aim to bolster system security, a move that typically benefits incumbents.

These incumbent advantages create significant barriers. New companies struggle to match the scale, established infrastructure, and regulatory familiarity of existing players. In 2024, the energy sector globally continued to see significant government intervention, with many nations implementing policies designed to support national energy champions and ensure grid stability, further solidifying the position of established entities.

- Incumbent Advantage: Established utilities benefit from long-standing relationships with governments and existing infrastructure.

- Regulatory Favoritism: Governments may offer preferential treatment or subsidies to existing, reliable energy providers.

- UK Market Reforms: Initiatives like the UK's electricity market reforms in 2024 are designed to enhance system security, often benefiting established operators.

- Uneven Playing Field: New entrants face challenges in replicating the scale and regulatory navigation capabilities of incumbents.

The threat of new entrants for Power Assets Holdings is significantly low due to immense capital requirements for infrastructure development and the extensive, established networks already in place. For instance, in 2024, the US electric utility sector's projected capital expenditures of around $150 billion underscore the financial muscle needed. Furthermore, stringent regulatory and licensing hurdles, coupled with decades of operational expertise and strong customer relationships, create formidable barriers that deter potential competitors.

| Barrier Type | Description | Impact on New Entrants | Example (2024 Data) |

|---|---|---|---|

| Capital Requirements | High upfront investment for infrastructure. | Substantial financial barrier. | US electric utility CAPEX projected at ~$150 billion. |

| Regulatory & Licensing | Complex permits, environmental standards, operational licenses. | Time-consuming and costly compliance. | Ongoing UK energy market reforms introduce new obligations. |

| Economies of Scale | Lower per-unit costs for large, established players. | New entrants struggle to match cost efficiencies. | Power Assets' global infrastructure enables bulk purchasing discounts. |

| Operational Experience | Decades of know-how in efficiency and reliability. | Difficult for newcomers to replicate expertise. | Power Assets' 135+ years in Hong Kong foster trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Power Assets Holdings is built upon a foundation of robust data, including the company's annual reports, regulatory filings with relevant authorities, and industry-specific research from reputable market intelligence firms. We also incorporate data from financial news outlets and macroeconomic indicators to provide a comprehensive view of the competitive landscape.