Power Assets Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Power Assets Holdings Bundle

Curious about Power Assets Holdings' strategic positioning? Our BCG Matrix preview highlights key areas, but to truly unlock their competitive advantage, you need the full picture. Understand where their "Stars" shine, their "Cash Cows" generate revenue, and where "Question Marks" demand attention.

Don't miss out on the actionable insights that can redefine your investment strategy. Purchase the complete Power Assets Holdings BCG Matrix report for a detailed quadrant breakdown, data-driven recommendations, and a clear roadmap to optimizing your portfolio.

This is your opportunity to gain a decisive edge. Get the full BCG Matrix today and transform raw data into confident, strategic decisions for Power Assets Holdings.

Stars

Power Assets Holdings recently acquired a 20% stake in UK Renewables Energy, formerly Aviva Wind, a move that positions it firmly within the 'Stars' category of the BCG Matrix. This significant investment includes 32 wind farms spread across England, Scotland, and Wales.

This strategic acquisition, undertaken with partners CK Infrastructure Holdings and CK Asset Holdings, highlights a commitment to the rapidly expanding UK renewable energy market. The deal, finalized in early 2024, underscores the growing importance of green energy investments.

With a remarkable 90% of its revenue secured by long-term agreements and government subsidies, UK Renewables Energy offers substantial growth potential and immediate returns. This financial stability, coupled with the global shift towards decarbonization, makes it a prime example of a 'Star' asset.

Phoenix Energy, representing Northern Ireland's primary natural gas distribution network, is positioned as a Star in the Power Assets Holdings BCG Matrix. Power Assets secured a 20% interest in Phoenix Energy in April 2024, a move bolstered by a favorable regulatory environment that underpins consistent revenue generation.

The company's commitment to evolving its gas networks for net-zero readiness and its exploration of hydrogen and green initiatives highlight its significant growth prospects. This aligns with the UK's broader decarbonization agenda, suggesting strong future market share potential.

HK Electric, a key subsidiary of Power Assets, significantly boosted its gas-fired generation capacity in March 2024 by commissioning a new 380-MW combined-cycle unit. This expansion raises gas-fired power to approximately 70% of its total electricity generation, a substantial shift towards cleaner energy sources.

This strategic move aligns with HK Electric's HK$22 billion Development Plan for 2024-2028, which includes a commitment to phase out coal power entirely by 2035. The investment underscores a focus on modernizing the grid and enhancing its intelligence, signaling a strong growth trajectory in sustainable power generation.

Australian Gas Infrastructure Group (AGIG) Hydrogen Projects

Australian Gas Infrastructure Group (AGIG), a key player in Power Assets Holdings' Australian operations, is making significant strides in the renewable hydrogen sector. The company has set ambitious targets, aiming to incorporate at least 10% renewable gas into its distribution networks by 2030, with a long-term goal of achieving 100% by 2050. This forward-thinking approach positions AGIG as a leader in the burgeoning hydrogen economy.

AGIG's commitment is evident in its active collaborations with government bodies and industry partners to advance hydrogen projects. This strategic engagement underscores their dedication to a high-growth, innovation-driven segment of the energy market. Their focus on decarbonization and developing new energy solutions firmly places them in the star category within the evolving energy landscape.

- AGIG's Renewable Gas Target: At least 10% by 2030, 100% by 2050.

- Strategic Focus: High-growth, innovative energy market segments.

- Key Initiative: Proactive engagement in delivering renewable hydrogen projects.

EDL's Renewable Natural Gas (RNG) Expansion in the US

Energy Developments Limited (EDL), a subsidiary of Power Assets Holdings, is significantly expanding its renewable natural gas (RNG) operations in the United States. This strategic move involves converting existing landfill gas-to-electricity plants into full-fledged RNG facilities, with a notable example being the Byron Center, Michigan project. By capturing and processing methane, a potent greenhouse gas, these facilities directly contribute to substantial emission reductions, aligning with global environmental objectives.

The US renewable natural gas market is experiencing robust growth, fueled by increasing demand for sustainable energy solutions and supportive environmental policies. EDL's expansion into this sector positions Power Assets Holdings to capitalize on this high-growth opportunity. For instance, the US EPA's Renewable Fuel Standard (RFS) program provides incentives for RNG production, creating a favorable market environment. In 2024, the demand for RNG is projected to continue its upward trajectory, driven by corporate sustainability goals and the need to decarbonize various sectors, including transportation and industrial processes.

- EDL's US RNG expansion targets landfill gas conversion.

- Projects like Byron Center, Michigan, exemplify this strategy.

- RNG production offers significant greenhouse gas emission reductions.

- The US RNG market is a high-growth area for Power Assets Holdings.

Power Assets Holdings' 'Stars' are assets with high market share in high-growth industries, demanding significant investment to maintain their position. UK Renewables Energy, with its 32 wind farms and 90% revenue secured by long-term agreements, exemplifies this, benefiting from the UK's decarbonization push. Phoenix Energy's strong revenue generation, driven by a favorable regulatory environment and its net-zero readiness initiatives, also marks it as a Star.

HK Electric's strategic expansion of gas-fired generation capacity to 70% of its portfolio, coupled with its commitment to phase out coal by 2035, positions it for sustained growth. Australian Gas Infrastructure Group (AGIG) is a Star due to its ambitious renewable hydrogen targets, aiming for 10% renewable gas by 2030 and 100% by 2050, actively engaging in high-growth hydrogen projects.

Energy Developments Limited (EDL) is a Star through its significant expansion of renewable natural gas (RNG) operations in the United States, converting landfill gas-to-electricity plants. The US RNG market's robust growth, supported by policies like the EPA's Renewable Fuel Standard, creates a favorable environment for EDL's projects, such as the Byron Center, Michigan facility.

| Asset | Market Growth | Market Share | Strategic Importance | Recent Developments (2024) |

|---|---|---|---|---|

| UK Renewables Energy | High (Renewable Energy) | Significant (32 wind farms) | Core to decarbonization strategy | Acquired 20% stake, 90% revenue secured |

| Phoenix Energy | High (Natural Gas Distribution) | Dominant (Northern Ireland) | Net-zero readiness, hydrogen exploration | Secured 20% interest, favorable regulatory environment |

| HK Electric | Moderate (Power Generation) | High (Hong Kong) | Grid modernization, coal phase-out | Commissioned 380-MW gas unit, HK$22bn Development Plan |

| AGIG | Very High (Renewable Hydrogen) | Emerging Leader | Hydrogen economy development | Targets 10% renewable gas by 2030, active project engagement |

| EDL (US RNG) | Very High (Renewable Natural Gas) | Growing presence | Decarbonization, US market expansion | Expanding RNG operations, Byron Center, Michigan project |

What is included in the product

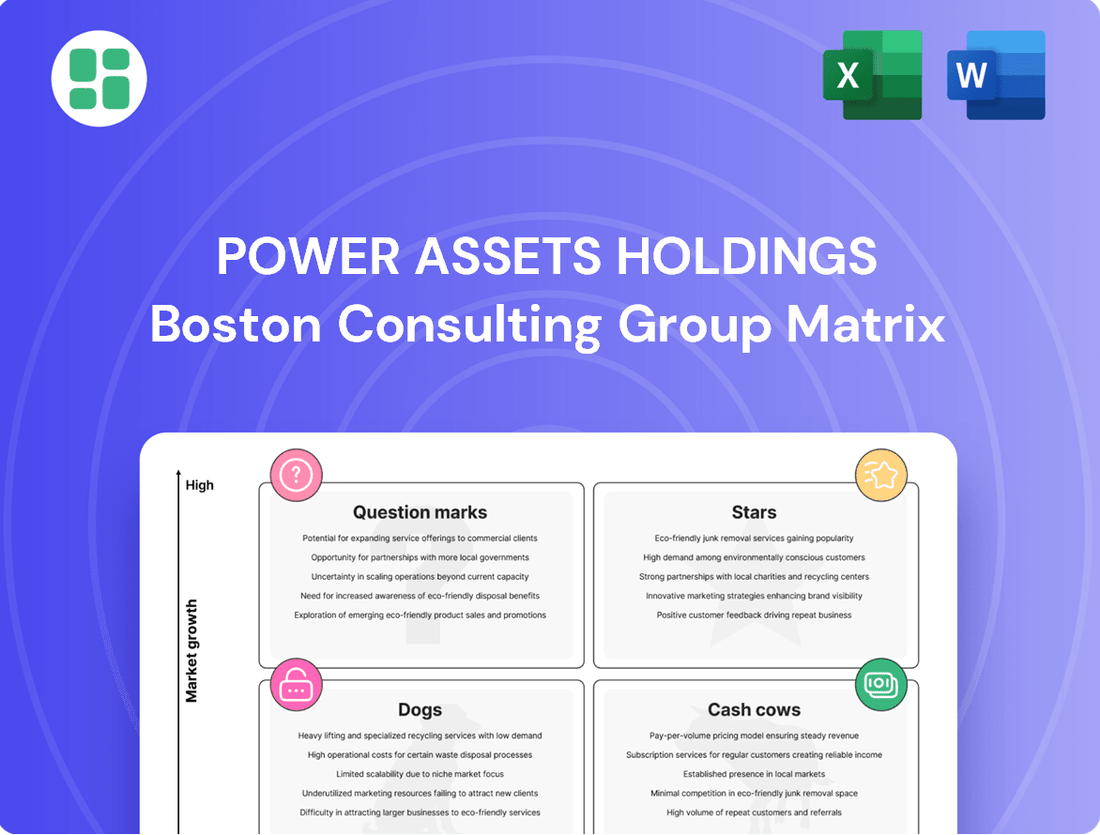

The Power Assets Holdings BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

A clear, one-page BCG Matrix overview for Power Assets Holdings instantly clarifies the strategic positioning of each business unit, alleviating the pain of complex portfolio analysis.

Cash Cows

UK Power Networks (UKPN), Power Assets Holdings' largest operation, remains a strong cash cow. Despite tighter price caps under the RIIO-ED2 period, it delivers stable financial results. For instance, in 2023, UKPN reported a regulatory profit of £699 million, demonstrating its consistent revenue generation.

UKPN's commitment to excellence is evident in its top ranking by Ofgem for customer service and reliability among Distribution System Operators. This operational strength translates into secured incentive awards, further bolstering its predictable cash flows. The business's mature, regulated nature ensures it continues to be a reliable source of income for Power Assets Holdings.

HK Electric, as the sole electricity provider in Hong Kong, is a cornerstone of Power Assets Holdings' portfolio, firmly positioned as a Cash Cow. In 2024, it continued to deliver robust and stable returns, contributing significantly to the Group's overall profitability, even with a minor dip from prior year figures. This consistent performance is underpinned by its exceptional operational efficiency, achieving a remarkable supply reliability rate exceeding 99.9999% in 2024.

Operating within a mature and highly regulated market, HK Electric benefits from a dominant market share and a well-established long-term development plan. This environment, characterized by predictable demand and regulated pricing, allows for consistent and substantial cash generation, solidifying its status as a reliable profit engine for the parent company.

SA Power Networks (SAPN) in Australia is a classic Cash Cow within the Power Assets Holdings portfolio. Its recent draft decision for the 2025-2030 regulatory reset signals a path to consistent, predictable returns, underscoring its stable income-generating capabilities.

As the first Australian electricity distributor to issue a certified green bond, SAPN showcases its established market leadership and commitment to sustainable finance. This move further solidifies its reliable revenue streams in a mature, regulated sector.

Operating in a mature, regulated market, SAPN is characterized by its ability to generate reliable cash flow. While growth prospects are limited, its high stability makes it a dependable source of earnings, fitting the definition of a Cash Cow perfectly.

Northern Gas Networks and Wales & West Utilities (UK)

Northern Gas Networks and Wales & West Utilities, key components of Power Assets Holdings, demonstrated robust performance in 2024. These UK gas distribution networks generated stable returns, underscoring their value as essential infrastructure. Their operation within established regulatory environments in mature markets provides a predictable revenue stream for the parent company.

These utilities are characterized by consistent operational efficiency and minimal capital expenditure needs for ongoing service provision. This low-investment requirement, coupled with their reliable cash generation, firmly establishes them as cash cows within Power Assets Holdings' portfolio. For instance, in 2024, these networks contributed significantly to the Group's overall earnings stability.

- 2024 Performance: Delivered stable returns to Power Assets Holdings.

- Market Position: Essential infrastructure in mature UK markets with supportive regulation.

- Financial Profile: Consistent performance and low ongoing investment requirements.

- BCG Classification: Firmly positioned as Cash Cows due to their reliable cash generation.

Wellington Electricity (New Zealand)

Wellington Electricity, a key asset within Power Assets Holdings, operated as a stable Cash Cow in 2024. The company delivered consistent and predictable cash flow, a hallmark of its mature market position in New Zealand. Its performance was underpinned by a strong focus on operational excellence.

The utility consistently surpassed network asset reliability targets, demonstrating its commitment to high service standards. This reliability, coupled with excellent customer service and safety records, solidified its dependable contribution to the Group's overall financial health. The mature New Zealand electricity distribution market offers limited growth prospects, reinforcing its Cash Cow status.

- Stable Operations: Wellington Electricity maintained consistent operations throughout 2024.

- Cash Flow Contribution: It provided steady and predictable cash flow to the Group.

- Reliability and Safety: The company exceeded network asset reliability targets, showcasing high safety and supply reliability.

- Mature Market: Operating in a mature market, it offers consistent returns with minimal growth potential.

Cash Cows within Power Assets Holdings are mature, stable businesses that generate more cash than they consume. These operations, like UK Power Networks and HK Electric, benefit from established market positions and regulated environments, ensuring consistent revenue streams. Their primary role is to fund other ventures within the company's portfolio, such as Stars or Question Marks.

These assets are characterized by their high market share in slow-growing industries. For instance, HK Electric's 2024 performance, while seeing a slight dip, still represented a significant and stable contribution to the group's earnings, underpinned by its near-perfect 99.9999% supply reliability. Similarly, SA Power Networks' draft decision for its 2025-2030 regulatory reset in Australia points to continued predictable returns.

The consistent profitability of these Cash Cows is crucial for Power Assets Holdings' overall financial health. They represent reliable sources of income, allowing the company to invest in future growth opportunities or return capital to shareholders. Their low reinvestment needs mean the surplus cash can be effectively deployed elsewhere.

The table below highlights the key characteristics of these Cash Cow assets:

| Asset | Market | 2024 Status | Key Characteristic | BCG Classification |

|---|---|---|---|---|

| UK Power Networks | UK | Stable Operations | High reliability, top customer service | Cash Cow |

| HK Electric | Hong Kong | Robust Returns | Dominant market share, high efficiency | Cash Cow |

| SA Power Networks | Australia | Predictable Returns | Market leadership, green bond issuer | Cash Cow |

| Northern Gas Networks | UK | Stable Performance | Essential infrastructure, low capex | Cash Cow |

| Wales & West Utilities | UK | Stable Performance | Essential infrastructure, low capex | Cash Cow |

| Wellington Electricity | New Zealand | Consistent Cash Flow | Exceeds reliability targets, strong safety | Cash Cow |

What You See Is What You Get

Power Assets Holdings BCG Matrix

The Power Assets Holdings BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, meticulously crafted by industry experts, will be delivered to you without any watermarks or demo content, ensuring immediate professional use. You can confidently expect to download the complete, ready-to-deploy BCG Matrix report, enabling swift strategic decision-making for Power Assets Holdings.

Dogs

Older coal-fired generation units at HK Electric are firmly in the 'dog' category of the BCG matrix. The company retired two such units in the first half of 2024, signaling a clear move away from this technology, with a target to phase out all coal generation by 2035.

These assets are characterized by low growth prospects due to increasing environmental regulations and a global shift towards decarbonization. Their declining market relevance, coupled with HK Electric's strategic divestment plans, solidifies their position as underperforming portfolio components.

Outdated thermal power plants without modernization plans are typically categorized as Dogs in the BCG Matrix. These assets, often reliant on coal or older oil technologies, face significant headwinds. For instance, as of early 2024, many regions are implementing stricter emissions standards, directly impacting the operational viability and profitability of such facilities.

These older plants struggle to compete as the global energy landscape rapidly shifts towards renewables and cleaner-burning fuels like natural gas. Without substantial investment in upgrades or conversion, their market share shrinks, and growth prospects dim considerably. This makes them a drag on a company's portfolio, requiring careful consideration for divestment or significant capital allocation for revitalization.

Power Assets Holdings' global reach may encompass minor investments in highly competitive or stagnant energy markets. These ventures, often characterized by low market share and minimal growth prospects, typically yield low returns. For instance, a small stake in a mature European electricity distribution network, where regulatory hurdles limit expansion and demand is stable, would likely fall into this category.

Such assets, while part of a diversified portfolio, demand management resources that could be better allocated to more promising opportunities. The disproportionate attention required for these minor holdings, relative to their financial contribution, aligns them with the characteristics of a 'dog' in the BCG matrix. This can occur even within Power Assets' substantial portfolio, where not every asset can be a star or a cash cow.

Assets with High Maintenance Costs and Low Efficiency

Operational assets that consistently demand high maintenance expenditures yet fail to generate commensurate revenue or secure significant market share are prime examples of Dogs within the Power Assets Holdings portfolio. These underperforming assets, often characterized by aging infrastructure or outdated technology, represent a drain on financial resources and managerial attention.

Their inherent inefficiency and limited growth prospects make them candidates for strategic divestiture or a significant reduction in capital investment. For instance, a power plant with consistently high repair bills, perhaps exceeding 15% of its annual revenue in maintenance costs, and a declining operational efficiency, could be a Dog. In 2023, some older, less efficient fossil fuel plants faced increased maintenance burdens while struggling to compete with newer, cleaner energy sources, illustrating this concept.

- High Maintenance Expenditure: Assets where maintenance costs significantly outpace revenue generation.

- Low Operational Efficiency: Units that consume more resources than necessary for the output they produce.

- Limited Market Share/Growth Potential: Businesses or assets that are not leaders in their market and show little prospect for future expansion.

- Strategic Review for Divestment: These assets typically undergo a review for potential sale or closure to reallocate capital to more promising ventures.

Legacy Oil Transmission Assets in Declining Demand Regions

Legacy oil transmission assets in regions with falling oil demand, such as parts of Europe, could be classified as dogs in Power Assets Holdings' portfolio. These pipelines face reduced throughput and potentially lower pricing power as fewer barrels need to be moved.

For instance, if Power Assets has pipelines in areas where electric vehicle adoption is rapidly increasing and coal-fired power plants are being phased out, this directly impacts the demand for oil transport. Such assets are characterized by low growth prospects and potentially shrinking market share.

- Low Growth: Regions with declining oil consumption offer limited opportunities for volume increases.

- Market Share Erosion: Competition from alternative energy sources and transport methods can further reduce the relevance of oil pipelines.

- Profitability Challenges: Reduced utilization and pricing pressure can make these assets less profitable.

- Example Scenario: A pipeline in a mature industrial region in the UK, seeing significant shifts towards natural gas and renewables, would likely fit this dog category.

Older, less efficient fossil fuel power plants within Power Assets Holdings' portfolio are prime examples of 'dogs' in the BCG matrix. These assets often face high maintenance costs and declining operational efficiency. For instance, in 2023, several older fossil fuel plants experienced increased maintenance burdens, struggling to compete with cleaner energy alternatives, directly impacting their profitability and growth prospects.

These underperforming assets, characterized by aging infrastructure, represent a drain on financial resources and managerial attention. Their limited market share and minimal growth potential often lead to strategic reviews for divestment or significant capital reduction.

Legacy oil transmission assets in regions with falling oil demand, such as parts of Europe, also fall into the dog category. These pipelines face reduced throughput and potentially lower pricing power as demand for oil transport diminishes. For example, pipelines in areas with rapid electric vehicle adoption and the phasing out of coal-fired power plants directly impact oil transport demand, leading to shrinking market share and profitability challenges.

| Asset Type | Characteristics | BCG Category | Example |

|---|---|---|---|

| Older Coal-Fired Power Plants | Low growth, high maintenance, declining relevance | Dog | HK Electric's retired units in H1 2024 |

| Mature European Distribution Network Stake | Low market share, minimal growth, regulatory hurdles | Dog | Minor investment in a stagnant energy market |

| Inefficient Fossil Fuel Plants | High maintenance costs (>15% of revenue), low efficiency | Dog | Plants struggling to compete with renewables in 2023 |

| Legacy Oil Pipelines in Declining Markets | Low growth, market share erosion, profitability challenges | Dog | Pipelines in UK industrial regions with shift to renewables |

Question Marks

Power Assets Holdings is actively exploring new hydrogen and green projects, moving beyond traditional gas infrastructure. These early-stage ventures are positioned in high-growth potential markets, but currently hold a small market share.

These initiatives, while forward-looking and crucial for future energy landscapes, demand substantial capital investment. Their success hinges on proving commercial viability and achieving widespread market acceptance, a common challenge for nascent technologies.

For instance, the global hydrogen market is projected to reach $250 billion by 2030, with green hydrogen expected to be a significant driver of this growth. Power Assets' investment in this area, though early, aligns with this substantial market expansion potential.

Power Assets Holdings' investments in advanced battery storage, like grid-scale lithium-ion systems, would likely be classified as question marks within a BCG matrix. These technologies operate in rapidly expanding markets, driven by the increasing need for grid stability and renewable energy integration.

Despite the market's growth potential, Power Assets currently holds a minimal market share in this emerging sector. For instance, while the global battery storage market was projected to reach over $100 billion by 2025, Power Assets' contribution is nascent, requiring significant capital expenditure to build capacity and gain traction.

HK Electric's significant HK$22 billion development plan from 2024 to 2028 prioritizes enhancing grid intelligence and automation. These initiatives are designed to boost future operational efficiency and reliability across its network.

However, the precise return on investment and the extent of widespread market adoption for these cutting-edge digital solutions remain in nascent stages of development. This positions them as high-growth potential ventures with currently unproven market share within the broader utility sector.

Smaller Scale International Renewable Ventures

Power Assets Holdings is actively exploring smaller-scale international renewable ventures. These are typically recently acquired or greenfield projects in nascent markets where the company is still establishing its footprint. Such ventures fall into the question mark category of the BCG matrix due to their high growth potential coupled with a currently limited contribution to the overall portfolio.

These question mark assets represent opportunities for Power Assets to diversify its renewable energy portfolio geographically and technologically. For instance, in 2024, Power Assets continued its strategy of seeking out such opportunities, particularly in emerging renewable markets. While specific financial figures for these nascent ventures are often proprietary and evolving, the company's stated investment strategy emphasizes a focus on expanding its presence in regions with strong governmental support for renewables and significant untapped market potential.

- High Growth Potential: These smaller ventures are positioned in markets experiencing rapid growth in renewable energy adoption, driven by favorable policies and increasing demand.

- Limited Market Share: As new entrants or early-stage developments, their current contribution to Power Assets' overall revenue and capacity is modest.

- Strategic Importance: They are crucial for building future market share and gaining operational experience in diverse international regulatory and operational environments.

- Investment Focus: Power Assets is actively identifying and evaluating these opportunities, aligning with its long-term vision for a diversified global clean energy portfolio.

AVR-Afvalverwerking B.V. (Netherlands) Reconstruction and Re-commissioning

AVR-Afvalverwerking B.V.'s Rozenburg facility, a significant player in the Dutch waste-to-energy market, is nearing the end of its extensive reconstruction following a 2023 fire. The successful re-commissioning of all seven incineration lines in January 2025 marks a critical milestone, signaling operational readiness.

While the waste-to-energy sector generally shows promise, AVR's specific situation presents a question mark within the Power Assets Holdings BCG Matrix. Its ability to regain market share and fully leverage its operational capacity post-reconstruction requires close observation and strategic investment to confirm its future growth trajectory.

Key considerations for AVR's positioning include:

- Market Recovery: Assessing the speed and extent to which AVR recaptures its pre-fire market share in waste processing.

- Operational Efficiency: Monitoring the plant's performance metrics and cost-effectiveness following the reconstruction.

- Regulatory Environment: Evaluating any changes in Dutch waste management policies or emissions standards that could impact operations.

- Competitive Landscape: Analyzing the actions and performance of competing waste-to-energy facilities in the Netherlands and surrounding regions.

Question marks represent emerging ventures with high growth potential but currently small market shares for Power Assets Holdings. These include investments in new hydrogen and green projects, advanced battery storage, and smaller international renewable ventures. The company is actively seeking these opportunities, recognizing their strategic importance for future diversification and market presence.

For instance, Power Assets' investment in green hydrogen aligns with a global market projected to reach $250 billion by 2030. Similarly, the battery storage market, valued at over $100 billion by 2025, offers significant growth, though Power Assets' current share is minimal. These ventures require substantial capital and face the challenge of proving commercial viability to capture future market share.

| Venture Area | Market Growth Potential | Current Market Share | Strategic Rationale | Example |

|---|---|---|---|---|

| Hydrogen & Green Projects | High (e.g., global market $250B by 2030) | Low | Diversification, future energy landscape | Early-stage green hydrogen initiatives |

| Advanced Battery Storage | High (e.g., global market >$100B by 2025) | Low | Grid stability, renewable integration | Grid-scale lithium-ion systems |

| International Renewables | High (emerging markets) | Low (nascent footprint) | Geographic and technological diversification | Recently acquired or greenfield projects |

| Digital Grid Solutions | High (efficiency & reliability focus) | Unproven | Operational enhancement | HK Electric's HK$22B development plan (2024-2028) |

| Waste-to-Energy (Specific Cases) | Moderate to High | Variable (post-event recovery) | Market recovery, operational leverage | AVR-Afvalverwerking B.V. Rozenburg facility |

BCG Matrix Data Sources

Our Power Assets Holdings BCG Matrix leverages extensive financial disclosures, detailed market analytics, and expert industry forecasts to provide a comprehensive view of our portfolio's strategic positioning.