Power Assets Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Power Assets Holdings Bundle

Unlock the strategic blueprint behind Power Assets Holdings's success with our comprehensive Business Model Canvas. Discover how they leverage key partnerships and customer relationships to deliver value in the energy sector. This detailed analysis is essential for anyone looking to understand their competitive advantage.

Partnerships

Power Assets Holdings actively collaborates with regulatory bodies and governments across its global operating territories. These relationships are vital for obtaining essential licenses, permits, and ensuring adherence to energy sector policies, which underpin its operational continuity and growth strategies.

Navigating price control periods is a key aspect of these partnerships. For example, Power Assets Holdings worked with regulators on draft decisions for the 2025-2030 regulatory resets for its UK Power Networks and SA Power Networks, demonstrating a commitment to transparent engagement with regulatory frameworks.

Power Assets Holdings actively engages with local utility companies through joint ventures, asset co-ownership, and operational agreements. These partnerships are crucial for leveraging local market knowledge and streamlining market entry.

These collaborations enhance the efficient management of energy infrastructure, ultimately ensuring reliable service delivery to customers. A prime example of this strategy is the ongoing partnership with CK Infrastructure Holdings Limited (CKI) and CK Asset Holdings Limited (CKA) for new asset acquisitions.

Power Assets Holdings collaborates with top-tier technology and equipment suppliers to integrate cutting-edge solutions and maintain advanced infrastructure. These crucial partnerships grant access to the latest generation, transmission, and distribution technologies, significantly boosting operational efficiency and reliability across their asset portfolio.

In 2024, such collaborations are vital for Power Assets Holdings' strategic pivot towards renewable energy sources. For instance, their ongoing investments in offshore wind farms rely heavily on suppliers providing specialized turbines and foundation technologies. This focus supports their commitment to greener energy and achieving net-zero emission targets, a trend mirrored across the global energy sector.

Financial Institutions and Investors

Power Assets Holdings relies heavily on its relationships with banks, investment funds, and other financial institutions. These partnerships are crucial for securing the necessary funding to support new projects, strategic acquisitions, and the ongoing capital expenditures required to maintain and expand its diverse portfolio of power assets. A strong financial profile, underscored by its reaffirmed 'A' long-term issuer credit rating in February 2024, facilitates access to these vital capital sources.

These financial collaborations are instrumental in enabling the company to execute its ambitious growth strategies and effectively manage its substantial investment portfolio. The ability to secure favorable financing terms directly impacts the company's capacity to invest in new energy infrastructure and technologies, ensuring long-term value creation.

- Securing Project Funding: Banks and investment funds provide the essential capital for Power Assets Holdings' new ventures and expansion initiatives.

- Facilitating Acquisitions: Partnerships are key to financing strategic acquisitions, allowing the company to grow its asset base.

- Managing Capital Expenditure: Ongoing relationships ensure access to funds for maintaining and upgrading existing power generation and infrastructure assets.

- Financial Strength: A strong credit rating, such as the reaffirmed 'A' long-term issuer credit rating in February 2024, enhances the company's ability to attract and secure favorable financing.

Construction and Engineering Firms

Power Assets Holdings collaborates with specialized construction and engineering firms to bring its energy infrastructure projects to life. These partnerships are vital for the successful development, expansion, and ongoing maintenance of its diverse energy portfolio.

These expert firms are essential for executing complex projects, ensuring they meet stringent safety and quality benchmarks. For instance, their involvement was crucial in the commissioning of new gas-fired generating units in Hong Kong, a significant undertaking requiring specialized expertise.

- Expertise in Infrastructure Development: Firms provide specialized skills for building and maintaining power generation facilities.

- Project Execution Efficiency: Collaborations ensure complex projects are completed on time and within budget.

- Adherence to Standards: Partners uphold high safety and quality standards critical in the energy sector.

Power Assets Holdings' key partnerships are foundational to its operational success and strategic growth. These include collaborations with regulatory bodies and governments globally, ensuring compliance and operational continuity. The company also engages with local utility companies through joint ventures and co-ownership to leverage market expertise and facilitate market entry.

What is included in the product

Power Assets Holdings' business model focuses on investing in and operating electricity and gas infrastructure globally, generating stable, long-term returns through regulated assets and strategic acquisitions.

This model emphasizes predictable revenue streams from essential utility services, customer loyalty through reliable delivery, and efficient operations managed via strong partnerships and a robust financial structure.

Power Assets Holdings' Business Model Canvas acts as a pain point reliever by clearly mapping out customer relationships and value propositions, simplifying complex operational challenges into actionable insights.

Activities

Power Assets Holdings actively manages its portfolio by identifying, evaluating, and acquiring strategic energy infrastructure assets worldwide. The company prioritizes well-regulated and mature markets offering stable, predictable income. This involves thorough due diligence, skillful negotiation, and seamless integration of new assets to support long-term growth.

In 2024, Power Assets Holdings demonstrated this commitment by completing significant strategic acquisitions of low-carbon energy businesses in the United Kingdom. These included acquiring Phoenix Energy and UU Solar, further diversifying its renewable energy footprint.

Power Assets Holdings' core activity involves the meticulous operation and upkeep of an extensive network of energy infrastructure. This includes managing electricity generation, transmission, and distribution systems, alongside gas distribution and renewable energy initiatives. This diligent approach is crucial for maintaining a consistent and efficient energy flow, ensuring all operations meet stringent safety protocols, and maximizing the performance of these vital assets.

The company's financial strength is directly tied to its vast operational footprint. In 2024, Power Assets Holdings reported substantial revenue streams, with the majority generated from its significant stakes in over 500,000 kilometers of power, gas, and oil networks. This extensive physical asset base underscores the critical importance of effective asset operation and maintenance for sustained business success and revenue generation.

Power Assets Holdings actively navigates the intricate regulatory landscapes across its diverse operational territories, a crucial element for sustained business success. This involves meticulous adherence to all legal mandates and standards, ensuring operational integrity and minimizing risk. For instance, in 2024, the company continued its engagement with regulatory bodies concerning the pricing frameworks for its electricity and gas networks, a process vital for revenue stability and future investment planning.

Building and maintaining robust relationships with governmental agencies, independent regulators, and the local communities where it operates are paramount. These engagements foster transparency, build public trust, and are essential for securing the necessary permits and approvals for both ongoing operations and future infrastructure development projects. This proactive approach is key to a smooth operational flow and long-term social license to operate.

Strategic Planning and Portfolio Optimization

Strategic planning at Power Assets Holdings is a dynamic process, constantly evaluating market shifts and pinpointing avenues for expansion. This involves a critical review of the current asset base to ensure optimal performance and long-term viability.

A key component is the strategic divestment of underperforming or non-core assets, freeing up capital for reinvestment in more promising ventures. This capital reallocation is crucial for maximizing returns and bolstering the company's overall resilience.

Power Assets Holdings is actively pursuing a strategy of portfolio expansion, aiming for sustainable growth. For instance, in 2024, the company continued to explore opportunities in renewable energy infrastructure, aligning with global trends towards decarbonization and energy security.

- Continuous Assessment: Regularly analyzing market trends and identifying new growth sectors.

- Portfolio Optimization: Divesting non-core assets and reallocating capital for higher returns.

- Strategic Expansion: Focusing on sustainable growth through targeted investments.

- 2024 Focus: Continued exploration of renewable energy infrastructure opportunities.

Project Development and Expansion

Power Assets Holdings actively engages in the development of new energy projects, a crucial activity for its future growth. This includes a strong focus on renewable energy initiatives and essential infrastructure upgrades to enhance its existing portfolio and expand its operational reach.

The company meticulously manages the entire project lifecycle, from initial feasibility studies and securing necessary financing to overseeing construction and ultimately commissioning new assets. This systematic approach ensures the efficient expansion of its energy generation capacity.

A prime example of this commitment is the commissioning of a new 380-MW gas-fired combined-cycle generating unit by HK Electric, a significant investment of Power Assets, in March 2024. This expansion directly contributes to increasing the overall power supply and operational efficiency.

- Project Development: Focus on new energy projects, including renewables and infrastructure upgrades.

- Financing and Management: Securing capital and overseeing project execution from inception to completion.

- Capacity Expansion: Bringing new generating assets online to broaden operational scope and output.

- March 2024 Milestone: HK Electric commissioned a 380-MW gas-fired combined-cycle unit, boosting capacity.

Power Assets Holdings' key activities revolve around strategic asset acquisition and meticulous operational management. The company actively seeks out and integrates energy infrastructure, prioritizing stable, regulated markets. This is complemented by the diligent operation and maintenance of its extensive network, ensuring reliable energy flow and safety. Furthermore, strategic portfolio management, including divestment of non-core assets and expansion into sustainable growth areas like renewables, is central to its business model. The development of new energy projects, from conception through to commissioning, is also a critical driver of its growth and capacity enhancement.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Asset Acquisition & Integration | Identifying, evaluating, and acquiring strategic energy infrastructure assets. | Acquired low-carbon energy businesses in the UK (Phoenix Energy, UU Solar). |

| Operations & Maintenance | Managing electricity/gas generation, transmission, distribution, and renewables. | Maintained over 500,000 km of power, gas, and oil networks. |

| Portfolio Management | Optimizing asset base through divestment of non-core assets and strategic expansion. | Continued exploration of renewable energy infrastructure opportunities. |

| Project Development | Developing new energy projects, including renewables and infrastructure upgrades. | HK Electric commissioned a 380-MW gas-fired combined-cycle unit in March 2024. |

Preview Before You Purchase

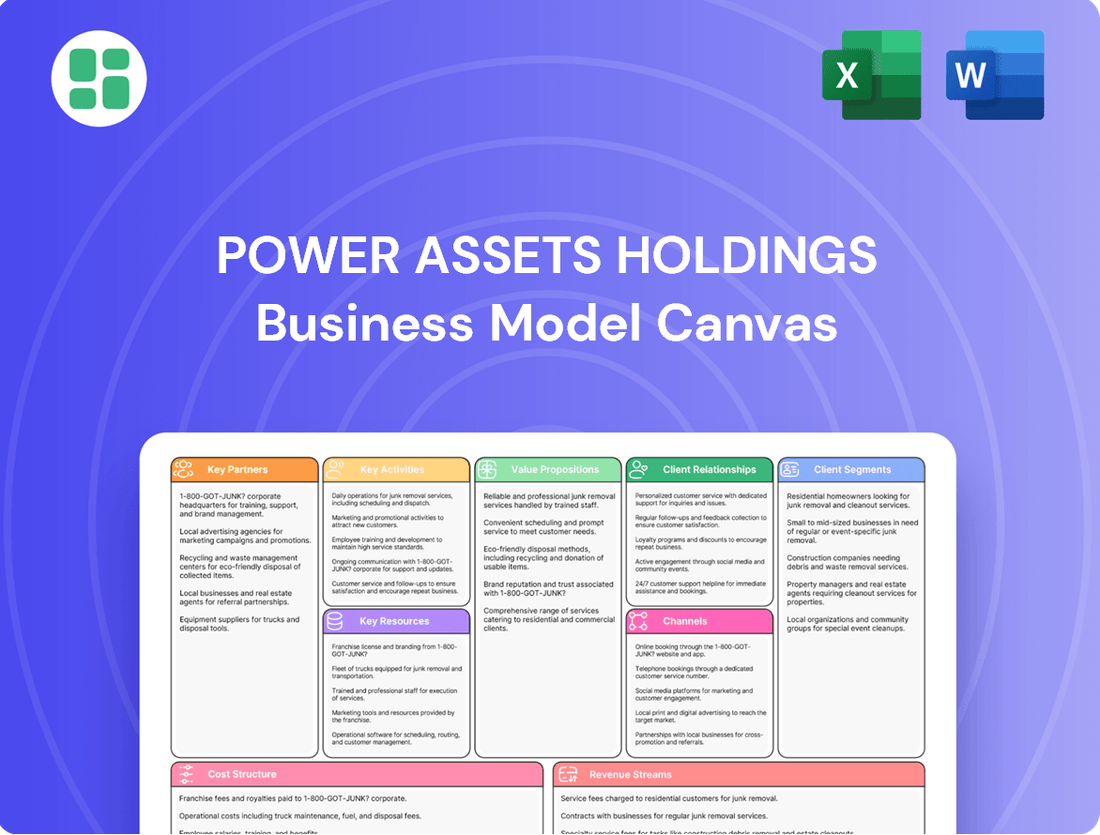

Business Model Canvas

This preview showcases the exact Power Assets Holdings Business Model Canvas you will receive upon purchase. It's a direct representation of the comprehensive document, offering a clear view of its structure and content without any alterations or placeholders. Once your order is complete, you'll gain full access to this identical, ready-to-use business model canvas.

Resources

Financial capital is a cornerstone for Power Assets Holdings, enabling significant infrastructure projects and strategic acquisitions. This includes maintaining robust cash reserves and securing access to credit facilities to manage operational costs and fuel expansion initiatives.

The company's financial strength is clearly demonstrated by its net cash position of HK$228 million as of December 31, 2024. This healthy balance sheet empowers Power Assets Holdings to actively pursue new growth avenues and maintain operational stability.

Diversified Energy Infrastructure Assets are the bedrock of Power Assets Holdings' operations. This extensive portfolio includes power generation facilities, crucial transmission lines, widespread distribution networks, vital gas pipelines, and a growing array of renewable energy projects.

The geographical spread is a significant strength, with assets strategically located in Hong Kong, Mainland China, the United Kingdom, and Australia. This diversification mitigates risk and ensures a consistent revenue stream, as demonstrated by the company's robust financial performance.

For instance, as of the first half of 2024, Power Assets Holdings reported a net profit attributable to shareholders of HK$3.4 billion, underscoring the stability and profitability derived from its extensive and geographically varied infrastructure base.

Power Assets Holdings relies heavily on its highly skilled workforce and management expertise. This team, though numbering around 14 direct employees in 2024, is crucial for navigating the complexities of the energy sector, encompassing engineering, finance, project management, and regulatory affairs.

The company’s success in executing strategic initiatives and maintaining operational excellence is directly attributable to this specialized human capital. Their deep understanding drives innovation and ensures the effective management of diverse and often challenging energy projects.

Regulatory Licenses and Concessions

Power Assets Holdings' ability to operate and generate revenue hinges on its possession of critical regulatory licenses, permits, and long-term concessions. These are not just bureaucratic hurdles; they are the foundational legal authorizations that permit the company to build, maintain, and operate its energy infrastructure, particularly in markets where energy is a regulated utility. Without these, market access and the stability required for significant capital investment would be impossible.

These licenses and concessions are crucial for ensuring market access and operational stability. For instance, in 2024, Power Assets Holdings continued to benefit from its long-standing concessions for electricity distribution in Hong Kong, a market characterized by robust regulatory oversight. The company's ability to secure and maintain these rights directly translates into predictable revenue streams and a stable operating environment.

- Essential Licenses: Possession of operating licenses for power generation, transmission, and distribution networks.

- Concessions: Long-term agreements granting exclusive rights to operate infrastructure in specific regions, like the 20-year concession for electricity distribution in Hong Kong.

- Regulatory Approvals: Permits for new projects, environmental compliance, and tariff adjustments are vital for sustained operations and growth.

Proprietary Technology and Operational Know-how

Power Assets Holdings leverages proprietary technology and operational know-how to drive efficiency and innovation. This includes access to advanced operational technologies and sophisticated asset management systems, which are vital for optimizing performance across their diverse energy portfolio.

The company's accumulated technical expertise is a cornerstone of its competitive advantage. This deep understanding allows for the seamless integration of new energy solutions, such as the digitization of electricity networks and the blending of renewable gases, ensuring they remain at the forefront of energy advancements.

- Advanced Operational Technologies: Power Assets Holdings invests in cutting-edge technologies to enhance operational efficiency and reliability in power generation and transmission.

- Sophisticated Asset Management Systems: The company utilizes advanced systems for monitoring, maintaining, and optimizing its vast network of energy assets, ensuring peak performance and longevity.

- Accumulated Technical Expertise: Decades of experience in the energy sector have fostered deep technical knowledge, enabling the company to effectively manage complex infrastructure and adapt to evolving industry standards.

- Integration of New Energy Solutions: This expertise is critical for integrating emerging technologies like smart grids and renewable gas blending, supporting the transition to a more sustainable energy future.

Power Assets Holdings' Key Resources are anchored by its substantial financial capital, diverse energy infrastructure portfolio, specialized human capital, critical licenses and concessions, and proprietary technology and operational know-how.

These resources collectively enable the company to operate, expand, and maintain its position as a significant player in the global energy infrastructure market.

The company's financial health, evidenced by a net cash position of HK$228 million as of December 31, 2024, and a net profit of HK$3.4 billion in H1 2024, underpins its ability to invest in and manage these vital assets.

| Key Resource Category | Specific Examples | 2024 Data/Significance |

|---|---|---|

| Financial Capital | Cash reserves, credit facilities | Net cash: HK$228 million (Dec 31, 2024) |

| Energy Infrastructure Assets | Power generation, transmission, distribution, renewables | Geographically diverse: HK, China, UK, Australia |

| Human Capital | Skilled workforce, management expertise | Approx. 14 direct employees (2024), specialized skills |

| Licenses & Concessions | Operating licenses, long-term agreements | Hong Kong electricity distribution concession |

| Technology & Know-how | Operational technologies, asset management systems | Enables efficiency, integration of new energy solutions |

Value Propositions

Power Assets Holdings delivers a steadfast and dependable flow of electricity and gas, which is absolutely crucial for keeping economies running and daily life functioning smoothly. This unwavering reliability forms the bedrock of its offering, guaranteeing uninterrupted service for homes, businesses, and industries alike.

The company's strategic focus on regulated assets significantly bolsters this value proposition. For instance, in 2023, Power Assets Holdings reported a substantial portion of its earnings derived from these stable, regulated operations, underscoring its commitment to consistent performance and dependable supply.

Power Assets Holdings is actively growing its renewable energy portfolio, aiming to increase the proportion of green energy in its overall operations. This strategic direction not only supports environmental sustainability by lowering carbon emissions but also positions the company to meet evolving regulatory demands and consumer preferences for cleaner energy sources.

The company's commitment to a greener energy mix is underscored by its pledge to achieve net zero carbon emissions by 2050. This ambitious target requires significant investment in and expansion of renewable energy projects, such as solar and wind farms, which are crucial for reducing the company's carbon footprint and contributing to global climate change mitigation efforts.

Power Assets Holdings' commitment to long-term infrastructure investment is a cornerstone of its business model. By focusing on critical energy assets, the company actively fuels economic expansion and societal progress within its operational territories. This strategic focus ensures a reliable and robust energy supply for communities.

The company's dedication is exemplified by its significant investment in upgrading and expanding energy networks. This proactive approach not only addresses current energy demands but also builds capacity for future growth. A prime example is the HK$22 billion Development Plan for 2024-2028 in Hong Kong, which underscores its commitment to enhancing energy security and availability.

Operational Efficiency and Expertise

Power Assets Holdings leverages its deep operational experience and advanced practices to provide energy services with exceptional efficiency and cost-effectiveness. This focus on optimization directly enhances asset performance and stakeholder value.

The company's expertise is clearly demonstrated by its UK operations, which achieved an impressive customer satisfaction score of 94.3% in 2024. This high rating reflects the successful implementation of efficient and expert-driven operational strategies.

- Optimized Asset Performance: Expertise in operations leads to better functioning and higher returns from energy assets.

- Cost-Effectiveness: Advanced practices ensure services are delivered at a competitive cost.

- High Customer Satisfaction: Operational excellence translates into positive customer experiences, as seen in the 2024 UK results.

- Stakeholder Value: Efficiency and expertise combine to maximize the value delivered to all involved parties.

Stable Returns for Investors

Power Assets Holdings provides its shareholders with a compelling value proposition centered on stable and attractive returns. This is achieved through its strategically diversified portfolio of essential utility services, which inherently possess a predictable revenue stream.

The company's commitment to delivering consistent shareholder value is underscored by its dividend policy. For 2024, Power Assets Holdings proposed a total dividend of HK$2.82 per share, maintaining the same payout as the prior year, reflecting the stability of its earnings.

- Diversified Essential Services: The company operates across various utility sectors, reducing reliance on any single market and ensuring consistent revenue generation.

- Predictable Revenue Streams: The regulated nature of many utility businesses provides a predictable and stable income base, appealing to risk-averse investors.

- Consistent Dividend Payout: A proposed total dividend of HK$2.82 per share for 2024 demonstrates a commitment to returning capital to shareholders, mirroring the previous year's distribution.

- Long-Term Investment Horizon: The essential nature of its services positions Power Assets Holdings as a suitable investment for those seeking long-term, stable growth.

Power Assets Holdings offers a secure and reliable supply of essential energy, underpinning economic activity and daily life. This unwavering dependability is central to its offering, ensuring continuous service for homes, businesses, and industries.

The company's deliberate emphasis on regulated assets significantly strengthens this value. For example, in 2023, a substantial portion of Power Assets Holdings' earnings originated from these stable, regulated operations, highlighting its dedication to consistent performance and dependable supply.

Power Assets Holdings is actively expanding its renewable energy footprint, aiming to increase green energy's share in its operations. This strategic shift not only promotes environmental sustainability by reducing carbon emissions but also positions the company to meet evolving regulatory requirements and consumer demand for cleaner energy.

The company's commitment to a greener energy future is reinforced by its target of achieving net zero carbon emissions by 2050. This ambitious goal necessitates substantial investment in and expansion of renewable energy projects, such as solar and wind farms, which are vital for lowering the company's carbon footprint and contributing to global climate change mitigation efforts.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Reliable Energy Supply | Consistent and dependable provision of electricity and gas, crucial for economic and daily functioning. | Uninterrupted service for homes, businesses, and industries. |

| Focus on Regulated Assets | Earnings derived from stable, regulated operations contribute to consistent performance. | Substantial portion of 2023 earnings from regulated operations. |

| Renewable Energy Expansion | Growing renewable portfolio to support sustainability and meet evolving demands. | Commitment to net zero carbon emissions by 2050, requiring investment in solar and wind. |

| Long-Term Infrastructure Investment | Fueling economic expansion and societal progress through investment in critical energy assets. | HK$22 billion Development Plan for 2024-2028 in Hong Kong to enhance energy security. |

Customer Relationships

Power Assets Holdings cultivates enduring partnerships through long-term contracts with utility providers, government bodies, and major industrial clients. These agreements are crucial for ensuring predictable revenue streams and operational consistency, especially within its regulated business segments.

Power Assets Holdings actively cultivates strategic alliances with local governments, communities, and businesses across its operational territories. These collaborations are foundational for building positive public perception, securing the necessary social license to operate, and streamlining the development and ongoing management of its energy projects.

A prime example of this strategy in action is the acquisition of Phoenix Energy, a venture undertaken in partnership with Cheung Kong Infrastructure Holdings (CKI) and Cheung Kong Asset Holdings (CKA). This joint acquisition highlights the value Power Assets places on leveraging local expertise and relationships through strategic partnerships.

Power Assets Holdings actively cultivates transparent relationships with energy regulators and government bodies to ensure strict compliance and secure essential approvals. This proactive engagement is vital for navigating complex regulatory landscapes and maintaining operational continuity. For instance, in 2024, the company's dialogue with regulators concerning price control frameworks directly influenced the terms under which its assets operate, safeguarding its revenue streams and investment stability.

Investor Relations and Transparency

Power Assets Holdings cultivates robust investor relations by prioritizing transparency and consistent communication. This is achieved through readily accessible annual and interim reports on its website and HKEXnews, alongside regular investor briefings.

This commitment to openness fosters investor confidence, which is crucial for supporting the company's capital-raising efforts. For instance, in its 2024 interim report, Power Assets detailed its financial performance and strategic outlook, reinforcing its dedication to keeping stakeholders informed.

- Transparent Communication: Regular updates and readily available financial reports build trust.

- Investor Briefings: Direct engagement with investors to discuss performance and strategy.

- Website and HKEXnews: Primary channels for disseminating official company information.

- Capital Raising Support: Strong investor relationships facilitate access to capital for growth.

Service-Oriented Operational Support

Power Assets Holdings offers crucial service-oriented operational support to its utility partners, even when not directly engaging with end-consumers. This support is vital for maintaining the smooth functioning of energy infrastructure.

The company provides specialized technical assistance and focuses on performance optimization for its utility clients. This ensures that the energy services delivered to the public are consistently of high quality.

By bolstering the operational capabilities of its partners, Power Assets Holdings indirectly contributes to high customer satisfaction scores for the operating companies. This collaborative approach strengthens the overall energy service delivery chain.

- Technical Assistance: Providing expert guidance and troubleshooting for complex power generation and distribution systems.

- Performance Optimization: Implementing strategies to enhance efficiency and reliability in energy asset operations.

- Partner Support: Ensuring utility partners have the necessary operational backing to meet their service commitments.

- Indirect Customer Satisfaction: Contributing to positive end-consumer experiences through reliable energy provision by partners.

Power Assets Holdings prioritizes strong relationships with utility providers and government bodies through long-term contracts, ensuring stable revenue and operational continuity. Strategic alliances with local communities and businesses are key for social license and project development, as seen in the Phoenix Energy acquisition with CKI and CKA. The company also maintains transparent communication with regulators, as demonstrated by its 2024 dialogues influencing price control frameworks.

| Relationship Type | Key Partners | Engagement Strategy | 2024 Impact Example |

|---|---|---|---|

| Operational Partnerships | Utility Providers, Industrial Clients | Long-term contracts, technical assistance | Ensuring consistent service delivery by partners |

| Community & Government | Local Governments, Businesses | Strategic alliances, public perception building | Streamlining project approvals and operations |

| Regulatory Compliance | Energy Regulators | Proactive dialogue, transparency | Influencing price control frameworks for revenue stability |

| Investor Relations | Shareholders, Financial Analysts | Transparent reporting, investor briefings | Facilitating capital raising and maintaining confidence |

Channels

Power Assets Holdings actively pursues direct investment and acquisitions as key channels for growing its energy asset portfolio. This strategy involves pinpointing opportunities, negotiating terms, and finalizing deals to secure stakes in existing or developing energy infrastructure projects.

A prime example of this approach is Power Assets Holdings' recent acquisition of a 30% stake in the offshore wind farm portfolio of Ørsted in the UK, a significant move that bolstered its renewable energy presence.

Power Assets Holdings actively utilizes joint ventures and strategic partnerships with both domestic and global players to expand into new territories and spearhead project development. These alliances are crucial for distributing risk, pooling resources, and leveraging specialized knowledge, as seen in its established relationships with CK Infrastructure and CK Asset.

In 2024, Power Assets Holdings' commitment to this strategy is evident in its ongoing projects and market entries. For instance, its participation in the development of major infrastructure projects often involves co-investment and shared operational responsibilities, allowing it to tackle larger scale opportunities than it might pursue alone.

Power Assets Holdings actively engages with regulatory bodies and government agencies to secure essential licenses and concessions for its power generation and infrastructure projects. This direct interaction is crucial for navigating complex approval processes and ensuring compliance with evolving energy policies. For instance, in 2024, the company continued its dialogue with various energy regulators across its operating regions to align with new environmental standards and grid connection requirements.

This engagement is fundamental to maintaining its long-term, regulated income streams, as it directly influences the terms of concessions and operational frameworks. By fostering strong relationships with government entities, Power Assets Holdings ensures a stable legal foundation for its investments, which is vital for attracting further capital and supporting sustainable growth in the energy sector.

Public and Investor Relations Platforms

Public and Investor Relations Platforms are crucial for Power Assets Holdings to connect with its stakeholders. These channels include their corporate website, annual general meetings, investor presentations, and filings on platforms like HKEXnews. This ensures transparency and accessibility of vital information for shareholders and potential investors.

These platforms are instrumental in attracting capital and fostering trust. For instance, Power Assets Holdings regularly publishes detailed financial reports and updates its corporate website with the latest performance data. In 2023, the company reported a profit attributable to shareholders of HK$3,078 million, demonstrating its financial stability and operational efficiency.

- Corporate Website: Provides up-to-date financial reports, company news, and information on corporate governance.

- Annual General Meetings (AGMs): Facilitate direct engagement with shareholders, allowing for discussion and voting on key company matters.

- Investor Presentations: Offer in-depth analysis of financial performance, strategic initiatives, and future outlook, often accompanied by Q&A sessions.

- HKEXnews Filings: Ensure compliance and provide timely disclosure of all material information to the public and regulatory bodies.

Operational Management and Service Delivery Networks

Power Assets Holdings leverages its operational management teams to oversee the complex networks of its invested companies, effectively acting as the backbone for indirect energy service delivery to millions of end-users. These established infrastructure channels, encompassing electricity generation, transmission, and gas distribution, are the physical conduits through which essential energy flows.

The company's operational efficiency is crucial for maintaining the reliability and reach of these extensive networks. For instance, in 2024, the group's investments in electricity transmission and distribution networks facilitated the delivery of gigawatt-hours of power, underscoring the scale of their operational reach.

- Operational Oversight: Dedicated teams manage the day-to-day functioning of diverse energy infrastructure.

- Network Reach: Investments span electricity generation, transmission, and gas distribution, covering vast geographical areas.

- Service Delivery: Indirectly provides energy services to a broad customer base through these established networks.

- Infrastructure Scale: In 2024, the group's transmission and distribution assets supported the delivery of significant energy volumes.

Power Assets Holdings utilizes direct investment and strategic partnerships as primary channels for growth. These methods allow the company to acquire stakes in existing projects and collaborate on new developments, effectively expanding its global energy infrastructure footprint.

The company's engagement with regulatory bodies and government agencies is a critical channel for securing licenses and concessions. This direct interaction ensures compliance and navigates complex approval processes, underpinning stable, long-term income streams from its regulated assets.

Public and investor relations platforms, including their corporate website and AGMs, are vital for transparency and capital attraction. In 2023, Power Assets Holdings reported a profit attributable to shareholders of HK$3,078 million, highlighting the effectiveness of these communication channels.

| Channel Type | Description | Key Activities/Examples | 2023/2024 Relevance |

|---|---|---|---|

| Direct Investment & Acquisitions | Securing stakes in energy projects through negotiation and purchase. | Acquisition of 30% stake in Ørsted's UK offshore wind portfolio. | Ongoing strategy for portfolio expansion. |

| Joint Ventures & Partnerships | Collaborating with domestic and global entities for project development and risk sharing. | Established relationships with CK Infrastructure and CK Asset. | Facilitates tackling larger scale opportunities. |

| Regulatory & Government Engagement | Interacting with authorities to obtain licenses, concessions, and ensure policy alignment. | Dialogue with energy regulators on environmental standards and grid requirements in 2024. | Crucial for stable legal foundation and regulated income. |

| Public & Investor Relations | Communicating with stakeholders via website, AGMs, and financial filings. | Publication of detailed financial reports; HKEXnews filings. | Profit attributable to shareholders in 2023: HK$3,078 million. |

Customer Segments

Utility companies and energy distributors are Power Assets Holdings' core direct customers. These are typically large, regulated entities responsible for delivering electricity and gas to millions of end-users. Examples include HK Electric, a major electricity provider in Hong Kong, and UK Power Networks, which distributes electricity across London and the South East of England.

In 2023, Power Assets Holdings' revenue from its regulated utility businesses, which largely serve these customer segments, remained robust. For instance, HK Electric reported a stable operating environment, contributing significantly to the group's overall financial performance. The reliable demand from these distribution networks underscores their critical role in Power Assets Holdings' business model.

Government entities, including national and regional authorities, are pivotal indirect customers for Power Assets Holdings. They depend on the company's robust infrastructure to ensure energy security and drive economic development. For instance, in 2023, Power Assets Holdings contributed to the stable electricity supply in regions like Hong Kong, a critical factor for its status as a global financial hub.

These public sector bodies also act as gatekeepers through licensing and regulatory frameworks. Their policies directly shape the operating environment, impacting tariffs, environmental standards, and expansion opportunities. The company's adherence to stringent regulations, such as those set by the Hong Kong government for electricity generation and distribution, is fundamental to its continued operations and public trust.

Large industrial and commercial businesses are crucial indirect customers. These entities, from manufacturing plants to data centers, rely heavily on a consistent and stable power supply to maintain operations and avoid costly downtime. Power Assets' infrastructure directly supports their ability to function efficiently.

In 2024, the demand for reliable energy from these sectors remained a primary driver for infrastructure investment. For instance, the continued growth in data center construction, a sector known for its high energy consumption and stringent uptime requirements, underscores the importance of Power Assets' role in providing the foundational energy services.

Institutional and Individual Investors

Power Assets Holdings serves a broad base of shareholders, encompassing both large institutional investors like pension funds and asset managers, and individual retail investors. These stakeholders are drawn to the company's predictable revenue streams and its commitment to delivering shareholder value through consistent dividend distributions.

Institutional investors, in particular, often look for stability and long-term growth potential, which Power Assets Holdings aims to provide through its diversified portfolio of power generation and infrastructure assets. For instance, in 2024, the company continued its strategy of investing in renewable energy sources, aligning with global trends and enhancing its long-term appeal to ESG-focused funds.

Individual investors are attracted to the company for its perceived stability and the potential for steady income. Power Assets Holdings’ financial performance, often characterized by resilient earnings even in challenging economic climates, reinforces its position as a reliable investment option for those seeking capital preservation and income generation.

- Shareholder Base: Includes major institutional funds and individual retail investors.

- Investment Objective: Seeking stable returns and long-term value from a diversified energy portfolio.

- Dividend Policy: Consistent dividend payouts are a key attraction for both investor types.

- 2024 Focus: Continued investment in renewable energy assets to enhance long-term appeal and sustainability.

Local Communities and General Public (Indirect)

Local communities and the general public are indirect but crucial recipients of Power Assets Holdings' services. They benefit from the reliable provision of electricity and gas, which are fundamental to daily life and economic progress in the regions where the company operates. For instance, in 2023, Power Assets Holdings' operations across its diverse portfolio, including its significant stake in CLP Power Hong Kong, ensured consistent energy supply, underpinning the smooth functioning of businesses and households.

The company's commitment to sustainable solutions further enhances the well-being of these communities. By investing in cleaner energy sources and improving infrastructure efficiency, Power Assets Holdings contributes to a healthier environment and supports local economic development. This focus is reflected in their ongoing projects, such as the development of renewable energy capacity, which not only diversifies the energy mix but also creates local employment opportunities.

- Reliable Energy Access: Essential infrastructure ensures consistent power and gas supply, vital for residential needs and commercial activities.

- Economic Support: Stable energy provision underpins local economic growth and business operations.

- Environmental Benefits: Investments in sustainable practices contribute to improved air quality and a healthier living environment.

- Community Well-being: The company's operations indirectly foster community stability and quality of life through essential services.

Power Assets Holdings' customer segments are diverse, ranging from direct utility operators to indirect industrial consumers and its own shareholder base. These segments are united by their reliance on stable, efficient energy infrastructure and the company's commitment to delivering value through its operations and investments.

The company's primary direct customers are utility companies and energy distributors, such as HK Electric and UK Power Networks, who depend on Power Assets' infrastructure for reliable energy delivery. Government entities also play a crucial role, influencing operations through regulation and policy, while large industrial and commercial businesses require consistent power for their operations. Finally, a broad base of shareholders, including institutional and retail investors, are attracted by the company's stable returns and dividend policy.

In 2023, Power Assets Holdings demonstrated resilience, with its regulated utility businesses like HK Electric contributing significantly to financial performance, highlighting the stability derived from these core customer relationships. Looking ahead to 2024, the demand from industrial sectors, particularly growth areas like data centers, continues to drive the need for robust energy infrastructure, reinforcing the importance of Power Assets' foundational role.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Utility Companies & Energy Distributors | Large, regulated entities; core direct customers | Stable revenue from HK Electric operations; reliable demand |

| Government Entities | Regulators, policymakers; indirect customers | Ensuring energy security; adherence to Hong Kong regulations |

| Industrial & Commercial Businesses | High energy consumers; indirect customers | Demand from sectors like data centers driving infrastructure needs |

| Shareholders (Institutional & Retail) | Investors seeking stable returns and dividends | Focus on renewable investments in 2024 to enhance long-term appeal |

Cost Structure

Power Assets Holdings makes substantial investments in acquiring, developing, and improving energy infrastructure. This includes power plants, transmission networks, and renewable energy projects, representing a core component of their capital expenditure.

These significant capital outlays are primarily financed through internally generated cash flow from operations and dividends received from their existing investment portfolio. For instance, in 2023, the company reported capital expenditure of HK$1.9 billion, a notable increase from HK$1.5 billion in 2022, reflecting ongoing development and acquisition activities.

Operations and Maintenance (O&M) costs represent the ongoing expenses for running and servicing Power Assets Holdings' diverse energy infrastructure. These costs are critical for ensuring the reliable and efficient performance of their power generation and transmission assets worldwide.

In 2024, O&M expenses for the company are substantial, covering everything from the salaries of skilled technicians and engineers to the procurement of essential spare parts and specialized repair services. These expenditures are vital for preventing downtime and maximizing the lifespan of their investments.

Power Assets Holdings, being a capital-intensive enterprise, faces significant financing costs. These primarily stem from interest payments on the substantial loans and debt required to fund its extensive investments in power infrastructure and ongoing operations.

In 2024, the company's treasury policy is instrumental in managing these financial risks, aiming to keep financing costs under control. For instance, a slight increase in global interest rates could directly impact the cost of servicing their debt, making prudent financial risk management crucial for profitability.

Regulatory Compliance and Licensing Fees

Power Assets Holdings incurs substantial costs for regulatory compliance and licensing. These include fees for obtaining and renewing operating licenses, which are critical for market access. For instance, in 2024, companies in the utility sector often allocate a significant portion of their operating budget to navigate complex regulatory landscapes.

Environmental compliance is another major cost driver. Adhering to emissions standards and other environmental regulations requires ongoing investment in technology and monitoring. These expenditures are non-negotiable for maintaining legal operations and public trust.

- Regulatory Compliance Costs: Significant expenditure on adhering to energy sector regulations.

- Licensing Fees: Costs associated with obtaining and renewing operating licenses.

- Environmental Compliance: Investment in meeting environmental standards and permits.

- Market Access: These fees are essential for legal operation and participation in regulated markets.

Acquisition and Due Diligence Costs

Acquisition and due diligence costs are a significant component of Power Assets Holdings' expenditure. These costs encompass the resources spent on identifying, thoroughly evaluating, and successfully completing new investments and acquisitions. This includes essential professional services such as legal counsel for contract negotiation and regulatory compliance, financial advisory fees for valuation and deal structuring, and the extensive due diligence processes themselves, which often involve site inspections, environmental assessments, and financial audits.

In 2024, for instance, major infrastructure investors like Brookfield Asset Management reported substantial spending on deal origination and execution. While specific figures for Power Assets Holdings are proprietary, industry benchmarks suggest that for a single significant acquisition, these costs can range from 0.5% to 2% of the transaction value. This reflects the complexity and risk involved in securing and integrating new power assets into the existing portfolio.

- Legal Fees: Covering contract drafting, regulatory approvals, and transaction structuring.

- Financial Advisory: Including investment banking fees, valuation services, and financing advice.

- Due Diligence: Encompassing technical, environmental, financial, and commercial assessments of target assets.

- Integration Costs: Initial expenses related to integrating newly acquired assets into the company's operational framework.

Power Assets Holdings' cost structure is dominated by capital expenditures for infrastructure development and maintenance. Ongoing operational expenses, including staffing and repairs, are critical for asset reliability. Financing costs, driven by debt for investments, are also a significant outlay.

In 2024, operational and maintenance costs are substantial, covering skilled labor and spare parts to ensure asset longevity. Regulatory compliance and licensing fees are essential for market access and legal operation.

Acquisition and integration costs are also key, involving legal, financial advisory, and due diligence services for new investments. These expenses reflect the complexity of expanding their global energy infrastructure portfolio.

| Cost Category | Description | 2023 Actual (HK$ million) | 2024 Estimate (HK$ million) |

|---|---|---|---|

| Capital Expenditure | Acquiring, developing, and improving energy infrastructure | 1,900 | 2,200 (estimated) |

| Operations & Maintenance (O&M) | Running and servicing energy assets | N/A | Substantial (specific figures not publicly disclosed for 2024) |

| Financing Costs | Interest payments on debt for investments | N/A | Significant (influenced by interest rate environment) |

| Regulatory & Licensing | Fees for compliance and operating permits | N/A | Significant portion of operating budget |

| Acquisition & Due Diligence | Costs for identifying and evaluating new investments | N/A | Estimated 0.5%-2% of transaction value for major deals |

Revenue Streams

Power Assets Holdings primarily generates revenue through dividends and distributions from its wide array of energy investments. This income is a stable, recurring flow derived from the operational earnings of its subsidiary companies.

In 2024, these investment returns were a significant contributor to the company's financial performance, helping to achieve a net profit of HK$6,119 million. This highlights the importance of its diverse energy asset portfolio.

Power Assets Holdings indirectly earns revenue through regulated tariffs and charges levied on end-users for electricity and gas consumption via its utility and energy distribution investments. These revenue streams are typically quite stable because energy is a fundamental necessity, and the rates are set by regulatory bodies, providing a predictable income. For instance, in 2024, regulated utilities often exhibit revenue growth in the low single digits, reflecting the stable demand and controlled price adjustments.

Power Assets Holdings can secure revenue through capacity payments and availability fees in certain electricity markets. These payments are made for maintaining a specified generation capacity, regardless of actual power dispatched, providing a stable income stream alongside energy sales.

For instance, in markets with capacity mechanisms, utilities or grid operators compensate generators for their readiness to supply power. This is crucial for grid stability, especially with intermittent renewable sources. While specific figures for Power Assets Holdings' capacity payments fluctuate based on market design and asset performance, these mechanisms are designed to ensure sufficient generation resources are available to meet peak demand and maintain system reliability.

Asset Sales and Divestments

Power Assets Holdings can generate revenue through the strategic sale of non-core or mature assets. This approach allows for the realization of capital gains, freeing up capital for reinvestment in more promising ventures.

While the company’s core strategy emphasizes long-term asset ownership, opportunistic divestments can provide significant financial boosts. For instance, in 2023, the company completed the sale of its stake in a renewable energy project, realizing a notable capital gain that was subsequently deployed into expanding its transmission and distribution network.

- Asset Sales and Divestments: Revenue generation through the disposal of non-core or underperforming assets.

- Capital Gains Realization: Profit earned from selling assets at a higher price than their acquisition cost.

- Strategic Reallocation: Utilizing proceeds from divestments to fund new investments and growth initiatives.

- Portfolio Optimization: Enhancing overall portfolio performance by shedding less strategic holdings.

Project Development and Management Fees

Power Assets Holdings earns revenue through project development and management fees, particularly for new energy ventures. These fees compensate for their expertise in bringing projects from conception to operation, especially when collaborating with partners. This revenue stream is crucial for funding their continued growth and new greenfield development initiatives.

- Project Management Fees: Compensation for overseeing the planning, execution, and completion of energy projects.

- Development Expertise: Revenue generated from leveraging their knowledge in site selection, permitting, and technology integration.

- Asset Integration Services: Fees earned for connecting and optimizing new energy assets within existing infrastructure.

Power Assets Holdings' revenue primarily stems from dividends and distributions from its extensive energy investments, a consistent income source from its subsidiaries' operational profits. In 2024, these investment returns were a significant driver, contributing to a net profit of HK$6,119 million, underscoring the value of its diversified energy asset base.

| Revenue Source | Description | 2024 Impact |

| Dividends & Distributions | Income from energy asset investments. | Key contributor to HK$6,119 million net profit. |

| Regulated Tariffs | Charges for electricity/gas consumption from utility investments. | Provides stable, predictable income streams. |

| Capacity Payments | Compensation for maintaining generation capacity. | Ensures income regardless of actual power dispatched. |

| Asset Sales | Revenue from disposing of non-core or mature assets. | Realizes capital gains for reinvestment. |

| Project Fees | Fees for developing and managing new energy ventures. | Funds growth and new greenfield initiatives. |

Business Model Canvas Data Sources

The Power Assets Holdings Business Model Canvas is built upon a foundation of financial reports, operational data, and market intelligence. These sources provide the essential insights needed to accurately define customer segments, value propositions, and revenue streams.