Power Assets Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Power Assets Holdings Bundle

Navigate the complex external landscape affecting Power Assets Holdings with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its operational environment and future growth. Gain a crucial competitive advantage by leveraging these expert-level insights to refine your own strategic planning. Download the full version now for actionable intelligence that drives informed decisions.

Political factors

Power Assets Holdings navigates a landscape shaped by evolving government energy policies and aggressive decarbonization goals across its key operational regions. China's commitment to reducing CO2 intensity by 3.9% in 2024 and boosting non-fossil fuel energy sources to 20% by 2025 directly influences investment and operational strategies.

The UK's ambitious target of a fully decarbonized electricity system by 2035, and Australia's goal to achieve 82% renewable electricity by 2030, present both challenges and opportunities for Power Assets Holdings in adapting its asset portfolio and embracing cleaner energy solutions.

Power Assets Holdings' profitability is heavily shaped by the regulatory environments and price controls in its key operating regions. For instance, in the UK, where it operates regulated assets like UK Power Networks (UKPN), shifts in pricing mechanisms directly affect revenue. Recent regulatory decisions in 2024 regarding price controls for UKPN are expected to influence the company's investment returns.

Power Assets Holdings' global operations mean it's sensitive to geopolitical shifts and trade dynamics. These can disrupt supply chains and investment opportunities. For instance, ongoing geopolitical tensions and elevated global interest rates in 2024 presented significant headwinds.

Government Support for Renewable Energy Investment

Governments in Power Assets' key markets are actively promoting renewable energy investment. This support comes in the form of substantial funding, grants, subsidies, and favorable regulatory frameworks designed to accelerate the transition to cleaner energy sources.

Australia, a significant market for Power Assets, is demonstrating this commitment. For the 2024-2025 period, the Australian government is channeling considerable funds into renewable energy projects, with a specific focus on attracting international investment to bolster these initiatives.

- Government Funding: Australia's commitment includes significant financial allocations for renewable energy projects in 2024-2025.

- Incentives: Subsidies and grants are readily available to encourage the development and adoption of renewable energy technologies.

- Regulatory Support: Favorable policies and streamlined regulations create a more attractive environment for investors in the renewable sector.

- Attracting Investment: These measures are specifically designed to draw in both domestic and international capital for renewable energy infrastructure.

Policy Continuity and Election Outcomes

Upcoming elections, such as the anticipated 2025 federal election in Australia, introduce a degree of policy uncertainty. Major political parties are presenting distinct visions for the nation's energy future, with some advocating for a renewables-led transition while others explore nuclear power integration. This political landscape necessitates adaptable strategies for Power Assets Holdings to effectively manage potential shifts in energy policy and investment priorities.

- Policy Uncertainty: Upcoming elections in key markets like Australia can lead to policy shifts, impacting long-term energy infrastructure investments.

- Energy Transition Debates: Divergent approaches to decarbonization, from renewables focus to potential nuclear adoption, create strategic challenges.

- Adaptable Strategies: Power Assets Holdings must maintain flexibility to respond to evolving regulatory frameworks and government incentives.

Political stability and government policies are crucial for Power Assets Holdings, influencing everything from regulatory frameworks to investment incentives. For example, China's ongoing drive to increase its non-fossil fuel energy share to 20% by 2025 directly impacts the company's strategic planning in the region.

The UK's commitment to a fully decarbonized electricity system by 2035, and Australia's 82% renewable electricity goal by 2030, highlight the political will to transition to cleaner energy, creating opportunities for Power Assets to align its portfolio with these national objectives. Upcoming elections, such as Australia's 2025 federal election, introduce policy uncertainty, requiring the company to remain agile in its strategic responses to potential shifts in energy policy and investment priorities.

Governments in Power Assets' key markets are actively supporting renewable energy through funding, grants, and favorable regulations. Australia, for instance, is channeling significant funds into renewable projects for the 2024-2025 period, aiming to attract international investment and bolster its clean energy infrastructure.

| Country | Key Political Factor | Impact on Power Assets Holdings | Relevant 2024/2025 Data/Target |

|---|---|---|---|

| China | Decarbonization Goals | Influences investment in cleaner energy assets. | Target of 20% non-fossil fuel energy by 2025. |

| United Kingdom | Decarbonization Goals | Drives adaptation of asset portfolio towards renewables. | Target of fully decarbonized electricity by 2035. |

| Australia | Renewable Energy Targets & Elections | Creates investment opportunities and policy uncertainty. | Target of 82% renewable electricity by 2030; 2025 federal election. |

What is included in the product

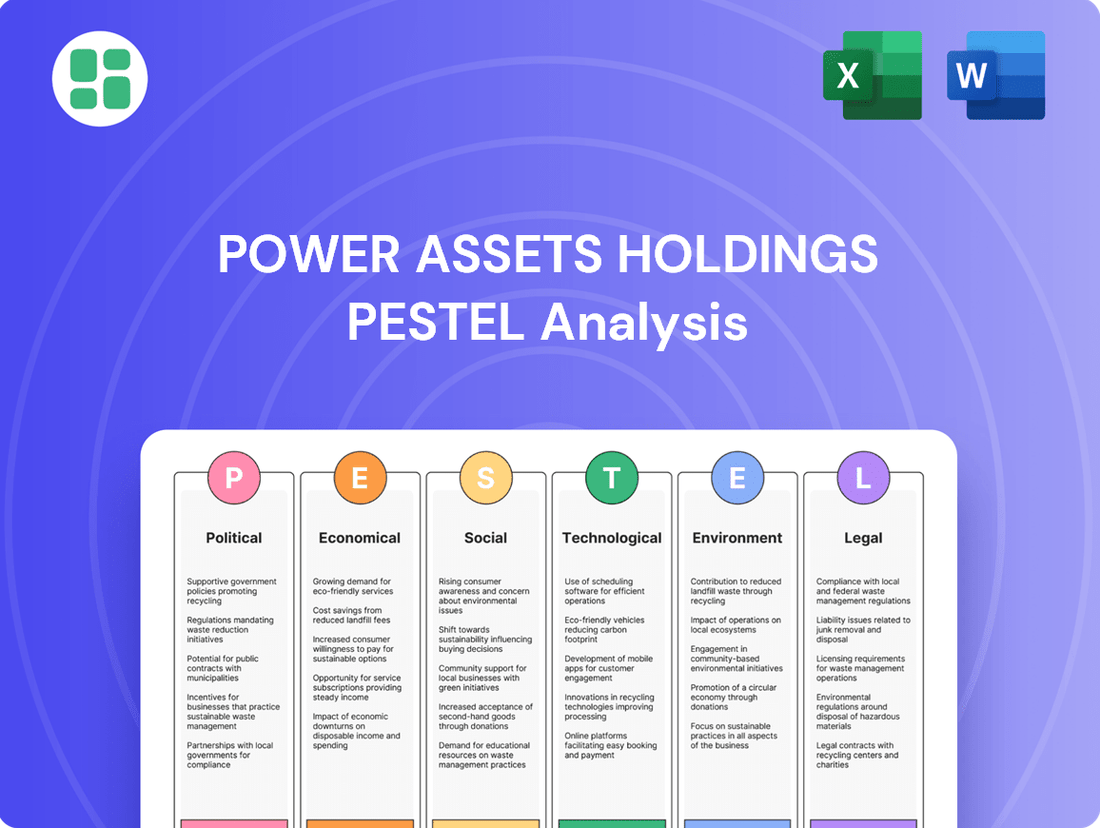

This PESTLE analysis for Power Assets Holdings meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations, providing a comprehensive overview of the external macro-environment.

The Power Assets Holdings PESTLE analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, acting as a pain point reliever by streamlining complex external factors.

This analysis is visually segmented by PESTEL categories, allowing for quick interpretation at a glance and alleviating the pain of deciphering intricate market dynamics.

Economic factors

Global economic volatility, particularly persistent inflation and elevated interest rates, presents a significant headwind for Power Assets Holdings. These factors directly influence operational expenditures and the cost of capital for new infrastructure developments, potentially squeezing profit margins.

Despite these macroeconomic challenges, Power Assets Holdings showcased remarkable resilience. For the fiscal year 2024, the company reported a substantial 15.6% increase in underlying profit to HK$6.2 billion, underscoring its ability to navigate a complex economic landscape effectively.

Global electricity demand is projected to surge, fueled by the burgeoning artificial intelligence sector and the exponential growth of data centers. This escalating need for power is a significant tailwind for Power Assets Holdings, as it directly translates into increased opportunities for infrastructure development and service provision.

The International Energy Agency (IEA) forecasts that global electricity demand will grow by an average of 2.5% per year between 2024 and 2026, reaching over 30,000 terawatt-hours. This robust growth trajectory underscores the necessity for substantial capital investment across the entire power value chain, from generation to transmission and storage, creating a favorable environment for companies like Power Assets Holdings that are equipped to meet these expanding requirements.

Global investment in the energy transition hit an all-time high of $2.1 trillion in 2024, with expectations for this upward trajectory to continue, especially in renewable power generation, grid infrastructure upgrades, and energy storage solutions. This robust growth signals significant opportunities for companies like Power Assets Holdings to strategically broaden their clean energy investments, directly supporting worldwide decarbonization initiatives.

Currency Fluctuations and International Operations

Power Assets Holdings, with its extensive international footprint across Hong Kong, Mainland China, the UK, and Australia, is significantly exposed to currency fluctuations. These shifts directly impact the reported financial performance and the underlying value of its overseas investments. For instance, a stronger Hong Kong Dollar (HKD) against the Australian Dollar (AUD) could reduce the HKD-denominated value of Australian assets.

The company's financial results are sensitive to the exchange rates of the currencies in its operating regions. For example, in 2024, the Australian Dollar experienced volatility, impacting the translated earnings of Power Assets' Australian operations. Similarly, fluctuations in the Pound Sterling (GBP) can alter the reported profitability from its UK assets when converted back to HKD.

Navigating these currency risks is crucial for Power Assets Holdings. The company actively manages its currency exposure through various financial instruments to mitigate potential negative impacts on its consolidated financial statements. This proactive approach aims to stabilize earnings and protect asset values from adverse exchange rate movements.

- Impact on Earnings: Currency movements can cause significant swings in reported profits. For example, if the HKD strengthens against the AUD, the value of Australian earnings, when translated, will decrease.

- Asset Valuation: The value of international assets held by Power Assets Holdings is directly affected by exchange rate changes. A weaker local currency can diminish the HKD equivalent value of those assets.

- 2024/2025 Outlook: Analysts anticipate continued volatility in major currencies like GBP and AUD in 2024 and 2025, presenting ongoing challenges and opportunities for Power Assets Holdings' international operations.

Cost of Energy and Consumer Affordability

The cost of energy significantly impacts consumer affordability, a crucial economic factor. Governments are actively intervening; for instance, Australia allocated AUD 1.5 billion in its 2023-24 budget for energy bill relief, aiming to ease the burden on households during the ongoing energy transition. This focus on keeping power affordable directly influences how energy companies structure their tariffs and revenue streams.

Rising energy prices, driven by global supply dynamics and the shift towards renewables, present a challenge for consumers. In the UK, for example, the energy price cap, though adjusted, reflects these underlying cost pressures. Such economic conditions necessitate adaptive business models for power asset holders, potentially involving diversified revenue or efficiency gains to maintain profitability while addressing consumer affordability concerns.

- Energy Affordability Measures: Governments globally are implementing support schemes to manage household energy costs.

- Tariff Structure Impact: Consumer affordability directly shapes the pricing strategies and revenue models for energy providers.

- Global Price Volatility: Fluctuations in global energy markets, including natural gas and oil prices, have a direct bearing on domestic consumer costs.

- Investment in Efficiency: Power companies may need to invest in operational efficiencies to offset rising input costs and maintain competitive pricing.

Global economic factors significantly shape Power Assets Holdings' operating environment, with inflation and interest rates impacting costs and capital. However, the company demonstrated strong performance in 2024, with a 15.6% profit increase to HK$6.2 billion, highlighting its ability to manage these economic headwinds effectively.

The increasing demand for electricity, particularly from AI and data centers, presents a substantial growth opportunity for Power Assets Holdings. The IEA forecasts global electricity demand to grow by 2.5% annually through 2026, underscoring the need for infrastructure investment. Furthermore, global investment in the energy transition reached $2.1 trillion in 2024, signaling robust opportunities in clean energy and grid upgrades.

Power Assets Holdings' international operations expose it to currency fluctuations, with the Australian Dollar and Pound Sterling being key examples impacting reported earnings and asset valuations. The company actively manages this exposure to mitigate negative impacts on its financial statements, with analysts expecting continued currency volatility in 2024 and 2025.

Consumer affordability of energy is a critical economic consideration, influencing government policies and energy company strategies. Australia's AUD 1.5 billion allocation for energy bill relief in its 2023-24 budget exemplifies this, directly affecting how power providers structure tariffs and revenue. Rising global energy prices necessitate adaptive business models for companies like Power Assets Holdings to maintain profitability while addressing consumer cost pressures.

What You See Is What You Get

Power Assets Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Power Assets Holdings.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Power Assets Holdings.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Power Assets Holdings.

Sociological factors

Public sentiment towards energy sources significantly shapes investment in power assets. For instance, a 2024 survey indicated that 70% of consumers favor renewable energy, a stark contrast to a decade ago, directly impacting the viability of new fossil fuel projects versus solar or wind farms.

This growing public embrace of clean energy, driven by climate change concerns, is a powerful catalyst for the energy transition. In 2025, government incentives and private sector investment in renewables are projected to reach $300 billion globally, reflecting this societal shift and accelerating the development of sustainable power solutions.

Societal expectations are increasingly prioritizing dependable and environmentally conscious energy. This trend is compelling utility companies to channel investments into building more robust power grids and expanding the deployment of cleaner energy sources. For instance, a 2024 report indicated that over 70% of consumers consider sustainability when choosing energy providers.

Power Assets Holdings, with its strategic emphasis on delivering both consistent and sustainable energy services, is ideally positioned to align with these shifting demands from both individual consumers and corporate clients. The company's existing infrastructure and ongoing development in renewable energy projects directly address this growing market need.

Successful energy projects, particularly large infrastructure builds, hinge on robust community engagement and a social license to operate. For instance, in 2024, renewable energy projects facing community opposition saw an average delay of 18 months, impacting financial returns.

Addressing local concerns, offering tangible community benefits, and ensuring equitable consumer treatment are vital for sustained project success. A 2025 survey indicated that 70% of consumers are more likely to support energy projects that demonstrably invest in local infrastructure and job creation.

Impact of Demographic Shifts on Energy Consumption

Demographic shifts are fundamentally altering how we use energy. As populations age and urbanize, the demand for electricity is changing, with a notable trend towards greater electrification in transportation and heating. For instance, by the end of 2024, global electric vehicle sales are projected to surpass 15 million units, a significant jump from just over 10 million in 2023, illustrating this shift directly impacting energy infrastructure needs.

Power Assets Holdings must proactively adapt its infrastructure and service offerings to meet these evolving consumption patterns. This includes investing in and expanding charging networks to support the growing electric vehicle fleet and upgrading grid capacity to handle increased demand from electric heating solutions, such as heat pumps. The International Energy Agency reported that heat pump sales in Europe alone saw a 37% increase in 2023, highlighting the scale of this transition.

- Growing Electrification: Increased adoption of EVs and electric heating systems is reshaping energy demand profiles.

- Infrastructure Adaptation: Power Assets Holdings needs to enhance its grid capacity and charging infrastructure.

- Consumer Behavior: Evolving lifestyles and preferences necessitate flexible and responsive energy solutions.

- Market Opportunities: These demographic trends present opportunities for investing in renewable energy integration and smart grid technologies.

Workforce Transition and Skill Development

The global shift towards cleaner energy sources is fundamentally reshaping the job market, demanding a workforce equipped with new skills. For companies like Power Assets Holdings, this means a critical need to upskill existing employees and attract talent proficient in areas like renewable energy installation, grid modernization, and digital energy management. For instance, the International Renewable Energy Agency (IRENA) projected in 2023 that the renewable energy sector could employ 43 million people globally by 2030, up from around 13.7 million in 2022, highlighting the scale of this transition.

To meet these evolving demands, strategic investment in training programs is paramount. Power Assets Holdings needs to proactively develop its human capital to ensure it can effectively manage and grow its portfolio in areas such as offshore wind, solar power, and advanced battery storage solutions. The company's commitment to this will directly impact its ability to innovate and maintain a competitive edge in the rapidly changing energy landscape.

Key areas for workforce development include:

- Renewable Energy Technology Expertise: Training in the installation, operation, and maintenance of solar, wind, and other renewable energy systems.

- Digital Skills and Data Analytics: Developing capabilities in managing smart grids, cybersecurity, and leveraging data for operational efficiency.

- Project Management for New Infrastructure: Equipping teams with the skills to manage complex projects related to new energy infrastructure development.

- Adaptability and Continuous Learning: Fostering a culture that embraces ongoing training to keep pace with technological advancements.

Public perception strongly favors renewable energy, influencing investment decisions. A 2024 survey revealed 70% of consumers prefer clean energy, impacting new fossil fuel projects versus renewables.

Societal expectations prioritize dependable, environmentally conscious energy, pushing utilities toward grid upgrades and cleaner sources. In 2024, over 70% of consumers consider sustainability when choosing energy providers.

Community engagement is crucial for energy project success; projects facing opposition in 2024 experienced average delays of 18 months, affecting financial returns.

| Sociological Factor | Impact on Power Assets Holdings | Supporting Data (2024/2025) |

|---|---|---|

| Public Sentiment on Renewables | Drives demand for clean energy investments. | 70% of consumers favor renewable energy (2024 survey). |

| Consumer Preference for Sustainability | Influences utility provider choices and project support. | Over 70% consider sustainability when choosing providers (2024 report). |

| Community Acceptance of Infrastructure | Delays impact project timelines and financial performance. | Renewable projects with opposition saw 18-month delays (2024). |

| Local Investment Expectations | Enhances project support and social license. | 70% more likely to support projects investing in local infrastructure (2025 survey). |

Technological factors

Rapid advancements in solar, wind, and energy storage technologies are significantly driving down costs and boosting efficiency. For instance, the global average leveled cost of electricity for utility-scale solar PV dropped by an estimated 89% between 2010 and 2022, while onshore wind saw a 69% decrease.

These trends are making renewable energy sources increasingly competitive with traditional fossil fuels. Power Assets Holdings is actively investing in innovation and technology to leverage these developments, aiming to accelerate its transition towards a greener energy portfolio and capitalize on the growing demand for sustainable power solutions.

The ongoing digitalization of energy infrastructure, particularly the advancement of AI-powered smart grids, is fundamentally reshaping how energy is distributed and managed. This technological shift is key to optimizing operations, boosting efficiency, and seamlessly integrating a wider array of energy sources, from renewables to traditional power. For Power Assets Holdings, this presents a significant opportunity to bolster system resilience and refine its management capabilities.

By embracing smart grid technologies, Power Assets Holdings can leverage real-time data analytics to predict and prevent outages, thereby enhancing service reliability. For instance, in 2024, investments in grid modernization are projected to reach hundreds of billions globally, with a significant portion allocated to digital solutions aimed at improving grid flexibility and efficiency. This digital transformation allows for better demand-side management and supports the integration of distributed energy resources, a growing trend in the energy sector.

Breakthroughs in battery storage, particularly advancements in lithium-ion and emerging technologies like solid-state batteries, are crucial for Power Assets Holdings. These innovations are vital for managing the intermittency of renewable energy sources, ensuring grid stability as the company increases its renewable asset portfolio. For instance, by late 2024, global renewable energy capacity additions were projected to reach new highs, necessitating robust storage solutions.

Efficient and scalable energy storage is directly linked to the long-term growth prospects of the power sector. Companies like Power Assets Holdings are investing in and benefiting from improved energy density and lower costs of storage solutions. The global energy storage market was valued at over $150 billion in 2023 and is expected to grow significantly through 2030, driven by these technological leaps.

Cybersecurity Risks to Critical Infrastructure

The growing dependence on digital technologies and interconnected networks significantly amplifies cybersecurity threats to critical energy infrastructure. This heightened vulnerability means Power Assets Holdings must prioritize and consistently allocate resources towards advanced cybersecurity defenses to safeguard its essential assets and maintain reliable service operations.

The financial implications are substantial, with global spending on cybersecurity for critical infrastructure projected to reach over $100 billion annually by 2025, according to industry analyses. For Power Assets Holdings, this translates into a continuous need for investment in areas such as:

- Threat detection and response systems

- Regular security audits and penetration testing

- Employee training on cybersecurity best practices

- Secure network architecture and data encryption

Emergence of New Energy Carriers (e.g., Hydrogen)

The burgeoning interest in novel energy carriers, particularly green hydrogen, signifies a significant technological shift with profound implications for Power Assets Holdings. While current cost structures and infrastructure requirements present considerable challenges, the potential for hydrogen to diversify the company's future energy mix is substantial.

The global hydrogen market is experiencing rapid growth, with projections indicating significant expansion in the coming years. For instance, the International Energy Agency (IEA) reported that global hydrogen production capacity reached approximately 95 million tonnes per year in 2023, with a notable increase in dedicated green hydrogen projects. This trend suggests a growing appetite for cleaner energy alternatives.

- Market Growth: The global clean hydrogen market is anticipated to grow from USD 13.9 billion in 2023 to USD 70.7 billion by 2030, at a compound annual growth rate (CAGR) of 26.4%.

- Investment Trends: Significant investments are being channeled into hydrogen production and infrastructure, with governments and private entities worldwide committing billions to accelerate its development.

- Technological Advancements: Ongoing research and development are focused on reducing the cost of electrolysis and improving the efficiency of hydrogen storage and transportation, making it more commercially viable.

Technological advancements in renewable energy, particularly solar and wind, continue to drive down costs and increase efficiency, making them increasingly competitive. For instance, the global average leveled cost of electricity for utility-scale solar PV saw an 89% drop between 2010 and 2022.

The digitalization of energy infrastructure, including AI-powered smart grids, is fundamentally changing energy distribution and management, enhancing efficiency and integration of various energy sources. Global investments in grid modernization, particularly digital solutions, are projected to reach hundreds of billions in 2024.

Breakthroughs in battery storage are crucial for managing renewable energy intermittency and ensuring grid stability, with the global energy storage market valued at over $150 billion in 2023.

The increasing reliance on digital systems necessitates robust cybersecurity measures, with global spending on cybersecurity for critical infrastructure expected to exceed $100 billion annually by 2025.

| Technology Area | Key Trend | Impact on Power Assets Holdings | Relevant Data Point (2023-2025) |

|---|---|---|---|

| Renewable Energy Costs | Declining costs, increasing efficiency | Enhanced competitiveness, portfolio expansion | Solar PV LCOE down 89% (2010-2022) |

| Smart Grids | Digitalization, AI integration | Optimized operations, improved reliability | Global grid modernization investments in hundreds of billions (2024) |

| Energy Storage | Battery advancements (density, cost) | Grid stability, renewable integration | Energy storage market >$150 billion (2023) |

| Cybersecurity | Increased threats to critical infrastructure | Need for enhanced security investments | Cybersecurity spending for critical infrastructure >$100 billion annually (by 2025) |

Legal factors

Stricter environmental regulations, such as the U.S. Environmental Protection Agency's (EPA) aim to cut power sector emissions by 30-32% from 2005 levels by 2030, directly shape energy companies' operational choices and future investments.

These mandates, including carbon emission limits and requirements for carbon capture technologies, influence decisions on plant operations and retirement. For instance, the U.S. power sector's CO2 emissions from electricity generation were approximately 1,533 million metric tons in 2023, a decrease from previous years, reflecting the impact of these regulations.

Securing the necessary licenses and permits for energy projects, especially for large-scale generation and transmission, presents a complex and time-consuming hurdle. For instance, in the United States, the process for a new major transmission line can take upwards of 5-10 years due to federal, state, and local regulatory requirements.

The lengthy and often intricate permitting procedures can significantly delay or even deter the development of crucial energy infrastructure. This directly impacts the pace at which new capacity, particularly from renewable sources, can be brought online. Streamlining these processes is therefore paramount to achieving energy transition goals.

In 2024, many regions are actively exploring reforms to expedite permitting. For example, some European countries are aiming to reduce the average permitting time for solar and wind projects by 30-50% through legislative changes and digitalized application systems, recognizing the urgency of faster deployment.

Competition laws and ongoing market deregulation in various regions directly influence Power Assets Holdings' market standing and how it approaches pricing. For instance, in markets where deregulation is actively pursued, new entrants can challenge established players, potentially leading to shifts in market share and pricing power. The evolving legal landscape aims to foster both investment and robust competition, crucial for building a secure and affordable net-zero energy future.

Consumer Protection Laws and Tariff Regulations

Consumer protection laws and specific tariff regulations significantly shape revenue streams for power asset holders. For instance, in the UK, Ofgem's oversight ensures fair treatment of consumers, impacting how companies can price energy. This directly affects the ability to pass on operational costs and investment expenses, influencing profitability.

Tariff caps, like those implemented in various European markets during the 2024-2025 period to address energy price volatility, can limit revenue potential. These regulations are designed to shield households from extreme price spikes, creating a more predictable but potentially constrained revenue environment for energy providers.

- Regulatory Oversight: Bodies like Ofgem actively monitor and influence pricing structures to safeguard consumer interests.

- Tariff Caps Impact: Regulations capping residential energy bills can directly limit the revenue Power Assets Holdings can generate from its customer base.

- Cost Pass-Through: The ability to pass on increased generation or infrastructure costs to consumers is often restricted by these legal frameworks.

- Fairness Mandates: Laws often mandate transparency and fairness in billing and service provision, adding compliance requirements.

International Energy Treaties and Agreements

Power Assets Holdings navigates a complex web of international energy treaties, impacting its global ventures. These agreements, particularly those focused on climate change mitigation and facilitating cross-border energy trade, are crucial for operational legitimacy and market participation. For instance, adherence to frameworks like the Paris Agreement, which aims to limit global warming, influences investment decisions in renewable energy sources and the phasing out of certain fossil fuel technologies. Failure to comply can jeopardize international partnerships and market access, as seen in trade disputes arising from differing environmental regulations.

The company's commitment to these international accords directly affects its ability to secure financing and maintain favorable trading relationships. As of early 2025, the global push for decarbonization, driven by these treaties, has led to increased investment in renewable energy infrastructure, with Power Assets Holdings actively participating in projects in regions aligning with these environmental goals. The evolving landscape of international energy policy, including potential carbon border adjustment mechanisms, necessitates continuous monitoring and strategic adaptation to ensure continued market access and competitive positioning.

- Climate Change Frameworks: Compliance with international agreements like the Paris Agreement is paramount for Power Assets Holdings' sustainability and access to global markets.

- Cross-Border Trade: Treaties governing international energy trade directly influence the company's ability to operate and exchange energy resources across national borders.

- Market Access and Partnerships: Adherence to international legal and regulatory frameworks is essential for maintaining strong business relationships and securing opportunities worldwide.

- Investment and Policy Influence: Global energy policies, shaped by international treaties, guide investment strategies towards cleaner energy sources and impact the long-term viability of existing assets.

Legal frameworks significantly influence Power Assets Holdings' operational scope and investment strategies, particularly concerning environmental compliance and permitting. Stricter regulations, like those aimed at reducing power sector emissions, necessitate adaptation in plant operations and future investments, impacting the pace of new capacity deployment.

Consumer protection laws and tariff regulations directly affect revenue streams, with caps on energy bills limiting profit potential while ensuring consumer affordability. The company must also navigate international energy treaties, such as those related to climate change, which are crucial for global ventures, financing, and market access.

| Legal Factor | Impact on Power Assets Holdings | Relevant Data/Example (2024-2025 Focus) |

|---|---|---|

| Environmental Regulations | Shapes operational choices, investment in cleaner technologies, and compliance costs. | U.S. EPA aims to cut power sector emissions by 30-32% from 2005 levels by 2030. |

| Permitting Processes | Can delay or deter energy infrastructure development, especially renewables. | New major transmission line permits in the U.S. can take 5-10 years. Some European countries aim to reduce solar/wind permitting time by 30-50% in 2024-2025. |

| Competition & Deregulation | Influences market standing, pricing strategies, and potential for new entrants. | Active deregulation in various markets fosters competition, potentially shifting market share. |

| Consumer Protection & Tariffs | Directly impacts revenue generation and profitability through price controls. | Tariff caps in Europe during 2024-2025 aim to shield households from price volatility, potentially limiting revenue. |

| International Energy Treaties | Crucial for global ventures, financing, market access, and investment in renewables. | Commitment to Paris Agreement influences investment in clean energy and phasing out fossil fuels. |

Environmental factors

Power Assets Holdings operates in a world increasingly focused on climate action, with many nations setting ambitious carbon neutrality targets. For instance, Hong Kong aims for carbon neutrality before 2050, the UK targets carbon-free electricity by 2035, and Australia has committed to net zero by 2050. These global and regional goals are driving a significant shift away from fossil fuels, impacting the energy sector directly.

This transition necessitates substantial investment in renewable energy sources and low-carbon technologies. For Power Assets Holdings, this means adapting its portfolio to align with these evolving environmental regulations and market demands. Failure to adapt could lead to stranded assets and missed opportunities in the burgeoning green energy market.

Governments globally are implementing ambitious renewable energy mandates, driving significant investment. For instance, Australia aims for 82% renewable electricity by 2030, and the UK targets up to 50 GW of offshore wind capacity by the same year.

These aggressive deployment targets present substantial growth avenues for Power Assets Holdings. The company is well-positioned to capitalize on these opportunities through strategic investments and development projects in the burgeoning renewable energy sector.

Resource availability, particularly water for cooling thermal power plants and land for renewable energy installations, presents a significant environmental factor for Power Assets Holdings. In 2024, many regions continue to face increasing water stress, impacting operational costs and potentially limiting expansion for traditional generation methods.

Climate change exacerbates these challenges. For instance, prolonged heatwaves, like those experienced in parts of Asia and Europe during the summer of 2024, not only drive up electricity demand but also reduce the efficiency of thermal power generation due to higher ambient temperatures, affecting Power Assets Holdings' operational performance.

Environmental Impact Assessments and Biodiversity Protection

New energy ventures, including those undertaken by Power Assets Holdings, are increasingly subject to comprehensive environmental impact assessments. These evaluations are critical for identifying and mitigating potential harm to local ecosystems and biodiversity. For instance, in 2024, the European Union continued to strengthen its environmental regulations, with a focus on renewable energy projects requiring detailed biodiversity action plans to offset habitat disruption. This trend is expected to intensify through 2025 as climate change concerns drive stricter oversight.

Power Assets Holdings must therefore integrate robust environmental protection measures into its operational framework and future project planning. Adherence to evolving international and national environmental standards is not merely a compliance issue but a strategic imperative. In 2024, companies failing to meet these standards faced significant penalties, with some projects delayed or halted due to inadequate biodiversity protection strategies. The company's commitment to sustainability will be a key factor in its long-term social license to operate and its financial performance.

Key considerations for Power Assets Holdings include:

- Mandatory Environmental Impact Assessments: Ensuring all new power generation and infrastructure projects undergo thorough EIAs, as mandated by regulations in key operating regions like Hong Kong and Australia.

- Biodiversity Action Plans: Developing and implementing specific plans to protect and, where possible, enhance local biodiversity at project sites, aligning with global best practices.

- Compliance with Emission Standards: Meeting or exceeding stringent air and water quality standards, particularly as the company expands its portfolio, potentially including more renewable energy sources.

- Waste Management and Circular Economy: Implementing advanced waste management protocols for construction and operational phases, promoting recycling and reuse to minimize environmental footprint.

Waste Management and Pollution Control

For Power Assets Holdings' existing thermal power plants, managing waste like coal ash and implementing robust pollution control are critical. These measures ensure compliance with increasingly stringent environmental laws and reduce the company's impact on ecosystems. For instance, in 2023, the company continued its commitment to reducing emissions, aligning with global trends towards cleaner energy production.

The global shift away from coal is a significant environmental factor. HK Electric, a subsidiary of Power Assets Holdings, has been actively involved in phasing out coal-fired generation. This strategic move reflects a broader industry trend and a response to climate change concerns, impacting the long-term viability of traditional thermal assets.

- Waste Management: Effective handling of byproducts like fly ash and bottom ash from coal combustion is crucial for Power Assets Holdings' thermal operations, with ongoing investments in advanced disposal and recycling technologies.

- Pollution Control: The company employs technologies such as flue gas desulfurization (FGD) and selective catalytic reduction (SCR) to meet strict air quality standards for SOx, NOx, and particulate matter.

- Coal Phase-Out: HK Electric's strategic direction includes reducing reliance on coal, with plans to transition towards lower-carbon energy sources, impacting the operational profile of its existing thermal portfolio.

Environmental regulations are increasingly shaping the energy sector, pushing companies like Power Assets Holdings towards cleaner operations. With countries setting ambitious net-zero targets, such as Hong Kong aiming for carbon neutrality before 2050, the demand for renewable energy is surging. This necessitates significant investment in green technologies and a strategic adaptation of existing portfolios to align with these evolving global and regional environmental goals.

PESTLE Analysis Data Sources

Our PESTLE analysis for Power Assets Holdings draws upon a comprehensive blend of official government publications, reputable industry research, and international economic databases. This ensures a robust understanding of regulatory landscapes, market dynamics, and technological advancements impacting the power sector.