PCC SE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PCC SE Bundle

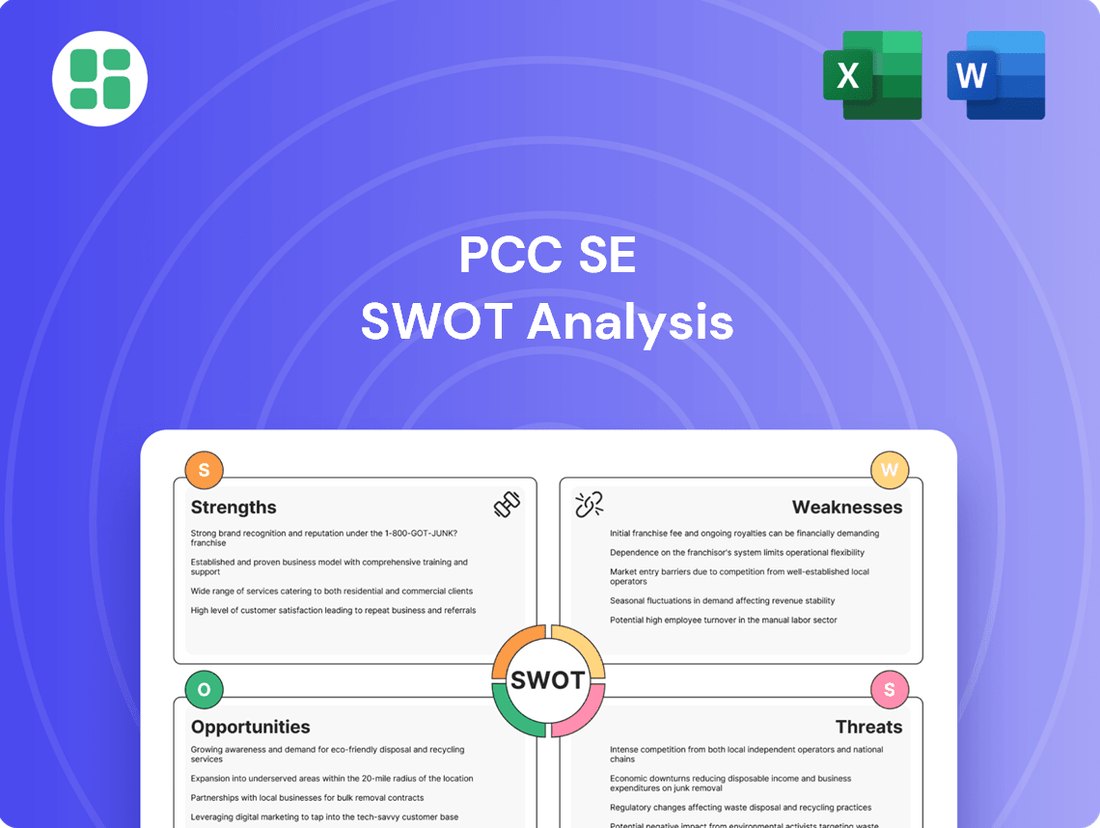

PCC SE demonstrates robust market presence and a strong brand reputation, but faces evolving regulatory landscapes and intense competition. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind PCC SE's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

PCC SE's strength lies in its deeply diversified industrial portfolio, spanning chemicals, energy, and logistics. This strategic spread across distinct sectors acts as a natural hedge against market volatility, ensuring resilience even when one area experiences a downturn. For instance, in 2024, while certain chemical markets faced headwinds, the company's energy segment, particularly its renewable energy initiatives, provided a significant buffer, contributing to overall stability.

PCC SE demonstrates strength through its strategic investment and M&A activities, consistently seeking to refine its business portfolio and enter new geographical markets. This proactive approach is evident in significant projects like the planned chlor-alkali facility in the United States, a move expected to bolster its North American presence.

Further demonstrating this commitment to growth, PCC SE is expanding its operations in polyols, a key segment for the company. These targeted investments are designed to enhance value chain integration and ultimately increase the overall enterprise value.

PCC SE demonstrates a significant commitment to sustainability, notably through its investments in renewable energy. For instance, its silicon metal plant in Iceland is powered entirely by renewable energy sources, significantly reducing its environmental impact.

This strategic focus on clean energy aligns PCC SE with growing global environmental consciousness and regulatory pressures. The company has set ambitious targets, aiming to reduce greenhouse gas emissions from its chemical production by 50% by 2030 and achieve net climate neutrality by 2050.

Established Market Leadership in Key Segments

PCC SE commands a leading position in crucial market segments, notably in intermodal transport within Poland. In 2024, the company held a substantial 19.6% share of freight revenue in this sector, underscoring its operational efficiency and competitive edge. This established market dominance translates into reliable revenue generation and a robust, loyal customer base.

Key strengths stemming from this market leadership include:

- Dominant Market Share: A 19.6% stake in Polish intermodal freight revenue (2024) highlights significant operational scale and market penetration.

- Operational Efficiency: Market leadership often correlates with streamlined processes and cost advantages, contributing to profitability.

- Customer Loyalty: A strong market position typically fosters a loyal customer base, ensuring consistent demand for services.

- Competitive Advantage: This leadership provides a buffer against new entrants and allows for greater pricing power.

Significant Investment in Research & Development

PCC SE demonstrates a strong commitment to innovation through significant investment in research and development. In 2024, the company allocated 8.5% of its revenue to R&D, a figure considerably above the typical spending within the chemical sector.

This strategic emphasis on R&D fuels the creation of advanced, high-performance products. It also supports the development of sustainable solutions, reinforcing PCC SE's market position and paving the way for sustained future growth.

- Substantial R&D Investment: 8.5% of revenue dedicated to R&D in 2024.

- Industry Outperformance: R&D spending exceeds the chemical industry average.

- Innovation Driver: Focus on developing high-performance and sustainable products.

- Competitive Advantage: Enhances market position and future growth potential.

PCC SE's diversified industrial portfolio, spanning chemicals, energy, and logistics, provides significant resilience. In 2024, its energy segment, particularly renewables, offset challenges in certain chemical markets, ensuring overall stability.

The company's strategic investments, such as the planned US chlor-alkali facility, bolster its presence in key markets and enhance value chain integration. PCC SE's commitment to sustainability, exemplified by its Iceland silicon metal plant running on 100% renewable energy, aligns with global environmental trends and emission reduction targets, aiming for a 50% cut in chemical production emissions by 2030.

PCC SE holds a leading position in intermodal transport in Poland, capturing 19.6% of freight revenue in 2024. This market dominance translates to operational efficiency, customer loyalty, and a strong competitive advantage.

Furthermore, PCC SE's substantial investment in R&D, at 8.5% of revenue in 2024, fuels the development of advanced and sustainable products, reinforcing its market standing and future growth prospects.

| Strength Area | Key Metric/Fact | Year | Impact |

|---|---|---|---|

| Diversification | Resilience from energy segment | 2024 | Market stability |

| Strategic Investments | Planned US chlor-alkali facility | Ongoing | Market expansion |

| Sustainability | Iceland plant on renewable energy | Ongoing | Reduced environmental impact |

| Market Leadership | 19.6% Polish intermodal freight revenue | 2024 | Operational efficiency, customer loyalty |

| R&D Investment | 8.5% of revenue | 2024 | Product innovation, future growth |

What is included in the product

This SWOT analysis provides a comprehensive overview of PCC SE's internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Offers a clear, actionable framework to identify and address PCC SE's strategic challenges and opportunities.

Weaknesses

PCC SE's financial results are highly sensitive to swings in commodity prices, especially for key inputs and outputs in its chemicals and silicon metal divisions. Changes in the cost of raw materials and the market prices for products such as polyols and chlorine directly influence the company's bottom line and overall earnings.

This vulnerability was clearly demonstrated in the first quarter of 2025. Despite experiencing an increase in sales volumes, PCC SE saw a decrease in its earnings. This downturn was primarily attributed to adverse movements in raw material and energy costs, highlighting the significant impact of external market forces on the company's profitability.

PCC SE's growth is vulnerable to global political tensions and economic downturns, particularly in its core markets like Germany and the EU. For instance, the ongoing energy crisis in Europe, exacerbated by geopolitical instability, directly impacts industrial production costs and consumer spending, which are crucial for PCC's chemical and energy segments. This sensitivity means that unforeseen events can significantly disrupt sales and investment plans.

The company's reliance on stable economic conditions in regions like Germany, which experienced a slight contraction in GDP in early 2024 according to preliminary estimates, presents a clear weakness. Geopolitical developments, such as trade disputes or regional conflicts, can create an unpredictable operating environment, making it challenging for PCC to forecast demand and manage supply chains effectively. This uncertainty can stifle strategic investments and operational expansion.

The silicon metal segment of PCC SE is grappling with intense pressure from low-cost imports, a persistent issue that significantly impacts profitability and market share. This competitive disadvantage is exacerbated by ongoing power shortages, which directly affect production efficiency and output levels.

These combined pressures led to a difficult decision: a temporary shutdown of the company's Icelandic silicon plant in mid-July 2025. This move underscores the segment's vulnerability to global market volatility and the aggressive pricing strategies of foreign competitors, highlighting a critical weakness in PCC SE's operational resilience.

In response, PCC SE is actively pursuing safeguard measures from relevant authorities. The company's reliance on such external interventions points to the severity of the challenges and the need for supportive policies to level the playing field for its domestic production capabilities.

Rising Operating and Financial Costs

PCC SE has faced a challenging start to 2025, with rising operating and financial costs impacting its bottom line. The company reported a decline in earnings for the first quarter of 2025, directly attributed to increased fixed costs and higher interest expenses. These pressures were exacerbated by significant negative exchange rate losses, highlighting the sensitivity of its financial performance to currency fluctuations.

The volatility of key currencies, such as the US dollar and the Polish złoty, has created substantial non-cash valuation effects. For instance, a weakening Polish złoty against the Euro can negatively impact the reported value of assets and liabilities denominated in złoty, thereby affecting overall financial results. This currency risk is a significant factor for PCC SE, given its international operations.

- Increased Fixed Costs: Higher operational overheads are directly impacting profitability.

- Rising Interest Expenses: Increased borrowing costs put pressure on financial performance.

- Negative Exchange Rate Losses: Volatility in currencies like USD and PLN caused significant non-cash valuation effects in Q1 2025.

- Impact on Earnings: The combination of these factors led to a decline in PCC SE's earnings in early 2025.

Intense Competitive Pressure

PCC SE grapples with significant competitive pressure, notably from countries like China, which benefit from less stringent social and environmental regulations. This creates an uneven playing field, particularly impacting segments such as silicon and other chemicals, where aggressive export strategies can drive down prices and erode market share.

The company's market position is further challenged by what it perceives as ruinous competition, stemming from these lower operational cost structures abroad. This dynamic can force price reductions, impacting profitability and requiring PCC SE to constantly adapt its strategies to maintain competitiveness in a globalized market.

In 2024, the global chemical industry, particularly in silicon production, experienced price volatility influenced by these international competitive pressures. For instance, reports indicated that Chinese silicon producers, often operating with lower energy costs and fewer environmental compliance burdens, significantly influenced global pricing trends, putting pressure on European manufacturers like PCC SE.

- Intense Global Competition: PCC SE faces aggressive competition, especially from Asian producers with lower operating costs.

- Price Erosion: Unfair competitive practices, including lower social and environmental standards, lead to price reductions in key markets like silicon.

- Market Share Challenges: The company's market position is threatened by these cost advantages enjoyed by international competitors.

PCC SE's profitability is highly susceptible to fluctuations in commodity prices and energy costs, as evidenced by its Q1 2025 earnings decline despite increased sales volumes. The company also faces significant headwinds from global economic instability and geopolitical tensions, which directly impact its core European markets, as seen with Germany's slight GDP contraction in early 2024.

The silicon metal segment is particularly vulnerable to intense competition from low-cost imports, compounded by power shortages, leading to the temporary shutdown of its Icelandic plant in July 2025. Furthermore, rising operational and financial costs, including higher interest expenses and negative exchange rate losses in Q1 2025, have put considerable pressure on the company's financial performance.

| Weakness | Impact | Example/Data |

|---|---|---|

| Commodity & Energy Price Volatility | Directly impacts profitability and earnings | Q1 2025 earnings decline attributed to adverse raw material and energy costs |

| Economic & Geopolitical Sensitivity | Disrupts sales, investment plans, and operational forecasting | Impact of European energy crisis on industrial production costs; German GDP contraction in early 2024 |

| Intense Global Competition (Silicon Metal) | Erodes market share and profitability | Temporary shutdown of Icelandic silicon plant in July 2025 due to low-cost imports and power shortages |

| Rising Operating & Financial Costs | Reduces bottom line and financial flexibility | Q1 2025 earnings decline due to increased fixed costs, interest expenses, and negative exchange rate losses |

What You See Is What You Get

PCC SE SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

PCC SE is poised for significant growth by entering the US chemical market, a move bolstered by its strategic investment in a new chlor-alkali plant. This expansion directly targets a key global market for its core chlorine business.

A crucial element of this opportunity is the secured, long-term supply agreement with Chemours, a major player in the chemical industry. This partnership not only validates the project but also mitigates market and sales risks by guaranteeing off-take.

Construction is slated to commence in early 2026, with the plant expected to be fully operational by 2028. This timeline positions PCC SE to capitalize on projected demand in the US market.

The escalating global demand for sustainable chemistry and green products offers a significant avenue for PCC SE. The company's commitment to developing eco-friendly solutions, such as low-carbon chemicals and resource-efficient technologies, directly caters to this growing market. This strategic alignment is poised to boost sales of its environmentally conscious product portfolio.

The logistics sector, especially intermodal container transport, is experiencing robust growth. This trend is driven by a surging demand for integrated road and rail freight solutions, offering both efficiency and environmental benefits. PCC SE's established market leadership in Poland within this domain provides a significant advantage to leverage this expanding market.

In 2023, the global intermodal freight market was valued at approximately $24.5 billion and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2030. PCC SE, by expanding its intermodal services, can further solidify its profitability and capture a larger share of this expanding market, capitalizing on the increasing preference for sustainable and cost-effective logistics.

Strategic Partnerships and Joint Ventures

PCC SE's strategic approach to forming partnerships, exemplified by its 50/50 joint venture for an oxyalkylates plant in Malaysia, presents a significant avenue for growth. This collaborative model allows for shared investment and risk mitigation, crucial in capital-intensive chemical manufacturing. Such ventures can unlock access to new geographic markets and specialized technologies that might be challenging to acquire independently.

These alliances are instrumental in expanding PCC SE's global footprint and enhancing its competitive positioning. By pooling resources and expertise, the company can accelerate its market penetration and diversify its product offerings. For instance, partnerships can provide immediate access to established distribution networks and local market knowledge, reducing the time and cost associated with organic expansion.

- Market Expansion: Joint ventures facilitate entry into new regions, such as the Malaysian market for oxyalkylates, broadening the company's revenue streams.

- Risk Sharing: Collaborations distribute the financial burden and operational risks associated with large-scale projects, improving capital efficiency.

- Technology and Expertise Access: Partnerships can bring in new technological capabilities or specialized operational know-how, fostering innovation and operational excellence.

- Global Reach Enhancement: These strategic alliances are key to extending PCC SE's international presence and solidifying its position as a global chemical player.

Increasing Adoption of Renewable Energy Sources

The global push towards renewable energy, exemplified by the booming electric vehicle market and widespread solar installations, is a major tailwind for silicon metal demand. For instance, the International Energy Agency projected in late 2024 that renewable energy capacity additions would continue to break records in 2025, significantly boosting the need for silicon, a key component in solar panels and batteries. This trend presents a substantial long-term opportunity for PCC SE's silicon production capabilities.

PCC SE's climate-friendly Icelandic plant is particularly well-positioned to capitalize on this growing market. With increasing scrutiny on the carbon footprint of manufacturing processes, PCC SE's commitment to sustainable production in Iceland offers a competitive advantage. The company's silicon production aligns directly with the environmental goals driving the renewable energy sector, creating a strong market pull.

Key aspects of this opportunity include:

- Growing demand for solar PV: Silicon metal is a primary raw material for photovoltaic cells, with global solar PV capacity expected to reach over 2,000 GW by the end of 2025, according to industry forecasts.

- Electric vehicle expansion: The increasing production of electric vehicles, which utilize silicon in batteries and power electronics, further drives the need for high-purity silicon.

- Sustainable production advantage: PCC SE's Icelandic plant, powered by renewable energy, offers a lower carbon footprint compared to competitors, appealing to environmentally conscious customers.

PCC SE can leverage its expertise in the logistics sector to capitalize on the growing demand for intermodal transport, especially in Poland where it holds a leading position. The global intermodal freight market, valued at approximately $24.5 billion in 2023, is projected to grow at a CAGR of over 5% through 2030, presenting a clear opportunity for expanded services and increased profitability.

Strategic joint ventures, such as the one for an oxyalkylates plant in Malaysia, offer a pathway to expand PCC SE's global footprint and access new markets and technologies. These collaborations enable risk sharing and capital efficiency, crucial for large-scale chemical manufacturing projects, and can accelerate market penetration.

The increasing global demand for sustainable chemistry and green products aligns perfectly with PCC SE's commitment to eco-friendly solutions. This strategic focus on low-carbon chemicals and resource-efficient technologies is expected to boost sales of its environmentally conscious product portfolio.

The booming renewable energy sector, particularly electric vehicles and solar installations, is driving significant demand for silicon metal. PCC SE's climate-friendly Icelandic plant, powered by renewable energy, is well-positioned to meet this demand, offering a competitive advantage due to its lower carbon footprint.

Threats

A global economic slowdown, particularly affecting key markets like Germany and the EU, presents a substantial threat to PCC SE. This weakness directly impacts industrial demand, which is crucial for PCC's chemical, energy, and logistics operations, potentially leading to reduced sales revenue. The economic climate in 2024 and early 2025 has already demonstrated these challenging conditions.

PCC SE faces a significant threat from intensified unfair competition, particularly from low-cost imports and dumping practices originating from non-European countries, with China being a primary source. These imports often benefit from less rigorous environmental and social regulations, allowing for lower production costs.

This disparity in regulatory burdens can lead to market price erosion and diminish the competitive standing of PCC SE's European-based manufacturing operations. For instance, the silicon metal market has been particularly susceptible to these pressures, impacting profitability and market share for established players.

PCC SE faces significant threats from vulnerabilities within its global supply chain. Unpredictable fluctuations in raw material and energy prices, such as those seen in the silicon segment, directly impact production costs and can erode profit margins. For instance, in late 2023 and early 2024, the chemical industry experienced price volatility for key inputs, directly affecting companies like PCC.

These disruptions can lead to production shortfalls, hindering PCC's ability to meet market demand. Power shortages, a recurring issue in certain regions where PCC operates, can further curtail production capacity, as was evident in the silicon segment’s output limitations. This volatility makes robust financial planning and maintaining operational stability increasingly challenging.

Stringent Environmental Regulations and Compliance Costs

PCC SE faces growing threats from increasingly stringent environmental regulations across its global operations. These regulations, aimed at reducing emissions and promoting sustainability, necessitate significant capital expenditures for upgrading facilities and adopting cleaner production methods. For instance, the European Union's Green Deal initiatives and similar policies in other key markets are driving up compliance costs for chemical manufacturers.

These evolving environmental standards can directly impact PCC SE's profitability by increasing operational expenses and potentially requiring substantial investments in new technologies. While these investments are crucial for long-term viability and responsible corporate citizenship, they can strain short-term financial performance and limit flexibility in capital allocation. The company must navigate these complex regulatory landscapes to maintain its competitive edge and operational efficiency.

- Increased Capital Expenditures: Compliance with new environmental standards often requires significant investment in upgrading existing infrastructure or building new, eco-friendlier facilities.

- Higher Operational Costs: Meeting stricter emission limits or waste disposal requirements can lead to increased costs for energy, raw materials, and specialized treatment processes.

- Potential Fines and Penalties: Non-compliance with environmental regulations can result in substantial fines, legal challenges, and reputational damage.

- Impact on Product Pricing: The costs associated with environmental compliance may need to be passed on to customers, potentially affecting market competitiveness if not managed effectively.

Geopolitical Instability and Policy Shifts

Geopolitical instability presents a significant threat to PCC SE. Ongoing conflicts and unpredictable policy shifts in key markets, such as Germany and the USA, create a volatile business environment. For instance, the ongoing geopolitical tensions in Eastern Europe could impact supply chains and market access for European companies like PCC SE.

These disruptions can directly affect investment climates and trade relations, potentially hindering PCC SE's expansion strategies. The German economy, a crucial market for many chemical companies, faced a contraction of 0.3% in 2023, underscoring the sensitivity to global economic and political factors.

- Uncertainty in German economic policy could affect investment decisions and market stability for PCC SE.

- Trade relation shifts between the US and Europe might impose new tariffs or regulations on chemical products.

- Regional conflicts could disrupt raw material sourcing or create logistical challenges for PCC SE's operations.

- Changes in environmental regulations in major markets could necessitate costly adjustments to production processes.

Intensified competition from non-European countries, often with lower production costs due to less stringent regulations, poses a significant threat to PCC SE's market share and profitability. This is particularly evident in sectors like silicon metal, where price erosion is a constant concern.

SWOT Analysis Data Sources

This PCC SE SWOT analysis is built upon a robust foundation of data, including audited financial statements, comprehensive market research reports, and insights from leading industry analysts.