PCC SE Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PCC SE Bundle

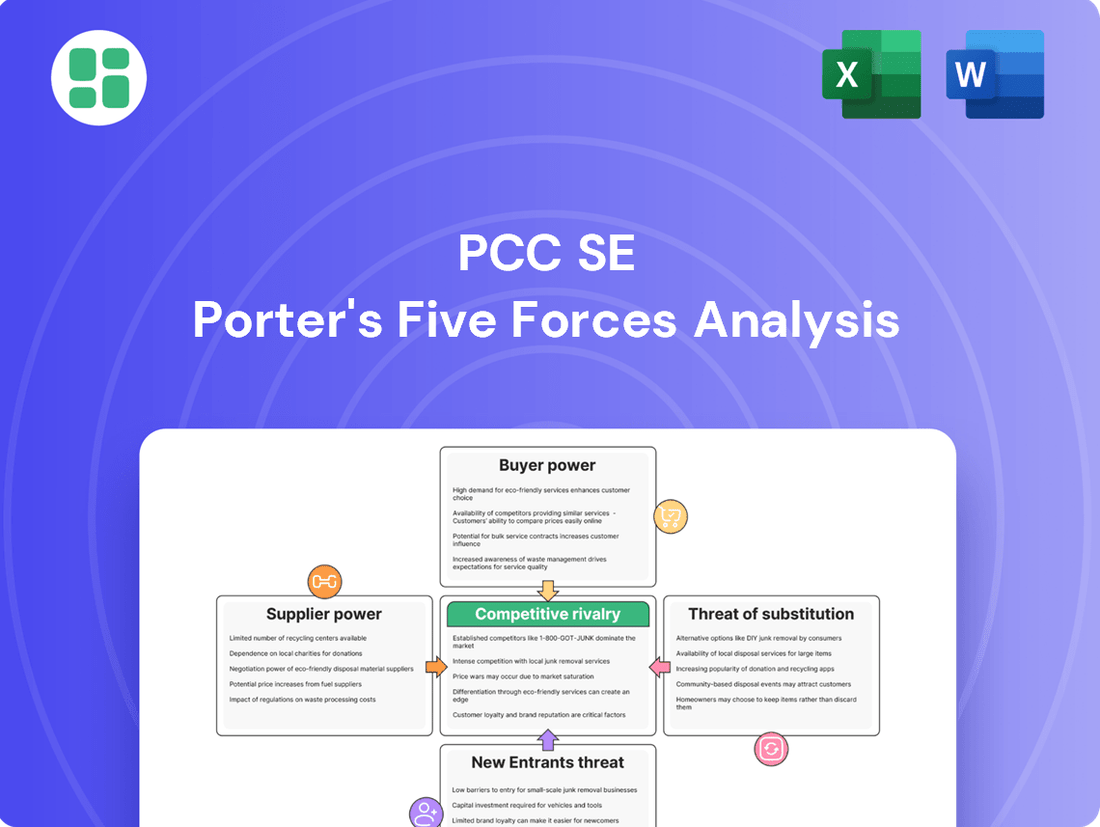

PCC SE operates in a dynamic market, facing pressures from powerful buyers and a moderate threat of new entrants. Understanding these forces is crucial for navigating its competitive landscape.

The full Porter's Five Forces Analysis provides a comprehensive, data-driven evaluation of PCC SE’s industry. It details the intensity of each force, revealing strategic advantages and potential risks.

Ready to gain a deeper strategic understanding? Unlock the complete analysis to explore PCC SE’s market position, competitive intensity, and external threats—all in one powerful report.

Suppliers Bargaining Power

PCC SE's reliance on key inputs like crude oil and natural gas exposes it to significant price volatility. For instance, the Silicon & Derivatives segment experienced impacts from raw material price fluctuations in early 2025, highlighting how these swings can directly affect PCC's cost base and overall profitability.

If PCC SE depends on a small group of suppliers for essential raw materials or energy, those suppliers can wield significant influence. This is especially true for specialized chemicals or large energy deals, where changing suppliers would be costly for PCC.

Supplier switching costs significantly influence bargaining power. For PCC SE, the expense and effort required to change suppliers, such as re-qualifying materials or adapting production lines, can be substantial. These costs are not uniform across PCC's diverse segments, with chemical and energy operations potentially facing higher hurdles than logistics.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of PCC SE's suppliers. If PCC can easily switch to alternative raw materials or energy sources, the leverage held by its current suppliers diminishes. For instance, if PCC is heavily reliant on a specific type of chemical input and few other suppliers offer it, those suppliers gain considerable power. However, if there are multiple viable alternatives or if PCC can develop its own substitute materials, this reduces supplier dependency.

PCC SE's ability to mitigate supplier power is enhanced by its potential for vertical integration. By producing some of its key inputs in-house, PCC can lessen its reliance on external suppliers. This strategy not only reduces the bargaining power of outside suppliers but also can lead to cost savings and greater control over the quality and supply chain. For example, a cement producer like PCC might consider investing in quarrying operations for limestone, a primary raw material, to reduce its dependence on external quarry suppliers.

- Reduced Supplier Leverage: The presence of readily available substitute inputs for PCC SE's production processes directly weakens the bargaining power of existing suppliers.

- Vertical Integration Strategy: PCC SE's capacity to vertically integrate and produce its own essential inputs, such as raw materials or energy, further diminishes supplier leverage.

- Impact on Input Costs: A diverse supplier base and the feasibility of substituting inputs allow PCC SE to negotiate more favorable terms, potentially lowering overall production costs.

- Market Dynamics: In 2024, global supply chain disruptions highlighted the importance of input substitutability; for example, fluctuations in coal prices due to geopolitical events encouraged companies to explore alternative energy sources for cement kilns.

Supplier Forward Integration Threat

The threat of supplier forward integration significantly impacts PCC SE's bargaining power. If suppliers possess the capability or motivation to enter PCC's markets, perhaps by manufacturing comparable chemicals or providing similar logistics, their leverage grows. This potential move could compel PCC to accept less advantageous supply agreements to secure necessary resources.

For instance, a key chemical supplier to PCC could decide to produce finished chemical products themselves, directly competing with PCC's core business. This would shift the power dynamic, as PCC would then rely on a competitor for essential inputs. In 2024, the chemical industry saw several instances of vertical integration, with major players acquiring downstream capabilities to control their value chains more effectively.

- Supplier Forward Integration Threat: Suppliers may integrate into PCC's markets, increasing their bargaining power.

- Impact on PCC: PCC could face less favorable terms to ensure supply continuity.

- Industry Trend: Vertical integration in the chemical sector was a notable trend in 2024, with companies seeking greater control over their operations.

The bargaining power of suppliers for PCC SE is influenced by the concentration of suppliers and the availability of substitutes. If PCC relies on a few key suppliers for critical raw materials like specialized chemicals or energy, these suppliers can command higher prices or dictate terms. For example, in 2024, disruptions in global energy markets led to increased costs for energy-intensive industries, impacting companies like PCC SE.

Switching costs also play a crucial role; the expense and effort required for PCC SE to change suppliers, especially for custom-formulated chemicals or integrated energy solutions, can be substantial, thereby strengthening supplier leverage. The threat of suppliers integrating forward into PCC's own business areas, such as producing finished chemical products, further amplifies their power.

| Factor | Impact on PCC SE | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power | Key input shortages in 2024 amplified this |

| Availability of Substitutes | Many substitutes reduce supplier power | Exploration of alternative materials increased |

| Switching Costs | High switching costs favor suppliers | Adaptation to new suppliers can be costly |

| Forward Integration Threat | Suppliers entering PCC's markets increases their power | Vertical integration was a notable trend in 2024 |

What is included in the product

This analysis unpacks the competitive forces impacting PCC SE, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and their collective influence on PCC SE's profitability and strategic positioning.

Instantly identify and address competitive threats with a visual breakdown of Porter's Five Forces, empowering strategic action.

Customers Bargaining Power

PCC SE's customers, particularly those in commodity chemical markets, exhibit significant price sensitivity. This is largely because the products offered are often standardized, meaning buyers can easily switch to competitors if prices are not competitive.

The intense competition, coupled with the influx of low-cost imports, especially from regions like China and Brazil, directly impacts PCC's ability to set prices and maintain healthy profit margins. This pressure was evident in the company's Q1 2025 financial results, which showed a notable impact on profitability due to these market dynamics.

If a few major customers represent a substantial percentage of PCC SE's revenue in a particular market, their bargaining power increases significantly. These large clients can leverage their purchasing volume to negotiate lower prices or more advantageous contract conditions, potentially squeezing PCC's profitability. For instance, if a single customer accounted for over 15% of PCC's sales in its chemicals division in 2024, their ability to dictate terms would be considerable.

Customers wield significant bargaining power when a wide array of substitute products or services are readily available. This ease of switching to alternatives directly diminishes a company's pricing leverage and forces it to compete more aggressively on factors beyond price, such as quality, innovation, or service.

For a company like PCC SE, operating in markets such as polyols, the presence of numerous alternative suppliers or even entirely different chemical compounds that can fulfill similar functions means customers have more options. For example, in 2024, the global polyols market saw continued diversification of suppliers, with key players like Dow Chemical and BASF maintaining substantial market share alongside regional producers, offering customers choices that can influence pricing negotiations.

Customer Backward Integration Threat

The threat of customers integrating backward into chemical production or logistics services can significantly limit PCC SE's pricing power. If a substantial customer opts to produce its own chemical raw materials, it directly reduces their dependence on external suppliers like PCC, potentially leading to decreased order volumes and increased price sensitivity.

This backward integration by customers poses a direct challenge to PCC SE's market position. For instance, a large industrial conglomerate that is a major consumer of specialty chemicals might invest in its own synthesis capabilities, thereby cutting out PCC SE as a supplier for those specific needs. This strategic move by a key client can erode PCC SE's revenue streams and necessitate a more competitive pricing strategy to retain remaining business.

- Customer Backward Integration Threat: If significant customers, like large manufacturing firms, decide to produce their own chemical inputs or manage their own logistics, they become less reliant on suppliers such as PCC SE.

- Impact on Pricing Power: This reduces PCC SE's ability to dictate prices, as customers have the alternative of in-house production, forcing PCC to be more competitive.

- Example Scenario: A major automotive manufacturer, a key buyer of various chemical coatings and adhesives, could invest in developing its own proprietary formulations or setting up its own distribution network.

- Market Dynamics: This trend is particularly relevant in industries where chemical inputs represent a substantial portion of a customer's cost structure, incentivizing them to explore vertical integration.

Information Asymmetry

Information asymmetry significantly impacts the bargaining power of customers concerning PCC SE. When customers possess detailed knowledge about market prices, PCC SE's production costs, and the availability of substitute products, their ability to negotiate favorable terms increases. This transparency can diminish PCC SE's capacity to charge premium prices, as customers can readily compare offers and identify the most cost-effective options.

For instance, in the chemical industry where PCC SE operates, readily available online marketplaces and industry reports in 2024 provide customers with unprecedented access to pricing benchmarks and competitor analyses. This makes it harder for any single supplier, including PCC SE, to maintain a significant price advantage based solely on information control. Customers can leverage this knowledge to demand lower prices or better service conditions.

- Informed Customers: Buyers with access to comprehensive market data can effectively challenge PCC SE's pricing strategies.

- Reduced Price Premiums: Transparent markets limit PCC SE's ability to command higher prices when customers are well-informed about alternatives and costs.

- Negotiation Leverage: Detailed information on competitor offerings empowers customers to negotiate more aggressively with PCC SE.

Customers of PCC SE, especially in commodity chemical segments, exert considerable bargaining power due to the standardized nature of many products, making switching to competitors easy. This price sensitivity is amplified by intense competition and the availability of low-cost imports, as seen in the pressure on PCC's profitability in early 2025. When a few major customers represent a significant portion of PCC's revenue, their ability to negotiate lower prices or more favorable terms increases substantially, potentially impacting the company's margins.

The availability of numerous substitutes and the potential for customers to integrate backward into production further empower buyers. For example, in the 2024 polyols market, a diverse supplier landscape including major players like Dow Chemical and BASF provided customers with ample choice, influencing pricing negotiations. Similarly, the threat of a large industrial client developing its own synthesis capabilities for specialty chemicals directly reduces their reliance on PCC SE, forcing more competitive pricing strategies.

Information asymmetry also plays a crucial role; well-informed customers, armed with market price benchmarks and competitor analyses readily available through online platforms and industry reports in 2024, can effectively challenge PCC SE's pricing. This transparency limits PCC's ability to command premium prices, as buyers can easily compare offers and demand better terms.

| Factor | Impact on PCC SE | 2024/2025 Relevance |

| Product Standardization & Substitutes | Increases customer ability to switch, reducing pricing power. | High, particularly in commodity chemicals. |

| Customer Concentration | Large customers with significant volume can negotiate better terms. | Significant if a few clients represent >15% of sales in a division. |

| Backward Integration Threat | Reduces customer dependence, forcing competitive pricing. | Relevant for major industrial consumers exploring in-house production. |

| Information Availability | Informed customers leverage data to negotiate lower prices. | Growing due to online marketplaces and industry reports. |

Full Version Awaits

PCC SE Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces Analysis document for PCC SE you'll receive immediately after purchase—no surprises, no placeholders. It comprehensively details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This in-depth analysis is professionally prepared and ready for your immediate use.

Rivalry Among Competitors

PCC SE operates in a chemical industry where growth rates vary significantly by segment. In mature areas, a slower industry growth rate, particularly evident in bulk chemicals, forces companies to intensely compete for existing market share, often leading to price wars and reduced profitability. This dynamic means companies like PCC SE must be exceptionally efficient and innovative to stand out.

However, the picture isn't uniformly challenging. Growth in specialized chemical segments, such as those catering to renewable energy or advanced materials, offers a different competitive landscape. In these expanding markets, the focus shifts from market share battles to innovation and capturing new demand, potentially easing some of the intense rivalry seen in mature segments. For instance, the global specialty chemicals market was projected to reach over $800 billion by 2024, indicating significant opportunity.

PCC SE operates across several diverse industries, meaning it faces a wide array of competitors. In many of these sectors, there are numerous established companies, some of which are significantly larger than PCC SE. This crowded competitive landscape, especially with the presence of global giants, naturally fuels intense rivalry.

This high degree of competition, particularly from similarly sized or larger global players, often translates into aggressive pricing strategies. Companies are constantly vying for market share, which can put pressure on profit margins. For instance, in the chemical sector where PCC SE is active, major global chemical companies often dictate pricing trends due to their scale and market influence.

In the often commoditized chemical industry, where products are largely interchangeable, intense price competition is a common challenge. PCC SE actively works to counter this by emphasizing product differentiation. This strategy is crucial for moving away from pure price wars.

PCC SE's commitment to specialty chemicals and sustainable production, exemplified by its Greenline® product range and investments in energy-efficient technologies, serves as a key differentiator. These efforts aim to create unique value propositions for customers, thereby mitigating the direct impact of price-based rivalry. For instance, in 2024, the company continued to expand its portfolio of eco-friendly products, responding to growing market demand for sustainable solutions.

Exit Barriers

PCC SE likely faces significant exit barriers due to its substantial investments in specialized industrial assets, particularly in its chemicals and energy segments. These assets, often requiring unique configurations and long lead times for deconstruction or repurposing, can trap capital and make it economically unviable for the company to exit certain operations even if they become unprofitable. This situation can lead to prolonged market presence of underperforming units, contributing to sustained competitive pressure within those specific industry segments.

The presence of high exit barriers means that even if PCC SE's performance in certain areas dips, it may be compelled to continue operating due to the sunk costs associated with its extensive production facilities. For instance, in 2024, the chemicals industry, a core area for PCC, saw ongoing challenges related to energy costs and global demand fluctuations. Companies with large, fixed asset bases, like PCC, often find it more cost-effective to continue production at a reduced capacity rather than incurring the substantial expenses of decommissioning or selling specialized plants.

- Specialized Assets: PCC's operations in areas like chlor-alkali or coal mining involve highly specific machinery and infrastructure that are difficult and costly to sell or repurpose.

- Long-Term Contracts: The company may be bound by long-term supply agreements or customer contracts that necessitate continued operation, even in less profitable periods.

- Investment in Production Facilities: Significant capital expenditure in plants and equipment creates a high financial hurdle for exiting these markets, effectively locking in PCC and its competitors.

- Market Dynamics: The continued operation of less profitable segments due to exit barriers can exacerbate oversupply issues, intensifying price competition among all players.

Competitive Strategies and Innovation

PCC SE navigates a competitive landscape where rivals vie through various strategies, including pricing, product innovation, and customer service. The company's approach, however, leans heavily on differentiation and operational efficiency.

PCC SE's strategic investments, such as its expansion into new chemical markets and its commitment to developing sustainable technologies, highlight a deliberate strategy to stand out from competitors. This focus on innovation and efficiency aims to build a stronger market position beyond simple price competition.

For instance, PCC SE's investments in renewable energy projects and environmentally friendly chemical production processes position it as a forward-thinking player. In 2023, the company reported significant capital expenditures, with a substantial portion allocated to modernization and sustainability initiatives, reflecting this competitive stance.

- Differentiation through Sustainability: PCC SE invests in green technologies, aiming to capture market share by offering environmentally conscious products.

- Efficiency-Driven Operations: The company focuses on optimizing production processes to reduce costs and improve margins, enhancing its competitive edge.

- Strategic Expansion: PCC SE pursues growth through targeted acquisitions and market entry, broadening its product portfolio and geographic reach.

PCC SE operates in a competitive chemical industry where rivals often engage in price wars, particularly in mature segments. The company counters this by emphasizing product differentiation, focusing on specialty chemicals and sustainable production, such as its Greenline® range. This strategy aims to create unique value and move away from pure price competition, especially as the global specialty chemicals market was projected to exceed $800 billion by 2024.

The presence of numerous established and larger global competitors, many with significant scale, intensifies rivalry for PCC SE. This often leads to aggressive pricing strategies as companies fight for market share, impacting profit margins. For example, major global chemical players frequently influence pricing trends due to their market dominance.

High exit barriers, stemming from substantial investments in specialized industrial assets and long-term contracts, can trap companies like PCC SE in less profitable operations. This can sustain competitive pressure, as seen in 2024 challenges within the chemicals sector related to energy costs and demand fluctuations, where continuing production at reduced capacity is often more economical than decommissioning large, fixed assets.

SSubstitutes Threaten

The threat of substitutes for PCC SE's products, particularly in its chemicals segment, is a considerable factor. For instance, alternative materials that can perform similar functions to polyols in various applications, such as insulation or coatings, present a direct challenge. If these substitutes offer a more attractive price-performance ratio, customers may switch, impacting PCC's market share and pricing power.

In 2024, the global polyols market, a key area for PCC, was valued at approximately USD 65 billion, with growth driven by demand in construction and automotive sectors. However, the emergence of bio-based polyols and recycled material alternatives, offering potentially lower environmental impact and competitive pricing, directly addresses this threat. The ability of PCC to innovate and maintain a competitive edge in both performance and cost against these evolving substitutes will be crucial.

Customer willingness to switch to alternative products is a key factor in assessing the threat of substitutes. For PCC SE, this propensity is shaped by brand loyalty, the perceived risks associated with switching, and how easy it is to make that transition. In markets where products are more standardized, like many commodity chemicals, price often becomes a dominant driver for customers considering substitutes.

In 2024, the chemical industry continues to see price sensitivity play a significant role. For instance, fluctuations in raw material costs can directly impact the pricing of basic chemicals, making it easier for customers to compare and switch if a competitor offers a more favorable price point. This dynamic is particularly relevant for PCC SE's commodity chemical segments, where switching costs might be relatively low.

Emerging technologies are a significant driver in the creation and enhancement of substitute products, directly impacting PCC SE's market position. For instance, advancements in sustainable materials and alternative energy sources are rapidly developing, offering viable replacements for PCC SE's core offerings in chemicals and energy.

Innovations in materials science, particularly in areas like advanced polymers and composites, could present long-term threats by offering lighter, stronger, or more environmentally friendly alternatives to PCC SE's traditional chemical products. Similarly, breakthroughs in battery technology and renewable energy generation directly challenge the demand for PCC SE's energy segment products.

Regulatory or Environmental Shifts Favoring Substitutes

Changes in regulations or growing environmental consciousness can significantly boost the appeal of substitute materials or energy sources, potentially impacting PCC SE's market position. For instance, stricter emissions standards or mandates for recycled content could make alternative products more competitive. PCC's proactive approach to sustainability, including investments in eco-friendly production processes, is designed to counter this threat by aligning its offerings with evolving market expectations.

The increasing global focus on carbon neutrality presents a tangible risk. By 2024, many nations are implementing or strengthening policies aimed at reducing carbon footprints, which could favor substitutes like renewable energy sources or alternative building materials over traditional cement and related products. PCC's commitment to reducing its own CO2 emissions by 25% by 2030, as outlined in its sustainability reports, directly addresses this evolving landscape.

- Regulatory Shifts: New environmental regulations could impose higher costs on PCC's operations or favor the use of substitute materials.

- Environmental Awareness: Increased consumer and corporate demand for sustainable products may drive adoption of alternatives to PCC's core offerings.

- PCC's Mitigation: PCC's sustainability initiatives, such as reducing CO2 emissions, aim to preemptively address these concerns and maintain competitiveness.

- Market Trends: The growing market for green building materials and renewable energy sources presents a direct challenge from potential substitutes.

Availability of Indirect Substitutes

The availability of indirect substitutes presents a significant threat to PCC SE. These substitutes aren't direct product replacements but rather shifts in consumer behavior or broader industry trends that can dampen the overall demand for PCC's offerings. For instance, the automotive sector's move towards lighter materials could directly impact the demand for silicon metal, a key product for PCC.

Consider the automotive industry's ongoing pursuit of fuel efficiency and reduced emissions. This trend is driving innovation in material science, with a growing emphasis on lightweight composites and advanced alloys. For example, by 2024, many major automakers are projecting increased use of aluminum and carbon fiber reinforced polymers in vehicle construction, potentially reducing the need for traditional materials like silicon metal in certain applications.

- Shifts in consumer preferences: Growing environmental consciousness can lead consumers to favor products made with sustainable or recycled materials, indirectly impacting demand for primary material producers like PCC.

- Technological advancements: Innovations in alternative materials or manufacturing processes could render existing products obsolete or less competitive. For example, advancements in battery technology might reduce the reliance on silicon in certain electronic components.

- Regulatory changes: New environmental or safety regulations could favor alternative materials or processes, thereby reducing demand for PCC's current product portfolio.

The threat of substitutes remains a key consideration for PCC SE, particularly as alternative materials and technologies emerge. For example, the push for sustainability in construction and automotive sectors could see increased adoption of bio-based polyols or recycled plastics, directly competing with PCC's offerings. By 2024, the global market for sustainable chemicals was projected to reach over USD 100 billion, highlighting the significant growth potential and competitive pressure from these alternatives.

Innovations in materials science, such as advanced composites and lighter alloys, are also presenting indirect substitution threats, especially in industries like automotive where weight reduction is paramount. The increasing demand for electric vehicles, for instance, may alter the demand for certain raw materials used in traditional internal combustion engine components. The global automotive industry in 2024 was heavily focused on electrification, with projections indicating a significant shift in material requirements for vehicle manufacturing.

| Substitute Category | Example Products | Impact on PCC SE (2024 Focus) |

|---|---|---|

| Sustainable Chemicals | Bio-based polyols, recycled plastics | Direct competition with PCC's chemical segment, potentially impacting market share and pricing. |

| Advanced Materials | Carbon fiber composites, advanced alloys | Indirect threat through demand shifts in sectors like automotive, potentially reducing need for silicon metal. |

| Renewable Energy | Solar, wind power technologies | Challenges PCC's energy segment by offering alternatives to traditional energy sources. |

Entrants Threaten

The chemicals, energy generation, and logistics industries, which form the core of PCC SE's operations, are inherently capital-intensive. Establishing new ventures in these sectors demands massive upfront investments in sophisticated plants, specialized equipment, and extensive infrastructure networks. For instance, building a new chemical production facility can easily run into hundreds of millions of euros, while developing a new power generation plant requires billions. This high barrier to entry significantly deters potential new competitors from challenging established players like PCC SE.

Established players like PCC SE leverage significant economies of scale in production, procurement, and distribution. This allows them to achieve lower per-unit costs, creating a substantial barrier for newcomers. For instance, in 2024, the global cement industry, where PCC SE operates, saw major players benefiting from integrated supply chains that reduced logistics expenses by an estimated 10-15% compared to smaller, fragmented operations.

New entrants would find it incredibly challenging to replicate these cost efficiencies without achieving a comparable production volume. The initial investment required to build production facilities and establish a robust supply network capable of competing on price would be immense, making it difficult for them to match the competitive pricing of incumbents.

Newcomers face significant hurdles in establishing effective distribution channels for chemicals and logistics. Building these networks requires substantial investment and time, making it difficult for new companies to compete with established players like PCC SE.

PCC SE benefits from its well-developed and extensive distribution infrastructure, particularly in intermodal transport within Poland. This established network acts as a strong barrier to entry, as new entrants would struggle to replicate the reach and efficiency of PCC SE's existing logistics capabilities.

Regulatory and Legal Barriers

The chemical and energy industries, where PCC SE operates, are heavily influenced by stringent regulatory and legal barriers. These include rigorous environmental protection laws, demanding safety protocols, and complex licensing procedures that new entrants must navigate. For instance, the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes significant compliance burdens and costs on chemical producers, impacting market access and operational setup.

These substantial compliance costs and the often lengthy approval processes act as significant deterrents for potential new competitors. Companies looking to enter these sectors must invest heavily in research, development, and infrastructure to meet these exacting standards, which can tie up capital for extended periods. This creates a formidable barrier, protecting established players like PCC SE from immediate competitive threats.

In 2024, the global chemical industry continued to face evolving regulatory landscapes. For example, increased scrutiny on plastic waste and emissions in Europe meant that companies needed to adapt their production processes and product portfolios. This ongoing regulatory pressure means that any new entrant would need substantial upfront investment and expertise to comply, reinforcing the existing barriers to entry.

- Environmental Regulations: Compliance with standards like REACH in Europe requires extensive data submission and risk assessment, costing millions for new chemicals.

- Safety Standards: Strict operational safety requirements in chemical plants necessitate advanced engineering and ongoing training, adding significant capital and operational expenses.

- Licensing and Permits: Obtaining necessary operating licenses in the energy and chemical sectors can be a protracted process, often involving multiple government agencies and public consultations.

- Compliance Costs: For a new chemical plant, estimated compliance costs for environmental and safety regulations can range from 10% to 20% of initial capital expenditure.

Brand Loyalty and Differentiation

While certain PCC SE products operate in commodity markets, the company's strategic expansion into specialty chemicals and sustainable solutions is a key factor in building brand loyalty. This differentiation makes it more challenging for new competitors to simply replicate existing offerings and capture market share. For instance, PCC's investments in bio-based polymers and circular economy initiatives, as highlighted in their 2024 sustainability reports, aim to create unique value propositions that resonate with environmentally conscious customers.

The threat of new entrants is somewhat mitigated by PCC SE's established reputation and customer relationships, particularly in niche markets. Building comparable brand recognition and trust requires significant time and investment, creating a barrier for newcomers. In 2024, PCC SE reported a customer retention rate of over 90% for its specialty chemical divisions, underscoring the stickiness of its client base.

- Brand Loyalty: PCC SE's diversified portfolio and focus on specialty chemicals and sustainable solutions foster customer loyalty.

- Product Differentiation: Investments in areas like bio-based polymers create unique value propositions, making it harder for new entrants.

- Market Entry Barriers: Establishing comparable brand recognition and trust requires substantial time and investment, acting as a deterrent.

- Customer Retention: In 2024, PCC SE maintained a customer retention rate exceeding 90% in its specialty chemical segments.

The threat of new entrants for PCC SE is considerably low due to high capital requirements, established economies of scale, and strong distribution networks. For example, building new chemical plants in 2024 can cost hundreds of millions of euros, a significant deterrent. PCC SE's integrated supply chains in its operational sectors, like cement, also provide cost advantages that are difficult for newcomers to match.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

| Capital Intensity | High upfront investment for plants and equipment. | Deters new players due to massive financial outlay. | New chemical plant investment: €100M - €1B+ |

| Economies of Scale | Lower per-unit costs for established players. | New entrants struggle to compete on price. | Logistics cost reduction for large players: 10-15% |

| Distribution Channels | Extensive and efficient logistics networks. | Replicating reach and efficiency is time-consuming and costly. | PCC SE's intermodal transport in Poland. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for PCC SE is built upon a robust foundation of data, including PCC SE's official annual reports, investor presentations, and public filings. We supplement this with industry-specific market research reports from reputable firms and relevant trade publications to capture a comprehensive view of the competitive landscape.