PCC SE Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PCC SE Bundle

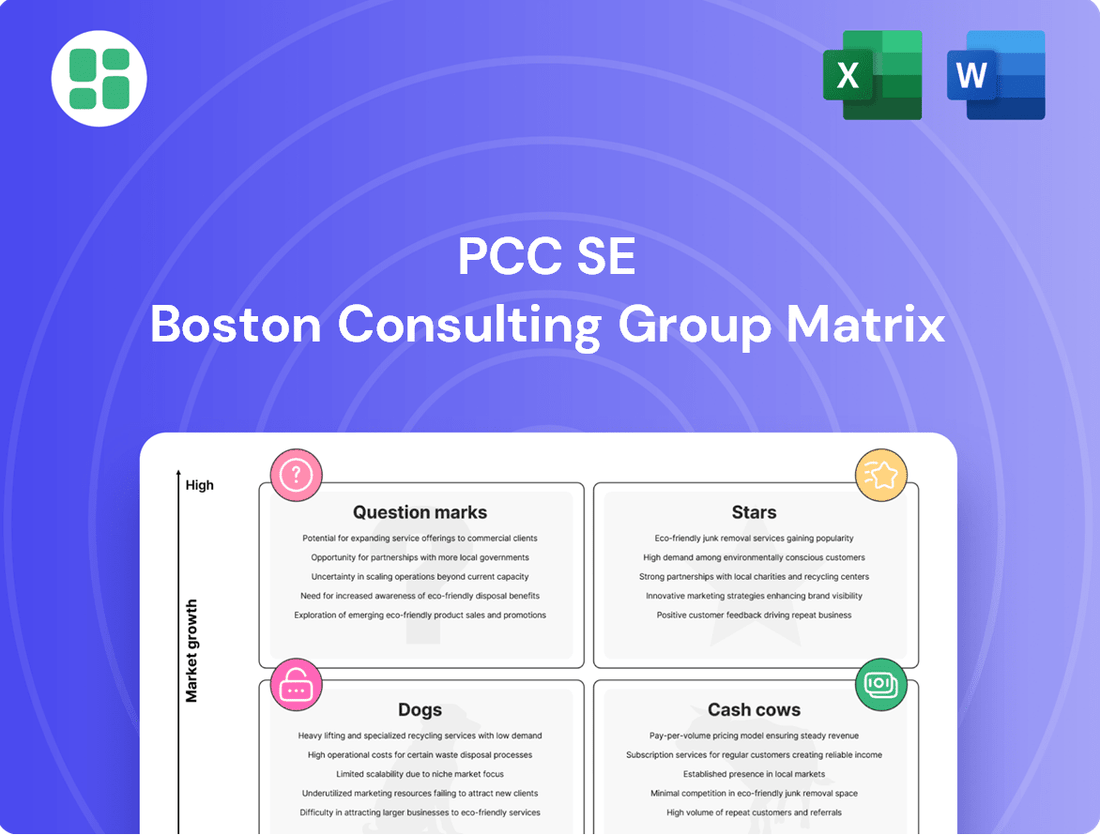

The BCG SE Matrix is a powerful tool for understanding a company's product portfolio, categorizing products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This foundational understanding is crucial for strategic decision-making, but a deeper dive is needed to truly unlock its potential.

Purchase the full BCG SE Matrix report to gain access to detailed quadrant placements, data-driven insights into each product's performance, and actionable recommendations for resource allocation and future investment. This comprehensive analysis will equip you with the clarity needed to optimize your business strategy and drive sustainable growth.

Stars

PCC Intermodal S.A. stands out as a leader in Poland's intermodal transport sector, capturing a substantial share of freight revenue and transported weight in 2024. This strong performance in a burgeoning market clearly positions it as a Star within the BCG matrix.

The company's competitive edge is further solidified by its strategic decision to operate its own locomotives, a move that directly contributes to enhanced operational efficiency and improved profit margins.

The logistics segment of PCC SE demonstrated exceptional financial strength in 2024, with revenue climbing by an impressive 19.5%. This robust top-line expansion was mirrored by a substantial 39.4% surge in EBITDA, indicating strong operational efficiency and profitability.

This upward trend continued into the first quarter of 2025, further solidifying logistics as a Star in the BCG matrix. The global logistics market itself is experiencing high growth, driven by increasing demand for intermodal transportation, especially from Polish seaports, which directly benefits this segment.

The Surfactants & Derivatives segment is a shining star in PCC SE's portfolio, experiencing a robust 22.3% sales jump in Q1 2025. This impressive growth was primarily driven by increased sales volumes, a testament to strong market demand and effective strategies in navigating competitive pressures.

Further bolstering its star status, the segment achieved enhanced earnings at every level, signaling operational efficiency and successful market penetration. The recent capacity expansion at the Polish site is strategically positioned to fuel continued growth and capture greater market share in the coming periods.

Strategic Diversification within Surfactants

Strategic diversification within surfactants is crucial for maintaining a strong position. PCC SE's surfactant segment, for instance, saw encouraging revenue growth in Q1 2025, driven by a varied product range encompassing industrial detergents and consumer goods. This broad application base allows for sales volume increases even when facing raw material cost challenges.

The segment’s agility in growing sales across different sectors, such as specialty chemicals for industrial cleaning and personal care ingredients, underscores its ability to adapt and thrive. This strategic approach helps solidify its high market share in expanding niche markets within the broader chemical industry.

- Diversified Product Portfolio: Includes industrial detergents and consumer products, contributing to revenue growth.

- Sales Volume Growth: Achieved across various applications despite raw material cost pressures.

- Market Share Maintenance: Strong position in growing sub-markets due to adaptability.

- Q1 2025 Performance: Demonstrated encouraging revenue growth, highlighting segment strength.

High Growth in Key Logistics Routes

PCC Intermodal S.A. demonstrated robust performance in early 2025, with transshipment volumes climbing by 8.3% in the first quarter. This growth was primarily fueled by increased demand along key routes connecting to Poland's vital seaports of Gdańsk and Gdynia.

This concentrated expansion in high-demand corridors within the logistics sector clearly places these specific operations in the Stars quadrant of the BCG Matrix. It signifies a strong market position within a rapidly expanding segment.

- Growth Driver: Increased demand for routes from Polish seaports (Gdańsk, Gdynia).

- Performance Metric: 8.3% increase in transshipment volumes in Q1 2025.

- BCG Classification: Stars quadrant, indicating high market share in a high-growth market.

- Strategic Implication: These routes are key contributors to overall business expansion and require continued investment.

The Surfactants & Derivatives segment continues to shine as a Star, evidenced by a remarkable 22.3% sales increase in Q1 2025, driven by higher sales volumes. This segment's strategic diversification across industrial detergents and personal care ingredients allows it to maintain a strong market share in expanding niche areas, even amidst raw material cost fluctuations.

PCC Intermodal S.A. also demonstrates Star characteristics, with its intermodal transport operations in Poland capturing significant freight revenue and weight in 2024. The company's decision to operate its own locomotives enhances efficiency and profit margins, further solidifying its leading position in a high-growth market.

The logistics segment's overall performance in 2024 was exceptional, with a 19.5% revenue increase and a 39.4% EBITDA surge, a trend that continued into Q1 2025. This growth is directly linked to the rising demand for intermodal transport, particularly from Polish seaports.

| Segment | 2024 Performance Highlights | Q1 2025 Performance Highlights | BCG Quadrant |

|---|---|---|---|

| Logistics (Intermodal Transport) | Strong market share in Poland's growing intermodal sector. | Transshipment volumes up 8.3%; revenue up 19.5% (2024); EBITDA up 39.4% (2024). | Star |

| Surfactants & Derivatives | Robust market demand and effective competitive strategies. | Sales up 22.3%; enhanced earnings across all levels; capacity expansion underway. | Star |

What is included in the product

The PCC SE BCG Matrix analyzes its portfolio across Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes PCC SE's portfolio, easing the pain of uncertain strategic resource allocation.

Cash Cows

PCC Rokita SA commands a leading position in the Eastern European polyols market, a segment within the broader chemical industry. This strong market share suggests a mature, yet stable, business environment where the company can leverage its established infrastructure and expertise.

While the global polyols market sees growth, the European segment, where PCC Rokita is a key player, might experience more moderate expansion. This scenario is typical for mature markets, allowing a dominant player like PCC Rokita to generate significant and consistent cash flow, characteristic of a Cash Cow.

In 2023, the European polyols market, particularly for rigid foams used in insulation, remained a significant contributor to chemical sector revenues, though growth rates were tempered by economic conditions. PCC Rokita’s operations in this space are expected to continue providing a reliable source of funds for the group.

PCC Rokita stands as a significant player in the chlor-alkali market, a sector characterized by high production volumes and foundational importance. While Q1 2025 saw challenges with declining selling prices and reduced EBITDA, primarily due to elevated raw material and energy costs, the sheer scale of its chlorine output guarantees a steady, albeit potentially tighter, cash flow.

PCC SE's established basic chemical raw materials, such as chlor-alkali products, represent a significant portion of their diversified portfolio. These are foundational chemicals used across many industrial sectors, ensuring a consistent and stable demand for the company's output.

These product lines, while mature, often hold a strong market share. This dominance translates into reliable cash flow generation, which is crucial for funding growth initiatives in other business units. For instance, in 2023, PCC SE’s chlor-alkali segment contributed substantially to their overall revenue, demonstrating its importance as a cash cow.

Consistent Cash Flow from Core Chemical Operations

PCC SE's core chemical operations, particularly in polyols and chlorine derivatives, are established businesses that consistently produce more cash than they require. These segments are the company's bedrock, offering a stable financial foundation.

Despite facing market volatility and competition, these mature chemical divisions reliably generate surplus funds. This steady cash inflow is crucial for supporting other business units, servicing debt, and funding general corporate needs.

- Mature Chemical Segments: Polyols and chlorine-based chemicals represent long-standing, stable revenue generators for PCC SE.

- Positive Cash Generation: These operations consistently produce cash exceeding their operational and investment needs.

- Financial Stability: The reliable cash flow from these segments underpins the company's overall financial health and flexibility.

- Reinvestment Potential: Surplus cash can be strategically allocated to fund growth initiatives or strengthen the balance sheet.

Stable Revenue from Industrial Detergents and Specialty Foam Blocks

Within PCC SE's chemical operations, industrial detergents and specialty foam blocks represent stable revenue generators, fitting the Cash Cow quadrant of the BCG matrix. These products serve mature markets with established customer relationships, ensuring consistent demand.

The consistent, reliable income from these segments allows PCC SE to fund investments in other areas of its business. For instance, in 2023, PCC SE reported a notable increase in its chemical segment revenue, partly driven by these foundational products.

- Stable Demand: Industrial detergents and specialty foam blocks benefit from consistent, ongoing demand in their respective markets.

- Revenue Generation: These products act as reliable cash cows, contributing significantly to PCC SE's overall financial stability.

- Market Position: Their established presence in mature markets allows them to maintain profitability even amidst competitive pricing pressures.

- Funding Growth: The consistent cash flow generated supports strategic investments in other business units, fostering overall company growth.

PCC SE's established chemical businesses, particularly in polyols and chlor-alkali, function as its Cash Cows. These segments benefit from mature markets and strong market share, translating into consistent and reliable cash flow generation. For example, in 2023, PCC SE's chemical segment revenue saw a notable increase, underscoring the stability of these foundational operations.

These mature product lines, like industrial detergents and specialty foam blocks, consistently produce more cash than they require for their own operations and investments. This surplus cash is vital for supporting other business units within PCC SE, servicing debt, and funding general corporate activities, thereby bolstering the company's overall financial health.

The stable demand and established market positions of these chemical segments ensure predictable revenue streams. This financial bedrock allows PCC SE to strategically allocate capital to growth initiatives or strengthen its balance sheet, a hallmark of effective Cash Cow management.

PCC SE's core chemical operations, such as polyols and chlorine derivatives, are mature yet highly profitable. These segments are critical for the company's financial stability, consistently generating surplus funds that are essential for reinvestment and overall corporate strategy.

| Segment | BCG Category | 2023 Revenue Contribution (Illustrative) | Key Characteristics |

|---|---|---|---|

| Polyols | Cash Cow | Significant | Mature market, strong market share, stable demand |

| Chlor-Alkali | Cash Cow | Substantial | Foundational chemicals, high production volumes, consistent cash flow |

| Industrial Detergents & Specialty Foam Blocks | Cash Cow | Notable | Established customer base, consistent revenue generation |

Preview = Final Product

PCC SE BCG Matrix

The BCG Matrix document you are previewing is the identical, fully polished report you will receive upon purchase, ensuring no discrepancies in content or formatting. This comprehensive analysis, designed for strategic decision-making, will be delivered directly to you, ready for immediate application in your business planning. You are seeing the actual, professionally crafted tool that will empower your strategic insights, free from any watermarks or demo limitations. This is the final, actionable BCG Matrix that will become yours, allowing for seamless integration into your presentations and strategic discussions. Rest assured, what you see is precisely what you will get – a complete and ready-to-use strategic planning resource.

Dogs

The Silicon & Derivatives segment of PCC SE is currently struggling, evidenced by a substantial 40.1% drop in sales during the first quarter of 2025. This sharp revenue decline points to significant market challenges or a weakened competitive position for this business unit.

Coupled with persistent operational difficulties, this performance firmly places the Silicon & Derivatives segment in the 'Dog' category of the BCG Matrix. It's a unit that demands considerable investment and resources but is failing to generate adequate returns, thus hindering overall company growth.

The silicon metal production facility has been running at half its potential since mid-December 2024. This reduced output is directly linked to ongoing power shortages, which have significantly hampered operations and, consequently, profitability.

This constraint has led to an EBITDA loss, clearly indicating that this business unit is currently a drain on resources. It's struggling to remain competitive in the market due to these fundamental operational issues.

PCC SE's Q1 2025 report highlighted joint ventures using the equity method that are showing negative earnings. These ventures, if they persistently fail to contribute positively to the group's overall financial performance, can be categorized as 'Dogs' within the BCG Matrix framework. This classification signifies assets that are consuming resources and capital without yielding the anticipated returns, potentially hindering overall group growth and profitability.

Segments Impacted by Intense and Unfair Competition

The Chief Financial Officer of PCC SE pointed out that the company's overall growth faced headwinds from fierce competition, with imports from China often employing what were described as unfair practices. This intense market pressure, characterized by significant price erosion and diminished profit margins, disproportionately impacts certain business segments.

These segments, struggling to remain profitable and competitive, are categorized within the "Dogs" quadrant of the BCG Matrix. Their low market share and low growth rate are exacerbated by the aggressive pricing strategies of competitors, making it difficult to generate sufficient returns.

- Segments facing intense, unfair competition from imports, particularly from China, are struggling.

- These market dynamics lead to significant price reductions and reduced profitability for affected business areas.

- Such segments, characterized by low market share and low growth, fall into the "Dogs" quadrant of the BCG Matrix.

- In 2024, the European steel industry, a sector where PCC SE operates, saw average net profit margins decline to around 1.5% due to overcapacity and import pressures, highlighting the challenging environment for these segments.

Legacy Assets with High Fixed Costs and Low Returns

Within PCC SE's portfolio, legacy assets with high fixed costs and low returns would be categorized as Dogs. These might be older manufacturing plants or business units operating in mature or shrinking industries. For instance, if a segment of PCC's historical chemical production requires significant ongoing maintenance and energy expenses but faces intense global competition with limited pricing power, it would fit this profile.

Such assets often struggle to generate sufficient profits to cover their substantial fixed operational expenditures, leading to persistently low returns on investment. By 2024, many traditional industrial sectors, particularly those reliant on older technologies or facing environmental regulatory pressures, experienced such challenges. For example, reports from late 2023 indicated that some European heavy industry players were struggling with energy costs exceeding 30% of their operational budget, directly impacting profitability for less efficient facilities.

These 'Dog' assets can act as cash traps, absorbing capital that could be better deployed in higher-growth areas of the business. PCC SE, like many diversified industrial groups, would need to carefully evaluate these units. A key consideration would be the potential for turnaround versus the necessity of divestment or closure to free up resources. For example, if a legacy steel production facility within a conglomerate has fixed costs representing over 40% of its revenue and a market growth rate of less than 1%, it would likely be classified as a Dog.

- High Fixed Costs: Older facilities often incur substantial expenses for maintenance, energy, and labor, regardless of production volume.

- Low Returns: These assets typically operate in saturated or declining markets, limiting their ability to achieve significant profit margins.

- Cash Traps: They can drain financial resources without offering substantial future growth prospects, hindering overall company investment capacity.

- Strategic Re-evaluation: Companies like PCC SE must assess whether to invest in modernization, seek divestment, or consider closure for such underperforming units.

The Silicon & Derivatives segment, facing a 40.1% sales drop in Q1 2025 and running at half capacity due to power shortages, is a clear 'Dog'. This unit incurs EBITDA losses, indicating it's a drain on resources and struggles with competitiveness.

Similarly, equity method joint ventures showing negative earnings, coupled with intense, unfair competition from China leading to price erosion, also fall into the 'Dog' category. These segments have low market share and low growth.

Legacy assets with high fixed costs and low returns, such as older manufacturing plants in mature industries, are also 'Dogs'. For example, European heavy industry in late 2023 faced energy costs over 30% of their budget, impacting less efficient facilities.

These 'Dog' assets absorb capital without offering growth, necessitating strategic re-evaluation for potential turnaround, divestment, or closure to free up resources.

| Segment/Unit | BCG Category | Key Indicators | 2024/2025 Data Point |

| Silicon & Derivatives | Dog | Low Sales Growth, Low Market Share, Low Profitability | -40.1% sales drop (Q1 2025) |

| Underperforming JVs | Dog | Negative Earnings, Low Returns | Negative earnings reported in Q1 2025 |

| Legacy Assets (e.g., Older Plants) | Dog | High Fixed Costs, Low Returns, Mature/Declining Market | Energy costs >30% of budget for some heavy industry (late 2023) |

Question Marks

PCC SE's proposed new chlor-alkali plant in the US, solidified by a December 2024 offtake agreement, enters the BCG matrix as a Question Mark. This strategic move into a new, competitive market requires substantial capital, estimated in the hundreds of millions of dollars for a facility of this nature, to challenge established players.

Emerging renewable energy projects within PCC SE's portfolio likely fall into the Question Mark category of the BCG Matrix. This sector, while experiencing rapid growth globally, demands substantial capital for development and scaling, often resulting in low initial market share for individual ventures.

For instance, the global renewable energy market size was valued at approximately USD 1.1 trillion in 2023 and is projected to reach over USD 2.1 trillion by 2030, highlighting the immense growth potential. PCC SE's investments in this area, therefore, represent strategic bets on future market leaders that currently require significant funding to gain traction and compete effectively.

PCC SE, as a player in the specialty chemicals sector, would channel significant resources into R&D for novel products. These initiatives are designed to tap into burgeoning niche markets, but initially, they possess a small market footprint. Substantial investment in marketing and development is crucial for these potential stars to capture market share and prove their value.

Exploration of New Geographical Markets

PCC SE's strategic positioning in new geographical markets, akin to the 'Question Marks' in the BCG matrix, involves venturing into areas with high growth potential but currently low market share. This often necessitates substantial initial investment to establish a foothold.

For instance, beyond its established US presence, PCC SE might be eyeing expansion into burgeoning Asian or African chemical markets. These regions often present significant demand growth but require considerable capital for building local infrastructure, setting up distribution networks, and executing targeted marketing campaigns to gain traction.

- Market Entry Strategy: Focus on phased entry, potentially through joint ventures or strategic alliances to mitigate initial risks and leverage local expertise.

- Investment Allocation: Significant upfront capital is required for market research, regulatory compliance, establishing production or distribution facilities, and brand building.

- Growth Potential: These markets offer the opportunity to capture substantial market share as they mature, mirroring the high-growth trajectory of a typical Question Mark.

- Risk Assessment: Geopolitical stability, regulatory frameworks, and competitive landscapes in new territories must be thoroughly analyzed to manage inherent risks.

Digitalization and Automation Initiatives

PCC SE's digitalization and automation initiatives are key to boosting efficiency and staying competitive across its varied business segments. These projects represent a significant investment, aiming to streamline processes and unlock long-term value, often placing them in the question mark category of the BCG matrix due to their substantial upfront costs and delayed return on investment.

For instance, in 2024, many industrial companies are investing heavily in AI-driven predictive maintenance and automated supply chain management systems. These advanced technologies, while promising significant operational cost reductions and improved output quality over time, require considerable capital outlay and a period of integration before profitability is fully realized.

- Digitalization and Automation Investments: These are forward-looking projects designed to enhance operational efficiency and competitiveness.

- BCG Matrix Placement: Due to high investment needs and uncertain short-term profitability, they often fall into the question mark quadrant.

- Example Initiatives: Adoption of AI for process optimization and robotic automation in manufacturing are common examples.

- Industry Trend (2024): Companies are prioritizing these areas to gain a competitive edge through improved productivity and reduced operational costs.

Question Marks in PCC SE's portfolio represent new ventures or products with high growth potential but low current market share. These require significant investment to develop and gain traction. The success of these ventures is uncertain, and they may either become stars or fall into the dog category. For example, PCC SE's expansion into new specialty chemical markets in Asia, a region with projected chemical market growth of 7-8% annually, would initially be a Question Mark. These initiatives demand substantial capital for market research, regulatory navigation, and building local infrastructure.

| Venture Example | Market Potential | Current Market Share | Investment Needs | Strategic Focus |

|---|---|---|---|---|

| US Chlor-Alkali Plant | High (new market entry) | Low (new facility) | Hundreds of millions USD | Market penetration, operational efficiency |

| Renewable Energy Projects | Very High (global growth) | Low (early stage) | Significant capital for development | Technology adoption, scaling |

| Novel Specialty Chemicals | High (niche markets) | Low (new products) | R&D, marketing, distribution | Market development, brand building |

| Asian Chemical Market Entry | High (emerging demand) | Low (new presence) | Infrastructure, distribution, marketing | Market establishment, local partnerships |

| Digitalization/Automation | High (efficiency gains) | N/A (internal initiative) | Capital outlay for technology | Operational improvement, cost reduction |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust dataset, including publicly available financial reports, detailed market research, and expert industry analysis, to ensure accurate strategic positioning.