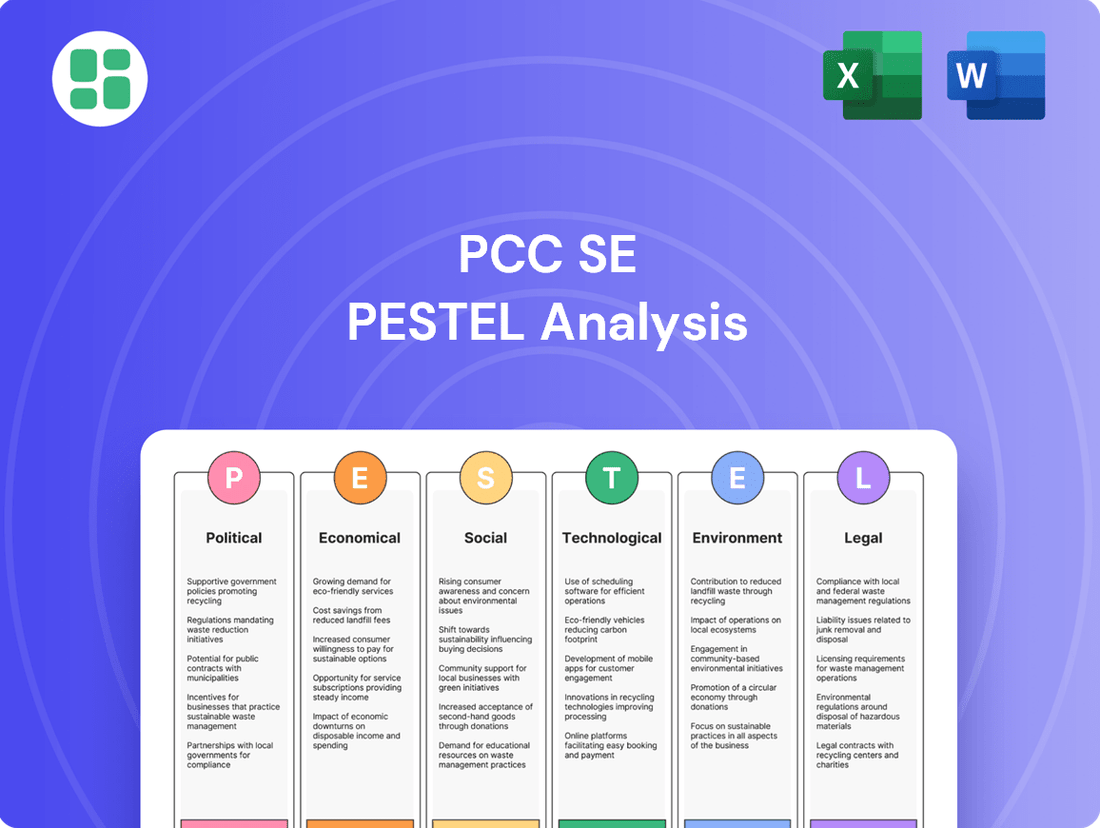

PCC SE PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PCC SE Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping PCC SE's future. Our expert-crafted PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and identify strategic opportunities. Download the full version now and gain a significant competitive advantage.

Political factors

PCC SE's business is heavily shaped by government policies and the general political climate, especially within its key markets of Germany and the European Union. Political stability directly impacts investment confidence and the predictability of the business landscape.

The economic slowdown and political instability observed in 2024, including the challenges faced by Germany's coalition government and policy shifts in the United States, have demonstrably affected PCC SE's performance. Such uncertainties can lead to delayed or altered investment strategies.

PCC SE grapples with significant competitive pressures, particularly from imports into its chemical divisions, which the company characterizes as operating under unfair conditions, with China being a notable source. This competitive landscape directly impacts pricing power and market share.

Geopolitical shifts and the export strategies of nations like China and Brazil, especially concerning silicon metal, create volatility in PCC SE's market positioning and necessitate adaptive pricing models. These external policies can disrupt established supply and demand dynamics.

The company's global operations are sensitive to trade agreements and potential tariff impositions in crucial markets, such as the United States. Such measures can introduce significant friction into PCC SE's logistics networks and affect the cost and availability of essential chemical raw materials, as seen in the 2024 trade discussions around critical minerals.

PCC SE navigates a complex web of regulations in the chemical and energy industries. For instance, the European Union's stringent REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, which was significantly updated in 2023, imposes rigorous requirements on chemical manufacturers regarding substance safety and environmental impact, directly influencing PCC SE's operational costs and product development.

Compliance with evolving environmental standards, such as those targeting emissions from chlor-alkali production, is paramount. In 2024, the EU continued to push for stricter industrial emissions directives, potentially requiring substantial investments in advanced abatement technologies for facilities like PCC SE's chlor-alkali plants.

Future regulatory changes, including potential carbon pricing mechanisms or mandates for renewable energy integration, could necessitate significant capital expenditures. For example, if new regulations in 2025 mandate higher percentages of green hydrogen in chemical processes, PCC SE might need to invest in new production facilities or upgrade existing ones, impacting its financial performance.

Subsidies and Incentives for Renewable Energy

Government subsidies and incentives are crucial for PCC SE's renewable energy projects. For instance, Germany, a key market for PCC SE, has consistently supported renewables through mechanisms like the Renewable Energy Sources Act (EEG). In 2023, Germany's renewable energy sources accounted for approximately 55% of its gross electricity consumption, a testament to the effectiveness of such policies in driving investment and expansion.

These favorable policy frameworks directly impact the economic viability and growth potential of PCC SE's green energy ventures. Changes in these incentives, such as adjustments to feed-in tariffs or tax credits, can significantly alter the attractiveness of new renewable energy investments, influencing strategic decisions and future capital allocation for the company.

Key aspects of these political factors include:

- Favorable Policy Frameworks: Government support, like Germany's EEG, has historically driven significant investment in renewable energy, benefiting companies like PCC SE.

- Investment Attractiveness: The presence and stability of subsidies and tax incentives directly influence the financial returns and attractiveness of new renewable energy projects.

- Policy Volatility Risk: Changes or reductions in government support can impact the profitability and expansion plans of PCC SE's renewable energy portfolio.

Geopolitical Risks and Supply Chain Security

Ongoing geopolitical tensions, including the protracted Russia-Ukraine conflict and instability in the Middle East, continue to present significant challenges for PCC SE's global supply chains and energy expenditures. These disruptions can lead to increased operational costs and potential material shortages, impacting production schedules and profitability.

In response, PCC SE is strategically exploring in-house production of key raw materials. A prime example is the planned chlor-alkali plant in the USA, a move designed to bolster supply chain resilience and decrease dependence on fluctuating global markets. This investment directly addresses the vulnerabilities exposed by recent geopolitical events.

- Geopolitical Uncertainty: The ongoing conflicts in Eastern Europe and the Middle East have a tangible impact on global trade routes and commodity prices, affecting companies like PCC SE.

- Supply Chain Vulnerability: Reliance on international suppliers for critical raw materials exposes PCC SE to risks of disruption, price volatility, and geopolitical leverage.

- Strategic Investment: The proposed US chlor-alkali plant represents a proactive measure to secure a stable supply of essential chemicals, reducing exposure to external shocks.

- Energy Cost Impact: Geopolitical events often correlate with increased energy prices, a significant cost factor for chemical production, necessitating strategies for cost mitigation.

Political stability within PCC SE's operating regions, particularly Germany and the EU, directly influences investment decisions and the predictability of its business environment. Economic slowdowns and political shifts, as seen in 2024 with Germany's coalition challenges, have demonstrably impacted company performance, underscoring the sensitivity to governmental policy and stability.

Government support, such as Germany's Renewable Energy Sources Act (EEG), has been instrumental in driving PCC SE's renewable energy projects, with renewables accounting for approximately 55% of Germany's gross electricity consumption in 2023. However, potential changes in these incentives, like adjustments to feed-in tariffs or tax credits in 2025, could significantly alter the attractiveness of future investments.

PCC SE faces regulatory hurdles, including the EU's REACH regulations, which mandate stringent chemical safety standards. Furthermore, evolving environmental directives in 2024, targeting emissions from chlor-alkali production, may necessitate substantial investments in new abatement technologies.

Geopolitical tensions, such as the ongoing conflict in Ukraine, continue to disrupt global supply chains and inflate energy costs for PCC SE. This has prompted strategic investments, like the planned chlor-alkali plant in the USA, aimed at enhancing supply chain resilience and reducing reliance on volatile international markets.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting PCC SE, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version of the PCC SE PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external challenges.

Economic factors

PCC SE's business trajectory for 2024 and 2025 is closely tied to global economic performance. While Germany and the broader EU are projected for modest growth, the United States and China are expected to exhibit more robust expansion.

The company has encountered significant competitive pressure and has had to implement price reductions in certain areas due to economic slowdowns in its primary sales regions. This economic climate directly impacts PCC SE's ability to maintain pricing power.

For its 2024-2026 budget, PCC SE is forecasting a 5% to 10% increase in sales for 2024. A portion of this anticipated growth is attributed to the successful completion of capacity expansion projects, enhancing its production capabilities.

Fluctuations in raw material and energy costs are a critical factor for PCC SE, especially impacting its chemical operations. For instance, the Chlorine & Derivatives segment is highly sensitive to these price swings.

In the first quarter of 2025, while lower commodity prices benefited the Trading & Services segment, other areas faced challenges. Adverse movements in raw material and energy expenses negatively affected earnings across different business units.

The significant impact of energy costs was evident at PCC SE's silicon plant in Iceland, which operated at only half capacity due to power shortages. This situation underscores the direct link between energy availability and operational efficiency.

Anticipated interest rate reductions are poised to benefit PCC SE by lowering borrowing costs and potentially boosting investment returns. The company demonstrated proactive capital management by redeeming bonds in February and April 2025, simultaneously issuing new debt to fund its long-term growth and investment portfolio.

PCC SE expects its EBITDA to net debt leverage ratio to temporarily rise in 2024 due to significant planned capital expenditures, with a return to its target leverage ratio projected for 2025.

Currency Fluctuations

Currency fluctuations present a significant economic factor for PCC SE. The company experienced substantial exchange rate losses, particularly in the first quarter of 2025, amounting to approximately €13 million. This volatility, especially concerning the US dollar and Polish złoty, directly impacted PCC SE's reported earnings.

These non-cash valuation effects stemming from currency movements can exert considerable pressure on pre-tax earnings. For instance, segments like Silicon & Derivatives are particularly susceptible to these swings, highlighting the need for robust currency risk management strategies.

- Q1 2025 Foreign Exchange Losses: Approximately €13 million.

- Key Currencies Impacting PCC SE: US Dollar and Polish Złoty.

- Affected Segments: Silicon & Derivatives particularly vulnerable.

- Impact on Earnings: Non-cash valuation effects weigh on pre-tax profit.

Market Demand and Competition

PCC SE operates in markets characterized by significant competition and prevailing economic softness, which has necessitated price adjustments in certain product categories. This challenging environment underscores the importance of strategic pricing and cost management for the company.

Despite these headwinds, PCC SE demonstrated resilience in Q1 2025, reporting increased sales driven by volume expansion across its Surfactants, Chlorine, Polyols, and Logistics divisions. For instance, the Surfactants segment saw a notable uptick in demand.

- Surfactants: Experienced increased sales volumes in Q1 2025.

- Chlorine: Contributed to overall sales growth through higher volumes.

- Polyols: Saw a positive impact on revenue from increased market penetration.

- Logistics: Benefited from higher activity levels, boosting segment sales.

The company's capacity to navigate evolving market conditions and optimize its operational expenses remains a critical factor in sustaining and improving its financial results within this highly competitive landscape.

Global economic performance is a key driver for PCC SE's outlook in 2024 and 2025, with projected modest growth in the EU contrasting with stronger expansion in the US and China.

The company has faced pricing pressures due to economic slowdowns, impacting its ability to maintain price levels, though Q1 2025 saw increased sales volumes in segments like Surfactants and Chlorine despite these challenges.

Interest rate trends are favorable, with anticipated reductions expected to lower borrowing costs for PCC SE, which proactively managed its capital structure by refinancing debt in early 2025.

Currency fluctuations, particularly involving the US Dollar and Polish Złoty, led to significant non-cash valuation losses of approximately €13 million in Q1 2025, affecting pre-tax earnings in sensitive segments like Silicon & Derivatives.

| Economic Factor | Impact on PCC SE | Data/Observation (Q1 2025 / Early 2025) |

|---|---|---|

| Global Economic Growth | Influences sales and demand | Modest EU growth, stronger US/China expansion |

| Inflation/Costs | Affects raw material and energy expenses | Adverse movements negatively impacted earnings; silicon plant operated at half capacity due to power shortages. |

| Interest Rates | Impacts borrowing costs and investment returns | Anticipated reductions beneficial; bonds redeemed and new debt issued for growth funding. |

| Currency Exchange Rates | Causes valuation losses and impacts earnings | €13 million in foreign exchange losses; US Dollar and Polish Złoty volatility noted. |

What You See Is What You Get

PCC SE PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PCC SE PESTLE analysis breaks down the political, economic, social, technological, legal, and environmental factors impacting the company. It offers a detailed strategic overview for informed decision-making.

Sociological factors

PCC SE, with its workforce of approximately 3,300 individuals, is significantly influenced by prevailing labor market dynamics. These include evolving employment rates, persistent wage growth pressures, and the critical availability of skilled professionals in its core sectors.

As of 2024-2025, the broader labor market demonstrates continued resilience, marked by steady job creation, though the pace of growth has moderated. However, regional disparities exist, with areas like Los Angeles County experiencing elevated unemployment rates, which could impact talent acquisition strategies.

The capacity of PCC SE to effectively recruit and retain specialized talent in the chemical, energy, and logistics industries is paramount. This is essential not only for maintaining current operational efficiency but also for supporting its strategic expansion initiatives in these competitive fields.

PCC SE's dedication to sustainability and ethical operations significantly influences how the public and its stakeholders view the company. Demonstrating genuine commitment to environmental stewardship and social fairness is no longer optional; it's a critical component of building trust and maintaining a positive corporate reputation.

In 2024, a significant majority of consumers, estimated at over 70%, stated they are more likely to purchase from brands that align with their values, particularly concerning environmental and social responsibility. This trend underscores the importance of PCC SE actively communicating its efforts in areas such as reducing its carbon footprint and supporting community initiatives.

Transparent reporting on these initiatives, including measurable progress on sustainability goals and active community engagement, is crucial for bolstering PCC SE's public image. For instance, companies that publish detailed sustainability reports, often aligned with global frameworks like the Global Reporting Initiative (GRI), tend to experience higher levels of consumer trust and investor confidence.

Consumer preferences are increasingly leaning towards sustainable products, a trend that directly impacts PCC SE's chemical and energy businesses. This growing demand is a significant sociological factor shaping market expectations and driving innovation.

PCC SE is actively responding to this by exploring higher-value applications for silicon metal, specifically targeting the booming electric vehicle market through its use in lithium-ion batteries. This strategic move aligns with the global push for greener technologies and demonstrates how evolving consumer values can spur new product development and market opportunities.

Health and Safety Standards in Operations

PCC SE, operating within the chemical and energy sectors, faces significant societal expectations regarding health and safety. These industries are inherently scrutinized for their potential impact on employee well-being and the environment. For instance, in 2024, the European Chemicals Agency (ECHA) reported a 5% increase in reported industrial accidents across the chemical sector, highlighting the ongoing need for robust safety measures.

Public and regulatory bodies demand high levels of industrial safety and environmental stewardship. This translates into continuous investment in advanced safety protocols, emergency preparedness, and environmentally responsible operational practices. The German Federal Institute for Occupational Safety and Health (BAuA) consistently emphasizes the importance of proactive risk management, with companies investing heavily in training and equipment to meet these evolving standards.

Ensuring a safe working environment and minimizing operational risks is a core priority for PCC SE. This commitment is reflected in their operational budgets, with significant allocations dedicated to safety training programs and the implementation of state-of-the-art safety technologies. In 2023, industry-wide spending on safety compliance and upgrades in the European chemical sector reached an estimated €15 billion, demonstrating the substantial financial commitment required.

- Employee Safety: PCC SE prioritizes comprehensive safety training and the provision of personal protective equipment to all employees, aiming to reduce workplace incidents.

- Community Protection: The company invests in advanced containment systems and emergency response plans to safeguard the surrounding communities from potential industrial hazards.

- Regulatory Compliance: Adherence to stringent national and international health and safety regulations, such as those set by OSHA in the US or similar bodies in Europe, is paramount to PCC SE's operations.

- Continuous Improvement: PCC SE actively monitors safety performance metrics and implements feedback loops to continuously enhance its safety standards and operational procedures.

Impact of Global Health Events (e.g., Pandemics)

Global health events, particularly the COVID-19 pandemic, have fundamentally reshaped the labor market and business operations. These events accelerated trends like remote work, forcing companies to adapt their infrastructure and management styles. Supply chains, already complex, faced unprecedented disruptions, highlighting vulnerabilities and the need for greater resilience. For PCC SE, understanding these shifts is crucial for navigating the post-pandemic economic landscape.

The long-term implications of these health crises continue to influence how businesses operate and how people work. Labor flexibility is now a key expectation for many employees, and companies are investing in digital tools to support remote and hybrid work models. Supply chain resilience has become a strategic imperative, with many organizations re-evaluating their sourcing and logistics to mitigate future shocks. For instance, a 2024 report indicated that 58% of companies globally have adjusted their supply chain strategies post-pandemic to enhance flexibility and reduce reliance on single sources.

- Labor Force Evolution: Increased demand for flexible work arrangements and a greater acceptance of remote work models.

- Remote Work Trends: Significant investment in digital collaboration tools and revised office space strategies.

- Supply Chain Disruptions: A heightened focus on building more resilient and diversified supply chains.

- Digital Work Performance: Ongoing evaluation and optimization of digital workflows and employee productivity in distributed environments.

Societal expectations regarding corporate responsibility, particularly in environmental and ethical practices, are increasingly influencing consumer behavior and investor sentiment. By 2024, over 70% of consumers indicated a preference for brands aligning with their values, pushing companies like PCC SE to proactively communicate their sustainability efforts and community engagement.

The demand for sustainable products is a significant sociological driver impacting PCC SE's chemical and energy sectors, prompting innovation. PCC SE's strategic focus on higher-value applications for silicon metal in the electric vehicle market exemplifies this alignment with evolving consumer values and the global shift towards greener technologies.

Societal emphasis on health and safety within the chemical and energy industries necessitates robust protocols and continuous investment. In 2024, reports showed a 5% increase in industrial accidents in the chemical sector, underscoring the critical need for companies like PCC SE to prioritize advanced safety measures and environmental stewardship to meet public and regulatory demands.

Technological factors

PCC SE's core business, centered on chemical raw materials like chlor-alkali products and polyols, is intrinsically linked to advancements in production technologies. These innovations are crucial for maintaining efficiency and competitiveness in a demanding market. The company's strategic approach involves consistent capital investment in both new green-field projects and upgrades to existing brown-field facilities to integrate these technological leaps.

The drive for more efficient and sustainable chemical manufacturing is a key technological factor influencing PCC SE. This includes exploring novel processes that reduce energy consumption and environmental impact, vital for long-term viability. For instance, in 2023, PCC SE announced significant investments in modernizing its chlor-alkali production facilities, aiming for a 15% increase in energy efficiency by 2025 through the adoption of advanced membrane technology.

PCC SE, as an energy producer, is significantly impacted by the swift evolution of renewable energy technologies. Advancements in solar photovoltaic (PV) and wind turbine efficiency directly influence the operational performance and economic viability of its clean energy projects. For instance, the global solar PV market is projected to see substantial growth, with installations expected to reach over 1,000 GW by the end of 2025, driving down costs and increasing output.

These technological leaps make renewable energy sources more competitive against traditional ones. Innovations in battery storage, crucial for grid stability, are also rapidly improving, with lithium-ion battery costs decreasing by over 90% in the last decade. PCC SE's strategic engagement with research institutions, such as its work with Fraunhofer ISE on silicon metal for solar applications, underscores its commitment to leveraging these technological advancements to optimize its energy portfolio and maintain a competitive edge.

PCC SE's logistics segment is poised to benefit significantly from automation and digitalization, enhancing both efficiency and competitive standing. The increasing integration of artificial intelligence and digital work performance, a trend observed across the labor market, presents a clear pathway to optimizing logistics operations. This includes implementing smart systems for better route planning and automating warehouse functions, potentially boosting transshipment volumes and market dominance, as demonstrated by successful adoption in Poland.

Research and Development (R&D) Investments

PCC SE's long-term strategy hinges on significant Research and Development (R&D) investments, especially in discovering novel, higher-value applications for its core products. A prime example is the exploration of silicon metal's potential in advanced lithium-ion batteries, a sector experiencing rapid technological advancement and increasing demand. This focus on innovation is vital for PCC SE to maintain its competitive edge within its specialized chemical markets.

While the broader pharmaceutical industry often garnishes headlines for its extensive R&D budgets, PCC SE's commitment to innovation within its niche chemical sectors is equally critical for sustained growth. The company actively pursues collaborations with leading research institutes and champions continuous process optimization to enhance efficiency and product quality. This dedication ensures they remain at the forefront of chemical innovation.

PCC SE's R&D efforts are strategically directed towards creating new market opportunities and improving existing product lines. This proactive approach to innovation is a key differentiator, allowing the company to adapt to evolving market demands and technological shifts. For instance, recent industry reports indicate a global surge in demand for battery-grade silicon, with market projections suggesting significant growth through 2025 and beyond, underscoring the strategic importance of PCC SE's silicon metal R&D.

Key aspects of PCC SE's R&D strategy include:

- Exploring advanced materials: Investigating silicon metal for use in next-generation lithium-ion batteries.

- Process optimization: Continuously refining production methods for greater efficiency and reduced environmental impact.

- Strategic partnerships: Collaborating with research institutions to leverage external expertise and accelerate innovation.

- Market-driven development: Focusing R&D on applications with high commercial potential and growing market demand.

Process Optimization and Efficiency

PCC SE consistently drives process optimization and efficiency across its operations. For instance, at PCC BakkiSilicon hf., significant efforts were directed towards enhancing its earnings through targeted process improvements.

Technological advancements play a crucial role in reducing waste, boosting product yields, and minimizing energy consumption. These improvements are fundamental for maintaining operational efficiency and effectively managing costs throughout PCC SE's diverse business segments.

Key areas of focus include:

- Automation: Implementing automated systems to streamline production and reduce manual labor, thereby increasing throughput and consistency.

- Energy Efficiency: Investing in energy-saving technologies and optimizing energy usage in production facilities, contributing to lower operating expenses and a reduced environmental footprint. For example, in 2023, PCC Rokita reported a reduction in specific energy consumption for key products through process adjustments.

- Waste Reduction: Developing and deploying technologies that minimize by-products and waste streams, leading to better resource utilization and lower disposal costs.

- Yield Improvement: Utilizing advanced process control and analytics to maximize the output of desired products from raw materials.

Technological advancements are pivotal for PCC SE's chemical production, driving efficiency and competitiveness through process optimization and new material exploration. The company's investment in modernizing chlor-alkali facilities, targeting a 15% energy efficiency boost by 2025 with advanced membrane technology, exemplifies this commitment. Furthermore, PCC SE is actively researching silicon metal's application in next-generation lithium-ion batteries, a sector projected for substantial growth through 2025, highlighting its focus on market-driven innovation and strategic partnerships.

Legal factors

PCC SE, deeply involved in the chemical and energy industries, faces a complex web of environmental regulations. These rules cover everything from controlling emissions and managing industrial waste to preventing pollution across its operations. For instance, in 2023, the European Union continued to strengthen its Green Deal initiatives, impacting chemical production and energy generation with stricter CO2 targets and waste reduction mandates.

Adhering to these environmental laws is not just a legal necessity but a core operational requirement for PCC SE. This demands ongoing investment in advanced environmental protection technologies and robust monitoring systems to ensure compliance. The company's commitment to sustainability is directly tied to its ability to meet evolving standards, such as those related to water quality and hazardous substance management in its production facilities.

Failure to comply with these critical environmental regulations carries substantial risks. Beyond the potential for significant financial penalties, such as those imposed for exceeding emission limits, non-compliance can severely damage PCC SE's reputation among stakeholders, including customers, investors, and the public. Maintaining a strong environmental record is therefore crucial for long-term business viability and market trust.

PCC SE's production of essential chemical raw materials, including chlor-alkali products, polyols, and silicon metal, demands rigorous adherence to product safety and quality standards. Compliance with national and international regulations covering chemical composition, safe handling, and clear labeling is paramount for consumer protection and continued market access.

PCC SE, with its workforce of around 3,300 employees, navigates a complex landscape of labor laws. These regulations cover critical areas like minimum wage, working hours, employee benefits, and the dynamics of union engagement. For instance, in Germany, where PCC SE has a significant presence, the minimum wage was raised to €12.41 per hour as of January 1, 2024, a factor that directly influences labor costs.

Evolving employment legislation presents ongoing challenges and opportunities. New mandates concerning workplace safety, such as stricter regulations on chemical handling in industrial settings, or changes to employee data privacy laws, can necessitate significant adjustments to operational procedures and increase compliance expenditures. These shifts require continuous monitoring and adaptation to ensure adherence and mitigate potential risks.

Competition Law and Anti-Trust Regulations

PCC SE operates within markets where competition law and anti-trust regulations are paramount. The company must actively ensure its business practices do not lead to monopolistic behavior or engage in unfair trade practices, which could attract regulatory scrutiny. This commitment to fair competition is crucial for maintaining market integrity and avoiding legal repercussions. For instance, in the European Union, the European Commission actively investigates and penalizes companies for anti-competitive agreements and abuses of dominant market positions, with significant fines levied in cases of violation.

PCC SE's acknowledgment of intense competition, sometimes on unfair terms, highlights the importance of vigilant monitoring and potential legal recourse. Navigating these regulations requires a proactive approach to compliance and a readiness to address any perceived breaches. The company's strategy likely involves staying abreast of evolving competition legislation across its operating regions to mitigate risks and ensure a level playing field.

- Regulatory Oversight: Competition authorities globally, including the European Commission and national bodies, actively enforce anti-trust laws.

- Compliance Burden: Companies like PCC SE face ongoing compliance requirements to avoid penalties for practices such as price-fixing or market manipulation.

- Market Dynamics: The perception of unfair competition necessitates a robust legal and compliance framework to protect PCC SE's market position.

International Trade Laws and Agreements

PCC SE navigates a complex web of international trade laws and agreements due to its extensive global operations, involving significant imports and exports. These regulations directly influence the cost and feasibility of cross-border transactions, impacting everything from raw material sourcing to finished product distribution.

The company strategically employs long-term off-take agreements, exemplified by its chlorine supply arrangements in the USA. This proactive legal structuring aims to mitigate market and sales risks inherent in international trade, ensuring supply chain stability and predictable revenue streams.

- Global Trade Landscape: Changes in trade policies, such as tariffs or import quotas, can materially affect PCC SE's profitability and operational efficiency in its international markets. For instance, shifts in US trade policy could impact the cost of chemicals imported or exported by the company.

- Risk Mitigation through Contracts: Long-term off-take agreements are crucial for securing predictable demand and supply, as demonstrated by PCC SE's U.S. chlorine contracts, which help buffer against market volatility.

- Regulatory Compliance: Adherence to evolving international trade regulations, including sanctions and trade facilitation measures, is paramount for maintaining seamless global operations and avoiding penalties.

PCC SE must navigate stringent product safety regulations, ensuring its chemical products meet rigorous national and international standards for composition, handling, and labeling. Compliance with these rules is essential for consumer protection and maintaining access to global markets. For example, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations in the EU continue to shape chemical production and trade, requiring extensive data submission and risk assessment for substances manufactured or imported.

The company's operations are also subject to evolving labor laws, impacting areas like minimum wage, working conditions, and employee benefits. As of January 1, 2024, Germany's minimum wage increased to €12.41 per hour, directly affecting labor costs for PCC SE's significant German workforce. Furthermore, new mandates on workplace safety, particularly concerning chemical handling, necessitate continuous adaptation of operational procedures.

PCC SE operates under strict competition and anti-trust laws, requiring vigilance against monopolistic practices and unfair trade. The European Commission actively enforces these regulations, imposing substantial penalties for violations such as price-fixing. Ensuring fair market practices is critical for PCC SE to maintain its market position and avoid legal repercussions.

Environmental factors

PCC SE's energy generation, particularly its renewable projects, is significantly shaped by evolving climate change policies. These policies, focused on decarbonization, directly impact the company's operational strategies and investment decisions in areas like silicon metal production.

The company's commitment to reducing its carbon footprint is evident in investments like PCC BakkiSilicon hf., a facility designed for more climate-friendly silicon metal production. This aligns with global trends pushing for lower emissions in industrial processes.

Navigating emissions targets and carbon pricing mechanisms remains a key challenge. For instance, the EU Emissions Trading System (ETS) price for 2024 has fluctuated, impacting operational costs for carbon-intensive activities, requiring PCC SE to adapt its compliance strategies.

The chemical industry, including PCC SE, is inherently tied to the availability of raw materials. Fluctuations in the supply and cost of these essential inputs, driven by factors like geopolitical instability or climate change impacts, pose a significant environmental and economic challenge. For instance, the global demand for key chemical feedstocks continues to rise, putting pressure on existing reserves.

PCC SE's strategy to secure its raw material supply, potentially through vertical integration or in-house production, directly addresses this environmental factor. This approach not only mitigates risks associated with external market volatility but also aligns with principles of sustainable sourcing. By controlling more of its supply chain, PCC SE can better manage the environmental footprint of its material acquisition, aiming for greater efficiency and reduced waste.

PCC SE is making significant strides in renewable energy, evident in its substantial investments. For instance, the company is a key player in the development of wind farms, with its subsidiary PCC Rokita operating a 30 MW wind park in Poland, contributing to the country's green energy mix. This focus on renewables not only aligns with global decarbonization efforts but also positions PCC SE to capitalize on the growing demand for sustainable energy solutions.

Waste Management and Pollution Control

PCC SE, as a chemical producer, faces significant responsibilities in waste management and pollution control. The company must navigate stringent environmental regulations governing the disposal of various industrial wastes and the mitigation of potential pollutants stemming from its manufacturing processes. This necessitates substantial investment in advanced pollution control technologies to ensure compliance and minimize ecological footprint.

Key areas of focus for PCC SE include the treatment of industrial wastewater and the control of air emissions. For instance, in 2023, the European Chemical Industry Council (Cefic) reported that its member companies invested approximately €10 billion in environmental protection measures, highlighting the scale of commitment required in this sector. Effective management of these aspects is crucial for maintaining operational licenses and public trust.

- Wastewater Treatment: Implementing advanced biological and chemical treatment processes to remove contaminants before discharge.

- Air Emission Control: Utilizing scrubbers, filters, and catalytic converters to reduce the release of harmful gases and particulate matter.

- Hazardous Waste Management: Ensuring safe and compliant disposal or recycling of hazardous materials generated during production.

- Regulatory Compliance: Adhering to national and international environmental standards, such as those set by the European Environment Agency (EEA).

Biodiversity and Ecosystem Protection

PCC SE's industrial activities, particularly those involving significant land use or water discharge, necessitate careful consideration of their impact on local biodiversity and ecosystems. For instance, in 2023, the company's operations, like many in the chemical sector, are subject to increasing scrutiny regarding their ecological footprint. Adhering to stringent environmental impact assessments and implementing proactive measures to protect natural habitats surrounding its facilities are crucial components of its environmental stewardship.

This focus is particularly pertinent for large-scale industrial sites and any new construction projects undertaken by PCC SE. For example, new plant developments often require detailed ecological surveys and mitigation plans to offset potential habitat disruption. The company's commitment to sustainability, as highlighted in its 2024 sustainability reports, includes initiatives aimed at minimizing negative impacts on sensitive environments.

- Biodiversity Impact Assessment: PCC SE is increasingly integrating biodiversity impact assessments into its project planning phases to identify and mitigate potential risks to local flora and fauna.

- Habitat Protection Measures: The company implements specific measures, such as creating buffer zones or restoring degraded land, around its operational sites to safeguard ecosystems.

- Water Discharge Management: Strict protocols are in place for managing water discharge, ensuring that effluent quality meets or exceeds regulatory standards to protect aquatic life.

- Sustainable Land Use: PCC SE aims to optimize land use for its facilities, minimizing encroachment on natural areas and exploring opportunities for ecological enhancement where feasible.

PCC SE's environmental strategy is deeply intertwined with global climate change policies and emissions regulations. The company's investments in renewable energy, such as its 30 MW wind park in Poland operated by PCC Rokita, directly address the need for decarbonization. Navigating the complexities of carbon pricing mechanisms, like the EU Emissions Trading System, remains a critical factor influencing operational costs for carbon-intensive processes.

The chemical industry's reliance on raw materials presents ongoing environmental challenges, with supply chain disruptions and rising feedstock costs impacting operations. PCC SE's approach to vertical integration and sustainable sourcing aims to mitigate these risks and reduce its overall environmental footprint.

Stringent regulations on waste management and pollution control demand significant investment in advanced technologies. PCC SE focuses on effective wastewater treatment and air emission control, mirroring industry-wide commitments, with European chemical companies investing billions annually in environmental protection.

Protecting local biodiversity and ecosystems is paramount for PCC SE's industrial activities. The company integrates ecological impact assessments into project planning and implements habitat protection measures, reflecting a growing emphasis on sustainable land use and minimizing ecological disruption.

PESTLE Analysis Data Sources

Our PESTLE Analysis for PCC SE is meticulously crafted using data from reputable sources like the International Energy Agency (IEA), European Union regulatory bodies, and leading market research firms specializing in the chemical sector. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting PCC SE.