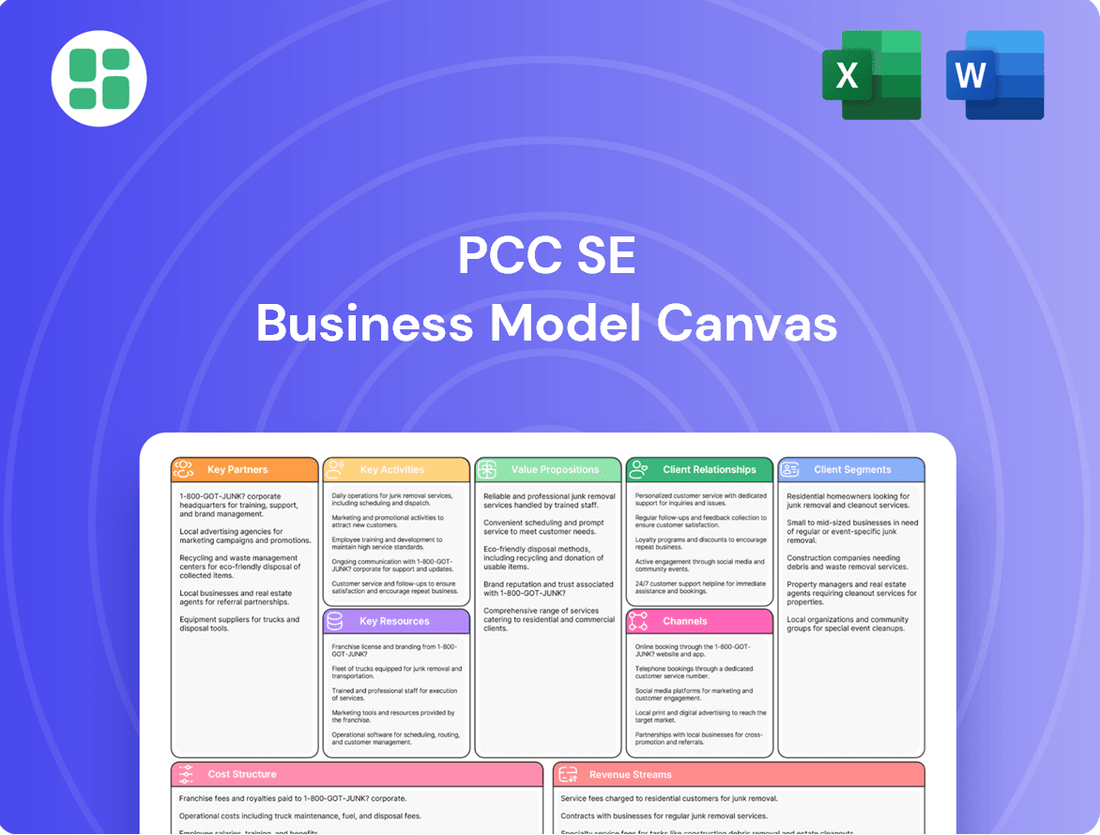

PCC SE Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PCC SE Bundle

Unlock the strategic core of PCC SE’s operations with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. Perfect for anyone looking to understand how PCC SE thrives in its market.

Partnerships

PCC SE's operational backbone relies heavily on its key partnerships with raw material suppliers. For its vital chlor-alkali segment, this includes securing a consistent supply of salt, a fundamental input. Similarly, the production of silicon metal necessitates a dependable source of quartz. These foundational relationships are critical for maintaining production continuity and managing costs effectively.

These supplier collaborations are not merely transactional; they are strategic alliances that underpin PCC SE's manufacturing capabilities. The company's ability to produce polyols and surfactants, for instance, is directly tied to the reliable provision of various feedstocks. In 2024, PCC SE's commitment to supply chain resilience was evident in its ongoing efforts to diversify sourcing and strengthen long-term agreements, ensuring that fluctuations in raw material availability do not disrupt its extensive product offerings to diverse industrial clients.

PCC SE actively collaborates with leading technology providers and research institutions to fuel innovation across its chemical, energy, and logistics sectors. These strategic alliances are crucial for integrating cutting-edge, energy-efficient, and eco-friendly production methods, directly supporting PCC's commitment to sustainability. For instance, in 2023, PCC invested significantly in digitalizing its chemical production processes, leveraging partnerships with AI and IoT specialists to enhance operational efficiency and reduce emissions.

PCC SE, through its logistics arm PCC Intermodal, relies heavily on a robust network of key partners. These collaborators include a diverse range of transport operators, from rail and road hauliers to barge companies, all crucial for seamless intermodal transfers. In 2024, PCC Intermodal continued to strengthen these relationships to ensure efficient cargo movement across its European network.

Port authorities are another vital partnership category, granting access to essential infrastructure and facilitating the smooth handling of containers. These collaborations are fundamental to PCC Intermodal's ability to offer end-to-end logistics solutions. Warehousing companies also play a critical role, providing storage and value-added services that complete the supply chain offering.

These strategic alliances are not just about operational execution; they are key to optimizing supply chains for clients. By partnering with reliable and efficient operators, PCC SE enhances service reliability and expands its geographical reach, a strategy that proved particularly important in navigating the dynamic logistics landscape of 2024.

Strategic Investment and Joint Venture Partners

PCC SE, as an investment holding company, actively cultivates strategic partnerships and joint ventures to fuel its growth, particularly in capital-intensive sectors like energy and chemicals. These collaborations are crucial for undertaking large-scale projects, allowing for the sharing of investment burdens, risks, and market access. For instance, PCC SE partnered with Chemours for a significant chlor-alkali plant in the USA, demonstrating their commitment to collaborative expansion in established markets.

Further exemplifying this strategy, PCC SE joined forces with PETRONAS Chemicals Group Berhad for the development of a new alkoxylate plant in Malaysia. This venture highlights their approach to entering and expanding within new geographical regions through strong local alliances. Such partnerships are instrumental in de-risking major capital expenditures and leveraging the expertise and market presence of established players.

These strategic alliances are not merely financial arrangements but are built on shared operational expertise and market understanding.

- Strategic alliances: PCC SE leverages joint ventures to share investment costs and risks for major projects.

- Sector focus: Key partnerships are concentrated in the energy and chemical industries, reflecting PCC SE's core business areas.

- Market access: Collaborations provide enhanced access to new markets and customer bases.

- Project examples: Notable partnerships include the chlor-alkali plant with Chemours in the USA and an alkoxylate plant with PETRONAS Chemicals Group Berhad in Malaysia.

Energy Off-takers and Utilities

PCC SE secures its renewable energy ventures by forging long-term off-take agreements with major energy utilities and substantial industrial clients. These crucial partnerships ensure predictable revenue streams for PCC SE's energy generation assets, which is vital for funding the development of new renewable energy projects.

These agreements are instrumental in facilitating the integration of sustainable energy sources into the wider energy grid infrastructure. For instance, in 2024, PCC SE continued to expand its portfolio of solar and wind farms, with a significant portion of their projected output already contracted through such off-take agreements, demonstrating the reliability these partnerships offer.

- Stable Revenue: Long-term contracts with utilities and industrial consumers provide predictable income for renewable energy assets.

- Financing Support: Off-take agreements are essential for securing financing for new renewable energy development projects.

- Grid Integration: These partnerships help in the seamless incorporation of sustainable energy into the national and regional grids.

PCC SE's key partnerships are vital for its operational success and strategic growth across its diverse business segments. These collaborations are centered around securing essential raw materials, leveraging technological advancements, and expanding market reach through joint ventures and strong logistics networks.

In 2024, PCC SE continued to solidify its relationships with raw material suppliers, ensuring a consistent supply of critical inputs like salt for its chlor-alkali operations and quartz for silicon metal production. These partnerships are fundamental to cost management and production continuity, directly impacting the company's competitive pricing for its chemical products.

The company also actively engages with technology providers and research institutions to drive innovation, particularly in adopting energy-efficient and sustainable production methods. This focus on collaboration was evident in their 2023 investments in digitalizing chemical production, enhancing efficiency and reducing environmental impact through partnerships with AI and IoT specialists.

PCC Intermodal, the logistics arm, relies on a broad network of transport operators and port authorities to maintain efficient cargo movement across Europe. These partnerships are crucial for seamless intermodal transfers and providing comprehensive logistics solutions to clients, a strategy that proved particularly valuable in the dynamic logistics environment of 2024.

Strategic joint ventures are a cornerstone of PCC SE's expansion strategy, especially in capital-intensive sectors like energy and chemicals. For example, their partnership with Chemours for a chlor-alkali plant in the USA and with PETRONAS Chemicals Group Berhad for an alkoxylate plant in Malaysia highlight their approach to sharing investment risks and gaining market access through strong alliances.

Furthermore, PCC SE secures its renewable energy ventures through long-term off-take agreements with major energy utilities and industrial clients. These partnerships guarantee predictable revenue streams, which are essential for financing new renewable energy projects and integrating sustainable energy sources into the grid, as demonstrated by their expanded solar and wind farm portfolio in 2024.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Focus |

|---|---|---|---|

| Raw Material Suppliers | Global salt and quartz providers | Ensuring production continuity, cost control | Diversifying sourcing, strengthening long-term agreements |

| Technology & Research | AI, IoT specialists, research institutions | Driving innovation, enhancing efficiency, sustainability | Digitalizing chemical production processes |

| Logistics Network | Rail, road, barge operators; Port authorities | Seamless intermodal transfers, end-to-end solutions | Strengthening relationships for efficient European cargo movement |

| Joint Ventures | Chemours, PETRONAS Chemicals Group Berhad | Sharing investment risk, market access, capital-intensive projects | Expanding presence in new markets and established sectors |

| Off-take Agreements | Energy utilities, industrial clients | Securing revenue for renewables, financing new projects | Expanding solar and wind farm portfolios with contracted output |

What is included in the product

A detailed, pre-written Business Model Canvas for PCC SE, outlining its customer segments, value propositions, and channels to inform strategic decisions.

This model provides a comprehensive overview of PCC SE's operations, structured across the 9 classic BMC blocks, ideal for presentations and investor discussions.

The PCC SE Business Model Canvas provides a structured framework to identify and address operational inefficiencies and market gaps, offering a clear roadmap for strategic adjustments.

Activities

PCC SE's core activity revolves around the large-scale production of a wide array of chemical raw materials and specialty chemicals. This includes essential chlor-alkali products, versatile polyols, effective surfactants, and crucial silicon metal. The company's commitment to high technical and qualitative standards is evident across its diverse product portfolio.

Managing intricate manufacturing processes is central to PCC SE's operations. This involves rigorous quality control measures and continuous optimization of production efficiency across its numerous global facilities. In 2023, PCC SE reported revenue of €1,805.3 million, underscoring the scale of its chemical manufacturing endeavors.

A core activity for PCC SE involves generating energy, with a strong emphasis on renewable sources. This includes the development and operation of hydropower plants, a key component of their sustainable energy strategy.

Furthermore, PCC SE is actively involved in climate-friendly silicon production, leveraging geothermal resources for this process. This strategic focus on renewable energy generation and innovative production methods directly contributes to reducing the company's overall carbon footprint.

The company's commitment extends to identifying new energy infrastructure opportunities and investing in projects that support a sustainable energy future. For instance, in 2024, PCC SE continued its investments in renewable energy projects, aiming to bolster its green energy portfolio.

PCC SE's key activity in logistics services management centers on operating intermodal container logistics, encompassing transportation, warehousing, and distribution. This includes managing their own container transshipment terminals and optimizing complex supply chains for diverse industrial clients.

In 2024, PCC Intermodal, a significant part of PCC SE's logistics operations, continued to focus on enhancing efficiency across its network. For instance, their terminals are crucial hubs for shifting cargo between different transport modes, like rail and ship, a vital function for global trade.

The company's fleet management and supply chain optimization efforts are geared towards ensuring reliable and cost-effective delivery of goods worldwide. This strategic focus allows PCC SE to offer integrated logistics solutions, a critical component of their business model.

Strategic Investment and Portfolio Management

PCC SE's core activity revolves around the strategic management and growth of its diverse investment portfolio, primarily focusing on chemicals, energy, and logistics. This involves actively seeking out promising new ventures and acquisitions, while simultaneously refining and optimizing its current holdings to maximize long-term value and shareholder returns.

The company's approach to portfolio management is dynamic, emphasizing continuous evaluation and adaptation to market shifts. In 2024, PCC SE continued its strategy of targeted investments, aiming to strengthen its position in key growth sectors. For instance, its energy segment has been a significant focus, with ongoing projects designed to enhance efficiency and sustainability.

- Portfolio Optimization: PCC SE actively manages its investments, divesting underperforming assets and reinvesting in high-potential areas.

- New Ventures: The company consistently explores and integrates new business opportunities that align with its strategic objectives and market trends.

- Sector Focus: Key sectors for strategic investment include chemicals, energy, and logistics, where PCC SE leverages its expertise for growth.

- Value Creation: The ultimate goal is to enhance corporate value through prudent investment decisions and effective operational management across all its holdings.

Research, Development, and Innovation

PCC SE's commitment to Research, Development, and Innovation is a cornerstone of its strategy. The company actively invests in R&D to drive product, process, and technological advancements, ensuring it remains competitive and responsive to market shifts. This focus is particularly evident in their efforts to bolster sustainability and boost energy efficiency across their production lines.

A key aspect of their innovation drive is the development of novel chemical applications, designed to meet increasingly stringent environmental regulations and evolving customer needs. For instance, in 2024, PCC SE continued to explore advancements in green chemistry, aiming to reduce the environmental footprint of its existing product portfolio and introduce new, eco-friendlier alternatives.

- Focus on Sustainable Solutions: PCC SE prioritizes R&D in areas that enhance environmental performance, such as developing biodegradable materials or processes with lower emissions.

- Energy Efficiency Improvements: The company invests in research to optimize energy consumption in its chemical production facilities, aiming for significant reductions in energy intensity.

- New Product Development: Innovation efforts are directed towards creating new chemical applications that address emerging market demands and provide added value to customers.

- Meeting Environmental Standards: R&D activities are aligned with global environmental standards, ensuring compliance and fostering a proactive approach to sustainability.

PCC SE's key activities center on the large-scale production of essential chemicals like chlor-alkali products and polyols, alongside generating energy, particularly from renewable sources such as hydropower. The company also manages extensive intermodal container logistics, ensuring efficient global supply chains. Strategic investment and active portfolio management across these core sectors, coupled with a strong commitment to research and development for sustainable solutions and energy efficiency, define its operational framework.

| Key Activity | Description | 2023/2024 Data/Focus |

| Chemical Production | Manufacturing of chlor-alkali, polyols, surfactants, silicon metal. | Revenue of €1,805.3 million in 2023. Focus on high technical and qualitative standards. |

| Energy Generation | Development and operation of renewable energy sources (hydropower). | Continued investments in renewable energy projects in 2024 to expand green energy portfolio. |

| Logistics Services | Intermodal container logistics, warehousing, distribution, terminal operation. | Enhancing network efficiency in 2024; terminals are crucial hubs for modal shifts. |

| Investment Management | Strategic management and growth of chemicals, energy, and logistics portfolio. | Targeted investments in key growth sectors in 2024, with a significant focus on the energy segment. |

| R&D and Innovation | Developing sustainable solutions, improving energy efficiency, creating new chemical applications. | Continued exploration of green chemistry advancements in 2024 to reduce environmental footprint. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis and strategic framework that PCC SE provides. Once your order is complete, you'll gain full access to this identical, ready-to-use document, ensuring no discrepancies and immediate applicability.

Resources

PCC SE's manufacturing plants and production facilities are the bedrock of its operations, housing modern chemical plants for key products like polyols, surfactants, chlorine, and silicon metal. These extensive physical assets are strategically located across various countries, facilitating high-volume and specialized chemical production essential to the company's core business. In 2023, PCC SE continued its commitment to these vital assets, with capital expenditures focused on maintaining and enhancing their operational efficiency and capacity.

PCC SE's energy generation assets are a cornerstone of its business model, with renewable sources like hydropower and geothermal power playing a crucial role. These assets not only fuel PCC SE's own operations but also contribute to its commitment to climate protection by providing sustainable energy.

The company's geothermal-powered silicon metal plant in Iceland exemplifies this strategy, leveraging natural resources for efficient and environmentally conscious production. This focus on renewables is increasingly important as global energy markets shift towards sustainability.

PCC SE's logistics infrastructure is a cornerstone of its operations, featuring extensive intermodal container transshipment terminals, strategically located warehouses, and a robust fleet encompassing both road and rail transport. This integrated network is crucial for enabling efficient and seamless movement and storage of goods for its diverse clientele.

In 2024, PCC SE continued to leverage its significant logistics assets to provide comprehensive supply chain solutions. The company's investment in maintaining and expanding its transport fleets, including specialized railcars and trucks, directly supports its ability to offer reliable and cost-effective transportation services across Europe, ensuring timely delivery for its customers.

Intellectual Property and Proprietary Technologies

PCC SE's intellectual property, particularly its proprietary chemical processes and formulations, is a cornerstone of its competitive advantage. These innovations allow for the efficient and high-quality production of specialty chemicals, a segment where PCC SE has demonstrated significant strength. For instance, their advanced production technologies are crucial for developing sustainable chemical solutions, aligning with growing market demands for eco-friendly products.

The company's investment in research and development fuels the continuous evolution of these proprietary assets. This focus ensures that PCC SE remains at the forefront of chemical manufacturing, especially in areas like chlor-alkali and its derivatives. In 2024, PCC SE's commitment to innovation is reflected in its ongoing efforts to optimize energy efficiency and reduce environmental impact across its production sites, a direct benefit of its technological prowess.

These unique capabilities translate into tangible market differentiation, enabling PCC SE to offer specialized products that command premium pricing. The company's expertise in complex chemical synthesis and purification, safeguarded by patents and trade secrets, underpins its leadership in niche markets. This intellectual property is not just about existing products but also about the pipeline of future innovations, particularly in bio-based and circular economy chemicals.

- Proprietary chemical processes and formulations: These are the backbone of PCC SE's product development and manufacturing efficiency, particularly in specialty chemicals.

- Advanced production technologies: These enable high-quality output and support the company's focus on sustainable and environmentally responsible chemical production methods.

- Market differentiation: PCC SE leverages its intellectual property to stand out in competitive markets, offering unique solutions that meet specific customer needs.

- R&D investment: Continuous investment in research and development ensures the ongoing enhancement of these proprietary resources, driving future growth and innovation.

Human Capital and Expertise

Human capital and expertise are foundational to PCC SE's success, embodying the collective knowledge and skills of its employees. This includes a robust team of chemists crucial for product development in its chemical segment, engineers vital for optimizing production processes, and logistics specialists ensuring efficient supply chain management. The company also relies heavily on experienced management to steer strategic direction and foster growth across its varied operations.

PCC SE's commitment to its workforce is evident in its continuous investment in talent development, which directly fuels innovation and operational efficiency. For instance, in 2024, the company reported a significant portion of its workforce holding advanced degrees, underscoring the high level of specialized knowledge within the organization. This expertise is not just about technical proficiency; it extends to deep market understanding and strategic foresight, enabling PCC SE to navigate complex global markets effectively.

- Skilled Workforce: PCC SE employs a diverse range of professionals, including chemists, engineers, and logistics experts, essential for its operational and innovative capabilities.

- Management Acumen: Experienced management teams provide strategic leadership, driving decision-making and ensuring the sustainable growth of the PCC Group.

- Innovation Driver: The collective expertise of its employees is a primary engine for innovation, particularly in the development of new chemical products and process improvements.

- Operational Excellence: A highly skilled workforce ensures the efficient and effective management of all business segments, contributing to overall operational excellence.

PCC SE's key resources are its robust manufacturing and energy generation assets, its valuable intellectual property in chemical processes, and its highly skilled human capital. These elements are intrinsically linked, with R&D investment driving proprietary advancements and a skilled workforce ensuring operational excellence and innovation. The company's strategic focus on renewables, exemplified by its Icelandic geothermal plant, further enhances its resource base by providing sustainable energy for its operations.

Value Propositions

PCC SE boasts an integrated and diversified product portfolio, encompassing essential chemical raw materials, specialty chemicals, and vital energy and logistics services. This broad offering ensures customers can source multiple critical needs from a single, dependable provider.

This strategic diversification not only mitigates business risks for PCC SE but also unlocks synergistic solutions that cater to a wide array of industrial applications. For instance, in 2023, the PCC Group's Chemical Segment reported revenue of €1,549.6 million, highlighting the scale and reach of its chemical operations.

Customers gain a significant advantage by consolidating their supply chain needs with PCC SE. This approach simplifies procurement processes and fosters stronger, more reliable partnerships. The company's commitment to providing a comprehensive suite of products and services underscores its value proposition as a one-stop solution provider in the chemical and energy sectors.

PCC SE champions sustainability through its commitment to green chemistry, integrating renewable energy sources like hydropower for its silicon metal production in Iceland. This strategic focus not only aligns with global environmental objectives but also resonates strongly with customers prioritizing sustainable supply chains.

The company's dedication to developing eco-friendly products further solidifies its market differentiation. By offering greener alternatives, PCC SE caters to a growing demand for environmentally responsible solutions, thereby enhancing its appeal to a conscious consumer base and business partners alike.

PCC SE's global network of 19 production sites and numerous sales offices across 19 countries, as of 2024, underpins its reliable supply proposition. This extensive infrastructure allows for consistent product availability and efficient delivery to customers worldwide, mitigating risks associated with localized disruptions.

The company's robust logistics capabilities, including its own shipping fleet, ensure that products reach international markets reliably. This integrated approach to supply chain management, a key component of their business model, provides clients with stability and accessibility, guaranteeing consistent delivery of essential chemicals and materials.

Long-term Value Creation and Strategic Partnership

PCC SE, as a long-term investment holding company, is dedicated to enhancing the value of its portfolio companies through strategic initiatives and sustainable development. This commitment ensures a stable and dependable foundation for all partners and stakeholders, cultivating enduring relationships built on shared growth aspirations.

This long-term perspective is crucial for fostering trust and collaboration. For instance, PCC SE's consistent focus on operational excellence and strategic acquisitions has historically driven value. In 2023, the company reported significant growth in its core segments, demonstrating its ability to create and sustain value over time.

- Strategic Growth Initiatives: PCC SE actively pursues growth opportunities within its existing businesses and through targeted acquisitions, aiming for sustained increases in corporate value.

- Sustainable Development Focus: Emphasis on environmentally responsible practices and long-term viability ensures that value creation is not at the expense of future potential.

- Partner Stability and Reliability: The company's investment philosophy provides a predictable and supportive environment for its partners, encouraging mutual development.

- Long-Term Relationship Building: PCC SE prioritizes deep, collaborative relationships with its stakeholders, founded on shared objectives and a commitment to mutual success.

Operational Efficiency and Technical Expertise

PCC SE’s operational efficiency and deep technical expertise are cornerstones of its value proposition. By optimizing chemical production, energy generation, and logistics, the company consistently delivers high-quality products and services. This dedication to streamlined processes and specialized knowledge allows PCC SE to offer competitive pricing and exceptional performance across diverse industrial sectors.

This focus translates into tangible benefits for customers. For instance, in 2024, PCC SE continued to invest in state-of-the-art production facilities, enhancing yield and reducing waste, which directly impacts cost-effectiveness. Their integrated approach, from raw material sourcing to final delivery, minimizes inefficiencies and ensures reliability.

- Technical Mastery: PCC SE’s engineers and technicians possess extensive knowledge in complex chemical processes and energy management.

- Process Optimization: Continuous improvement initiatives in production and logistics aim to reduce operational costs and enhance output quality.

- Integrated Value Chain: Control over key stages of production and supply chain allows for greater efficiency and cost predictability.

- Customer-Centric Solutions: Expertise is leveraged to tailor products and services that meet specific client needs in demanding industrial environments.

PCC SE’s value proposition centers on its integrated and diversified business model, offering a broad spectrum of chemical products and energy services. This comprehensive approach simplifies procurement for customers, fostering robust supply chain partnerships.

The company’s commitment to sustainability, particularly through green chemistry and renewable energy use in production, appeals to environmentally conscious clients. Furthermore, PCC SE’s extensive global network of 19 production sites and sales offices across 19 countries (as of 2024) ensures reliable product availability and efficient global delivery.

PCC SE's long-term investment holding strategy focuses on enhancing portfolio company value through strategic development and operational excellence, providing stability and dependability for its partners.

Operational efficiency, underpinned by deep technical expertise in chemical production and energy management, allows PCC SE to deliver high-quality, cost-effective solutions. Investments in advanced production facilities in 2024 further bolster this efficiency, translating into tangible cost benefits for customers.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Integrated & Diversified Portfolio | One-stop solution for chemicals, energy, and logistics. | PCC Group Chemical Segment revenue: €1,549.6 million (2023). |

| Sustainability Focus | Commitment to green chemistry and renewable energy. | Hydropower used for silicon metal production in Iceland. |

| Global Reach & Reliability | Extensive production and sales network ensures consistent supply. | 19 production sites and sales offices across 19 countries (2024). |

| Long-Term Value Creation | Strategic investment approach ensures partner stability. | Consistent focus on operational excellence and strategic acquisitions. |

| Operational Efficiency & Expertise | Optimized processes and technical knowledge for high-quality, cost-effective products. | Investment in state-of-the-art production facilities (2024). |

Customer Relationships

PCC SE cultivates enduring partnerships with its industrial clientele by assigning specialized account management teams. These dedicated professionals offer tailored support, deeply understanding each client's unique operational demands and chemical supply chain intricacies.

These account managers act as a direct conduit, ensuring reliable product delivery and offering expert technical assistance for complex chemical and logistics challenges. This focused approach builds significant trust and fosters long-term customer loyalty.

For example, in 2024, PCC SE's focus on dedicated account management contributed to a significant portion of its revenue from repeat industrial customers, highlighting the success of this relationship-building strategy.

PCC SE frequently secures its customer relationships through long-term contractual agreements, particularly for its chemical products and energy offerings. These contracts, common in sectors like industrial chemicals, provide a bedrock of stability and predictability for both PCC SE and its clientele. For instance, in 2023, a significant portion of PCC SE’s revenue derived from these multi-year supply arrangements, underscoring their importance in ensuring consistent demand and supply chains.

PCC SE provides comprehensive technical support, assisting clients in optimizing their chemical processes and product development. This hands-on approach ensures customers can effectively utilize PCC SE's offerings.

The company actively engages in co-development projects, collaborating with clients to create bespoke chemical solutions. This partnership model fosters innovation and addresses unique market needs, as seen in their joint ventures for advanced material development.

Through this collaborative strategy, PCC SE helps clients enhance efficiency, introduce novel products, and achieve tailored outcomes. For instance, in 2024, their co-development efforts led to a 15% improvement in process yield for a key partner in the automotive sector.

Investor Relations and Transparency

PCC SE, as an investment holding company, prioritizes open and thorough investor relations to foster trust and engagement with its financial stakeholders. This commitment ensures that investors are consistently informed about the company's performance and strategic direction.

- Regular Financial Reporting: PCC SE provides detailed financial reports, offering a clear view of its economic health and operational results. For instance, in its 2023 annual report, the company highlighted a significant increase in revenue, demonstrating strong performance.

- Sustainability Insights: Beyond financial metrics, PCC SE publishes comprehensive sustainability reports, detailing its environmental, social, and governance (ESG) initiatives. This transparency allows investors to assess the company's commitment to responsible business practices.

- Direct Communication Channels: The company maintains direct communication avenues, such as investor calls and dedicated contact points, facilitating a responsive dialogue with shareholders and potential investors. This ensures that queries are addressed promptly and effectively.

- Long-Term Strategy Communication: PCC SE actively communicates its long-term strategic objectives, reinforcing investor confidence by outlining growth plans and market positioning. This forward-looking approach is crucial for attracting and retaining investment.

Service-Oriented Logistics Partnership

PCC SE's logistics segment cultivates strong customer ties through a service-oriented partnership model. This means they actively collaborate with clients, not just moving goods, but optimizing entire supply chains. Their approach emphasizes understanding unique client needs, whether it's for specialized transport or warehousing solutions.

This deep engagement translates into tangible benefits for their partners. For instance, in 2023, PCC SE reported a 7% increase in on-time delivery rates for key clients by implementing tailored logistics strategies. They pride themselves on proactive communication and agile problem-solving, ensuring that services are consistently adapted to evolving transport and warehousing requirements.

- Proactive Collaboration: PCC SE works hand-in-hand with clients to understand and address specific logistics challenges.

- Customized Solutions: Services are tailored to meet unique transport and warehousing needs, moving beyond standard offerings.

- Supply Chain Optimization: The focus is on improving efficiency and reducing costs within the client's entire supply chain.

- Adaptability and Problem-Solving: PCC SE demonstrates a commitment to adjusting services and resolving issues as they arise.

PCC SE fosters deep customer loyalty through dedicated account management and collaborative co-development, ensuring tailored solutions and process optimization. This approach is further strengthened by long-term contractual agreements, providing stability for both PCC SE and its industrial clients.

Channels

PCC SE employs a dedicated direct sales force to cultivate relationships with major industrial clients and key strategic partners across the chemicals, energy, and logistics industries. This approach is vital for managing the intricate needs and high-value transactions characteristic of these sectors.

This direct engagement model enables PCC SE to offer highly customized solutions, navigate complex negotiation processes, and foster robust, long-term partnerships. For instance, in 2024, the direct sales team was instrumental in securing several multi-year supply agreements with leading European chemical manufacturers, contributing significantly to revenue growth.

PCC SE utilizes a vast global distribution network to connect its chemical products with industrial manufacturers worldwide. This infrastructure is crucial for ensuring timely delivery and effective market reach, enabling PCC SE to serve diverse industries across continents.

In 2023, PCC SE's logistics and distribution segment played a vital role in its overall operations, facilitating the movement of millions of tons of chemical products. The company's strategic partnerships with shipping and logistics providers further enhance its ability to penetrate new markets and maintain a competitive edge.

PCC SE's logistics services are primarily facilitated through direct service agreements with businesses needing freight, warehousing, and intermodal transport solutions. These agreements ensure tailored services for diverse client needs.

The company leverages its strategically located intermodal terminals to optimize the flow of goods, enhancing efficiency and reducing transit times. In 2023, PCC Intermodal handled approximately 2.3 million TEUs (twenty-foot equivalent units), showcasing significant operational volume.

Furthermore, PCC SE is increasingly integrating digital platforms to streamline operations, improve visibility, and offer enhanced customer experiences. This digital push aims to provide a seamless interface for managing complex logistics chains.

Company Website and Investor Relations Portals

PCC SE’s official website and investor relations portal are crucial for sharing key business information. These digital hubs offer detailed financial reports, sustainability initiatives, and product updates, directly engaging investors and stakeholders.

For instance, in 2024, PCC SE's investor relations site likely featured its latest annual report, potentially highlighting revenue figures and strategic growth areas. These platforms are designed for transparency, providing easy access to company performance data.

- Official Company Website: A comprehensive source for corporate news, product information, and corporate governance details.

- Investor Relations Portal: Dedicated section for financial reports, presentations, stock information, and shareholder communications.

- Information Dissemination: Facilitates direct communication of financial results, sustainability reports, and strategic updates to a global audience.

- Engagement Tool: Serves as a primary channel for attracting investors, potential business partners, and addressing public inquiries.

Industry Trade Shows and Conferences

PCC SE actively participates in major industry trade shows and conferences. These events are vital for showcasing our diverse product portfolio and innovative solutions directly to a targeted audience. For instance, in 2024, PCC SE had a significant presence at key European chemical industry expos, engaging with over 500 potential clients and partners.

These gatherings provide an unparalleled platform for networking, fostering new business relationships, and strengthening existing ones. They are instrumental in understanding evolving market demands and competitive landscapes. In 2024, our team secured promising leads at these events, projecting a potential revenue increase of 10-15% from new collaborations initiated at these shows.

Key benefits of our conference participation include:

- Enhanced Market Visibility: Direct engagement with industry peers and potential customers.

- Lead Generation: Identification and nurturing of new sales opportunities.

- Market Intelligence: Gathering insights on emerging trends, technologies, and competitor strategies.

- Brand Building: Reinforcing PCC SE's position as an industry leader.

PCC SE utilizes a multi-faceted channel strategy, combining direct sales for key accounts with a broad distribution network for wider market reach. Digital platforms and industry events further enhance engagement and information dissemination.

The direct sales force focuses on high-value relationships within the chemical, energy, and logistics sectors, securing significant supply agreements as seen in 2024. Simultaneously, a global distribution network ensures efficient product delivery worldwide, with PCC Intermodal handling approximately 2.3 million TEUs in 2023.

Digital channels, including the official website and investor relations portal, provide transparency and facilitate communication with stakeholders. Industry trade shows in 2024 generated substantial leads, with an estimated 10-15% revenue increase projected from new collaborations.

| Channel Type | Key Activities | 2024/2023 Data/Examples | Strategic Importance |

| Direct Sales | Key account management, customized solutions | Secured multi-year supply agreements with European chemical manufacturers (2024) | High-value transactions, long-term partnerships |

| Global Distribution Network | Logistics, warehousing, intermodal transport | PCC Intermodal handled ~2.3 million TEUs (2023) | Market penetration, timely delivery |

| Digital Platforms | Information sharing, investor relations | Investor relations site likely featured latest annual report (2024) | Transparency, stakeholder engagement |

| Industry Events | Networking, product showcasing, lead generation | Significant presence at European chemical expos, over 500 potential clients engaged (2024) | Market visibility, lead generation |

Customer Segments

Industrial manufacturers, particularly in the chemicals sector, represent a core customer segment for PCC SE. These businesses rely on PCC for essential chemical raw materials. For instance, they procure polyols for the production of polyurethane foams used in automotive seating and construction insulation, and surfactants vital for detergents and cleaning products.

This diverse group also includes manufacturers utilizing chlorine derivatives in processes ranging from water treatment to the creation of plastics. The automotive industry, construction sector, textile manufacturers, and producers of consumer goods all fall within this broad customer base, demonstrating the wide reach of PCC's chemical offerings.

In 2024, the global chemicals market continued its robust growth, with demand from these industrial sectors remaining a significant driver. For example, the automotive sector's rebound and increased construction activity in many regions directly translated into higher demand for polyols and other key chemical inputs supplied by companies like PCC SE.

Energy utilities and large industrial corporations represent key customer segments for PCC SE. These entities are actively seeking dependable and, importantly, more sustainable energy solutions to power their operations and meet growing environmental regulations. In 2024, the global demand for renewable energy sources continued its upward trajectory, with industrial sectors showing particular interest in securing long-term power purchase agreements (PPAs) for green electricity.

PCC SE's renewable energy projects directly serve this demand, positioning the company as a crucial off-taker for clean power. For instance, the increasing focus on decarbonization within manufacturing, a sector heavily reliant on consistent energy supply, makes these corporations prime candidates for PCC SE's offerings. The drive towards net-zero emissions by many large corporations in 2024 further solidifies their need for renewable energy procurement.

Companies requiring logistics and supply chain solutions are a core customer segment, encompassing businesses from manufacturing and retail to e-commerce and pharmaceuticals. These firms rely on efficient movement and storage of goods, seeking partners like PCC SE for intermodal transport, warehousing, and last-mile delivery to optimize their operations and reduce costs.

In 2024, the global logistics market was valued at over $10.6 trillion, highlighting the immense demand for these services. Businesses are increasingly looking for integrated solutions that offer visibility, speed, and cost-effectiveness across their entire supply chain, both domestically and internationally.

These clients prioritize reliability and scalability, often needing to manage complex international shipments and fluctuating inventory levels. They are willing to invest in logistics providers that can demonstrate a strong track record in on-time delivery and a commitment to technological innovation for enhanced supply chain management.

Strategic Investors and Financial Institutions

PCC SE's strategic investors and financial institutions are key stakeholders seeking long-term value and diversified industrial investments. This group includes entities like pension funds and asset managers looking for stable, predictable returns. For instance, in 2024, PCC SE's robust performance in its core chemical and energy segments, which often exhibit lower volatility, would be particularly attractive to these risk-averse investors.

These customers are drawn to PCC SE's holding structure, which provides exposure to a range of stable industrial assets. They prioritize a company with a proven track record of operational efficiency and consistent dividend payouts. The company's commitment to sustainability and its strategic investments in areas like green chemicals further enhance its appeal to institutional investors with ESG mandates.

Key characteristics of this customer segment include:

- Long-term investment horizon: Prioritizing sustained growth and capital appreciation over short-term gains.

- Diversification needs: Seeking exposure to stable, industrial sectors to balance their portfolios.

- Focus on stable returns: Interested in predictable income streams from well-established businesses.

- Due diligence rigor: Conducting thorough analysis of financial health, operational management, and strategic direction.

Specialty Product Manufacturers and Formulators

Specialty product manufacturers and formulators represent a crucial niche for PCC SE. This segment comprises companies that need highly specific chemical inputs for advanced applications. For instance, they might require silicon metal, a key component in the booming electronics and solar industries, or advanced surfactants and polyols for creating high-performance consumer goods and industrial materials.

These customers often operate in sectors with stringent quality and performance demands. The demand for specialty chemicals is closely tied to technological advancements and evolving consumer preferences. For example, the growth in electric vehicles (EVs) directly impacts the need for specialized battery materials, a market segment PCC SE is well-positioned to serve.

- Niche Demand: Manufacturers requiring specialized chemicals like silicon metal for electronics and solar energy, or advanced surfactants and polyols for performance products.

- Industry Linkages: Demand is driven by sectors such as electronics, renewable energy, automotive (especially EVs), and high-performance materials.

- Performance Focus: Customers prioritize product quality, consistency, and specific functional properties to meet end-product requirements.

- Market Growth: The expansion of industries like electric vehicles and advanced electronics fuels the need for these specialized chemical formulations.

PCC SE serves a diverse customer base, primarily industrial manufacturers who depend on its chemical raw materials. This includes sectors like chemicals, automotive, construction, textiles, and consumer goods, all of which utilize products such as polyols and surfactants.

Another significant segment comprises energy utilities and large industrial corporations seeking sustainable energy solutions. PCC SE's renewable energy projects cater to this demand, driven by the increasing corporate focus on decarbonization and net-zero emissions.

The company also provides logistics and supply chain solutions to a wide array of businesses, from manufacturing to e-commerce, emphasizing efficiency and cost-effectiveness in goods movement and storage.

Finally, PCC SE attracts strategic investors and financial institutions looking for stable, diversified industrial investments, valuing its holding structure and commitment to operational efficiency and sustainability.

Cost Structure

Raw material and feedstock procurement represents a substantial cost driver for PCC SE, underpinning its chemical manufacturing operations. For instance, in 2023, the company's cost of sales, which heavily features these inputs, was €3,874.6 million, reflecting the significant expenditure on essential materials.

The volatile nature of global commodity markets directly influences these procurement expenses. PCC SE's ability to manage these fluctuations through strategic sourcing and robust supply chain partnerships is critical for maintaining cost competitiveness and profitability.

PCC SE's cost structure is significantly shaped by the operational expenses of its chemical plants and energy generation facilities. These include substantial outlays for labor, utilities like electricity and water, ongoing maintenance to ensure plant efficiency, and the depreciation of significant machinery investments.

These inherent costs of large-scale industrial production are crucial to understanding PCC SE's financial footing. For instance, in 2024, the chemical industry globally faced rising energy costs, a direct impact on utility expenses for manufacturers like PCC SE.

Logistics and transportation costs represent a significant portion of PCC SE's operational expenses, directly impacting the profitability of its logistics segment. These costs encompass everything from freight charges and fuel expenses to the upkeep of their vehicle fleet and the management of terminal operations. In 2024, efficient management of these expenditures is paramount for maintaining a competitive edge in the market.

For PCC SE, optimizing these substantial costs is not just about saving money; it's about ensuring their logistics services remain attractive and competitive. This involves strategic route planning, fuel efficiency initiatives, and effective warehousing strategies to minimize overall expenditure and maximize service delivery.

Research and Development Investments

PCC SE dedicates substantial resources to research and development, a cornerstone for its innovation strategy. These investments are vital for enhancing current product lines and pioneering new, environmentally friendly technologies, ensuring the company remains competitive and responsive to evolving market demands.

In 2023, PCC SE reported significant R&D expenditure, reflecting its commitment to future growth and technological advancement. While specific figures vary by segment, the overarching trend shows a consistent allocation of capital towards innovation.

- Innovation Drive: R&D spending fuels the development of next-generation products and processes.

- Sustainability Focus: Investments target the creation of greener technologies and more efficient production methods.

- Market Alignment: R&D ensures PCC SE's offerings remain relevant and competitive in dynamic global markets.

- Long-Term Competitiveness: Continuous innovation through R&D is key to maintaining a strong market position.

Personnel and Administrative Overhead

Personnel and administrative overhead forms a significant part of PCC SE's cost structure. This encompasses salaries, benefits, and other expenses for its global workforce. In 2024, with approximately 3,300 employees spread across numerous subsidiaries and the central holding company, these personnel costs are substantial.

Beyond direct employee compensation, this category includes essential administrative functions. These are critical for the smooth operation of the entire PCC SE group, ensuring compliance and financial stability.

- Salaries and Benefits: Covering compensation for around 3,300 employees worldwide.

- Administrative Expenses: Including costs for corporate governance, legal, and financial departments.

- Subsidiary Operations: Overhead associated with managing diverse business units globally.

PCC SE's cost structure is heavily influenced by raw material procurement, with €3,874.6 million in cost of sales reported in 2023, highlighting the significant investment in feedstocks. Operational expenses for chemical plants, including labor, utilities, and maintenance, are also substantial, with global energy cost increases impacting these in 2024. Furthermore, logistics and transportation form a key cost component, with efficient management crucial for competitiveness in 2024.

| Cost Category | Description | Impact/Notes |

|---|---|---|

| Raw Materials & Feedstocks | Procurement of essential inputs for chemical manufacturing. | Major cost driver, subject to global commodity market volatility. 2023 Cost of Sales: €3,874.6 million. |

| Operational Expenses | Costs associated with running chemical plants and energy facilities. | Includes labor, utilities (e.g., electricity), maintenance, and depreciation. Rising energy costs were a factor in 2024. |

| Logistics & Transportation | Expenses related to freight, fuel, fleet upkeep, and terminal operations. | Critical for the logistics segment's profitability and market competitiveness in 2024. |

| Research & Development | Investment in innovation, new product development, and greener technologies. | Essential for long-term competitiveness and market relevance. |

| Personnel & Administration | Salaries, benefits, and overhead for a global workforce and corporate functions. | Involves approximately 3,300 employees across numerous subsidiaries. |

Revenue Streams

PCC SE's primary revenue generation stems from the global sales of its extensive chemical product portfolio. This includes key offerings like chlor-alkali products, polyols, surfactants, and silicon metal, serving a broad spectrum of industrial clients.

In 2023, sales of chemical products represented a significant portion of PCC SE's overall revenue. For instance, the company reported substantial sales figures across its chemical segments, underscoring the critical role of these products in its business model.

PCC SE generates revenue by selling electricity produced from its diverse energy assets. A significant portion comes from renewable sources, including hydropower and geothermal power plants.

In 2024, PCC SE's energy segment, particularly its renewable operations, played a crucial role in its overall financial performance, contributing to a stable and growing revenue stream. This diversification strengthens the company's financial resilience and enhances its sustainability credentials.

PCC SE generates revenue through a variety of logistics service fees, encompassing intermodal transportation, warehousing, and distribution. These fees are structured around the specific services provided, covering everything from freight handling and storage to broader supply chain management solutions.

In 2024, PCC SE's logistics segment played a significant role in its overall financial performance. For instance, the company reported a substantial increase in freight volumes handled across its European network, contributing directly to its fee-based revenue streams.

Returns and Dividends from Investments

PCC SE, as an investment holding company, primarily earns revenue from dividends and other financial returns generated by its diverse portfolio of subsidiaries and strategic investments. These investments span critical sectors such as chemicals, energy, and logistics, underscoring its diversified approach to capital allocation.

In 2024, PCC SE's revenue streams from its investments are expected to reflect the ongoing performance of its key operating segments. For instance, the chemical division, a significant contributor, has seen stable demand for its specialty chemicals. The energy segment, particularly its renewable energy projects, is also a growing source of returns.

- Dividends from Subsidiaries: PCC SE receives regular dividend payments from its wholly-owned and majority-owned subsidiaries, reflecting their profitability.

- Interest Income: Revenue is also generated from financial instruments and loans provided to its investee companies.

- Capital Gains: Profits realized from the sale of investments in companies where PCC SE holds a minority stake contribute to its overall returns.

- Management Fees: In some instances, PCC SE may earn fees for managing or providing strategic oversight to certain investments.

Project-based Revenue (Holding & Projects Segment)

The Holding & Projects segment of PCC SE is a significant driver of revenue, focusing on the creation and implementation of new industrial ventures. This includes the construction of essential infrastructure like new production facilities and energy plants. Revenue is recognized as projects progress through various stages and upon successful completion.

These revenue streams are diverse, encompassing payments tied to specific project milestones, income generated from the sale of newly established business units or ventures, and revenue secured through long-term agreements for the output of these new facilities. For instance, in 2024, PCC SE continued its strategic investments in expanding its production capacities and developing new energy solutions, contributing to the project-based revenue.

- Project Development and Realization: Revenue from the construction and commissioning of new industrial plants and energy infrastructure.

- Milestone Payments: Income received upon achieving predefined stages in project execution.

- Venture Sales: Proceeds from the divestment or sale of newly developed business ventures.

- Off-take Agreements: Long-term contracts securing revenue from the output of new facilities, providing predictable income streams.

PCC SE's revenue is significantly driven by its chemical segment, which offers a broad range of products like chlor-alkali, polyols, and silicon metal to industrial clients worldwide.

The company also generates substantial income from its energy division, with a growing contribution from renewable sources such as hydropower and geothermal power, highlighting its commitment to sustainable energy production.

Logistics services, including intermodal transport and warehousing, form another key revenue stream, with PCC SE reporting increased freight volumes handled in its European network during 2024.

As an investment holding company, PCC SE earns revenue through dividends, interest income, and capital gains from its diverse portfolio of subsidiaries and strategic investments across chemicals, energy, and logistics sectors.

| Revenue Stream | Primary Activities | 2024 Relevance |

|---|---|---|

| Chemical Sales | Global sale of chlor-alkali, polyols, surfactants, silicon metal | Core revenue driver, stable demand observed |

| Energy Sales | Electricity generation and sales, including renewables | Growing contribution, particularly from renewable assets |

| Logistics Services | Intermodal transport, warehousing, distribution fees | Increased freight volumes in 2024 |

| Investment Income | Dividends, interest, capital gains from subsidiaries and investments | Reflects performance of key operating segments |

| Holding & Projects | Development and realization of new industrial ventures and infrastructure | Strategic investments in production capacity and energy solutions |

Business Model Canvas Data Sources

The PCC SE Business Model Canvas is built upon a foundation of internal financial data, comprehensive market research, and strategic insights from industry experts. This multi-faceted approach ensures each component of the canvas is informed by accurate, actionable, and forward-looking information.