Ovintiv SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ovintiv Bundle

Ovintiv's SWOT analysis reveals a company navigating a dynamic energy landscape, balancing strong operational execution with the inherent volatility of commodity prices. While its efficient production and strategic asset base present significant strengths, the company also faces challenges related to market fluctuations and evolving environmental regulations.

Want the full story behind Ovintiv's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ovintiv boasts a powerful and varied collection of assets situated in North America's most productive oil and gas territories: the Permian, Montney, and Anadarko basins. This strategic positioning across multiple regions not only diversifies its operations geographically but also grants access to substantial proved reserves, totaling 2.1 billion barrels of oil equivalent (BOE) as of the end of 2024. A significant 59% of these reserves are liquids, highlighting the company's strong position in high-value hydrocarbon markets.

Ovintiv's unwavering commitment to capital discipline and operational efficiency is a significant strength. This focus directly translates into robust financial performance and improved returns for shareholders.

The company actively pursues initiatives to lower drilling and completion expenses, boost drilling efficiency, and maximize capital deployment in prime areas like the Permian. For instance, Ovintiv anticipates generating roughly $1.5 billion in free cash flow in 2025, even under moderate commodity price scenarios, underscoring their dedication to low-cost production.

Ovintiv has a clear strategy focused on generating consistent free cash flow and rewarding its shareholders. This commitment is evident in its financial performance and capital allocation plans.

In 2024, the company achieved a significant milestone by generating $1.7 billion in Non-GAAP Free Cash Flow. This strong cash generation allowed Ovintiv to return over $900 million to shareholders through a combination of dividends and share repurchases.

Further underscoring its dedication to shareholder value, Ovintiv has implemented a capital allocation framework. This framework mandates that at least 50% of its Non-GAAP Free Cash Flow, after accounting for base dividends, will be returned to shareholders, demonstrating a robust and ongoing commitment.

Strategic Acquisitions and Divestitures for Portfolio Optimization

Ovintiv's strategic approach to portfolio management, including acquisitions and divestitures, significantly bolsters its competitive standing. The company actively refines its asset base to maximize value and operational efficiency. This proactive strategy is crucial for adapting to market dynamics and ensuring long-term growth.

A prime example is Ovintiv's late 2024 acquisition of oil-rich Montney assets. This move not only expanded its production capacity but also added premium well locations, enhancing its inventory runway. The company anticipates this will boost its 2025 Non-GAAP Free Cash Flow.

Complementing this acquisition, Ovintiv divested its Uinta assets. This strategic divestiture is projected to generate annual cost synergies, further strengthening its financial position. These actions underscore a commitment to optimizing the asset portfolio for superior returns.

- Portfolio Optimization: Actively manages assets through strategic acquisitions and divestitures.

- Montney Acquisition (Late 2024): Enhanced asset quality with significant production and premium well locations.

- Uinta Divestiture: Expected to generate annual cost synergies and improve financial flexibility.

- Financial Impact: Anticipates increased 2025 Non-GAAP Free Cash Flow due to these transactions.

Strong Financial Health and Investment Grade Rating

Ovintiv demonstrates robust financial health, underscored by its commitment to a conservative leverage target of 1.0 times Non-GAAP Debt to Adjusted EBITDA at mid-cycle pricing, with an ultimate total debt goal of $4.0 billion. This strategic financial management provides a solid foundation for sustained operations and growth.

As of year-end 2024, the company reported total debt of $5.45 billion. This figure reflects ongoing efforts to manage its capital structure effectively while pursuing its long-term financial objectives.

Further validating its financial strength, Ovintiv holds investment-grade ratings from four major credit rating agencies. This recognition signifies the company's financial stability and its favorable access to capital markets, crucial for funding future initiatives and weathering economic fluctuations.

- Strong Balance Sheet: Targeting a leverage ratio of 1.0x Non-GAAP Debt to Adjusted EBITDA at mid-cycle.

- Debt Reduction Goal: Aiming for a total debt of $4.0 billion.

- Current Debt Level: Reported total debt of $5.45 billion at the end of 2024.

- Investment Grade Status: Rated investment grade by four credit rating agencies, indicating financial stability.

Ovintiv's strategic asset base, spanning the Permian, Montney, and Anadarko basins, provides significant operational advantages and access to substantial reserves. The company's disciplined approach to capital allocation, focused on efficiency and cost reduction, consistently generates strong free cash flow, as evidenced by its 2024 performance. This financial discipline, coupled with a clear strategy for shareholder returns and proactive portfolio management, positions Ovintiv for sustained value creation.

| Metric | 2024 (Actual) | 2025 (Projected) | Significance |

|---|---|---|---|

| Proved Reserves (BOE) | 2.1 billion | N/A | Diversified and substantial resource base. |

| Non-GAAP Free Cash Flow | $1.7 billion | ~$1.5 billion | Demonstrates strong cash generation capability. |

| Shareholder Returns | >$900 million | N/A | Commitment to rewarding investors. |

| Leverage Target (Debt/EBITDA) | N/A | 1.0x (mid-cycle) | Focus on financial strength and stability. |

What is included in the product

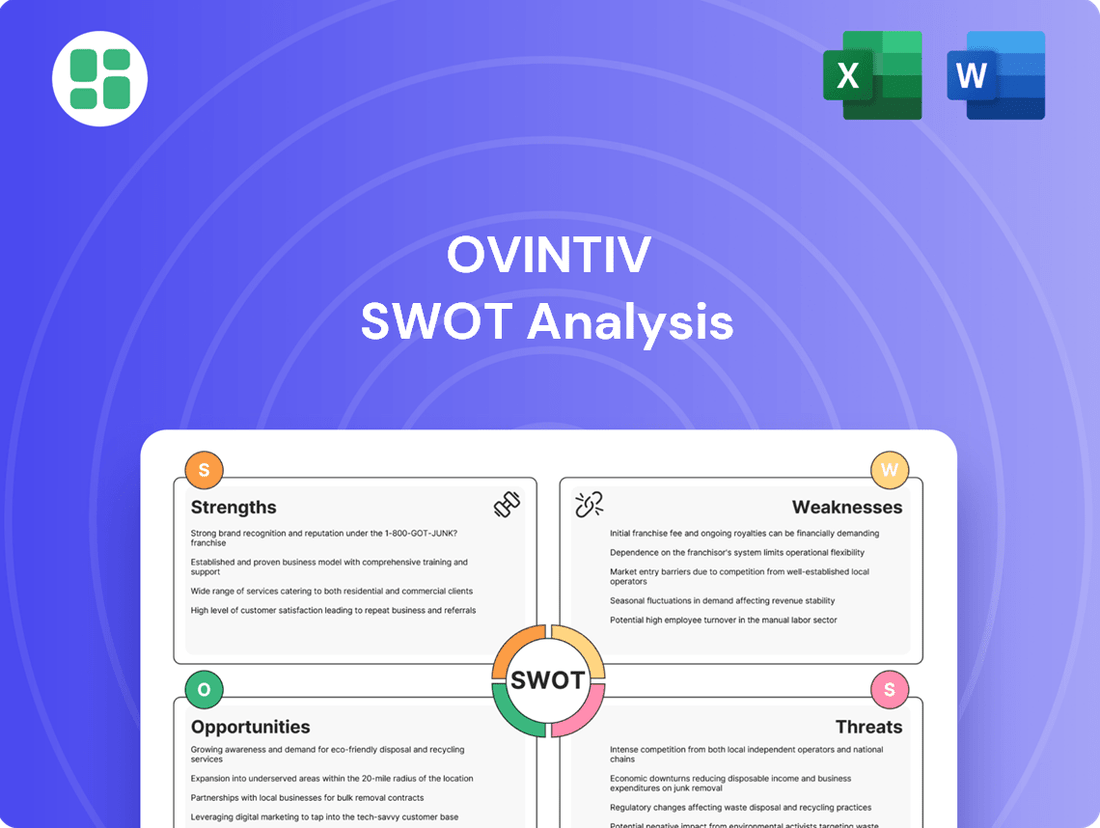

Delivers a strategic overview of Ovintiv’s internal and external business factors, highlighting its operational strengths, potential weaknesses, market opportunities, and industry threats.

Offers a clear, actionable framework to identify and address Ovintiv's critical strategic challenges and opportunities.

Weaknesses

Ovintiv's financial health is directly influenced by the unpredictable swings in oil and natural gas prices, a common challenge for energy producers. These price fluctuations can cause significant shifts in the company's earnings, cash generation, and overall profitability.

For instance, a downturn in commodity prices compared to earlier projections has already resulted in a revised expectation of lower free cash flow for 2025.

Ovintiv's substantial debt load remains a notable weakness. At the close of 2024, the company reported total debt at $5.45 billion. While Ovintiv has a stated long-term goal of reducing this to $4.0 billion, the current higher debt levels can constrain its financial maneuverability.

This significant debt can translate into higher interest expenses, impacting profitability. Furthermore, elevated debt makes Ovintiv more susceptible to financial distress during economic downturns or periods of volatile commodity prices, potentially limiting its capacity to invest in growth or respond to market shifts.

Ovintiv's significant reliance on the Permian, Montney, and Anadarko basins exposes it to substantial geographic concentration risk. For instance, in the first quarter of 2024, the Permian basin contributed approximately 45% of Ovintiv's total oil production.

This concentration means that any negative events, such as stricter environmental regulations or unforeseen operational disruptions in these core areas, could have a disproportionately large impact on the company's financial results and overall stability.

Declining Revenue Growth Compared to Peers

Ovintiv's revenue growth, while positive recently, is projected to lag behind its industry. The company's forecasted annual revenue growth rate stands at -3.11%, significantly lower than the US Oil & Gas E&P industry's average forecast of 6.11%. This disparity indicates a potential struggle for Ovintiv to keep pace with its competitors in expanding its top line.

This underperformance in revenue growth compared to peers could signal challenges in market share acquisition or the effectiveness of its growth strategies. For instance, a comparison with key competitors might reveal differing investment levels in exploration and production, or varying success in securing new reserves.

- Lagging Growth Projection: Ovintiv's forecasted annual revenue growth of -3.11% contrasts sharply with the US Oil & Gas E&P industry's average forecast of 6.11%.

- Competitive Disadvantage: This suggests Ovintiv may not be expanding its revenue as effectively as its industry peers.

Environmental, Social, and Governance (ESG) Pressures

The energy sector, including Ovintiv, faces significant pressure to address its environmental footprint, especially concerning greenhouse gas emissions and sustainable resource extraction. This scrutiny is intensifying from investors, regulators, and the public alike.

While Ovintiv actively publishes sustainability reports, the growing emphasis on Environmental, Social, and Governance (ESG) criteria presents potential challenges. These include increased compliance costs associated with stricter environmental regulations, potential operational limitations designed to reduce emissions, and the risk of reputational damage if sustainability targets are not met or perceived as insufficient.

- Increased Compliance Costs: Adhering to evolving environmental standards and reporting requirements can elevate operational expenses. For instance, the U.S. Securities and Exchange Commission (SEC) proposed new climate disclosure rules in 2024, which, if enacted, could increase compliance burdens for energy companies.

- Operational Restrictions: Future regulations or investor demands might necessitate changes in extraction methods or production levels, potentially impacting output and profitability.

- Reputational Risk: A perceived lack of progress on ESG goals can negatively affect investor confidence and brand image, influencing access to capital and market share.

Ovintiv's significant debt load, standing at $5.45 billion at the end of 2024, presents a key weakness. This high leverage can lead to increased interest expenses, thereby reducing profitability and financial flexibility. The company's susceptibility to economic downturns or volatile commodity prices is amplified by this debt, potentially hindering its ability to invest in growth initiatives.

Same Document Delivered

Ovintiv SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the exact Ovintiv SWOT analysis that will be yours after purchase. No hidden content, just the complete, actionable insights.

Opportunities

Ovintiv can significantly boost its operational efficiency by embracing advanced technologies in drilling and completion. For instance, the adoption of Trimulfrac technology, which allows for simultaneous fracturing of multiple stages, has demonstrated potential to increase well productivity and lower per-well costs. This focus on innovation is key to unlocking greater value from existing and future assets.

Continued investment in and refinement of these operational processes are crucial. By improving recovery rates and shortening cycle times, Ovintiv can achieve sustained gains in capital efficiency. This translates directly into higher production volumes and a stronger free cash flow generation, vital for shareholder returns and reinvestment in growth opportunities.

Ovintiv's strategic focus on optimizing its asset base through targeted acquisitions in its core Permian and Montney basins offers a significant growth avenue. These bolt-on deals, designed to be accretive to free cash flow, can bolster its premium well inventory. For instance, in 2024, Ovintiv continued to evaluate opportunities to enhance its acreage positions, aiming to extend its operational runway and solidify its leadership in these key North American plays.

Despite the global push for renewables, the International Energy Agency (IEA) projects oil and gas demand to remain robust through 2030, especially in developing nations. This sustained need for traditional energy sources presents a significant opportunity for Ovintiv.

As a key North American producer, Ovintiv is strategically positioned to capitalize on this ongoing demand, offering a stable market for its oil, natural gas, and natural gas liquids. The company's production capabilities align directly with these projected market needs.

Diversification into Lower-Carbon Solutions

Ovintiv has a significant opportunity to diversify its portfolio by investing in lower-carbon energy solutions. This strategic move could involve developing or acquiring assets in areas like carbon capture, utilization, and storage (CCUS) or even venturing into renewable energy projects. Such diversification is crucial for mitigating long-term environmental, social, and governance (ESG) risks, which are increasingly important to investors.

By embracing these cleaner energy avenues, Ovintiv can attract a wider range of investors, including those focused on sustainable investments. This aligns the company with the global energy transition, a trend that is reshaping the industry landscape. For instance, in 2024, the global investment in energy transition technologies reached an estimated $1.7 trillion, highlighting the significant market potential for companies willing to adapt.

- Mitigate ESG Risks: Proactively addressing climate concerns by investing in lower-carbon solutions can improve Ovintiv's ESG ratings and appeal to a broader investor base.

- Attract New Capital: Diversification into renewables and CCUS can unlock access to green financing and attract investors specifically targeting sustainable energy opportunities.

- Future-Proof Operations: Aligning with the energy transition trends positions Ovintiv for long-term viability and growth in a market that is increasingly prioritizing decarbonization.

Optimizing Natural Gas and NGLs Production

While Ovintiv has strategically pivoted towards oil, a significant opportunity lies in optimizing its existing natural gas and NGLs production. The company holds substantial reserves in these hydrocarbons, offering a foundation for enhanced output.

Strategic marketing initiatives and targeted infrastructure investments can unlock greater value from these assets. For instance, improved access to premium markets or enhanced processing capabilities for NGLs could significantly boost profitability, especially if demand trends for these products remain strong or expand in key regions.

- Natural Gas Reserves: Ovintiv reported approximately 3.7 trillion cubic feet of proved natural gas reserves as of year-end 2023, highlighting a substantial resource base.

- NGLs Production Growth: The company has seen NGLs production increase, with an average of 101,000 barrels per day in Q1 2024, indicating operational success in this segment.

- Market Demand: Global demand for natural gas is projected to grow, with the International Energy Agency (IEA) forecasting a 2.5% increase in 2024, creating a favorable market environment.

Ovintiv can enhance its competitive edge by leveraging advanced technologies to improve operational efficiency and reduce costs. Innovations like Trimulfrac technology can boost well productivity and lower per-well expenses, directly contributing to stronger free cash flow generation.

Strategic acquisitions in core Permian and Montney basins present a clear growth path, aiming to add accretive assets and expand its premium well inventory. Ovintiv's commitment to optimizing its asset base in these key North American plays solidifies its market position.

The company is well-positioned to benefit from continued robust demand for oil and gas, especially in developing economies, as projected by the IEA. Ovintiv's production capabilities align with these sustained market needs.

Diversifying into lower-carbon solutions, such as CCUS or renewables, offers a significant opportunity to mitigate ESG risks and attract a broader investor base. This strategic pivot aligns Ovintiv with global energy transition trends, with global investment in these technologies reaching an estimated $1.7 trillion in 2024.

Optimizing its substantial natural gas and NGLs reserves through strategic marketing and infrastructure investments can unlock greater value. Ovintiv reported approximately 3.7 trillion cubic feet of proved natural gas reserves as of year-end 2023, and its NGLs production averaged 101,000 barrels per day in Q1 2024, capitalizing on growing global demand.

Threats

Ovintiv faces a significant threat from the volatile nature of global commodity markets. Fluctuations in oil and natural gas prices can drastically impact the company's earnings. For instance, during periods of low oil prices, such as those seen in early 2020, companies like Ovintiv experienced substantial revenue reductions, directly affecting their ability to fund operations and return capital to shareholders.

Ovintiv faces growing threats from increasingly strict environmental regulations and climate policies. These measures, especially concerning greenhouse gas emissions and methane leakage, could significantly raise operating costs and require substantial capital investment to ensure compliance.

For instance, the Canadian government's proposed methane emission regulations, aiming for a 75% reduction by 2030, could impact Ovintiv's operations in regions like the Montney. Such policies may also restrict future drilling activities or mandate costly upgrades to emissions reduction technology, potentially affecting project timelines and profitability.

Ovintiv faces significant competition in key North American operating areas such as the Permian Basin and the Montney. This crowded landscape means many companies are seeking the same valuable land and resources.

The intense rivalry directly impacts Ovintiv by potentially inflating the cost of acquiring new acreage and increasing overall operational expenses. For instance, in 2023, the Permian Basin saw significant M&A activity, with deal values reflecting the high demand for prime acreage.

This competitive pressure can also lead to lower realized prices for Ovintiv's products, as supply outstrips demand or producers compete aggressively on price. Such conditions directly affect the company's profitability and its ability to fund future growth initiatives.

Shift Towards Renewable Energy and Decarbonization

The intensifying global shift towards renewable energy and decarbonization poses a significant long-term threat to companies like Ovintiv, which are primarily engaged in fossil fuel production. As governments and industries worldwide accelerate their commitment to reducing carbon emissions, the demand for oil and gas is expected to face sustained pressure.

This transition could directly impact Ovintiv's asset valuations and the long-term viability of its core business. For instance, projections from the International Energy Agency (IEA) in their 2024 scenarios indicate a potential plateau in oil demand by the late 2020s, with a subsequent decline in the following decades. This trend is driven by factors such as:

- Increasing adoption of electric vehicles (EVs): Global EV sales reached over 14 million units in 2023, a substantial increase from previous years, directly impacting gasoline demand.

- Growth in renewable electricity generation: Renewables accounted for over 80% of new power capacity additions globally in 2023, reducing reliance on fossil fuel-based power generation.

- Policy and regulatory changes: Many jurisdictions are implementing stricter emissions standards and carbon pricing mechanisms, making fossil fuels less competitive.

Geopolitical Risks and Supply Chain Disruptions

Geopolitical instability, including trade disputes and regional conflicts, poses a significant threat to Ovintiv's operations. These events can directly impact energy supply chains, leading to volatility in transportation costs and overall market uncertainty for commodities. For instance, the ongoing tensions in Eastern Europe have demonstrated how quickly global energy markets can react to geopolitical shifts, affecting pricing and availability of resources crucial for Ovintiv's production and distribution.

Such disruptions can impede Ovintiv's logistical capabilities, making it harder to move products to market efficiently. Furthermore, the procurement of essential equipment and services could face delays or increased costs due to these global pressures. This creates a challenging operating environment, potentially leading to operational slowdowns and a rise in overall expenses for the company.

- Supply Chain Vulnerability: Ovintiv, like many energy companies, relies on a complex global supply chain for equipment, services, and transportation. Geopolitical events can create bottlenecks and increase lead times.

- Commodity Price Volatility: Global conflicts and trade tensions often lead to sharp fluctuations in oil and natural gas prices, directly impacting Ovintiv's revenue and profitability. For example, the Brent crude oil price experienced significant volatility in 2024 due to various geopolitical flashpoints.

- Operational and Cost Uncertainty: Disruptions can lead to increased operational costs through higher shipping rates, insurance premiums, and the need to secure alternative suppliers or logistics routes.

Ovintiv faces intense competition in its core operating regions, such as the Permian Basin and Montney shale plays. This rivalry can drive up the cost of acquiring new land and increase operational expenses, as seen with the robust M&A activity in the Permian during 2023. The crowded market also pressures realized prices for oil and gas, directly impacting profitability.

The global energy transition poses a long-term threat, with increasing EV adoption and renewable energy growth potentially dampening oil and gas demand. The International Energy Agency's 2024 outlook suggests oil demand may plateau by the late 2020s, impacting asset valuations.

Geopolitical instability, including trade disputes and regional conflicts, creates significant supply chain vulnerabilities and commodity price volatility. For instance, global events in 2024 have already demonstrated how quickly energy markets react, leading to increased operational costs and uncertainty for companies like Ovintiv.

Stricter environmental regulations and climate policies, such as Canada's proposed methane emission reductions, represent another significant challenge. These could escalate operating costs and necessitate substantial capital investment for compliance, potentially affecting project timelines and profitability.

SWOT Analysis Data Sources

This Ovintiv SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and expert industry commentary to ensure a well-informed and actionable assessment.