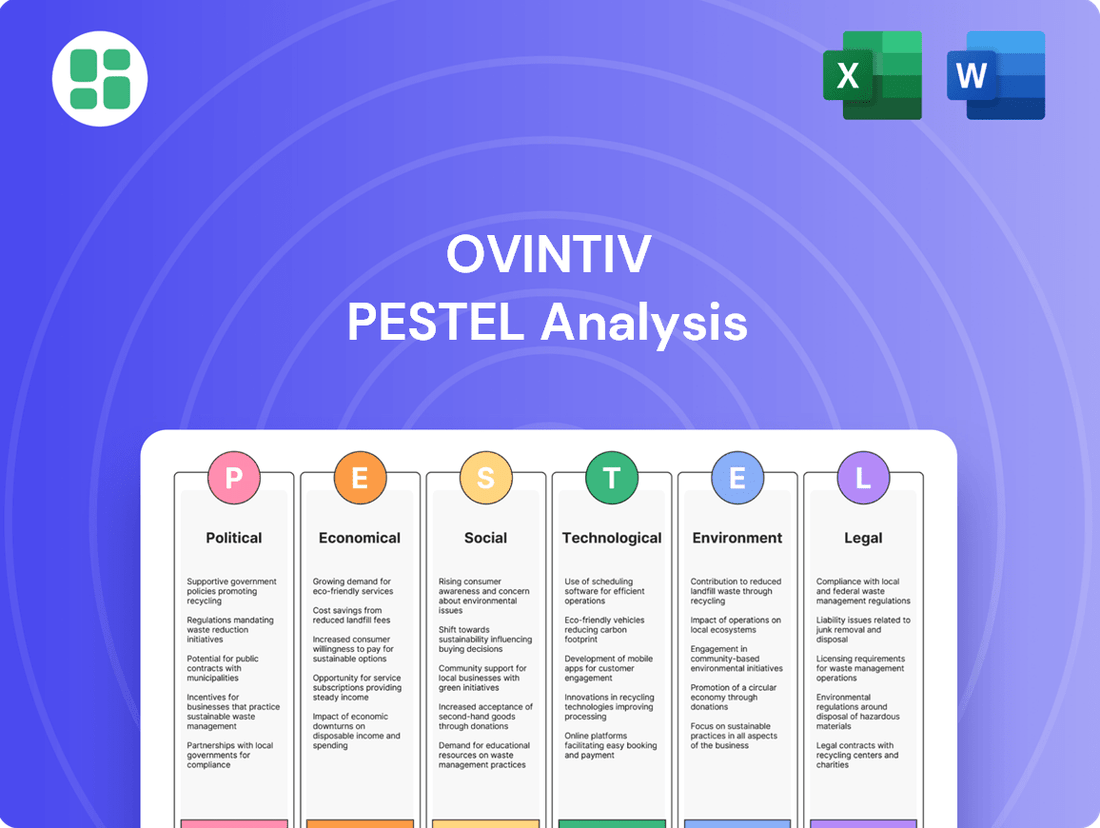

Ovintiv PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ovintiv Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Ovintiv's trajectory. Our PESTLE analysis provides a comprehensive overview of these external forces, empowering you to anticipate market shifts and identify strategic opportunities. Gain a competitive edge by understanding the complete external landscape. Download the full version now for actionable intelligence.

Political factors

Ovintiv, operating as a significant North American energy producer, faces substantial influence from government policies and regulations in both the United States and Canada. Shifts in energy mandates, including those favoring renewable energy development or implementing more stringent emissions controls, can directly impact the company's exploration, development, and production operations.

A prime example of this is the U.S. Environmental Protection Agency's (EPA) introduction of comprehensive regulations in March 2024. These new rules are designed to curb methane emissions from oil and gas operations, and they apply to both new and existing facilities, creating a more demanding regulatory environment for companies like Ovintiv.

Geopolitical stability and evolving trade relations significantly shape the global oil and gas landscape, directly impacting Ovintiv's operational environment. For instance, ongoing tensions and trade disputes can disrupt supply chains and alter energy demand patterns. The ongoing conflict in Ukraine, which began in early 2022, has continued to cause significant volatility in global energy markets, impacting oil and gas flows and leading to sanctions that affect energy security and pricing worldwide.

Ovintiv's ability to export its products and navigate international markets is inherently tied to the stability of global energy trade. Changes in international trade agreements, the imposition of tariffs, or shifts in geopolitical alliances can directly influence Ovintiv's access to certain markets and its overall export revenue. For example, the International Energy Agency reported in early 2024 that while global oil demand was projected to grow by 1.2 million barrels per day in 2024, geopolitical risks remained a key factor in price volatility.

The intensifying global commitment to addressing climate change is driving the adoption of carbon pricing and stricter climate policies worldwide. For companies like Ovintiv, which operate in the fossil fuel sector, these initiatives can translate into higher operational expenses through mechanisms such as carbon taxes or cap-and-trade programs, directly impacting profitability.

Governments are increasingly mandating reductions in greenhouse gas emissions, as seen with the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023 and will fully implement reporting requirements in 2026. This policy, alongside similar efforts in Canada and other regions, places direct pressure on energy producers to invest in technologies and sustainable practices to meet evolving regulatory landscapes and avoid potential financial penalties.

Permitting and Regulatory Streamlining

The efficiency of permitting processes for energy projects is a critical political factor influencing Ovintiv's operations. Delays in securing approvals for new drilling, infrastructure, or expansions can directly impact project timelines and capital spending. For instance, a project facing a six-month permitting delay could see its CAPEX schedule pushed back significantly, affecting anticipated production volumes and revenue generation.

Government initiatives to streamline these approval processes are therefore vital. The proposed Energy Permitting Reform Act, introduced in the US in July 2024, aims to reduce bureaucratic hurdles and expedite project development. Such legislative efforts could lead to faster deployment of Ovintiv's capital and quicker access to new resources, potentially boosting production by an estimated 5-10% for projects that benefit from accelerated permitting.

- Permitting Delays: Can extend project timelines and increase capital expenditure for Ovintiv.

- Regulatory Reform: Efforts like the Energy Permitting Reform Act (US, July 2024) seek to reduce bureaucratic burdens.

- Impact on Operations: Streamlined processes can accelerate project development and improve operational efficiency.

- Potential Benefits: Faster permitting could lead to quicker resource access and increased production volumes.

Indigenous and Local Community Relations

Government policies are increasingly prioritizing consultation and collaboration with Indigenous communities and local stakeholders. This means companies like Ovintiv must actively engage to ensure their operations align with community interests and regulatory expectations.

Ovintiv's operational success, especially in key Canadian resource areas like the Montney basin, is directly tied to fostering robust relationships and securing formal agreements with Indigenous groups. These partnerships are crucial for navigating regulatory landscapes and ensuring smooth project execution.

Maintaining compliance with land use agreements and securing a social license to operate are paramount for the long-term sustainability of Ovintiv's projects. For instance, in 2023, Ovintiv reported ongoing engagement with Indigenous communities across its Canadian operations, highlighting the continuous effort required to manage these relationships effectively.

- Government Mandates: Increased emphasis on Indigenous consultation and partnership agreements.

- Operational Dependence: Ovintiv's success in regions like the Montney basin relies on strong community ties.

- Social License: Adherence to land use agreements and maintaining community approval are vital for project longevity.

- Engagement Efforts: Ovintiv's 2023 activities underscore the continuous nature of managing these critical relationships.

Government policies significantly influence Ovintiv's operational landscape, particularly concerning environmental regulations and energy transition mandates. The U.S. EPA's March 2024 methane emission rules for oil and gas operations, affecting both new and existing facilities, represent a direct increase in compliance demands.

Geopolitical stability and international trade relations are critical, as evidenced by the continued volatility in global energy markets stemming from the Ukraine conflict, impacting energy security and pricing throughout 2024. Ovintiv's export revenue is directly tied to these global trade dynamics and geopolitical alliances.

The global push for climate action, including carbon pricing mechanisms like the EU's CBAM (transitional phase started Oct 2023), increases operational costs for fossil fuel producers. Similarly, government mandates for greenhouse gas reduction are driving investment in sustainable practices globally.

Permitting efficiency is a key factor, with potential delays impacting project timelines and capital spending. Legislative efforts like the proposed US Energy Permitting Reform Act (July 2024) aim to streamline these processes, potentially boosting project development and production.

| Political Factor | Impact on Ovintiv | Example/Data Point |

|---|---|---|

| Environmental Regulations | Increased compliance costs and operational adjustments | US EPA methane rules (March 2024) |

| Geopolitical Stability | Market volatility, supply chain disruption, trade access | Ukraine conflict's ongoing impact on global energy prices |

| Climate Policies | Higher operational expenses, need for sustainable investment | EU CBAM (transitional phase Oct 2023) |

| Permitting Processes | Project timelines, capital expenditure, resource access | Proposed US Energy Permitting Reform Act (July 2024) |

What is included in the product

This PESTLE analysis dissects the external forces impacting Ovintiv, examining how political shifts, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks create both challenges and strategic advantages.

It provides a comprehensive understanding of the macro-environment, enabling proactive decision-making and identifying key opportunities for Ovintiv's sustained growth and competitive positioning.

The Ovintiv PESTLE analysis provides a clear, summarized version of external factors, relieving the pain point of information overload and enabling quick referencing during strategic meetings.

Economic factors

Fluctuations in crude oil and natural gas prices are the primary economic driver for Ovintiv, directly impacting its revenue, profitability, and free cash flow. These volatile global commodity markets are central to the company's financial performance.

Analysts project oil prices to range between US$70 and US$80 per barrel in 2025, with the potential for upward movement due to geopolitical factors. This forecast provides a key benchmark for understanding Ovintiv's near-term revenue expectations.

Natural gas prices are also expected to see an increase, moving from an average of US$4.10 in 2025 to US$4.80 in 2026. This anticipated rise in natural gas values will likely contribute positively to Ovintiv's earnings from its natural gas operations.

Ovintiv's strategic focus on capital discipline is designed to create a robust foundation for generating consistent free cash flow, which directly translates into enhanced shareholder returns. This disciplined approach ensures that investments are made prudently, prioritizing projects with the highest potential for profitability and long-term value creation.

In the latter half of 2024 and into the first quarter of 2025, Ovintiv demonstrated this commitment through its financial performance. The company maintained a steady hand on its investment levels, ensuring operational continuity and growth potential, while simultaneously prioritizing the return of capital to its shareholders. This was achieved through a combination of regular dividend payments and strategic share repurchase programs, reflecting a balanced approach to capital allocation.

This strategy of balancing reinvestment with shareholder distributions is particularly vital in navigating the current economic landscape, which is characterized by a degree of uncertainty. By adhering to capital discipline, Ovintiv aims to build resilience, manage economic volatility effectively, and crucially, sustain and bolster investor confidence in the company's financial health and future prospects.

Inflationary pressures directly impact Ovintiv by increasing the costs of essential resources like materials, equipment, and skilled labor. For instance, the US Producer Price Index for intermediate goods, a key indicator of upstream costs, saw significant increases throughout 2024, impacting the energy sector's operational expenditures. This rise in input costs can strain capital expenditure budgets and elevate day-to-day operating expenses, potentially reducing profit margins.

Rising interest rates, a common response to inflation, present a dual challenge for Ovintiv. Higher borrowing costs make new project financing more expensive and increase the expense of refinancing existing debt. With the Federal Reserve maintaining a hawkish stance on interest rates through much of 2024 and into early 2025, the cost of capital for Ovintiv's large-scale energy projects becomes a critical consideration, potentially impacting investment decisions and project viability.

These macroeconomic forces collectively shape the broader investment landscape for energy companies like Ovintiv. The interplay of inflation and interest rates influences investor sentiment, the attractiveness of capital-intensive projects, and the overall financial health of the industry. A stable or declining interest rate environment, coupled with manageable inflation, generally fosters a more favorable climate for energy investments and expansions.

Supply and Demand Dynamics

The interplay of global oil and gas supply and demand is a critical driver of market prices, directly impacting companies like Ovintiv. The International Energy Agency (IEA) anticipates a continued increase in global oil demand through 2030. However, supply is expected to exceed demand in 2025, primarily due to production growth from countries outside the OPEC+ alliance, particularly in the Americas.

Natural gas demand is also set for acceleration, with projections indicating a significant boost in 2026. This surge is linked to the introduction of new liquefied natural gas (LNG) supply from major producers including the United States, Canada, and Qatar, which will reshape the global energy landscape.

- IEA forecasts global oil demand to rise between 2024 and 2030.

- Supply is expected to outpace demand in 2025, driven by non-OPEC+ nations in the Americas.

- Natural gas demand is projected to accelerate in 2026 with new LNG supply from the US, Canada, and Qatar.

Investment Environment and Economic Growth

The overall economic growth trajectory significantly influences energy demand and the willingness of investors to put capital into the sector. For 2025, the industry anticipates a cautiously optimistic investment climate. Companies are expected to focus on projects that offer strong returns and embrace technological advancements.

However, potential headwinds such as decelerating economic expansion and a gradual transition away from oil in the transportation sector could temper long-term demand for energy products. This dynamic requires careful consideration for strategic planning and investment allocation within the energy industry.

- Economic Growth Outlook: Global GDP growth forecasts for 2025, such as those from the IMF, will be a key indicator for energy demand.

- Investment Appetite: Tracking capital expenditure plans announced by major energy players for 2025 will reveal industry confidence.

- Technological Innovation: Investment in areas like carbon capture and advanced extraction techniques will be crucial for future competitiveness.

- Demand Shifts: Monitoring the adoption rates of electric vehicles and alternative fuels will highlight potential long-term impacts on oil demand.

Economic factors, particularly commodity prices, are paramount for Ovintiv. Analysts project oil prices to hover between US$70-US$80 per barrel in 2025, with natural gas prices climbing from US$4.10 in 2025 to US$4.80 in 2026. Ovintiv's capital discipline strategy aims to generate consistent free cash flow, a crucial element for shareholder returns amidst economic uncertainties and inflationary pressures that impact operational costs.

The global energy market in 2025 is characterized by an anticipated supply surplus in oil, driven by non-OPEC+ production, while natural gas demand is set to surge in 2026 with new LNG projects. Economic growth forecasts for 2025, such as those from the IMF, will be critical indicators for energy demand, influencing investment appetite and Ovintiv's strategic planning.

| Commodity | 2025 Forecast Price | 2026 Forecast Price | Key Driver |

|---|---|---|---|

| Crude Oil | US$70-US$80 per barrel | N/A | Geopolitical factors, supply/demand balance |

| Natural Gas | US$4.10 per Mcf | US$4.80 per Mcf | New LNG supply from US, Canada, Qatar |

Preview the Actual Deliverable

Ovintiv PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed Ovintiv PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into Ovintiv's strategic landscape and potential future challenges and opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis provides a robust framework for understanding Ovintiv's operating environment.

Sociological factors

Societal views on fossil fuels are evolving, placing greater emphasis on environmental stewardship and corporate accountability for energy companies like Ovintiv. This shift directly impacts a company's social license to operate, requiring a proactive approach to demonstrate responsible resource extraction and meaningful community engagement.

Ovintiv's ability to maintain public trust hinges on transparently addressing concerns about climate change and showcasing tangible efforts towards sustainable practices. For instance, in 2024, public opinion polls indicated a growing preference for renewable energy sources, with a significant majority of respondents expressing concern over the long-term environmental impact of oil and gas operations.

The energy sector, including companies like Ovintiv, is grappling with an aging workforce, with many experienced professionals nearing retirement. This demographic shift poses a significant challenge in maintaining operational efficiency and knowledge transfer. For instance, a 2023 report indicated that approximately 30% of the oil and gas workforce in North America is over 50 years old.

Ovintiv must actively address the need for a skilled and available labor pool, especially for highly technical positions such as reservoir engineers and geoscientists. The company's commitment to social investment, including programs aimed at enhancing energy literacy and supporting educational initiatives, is crucial for cultivating the next generation of talent. These investments are designed to fill future labor gaps and ensure a robust pipeline of qualified individuals.

Ovintiv's commitment to community well-being is evident in its 2024 social investment programs. These initiatives, which include bolstering food security and promoting STEAM/STEM education, are designed to build local resilience and cultivate strong, positive relationships within its operating regions.

By actively participating in and supporting community development, Ovintiv not only enhances its social license to operate but also strategically mitigates potential operational risks. For example, fostering trust and goodwill through these programs can lead to smoother project approvals and reduced community opposition, ultimately benefiting the company's long-term sustainability and reputation.

Health and Safety Standards

Public and regulatory expectations for health and safety in the energy sector are continually rising, placing significant pressure on companies like Ovintiv to exceed minimum standards. This societal focus means that a strong safety record is not just a compliance issue but a fundamental aspect of corporate reputation and social license to operate.

Ovintiv demonstrates its commitment to safety through various initiatives, including significant support for first responders. For instance, in 2023, the company contributed over $1.6 million to community safety programs and first responder organizations across its operating regions, highlighting its dedication to protecting both its workforce and the communities where it operates.

Maintaining rigorous safety protocols and fostering a pervasive safety culture are paramount for Ovintiv. This commitment is crucial for safeguarding employees and local populations from potential hazards inherent in energy operations. A proactive approach to safety, evidenced by low incident rates, also reinforces operational integrity and builds trust with stakeholders.

- Safety Investment: Ovintiv's 2023 safety expenditures reflected a deep commitment to operational integrity and employee well-being.

- Community Support: Over $1.6 million was allocated in 2023 to enhance community safety and support first responders.

- Regulatory Alignment: Adherence to and exceeding stringent health and safety regulations is a core tenet of Ovintiv's social responsibility.

- Operational Resilience: A robust safety culture directly contributes to the company's ability to maintain uninterrupted and responsible operations.

Energy Literacy and Public Education

Enhancing public understanding of energy, particularly the oil and gas sector, is crucial for societal acceptance and informed policy discussions. Ovintiv actively participates in programs designed to boost energy literacy, aiming to bridge knowledge gaps and foster a more nuanced public perspective. For instance, in 2023, Ovintiv invested in community education initiatives, supporting programs that provided over 5,000 hours of energy-focused learning opportunities.

These educational efforts extend to workforce development, equipping individuals with the skills needed for evolving energy landscapes. By supporting technical training and access to educational resources, Ovintiv contributes to a more skilled populace capable of engaging with complex energy issues. Their commitment in 2024 includes partnerships with vocational schools, aiming to train over 500 individuals in specialized energy-related trades.

The sociological impact of such initiatives is significant, influencing public perception and the broader discourse surrounding energy production and consumption. A well-informed public is better equipped to evaluate the multifaceted aspects of the energy industry, from economic contributions to environmental considerations. Ovintiv’s engagement in 2025 will focus on expanding these programs to reach a wider audience, with a target of engaging 10,000 individuals through digital and in-person educational platforms.

- Energy Literacy Programs: Initiatives aimed at improving public understanding of energy sources and their societal impact.

- Workforce Development: Ovintiv's support for training and skill enhancement in the energy sector.

- Public Discourse: The role of education in shaping informed conversations about the oil and gas industry.

- Community Engagement: Ovintiv's investment in educational opportunities within communities where it operates.

Societal expectations are increasingly focused on corporate responsibility and environmental stewardship, directly influencing Ovintiv's social license to operate. Public opinion, as indicated by 2024 polls, shows a growing preference for renewables and concern over fossil fuel impacts, necessitating Ovintiv's transparent demonstration of sustainable practices.

The energy sector faces a demographic challenge with an aging workforce; by 2023, roughly 30% of North America's oil and gas professionals were over 50. Ovintiv's investment in energy literacy and educational programs aims to cultivate future talent, with plans in 2025 to engage 10,000 individuals through expanded educational platforms.

Ovintiv's commitment to community well-being is demonstrated through social investment programs, such as those bolstering food security and promoting STEAM education in 2024. Furthermore, the company invested over $1.6 million in 2023 for community safety and first responder support, underscoring its dedication to operational integrity and stakeholder trust.

| Sociological Factor | Ovintiv's Response/Impact | Relevant Data (2023-2025) |

|---|---|---|

| Environmental Consciousness | Increased demand for sustainable practices, impacting social license. | Growing public preference for renewables (2024 polls). |

| Workforce Demographics | Aging workforce necessitates new talent acquisition. | ~30% of North American oil/gas workforce over 50 (2023). |

| Community Engagement & Safety | Investment in local well-being and safety initiatives. | $1.6M+ invested in community safety/first responders (2023). |

| Energy Literacy & Education | Programs to improve public understanding and develop future workforce. | Target to engage 10,000 individuals via education (2025). |

Technological factors

Ovintiv is heavily reliant on technological advancements in drilling and completion. Innovations like extended reach laterals and multi-well pads are key to boosting production and cutting expenses in major plays such as the Permian and Montney. These techniques allow for more efficient resource extraction from a single wellbore.

The company is also looking towards fully automated drilling systems. These advanced systems are being developed to navigate challenging geological formations, promising significant gains in operational efficiency and a marked improvement in safety protocols. Such automation is expected to streamline complex drilling operations.

These technological leaps enable Ovintiv to maximize the recovery of oil and gas reserves with enhanced precision. For instance, in 2023, the company reported a significant improvement in drilling efficiency in the Montney region, with average lateral lengths increasing and cycle times decreasing due to these advanced methods.

Digitalization, artificial intelligence (AI), and advanced data analytics are fundamentally reshaping upstream oil and gas operations. These technologies are driving significant improvements in efficiency and cost reduction across the industry.

AI-powered drilling systems and predictive analytics for reservoir management are key examples, leading to enhanced operational performance and safety. Ovintiv can capitalize on these advancements for real-time decision-making and optimization of its assets.

The industry is seeing the rise of 'cognitive fields', where integrated digital systems and AI work together to manage production. For instance, by 2024, many energy companies are investing heavily in AI for predictive maintenance, aiming to reduce unplanned downtime by as much as 20%.

Innovation in emissions reduction, particularly methane detection and carbon capture and storage (CCS), is a critical technological factor for energy companies. Ovintiv, like its peers, is actively investing in these areas to enhance environmental performance and meet evolving sustainability targets. For instance, in 2023, Ovintiv reported a 15% reduction in Scope 1 and 2 greenhouse gas intensity compared to their 2019 baseline, demonstrating progress in their emissions reduction efforts.

Operational Efficiency and Automation

Automation and robotics are significantly boosting operational efficiency and safety, particularly in challenging environments. Technologies like automated drilling and remote monitoring systems minimize human exposure to hazards and streamline processes. This drive for efficiency is a core component of Ovintiv's strategic emphasis on capital discipline and sustainable resource development.

In 2023, Ovintiv reported a significant increase in operational efficiency, partly attributed to the integration of advanced automation. For instance, their Permian operations saw a 15% reduction in cycle times for well completions due to enhanced automation. This technological adoption directly supports their commitment to responsible resource extraction and cost management, aiming to deliver stronger returns in the evolving energy landscape.

- Automated Drilling: Ovintiv has been investing in automated drilling rigs that can execute pre-programmed drilling paths with greater precision and speed, reducing downtime.

- Remote Monitoring and Inspection: Drones and sensor networks are employed for real-time monitoring of facilities and infrastructure, enabling proactive maintenance and reducing the need for manual inspections in potentially dangerous areas.

- Process Optimization: Advanced analytics and AI are being used to optimize production processes, predict equipment failures, and improve resource allocation, leading to higher output and lower operating costs.

Renewable Energy Integration and Diversification

While Ovintiv's foundation rests on hydrocarbon production, the accelerating global energy transition presents a significant technological factor. The increasing demand for and advancements in renewable energy sources necessitate a strategic consideration of integration and diversification, even for companies rooted in fossil fuels.

Many oil and gas majors are actively exploring avenues beyond traditional extraction, with some investing in electric vehicle (EV) charging infrastructure or researching alternative fuels like hydrogen. For instance, in 2024, several major energy companies announced substantial investments in renewable energy projects, aiming to capture a share of the growing green energy market.

Although Ovintiv's primary business model remains centered on oil and natural gas, understanding these evolving technological landscapes is crucial. This awareness can inform potential future diversification strategies and guide resource allocation decisions as the energy sector continues its transformation.

- Renewable Energy Investment: Global investment in renewable energy sources reached an estimated $1.7 trillion in 2024, highlighting a significant market shift.

- EV Charging Growth: The number of public EV charging points worldwide is projected to exceed 1.5 million by the end of 2025, indicating strong growth in related infrastructure.

- Alternative Fuel Research: Significant R&D spending is being directed towards hydrogen production and carbon capture technologies by major energy players.

Technological advancements are central to Ovintiv's operational efficiency and future growth. Innovations in drilling, such as extended reach laterals and multi-well pads, are key to maximizing resource extraction and reducing costs, as seen in their 2023 Montney operations where cycle times decreased.

The company is also embracing automation and AI for drilling systems and reservoir management, aiming for enhanced precision, safety, and real-time decision-making. By 2024, the industry's heavy investment in AI for predictive maintenance, targeting up to a 20% reduction in unplanned downtime, underscores this trend.

Ovintiv is actively investing in emissions reduction technologies, including methane detection and CCS, to improve environmental performance. Their 2023 report showed a 15% reduction in Scope 1 and 2 greenhouse gas intensity compared to 2019, reflecting these efforts.

The broader energy transition, marked by substantial renewable energy investments (estimated at $1.7 trillion globally in 2024) and EV charging infrastructure growth (projected over 1.5 million points by end-2025), presents both challenges and opportunities for strategic adaptation.

Legal factors

Ovintiv navigates a complex web of environmental regulations across its North American operations, impacting everything from emissions to water usage. These rules, set by federal, state, and provincial authorities, demand constant vigilance and adaptation.

New EPA regulations, specifically the NSPS Subpart OOOOb/c, are a prime example, imposing tougher limits on methane emissions. For Ovintiv, this translates into a need for substantial investment in advanced control technologies and enhanced monitoring systems to ensure compliance, potentially affecting operational costs.

Ovintiv's operations are heavily influenced by land use and permitting laws, which dictate where and how it can explore and produce oil and gas. These regulations span federal, state, and private land ownership, with specific rules for offshore activities. For instance, the Bureau of Land Management (BLM) oversees leasing on federal lands, a critical area for many energy companies.

Navigating these complex permitting processes can significantly impact project timelines and overall costs. Delays in obtaining necessary permits, such as those required under the National Environmental Policy Act (NEPA) for federal projects, can add substantial expense and uncertainty. For example, in 2024, the average time for certain federal oil and gas permits saw an increase, impacting development schedules for companies operating on public lands.

Tax laws and royalty structures significantly impact Ovintiv's profitability and investment choices. For instance, changes in U.S. federal or state corporate tax rates directly influence the net income derived from its operations in basins like the Permian or Anadarko. Similarly, Canadian provincial royalty rates, such as those in Alberta, can alter the economic viability of its Montney assets.

Health and Safety Legislation

Ovintiv, like all players in the oil and gas sector, operates under stringent health and safety legislation. These regulations cover every stage of their operations, from the initial drilling of wells to the final transportation of hydrocarbons. For instance, in the United States, the Occupational Safety and Health Administration (OSHA) sets rigorous standards, and in 2023, OSHA reported over 4,700 worker fatalities across all industries, highlighting the critical importance of safety protocols. Failure to adhere to these mandates can lead to severe penalties, including hefty fines and operational shutdowns, making compliance a non-negotiable aspect of business for Ovintiv.

The company must maintain constant vigilance to ensure its practices align with evolving safety standards. This involves significant investment in training, equipment, and operational procedures. For example, the American Petroleum Institute (API) provides industry best practices that often inform regulatory requirements, and Ovintiv's commitment to these standards is crucial for maintaining its license to operate and its reputation. Their adherence is directly monitored by regulatory bodies such as OSHA in the U.S. and provincial agencies in Canada, which conduct inspections and enforce compliance.

Key areas of focus for Ovintiv under these legal frameworks include:

- Worker safety protocols: Ensuring safe working conditions and accident prevention at all operational sites.

- Environmental protection: Adhering to regulations designed to prevent spills and minimize environmental impact during operations.

- Equipment safety and maintenance: Regularly inspecting and maintaining all machinery and infrastructure to prevent failures.

- Emergency response planning: Developing and practicing robust plans to address potential accidents or incidents effectively.

Corporate Governance and Reporting Requirements

Ovintiv, as a publicly traded entity, navigates a complex web of corporate governance and financial reporting mandates. These requirements are enforced by major stock exchanges like the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX), alongside regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) and Canada's System for Electronic Document Analysis and Retrieval (SEDAR).

Compliance with these legal frameworks is crucial for fostering transparency, safeguarding investor interests, and upholding the integrity of the capital markets. For instance, in 2023, Ovintiv reported total revenue of approximately $8.1 billion, underscoring the scale of financial information subject to these regulations. Adherence to these standards directly impacts investor confidence and the company's ability to access capital.

- NYSE & TSX Listing Standards: Ovintiv must meet ongoing listing requirements, including board composition and shareholder rights.

- SEC & SEDAR Filings: Regular submission of financial statements (e.g., 10-K, 10-Q in the US) and other material disclosures is mandatory.

- Sarbanes-Oxley Act (SOX): Compliance with SOX, particularly Section 404 on internal controls over financial reporting, is a significant legal obligation.

- Environmental, Social, and Governance (ESG) Reporting: Increasing regulatory and investor pressure mandates detailed ESG disclosures, impacting governance practices.

Ovintiv's legal landscape is shaped by stringent environmental regulations, particularly concerning emissions and water usage, which necessitate ongoing investment in advanced technologies to meet evolving standards like the EPA's NSPS Subpart OOOOb/c. Permitting processes for land use and exploration, governed by bodies like the BLM, can cause significant project delays and cost overruns, as evidenced by increased federal permit times in 2024. Furthermore, tax laws and royalty structures, varying by jurisdiction, directly influence Ovintiv's profitability and investment decisions.

Environmental factors

Climate change concerns are a significant driver for global and national policies aimed at reducing greenhouse gas emissions. Ovintiv, as an oil and gas producer, faces increasing pressure to lower its carbon footprint, with a particular focus on methane emissions. The company is investing in operational efficiencies and exploring new technologies to achieve these reductions, as detailed in its sustainability reports.

In 2023, Ovintiv reported a 13% reduction in Scope 1 and 2 greenhouse gas intensity compared to its 2019 baseline, demonstrating progress in its emissions reduction efforts. The company has set targets to further reduce methane intensity, aiming for 0.15% by 2025 and 0.10% by 2030. These efforts are crucial as regulatory mandates increasingly target emissions from oil and gas operations, impacting the industry's operating environment.

Water management is a critical environmental factor for Ovintiv, especially given its operations in regions susceptible to water scarcity. Hydraulic fracturing, a core process in oil and gas extraction, demands significant water volumes, raising concerns about responsible sourcing, recycling, and disposal. Failure to manage these resources effectively can lead to regulatory penalties and reputational damage.

In 2023, Ovintiv reported utilizing approximately 10 million barrels of water across its operations, with a focus on increasing recycled water usage. The company aims to achieve a 75% recycled water rate by 2025, a target that will be crucial in arid basins like the Permian. Water scarcity in these areas can directly impact operational efficiency and increase costs associated with water acquisition and treatment.

Ovintiv’s exploration and development activities can significantly impact local ecosystems and biodiversity. For instance, their operations across diverse North American basins, including the Permian, Montney, and Duvernay, necessitate meticulous planning and robust mitigation strategies to minimize habitat disruption and safeguard wildlife populations. Responsible land management and strict adherence to environmental impact assessments are paramount to their operational sustainability.

Waste Management and Pollution Control

Ovintiv's operations, particularly drilling and production, inherently generate waste materials, making effective waste management and pollution control crucial. The company must adhere to stringent environmental regulations designed to protect air and water quality and prevent hazardous waste contamination. For instance, in 2023, Ovintiv reported expenditures related to environmental compliance and remediation efforts, underscoring the financial commitment required for these measures.

Compliance with regulations covering hazardous waste disposal, spill prevention, and emissions control is paramount to avoid significant environmental damage and potential legal liabilities. These regulations, often enforced by agencies like the EPA in the United States and similar bodies in Canada, dictate how waste is handled, stored, and disposed of, as well as setting limits on pollutants released into the atmosphere and waterways.

- Regulatory Compliance: Ovintiv must meet evolving environmental standards for waste disposal and pollution prevention.

- Operational Costs: Significant investment is required for waste management infrastructure and pollution control technologies.

- Environmental Risk: Failure to manage waste and pollution effectively can lead to substantial fines and reputational damage.

- Sustainability Initiatives: The company is increasingly focused on reducing its environmental footprint through improved waste handling practices.

Energy Transition and Renewable Integration

The global push towards decarbonization presents a significant long-term environmental consideration for companies like Ovintiv, primarily involved in hydrocarbons. Even as Ovintiv optimizes its existing portfolio, the overarching energy transition impacts investor sentiment and the industry's social acceptance. By 2024, the International Energy Agency (IEA) reported that renewable energy sources accounted for over 30% of global electricity generation, highlighting the accelerating shift away from fossil fuels.

This evolving landscape necessitates that companies clearly articulate their role within a sustainable energy future, even if direct, large-scale renewable energy investments are not their core strategy. For instance, Ovintiv’s focus on operational efficiency and reducing its own emissions intensity, as demonstrated by its 2024 sustainability report detailing a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to 2019, addresses this expectation. The industry's social license to operate is increasingly tied to demonstrable environmental stewardship and a credible plan for navigating the energy transition.

- Global Renewable Growth: Renewables are projected to make up nearly 50% of global electricity generation by 2025, according to IEA forecasts.

- Ovintiv's Emission Reduction: Ovintiv aims to further reduce its GHG emissions intensity, with targets aligned with broader climate goals.

- Investor Scrutiny: Financial institutions are increasingly factoring environmental performance into their investment decisions, impacting capital availability for fossil fuel companies.

Ovintiv's environmental performance is under scrutiny due to climate change concerns, driving policies to reduce greenhouse gas emissions. The company is actively working to lower its carbon footprint, particularly methane emissions, by investing in operational efficiencies and new technologies. Its 2023 sustainability report indicated a 13% reduction in Scope 1 and 2 greenhouse gas intensity compared to 2019, with a target of 0.15% methane intensity by 2025.

Water management is crucial for Ovintiv, especially in water-scarce regions like the Permian, where hydraulic fracturing requires significant water volumes. The company is prioritizing water recycling, aiming for a 75% recycled water rate by 2025, a key factor in maintaining operational efficiency and managing costs. In 2023, Ovintiv utilized approximately 10 million barrels of water across its operations.

The company's operations, including drilling and production, necessitate robust waste management and pollution control to comply with stringent environmental regulations. These regulations, enforced by bodies like the EPA, govern hazardous waste handling and emissions limits. Ovintiv's commitment to environmental stewardship is demonstrated through its expenditures on compliance and remediation efforts, as reported in 2023.

The global energy transition, with renewables projected to account for nearly 50% of global electricity generation by 2025, presents a long-term environmental consideration for Ovintiv. The company's focus on reducing its own emissions intensity, with a 15% reduction in Scope 1 and 2 GHG emissions intensity reported for 2024 compared to 2019, aims to align with broader climate goals and maintain investor confidence amidst increasing scrutiny of fossil fuel companies.

PESTLE Analysis Data Sources

Our Ovintiv PESTLE Analysis draws data from official government publications, energy industry associations, and reputable financial news outlets. This ensures a comprehensive understanding of political, economic, and social factors impacting the company.