Ovintiv Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ovintiv Bundle

Unlock the strategic potential of Ovintiv's product portfolio with our comprehensive BCG Matrix analysis. Understand which assets are driving growth and which require careful consideration to optimize resource allocation and future investments.

This preview offers a glimpse into Ovintiv's market positioning, but the full BCG Matrix provides the detailed quadrant placements, market share data, and growth rate insights you need. Purchase the complete report to gain a clear roadmap for strategic decision-making and capitalize on every opportunity.

Stars

Ovintiv's Permian Basin assets are a significant contributor to its portfolio, positioned as a strong performer. The company intends to allocate between $1.2 billion and $1.3 billion in 2025 to develop this region, targeting the completion of 130 to 140 net wells.

This area is characterized by its rich liquid content, with production comprising 80-81% liquids, underscoring its high-value output. Ovintiv has consistently achieved impressive well performance and capital efficiency in the Permian.

The ongoing investment strategy focuses on optimizing returns by accelerating drilling and completion times while simultaneously driving down operational costs in this key basin.

Ovintiv's acquisition of oil-rich Montney assets, finalized in January 2025, dramatically boosts its premium oil reserves. This strategic move, adding around 70 million barrels of oil equivalent per day (MBOE/d) and 900 net well locations, positions Ovintiv as a leading operator in the Montney play, extending its inventory life to approximately 15 years.

The company is diligently integrating these newly acquired assets, focusing on achieving significant cost reduction synergies. This integration is crucial for maximizing the value of the acquisition and enhancing Ovintiv's overall operational efficiency and profitability within the Montney region.

Ovintiv prioritizes capital efficiency, especially in its prime oil regions like the Permian and Montney. This translates to lower drilling and completion expenses, faster execution, and the adoption of advanced techniques such as Trimulfrac.

These operational enhancements enable Ovintiv to sustain or boost well development while reducing capital outlay, leading to enhanced production volumes from each well. For instance, in 2023, the company reported a 10% reduction in its Permian drilling and completion costs compared to 2022, showcasing tangible efficiency gains.

Strategic Portfolio High-Grading

Ovintiv's strategic portfolio high-grading is a core element of its business model, aiming to optimize asset quality and financial performance. This involves a deliberate process of shedding less productive or more expensive assets while actively pursuing acquisitions of high-value, oil-focused properties. This strategy directly bolsters the profitability and future growth prospects of the company's core holdings by ensuring capital is concentrated on the most promising ventures.

A prime example of this strategic maneuver in action is Ovintiv's recent acquisition in the Montney region, which is known for its rich oil and gas reserves. Simultaneously, the company divested its Uinta assets, a move that aligns with the objective of simplifying its operational footprint and focusing on premium resource plays. These actions underscore a commitment to enhancing the overall quality and economic efficiency of its asset base.

- Portfolio Optimization: Ovintiv consistently refines its asset mix by divesting non-core or higher-cost operations.

- Acquisition Focus: The company targets premium, oil-rich assets to enhance its resource base.

- Montney Acquisition: This recent move exemplifies the strategy of acquiring high-value, liquids-rich acreage.

- Uinta Divestiture: This action demonstrates the commitment to shedding less strategic or higher-cost assets.

Increased Production Guidance

Ovintiv has demonstrated exceptional operational execution, consistently meeting and often surpassing its production targets. This track record has led to an upward revision of its full-year 2024 total production guidance, with a strong outlook maintained for 2025.

This increased production guidance underscores Ovintiv's robust operational capabilities and its commitment to achieving growth in its key operating areas. The company's strategic focus on the Permian and Montney basins is a primary driver for these higher production volumes, positioning Ovintiv for continued success.

- Raised 2024 Production Guidance: Ovintiv has increased its total production targets for the full year 2024.

- Strong 2025 Outlook: The company maintains a positive and robust production outlook for 2025.

- Core Basin Strength: The Permian and Montney basins are critical to achieving these elevated production levels.

- Operational Excellence: Consistent performance exceeding guidance highlights strong operational management.

Ovintiv's Permian Basin and Montney assets are clearly its Stars in the BCG matrix, generating significant cash flow and exhibiting strong growth potential. The company's strategic focus on these premium, oil-rich regions, evidenced by substantial planned investments and successful acquisitions, solidifies their position. These assets are characterized by high liquids content and exceptional operational efficiency, driving Ovintiv's overall performance and future prospects.

| Asset Area | Strategy Focus | Key Metrics | Investment (2025 Est.) |

|---|---|---|---|

| Permian Basin | Optimize returns, accelerate drilling, reduce costs | 80-81% Liquids, 10% cost reduction (2023 vs 2022) | $1.2 - $1.3 billion |

| Montney | Integrate acquisitions, achieve cost synergies | ~70 MBOE/d acquired, ~15 years inventory life | Integrated into overall capital plan |

What is included in the product

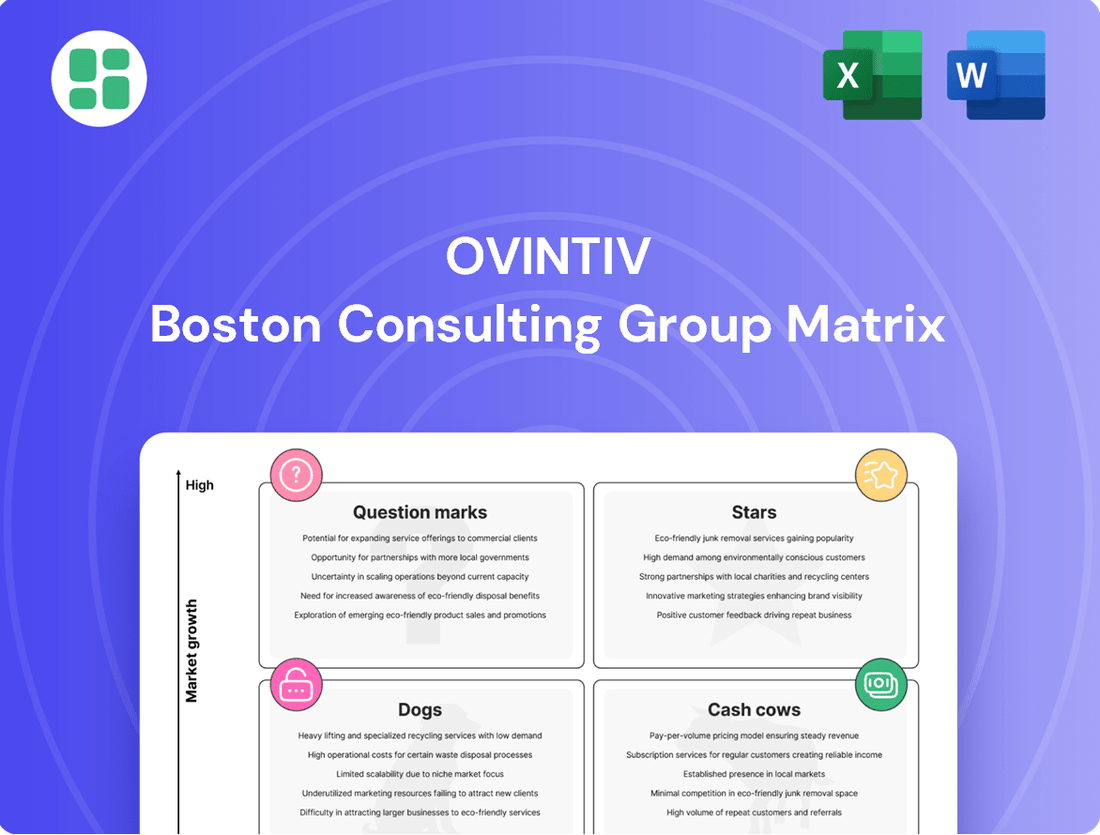

Ovintiv's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal portfolio performance.

Ovintiv's BCG Matrix offers a clear, one-page overview, simplifying complex portfolio decisions.

Cash Cows

Ovintiv's focus on generating sustainable free cash flow is a key indicator of its strong position. For the full year 2024, the company reported a robust $1.7 billion in free cash flow, with expectations for continued strength throughout 2025.

This consistent cash generation is characteristic of a cash cow, offering significant financial flexibility. This allows Ovintiv to effectively manage debt, reward shareholders through returns, and pursue strategic growth opportunities.

The company's commitment to a disciplined capital program is fundamental to underpinning this impressive and sustainable free cash flow performance.

Ovintiv's disciplined capital allocation strategy is designed to maximize returns from its established "Cash Cows." The company is committed to returning at least 50% of its free cash flow, after paying its base dividend, directly to shareholders via share repurchases and variable dividends. This focus ensures that mature, profitable assets translate into tangible value for investors.

The remaining free cash flow is strategically directed towards debt reduction, with a clear long-term target of $4.0 billion in debt. This commitment to a strong balance sheet provides financial stability and flexibility, further supporting shareholder returns and the overall health of the business.

Ovintiv's mature, efficient Permian operations are clear cash cows. These established areas, characterized by optimized infrastructure and lower decline rates, consistently generate substantial and stable cash flows. In 2024, Ovintiv reported that its Permian segment continued to be a significant contributor to its overall financial performance, benefiting from disciplined capital allocation and operational excellence.

Stable Natural Gas Production with Hedging

Ovintiv's extensive natural gas production, especially from its mature Montney assets, acts as a significant and reliable revenue generator. These operations are designed for consistent output, providing a stable foundation for the company's financial performance.

The company actively employs hedging strategies and secures firm transportation agreements. These measures are crucial for shielding its natural gas operations from the unpredictable swings in market prices, thereby fostering more dependable cash flows from these mature assets.

- Montney Asset Contribution: In 2024, Ovintiv continued to benefit from its established Montney assets, which are known for their stable and predictable natural gas output.

- Hedging Effectiveness: The company’s hedging program in 2024 aimed to lock in favorable prices, reducing the impact of price volatility and ensuring consistent revenue streams from its gas production.

- Transportation Security: Firm transportation agreements in place for 2024 guaranteed that Ovintiv could deliver its natural gas to market, avoiding potential curtailments and realizing its production value.

Operational Excellence Driving Cost Control

Ovintiv's commitment to operational excellence has demonstrably lowered its upstream operating expenses and transportation costs. For instance, in 2023, the company reported a reduction in its operating expense per barrel of oil equivalent (boe) compared to previous periods, a direct result of these efficiency drives.

These cost savings in their more established assets directly translate into fatter profit margins and a healthier cash flow. This financial strength underpins the classification of these well-managed assets as cash cows within Ovintiv's portfolio.

The company's focus on reducing costs per boe not only boosts profitability but also enhances the overall financial resilience of its operations.

- Reduced Operating Expenses: Ovintiv's 2023 results showed a decrease in operating costs per boe, driven by efficiency initiatives.

- Transportation Cost Savings: Streamlined logistics have contributed to lower overall transportation expenses for their production.

- Enhanced Profit Margins: Lower costs directly improve the profitability of their mature, cash-generating assets.

- Increased Cash Flow: Operational efficiencies are a key driver of consistent and robust cash flow generation.

Ovintiv's mature Permian and Montney assets are prime examples of cash cows. These operations consistently generate substantial, stable cash flows due to optimized infrastructure and lower decline rates. The company's commitment to operational excellence, evidenced by reduced operating expenses per barrel of oil equivalent (boe) in 2023, directly enhances profit margins and cash generation from these established assets.

Hedging strategies and firm transportation agreements further stabilize revenue streams from natural gas production, shielding them from market volatility. This disciplined approach ensures these mature assets provide reliable financial returns, supporting Ovintiv's overall financial health and shareholder value.

| Asset Type | Key Characteristics | 2024 Contribution |

| Permian Operations | Mature, optimized infrastructure, lower decline rates | Significant contributor to financial performance |

| Montney Natural Gas | Stable and predictable output, extensive production | Reliable revenue generator, foundation for financial performance |

| Operational Efficiency | Reduced operating expenses per boe (e.g., 2023 improvements) | Enhanced profit margins, increased cash flow |

Preview = Final Product

Ovintiv BCG Matrix

The Ovintiv BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after your purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use resource. You can confidently use this preview as a direct representation of the valuable insights and actionable strategies contained within the complete Ovintiv BCG Matrix report.

Dogs

Ovintiv's divestiture of its Uinta Basin assets for roughly $2.0 billion in 2024 highlights a strategic move away from a higher-cost, legacy portfolio. These assets, largely undeveloped, were likely underperforming and not aligned with the company's focus on more profitable, oil-rich plays. This action positions Ovintiv to concentrate resources on its core, high-margin assets.

Ovintiv’s strategy of non-core asset rationalization is a key component of its business approach. This involves divesting properties that no longer align with the company's core objectives or offer competitive returns. For instance, the sale of the Uinta Basin assets in 2023, following the earlier divestiture of the Williston Basin, exemplifies this. These moves are designed to sharpen the company's focus on its most promising areas.

These divested assets, while capable of production, are often less efficient or profitable when compared to Ovintiv's primary operational focus. By shedding these properties, the company liberates capital. This freed-up capital is then strategically redeployed into higher-value opportunities, such as expanding operations in their core plays like the Permian or Montney regions.

In 2023, Ovintiv completed the sale of its Uinta Basin assets for approximately $1.1 billion. This strategic move allowed the company to reduce its debt and enhance its financial flexibility, directly supporting its objective of reinvesting in assets with superior growth potential and profitability. Such rationalization is crucial for maximizing shareholder value and maintaining a competitive edge in the energy sector.

Underperforming older wells, characterized by high decline rates and substantial maintenance costs for meager returns, would likely be classified as dogs within Ovintiv's portfolio. These assets demand disproportionate capital for minimal output, making them prime candidates for divestiture or abandonment.

While Ovintiv's public disclosures don't explicitly label specific wells as dogs, their consistent focus on capital discipline and optimizing returns strongly suggests an ongoing assessment of such underperforming assets. This strategic approach implies a proactive management of the well inventory, aiming to shed liabilities that drag down overall performance.

For instance, in 2024, Ovintiv's capital expenditure plan prioritized high-return unconventional developments, underscoring a commitment to allocating resources where they generate the most value. This strategic allocation naturally leads to the de-prioritization and potential exit from older, less productive conventional wells that no longer meet these stringent return thresholds.

Marginal Natural Gas Plays

Marginal natural gas plays, often characterized by unfavorable pricing differentials or elevated lifting costs that outpace revenue, can be viewed as dogs within Ovintiv's portfolio. These segments may struggle to generate sufficient returns, especially when market conditions are volatile.

Ovintiv's strategic emphasis on diversifying its natural gas markets and employing robust hedging strategies is designed to buffer against such risks. However, any production that remains unhedged or incurs exceptionally high operational expenses could indeed be classified in this category.

For instance, if a specific basin experiences a significant price discount compared to benchmark Henry Hub prices, and its production costs exceed this differential, it would represent a marginal play. As of early 2024, some smaller, non-core natural gas assets in regions with limited takeaway capacity might face these challenges, impacting their profitability.

- Unfavorable Pricing: Plays with significant discounts to benchmark gas prices, potentially due to regional supply/demand imbalances or transportation constraints.

- High Lifting Costs: Operations where the cost to extract and produce natural gas is disproportionately high relative to the revenue generated.

- Market Diversification Impact: Ovintiv's efforts to spread sales across various markets can mitigate dog status, but unhedged volumes in less favorable markets remain vulnerable.

- 2024 Sensitivity: The profitability of marginal plays in 2024 is heavily influenced by natural gas spot prices, which have shown considerable fluctuation, impacting the economic viability of higher-cost production.

Assets with High Operating Expenses

Assets with high operating expenses, often referred to as dogs in a BCG matrix context, are those that consistently demand significant upstream operating or transportation and processing costs per barrel of oil equivalent. This occurs without a corresponding increase in production volume or a favorable liquids content. For instance, if an asset's operating cost per barrel is notably higher than the industry average, say exceeding $25 per boe, and it doesn't compensate with a high percentage of valuable light crude or natural gas liquids, it falls into this category.

These underperforming assets can become significant cash drains, negatively impacting a company's overall capital efficiency. In 2024, for example, companies with a substantial portion of their portfolio in such high-cost, low-return assets experienced a noticeable dip in their free cash flow generation. This situation compels management to seriously consider strategic options, such as divestment to unlock capital or a drastic reduction in investment to minimize further cash erosion.

Consider the following characteristics of these dog assets:

- High Cost Per Barrel: Operating expenses per barrel of oil equivalent (boe) are consistently above industry benchmarks, potentially by 20% or more.

- Low Production or Liquids Yield: These assets do not deliver sufficient production volumes or a high enough proportion of valuable liquids to justify their operating costs.

- Cash Drain: They consume more capital than they generate, reducing overall profitability and capital efficiency.

- Strategic Review: Companies often evaluate these assets for potential divestment or significantly scaled-back development plans to improve portfolio performance.

Assets classified as Dogs in Ovintiv's portfolio are those that are capital-intensive with low returns, often characterized by high operating costs and declining production. These segments, like marginal natural gas plays or older conventional wells, struggle to generate sufficient revenue, especially in volatile market conditions. Ovintiv's strategic divestitures, such as the Uinta Basin assets in 2024, reflect a move to shed these underperforming assets and reallocate capital to more profitable, high-return areas. This focus on portfolio optimization is key to enhancing overall financial performance and shareholder value.

Question Marks

Ovintiv actively explores and tests novel drilling and completion techniques to boost operational efficiency and resource extraction. These advanced technologies, though promising for future growth, currently represent a small fraction of Ovintiv's total operations, as they are still in the pilot or early implementation stages.

For instance, in 2024, Ovintiv reported testing advanced automation in its Permian operations, aiming to reduce cycle times by up to 15%. While initial results are encouraging, widespread adoption hinges on proving consistent cost savings and reliability across diverse geological conditions.

Ovintiv might target bolt-on acquisitions in developing basins, aiming to bolster its presence in areas with significant growth potential. These strategic moves would initially represent smaller market shares but are poised for expansion as the company integrates and develops acquired assets, aligning with a Stars or Question Marks quadrant strategy.

Ovintiv's presence in the Anadarko Basin, while contributing to its overall output, presents a strategic question mark within its portfolio. Planned investments for 2025 are notably lower compared to its Permian and Montney assets, indicating a potentially slower growth outlook for this region.

The basin's future role hinges on Ovintiv's decision to either boost investment for accelerated growth or maintain its current contribution level, balancing steady production against the higher expansion potential seen elsewhere.

Unproven or Early-Stage Exploration Prospects

Ovintiv's unproven or early-stage exploration prospects are akin to the question marks in the BCG matrix. These are areas where the company is investing in the potential for future growth, but success is far from guaranteed. Think of them as the wildcat wells or undeveloped acreage that could hold vast reserves, but also might yield nothing.

These ventures represent a high-risk, high-reward proposition. While they currently contribute negligibly to Ovintiv's overall production or market share, a successful discovery could significantly alter the company's future trajectory. The capital expenditure required to explore and develop these prospects is substantial, underscoring the speculative nature of these investments.

- High Potential Growth: Successful exploration could unlock significant new reserves, boosting future production and cash flows.

- Negligible Market Share: Currently, these prospects do not contribute meaningfully to Ovintiv's existing market position.

- Significant Investment Required: Proving commercial viability and scaling production demands substantial capital outlay.

- High Risk, High Reward: These ventures carry a considerable risk of failure but offer the potential for outsized returns if successful.

Scaling Recently Integrated Assets Beyond Initial Synergies

While Ovintiv's Montney acquisition is positioned as a Star in the BCG matrix, the question mark arises from the challenge of scaling these assets beyond the initial integration and synergy realization. This requires substantial ongoing capital investment and a sustained strategic focus to unlock their full, long-term growth potential.

To truly maximize the value of the Montney assets, Ovintiv will need to commit significant capital. For instance, in 2024, the company planned to invest approximately $1.3 billion in its Canadian operations, with a substantial portion allocated to the Montney. This ongoing investment is crucial for expanding production and infrastructure to capture a larger market share.

- Capital Allocation: Continued significant capital deployment into the Montney is essential for infrastructure expansion and drilling programs.

- Strategic Focus: Maintaining a dedicated strategic emphasis on the Montney ensures that growth opportunities are identified and pursued effectively.

- Market Share Growth: The ability to scale production and optimize operations will directly translate into an increased market share within the natural gas sector.

- Long-Term Potential: Realizing the full potential requires a multi-year commitment to development, moving beyond the initial integration phase.

Ovintiv's question marks represent ventures with uncertain futures but significant potential. These are areas where the company is investing in new technologies or undeveloped acreage, like its early-stage automation tests in the Permian, aiming for efficiency gains. While these initiatives currently contribute minimally, a successful outcome could dramatically shift Ovintiv's market position. For example, the Anadarko Basin, with lower planned investments for 2025 compared to core assets, is a strategic question mark, its future role dependent on increased capital allocation for growth.

| BCG Category | Ovintiv Example | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Marks | Early-stage automation in Permian | High (potential for efficiency gains) | Low (currently small fraction of operations) | Requires further investment and proof of concept to become a Star or Dog. |

| Question Marks | Undeveloped acreage/exploration prospects | High (potential for new reserves) | Low (negligible current contribution) | High risk, high reward; success could lead to significant future growth. |

| Question Marks | Anadarko Basin (lower planned 2025 investment) | Moderate (dependent on future investment) | Moderate (contributes to overall output) | Decision point: increase investment for growth or maintain current contribution. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.