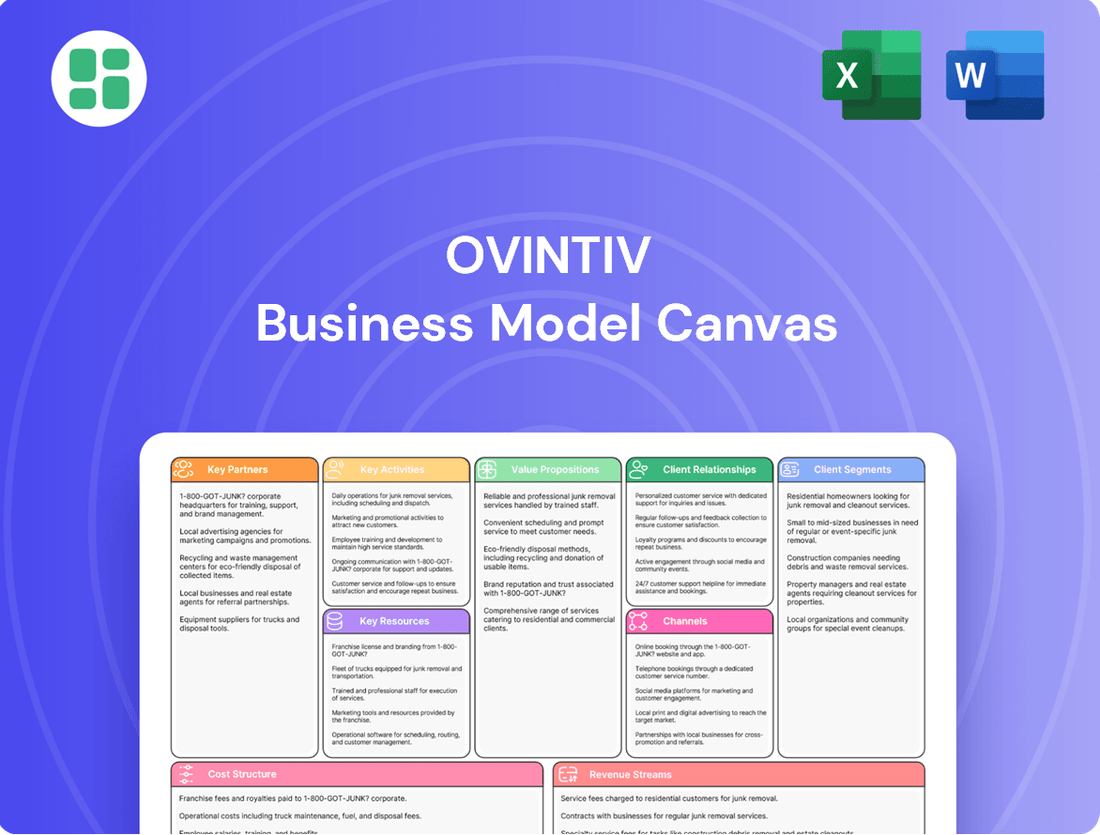

Ovintiv Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ovintiv Bundle

Unlock the strategic core of Ovintiv's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their competitive advantage. Perfect for anyone seeking to understand the mechanics of a leading energy company.

Partnerships

Ovintiv heavily depends on a robust network of specialized service providers and contractors for its core operations, encompassing drilling, completion, and well servicing activities. These crucial partnerships provide access to essential specialized equipment, advanced technical expertise, and skilled labor necessary for efficient and safe resource development across its key operating basins like the Permian, Montney, and Anadarko.

Ovintiv relies heavily on midstream partners for critical infrastructure, including pipelines and processing facilities, to move its oil and natural gas to market. These partnerships are vital for ensuring the efficient and cost-effective transportation and processing of its production. For example, in 2024, Ovintiv continued to leverage its midstream agreements to optimize its supply chain and access key demand centers.

Ovintiv actively collaborates with technology and innovation partners to boost operational efficiency and lessen its environmental footprint. For instance, in 2024, the company continued to integrate advanced digital solutions across its field operations, aiming for better data-driven decision-making and resource optimization.

These partnerships are crucial for adopting cutting-edge drilling techniques and technologies that enhance resource recovery while simultaneously reducing emissions. Ovintiv's commitment to innovation is reflected in its ongoing exploration and implementation of new methods to improve performance and sustainability.

Joint Venture Partners

Ovintiv strategically partners through joint ventures to share significant risks and costs associated with large-scale energy projects. These collaborations allow Ovintiv to leverage specialized expertise from partners, leading to more efficient operations and better resource management. For instance, in 2024, Ovintiv continued to evaluate opportunities for such alliances to access new, high-potential acreage and critical infrastructure, thereby optimizing capital deployment.

These joint ventures enhance Ovintiv's operational scale and market reach within its core operating basins. By pooling resources and knowledge, the company can more effectively develop complex projects and expand its production capacity. This approach is crucial for maintaining a competitive edge and maximizing the value of its asset portfolio.

Key benefits of these partnerships include:

- Risk Mitigation: Sharing the financial burden and operational risks of exploration and production.

- Expertise Sharing: Accessing complementary technical skills and market knowledge from partners.

- Acreage Access: Gaining entry to new or contiguous land positions that might be difficult to secure independently.

- Infrastructure Optimization: Collaborating on the development and utilization of shared infrastructure like pipelines and processing facilities.

Regulatory Bodies and Local Communities

Maintaining robust relationships with regulatory bodies and local communities is paramount for Ovintiv. These partnerships are crucial for obtaining and retaining operating permits, ensuring strict adherence to environmental and safety regulations, and cultivating a social license to operate. For instance, in 2023, Ovintiv reported significant community investment totaling $18.1 million across its operating regions, underscoring its commitment to these vital relationships.

These collaborations involve proactive, transparent communication and a steadfast commitment to regulatory compliance. Ovintiv actively engages with stakeholders to address concerns and build trust. This approach is fundamental to responsible resource development, ensuring that operations align with societal expectations and environmental stewardship.

- Regulatory Compliance: Adherence to all federal, state, and local regulations, including environmental protection and worker safety standards.

- Community Engagement: Investing in local initiatives, supporting economic development, and maintaining open dialogue with community members.

- Permitting and Approvals: Securing necessary permits and approvals from governmental agencies for exploration and production activities.

- Social License to Operate: Building and maintaining trust and acceptance from the communities where Ovintiv operates.

Ovintiv's key partnerships are essential for operational success and strategic growth, encompassing service providers, midstream companies, technology innovators, and joint venture participants. These alliances provide critical access to specialized equipment, infrastructure, and expertise, enabling efficient resource development and market access.

In 2024, Ovintiv continued to strengthen its relationships with technology partners to enhance operational efficiency and reduce its environmental impact through the integration of advanced digital solutions. The company also strategically utilized joint ventures to share risks and costs, access new acreage, and optimize capital deployment, thereby expanding its operational scale and market reach.

| Partnership Type | Key Role | 2024 Focus/Example |

|---|---|---|

| Service Providers & Contractors | Drilling, completion, well servicing | Access to specialized equipment and technical expertise |

| Midstream Partners | Transportation and processing of oil and gas | Optimizing supply chain and access to demand centers |

| Technology & Innovation Partners | Enhancing operational efficiency, reducing environmental footprint | Integrating advanced digital solutions for data-driven decision-making |

| Joint Venture Partners | Risk sharing, cost sharing, acreage access | Accessing new acreage and critical infrastructure, optimizing capital deployment |

What is included in the product

A detailed breakdown of Ovintiv's strategy, outlining its target customer segments in the energy sector, its value proposition centered on efficient and responsible resource development, and the key activities and resources required for its operations.

Ovintiv's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex oil and gas operations, enabling quick identification of inefficiencies and strategic alignment.

This structured approach allows Ovintiv to efficiently pinpoint and address operational challenges, streamlining resource allocation and improving overall business performance.

Activities

Ovintiv's exploration and appraisal activities are central to its business, focusing on identifying and evaluating new oil and natural gas prospects. These efforts are concentrated in its key strategic basins: the Permian, Montney, and Anadarko. The company leverages advanced geological and geophysical studies to thoroughly assess the resource potential of these areas. This meticulous evaluation helps determine the most promising locations for future drilling and development, directly impacting the company's long-term production capabilities.

Drilling and completions are core to Ovintiv's operations, focusing on extracting oil and natural gas. This involves drilling new wells and then completing them, often using sophisticated methods like hydraulic fracturing, to access the valuable hydrocarbons trapped underground.

These activities are essential for maintaining and increasing Ovintiv's production. By bringing new wells online, the company ensures a steady supply of resources, directly impacting its ability to meet market demand and grow its overall output across its diverse land holdings.

In 2024, Ovintiv continued to emphasize efficient drilling and completion techniques. For instance, the company reported achieving significant advancements in well productivity and cycle times, contributing to a strong operational performance throughout the year.

Ovintiv’s production and operations management is focused on maximizing the recovery of hydrocarbons from its existing wells and infrastructure. This means they are constantly monitoring and maintaining their facilities to ensure everything runs smoothly, safely, and with minimal environmental impact.

In 2024, Ovintiv continued to prioritize operational efficiency. For instance, their focus on optimizing production from existing assets contributed to their ability to generate strong free cash flow, a key metric for their financial performance.

The company’s commitment to responsible operations is reflected in their ongoing efforts to reduce emissions and improve water management practices across their production sites, ensuring long-term sustainability.

Capital Allocation and Portfolio Optimization

Ovintiv’s capital allocation strategy is central to its operations, prioritizing investments in its most promising assets to drive sustainable free cash flow generation. This strategic focus guides decisions on acquiring and divesting assets to refine its portfolio.

A prime example of this strategy in action is the company's recent acquisition in the Montney region, a move designed to bolster its presence in a high-value basin. Concurrently, the divestiture of assets in the Uinta basin demonstrates a commitment to portfolio optimization, ensuring capital is deployed where it can yield the greatest returns.

- Strategic Capital Allocation: Directing investments towards highest-return projects across its multi-basin portfolio.

- Portfolio Enhancement: Executing acquisitions and divestitures to improve asset quality and strategic focus.

- 2024 Focus: Continued emphasis on disciplined capital deployment and shareholder returns, with a significant portion of capital expected to be returned to shareholders through buybacks and dividends.

Marketing and Risk Management

Ovintiv’s marketing activities focus on selling its produced oil, natural gas, and natural gas liquids to a diverse customer base. This involves securing favorable sales agreements and managing transportation logistics to ensure efficient delivery and optimal pricing for its products.

Risk management is a critical component, primarily through the implementation of hedging strategies. These strategies are designed to mitigate the impact of commodity price volatility on the company's revenue streams. By hedging, Ovintiv aims to lock in prices for a portion of its future production, thereby protecting against adverse market fluctuations and ensuring more predictable financial performance.

- Marketing: Ovintiv sells crude oil, natural gas, and NGLs to various industrial and commercial customers.

- Risk Management: Hedging strategies are employed to manage commodity price risk.

- Objective: To ensure stable revenue streams and protect against market volatility.

- Outcome: Optimization of realized product prices and improved financial predictability.

Ovintiv’s marketing and risk management activities are crucial for translating its production into revenue. The company sells its crude oil, natural gas, and natural gas liquids to a broad range of customers, focusing on securing advantageous sales agreements and managing the logistics of transportation to ensure efficient delivery and optimal pricing.

Risk management, particularly through hedging strategies, is employed to buffer against the inherent volatility of commodity prices. These strategies aim to secure prices for future production, thereby enhancing financial predictability and protecting revenue streams from adverse market swings.

In 2024, Ovintiv continued to execute its marketing and risk management plans to optimize realized prices and maintain financial stability amidst fluctuating market conditions.

| Activity | Description | 2024 Focus/Outcome |

|---|---|---|

| Marketing | Sales of crude oil, natural gas, and NGLs to diverse customers. | Securing favorable sales agreements and managing transportation logistics. |

| Risk Management | Hedging strategies to mitigate commodity price volatility. | Protecting revenue streams and ensuring predictable financial performance. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, providing a comprehensive overview of Ovintiv's strategic framework. This isn't a sample or mockup; it's a direct representation of the final, ready-to-use deliverable. Upon completing your order, you'll gain full access to this same detailed analysis, ensuring transparency and immediate utility for your understanding of Ovintiv's operations.

Resources

Ovintiv's core strength lies in its substantial proved oil, natural gas, and natural gas liquids reserves. These reserves are primarily concentrated in the Permian, Montney, and Anadarko basins, forming the bedrock of its operations and future revenue potential.

As of the end of 2023, Ovintiv reported approximately 3.5 billion barrels of oil equivalent (boe) in proved reserves. This vast resource base is crucial for sustaining and growing its production volumes, directly impacting its ability to generate cash flow and shareholder value.

Ovintiv's extensive land and mineral rights acreage positions, particularly in core North American basins like the Permian, Montney, and Anadarko, are foundational to its business. These vast holdings grant the company long-term, cost-effective access to significant hydrocarbon resources, ensuring a robust inventory for future development.

As of the first quarter of 2024, Ovintiv reported approximately 6,000 net sections of total acreage across its key operating areas. This substantial acreage base is directly linked to its ability to plan and execute multi-year development programs, providing a stable platform for sustained production and reserve growth.

These mineral rights are not just about current production; they represent a strategic advantage, enabling Ovintiv to efficiently deploy capital and expand its drilling inventory. This foresight is critical for maintaining competitive operational costs and maximizing the economic potential of its resource base over the long term.

Ovintiv's drilling and production infrastructure is a cornerstone of its operations, encompassing a vast network of physical assets. This includes essential equipment like drilling rigs, numerous well sites, and an extensive system of pipelines for efficient hydrocarbon transportation.

These facilities are critical for the entire lifecycle of oil and gas extraction, from initial exploration and development to the final production stages. The company's investment in and maintenance of this infrastructure directly impacts its ability to extract resources cost-effectively and deliver them to market.

As of the first quarter of 2024, Ovintiv reported capital expenditures of approximately $700 million, a significant portion of which is allocated to maintaining and enhancing its production infrastructure. This ongoing investment underscores the vital role these physical resources play in the company's business model and its commitment to operational efficiency.

Human Capital and Expertise

Ovintiv's human capital is a cornerstone of its operations, encompassing a diverse team of geologists, engineers, field operators, and seasoned management. This collective expertise is fundamental to their success in unconventional resource development.

The deep knowledge possessed by these professionals in areas like reservoir characterization, drilling optimization, and production enhancement is crucial for unlocking the full potential of Ovintiv's asset base. Their strategic planning capabilities further ensure efficient resource allocation and long-term value creation.

- Skilled Workforce: Ovintiv employs highly trained geoscientists and engineers specializing in complex shale plays.

- Operational Excellence: Field operators are key to maintaining efficient and safe production processes.

- Strategic Leadership: Management's expertise guides asset development and capital allocation.

- Innovation: The company relies on its people to drive innovation in extraction and processing technologies.

Financial Capital and Liquidity

Ovintiv's financial capital is a cornerstone of its business model, enabling robust operations and strategic expansion. In 2024, the company demonstrated its financial strength through significant cash flow generation and strategic deployment of capital. Access to credit facilities and capital markets further bolsters its ability to fund key initiatives.

Maintaining a healthy liquidity position is paramount for Ovintiv. This ensures the company can meet its financial obligations, invest in growth opportunities, and return value to shareholders. A strong balance sheet underpins confidence and provides flexibility in a dynamic energy market.

- Cash Flow Generation: Ovintiv reported strong operational cash flow in 2024, providing a solid base for its financial activities.

- Credit Facilities: The company has access to substantial revolving credit facilities, offering financial flexibility for working capital and general corporate purposes.

- Capital Markets Access: Ovintiv can tap into capital markets to secure funding for major projects and strategic acquisitions.

- Liquidity Management: Prudent management of cash and cash equivalents ensures Ovintiv can navigate market fluctuations and pursue growth.

Ovintiv's key resources include its substantial proved reserves, extensive land and mineral rights, robust drilling and production infrastructure, skilled human capital, and strong financial resources. These elements collectively enable the company to efficiently extract and deliver hydrocarbons, drive innovation, and maintain financial stability.

| Key Resource | Description | 2024 Data/Context |

| Proved Reserves | Significant oil, natural gas, and NGL reserves in key North American basins. | Approximately 3.5 billion boe (end of 2023). |

| Land & Mineral Rights | Vast acreage providing long-term access to hydrocarbon resources. | Around 6,000 net sections across core areas (Q1 2024). |

| Infrastructure | Drilling rigs, well sites, and pipeline systems for extraction and transport. | Capital expenditures of ~$700 million allocated to infrastructure (Q1 2024). |

| Human Capital | Expertise in geology, engineering, operations, and management. | Specialized geoscientists and engineers driving operational excellence and innovation. |

| Financial Capital | Cash flow generation, credit facilities, and access to capital markets. | Strong operational cash flow and access to substantial revolving credit facilities. |

Value Propositions

Ovintiv ensures a steady flow of vital energy resources like oil and natural gas, which are fundamental to powering everything from our homes to industries. This consistent supply underpins economic activity and everyday conveniences.

The company is committed to responsible resource extraction, integrating environmental stewardship into its operations. This focus aims to minimize impact and ensure sustainable production practices for the long term.

In 2024, Ovintiv continued to prioritize operational efficiency and safety across its North American assets, reinforcing its commitment to reliable energy delivery while adhering to stringent environmental standards.

Ovintiv's commitment to sustainable free cash flow generation is a cornerstone of its business model. This consistent cash generation underpins the company's ability to maintain capital discipline, allowing for strategic investments and shareholder returns.

In 2024, Ovintiv demonstrated robust free cash flow generation, a testament to its operational efficiency and prudent financial management. This financial strength provides the flexibility to navigate market fluctuations and pursue growth opportunities.

Ovintiv is dedicated to generating enduring shareholder returns by consistently providing both base dividends and executing share repurchase programs. This dual approach is designed to boost investor value and deliver reliable financial advantages, underscoring the company's commitment to efficient capital deployment and sound financial management.

In 2024, Ovintiv continued its focus on shareholder returns, with the company announcing a quarterly base dividend of $0.35 per share. Alongside this, a significant share repurchase program was in effect, demonstrating a proactive strategy to return capital directly to investors and enhance per-share metrics.

Optimized Portfolio of High-Quality Assets

Ovintiv manages a premier, multi-basin portfolio of oil and natural gas assets. These are strategically situated in key North American resource plays, including the Permian, Montney, and Anadarko basins. This focus ensures access to high-quality, low-cost production opportunities.

The company's optimized asset base boasts a substantial inventory of premium drilling locations. This depth of opportunity underpins Ovintiv's ability to deliver consistent, long-term production growth and robust value creation for shareholders.

- Strategic Asset Locations: Permian, Montney, Anadarko basins.

- Deep Drilling Inventory: Premium locations for long-term production.

- Quality Focus: Emphasis on high-quality, cost-effective assets.

Operational Excellence and Capital Efficiency

Ovintiv prioritizes operational excellence, consistently refining its drilling and completion processes to boost efficiency. This dedication to improvement directly impacts its capital efficiency, ensuring that investments yield maximum returns. For instance, in 2024, the company aimed for significant improvements in its Permian Basin operations, targeting a 5% reduction in well costs through enhanced execution and technology adoption.

This focus on operational rigor translates into tangible benefits for Ovintiv and its stakeholders. By lowering costs and increasing output per well, the company enhances its profitability and strengthens its competitive position in the energy market. In the first quarter of 2024, Ovintiv reported a 10% year-over-year increase in production per rig, a direct result of these efficiency gains.

- Enhanced Drilling and Completion Efficiencies: Ovintiv's commitment to continuous improvement in its operational workflows.

- Leading Capital Efficiency: Maximizing the economic value derived from its asset base through smart capital deployment.

- Cost Reduction and Productivity Gains: Direct impact of operational excellence on the company's bottom line and output.

- Maximizing Economic Returns: The ultimate goal of achieving superior performance from its oil and gas assets.

Ovintiv's value proposition centers on delivering reliable energy while fostering financial strength and rewarding shareholders. The company leverages its premium asset base and operational expertise to generate sustainable free cash flow, ensuring consistent returns through dividends and share repurchases.

Customer Relationships

Ovintiv actively cultivates investor relations through quarterly earnings calls, investor days, and detailed annual reports. These channels ensure stakeholders receive timely updates on operational performance, strategic initiatives, and capital deployment, such as the $1.3 billion in share repurchases and dividends returned to shareholders in 2023.

This proactive communication strategy aims to build and maintain trust with the financial community. By providing clear insights into Ovintiv's financial health and future outlook, the company empowers investors to make well-informed decisions regarding their holdings.

Ovintiv's relationships with direct purchasers of oil, natural gas, and NGLs are largely transactional, heavily influenced by current market demand and prevailing pricing. These interactions focus on securing favorable sales contracts and ensuring the efficient delivery of produced volumes to diverse downstream markets.

In 2024, Ovintiv's marketing and midstream segment generated significant revenue, with approximately 70% of its crude oil and condensate volumes sold under market-based agreements, reflecting the dynamic nature of these customer relationships. The company actively manages these agreements to optimize off-take and capture value across various basins.

Ovintiv actively engages with communities in its operational regions, focusing on addressing concerns and fostering local development to secure its social license to operate. In 2023, the company reported approximately $13.8 million in community investments and sponsorships, demonstrating a commitment to tangible local contributions.

This engagement extends to creating employment opportunities and maintaining open communication channels, aiming to build lasting, mutually beneficial relationships. Ovintiv’s workforce in 2023 comprised around 4,400 employees, with a significant portion contributing to the local economies where they operate.

Regulatory Compliance and Government Relations

Ovintiv actively manages its relationships with governmental and regulatory bodies to ensure strict adherence to environmental, safety, and operational standards. This proactive engagement is crucial for maintaining its license to operate and fostering trust.

The company engages in regular reporting and dialogues with agencies to stay compliant with evolving regulations. For instance, in 2024, Ovintiv continued to focus on meeting stringent methane emission reduction targets, a key area of regulatory scrutiny in the energy sector.

- Environmental Compliance: Adherence to air, water, and land use permits, including ongoing monitoring and reporting as mandated by federal, state, and provincial authorities.

- Safety Regulations: Implementing and maintaining robust safety protocols that meet or exceed Occupational Safety and Health Administration (OSHA) and similar international standards.

- Energy Policy Dialogue: Participating in discussions and providing input on energy policy development, particularly concerning resource management and climate initiatives.

- Permitting and Approvals: Securing and maintaining necessary permits for exploration, production, and infrastructure development, often involving extensive environmental impact assessments.

Supply Chain Partnerships

Ovintiv’s supply chain partnerships with providers of equipment, materials, and essential services are fundamental to maintaining seamless operations and optimizing efficiency. These relationships are carefully cultivated to guarantee punctual deliveries, uphold stringent quality standards, and ensure cost-effectiveness. For instance, in 2024, Ovintiv continued to leverage strategic alliances with key drilling and completion service providers, a critical component of their operational strategy.

These collaborations are actively managed to bolster the entire supply chain's resilience, ensuring Ovintiv can adapt to market fluctuations and operational demands. Effective management includes robust contract negotiations and performance monitoring, directly impacting project timelines and budget adherence. The company's commitment to strong supplier relationships was evident in its 2024 capital expenditure plans, which included significant investments in securing necessary resources and services.

- Supplier Relationship Management: Ovintiv focuses on building and maintaining strong ties with its equipment and service suppliers.

- Operational Continuity: These partnerships are vital for ensuring the uninterrupted flow of necessary resources and services.

- Cost and Quality Control: Managing these relationships effectively contributes to both the quality of materials and services and their overall cost.

- Supply Chain Resilience: Strong supplier partnerships enhance Ovintiv's ability to withstand disruptions and maintain operational stability.

Ovintiv's customer relationships extend to its direct purchasers of oil, natural gas, and NGLs, characterized by transactional interactions driven by market demand and pricing. The company focuses on securing favorable sales contracts and ensuring efficient delivery, with approximately 70% of its crude oil and condensate volumes sold under market-based agreements in 2024.

Investor relations are actively managed through quarterly earnings calls, investor days, and annual reports, providing timely updates on performance and strategy. This proactive communication aims to build trust and empower informed investment decisions, as demonstrated by the $1.3 billion in share repurchases and dividends returned to shareholders in 2023.

Community engagement is key to Ovintiv's social license to operate, involving addressing local concerns and fostering development, with $13.8 million in community investments and sponsorships reported in 2023. This commitment supports local economies, where Ovintiv employed approximately 4,400 individuals in 2023.

Supplier partnerships are crucial for operational efficiency, focusing on punctual deliveries, quality standards, and cost-effectiveness. In 2024, Ovintiv continued to leverage strategic alliances with key drilling and completion service providers to ensure operational continuity and supply chain resilience.

Channels

Ovintiv's extensive network of pipelines and gathering systems serves as the critical artery for moving its oil, natural gas, and natural gas liquids from the wellhead to processing facilities and ultimately to market. This infrastructure is paramount for ensuring efficient and reliable transportation of its products from key basins like the Montney and Permian.

In 2024, Ovintiv continued to leverage and optimize these vital channels. The company's commitment to midstream infrastructure is a cornerstone of its operational strategy, facilitating the continuous flow of hydrocarbons and supporting its production volumes which in 2023 reached an average of 523,000 barrels of oil equivalent per day.

Ovintiv processes its natural gas and NGLs through a network of strategically located facilities, transforming raw production into marketable commodities. These plants are crucial for separating components like ethane, propane, and butane, ensuring they meet stringent industry specifications for distribution to end-users.

In 2024, Ovintiv continued to optimize its processing capacity, with a significant portion of its production being processed through its owned and operated facilities, as well as through fee-based agreements with third-party processors. This infrastructure is key to realizing the full value of its extensive natural gas reserves.

Ovintiv's direct sales strategy involves delivering crude oil straight to refineries, bypassing intermediaries. This ensures a consistent market for their production.

Simultaneously, Ovintiv supplies natural gas directly to utilities and industrial clients. This dual approach secures product off-take and generates revenue tied to prevailing market prices and existing contracts.

In 2024, Ovintiv's emphasis on direct sales contributed to its strong financial performance, with the company reporting significant volumes of crude oil and natural gas delivered through these channels, underpinning its revenue generation.

Investor Relations Portal and Publications

Ovintiv's investor relations portal acts as a central hub for all crucial financial information. This includes detailed company reports, investor presentations, and vital sustainability reports, ensuring transparency and accessibility for stakeholders.

These publications are disseminated through the official investor relations website and public filings, providing a comprehensive overview of the company's performance and strategic direction. This approach is designed to inform and actively engage a broad spectrum of financial stakeholders, from individual investors to institutional analysts, as well as the general public.

- Financial Information: Ovintiv regularly publishes quarterly and annual financial results, offering insights into revenue, earnings, and operational costs. For instance, in the first quarter of 2024, Ovintiv reported total revenues of approximately $1.7 billion.

- Company Reports: In-depth annual reports detail the company's operations, market conditions, and future outlook.

- Presentations: Investor presentations often accompany earnings releases, providing visual summaries and management commentary on key performance indicators and strategic initiatives.

- Sustainability Reports: These reports highlight Ovintiv's commitment to environmental, social, and governance (ESG) principles, detailing progress on emissions reduction and community engagement.

Industry Conferences and Forums

Ovintiv actively engages in industry conferences and forums, acting as a key communication channel. These events provide direct access to investors, financial analysts, and other stakeholders, fostering transparency and building relationships. For instance, Ovintiv participated in the CIBC Eastern Canada Energy Conference in early 2024, presenting its strategic outlook and operational performance.

These platforms are crucial for disseminating company updates, strategic direction, and financial performance. They offer opportunities for Ovintiv to highlight its low-carbon energy development strategy and its commitment to shareholder returns. In 2023, the company returned $1.7 billion to shareholders, a figure often discussed at such industry gatherings.

- Investor Relations: Direct engagement with the investment community, facilitating dialogue on strategy and performance.

- Market Intelligence: Gathering insights on industry trends, competitor activities, and emerging technologies.

- Brand Visibility: Enhancing Ovintiv's profile as a leading energy producer and innovator.

- Networking: Building and strengthening relationships with key industry players and potential partners.

Ovintiv utilizes a robust network of pipelines and gathering systems to transport its oil, natural gas, and NGLs from production sites to processing facilities and markets. In 2024, the company continued to optimize this essential infrastructure, which is critical for its operations in key basins like the Montney and Permian.

The company also operates processing facilities to refine its raw production into marketable commodities, ensuring products meet industry specifications. Ovintiv's 2023 production averaged 523,000 boe/d, highlighting the scale of operations supported by these facilities.

Direct sales to refineries for crude oil and to utilities and industrial clients for natural gas form another key channel. This strategy secures off-take and generates revenue, with Ovintiv emphasizing these channels for strong financial performance in 2024.

Ovintiv's investor relations portal and participation in industry conferences serve as vital communication channels. In Q1 2024, the company reported revenues of approximately $1.7 billion, with $1.7 billion returned to shareholders in 2023, demonstrating active engagement with stakeholders.

Customer Segments

Ovintiv's primary customer base in the energy markets consists of entities that require a steady and dependable supply of crude oil, natural gas, and natural gas liquids (NGLs). This includes major refiners who process crude oil into gasoline and other fuels, utilities that rely on natural gas for power generation, and a wide array of industrial users who depend on these commodities for their operations.

These purchasers, such as large industrial consumers and energy trading firms, value Ovintiv for its ability to deliver high-quality energy products consistently. For instance, in 2024, the demand for natural gas from power generation remained robust, with utilities actively seeking reliable sources to meet peak season requirements.

Investors and shareholders, encompassing individual retail investors, large institutional funds, and keenly observing financial analysts, form a critical customer segment for Ovintiv. These stakeholders are primarily driven by the prospect of financial returns, closely monitoring Ovintiv's stock performance, its strategic capital deployment, and the consistency of shareholder distributions like dividends and share buybacks.

For instance, in the first quarter of 2024, Ovintiv reported adjusted EBITDA of $1.2 billion and returned $300 million to shareholders through dividends and share repurchases, demonstrating tangible efforts to meet investor expectations for financial gains and capital appreciation.

Governments and regulatory bodies are crucial stakeholders for Ovintiv, shaping the landscape through policies on emissions, resource development, and taxation. For instance, in 2024, Ovintiv continued to navigate evolving environmental regulations across its operating regions in North America, impacting operational costs and investment decisions.

Maintaining strong relationships and ensuring full compliance with these mandates is essential for Ovintiv's license to operate and long-term sustainability. This includes adhering to reporting requirements and engaging proactively with agencies on environmental stewardship and safety standards.

Local Communities and Landowners

Local communities and landowners are essential partners for Ovintiv, directly affected by our operations. We prioritize building strong, trust-based relationships through consistent engagement and investment. In 2024, Ovintiv continued its commitment to community well-being, contributing to local initiatives and supporting economic development in the regions where we operate, reflecting our dedication to being a responsible neighbor.

- Community Investment: In 2024, Ovintiv allocated significant resources to community development programs, focusing on education, infrastructure, and environmental stewardship.

- Landowner Relations: Maintaining open communication and fair agreements with landowners is paramount for our long-term operational success and social license.

- Economic Impact: Ovintiv's operations in 2024 generated substantial economic benefits for local communities through job creation, local procurement, and tax revenues.

- Stakeholder Engagement: Regular dialogue with community leaders and residents ensures our operations align with local expectations and concerns.

Employees and Potential Employees

Employees and potential employees represent a crucial internal customer segment for Ovintiv. Their expertise, particularly in areas like reservoir engineering and field operations, directly fuels the company's ability to extract and produce oil and gas efficiently. Ovintiv's commitment to a safe and inclusive workplace is paramount for retaining this skilled workforce and fostering innovation. In 2023, Ovintiv reported approximately 2,400 employees, highlighting the significance of this group to their operations.

Attracting and retaining top talent is a strategic imperative for Ovintiv. This involves offering competitive compensation, robust training programs, and opportunities for career advancement. A strong employer brand, emphasizing safety and employee well-being, is key to securing the necessary human capital for sustained operational excellence and growth.

- Skilled Workforce: Ovintiv relies on a diverse range of employees, from geoscientists to rig operators, whose specialized skills are essential for exploration, development, and production activities.

- Talent Acquisition & Retention: The company actively recruits and retains talent through competitive benefits, professional development, and a focus on creating a positive work environment.

- Safety Culture: Maintaining a strong safety record is critical, not only for employee well-being but also for operational continuity and reputation.

- Innovation & Productivity: An engaged and motivated workforce drives innovation in operational efficiency and contributes directly to Ovintiv's overall productivity and financial performance.

Ovintiv serves a diverse customer base, primarily focused on the energy sector. This includes large industrial consumers, refiners, and utilities that require a consistent supply of crude oil, natural gas, and natural gas liquids (NGLs) for their operations. In 2024, the demand for natural gas from power generation remained strong, underscoring the importance of reliable supply for utilities.

Investors and financial professionals represent another key segment, evaluating Ovintiv based on its financial performance and shareholder returns. The company's commitment to returning capital, such as the $300 million distributed to shareholders in Q1 2024 through dividends and buybacks, directly appeals to this group. Financial analysts closely track metrics like the $1.2 billion adjusted EBITDA reported in the same quarter.

Governments, regulatory bodies, local communities, landowners, and employees are also vital stakeholders whose needs and expectations shape Ovintiv's operations and strategy. For instance, in 2024, the company continued to adapt to evolving environmental regulations, demonstrating a commitment to compliance and community engagement.

Cost Structure

Ovintiv's cost structure heavily relies on capital expenditures for drilling, completing, and developing infrastructure in its core operational areas like the Permian, Montney, and Anadarko basins. These significant investments are crucial for maintaining and expanding production.

For 2025, Ovintiv has outlined substantial capital investment plans, with a significant portion allocated to these development activities. This underscores the high upfront costs associated with their upstream oil and gas operations.

Ovintiv's operating expenses (Opex) are primarily driven by the ongoing costs of hydrocarbon production. These include essential elements like lease operating expenses, which cover the day-to-day management of wells, utilities for operations, and regular maintenance to ensure asset integrity. Field personnel salaries are also a significant component, reflecting the human capital required for efficient extraction.

The company actively pursues operational efficiency as a core strategy to manage and reduce these per-barrel costs. For instance, in the first quarter of 2024, Ovintiv reported total operating expenses of approximately $1.4 billion, demonstrating their commitment to cost control amidst production activities.

Ovintiv's cost structure heavily features transportation and processing expenses for its oil, natural gas, and NGLs. These are critical as they move products from the wellhead to buyers, impacting overall profitability. For instance, in 2023, Ovintiv reported significant transportation and marketing costs, reflecting the extensive infrastructure needed to get their products to market.

Pipeline fees and processing charges are key components of these costs. The availability of pipelines and the market's willingness to pay for processed products directly influence these expenses. Factors like infrastructure bottlenecks or regional price disparities can significantly elevate these operational outlays for Ovintiv.

Production, Mineral, and Other Taxes

Ovintiv faces significant costs through production, mineral, and other taxes. These are essentially royalties and levies tied directly to the volume and value of oil and natural gas produced. These taxes represent a direct cost of extracting resources and operating within specific jurisdictions.

These taxes are typically calculated as a percentage of upstream product revenue, meaning as commodity prices rise and production increases, so does the tax burden. For example, in 2023, Ovintiv's total operating expenses, which would include these taxes, were approximately $7.2 billion. While specific tax percentages vary by region and commodity, they are a fundamental component of the cost structure.

- Production Taxes: Levies based on the volume of oil and gas extracted.

- Mineral Royalties: Payments to landowners or governments for the right to extract minerals.

- Other Taxes: This can include corporate income taxes, property taxes, and severance taxes, all impacting operational costs.

General and Administrative (G&A) Expenses and Interest Expense

General and Administrative (G&A) expenses encompass Ovintiv's corporate overhead, including salaries for its administrative teams and other operational support functions. In 2024, managing these costs effectively remains a priority for efficient operations. Interest expense represents the cost of servicing the company's outstanding debt obligations.

Ovintiv actively works to maintain a robust balance sheet, which is crucial for managing interest expenses and ensuring overall financial stability. This focus on financial health allows the company to navigate market fluctuations and pursue strategic growth opportunities. For instance, as of the first quarter of 2024, Ovintiv reported total debt of approximately $5.1 billion, highlighting the importance of managing interest payments.

- G&A Expenses: Corporate overhead, administrative salaries, and operational support costs.

- Interest Expense: Costs associated with servicing the company's debt.

- Balance Sheet Strength: Key to managing interest expenses and financial health.

- Debt Management: Approximately $5.1 billion in total debt as of Q1 2024 underscores the significance of interest expense control.

Ovintiv's cost structure is dominated by capital expenditures for developing its key U.S. and Canadian basins, alongside significant operating expenses for ongoing production. These include lease operating expenses, field personnel, and essential maintenance. Transportation and processing costs are also substantial, ensuring products reach market, with taxes and royalties directly tied to production volume and value forming another core expense. Finally, general and administrative costs and interest on debt round out the major cost categories.

| Cost Category | Key Components | 2024/2025 Focus/Data |

| Capital Expenditures | Drilling, completion, infrastructure development | Significant investment in Permian, Montney, Anadarko basins for 2025. |

| Operating Expenses (Opex) | Lease operating expenses, utilities, maintenance, field personnel | Total Opex approx. $1.4 billion in Q1 2024. |

| Transportation & Processing | Pipeline fees, processing charges | Significant costs in 2023; influenced by infrastructure availability. |

| Taxes & Royalties | Production, mineral, severance, property taxes | Direct cost of extraction; Total operating expenses (including taxes) approx. $7.2 billion in 2023. |

| General & Administrative (G&A) | Corporate overhead, administrative salaries | Ongoing priority for efficient operations in 2024. |

| Interest Expense | Servicing debt obligations | Total debt approx. $5.1 billion as of Q1 2024. |

Revenue Streams

Ovintiv's most significant revenue stream comes from selling crude oil and condensate. These liquids are primarily produced from their operations in the Permian Basin and the Montney region. In the first quarter of 2024, Ovintiv reported that crude oil and condensate sales accounted for a substantial portion of their total revenue, underscoring its importance to the company's financial performance.

Ovintiv generates significant revenue from selling its natural gas production. This segment is a core part of their business, supplying essential energy to utilities and industrial clients.

In the first quarter of 2024, Ovintiv reported an average realized natural gas price of $2.04 per thousand cubic feet (Mcf), contributing to their overall financial performance.

Ovintiv generates significant revenue from the sale of Natural Gas Liquids (NGLs), which are valuable byproducts extracted during natural gas processing. These include propane, butane, and ethane, essential components for various industrial and consumer applications.

In 2024, NGL prices have shown resilience, with ethane averaging around $0.70 per gallon and propane around $0.95 per gallon, contributing substantially to Ovintiv's overall financial performance alongside its core natural gas sales.

Risk Management Gains

Ovintiv's revenue streams benefit significantly from its robust risk management strategies, particularly commodity price hedging. These activities act as a buffer against the volatility inherent in oil and gas markets, ensuring more predictable financial outcomes.

By employing financial instruments to lock in prices, Ovintiv stabilizes its revenue and cash flow, making it easier to plan operations and investments. For instance, in the first quarter of 2024, Ovintiv reported that its realized commodity prices benefited from its hedging program, contributing positively to its financial performance.

- Commodity Price Hedging: Mitigates losses from falling oil and natural gas prices.

- Revenue Stabilization: Provides a more consistent income stream despite market fluctuations.

- Cash Flow Predictability: Enhances financial planning and operational certainty.

- Financial Instrument Gains: Potential for positive returns from well-executed hedging strategies.

Asset Divestitures and Other Proceeds

While not a primary recurring revenue stream, the sale of non-core assets can generate significant cash proceeds. These divestitures contribute to Ovintiv's financial liquidity and support its capital allocation strategy. For instance, in 2023, Ovintiv completed the sale of its Uinta Basin assets for approximately $1.0 billion. This strategic move allowed the company to focus on its core, high-return assets.

The proceeds from asset divestitures can be utilized for various purposes, including debt reduction, share repurchases, or reinvestment in attractive growth opportunities. This flexibility enhances the company's financial resilience and its ability to adapt to market dynamics. These one-time cash inflows are crucial for managing the balance sheet and returning value to shareholders.

- Asset Divestitures: Sale of non-core assets generates significant cash.

- Financial Liquidity: Proceeds enhance the company's cash position.

- Capital Allocation: Funds support debt reduction, share buybacks, or reinvestment.

- Strategic Focus: Divestitures allow concentration on core, high-return assets.

Ovintiv's revenue is primarily driven by the sale of crude oil and condensate, natural gas, and natural gas liquids (NGLs). The company also generates income from commodity price hedging and the divestiture of non-core assets.

| Revenue Stream | Primary Products/Activities | Key Regions/Notes | 2024 Data Point (Q1) |

|---|---|---|---|

| Crude Oil & Condensate Sales | Liquids production | Permian Basin, Montney | Substantial portion of total revenue |

| Natural Gas Sales | Natural gas production | Core business segment | Average realized price of $2.04/Mcf |

| Natural Gas Liquids (NGLs) Sales | Propane, butane, ethane | Byproducts of gas processing | Ethane avg. $0.70/gallon, Propane avg. $0.95/gallon |

| Commodity Price Hedging | Financial instruments | Revenue stabilization, cash flow predictability | Benefited realized prices in Q1 2024 |

| Asset Divestitures | Sale of non-core assets | Enhances liquidity, supports capital allocation | 2023 Uinta Basin sale for ~$1.0 billion |

Business Model Canvas Data Sources

The Ovintiv Business Model Canvas is informed by a robust combination of internal financial statements, operational performance data, and external market intelligence reports. This multi-faceted approach ensures that each component of the canvas is grounded in factual evidence and reflects the company's current strategic landscape.