Ovintiv Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ovintiv Bundle

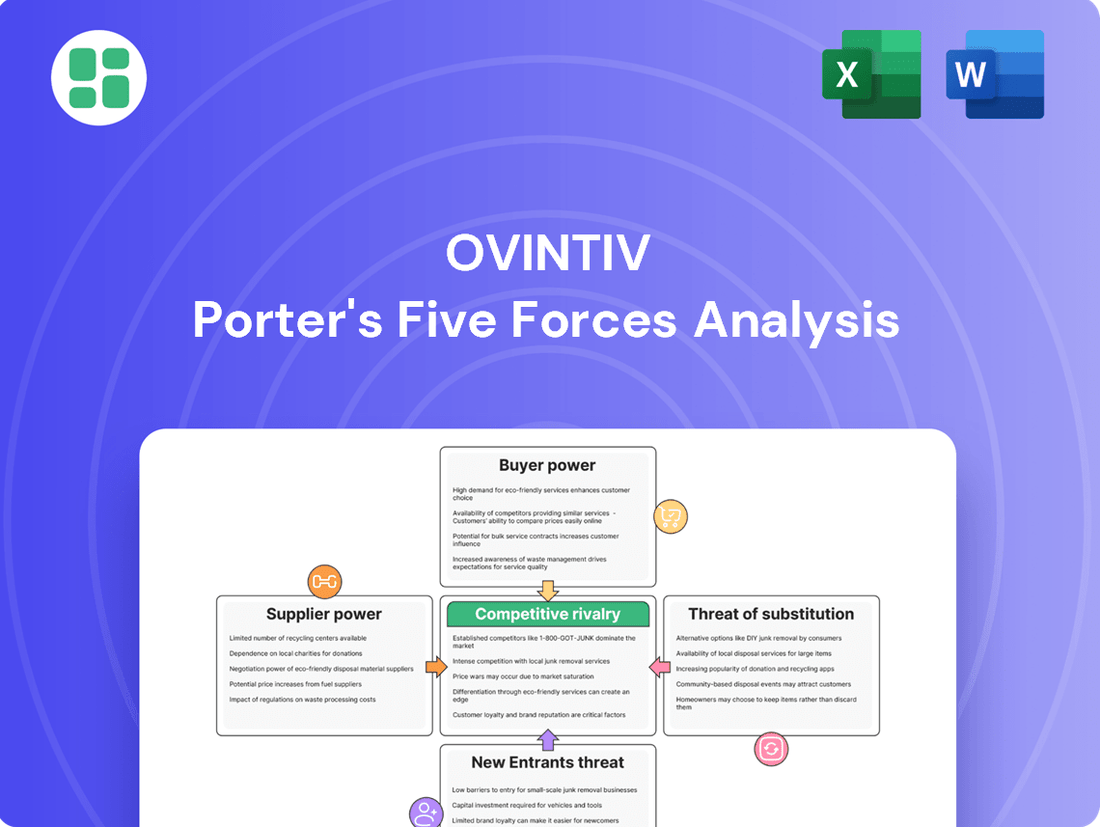

Ovintiv navigates a complex energy landscape where the bargaining power of buyers and the threat of substitutes significantly shape its profitability. Understanding these forces is crucial for strategic planning in the oil and gas sector.

The complete report reveals the real forces shaping Ovintiv’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The oilfield services (OFS) sector, crucial for Ovintiv's operations, is experiencing increasing consolidation. This means fewer, larger companies are controlling the supply of essential equipment, technology, and skilled labor for drilling and completion activities.

This concentration can shift power towards these service providers. For instance, in 2024, the top five oilfield service companies accounted for a significant portion of the global OFS market revenue, potentially giving them greater leverage in negotiations with exploration and production (E&P) firms like Ovintiv, especially for specialized or proprietary technologies.

Suppliers of highly specialized drilling rigs, completion services, and advanced technologies hold significant sway due to the unique nature and substantial investment required for their offerings. Ovintiv's strategic emphasis on optimizing its asset portfolio within challenging basins frequently necessitates these tailored solutions, thereby reducing the company's readily available alternatives.

Labor and talent scarcity significantly bolsters the bargaining power of suppliers of human capital within the energy sector. A shortage of specialized professionals like engineers, geologists, and skilled field technicians means companies must compete more fiercely for talent.

This competition directly translates to higher labor costs for energy producers, as seen in the increasing average salaries for petroleum engineers. For instance, in 2024, the demand for experienced geoscientists and reservoir engineers outstripped supply, leading to salary increases of up to 15% in some regions for critical roles.

Such scarcity not only inflates operational expenses but also poses a substantial risk to project timelines and overall operational efficiency. When key personnel are difficult to recruit and retain, energy companies may face delays in exploration, development, and production activities, directly impacting their output and profitability.

Supply Chain Stability and Geopolitical Factors

Geopolitical events and ongoing global supply chain disruptions continue to significantly impact the availability and cost of critical materials for companies like Ovintiv, including steel and tubular goods. These external pressures can shift the balance of power toward raw material suppliers and manufacturers.

While Ovintiv strategically pre-purchased steel for its 2025 program, mitigating some immediate price volatility, the broader market dynamics remain a concern. For instance, in 2024, the International Energy Agency reported that while oil prices experienced fluctuations, the cost of essential equipment and services for the energy sector remained elevated due to persistent supply chain constraints and geopolitical tensions, directly affecting companies reliant on these inputs.

- Impact of Geopolitics: Events such as regional conflicts or trade disputes can disrupt production and logistics, leading to scarcity and price increases for key commodities.

- Supply Chain Vulnerabilities: The reliance on a limited number of global suppliers for specialized materials or components makes companies susceptible to supplier leverage.

- Cost Pressures: Increased transportation costs, labor shortages, and inflationary pressures globally contribute to higher input prices, empowering suppliers who can deliver reliably.

Switching Costs for Ovintiv

Switching oilfield service providers or equipment for Ovintiv can incur substantial expenses. These include potential contract termination fees, the cost of re-tooling operations for new equipment, and the inevitable disruptions to ongoing projects. For instance, in 2023, the oil and gas industry saw increased capital expenditures by exploration and production companies, which often translates to longer-term commitments with service providers, making early termination more costly.

These significant switching costs effectively limit Ovintiv's ability to easily change suppliers. This lack of flexibility inherently strengthens the bargaining position of existing service providers and equipment manufacturers. They can leverage these high switching costs to negotiate more favorable terms, potentially impacting Ovintiv's operational costs and profitability.

- High Capital Investment: Oilfield equipment often represents a significant capital outlay, meaning suppliers have invested heavily and are less willing to absorb losses from early contract terminations.

- Specialized Equipment and Training: Many services and equipment are highly specialized, requiring specific training for Ovintiv's personnel, adding a layer of cost and complexity to switching.

- Operational Integration: Service providers are often deeply integrated into Ovintiv's operational workflows, making a seamless transition to a new provider challenging and potentially time-consuming.

Ovintiv faces considerable bargaining power from its suppliers, particularly in the oilfield services sector, due to market consolidation and the specialized nature of many offerings. In 2024, the increasing concentration within the OFS market, with major players dominating revenue, grants these suppliers greater leverage in negotiations. This is further amplified by the scarcity of specialized talent, driving up labor costs for Ovintiv, as evidenced by up to 15% salary increases for critical roles in 2024.

The company's reliance on specialized equipment and services, coupled with high switching costs, further entrenches supplier power. Geopolitical events and supply chain disruptions in 2024 also contributed to elevated costs for essential materials, impacting Ovintiv's operational expenses and project timelines.

| Factor | Description | 2024 Impact/Data Point |

|---|---|---|

| Market Consolidation | Fewer, larger OFS companies control essential services and technology. | Top 5 OFS companies held a significant market share. |

| Talent Scarcity | Shortage of specialized professionals increases labor costs. | Up to 15% salary increase for critical roles like geoscientists. |

| Specialized Offerings | Unique, high-investment equipment and services limit alternatives. | Ovintiv's need for tailored solutions in challenging basins. |

| Switching Costs | High expenses and disruptions associated with changing suppliers. | Increased CapEx in 2023 led to longer-term supplier commitments. |

| Geopolitical/Supply Chain | Disruptions increase costs for materials like steel. | Elevated equipment and service costs reported by IEA. |

What is included in the product

This analysis delves into the competitive forces shaping Ovintiv's industry, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry to understand its strategic positioning.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Ovintiv.

Customers Bargaining Power

The commodity nature of oil, natural gas, and natural gas liquids means Ovintiv's products are largely undifferentiated. Customers, such as refineries and industrial users, can easily switch suppliers based on price, as the core product is the same across different producers. This lack of product differentiation significantly amplifies the bargaining power of these customers.

Ovintiv's large industrial customers, such as major refiners and chemical manufacturers, wield considerable bargaining power. Their substantial purchase volumes allow them to negotiate for lower prices and more favorable contract terms, directly impacting Ovintiv's profitability. For instance, in 2024, major industrial consumers of natural gas and crude oil often leveraged long-term supply agreements to secure consistent pricing, putting pressure on producers like Ovintiv to offer competitive rates.

The energy sector, including companies like Ovintiv, operates in an environment of high market transparency for commodity prices. This means customers, whether they are refiners, industrial users, or even governments, have easy access to real-time pricing information for oil and natural gas. This transparency empowers them, allowing them to track price movements and leverage this knowledge during negotiations.

This transparency is amplified by the inherent volatility of commodity prices. For instance, in 2024, crude oil prices experienced significant swings, influenced by geopolitical events and supply-demand dynamics. Such fluctuations create opportunities for customers to push for lower prices when the market is down, directly impacting producers' profit margins and forcing them to remain highly competitive.

Downstream Integration Potential

The potential for downstream integration by customers, particularly large integrated energy companies, presents a significant factor in Ovintiv's bargaining power of customers. These sophisticated buyers possess the financial and technical capabilities to potentially move backward into exploration and production activities themselves, thereby reducing their reliance on suppliers like Ovintiv.

While this backward integration is not a widespread reality for all of Ovintiv's customers, the mere theoretical threat can exert pressure on Ovintiv's pricing power. For instance, if a major downstream player were to consider developing its own upstream assets, it could leverage this possibility to negotiate more favorable terms with existing suppliers.

- Downstream Integration Threat: Large integrated energy companies may possess the capacity to integrate backward into Ovintiv's core business of exploration and production.

- Pricing Power Constraint: This potential for integration, even if not fully realized, can serve as a constraint on Ovintiv's ability to dictate prices.

- Customer Leverage: The presence of such capable buyers gives them leverage in negotiations, potentially impacting Ovintiv's profit margins.

Alternative Energy Sources for Customers

Customers are increasingly exploring and adopting alternative energy sources, a trend significantly influenced by global sustainability initiatives and evolving regulatory landscapes. This shift directly impacts the bargaining power of customers within the energy sector, as the availability of substitutes grows.

The expanding array of renewable energy options, including solar, wind, and advancements in battery storage, alongside the push towards electrification in transportation and industry, grants consumers more leverage. They can now more readily choose to reduce their reliance on traditional fossil fuels, forcing energy providers to compete more aggressively on price and service.

For instance, in 2024, global investment in renewable energy is projected to reach new highs, with the International Energy Agency (IEA) forecasting that renewables will account for over 90% of global electricity capacity expansion in the coming years. This growing market share of alternatives inherently strengthens the customer's position.

- Growing Substitute Availability: The increasing viability and adoption of solar, wind, and electric vehicles provide customers with tangible alternatives to traditional fossil fuels.

- Sustainability Drivers: Customer demand for environmentally friendly options, spurred by corporate ESG goals and consumer awareness, empowers them to seek out and favor cleaner energy sources.

- Regulatory Influence: Government policies promoting renewable energy and carbon reduction further facilitate customer access to and preference for alternative energy, amplifying their bargaining power.

- Price Sensitivity: As the cost of renewable technologies continues to decline, customers become more price-sensitive regarding fossil fuel purchases, leveraging alternative pricing structures.

Ovintiv's customers, particularly large industrial buyers like refineries and chemical plants, hold significant bargaining power due to the commodity nature of oil and gas. Their ability to switch suppliers easily, coupled with high market transparency for pricing, allows them to negotiate favorable terms. This power is further amplified by the threat of downstream integration and the growing availability of alternative energy sources.

The energy market's transparency means customers can readily access real-time price data, empowering them in negotiations. In 2024, fluctuating commodity prices, driven by global events, created opportunities for customers to push for lower prices, directly impacting Ovintiv's margins.

The increasing adoption of renewable energy sources, like solar and wind, provides customers with viable alternatives to fossil fuels. This trend, supported by global sustainability initiatives and government policies, strengthens customer leverage and compels energy providers to remain competitive.

| Factor | Impact on Ovintiv | 2024 Relevance |

|---|---|---|

| Commodity Nature & Undifferentiation | High customer switching ability, price sensitivity | Core products like WTI crude and AECO natural gas are largely interchangeable. |

| Large Buyer Concentration | Significant negotiation leverage for major industrial clients | Large refiners and chemical producers can demand volume discounts. |

| Market Transparency | Customers easily compare prices, reducing Ovintiv's pricing power | Real-time commodity price feeds are widely accessible. |

| Threat of Downstream Integration | Potential for customers to become competitors | Integrated energy companies could develop their own upstream assets. |

| Availability of Substitutes (Renewables) | Growing customer preference for alternatives | Global renewable energy investment surged in 2024, increasing competitive pressure. |

Full Version Awaits

Ovintiv Porter's Five Forces Analysis

This preview showcases the complete Ovintiv Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the oil and gas industry. You are viewing the exact, professionally formatted document that will be available for immediate download upon purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The North American exploration and production (E&P) sector, especially in shale plays, features a significant number of companies. This fragmentation means intense competition for prime drilling locations, skilled labor, and essential services. For instance, in 2023, the Permian Basin alone saw activity from over 100 distinct E&P operators, highlighting the crowded nature of the market.

Ovintiv faces intense competition within its core operational basins, such as the Permian, Montney, and Anadarko. This means many companies are all trying to secure the best drilling sites and utilize available infrastructure, which can drive up costs and squeeze profit margins.

Ovintiv's competitive rivalry is intensifying as companies prioritize capital discipline and free cash flow generation over sheer production volume. This strategic pivot means competition is now centered on operational efficiency, attractive returns, and enhanced shareholder value, compelling firms to refine their business models and optimize resource allocation.

For instance, in 2023, many North American oil and gas producers, including those competing with Ovintiv, demonstrated this trend by returning significant capital to shareholders through buybacks and dividends, rather than reinvesting aggressively in production growth. This focus on efficient capital deployment shapes the competitive landscape, pushing rivals to innovate in cost management and asset optimization to maintain market share and profitability.

Mergers and Acquisitions Activity

The oil and gas industry is experiencing a significant surge in mergers and acquisitions (M&A). This consolidation is creating larger, more formidable competitors. For instance, in 2023 alone, the sector saw major deals such as ExxonMobil's acquisition of Pioneer Natural Resources for approximately $60 billion and Chevron's agreement to acquire Hess for around $53 billion. These transactions are reshaping the competitive landscape.

These consolidated entities can leverage greater economies of scale and realize substantial operational synergies. This enhanced efficiency and market power present a more potent competitive threat to companies like Ovintiv. The ability of these larger players to negotiate better terms with suppliers and customers, coupled with optimized production and distribution, intensifies the pressure on smaller or less integrated companies.

- Increased Scale: Major M&A deals lead to companies with significantly larger asset bases and production volumes.

- Synergy Realization: Merged entities aim to cut costs through shared infrastructure, streamlined operations, and reduced overhead.

- Enhanced Market Power: Larger companies may have greater influence over pricing and supply within key regions.

Technological Advancements and Efficiency Gains

Competitive rivalry in the oil and gas sector, particularly for companies like Ovintiv, is significantly fueled by rapid technological advancements. Innovations in drilling and completion techniques, such as extended horizontal laterals and multi-well pad development, are constantly pushing the boundaries of efficiency and productivity. These advancements directly translate into lower per-barrel costs and increased output, creating a dynamic where early adopters gain a substantial advantage.

Companies that effectively integrate these new technologies, like advanced hydraulic fracturing designs or real-time data analytics for reservoir management, can significantly improve their operational performance. For instance, the industry has seen a trend towards longer horizontal wells, with average lateral lengths increasing year over year, allowing for more efficient resource extraction from a single pad. This continuous push for innovation means that firms lagging in technological adoption face mounting pressure to invest and catch up, intensifying the competitive landscape.

- Technological Innovation: Continuous advancements in drilling, completion, and production technologies are a primary driver of rivalry.

- Efficiency Gains: Technologies like longer laterals and multi-well pads directly improve well productivity and reduce per-unit costs.

- Competitive Edge: Early adoption of new technologies provides a significant advantage, forcing competitors to invest to remain relevant.

- Cost Reduction: Technological improvements are crucial for lowering the breakeven costs of oil and gas production.

Ovintiv operates in a highly competitive North American E&P market, characterized by numerous players vying for resources and market share. This intense rivalry is further amplified by ongoing industry consolidation, with major acquisitions in 2023, such as ExxonMobil's $60 billion Pioneer Natural Resources deal and Chevron's $53 billion Hess agreement, creating larger, more efficient competitors. These consolidations grant enhanced economies of scale and market power, intensifying pressure on companies like Ovintiv to optimize operations and maintain cost competitiveness.

| Competitor Action | Impact on Ovintiv | 2023 Data Point |

|---|---|---|

| Major M&A Activity | Increased scale and market power of rivals | ExxonMobil/Pioneer ($60B), Chevron/Hess ($53B) |

| Focus on Capital Discipline | Competition shifts to efficiency and shareholder returns | Many producers prioritized buybacks/dividends over growth |

| Technological Adoption | Need for continuous innovation to reduce costs | Increased average lateral lengths in key basins |

SSubstitutes Threaten

The increasing adoption of renewable energy sources presents a substantial threat to companies like Ovintiv. As solar and wind power become more economically viable and widely deployed, they directly compete with traditional fossil fuels, potentially diminishing demand for oil and natural gas.

By 2024, global renewable energy capacity continued its upward trajectory, with solar photovoltaic and wind power leading the expansion. This trend signifies a long-term shift in energy consumption patterns, impacting the market share and profitability of fossil fuel producers.

The escalating adoption of electric vehicles (EVs) and the broader electrification of industrial sectors present a significant threat of substitution for Ovintiv. As more consumers and businesses shift to electric alternatives, the demand for traditional fuels like natural gas, a key product for Ovintiv, is directly impacted. For instance, by the end of 2023, global EV sales surpassed 13 million units, a substantial increase from previous years, signaling a clear move away from internal combustion engines.

Continuous advancements in energy efficiency are a significant threat to Ovintiv. For instance, in 2024, the International Energy Agency reported that energy efficiency measures are projected to save the equivalent of the total energy demand of the European Union by 2030. This reduction in overall energy consumption directly translates to decreased demand for fossil fuels like oil and natural gas, making them more substitutable by other energy sources or simply by using less.

These efficiency improvements, driven by both technological innovation and policy, effectively act as a substitute for new oil and gas production. As buildings become better insulated and appliances more efficient, the need for heating and electricity derived from traditional sources diminishes. This trend is accelerating, meaning less investment will be needed in upstream energy production, impacting companies like Ovintiv.

Biofuels and Hydrogen Development

The growing development and commercialization of alternative fuels like biofuels and hydrogen, especially ‘green’ hydrogen, pose a significant threat of substitution for traditional oil and gas products. These alternatives are becoming more competitive as the global push for decarbonization intensifies. For instance, in 2024, investments in green hydrogen projects saw a substantial increase, with many nations setting ambitious targets for its adoption in transportation and industrial sectors, directly impacting demand for fossil fuels.

These emerging fuel sources offer viable pathways to reduce greenhouse gas emissions across various applications, from heavy-duty transport to industrial heating. As technology advances and economies of scale are achieved, biofuels and hydrogen are expected to capture a larger share of the energy market. By 2024, several major economies had already implemented policies and incentives to accelerate the adoption of these cleaner alternatives, signaling a clear shift away from conventional energy sources.

- Growing Investment in Green Hydrogen: Global investment in green hydrogen production facilities is projected to reach hundreds of billions of dollars by the late 2020s, indicating a strong market commitment.

- Biofuel Mandates and Targets: Many countries have strengthened biofuel mandates, aiming for increased renewable content in transportation fuels, which directly competes with gasoline and diesel.

- Technological Advancements: Innovations in electrolysis and fuel cell technology are continuously improving the efficiency and reducing the cost of hydrogen, making it a more attractive substitute.

- Decarbonization Goals: Ambitious climate targets set by governments and corporations worldwide are driving the demand for low-carbon energy solutions, including biofuels and hydrogen.

Policy and Regulatory Push for Decarbonization

Government policies and regulations are a significant driver for the threat of substitutes in the energy sector. Initiatives like carbon pricing mechanisms and renewable energy mandates directly encourage the adoption of cleaner alternatives to traditional fossil fuels. For instance, in 2024, many jurisdictions continued to implement or strengthen carbon taxes, making fossil fuel consumption more expensive and thus making substitutes more competitive.

These regulatory pushes create a more favorable environment for substitute energy sources to gain market share. Mandates for renewable energy, such as solar and wind power, directly limit the demand for oil and gas. By 2024, the global installed capacity for renewable energy sources continued its upward trajectory, with significant investments flowing into wind and solar projects, directly impacting the market for fossil fuel producers.

Restrictions on fossil fuel use, including potential bans on internal combustion engine vehicles in certain regions by future dates, further amplify this threat. These policies signal a long-term shift away from hydrocarbon dependence. The increasing stringency of environmental regulations worldwide means that companies like Ovintiv must contend with a growing array of viable, and increasingly subsidized, energy substitutes.

- Carbon Pricing: Many countries and regions have implemented or are considering carbon pricing mechanisms, increasing the cost of emissions-intensive energy.

- Renewable Energy Mandates: Policies requiring a certain percentage of electricity to come from renewable sources directly displace fossil fuel generation.

- Fuel Efficiency Standards: Stricter standards for vehicles and industrial equipment reduce the overall demand for fossil fuels.

- Subsidies for Alternatives: Government support for renewable energy technologies and electric vehicles makes substitutes more economically attractive.

The threat of substitutes for Ovintiv is substantial, driven by the accelerating adoption of renewable energy and electric vehicles. By 2024, global EV sales had surpassed 13 million units, a clear indicator of consumer shift away from traditional fuels. Furthermore, advancements in energy efficiency, projected to save the EU's total energy demand by 2030, directly reduce the need for oil and gas.

Alternative fuels like biofuels and hydrogen are also gaining traction, supported by significant investments and government targets for decarbonization. For example, green hydrogen production is seeing massive investment, making it a more competitive substitute. These trends, coupled with supportive government policies such as carbon pricing and renewable energy mandates, create a challenging landscape for fossil fuel producers.

| Substitute | 2024 Status/Trend | Impact on Ovintiv |

| Renewable Energy (Solar/Wind) | Continued capacity expansion globally | Reduced demand for natural gas and oil in power generation |

| Electric Vehicles (EVs) | Sales exceeded 13 million units globally by end of 2023 | Decreased demand for gasoline and diesel |

| Energy Efficiency | Projected to save EU's total energy demand by 2030 | Lower overall energy consumption, reducing fossil fuel needs |

| Biofuels & Hydrogen | Increasing investment in green hydrogen; strengthened biofuel mandates | Direct competition in transportation and industrial sectors |

Entrants Threaten

The oil and gas exploration and production sector, where Ovintiv operates, is characterized by exceptionally high capital requirements. Companies need substantial funding for acquiring exploration rights, drilling wells, constructing pipelines, and maintaining operational infrastructure. For instance, the average cost of drilling a single oil well can range from $2 million to over $10 million, depending on depth and complexity, as of 2024 data.

These significant upfront investments create a formidable barrier to entry for potential new competitors. New companies would need to secure hundreds of millions, if not billions, of dollars to even begin operations at a meaningful scale. This financial hurdle effectively deters many smaller or less-capitalized entities from entering the market, thereby reducing the threat of new entrants.

New entrants in the oil and gas sector, like Ovintiv, confront a formidable array of regulatory hurdles and stringent environmental compliance requirements. These include obtaining numerous permits for exploration, production, and transportation, each with its own set of complex specifications and lengthy review periods. For instance, in 2024, the average time to secure a new drilling permit in key U.S. shale plays often extended for months, demanding significant upfront investment in legal and technical expertise.

The threat of new entrants concerning access to prime acreage and infrastructure for companies like Ovintiv is relatively low. Established players, including Ovintiv, have secured significant and contiguous land holdings in highly productive resource regions. For instance, Ovintiv reported holding approximately 2.3 million net acres in the Permian, Montney, and Duvernay plays as of the end of 2023, many of which are already developed or have established production facilities.

New companies entering these markets would face substantial hurdles in acquiring comparable quality acreage. The most attractive and economically viable land is often already controlled by existing operators. Furthermore, the cost and time required to build out the necessary midstream infrastructure – pipelines for gathering, processing, and transporting oil and gas – represent a significant capital expenditure and a major barrier to entry.

Economies of Scale and Operational Expertise

Incumbent companies like Ovintiv enjoy significant advantages due to established economies of scale. This translates to lower per-unit costs in critical areas such as drilling, production, and managing their extensive supply chains. For instance, in 2024, major oil and gas producers continued to leverage their vast infrastructure to optimize operational efficiency, a feat challenging for newcomers to match.

Furthermore, decades of accumulated operational experience and access to proprietary geological data create a substantial barrier to entry. New entrants would struggle to replicate this deep well of knowledge and the insights derived from years of exploration and production activities, which are crucial for identifying and extracting resources cost-effectively.

- Economies of Scale: Lower per-unit costs in drilling, production, and supply chain management for established players.

- Operational Expertise: Decades of experience in the industry leading to more efficient and effective operations.

- Proprietary Data: Exclusive access to geological data that informs successful exploration and extraction strategies.

- Capital Intensity: The high upfront investment required to build similar operational capabilities and data sets deters new entrants.

Commodity Price Volatility and Investment Risk

The inherent volatility of oil and gas prices presents a substantial barrier for new entrants, significantly increasing investment risk. Securing the necessary financing and guaranteeing a return on investment becomes exceptionally difficult when commodity prices can fluctuate dramatically. For instance, in early 2024, West Texas Intermediate (WTI) crude oil prices experienced notable swings, trading in a range that highlighted the unpredictable nature of the market.

Periods of low oil and gas prices, which can emerge rapidly, have the potential to render new projects economically unviable. This economic uncertainty acts as a powerful deterrent, discouraging potential new players from entering the market. The risk of investing capital only to face unprofitable operations due to price downturns is a primary concern for any prospective entrant.

- High Capital Requirements: New entrants often need substantial upfront capital for exploration, drilling, and infrastructure, which is harder to secure in volatile price environments.

- Unpredictable Revenue Streams: Fluctuating commodity prices lead to unpredictable revenue, making long-term financial planning and debt servicing challenging for new companies.

- Financing Challenges: Lenders and investors are often more hesitant to finance projects in industries with such price volatility, demanding higher returns or imposing stricter terms.

- Operational Scale: Established players with economies of scale are better equipped to weather price downturns, making it difficult for smaller, new entrants to compete effectively during low-price periods.

The threat of new entrants in the oil and gas sector, particularly for companies like Ovintiv, is generally considered low. This is primarily due to the immense capital required to enter the market, with drilling a single well costing millions of dollars as of 2024. Furthermore, established players benefit from significant economies of scale and deep operational expertise, making it difficult for newcomers to compete effectively.

Regulatory complexities and the need to secure prime acreage also act as substantial barriers. Ovintiv, for example, held approximately 2.3 million net acres in key plays by the end of 2023, a scale challenging for new entrants to replicate. The inherent price volatility of oil and gas further exacerbates the risk for new companies, making financing and ensuring profitability a significant hurdle.

| Barrier to Entry | Impact on New Entrants | Ovintiv's Position |

| High Capital Requirements | Deters smaller or less-capitalized firms. | Established infrastructure and access to capital. |

| Regulatory Hurdles | Requires significant legal and technical expertise. | Experienced in navigating complex compliance. |

| Access to Prime Acreage | Limited availability of high-quality land. | Large, contiguous land holdings in productive regions. |

| Economies of Scale | Higher per-unit costs for new entrants. | Lower operational costs due to scale. |

| Price Volatility | Increases investment risk and financing difficulty. | Better positioned to weather market fluctuations. |

Porter's Five Forces Analysis Data Sources

Our Ovintiv Porter's Five Forces analysis is built upon a robust foundation of data, including Ovintiv's annual reports and SEC filings, industry-specific market research reports from firms like Wood Mackenzie, and broader economic data from sources such as the EIA and Bloomberg.