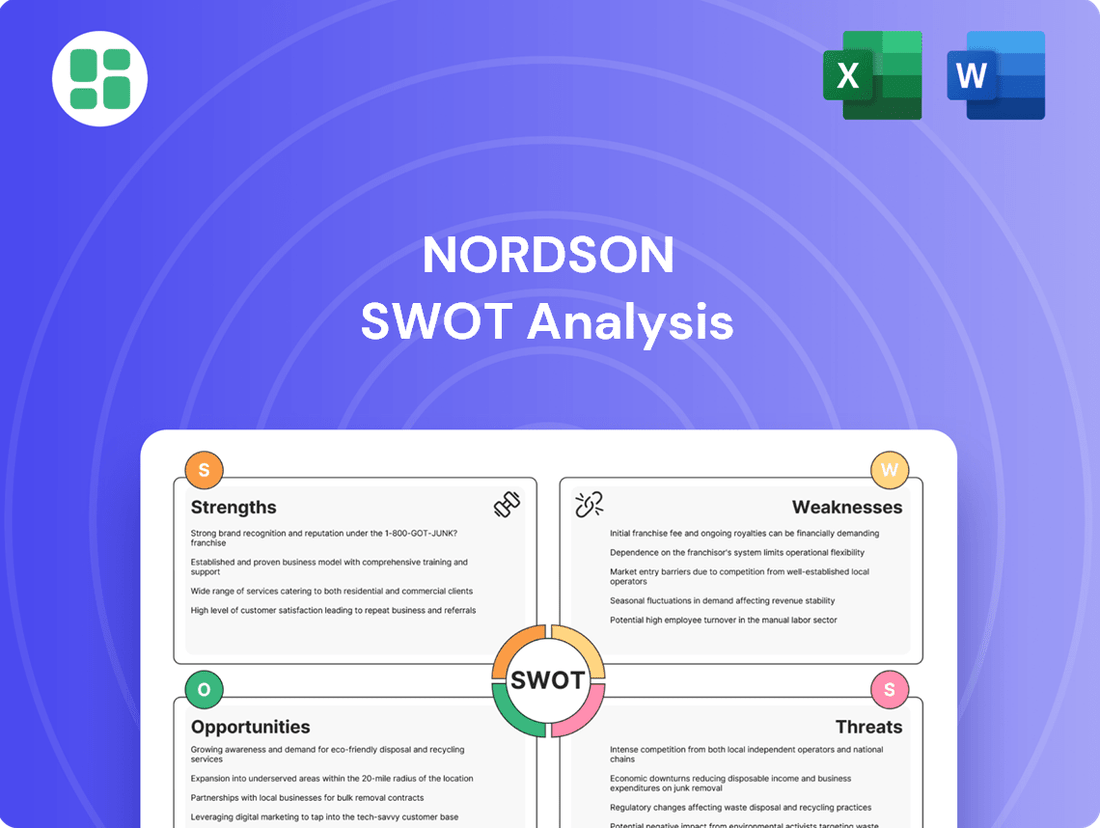

Nordson SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nordson Bundle

Nordson's innovative dispensing systems and advanced technologies position it strongly in diverse, high-growth markets, but its reliance on global economic conditions presents a key challenge. Understanding these dynamics is crucial for any strategic investor or business planner.

Want the full story behind Nordson’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Nordson's strength lies in its diverse and specialized product portfolio, encompassing solutions for dispensing, applying, and controlling adhesives, coatings, polymers, and fluids. This broad range serves a multitude of industries, from electronics to medical devices, which helps to stabilize revenue by not being overly dependent on any single sector.

This diversification is a key risk mitigator. For example, in fiscal year 2023, Nordson reported net sales of $6.5 billion, with its Industrial Technologies segment, a significant contributor to this diverse revenue, showing robust performance. This broad market penetration ensures that even if one industry experiences a downturn, others can help offset the impact, contributing to consistent financial health.

Nordson's market leadership is evident across its diversified niche end markets, driven by proprietary technologies and a substantial patent portfolio in areas like precision dispensing, application, and curing. This technological edge is a key differentiator.

The company's competitive advantages are further solidified by its strong brand recognition and a consistent commitment to technological advancement. For instance, Nordson's investment in R&D, which often represents a significant portion of its revenue, fuels its innovation pipeline.

A global service network complements its product offerings, enabling Nordson to provide comprehensive support and maintain strong customer relationships. This integrated approach helps the company to effectively defend its market share against competitors.

Nordson boasts an impressive global footprint, with direct operations spanning over 35 countries. This extensive reach is a significant strength, allowing the company to tap into diverse markets and customer segments worldwide. In fiscal year 2024, approximately 67% of Nordson's revenue was generated from international operations, underscoring its robust global presence and market penetration.

The company's direct sales model is another key advantage. This approach fosters deep customer relationships and allows Nordson to offer specialized application expertise. By working directly with clients, Nordson can better understand their unique challenges and provide tailored solutions, enhancing customer loyalty and driving sales.

Consistent Financial Performance and Shareholder Returns

Nordson consistently delivers robust financial results, evidenced by its record sales of $2.7 billion and EBITDA of $849 million in fiscal 2024. This strong performance is underpinned by a strategic target to achieve $3 billion in sales by 2025, showcasing a clear growth trajectory.

The company's dedication to shareholder value is exceptionally strong. Nordson proudly holds the status of a 'dividend aristocrat,' having consistently raised its dividends for an impressive 61 consecutive years. This long-standing commitment to returning capital to shareholders is further amplified through active share repurchase programs.

- Record Fiscal 2024 Performance: Sales of $2.7 billion and EBITDA of $849 million.

- Future Growth Target: Aiming for $3 billion in sales by 2025.

- Dividend Aristocrat Status: 61 consecutive years of dividend increases.

- Shareholder Return Strategy: Combines consistent dividend growth with share repurchases.

Strategic Acquisitions and Growth Strategy (Ascend Strategy)

Nordson's Ascend Strategy, initiated in 2021, clearly outlines a path to achieve top-tier growth, targeting over 30% EBITDA margins and $3 billion in sales by 2025. This ambitious plan is heavily reliant on both organic expansion and strategic inorganic moves.

The company has actively pursued acquisitions to bolster its market position and diversify revenue. A prime example is the 2024 acquisition of Atrion Medical, which significantly broadened Nordson's reach in the medical fluid components sector and its precision agriculture addressable markets. This move is crucial for driving inorganic growth and building more resilient, recurring revenue streams.

- Ascend Strategy Targets: Aiming for over 30% EBITDA and $3 billion in sales by 2025.

- 2024 Acquisition: Atrion Medical acquisition expanded medical fluid components and precision agriculture presence.

- Inorganic Growth Driver: Acquisitions like Atrion are key to Nordson's expansion strategy.

- Recurring Revenue Focus: Strategic purchases are designed to enhance the stability and predictability of income.

Nordson's diversified product portfolio across various industries acts as a significant strength, stabilizing revenue streams. Its market leadership in specialized niches, supported by proprietary technology and a robust patent portfolio, provides a distinct competitive advantage.

The company's commitment to R&D fuels innovation, while its extensive global service network strengthens customer relationships and market defense. Nordson's direct sales model fosters deep client engagement, enabling tailored solutions and enhanced loyalty.

Financially, Nordson demonstrates resilience and growth, with record fiscal 2024 sales of $2.7 billion and a target of $3 billion in sales by 2025. Its status as a dividend aristocrat, with 61 consecutive years of dividend increases, highlights a strong dedication to shareholder returns.

| Metric | Fiscal Year 2023 | Fiscal Year 2024 | Target by 2025 |

|---|---|---|---|

| Net Sales | $6.5 billion | $2.7 billion | $3 billion |

| EBITDA | N/A | $849 million | Over 30% margin |

| Dividend Increases | 60 consecutive years | 61 consecutive years | Continued Growth |

What is included in the product

Analyzes Nordson’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Nordson's significant reliance on acquisitions for growth presents a notable weakness. While these strategic moves have undeniably expanded its market reach and revenue streams, such as the acquisition of CyberOptics in 2021 for $101 million, this strategy may not be a sustainable long-term solution without a stronger organic growth engine. The integration of acquired companies also carries inherent risks and can lead to increased operating expenses, potentially impacting profitability if not managed effectively.

Nordson's reliance on cyclical end markets presents a notable weakness. Sectors like industrial systems, electronics processing, and x-ray products are particularly susceptible to economic fluctuations. This sensitivity was evident in recent performance, with organic sales declines observed in both the Industrial Precision Solutions and Advanced Technology Solutions segments. For instance, in the first quarter of fiscal year 2024, Nordson reported a 3% organic sales decline in Industrial Precision Solutions, highlighting the impact of broader economic slowdowns on its revenue streams.

Nordson has encountered increasing selling and administrative expenses, notably influenced by acquisition-related costs. This has consequently put pressure on their operating margins. For instance, in the first quarter of fiscal year 2025, the company observed a dip in its operating margin, directly attributable to these rising operational expenditures.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations represent a notable weakness for Nordson, given its substantial international sales. Unfavorable currency movements can directly impact the reported value of its overseas earnings when translated back into U.S. dollars, potentially dampening revenue growth and profitability.

For instance, in the first quarter of fiscal year 2024, Nordson reported that currency headwinds negatively impacted sales by approximately 1% year-over-year. This demonstrates the tangible effect that currency volatility can have on the company's top-line performance across various operating segments.

- Global Exposure: Nordson's significant international revenue base makes it inherently vulnerable to currency swings.

- Impact on Sales: Adverse currency movements have historically presented a headwind to sales growth, as seen in recent quarterly reports.

- Profitability Concerns: Beyond revenue, currency fluctuations can also affect the profitability of overseas operations when repatriated.

- Forecasting Challenges: Managing and forecasting financial results becomes more complex due to the unpredictable nature of exchange rates.

Dependence on Customer Capital Investment

Nordson's reliance on its customers' capital expenditure plans presents a significant vulnerability. When customers, especially those in industrial and electronics manufacturing, tighten their belts and reduce spending, Nordson's sales can take a direct hit. This was evident in late 2024, where a slowdown in customer investment directly translated to weaker demand for Nordson's equipment, particularly for larger system orders.

This dependence means Nordson's revenue is closely linked to the economic cycles of its client base. For instance, a downturn in the semiconductor industry, a key market for Nordson, can disproportionately affect the company's performance. In the first quarter of fiscal year 2025, Nordson reported a 3% decrease in sales for its Semiconductor Solutions segment compared to the prior year, a clear indicator of this customer capital investment sensitivity.

- Customer Spending Sensitivity: Nordson's revenue is directly tied to the capital investment decisions of its customers, making it susceptible to economic downturns that curb spending.

- Sectoral Reliance: The company's performance is heavily influenced by the health of specific industries, such as electronics and industrial manufacturing, which are prone to cyclical capital expenditure.

- Impact of Reduced Demand: Weaknesses in customer spending, as observed in late 2024, can lead to a noticeable drop in demand, particularly impacting sales of higher-ticket capital equipment.

- Q1 FY2025 Performance: A 3% year-over-year sales decline in the Semiconductor Solutions segment in Q1 FY2025 highlights the direct impact of reduced customer investment in key markets.

Nordson's substantial international presence, while a strength, also exposes it to significant currency exchange rate fluctuations. Unfavorable movements in foreign currencies can erode the value of its overseas earnings when translated back into U.S. dollars, directly impacting reported revenue and profitability. For example, in the first quarter of fiscal year 2024, currency headwinds negatively impacted Nordson's sales by approximately 1% year-over-year, illustrating the tangible effect of this vulnerability.

The company's dependence on customer capital expenditure plans represents another key weakness. When clients in sectors like industrial and electronics manufacturing scale back their investments, Nordson's sales suffer directly, particularly for larger equipment orders. This sensitivity was evident in late 2024, where reduced customer investment led to weaker demand. The Semiconductor Solutions segment, for instance, saw a 3% year-over-year sales decrease in Q1 FY2025, directly reflecting this customer spending sensitivity.

| Weakness Category | Specific Impact | Financial Year/Period | Data Point |

| Currency Fluctuations | Negative impact on reported sales | Q1 FY2024 | -1% year-over-year sales impact |

| Customer Capital Expenditure | Reduced demand for equipment | Late 2024 | Weaker demand observed |

| Customer Capital Expenditure | Sales decline in key segment | Q1 FY2025 | -3% sales decline in Semiconductor Solutions |

Full Version Awaits

Nordson SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Nordson is well-positioned to capitalize on expansion opportunities within high-growth sectors. Key areas include medical devices, where the company's acquisition of Atrion Medical strengthens its foothold in infusion therapies and drug delivery systems. The electronics market, particularly semiconductors, presents another significant avenue for growth, driven by increasing demand for advanced technologies.

The company's focus on precision agriculture also aligns with a growing global need for efficient food production. In 2024, the global medical device market was projected to reach over $600 billion, with continued strong growth expected. Similarly, the semiconductor industry is experiencing robust demand, with forecasts indicating continued expansion through 2025 and beyond, fueled by AI and advanced computing.

Nordson is well-positioned to capitalize on the escalating global adoption of automation and Industry 4.0. Their precision dispensing and control technologies are fundamental to the smart manufacturing processes driving this shift. For instance, the company's advanced fluid dispensing systems, incorporating sophisticated motion control and vision capabilities, directly address the market's need for enhanced automation in production lines.

Nordson's history of successful strategic acquisitions provides a strong foundation for continued inorganic growth. By acquiring companies with complementary technologies, such as those in the advanced materials or semiconductor sectors, Nordson can broaden its product offerings and enhance its competitive edge. For instance, the company's acquisition of CyberOptics in 2021 for $100 million bolstered its semiconductor inspection capabilities, a key growth area.

New Product Development and Innovation

Nordson's commitment to continuous investment in research and development, guided by its NBS Next growth framework, fuels the introduction of innovative and differentiated product solutions. This strategic focus allows the company to stay ahead of market trends and customer demands.

Accelerating the go-to-market strategies for new products is a key opportunity. For instance, the Nordson® Quadra™ Pro manual x-ray system exemplifies this, directly addressing evolving customer needs in advanced electronics inspection and solidifying Nordson's competitive position. In fiscal year 2023, Nordson reported that new products launched in the preceding three years represented approximately 30% of total sales, highlighting the success of their innovation pipeline.

- Innovation Engine: Ongoing R&D investment and the NBS Next framework are central to Nordson's ability to launch new, high-value product offerings.

- Market Responsiveness: Faster introduction of advanced solutions, such as the Nordson® Quadra™ Pro, allows Nordson to capture emerging market opportunities and meet specific customer requirements.

- Revenue Driver: New products launched within the last three years contributed a significant portion, around 30%, to Nordson's total revenue in FY2023, demonstrating the financial impact of their innovation strategy.

Sustainability and Efficiency Solutions

The increasing global focus on sustainability and ESG principles is creating significant demand for manufacturing solutions that enhance resource efficiency and minimize waste. Nordson’s precision dispensing and processing technologies are well-positioned to capitalize on this trend, enabling customers to achieve higher yields and reduce material consumption.

For example, in 2023, Nordson reported that its customers in various sectors are adopting its solutions to meet stringent environmental regulations and achieve their own sustainability targets. This trend is expected to accelerate, with the global market for sustainable manufacturing technologies projected to grow substantially in the coming years, driven by both consumer preference and regulatory pressures.

- Growing Demand for Resource Efficiency: Businesses are actively seeking ways to reduce energy consumption and material waste in their production lines.

- Alignment with ESG Initiatives: Nordson's technologies directly support Environmental, Social, and Governance goals by enabling cleaner and more efficient manufacturing.

- Market Opportunity in Sustainable Technologies: The company can leverage its expertise to offer solutions that meet the evolving needs of environmentally conscious industries.

- Precision Leading to Reduced Waste: Higher precision in application processes, a core Nordson strength, translates to less material used and less scrap generated.

Nordson is poised to benefit from the increasing demand for automation and advanced manufacturing, particularly within the semiconductor and medical device sectors. The company's strategic acquisitions and consistent investment in R&D, as evidenced by new products contributing approximately 30% of FY2023 sales, position it to capture growth in these expanding markets.

Furthermore, the global push towards sustainability presents a significant opportunity, as Nordson's precision technologies enable greater resource efficiency and waste reduction for its customers. This alignment with ESG principles is expected to drive further adoption of its solutions in environmentally conscious industries.

| Growth Area | Market Driver | Nordson's Advantage |

|---|---|---|

| Medical Devices | Aging population, increased healthcare spending | Atrion Medical acquisition, infusion therapies |

| Semiconductors | AI, 5G, IoT adoption | CyberOptics acquisition, advanced inspection |

| Automation/Industry 4.0 | Smart manufacturing, efficiency gains | Precision dispensing, motion control |

| Sustainability | Environmental regulations, resource efficiency | Reduced material consumption, higher yields |

Threats

Nordson faces formidable competition from established players like Graco Inc., Illinois Tool Works Inc., and Henkel AG & Co. KGaA. This crowded landscape means Nordson must constantly differentiate itself, as customers often prioritize price. For instance, in the first quarter of 2024, Nordson reported a 3% increase in sales to $666.5 million, but this growth is achieved amidst significant pricing pressures across its diverse markets.

As a global entity, Nordson faces significant headwinds from worldwide economic shifts and geopolitical tensions. For instance, the ongoing conflict in Ukraine and broader global instability can dampen industrial investment and affect demand across its diverse customer base, potentially impacting Nordson's sales and overall profitability.

These global economic fluctuations can lead to unpredictable market conditions, affecting everything from raw material costs to consumer spending. For example, a slowdown in major economies like China or the Eurozone, which are key markets for industrial goods, could reduce demand for Nordson's specialized equipment, directly impacting its revenue streams.

Supply chain disruptions, often exacerbated by geopolitical events, pose another substantial threat. These disruptions can delay production, increase logistics costs, and make it harder for Nordson to meet customer orders, ultimately squeezing profit margins and potentially damaging customer relationships.

The industrial technology landscape is characterized by swift technological evolution. Competitors or emerging players might introduce game-changing innovations that diminish the competitiveness of Nordson's current offerings, or even make them outdated. This necessitates continuous and substantial investment in research and development to maintain a leading edge.

For instance, in the semiconductor industry, where Nordson has significant exposure, the pace of innovation in chip manufacturing processes demands constant adaptation. Companies that fail to integrate new lithography techniques or advanced materials risk falling behind. Nordson's commitment to R&D, evidenced by its consistent spending, aims to mitigate this threat by developing next-generation dispensing and testing solutions.

Supply Chain Disruptions and Raw Material Volatility

Nordson, operating within the manufacturing sector, is inherently exposed to the significant risks posed by supply chain disruptions and the fluctuating prices of raw materials. These vulnerabilities can directly impact its operational efficiency and profitability. For instance, a global shortage of critical components, as seen in the semiconductor industry impacting various electronics manufacturers in 2022 and 2023, could similarly affect Nordson's production schedules and ability to fulfill orders.

The volatility in raw material costs, such as metals or specialized chemicals essential for Nordson's product lines, presents a continuous challenge. A surge in commodity prices, like the increase in nickel prices by over 20% in early 2024 due to geopolitical tensions, could substantially elevate Nordson's cost of goods sold, squeezing profit margins if these increases cannot be effectively passed on to customers.

- Increased Production Costs: Volatile raw material prices directly inflate manufacturing expenses.

- Extended Lead Times: Supply chain bottlenecks can delay the availability of necessary components, lengthening production cycles.

- Reduced Customer Satisfaction: Inability to meet demand due to disruptions can damage customer relationships and market share.

Cybersecurity Risks

Nordson, like many global enterprises, confronts significant cybersecurity risks. The increasing sophistication of cyberattacks poses a constant threat to its information technology infrastructure and sensitive data. A breach could lead to the compromise of valuable intellectual property, operational disruptions, and a severe erosion of customer confidence, underscoring the need for ongoing, robust cybersecurity investments.

The financial impact of such threats is substantial. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report. This highlights the potential financial strain Nordson could face from a successful cyberattack, including remediation costs, regulatory fines, and lost business. Consequently, proactive and adaptive cybersecurity strategies are paramount to safeguarding the company's assets and reputation.

- Data Breach Costs: In 2023, the average cost of a data breach globally was $4.45 million, a figure Nordson must consider in its risk mitigation planning.

- Operational Disruption: Cyberattacks can halt production lines and supply chains, directly impacting revenue and delivery schedules.

- Reputational Damage: A significant security incident can erode customer trust, leading to long-term brand value impairment.

- Regulatory Scrutiny: Increased data privacy regulations worldwide mean that breaches can result in substantial fines and legal liabilities.

Nordson faces intense competition from well-established rivals, necessitating continuous innovation and competitive pricing strategies. The company's growth, as seen in its Q1 2024 sales increase, occurs within a market where price sensitivity is a significant factor for customers.

Global economic instability and geopolitical events pose substantial threats, potentially dampening industrial investment and impacting demand across Nordson's diverse customer base. For instance, slowdowns in key markets like China or the Eurozone could directly reduce revenue.

Supply chain disruptions, often linked to geopolitical issues, present another significant risk, potentially delaying production, increasing logistics costs, and harming customer relationships. The volatile pricing of raw materials, such as metals, can also squeeze profit margins if cost increases cannot be passed on.

Technological advancements by competitors or new market entrants could render Nordson's current offerings less competitive, requiring ongoing R&D investment. For example, in the semiconductor sector, failure to adapt to new manufacturing processes could lead to obsolescence.

SWOT Analysis Data Sources

This Nordson SWOT analysis is built on a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.