Nordson Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nordson Bundle

Unlock the strategic core of Nordson's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver unique value, and generate revenue. Perfect for anyone looking to understand and replicate effective business strategies.

Partnerships

Nordson’s business model heavily depends on its technology and component suppliers, who provide the specialized parts and materials crucial for its precision dispensing and processing equipment. These partnerships are vital for ensuring Nordson can integrate the latest advancements into its products, maintaining its competitive edge in high-tech industries. For instance, in 2024, Nordson continued to strengthen relationships with key semiconductor equipment suppliers, a sector where component quality directly impacts the yield and performance of its customers' manufacturing processes.

Nordson strategically collaborates with a global network of distributors and sales channel partners to amplify its market presence and deliver tailored customer support. These alliances are crucial for penetrating new markets and effectively serving varied customer demographics, particularly in areas where a direct operational footprint is less cost-effective.

These partners bring invaluable local market knowledge and leverage their existing customer relationships to drive sales and provide essential after-sales service. For instance, in 2023, Nordson reported that its international sales, driven significantly by its channel partners, represented a substantial portion of its total revenue, underscoring the critical role these relationships play in its global strategy.

Nordson actively partners with Original Equipment Manufacturers (OEMs) and system integrators, embedding its dispensing and application technologies into their larger machinery. These collaborations are vital for making Nordson's solutions integral to new industrial equipment, as seen in the automotive sector where OEMs increasingly rely on advanced adhesive dispensing for lightweighting initiatives. For instance, Nordson's systems are critical for the precise application of structural adhesives in electric vehicle battery pack assembly, a growing market segment.

Research and Development Institutions

Nordson actively partners with universities and research institutions to push the boundaries of material science and fluid dynamics. These collaborations are crucial for staying ahead in automation technology. For instance, in 2023, Nordson's R&D spending reached $338.1 million, a significant portion of which fuels these external partnerships to explore novel applications and develop advanced dispensing and processing solutions.

These strategic alliances with academic and research centers, including industry consortia, are vital for Nordson's innovation pipeline. They facilitate the exploration of emerging technologies and accelerate the development of next-generation products. For example, in 2024, Nordson announced a joint research project with a leading materials science university focused on developing advanced adhesives for the semiconductor industry, aiming to improve manufacturing efficiency and product reliability.

- University Collaborations: Partnerships with universities provide access to cutting-edge research and talent, fostering long-term innovation in areas like polymer science and advanced manufacturing.

- Research Centers: Collaborations with specialized research centers allow Nordson to tackle complex technical challenges and accelerate the validation of new technologies.

- Industry Consortia: Participation in industry consortia enables Nordson to share knowledge, set standards, and collectively address broad industry needs, such as sustainability in manufacturing processes.

- Joint R&D Initiatives: These initiatives focus on specific technological advancements, shortening product development timelines and ensuring Nordson's solutions remain at the forefront of market demand.

Strategic Acquisition Targets

Nordson actively pursues strategic acquisitions to bolster its product offerings, penetrate new, rapidly expanding markets, and elevate its technological prowess. This proactive approach is central to its long-term growth and diversification strategy, known as Ascend. For instance, the 2023 acquisition of Atrion Medical, a leader in medical fluid components, significantly strengthened Nordson's presence in the healthcare sector and added valuable recurring revenue streams.

These acquisitions are carefully selected to align with Nordson's core competencies and future market opportunities. The company's robust financial performance in recent years, including reporting approximately $2.7 billion in revenue for fiscal year 2023, provides the financial capacity to execute these strategic moves. Nordson’s commitment to inorganic growth through acquisitions demonstrates a clear strategy for enhancing shareholder value.

- Strategic Acquisition Focus: Expansion of product portfolio, entry into high-growth markets, and enhancement of technological capabilities.

- Recent Example: Acquisition of Atrion Medical to strengthen medical fluid components and recurring revenue.

- Growth Strategy Alignment: Acquisitions are a cornerstone of Nordson's Ascend Strategy for long-term growth and diversification.

- Financial Capacity: Supported by strong financial performance, such as over $2.7 billion in revenue in fiscal year 2023, enabling strategic investments.

Nordson's key partnerships are diverse, encompassing technology suppliers, distributors, OEMs, research institutions, and strategic acquisition targets. These alliances are critical for innovation, market reach, and expanding its technological capabilities across various industries.

These collaborations ensure Nordson stays at the forefront of technological advancements and effectively serves its global customer base. For example, in 2024, Nordson continued to deepen its ties with semiconductor component suppliers, crucial for maintaining high-performance equipment in that sector.

The company's strategic acquisitions, like that of Atrion Medical in 2023, further underscore the importance of partnerships in driving growth and entering new markets, such as healthcare, which contributed to its over $2.7 billion revenue in fiscal year 2023.

Nordson's investment in R&D, with $338.1 million spent in 2023, often involves collaborations with universities and research centers to accelerate the development of next-generation dispensing and processing solutions.

| Partner Type | Strategic Importance | 2023/2024 Relevance |

| Technology & Component Suppliers | Ensuring cutting-edge materials and parts for advanced equipment. | Strengthened semiconductor supplier relationships in 2024. |

| Distributors & Sales Channels | Expanding market reach and providing localized customer support. | International sales via partners formed a substantial revenue portion in 2023. |

| OEMs & System Integrators | Integrating Nordson's technology into larger machinery. | Critical for EV battery assembly and automotive lightweighting. |

| Universities & Research Institutions | Driving innovation in material science and automation. | $338.1M R&D spend in 2023 fueled external partnerships; joint project in 2024 for semiconductor adhesives. |

| Acquisition Targets | Bolstering product offerings and market presence. | Atrion Medical acquisition in 2023 expanded healthcare sector presence. |

What is included in the product

A structured framework detailing Nordson's approach to creating, delivering, and capturing value, encompassing customer relationships, revenue streams, and key resources.

This model maps out Nordson's customer segments, value propositions, channels, and customer relationships to understand how they serve their markets.

The Nordson Business Model Canvas acts as a pain point reliver by providing a structured framework to identify and address complex business challenges, allowing for clear visualization of interdependencies and potential solutions.

Activities

Nordson's core activities revolve around relentless investment in research and development, focusing on pioneering new precision dispensing, application, and control technologies. This commitment fuels the creation of sophisticated solutions tailored for a wide array of materials, including adhesives, coatings, polymers, and fluids.

The company's innovation engine is directly responsive to evolving customer requirements and dynamic market trends, ensuring Nordson maintains a distinct competitive advantage. For instance, in fiscal year 2023, Nordson reported significant investments in R&D, reflecting their dedication to advancing these critical technological capabilities.

Nordson's core operations revolve around the precision manufacturing of sophisticated equipment, advanced systems, and specialized consumable components. This intricate process demands robust engineering capabilities and rigorous quality assurance at every stage, ensuring the consistent reliability and superior performance that their global clientele expects.

The company's commitment to manufacturing excellence directly translates into high-precision application capabilities and exceptional product durability for end-users. For instance, in 2023, Nordson reported that its manufacturing segment generated $2.2 billion in revenue, underscoring the significant scale and importance of these activities.

Nordson’s global sales and marketing efforts are powered by a direct sales force and application specialists. These teams possess deep technical knowledge, crucial for understanding customer needs and showcasing how Nordson's solutions enhance manufacturing processes.

This close-to-the-customer approach is fundamental to problem-solving and boosting operational efficiency. For instance, in 2023, Nordson reported that its sales and marketing activities directly contributed to its revenue, with a significant portion of its sales driven by its direct sales channels and specialized application support.

Customer Service and Technical Support

Nordson's commitment to customer service and technical support is a cornerstone of its business, ensuring clients maximize the value of their sophisticated equipment. This involves providing comprehensive post-sales assistance, including on-site field service, remote troubleshooting, and readily available spare parts and consumables. This dedication fosters loyalty and drives recurring revenue streams.

The company's support infrastructure is designed to maintain the optimal performance of installed systems, minimizing downtime for customers. This focus on reliability is crucial in the industries Nordson serves, where production continuity is paramount. For instance, in 2023, Nordson's Service and Support segment contributed significantly to its overall financial performance, reflecting the essential nature of these offerings.

- Field Service and Maintenance: Offering expert technicians for installation, calibration, and preventative maintenance ensures equipment longevity and peak operational efficiency.

- Technical Support and Troubleshooting: Providing rapid response to technical inquiries and issues, whether through phone, email, or remote diagnostics, minimizes customer disruption.

- Spare Parts and Consumables: Maintaining a robust supply chain for essential parts and consumables guarantees that customers can quickly replace worn components and continue production.

- Training and Education: Equipping customer personnel with the knowledge to operate and maintain Nordson systems effectively enhances user proficiency and system uptime.

Supply Chain Management and Logistics

Nordson's supply chain management and logistics are central to its operational success. This involves the intricate process of sourcing raw materials globally, managing production, and ensuring the timely delivery of both finished products and essential spare parts to customers worldwide. Effectively navigating this complex network requires meticulous inventory control and strong relationships with a wide array of suppliers.

The company's commitment to operational excellence is underscored by its extensive global reach. Nordson operates with a direct presence in over 35 countries, facilitating efficient logistics and responsive customer support across diverse markets. This broad geographic footprint is key to minimizing delivery times and managing costs effectively.

- Global Sourcing and Procurement: Nordson procures a variety of raw materials and components from a global network of suppliers, emphasizing quality and reliability.

- Inventory Optimization: The company employs strategies to maintain optimal inventory levels, balancing the need for product availability with the costs associated with holding stock.

- Logistics and Distribution: Managing the transportation and warehousing of products to ensure efficient and cost-effective delivery to over 35 countries is a core activity.

- Supplier Relationship Management: Building and maintaining strong partnerships with suppliers is critical for ensuring consistent material flow and managing supply chain risks.

Nordson's key activities are deeply rooted in innovation and precision manufacturing. They invest heavily in research and development to create advanced dispensing, application, and control technologies for various materials. This focus on R&D directly addresses evolving customer needs and market dynamics, ensuring their competitive edge.

The company also excels in the precise manufacturing of sophisticated equipment and specialized components. This requires strong engineering and quality control to deliver the reliability their global customers expect. In fiscal year 2023, Nordson's manufacturing segment generated $2.2 billion in revenue, highlighting the scale of these operations.

Furthermore, Nordson's direct sales force and application specialists are crucial for customer engagement. These teams possess deep technical expertise, enabling them to effectively solve customer problems and improve manufacturing processes. This customer-centric approach drives their sales and reinforces their value proposition.

Nordson also prioritizes robust customer service and technical support, ensuring clients maximize the value of their equipment. This includes field service, troubleshooting, and readily available spare parts, which foster loyalty and recurring revenue. In 2023, their Service and Support segment played a significant role in their overall financial performance.

| Key Activity | Description | Fiscal Year 2023 Impact |

|---|---|---|

| Research & Development | Pioneering new precision dispensing, application, and control technologies. | Significant investment to maintain competitive advantage. |

| Manufacturing | Precision manufacturing of equipment, systems, and consumable components. | Generated $2.2 billion in revenue. |

| Sales & Marketing | Direct sales force and application specialists engage customers. | Drove significant portion of revenue through direct channels and support. |

| Service & Support | Providing post-sales assistance, troubleshooting, and spare parts. | Contributed significantly to overall financial performance. |

Preview Before You Purchase

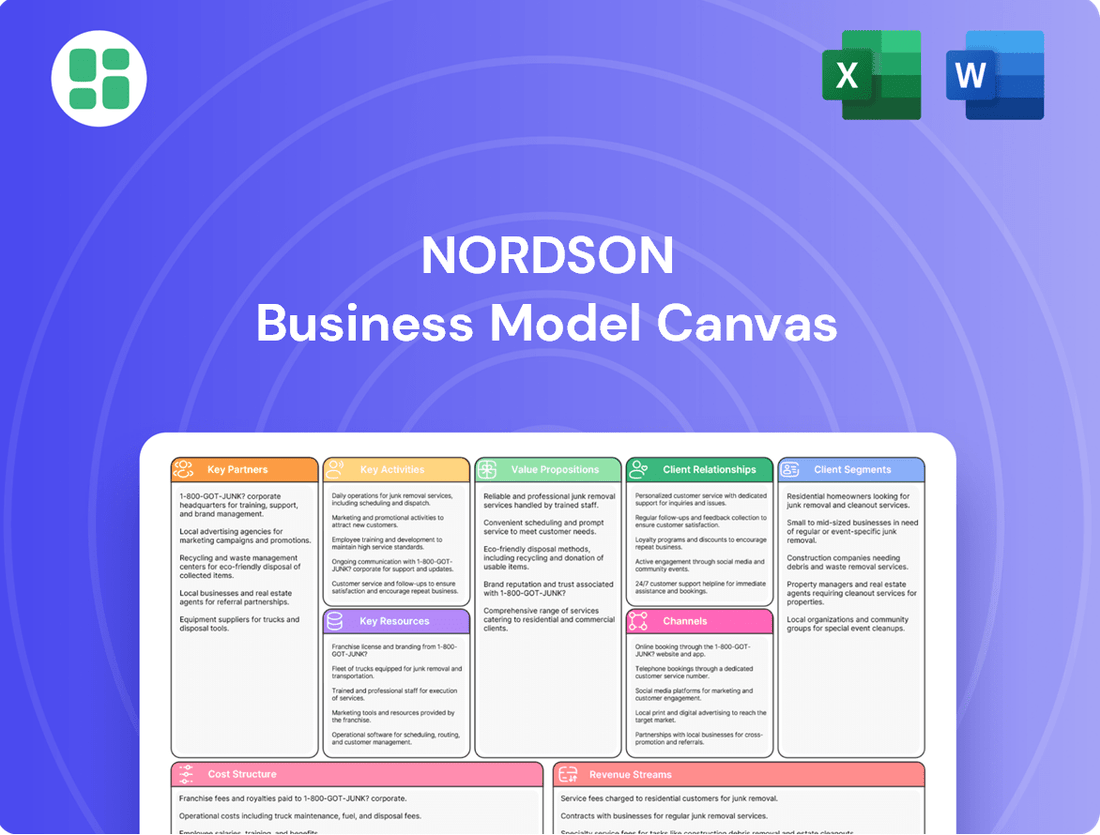

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of Nordson's strategic approach. This isn't a sample; it's a direct representation of the complete file, ensuring you get precisely what you see. Once your order is processed, you'll gain full access to this detailed and professionally structured document, ready for your analysis.

Resources

Nordson's intellectual property, including a vast array of patents, trade secrets, and proprietary technologies, forms a cornerstone of its business model. These assets are critical for its leadership in precision dispensing, application, and control systems, offering a distinct competitive edge.

This deep well of innovation directly translates into differentiated product offerings, allowing Nordson to command premium pricing and maintain strong market positions. For instance, in 2023, Nordson reported $2.7 billion in revenue, a testament to the market's demand for its technologically advanced solutions protected by this intellectual capital.

Nordson's specialized manufacturing facilities and highly specialized equipment are the backbone of its precision technology solutions. These state-of-the-art plants are engineered for the efficient, high-quality production of complex systems and components, crucial for maintaining their competitive edge.

The company's commitment to advanced manufacturing is evident in its global operational footprint, which spans over 35 countries. This extensive network ensures localized production and support, allowing Nordson to serve diverse markets effectively. For instance, in fiscal year 2023, Nordson reported capital expenditures of $301.4 million, a significant portion of which would be allocated to maintaining and upgrading these critical manufacturing assets to support innovation and capacity expansion.

Nordson's skilled engineering and technical workforce is a cornerstone of its operations, representing a critical human resource. This team, comprising engineers, application specialists, and technical service personnel, possesses deep expertise in areas like material science, fluid dynamics, and automation. Their knowledge is essential for Nordson to create, produce, and support its sophisticated product offerings across various industries.

In 2024, Nordson continued to emphasize employee engagement and development as key strategic pillars. This focus is designed to ensure that its technical talent remains at the forefront of innovation and customer support, directly contributing to the company's ability to deliver high-value solutions and maintain its competitive edge in specialized markets.

Global Sales and Service Network

Nordson's extensive global sales and service network, present in over 35 countries, is a cornerstone of its business model. This expansive reach ensures they can effectively connect with and support a wide array of customers worldwide, fostering strong relationships and providing localized expertise.

This close proximity to customers allows for highly responsive technical support and streamlined product delivery, embodying a truly customer-centric approach. For instance, in fiscal year 2023, Nordson reported that its global presence facilitated significant market penetration and customer satisfaction, contributing to its overall revenue growth.

- Global Reach: Operations in over 35 countries.

- Customer Proximity: Enables close relationships and localized support.

- Operational Efficiency: Facilitates efficient product delivery and service.

- Market Penetration: Key driver for revenue growth and customer satisfaction.

Established Brand Reputation and Customer Base

Nordson's established brand reputation, built on decades of delivering precision, reliability, and innovation in industrial technology, serves as a critical intangible asset. This strong brand recognition, a testament to their consistent performance, significantly aids in attracting and retaining a diverse customer base across numerous end markets.

The company's loyal and varied customer base is a cornerstone of its business model, providing predictable and stable revenue streams. For instance, Nordson reported net sales of $6.2 billion for fiscal year 2023, showcasing the substantial revenue generated from its established customer relationships.

- Brand Equity: Nordson is recognized globally for high-performance dispensing, sealing, and curing solutions.

- Customer Loyalty: Repeat business and long-term contracts are common due to the critical nature of Nordson's equipment in customer manufacturing processes.

- Market Penetration: The brand's strength allows for easier entry and expansion into new geographic regions and product segments.

- Revenue Stability: A diverse customer base across industries like electronics, medical, and automotive mitigates risk and ensures consistent demand.

Nordson's intellectual property, including patents and trade secrets, is a key resource, enabling its leadership in precision dispensing and control systems. This innovation directly supports its differentiated product offerings and premium pricing strategy. For example, in 2023, the company's strong patent portfolio underpinned its ability to generate $2.7 billion in revenue.

The company's skilled workforce, particularly its engineers and technical specialists, is another crucial asset. Their expertise in material science and automation is vital for developing and supporting Nordson's complex solutions. In 2024, Nordson continued to invest in employee development to maintain this technical edge.

Nordson's global sales and service network, operating in over 35 countries, ensures close customer proximity and responsive support. This extensive reach is a significant factor in its market penetration and customer satisfaction, contributing to its consistent revenue growth.

The established Nordson brand, synonymous with reliability and innovation, is a powerful intangible asset. This strong brand equity fosters customer loyalty and facilitates expansion into new markets, reinforcing its market position and revenue stability, as evidenced by its $6.2 billion in net sales in fiscal year 2023.

| Key Resource | Description | Impact | 2023 Data Point |

|---|---|---|---|

| Intellectual Property | Patents, trade secrets, proprietary technologies | Competitive advantage, premium pricing | $2.7 billion in revenue |

| Skilled Workforce | Engineers, technical specialists | Product innovation and support | Continued investment in employee development in 2024 |

| Global Network | Sales and service in 35+ countries | Customer proximity, market penetration | Facilitated market penetration and customer satisfaction |

| Brand Reputation | Decades of reliability and innovation | Customer loyalty, market expansion | $6.2 billion in net sales |

Value Propositions

Nordson's high-precision material application and control is a cornerstone value proposition, offering customers unparalleled accuracy in dispensing adhesives, coatings, polymers, and fluids. This level of control directly translates to enhanced product quality and reduced material consumption, a critical factor for manufacturers aiming for efficiency and sustainability.

For instance, in the electronics sector, Nordson's dispensing systems contribute to the reliable assembly of intricate components, where even minute variations can impact performance. This precision is vital for industries like automotive and medical devices, where product integrity and safety are paramount.

In 2024, the demand for advanced material application technologies that minimize waste and maximize yield continues to grow, driven by stricter environmental regulations and the pursuit of operational excellence across global manufacturing. Nordson's commitment to precision directly addresses these market needs.

Nordson's technologies are engineered to streamline production lines, boosting efficiency and minimizing equipment downtime. For instance, their dispensing systems can reduce material waste by up to 15% in certain adhesive applications, directly translating to lower operating expenses for manufacturers.

By enabling higher product yields and reducing scrap rates, Nordson empowers its clients to achieve substantial cost savings. This focus on operational improvement and material optimization is a core element of their value proposition, directly impacting customer profitability.

Nordson excels by offering highly customizable and industry-specific technology solutions, directly addressing the unique needs of sectors like packaging, electronics, and medical devices. This tailored approach ensures their systems integrate smoothly into existing production processes, providing significant value. For instance, in 2024, Nordson's continued investment in application expertise allowed them to refine dispensing systems for advanced semiconductor manufacturing, a market demanding extreme precision and specialized material handling.

Reliability, Durability, and Long-Term Performance

Nordson’s value proposition centers on delivering exceptional reliability, durability, and long-term performance. Customers gain significant advantages from systems engineered with robust design and superior manufacturing, guaranteeing consistent operation and an extended service life. This commitment to quality directly translates into minimized maintenance requirements and maximized operational uptime for clients.

The inherent durability of Nordson's equipment plays a crucial role in reducing total cost of ownership. By minimizing the need for frequent repairs and replacements, businesses can achieve a more predictable and cost-effective manufacturing process. This focus on longevity ensures a dependable operational environment, allowing customers to concentrate on their core production goals.

- Reliability: Nordson's systems are built for consistent, trouble-free operation, reducing production interruptions.

- Durability: High-quality materials and construction ensure equipment longevity, even in demanding industrial settings.

- Long-Term Performance: Customers benefit from sustained efficiency and output over the lifespan of Nordson products.

- Lower Total Cost of Ownership: Reduced maintenance and fewer replacements contribute to significant cost savings for businesses.

Global Technical Support and Application Expertise

Nordson's commitment to global technical support and application expertise is a cornerstone of its value proposition. They provide customers with expert guidance from initial setup through ongoing operation, ensuring optimal system performance.

This support extends to troubleshooting and continuous training, crucial for maximizing the efficiency of Nordson's advanced dispensing and processing equipment. For instance, in 2024, Nordson reported significant customer satisfaction scores directly linked to their responsive technical service teams.

- Global Reach: Providing expert assistance across diverse geographical locations.

- Application Focus: Tailoring support to specific customer processes and challenges.

- Lifecycle Support: Offering guidance from installation to post-sales service and upgrades.

- Performance Optimization: Helping clients achieve peak operational efficiency with their Nordson systems.

Nordson's value proposition centers on delivering highly precise material application and control, enabling enhanced product quality and reduced waste for manufacturers. This precision is critical in industries like electronics and medical devices, where accuracy directly impacts performance and safety.

The company's technologies streamline production lines, boosting efficiency and minimizing downtime, with some dispensing systems reducing material waste by up to 15%. This focus on operational improvement and material optimization leads to substantial cost savings for clients through higher yields and lower scrap rates.

Nordson offers customized, industry-specific solutions, ensuring seamless integration into existing processes. Their commitment to reliability, durability, and long-term performance minimizes maintenance and maximizes uptime, contributing to a lower total cost of ownership. Furthermore, their global technical support and application expertise ensure optimal system performance and customer satisfaction, as evidenced by strong customer feedback in 2024.

| Value Proposition Aspect | Description | Key Benefit | Example/Data (2024 Focus) |

|---|---|---|---|

| Precision Material Application | High-accuracy dispensing of adhesives, coatings, and fluids. | Improved product quality, reduced material waste. | Critical for intricate electronics assembly; up to 15% waste reduction in some adhesive applications. |

| Operational Efficiency & Cost Savings | Streamlined production, reduced downtime, higher yields. | Lower operating expenses, increased profitability. | Minimized scrap rates directly impact customer bottom lines. |

| Customization & Integration | Industry-specific solutions tailored to unique needs. | Seamless integration, enhanced process value. | Refined dispensing for advanced semiconductor manufacturing in 2024. |

| Reliability & Durability | Robust design, superior construction, extended service life. | Minimized maintenance, maximized operational uptime. | Contributes to a lower total cost of ownership for clients. |

| Technical Support & Expertise | Global guidance from setup to ongoing operation. | Optimized system performance, high customer satisfaction. | Strong 2024 customer satisfaction scores linked to responsive technical service. |

Customer Relationships

Nordson prioritizes customer relationships through dedicated account managers and sales engineers. These professionals engage directly with clients, delving into their specific requirements to craft customized solutions. This consultative approach ensures optimal performance for each unique application.

This deep engagement fosters significant technical collaboration and builds a strong foundation of trust. For instance, in 2024, Nordson's customer satisfaction scores related to technical support and problem-solving saw a notable increase, reflecting the effectiveness of this dedicated relationship model.

Nordson's customer relationships are deeply rooted in providing long-term technical support and service contracts, ensuring their sophisticated equipment continues to perform optimally long after the initial purchase. This commitment extends to comprehensive maintenance programs and readily available technical assistance, fostering customer loyalty and minimizing downtime.

These ongoing services are crucial for the longevity and peak performance of Nordson's installed base, directly contributing to customer satisfaction and operational efficiency. For instance, in 2023, Nordson reported strong performance in its Service and Support segment, reflecting the value customers place on these essential offerings, which helps maintain their production lines without interruption.

Nordson actively partners with key customers in collaborative research and development, focusing on creating bespoke solutions for new and evolving applications. This deep engagement ensures that Nordson's offerings precisely meet unique customer needs, fostering innovation.

By working together, customers gain access to Nordson's specialized knowledge and technological capabilities, effectively addressing their most complex challenges. This symbiotic relationship transforms Nordson from a mere vendor into an indispensable strategic partner in their customers' innovation journeys.

Online Resources and Self-Service Portals

Nordson leverages comprehensive online resources, including detailed technical documentation and extensive FAQ sections. These digital platforms empower customers to find answers and solutions independently, streamlining their support experience.

The company's commitment to digital self-service extends to potentially offering e-commerce capabilities for ordering spare parts and consumables. This provides a convenient and efficient channel for customers to manage their operational needs.

These online offerings significantly enhance customer efficiency and responsiveness by addressing common inquiries through readily available information. For instance, in 2024, many industrial equipment manufacturers reported a significant increase in customer inquiries handled through self-service portals, often exceeding 60% for routine technical questions.

- Extensive Online Documentation: Providing access to manuals, datasheets, and troubleshooting guides.

- FAQ and Knowledge Base: A searchable repository of common questions and their solutions.

- E-commerce for Parts: Enabling direct online purchase of spare parts and consumables.

- Customer Support Portals: Offering case tracking and direct communication with support teams.

Training and Application Assistance

Nordson provides comprehensive training and dedicated application assistance, ensuring their customers’ teams master the operation and upkeep of precision technology. This focus on education maximizes the utility of Nordson's advanced equipment, driving optimal performance and outcomes for clients.

This commitment extends beyond product delivery, reinforcing Nordson's dedication to fostering customer success and long-term partnerships. For instance, in 2024, Nordson reported that over 90% of customers utilizing their training programs saw improved process efficiency within six months.

- Enhanced Equipment Proficiency: Customers gain the skills to operate and maintain Nordson's technology effectively.

- Maximized Value: Training ensures clients achieve the full potential and return on investment from their Nordson equipment.

- Optimal Performance: Hands-on assistance helps fine-tune processes for superior results and product quality.

- Customer Success Focus: This support underscores Nordson's dedication to client achievement and operational excellence.

Nordson cultivates robust customer relationships through a multi-faceted approach, emphasizing direct engagement, technical collaboration, and ongoing support. This strategy ensures clients receive tailored solutions and maximize the value of Nordson's advanced technologies.

This dedication to customer success is reflected in their high satisfaction rates, particularly concerning technical support and problem-solving, which saw a notable increase in 2024. Furthermore, the strong performance of their Service and Support segment in 2023 highlights the perceived value of their long-term maintenance and assistance programs.

Nordson's commitment extends to collaborative R&D, transforming them into strategic partners who help clients overcome complex challenges and drive innovation. Their online resources and training programs further empower customers, enhancing equipment proficiency and operational efficiency, with over 90% of training participants reporting improved efficiency in 2024.

| Customer Relationship Aspect | Key Activities | Impact on Customers | 2024/2023 Data Points |

|---|---|---|---|

| Direct Engagement | Dedicated Account Managers, Sales Engineers | Tailored solutions, deep understanding of needs | Increased customer satisfaction scores for technical support in 2024 |

| Technical Collaboration & Support | Collaborative R&D, long-term service contracts, maintenance programs | Problem-solving, optimal equipment performance, reduced downtime | Strong performance in Service and Support segment (2023) |

| Customer Empowerment | Online documentation, FAQs, training programs, e-commerce for parts | Enhanced proficiency, self-service capabilities, maximized ROI | Over 90% of training users saw improved efficiency (2024) |

Channels

Nordson's direct sales force is a cornerstone of its strategy, employing specialized sales professionals and application engineers. This team engages directly with industrial clients, fostering deep understanding and building robust relationships.

This direct engagement is crucial for complex systems, enabling tailored solutions and strategic account management. In 2023, Nordson reported that its sales and marketing expenses, which include the direct sales force, were approximately $1.3 billion, highlighting the significant investment in this channel.

Nordson's strategy to broaden its market presence, particularly in varied international territories and for specialized product categories, relies heavily on its established network of authorized distributors and agents. These partners are crucial for providing localized market entry, robust sales assistance, and often initial technical support, thereby extending Nordson's reach beyond its direct sales capabilities.

In 2024, Nordson continued to refine this channel strategy, with distributors and agents playing a key role in markets where direct presence might be less efficient. For instance, in emerging markets, these partners often handle the complexities of local regulations and customer relationships, contributing significantly to overall market penetration and sales volume.

Nordson's corporate website is a crucial touchpoint, offering comprehensive product information, financial reports, and investor relations updates. In 2023, their digital presence saw significant engagement, with website traffic increasing by 15% year-over-year, indicating a growing reliance on online channels for customer and stakeholder information.

Beyond the website, Nordson leverages digital platforms like LinkedIn and industry-specific forums to enhance brand visibility and engage with the industrial community. This digital outreach is vital for sharing technical content and fostering dialogue, contributing to their market leadership.

Industry Trade Shows and Exhibitions

Nordson actively participates in key industry trade shows and exhibitions, a vital channel for showcasing its advanced technologies and demonstrating product capabilities. These events serve as crucial platforms for direct engagement with both current and potential customers, fostering valuable relationships and gathering immediate market feedback.

These exhibitions are instrumental in generating new sales leads and reinforcing Nordson's strong market presence. For example, in 2024, participation in events like the Advanced Manufacturing (AM) Expo and the International Manufacturing Technology Show (IMTS) provided significant opportunities to connect with a broad audience of industry professionals.

- Lead Generation: Trade shows are a primary source for identifying and qualifying new business opportunities, contributing directly to sales pipelines.

- Brand Visibility: Exhibiting at major industry events enhances Nordson's brand recognition and positions it as a leader in its respective markets.

- Customer Engagement: These forums allow for face-to-face interactions, enabling Nordson to address customer needs and showcase innovative solutions effectively.

- Market Intelligence: Direct exposure to industry trends and competitor activities at these shows provides valuable insights for strategic planning.

Strategic OEM Partnerships

Nordson's strategic OEM partnerships represent a crucial indirect sales channel, where their specialized equipment is integrated into larger systems produced by other original equipment manufacturers. This symbiotic relationship allows Nordson to reach a wider audience of end-users by becoming a preferred component supplier within these broader product ecosystems.

This channel is particularly vital for Nordson's embedded solutions, enabling them to expand their market footprint significantly without direct consumer engagement. For instance, in the semiconductor industry, Nordson's dispensing and coating equipment is often a standard offering within larger manufacturing lines, providing them with access to a vast installed base.

In 2023, Nordson's Industrial Technologies segment, which heavily relies on OEM integration, reported strong performance, with revenue growth driven by demand in electronics and advanced manufacturing sectors. This segment's success underscores the importance of these OEM relationships in driving volume and market penetration.

- OEM Integration: Nordson's products are built into larger systems from other manufacturers.

- Indirect Channel: This partnership acts as a significant route to market, reaching more end-users.

- Market Expansion: Crucial for embedded solutions, increasing Nordson's presence in diverse industries.

- 2023 Performance: The Industrial Technologies segment, benefiting from OEM ties, showed robust revenue growth.

Nordson utilizes a multi-channel approach, with direct sales, distributors, digital platforms, and OEM partnerships being key. The direct sales force, comprising specialized professionals, fosters deep client relationships for complex solutions, supported by substantial sales and marketing investments. Authorized distributors and agents are vital for market penetration in diverse international territories and specialized product categories, offering localized support.

Digital channels, including a corporate website and social media, enhance brand visibility and customer engagement, with website traffic seeing a 15% increase in 2023. Industry trade shows remain critical for showcasing technology, generating leads, and gathering market intelligence, with significant participation in events like IMTS in 2024. OEM partnerships provide an essential indirect route, integrating Nordson's equipment into larger systems and expanding market reach, as evidenced by strong performance in the Industrial Technologies segment in 2023.

| Channel Type | Description | Key Role | 2023/2024 Data Point |

| Direct Sales | Specialized sales force and application engineers | Deep client relationships, tailored solutions | Sales & Marketing Expenses ~$1.3 billion (2023) |

| Distributors & Agents | Authorized partners in various territories | Localized market entry, sales assistance | Crucial for emerging markets and specialized categories (2024) |

| Digital Platforms | Corporate website, social media, industry forums | Brand visibility, information dissemination | Website traffic up 15% YoY (2023) |

| Trade Shows | Industry exhibitions and events | Product showcase, lead generation, market intelligence | Participation in AM Expo, IMTS (2024) |

| OEM Partnerships | Integration into other manufacturers' systems | Indirect sales, market expansion for embedded solutions | Strong performance in Industrial Technologies segment (2023) |

Customer Segments

Packaging manufacturers, a core customer segment for Nordson, rely heavily on precision adhesive and coating application for product integrity and aesthetics. These companies produce packaging for a vast array of consumer goods, from durable electronics to everyday non-durables. For instance, the global flexible packaging market alone was valued at approximately $250 billion in 2023, highlighting the scale of this industry and its dependence on advanced manufacturing processes.

Electronics and semiconductor manufacturers are a core customer segment for Nordson. These companies, involved in producing everything from intricate circuit boards to the tiny chips that power our devices, depend on Nordson's advanced dispensing systems. These systems are crucial for applying materials like epoxies, silicones, and flux with extreme precision, enabling the miniaturization and enhancing the performance and reliability of modern electronics.

The demand from this sector is significant, driven by the relentless pace of technological advancement. In 2024, the global semiconductor market alone was projected to reach over $600 billion, underscoring the scale of this high-growth end market. Nordson's solutions directly address the critical need for accurate material application in this dynamic and expanding industry.

Medical device and life science companies rely on Nordson for critical fluid management and material application needs. These manufacturers, producing everything from diagnostic equipment to advanced life support systems, require utmost precision and sterility. Nordson’s offerings, bolstered by the Atrion acquisition, are vital for applications in drug delivery and infusion therapies.

The life sciences sector, a significant market for Nordson, saw continued growth through 2024. Companies in this segment are increasingly investing in advanced manufacturing processes to meet stringent regulatory requirements and patient safety standards. Nordson’s specialized dispensing and testing solutions directly address these demands, ensuring product integrity and performance in life-saving medical technologies.

General Industrial and Automotive Manufacturers

This broad customer segment encompasses a wide array of industrial applications, from automotive component manufacturing and general assembly to the fabrication of numerous products. Nordson’s specialized dispensing, coating, and bonding technologies are crucial for enhancing efficiency, improving product quality, and optimizing material usage across these diverse manufacturing processes. This segment is further broken down to include manufacturers of consumer durables and various industrial goods.

For instance, in the automotive sector, Nordson’s solutions are integral to applications like sealing body panels, bonding interior components, and applying protective coatings, contributing to vehicle durability and aesthetics. In 2024, the global automotive market continued its recovery, with production volumes showing steady growth, directly impacting the demand for advanced manufacturing equipment and consumables that Nordson provides. The company's focus on precision and automation aligns with industry trends towards lighter materials and more complex assembly processes.

- Automotive Manufacturing: Critical for sealing, bonding, and coating vehicle components to enhance durability and finish.

- General Assembly: Used across various industries for precise application of adhesives and sealants in product assembly.

- Product Fabrication: Supports the creation of diverse goods, including consumer durables, by ensuring efficient and high-quality material application.

- Efficiency and Quality Gains: Nordson's technologies directly contribute to reduced waste, faster production cycles, and improved end-product reliability for these manufacturers.

Precision Agriculture and Nonwovens Producers

This customer segment encompasses companies focused on precision agriculture and nonwovens production. In precision agriculture, manufacturers rely on Nordson's dispensing systems for highly accurate application of crop protection chemicals and seed treatments, aiming to optimize yields and reduce waste. For instance, the global precision agriculture market was valued at approximately $8.5 billion in 2023 and is projected to grow significantly.

Nonwovens producers utilize Nordson's technologies for various applications, including the manufacturing of hygiene products like diapers and medical textiles, as well as industrial filters and construction materials. The nonwovens market is substantial, with global revenues estimated to be over $60 billion in 2024, driven by demand in healthcare and consumer goods.

- Precision Agriculture Focus: Manufacturers developing specialized dispensing systems for enhanced crop protection and seed treatment efficiency.

- Nonwovens Applications: Producers of nonwoven materials for hygiene, filtration, and construction sectors benefiting from Nordson's application technologies.

- Market Significance: The precision agriculture market was valued around $8.5 billion in 2023, while the nonwovens market exceeded $60 billion in 2024.

- Nordson's Role: Providing technologies that ensure efficient and precise material application critical for these specialized industries.

Nordson serves a diverse customer base, including packaging manufacturers who require precise application for product integrity, and electronics/semiconductor companies needing highly accurate dispensing for miniaturized components. The medical device and life science sector relies on Nordson for critical fluid management, particularly in drug delivery systems. Furthermore, a broad industrial segment, encompassing automotive and general assembly, benefits from Nordson's bonding and coating technologies to improve efficiency and product quality.

| Customer Segment | Key Needs | 2023/2024 Market Data Point | Nordson's Contribution |

|---|---|---|---|

| Packaging Manufacturers | Product integrity, aesthetics | Global flexible packaging market ~$250 billion (2023) | Precision adhesive and coating application |

| Electronics & Semiconductor | Miniaturization, performance, reliability | Global semiconductor market >$600 billion (2024 projection) | Advanced dispensing systems for critical materials |

| Medical Device & Life Science | Precision, sterility, drug delivery | Continued growth in life sciences sector (2024) | Specialized fluid management and testing solutions |

| Industrial (Automotive, General Assembly) | Efficiency, quality, durability | Automotive market showing steady growth (2024) | Bonding, sealing, and coating technologies |

| Precision Agriculture & Nonwovens | Yield optimization, hygiene, filtration | Precision agriculture market ~$8.5 billion (2023); Nonwovens market >$60 billion (2024) | Accurate dispensing for crop treatments; application tech for nonwovens |

Cost Structure

Nordson's commitment to innovation is reflected in its significant Research and Development (R&D) costs, a primary driver of its expense structure. These investments are crucial for developing cutting-edge technologies, enhancing current product offerings, and investigating novel material applications.

These R&D expenditures encompass a broad range of items, including the compensation for highly skilled engineers and scientists, the acquisition and maintenance of advanced laboratory equipment, and the creation of prototypes. For instance, in fiscal year 2023, Nordson reported R&D expenses of $365.2 million, underscoring the substantial resources allocated to maintaining its technological leadership and competitive advantage in the market.

Manufacturing and production costs for Nordson are substantial, covering essential elements like raw materials, direct labor, and the overhead involved in creating their high-precision dispensing systems, components, and consumables. The intricate nature of their product lines necessitates rigorous quality control processes and investment in specialized machinery, both of which add significantly to the overall expense.

For instance, Nordson's commitment to quality and advanced manufacturing is reflected in their ongoing investments. In fiscal year 2023, the company reported Cost of Sales of $2.7 billion, a figure directly impacted by these manufacturing and production expenses. Initiatives like NBS Next are specifically designed to streamline operations and improve efficiency, thereby optimizing these critical cost areas.

Sales, General, and Administrative (SG&A) expenses are a significant component of Nordson's cost structure, encompassing global sales and marketing efforts, direct sales force compensation, and essential administrative functions. These costs are directly tied to Nordson's strategy of maintaining a close relationship with its customers worldwide.

Nordson's commitment to a direct, close-to-the-customer approach, with a presence in over 35 countries, necessitates substantial investment in its sales infrastructure and support networks. For instance, in the fiscal year 2023, Nordson reported SG&A expenses of $902.5 million, reflecting the operational demands of its global reach and customer engagement model.

Global Service and Support Infrastructure Costs

Nordson's global service and support infrastructure represents a significant cost driver, essential for maintaining customer satisfaction and operational efficiency. This includes the expenses associated with a worldwide network of service centers, skilled technical personnel, and the management of extensive spare parts inventory. For instance, in fiscal year 2023, Nordson reported that its selling, general, and administrative expenses, which encompass these service costs, totaled $1.15 billion.

The operationalization of this infrastructure involves substantial investment in staffing, training, and maintaining regional service hubs to ensure prompt and effective customer assistance. Furthermore, robust logistics are in place for the rapid delivery of replacement parts, a critical component in minimizing equipment downtime for clients.

- Staffing and Training: Costs associated with employing and upskilling a global team of service engineers and support staff.

- Inventory Management: Expenses related to maintaining adequate levels of spare parts across various distribution points.

- Logistics and Distribution: Costs incurred for the efficient and timely delivery of parts and on-site service to customers worldwide.

- Service Center Operations: Overhead and operational expenses for maintaining physical service locations.

Acquisition and Integration Costs

Nordson's inorganic growth strategy, exemplified by acquisitions like Atrion Medical, incurs substantial costs. These expenses encompass thorough due diligence to vet potential targets, legal and advisory fees for transaction structuring, and the significant undertaking of integrating acquired businesses' operations, IT systems, and cultures. For instance, in fiscal year 2023, Nordson completed several acquisitions, contributing to their overall cost structure.

The financial impact of these acquisition and integration activities is considerable. Beyond the purchase price, Nordson allocates resources to ensure these new entities seamlessly blend into its existing framework. This process is critical for unlocking the full strategic and financial potential of each acquisition, turning upfront investment into long-term value.

- Due Diligence: Costs associated with investigating the financial, operational, and legal health of target companies.

- Transaction Fees: Expenses for legal counsel, investment bankers, and accountants involved in deal execution.

- Integration Expenses: Outlays for merging IT systems, consolidating operations, rebranding, and retaining key personnel.

- Post-Acquisition Adjustments: Potential costs related to restructuring or addressing unforeseen issues identified after the deal closes.

Nordson's cost structure is heavily influenced by its commitment to innovation and manufacturing excellence. Key expenses include research and development, manufacturing and production, sales, general and administrative functions, global service and support, and costs associated with acquisitions and integration.

These costs are directly tied to Nordson's strategy of delivering high-value, technologically advanced solutions to its customers across various industries. For fiscal year 2023, Nordson's Cost of Sales was $2.7 billion, while Selling, General, and Administrative expenses amounted to $1.15 billion, reflecting the significant investments in these areas.

| Cost Category | Description | Fiscal Year 2023 Impact |

| Research & Development | Developing new technologies and enhancing products. | $365.2 million |

| Manufacturing & Production | Raw materials, labor, and overhead for high-precision systems. | Contributes to Cost of Sales ($2.7 billion) |

| Sales, General & Administrative (SG&A) | Global sales, marketing, and administrative functions. | $1.15 billion |

| Service & Support | Global network of service centers and technical personnel. | Included within SG&A |

| Acquisitions & Integration | Due diligence, transaction fees, and merging operations. | Ongoing impact from strategic acquisitions. |

Revenue Streams

Nordson's primary revenue stream is the sale of its sophisticated precision dispensing equipment and systems. These high-value capital goods, which include dispensing systems, application equipment, and control units, are crucial investments for customers across diverse industrial and consumer markets. This segment forms the bedrock of their business model, driving significant financial performance.

In fiscal year 2023, Nordson reported total sales of $6.5 billion, with their dispensing and process solutions, which heavily feature this revenue stream, demonstrating robust performance. For instance, their Advanced Technology Solutions segment, a key area for precision dispensing, saw substantial contributions, reflecting strong demand for these specialized technologies.

Nordson generates a significant and consistent revenue from selling consumable parts like nozzles and cartridges, along with essential spare parts. These are crucial for keeping their installed systems running smoothly and for routine maintenance. This ongoing demand creates a stable and predictable income for the company.

This segment is a cornerstone of Nordson's financial stability, contributing to a business model that increasingly relies on recurring revenue. In fact, as of the first quarter of 2024, over 50% of Nordson's total revenue is now recurring, a testament to the importance of these ongoing sales.

Nordson generates revenue from service contracts, extended warranties, and maintenance agreements. These offerings provide customers with crucial technical support, proactive maintenance, and repair services, ensuring their equipment runs smoothly and lasts longer.

These service agreements are vital for fostering strong, long-term customer relationships and contribute significantly to Nordson's recurring revenue streams. For instance, in fiscal year 2023, Nordson reported that its services segment, which includes these agreements, demonstrated robust growth, reflecting the value customers place on ongoing support and equipment upkeep.

Upgrades and Customization of Existing Systems

Nordson generates significant revenue by providing upgrades and customization services for its installed base of equipment. This allows customers to enhance the capabilities of their existing systems, adapting to new production demands or boosting overall efficiency. For instance, in fiscal year 2023, Nordson reported strong performance in its aftermarket businesses, which include upgrades and services, contributing to overall revenue growth.

This revenue stream capitalizes on Nordson's established customer relationships and the inherent need for continuous improvement in manufacturing processes. By offering tailored solutions, Nordson extends the useful life of its products and deepens customer loyalty. These upgrades can range from software enhancements to hardware modifications, ensuring customers remain competitive.

- Upgrades and Customization: Nordson offers modifications and enhancements to existing customer systems.

- Leveraging Installed Base: This revenue stream capitalizes on equipment already deployed by customers.

- Tailored Solutions: Services are designed to meet evolving customer production requirements and performance needs.

- Extended Product Value: Customization extends the lifecycle and value proposition of Nordson's products.

Licensing and Royalty Fees

Nordson leverages licensing and royalty fees as a strategic revenue stream, allowing other manufacturers to utilize its advanced technologies and intellectual property. This approach expands the reach of Nordson's innovations into new markets without the need for direct manufacturing, fostering partnerships and accelerating market penetration.

Royalty agreements typically involve a percentage of sales or a fixed fee for the use of Nordson's patented processes or product designs. For example, if a company licenses Nordson's specialized coating technology for its own product lines, Nordson would receive ongoing payments. This creates a more passive income stream, diversifying revenue beyond direct product sales.

While specific figures for licensing and royalty revenue are not always broken out separately in public financial reports, Nordson's commitment to innovation, as evidenced by its significant R&D investments, suggests a robust pipeline of technologies available for such arrangements. In fiscal year 2023, Nordson reported total revenue of $6.0 billion, with a strong focus on developing and protecting its intellectual capital.

- Technology Licensing: Nordson grants rights to use its proprietary technologies to third parties.

- Royalty Income: Revenue generated from a percentage of sales or fees tied to licensed IP.

- Market Expansion: Facilitates broader adoption of Nordson's innovations without direct manufacturing.

- Passive Revenue: Contributes to income diversification and profitability.

Nordson's revenue streams are diverse, built around its core expertise in precision dispensing and process solutions. The company primarily earns from selling its sophisticated dispensing equipment and systems, which are critical capital investments for customers across various industries. Complementing these sales, Nordson generates substantial recurring revenue through the sale of consumable parts and spare parts necessary for maintaining its installed equipment base.

Furthermore, Nordson secures ongoing income via service contracts, extended warranties, and maintenance agreements, ensuring customer satisfaction and equipment longevity. The company also profits from upgrades and customization services, allowing clients to enhance existing systems and adapt to evolving production needs. Finally, Nordson leverages its intellectual property through technology licensing and royalty fees, expanding market reach for its innovations.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Illustrative) |

|---|---|---|

| Equipment Sales | Sale of dispensing systems, application equipment, and control units. | Major contributor, forming the bedrock of sales. |

| Consumables & Spare Parts | Sale of nozzles, cartridges, and replacement parts. | Drives recurring revenue and ensures operational continuity. |

| Service Contracts & Warranties | Technical support, proactive maintenance, and repair services. | Fosters long-term customer relationships and predictable income. |

| Upgrades & Customization | Modifications and enhancements to existing customer systems. | Leverages installed base for continued revenue generation. |

| Licensing & Royalties | Granting rights to use proprietary technologies and IP. | Diversifies income and expands market reach for innovations. |

Business Model Canvas Data Sources

The Nordson Business Model Canvas is informed by a blend of internal financial statements, customer feedback, and operational performance metrics. This comprehensive approach ensures each component of the canvas is grounded in empirical evidence and actionable insights.