Nordson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nordson Bundle

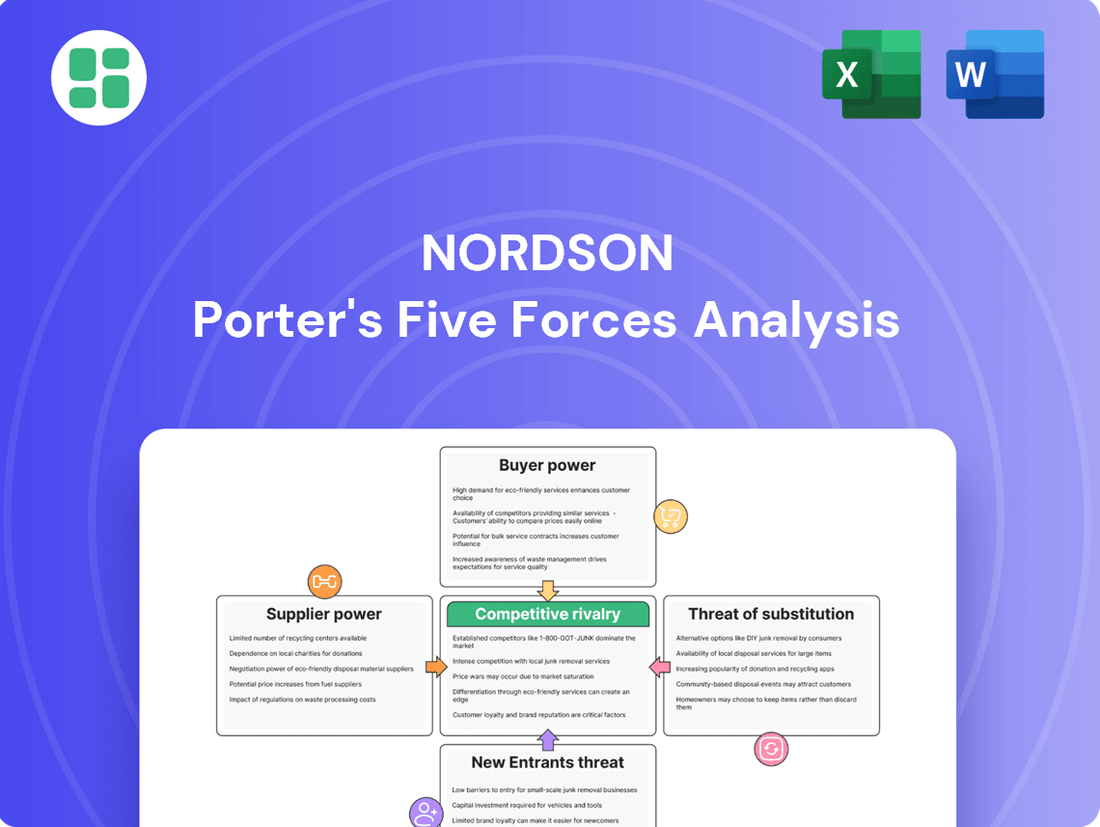

Nordson's competitive landscape is shaped by the interplay of five critical forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for any business operating within or looking to enter Nordson's market.

This brief overview highlights the core elements of Nordson's industry structure. To truly grasp the strategic implications and uncover actionable insights for your own business, you need the full picture.

Ready to move beyond the basics? Get a full strategic breakdown of Nordson’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration significantly impacts Nordson's bargaining power. If Nordson relies on a limited number of suppliers for its highly specialized components, these suppliers gain leverage. For instance, if only two or three global firms can produce a critical micro-valve used in Nordson's dispensing equipment, those suppliers can command higher prices and dictate delivery terms.

The degree to which these suppliers are dependent on Nordson's business is also crucial. If a key supplier's revenue is heavily weighted towards Nordson, they may be more willing to negotiate favorable terms to retain that business. Conversely, if the supplier serves a broad customer base across multiple industries, Nordson's importance to them diminishes, strengthening the supplier's bargaining position.

Nordson faces significant switching costs for its specialized materials like adhesives, coatings, polymers, and fluids, as well as precision components. Re-engineering products to accommodate new materials or components can be a lengthy and expensive process. For instance, if a new adhesive requires extensive product redesign and testing, the cost to Nordson escalates dramatically.

The requalification of materials is another substantial barrier. Regulatory approvals and performance validation for critical applications can take months and involve considerable R&D investment. Similarly, retooling manufacturing lines to handle different material specifications or component dimensions adds another layer of expense and potential downtime, directly impacting Nordson's operational efficiency and cost structure.

In 2023, Nordson reported research and development expenses of $467.5 million, highlighting the company's commitment to innovation and product development. A significant portion of this R&D is likely tied to material science and component integration, meaning any supplier change could necessitate a substantial reallocation of these resources, thereby increasing the bargaining power of existing suppliers.

The uniqueness of supplier inputs plays a crucial role in the bargaining power of suppliers for Nordson. If suppliers provide highly differentiated, proprietary, or patented materials and components, their leverage increases significantly. For instance, if a supplier holds a patent on a critical advanced material essential for Nordson's high-performance dispensing systems, that supplier can command higher prices.

Nordson relies on specialized raw materials and precision parts for its advanced industrial equipment. When these inputs are not readily available from multiple sources or require unique manufacturing processes, suppliers offering them gain considerable bargaining power. This is particularly true for suppliers of specialized polymers, advanced ceramics, or custom-engineered components that are integral to Nordson's product differentiation and technological edge.

In 2023, Nordson's cost of goods sold was approximately $1.8 billion. A significant portion of this cost is tied to the specialized inputs they procure. If a key supplier of a proprietary semiconductor manufacturing material, for example, experiences production issues or decides to increase prices due to its unique offering, Nordson might face increased costs or supply chain disruptions, highlighting the supplier's strong position.

Threat of Forward Integration by Suppliers

The threat of forward integration by Nordson's suppliers poses a significant challenge. If suppliers possess the capability and inclination to directly enter the precision dispensing and application equipment market, they could leverage this potential to negotiate more favorable terms with Nordson. This would effectively turn a supplier into a competitor, thereby increasing their bargaining power.

For instance, a key supplier of specialized valves or control systems might possess the technical expertise and manufacturing infrastructure to produce complete dispensing units. Should such a supplier decide to pursue this strategy, Nordson would face direct competition from entities that already understand its supply chain and potentially have established relationships with Nordson's customers. This scenario could lead to price pressures and a reduction in Nordson's profit margins.

- Supplier Capability: Assess if suppliers have the technical expertise and manufacturing capacity to produce Nordson's core products.

- Market Entry Barriers: Evaluate how easily a supplier could overcome barriers to entry in Nordson's market, such as brand recognition and distribution networks.

- Competitive Landscape: Consider if existing competitors are also suppliers, which could amplify the threat of forward integration.

Importance of Nordson to Suppliers

Nordson's bargaining power with its suppliers is significantly influenced by its relative importance to those suppliers. If Nordson accounts for a small fraction of a supplier's total revenue, that supplier has less incentive to negotiate favorable terms or prices for Nordson. This is because the supplier can more easily absorb the loss of Nordson's business and has other customers to rely on, thus holding greater power.

Conversely, when Nordson represents a substantial portion of a supplier's sales, Nordson gains considerable leverage. In such scenarios, suppliers are more inclined to offer competitive pricing and flexible terms to retain Nordson as a key client. This dynamic is crucial in understanding the supplier power within Nordson's supply chain.

- Nordson's Revenue Share: Analyzing the percentage of a supplier's total revenue that Nordson constitutes is key. For instance, if a critical component supplier derives 20% of its annual sales from Nordson, that supplier's willingness to concede on price or delivery terms is likely lower than if Nordson represented only 1% of their business.

- Supplier Dependence: A supplier heavily reliant on Nordson for its revenue will be more accommodating. This dependence reduces the supplier's bargaining power and increases Nordson's ability to dictate terms, potentially leading to cost savings and improved supply chain reliability.

- Market Concentration: The number of alternative suppliers available for Nordson's required inputs also plays a role. If there are many suppliers for a particular raw material or component, Nordson's individual importance to any single supplier diminishes, potentially increasing supplier power if they are specialized.

The bargaining power of suppliers to Nordson is substantial when they provide unique or highly specialized inputs. If Nordson relies on a few suppliers for critical, proprietary components, these suppliers can dictate terms and prices. This is amplified when switching costs, including re-engineering and requalification processes, are high, as is often the case with Nordson's advanced materials and precision parts.

Nordson's 2023 R&D expenditure of $467.5 million underscores the complexity and specialization involved in its products, meaning supplier changes could necessitate significant resource reallocation. Furthermore, if suppliers can credibly threaten to integrate forward into Nordson's markets, their leverage increases, potentially leading to price pressures. Nordson's relative importance to a supplier also shapes this dynamic; a supplier with a large portion of its revenue tied to Nordson has less power.

| Factor | Impact on Nordson's Supplier Bargaining Power | Example/Data Point |

| Supplier Concentration | High if few suppliers for specialized inputs | Critical micro-valve suppliers for dispensing equipment |

| Switching Costs | High due to re-engineering, requalification | Adhesives, polymers, precision components |

| Uniqueness of Inputs | High if inputs are proprietary or patented | Advanced materials for high-performance systems |

| Forward Integration Threat | Increases supplier leverage | Suppliers potentially entering dispensing equipment market |

| Nordson's Revenue Share | Lowers supplier power if Nordson is a major customer | Supplier revenue dependence on Nordson |

What is included in the product

Analyzes the five competitive forces impacting Nordson's industry, including threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force—no more guessing where the real pressure lies.

Customers Bargaining Power

Customer concentration is a key factor in understanding the bargaining power of customers. If Nordson serves a market with many small customers, their individual influence is limited. However, if a few very large customers represent a significant portion of Nordson's revenue, those customers gain considerable leverage to negotiate pricing and favorable terms.

Nordson operates across diverse end markets, including packaging, electronics, medical, and industrial sectors. This diversification generally dilutes the impact of any single customer. Crucially, Nordson's 2024 annual report explicitly states that no single customer accounted for ten percent or more of its total sales, indicating a low level of customer concentration.

Switching from Nordson's precision technology solutions to a competitor's system can involve significant costs for customers. These include expenses related to retraining personnel on new equipment, revalidating established production processes to ensure compliance and quality, and the complex integration of entirely new hardware and software into existing manufacturing lines.

Nordson's deep application expertise and extensive direct global sales and service network further contribute to these switching costs. Customers rely on Nordson not just for equipment, but for the knowledge to optimize its use, making a transition to a less experienced provider more challenging and potentially disruptive.

Nordson's products are not highly standardized; instead, the company focuses on differentiated solutions and proprietary dispensing technology. This specialization means customers often rely on Nordson's unique capabilities, which inherently limits their bargaining power.

For instance, Nordson's advanced dispensing systems, critical for industries like electronics and medical devices, are often tailored to specific manufacturing processes. This customization makes it difficult for customers to switch to alternative suppliers without significant disruption and cost.

In 2024, Nordson continued to emphasize innovation in its product lines, further solidifying its position as a provider of specialized, high-value solutions. This strategy directly counters the bargaining power of customers by creating a dependency on Nordson's technical expertise and performance.

Threat of Backward Integration by Customers

The threat of backward integration by Nordson's customers is generally low, especially for highly specialized and critical precision dispensing and application technologies. Developing proprietary, high-performance equipment requires significant R&D investment, specialized engineering expertise, and manufacturing capabilities that most customers in Nordson's target industries do not possess or find it uneconomical to replicate.

If customers were to successfully integrate backward and produce their own solutions, their bargaining power would significantly increase, potentially leading to price reductions or demands for customized features. However, the complexity and proprietary nature of Nordson's core technologies make this a difficult and costly endeavor for most buyers.

- Low Likelihood of Backward Integration: Customers typically lack the specialized R&D and manufacturing expertise to replicate Nordson's advanced dispensing and application systems.

- High Cost of Replication: The significant investment required for developing and producing comparable in-house technology deters most customers.

- Focus on Core Competencies: Nordson's customers generally prefer to focus on their own product manufacturing rather than investing in capital-intensive equipment development.

Customer Price Sensitivity

Nordson's customers exhibit varying degrees of price sensitivity. In sectors where Nordson's dispensing, adhesive, and coating equipment are integral to achieving high product quality, optimizing manufacturing efficiency, and minimizing material waste, customers are generally less sensitive to price increases. For instance, in the semiconductor industry, where precision and yield are paramount, the cost of Nordson's advanced equipment is often justified by its contribution to reduced defects and higher throughput. This criticality means that the value derived from Nordson's technology can outweigh minor price fluctuations.

However, in more commoditized applications or for customers with less stringent performance requirements, price can become a more significant factor. Nordson's ability to differentiate through innovation, service, and reliability helps mitigate this sensitivity. For example, Nordson's 2023 annual report highlighted strong demand in high-tech segments, suggesting that the performance benefits of their solutions often trump price concerns in these critical markets.

- Criticality of Technology: In markets like electronics assembly or medical device manufacturing, Nordson's equipment is often essential for meeting demanding specifications, making customers less responsive to price changes.

- Total Cost of Ownership: Customers often consider the total cost of ownership, including efficiency gains, reduced waste, and equipment longevity, which can make Nordson's higher initial price more palatable.

- Supplier Dependence: If Nordson is a primary supplier for a critical manufacturing process, customers may have limited alternatives, reducing their bargaining power on price.

Nordson's customers generally have low bargaining power. This is primarily due to low customer concentration, as no single customer accounted for 10% or more of Nordson's sales in 2024. Furthermore, the high switching costs associated with Nordson's specialized, differentiated technology, coupled with the low likelihood of backward integration by customers, significantly limits their leverage.

| Factor | Assessment | Nordson's Position |

|---|---|---|

| Customer Concentration | Low | No single customer > 10% of sales (2024) |

| Switching Costs | High | Training, revalidation, integration complexity |

| Product Differentiation | High | Proprietary technology, specialized solutions |

| Backward Integration Threat | Low | High R&D, expertise, and manufacturing costs |

| Price Sensitivity | Varies (Low in high-tech segments) | Value outweighs price for critical applications |

Preview the Actual Deliverable

Nordson Porter's Five Forces Analysis

This preview showcases the complete Nordson Porter's Five Forces Analysis you will receive immediately after purchase. You're looking at the actual, professionally formatted document, ensuring no surprises or placeholder content. Once you complete your purchase, you’ll get instant, ready-to-use access to this exact file for your strategic planning.

Rivalry Among Competitors

Nordson faces a competitive landscape characterized by a mix of large, diversified players and smaller, specialized firms across its various precision technology segments. The number and size of these competitors vary significantly depending on the specific niche market. For instance, in semiconductor equipment, Nordson competes with giants like Applied Materials and Lam Research, which are substantially larger and have broader product portfolios.

However, in other areas, such as dispensing systems for adhesives or coatings, the competitive intensity might stem from a larger pool of mid-sized and smaller, highly specialized companies. This fragmented competition within specific niches can still lead to robust rivalry, as these smaller players often possess deep expertise and agility. For example, in the industrial coatings market, Nordson might contend with companies like Graco and ITW, alongside numerous regional specialists.

The precision dispensing, application, and control systems markets Nordson operates in are generally experiencing healthy growth. For instance, the global adhesives and sealants market was valued at approximately $60 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5-6% through 2028. This expansion can temper intense rivalry as companies can grow by capturing a larger share of an expanding pie.

However, specific segments within Nordson's purview, such as high-speed precision fluid dispensing for electronics manufacturing, are seeing even more dynamic growth. This segment is driven by advancements in semiconductor technology and increasing demand for sophisticated electronic devices. Such robust growth in key areas suggests that while competition exists, the expanding market size may provide opportunities for all players to gain revenue without necessarily engaging in aggressive market share battles.

Nordson's competitive edge is significantly bolstered by its product differentiation. The company actively cultivates this through proprietary technology and deep application expertise across its diverse product lines. This focus allows Nordson to offer specialized solutions that are not easily replicated by competitors, thereby reducing direct price-based competition.

The company's strategy of emphasizing its unique product offerings and technical know-how directly combats the intensity of rivalry. For instance, in the semiconductor equipment market, Nordson's advanced dispensing and testing solutions often provide performance advantages that command premium pricing, underscoring the value of their differentiation.

Nordson's direct global sales and service network further strengthens its differentiated position. This integrated approach ensures customers receive tailored support and expertise, fostering loyalty and creating switching costs that competitors find difficult to overcome. This model was evident in their 2023 performance, where revenue reached $6.2 billion, showcasing the market's acceptance of their differentiated value proposition.

Exit Barriers

Exit barriers in the precision technology industry can significantly influence competitive rivalry. For instance, companies heavily invested in highly specialized manufacturing equipment, like advanced semiconductor fabrication tools or intricate medical device assembly lines, face substantial costs if they attempt to divest or repurpose these assets. This often traps them in the market, even when profitability is low, as the resale value of such specialized machinery may be minimal.

High fixed costs associated with research and development, extensive intellectual property portfolios, and established global supply chains also contribute to elevated exit barriers. Companies that have poured billions into developing proprietary technologies or building robust distribution networks find it economically unfeasible to simply walk away. This commitment can lead to continued competition, with firms striving to maintain market share and recoup their investments, even in challenging economic conditions.

- Specialized Assets: Companies in precision technology often operate with highly specific, non-transferable machinery, making liquidation difficult and costly.

- High Fixed Costs: Significant investments in R&D, intellectual property, and custom-built facilities mean that exiting the market incurs substantial unrecoverable expenses.

- Strategic Interrelationships: A company's precision technology division might be deeply integrated with other business units, making its standalone exit disruptive and financially damaging to the parent organization.

- Labor and Expertise: The need for highly skilled labor, often trained on proprietary processes, creates an exit barrier as specialized talent may not be easily redeployed elsewhere.

Diversity of Competitors

The digital fluid dispenser market features a diverse competitive landscape, with players like Nordson EFD, Fisnar, and Dover Corporation employing distinct strategies. Nordson EFD, for instance, often focuses on high-precision, high-volume industrial applications, leveraging its established brand and extensive distribution network. Fisnar, on the other hand, might target a broader range of industries with a mix of standard and specialized dispensing solutions, emphasizing value and accessibility. Dover Corporation, through its various subsidiaries, can encompass a wide spectrum of dispensing technologies, from precision micro-dispensing to larger-scale industrial systems, aiming to capture market share across different segments.

This strategic divergence fuels intense rivalry. Companies with different origins and goals can lead to unpredictable market dynamics. For example, a startup might prioritize rapid innovation and aggressive pricing to gain market entry, while a long-established player could focus on customer loyalty and integrated service offerings. The pursuit of varying objectives, such as market share dominance versus niche specialization, means competitors are constantly adapting their tactics, from product development and marketing campaigns to pricing structures and channel strategies.

- Nordson EFD: Known for high-precision industrial dispensing, strong brand recognition, and a broad distribution network.

- Fisnar: Offers a mix of standard and specialized dispensing solutions, often emphasizing value and accessibility across various industries.

- Dover Corporation: Operates through diverse subsidiaries, covering a wide range of dispensing technologies from micro-dispensing to large-scale industrial systems.

- Impact of Diversity: Varied strategies and goals among competitors lead to unpredictable market dynamics and intense rivalry, as each player pursues different objectives and employs unique competitive tactics.

Nordson operates in markets with varying degrees of competitive rivalry, influenced by the number, size, and strategies of its competitors. While larger, diversified companies like Applied Materials and Lam Research pose a significant challenge in semiconductor equipment, numerous smaller, specialized firms compete in segments like dispensing systems. This fragmentation, coupled with robust growth in markets such as adhesives and sealants, which was valued at approximately $60 billion in 2023, can temper aggressive competition by allowing companies to expand within a growing market. For instance, the global adhesives and sealants market is projected for 5-6% CAGR through 2028.

Nordson's competitive advantage stems from its product differentiation, built on proprietary technology and deep application expertise, which reduces direct price competition. This is evident in its advanced dispensing and testing solutions for semiconductors, which command premium pricing. Furthermore, its direct global sales and service network fosters customer loyalty and creates switching costs, contributing to its 2023 revenue of $6.2 billion. High exit barriers, including specialized assets and substantial R&D investments, also influence rivalry by keeping companies invested in the market.

In the digital fluid dispenser market, Nordson EFD competes with companies like Fisnar and Dover Corporation, each employing distinct strategies. Nordson EFD focuses on high-precision industrial applications, while Fisnar emphasizes value and accessibility. Dover Corporation offers a broad spectrum of technologies. This strategic divergence leads to unpredictable market dynamics and intense rivalry as competitors adapt tactics to achieve varying objectives, from market share to niche specialization.

| Competitor | Market Focus | Key Differentiators |

|---|---|---|

| Applied Materials | Semiconductor Equipment | Larger scale, broader product portfolio |

| Lam Research | Semiconductor Equipment | Larger scale, broader product portfolio |

| Graco | Industrial Coatings, Dispensing Systems | Specialized expertise, regional presence |

| ITW | Industrial Coatings, Dispensing Systems | Specialized expertise, regional presence |

| Nordson EFD | Digital Fluid Dispensers | High-precision, industrial applications, strong brand |

| Fisnar | Digital Fluid Dispensers | Value and accessibility, standard and specialized solutions |

| Dover Corporation | Digital Fluid Dispensers | Diverse subsidiaries, micro-dispensing to large-scale systems |

SSubstitutes Threaten

The threat of substitutes for Nordson's precision dispensing systems is moderate, primarily driven by the price-performance trade-off. While Nordson offers highly advanced and precise solutions, alternative methods like manual dispensing or less sophisticated automated systems can be significantly cheaper, though they often sacrifice accuracy and efficiency. For instance, manual application might cost a fraction of Nordson's automated equipment, but it cannot match the consistent droplet volume or placement required for high-tech manufacturing.

Customer willingness to switch from Nordson's solutions hinges on several factors. Brand loyalty plays a role, as does the perceived risk and difficulty of integrating new systems. Nordson's deep involvement in critical manufacturing processes and its extensive application knowledge are significant deterrents to substitution.

For instance, in the semiconductor industry, where Nordson's dispensing and coating equipment is vital for precision manufacturing, the cost and complexity of retooling and validating new processes are substantial. This creates a high switching cost for customers, making them less likely to explore alternatives, especially if Nordson's products offer reliable performance and support. In 2023, Nordson reported strong demand across its key segments, indicating customer stickiness.

Technological advancements are a significant threat of substitutes for Nordson. Emerging technologies like additive manufacturing, or 3D printing, offer alternative methods for creating complex parts, potentially reducing the need for Nordson's precision dispensing systems in certain applications. For example, the global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to grow significantly, indicating a rising capability for substitute solutions.

Indirect Substitutes

Indirect substitutes for Nordson’s solutions arise when customers find alternative ways to address their core needs. For instance, advancements in product design or material science could reduce or eliminate the necessity for specific adhesive or coating applications, effectively substituting Nordson's equipment. In 2024, the automotive sector, a key market for Nordson, saw a growing trend towards lighter materials and integrated component designs, potentially lowering the demand for certain bonding and sealing processes.

Consider these potential indirect substitutes:

- Innovative Material Science: Development of self-healing or inherently bonded materials could bypass the need for applied adhesives.

- Product Redesign: Engineering products to eliminate the need for assembly steps typically requiring Nordson’s dispensing or coating technologies.

- Alternative Manufacturing Processes: Adoption of methods like additive manufacturing (3D printing) that can create complex geometries without requiring separate adhesive or coating steps.

- Shift in Consumer Preferences: A move towards products that are more easily disassembled or repaired could reduce the reliance on permanent bonding solutions.

Regulatory and Environmental Shifts

Regulatory and environmental shifts can significantly impact the threat of substitutes for Nordson's technologies. For example, stricter regulations on volatile organic compounds (VOCs) or specific hazardous materials used in industrial processes could push manufacturers to seek alternative bonding, sealing, or coating solutions that are more environmentally friendly or compliant. This could directly favor substitute technologies that utilize water-based adhesives, UV-curable materials, or entirely different assembly methods that bypass the need for Nordson's specialized dispensing equipment.

Consider the automotive industry's increasing focus on sustainability. New mandates for reduced emissions or the elimination of certain chemicals in vehicle manufacturing could accelerate the adoption of alternative materials and processes. If these alternatives require different application methods, it presents a direct threat to Nordson's existing market share for its dispensing systems. For instance, a push towards lighter vehicle construction might favor advanced composite materials requiring novel joining techniques, potentially bypassing traditional adhesive dispensing.

The push for a circular economy also plays a role. Regulations promoting recyclability or the use of recycled content in products could necessitate new manufacturing approaches. If these new approaches rely on materials or assembly methods that are incompatible with Nordson's current dispensing technology, it opens the door for substitute solutions. For example, a focus on easily disassembled products for recycling might favor mechanical fasteners over permanent adhesive bonds, impacting demand for Nordson's adhesive dispensing equipment.

- Regulatory Pressure: Increased environmental regulations, such as those targeting VOC emissions or specific hazardous substances, can drive demand for substitute technologies and materials.

- Material Innovation: The development of new, compliant materials (e.g., water-based adhesives, eco-friendly coatings) may require different application methods, posing a threat to existing dispensing solutions.

- Circular Economy Initiatives: Policies promoting recyclability and the use of recycled content can lead to shifts in manufacturing processes, favoring alternative joining or assembly techniques over traditional adhesive applications.

The threat of substitutes for Nordson's precision dispensing systems is moderate, influenced by cost-effectiveness and emerging technologies. While Nordson excels in precision and automation, cheaper manual methods or less advanced automated systems can serve as substitutes, albeit with lower performance. For example, in 2024, the electronics assembly sector continues to explore cost-saving measures, potentially favoring simpler dispensing solutions where extreme precision isn't paramount.

Technological advancements, particularly in additive manufacturing, present a growing substitute threat. 3D printing offers alternative ways to create complex parts, potentially reducing the need for traditional dispensing in certain applications. The global 3D printing market, projected to reach over $30 billion by 2027, highlights this evolving landscape.

Indirect substitutes also emerge from product redesign and material science innovation. For instance, the automotive industry's 2024 trend towards integrated designs and advanced composites may reduce reliance on specific bonding or sealing processes. Regulatory shifts, like stricter VOC limits, can also favor alternative, compliant materials and application methods.

Entrants Threaten

Entering the precision technology solutions market, like that for fluid dispensing systems, demands substantial upfront investment. This includes significant outlays for research and development, establishing sophisticated manufacturing facilities, and acquiring highly specialized equipment.

These high capital requirements act as a formidable barrier to entry for potential new competitors. For instance, the global fluid dispensing systems market is projected for robust growth, with some estimates suggesting it could reach over $10 billion by 2029, indicating the scale of investment needed to compete effectively.

Established players like Nordson benefit significantly from economies of scale, meaning their per-unit production costs decrease as output increases. This is particularly evident in their global manufacturing and distribution networks, allowing them to absorb fixed costs over a larger volume. For instance, Nordson's extensive product portfolio across various industrial applications, from dispensing systems to fluid management, also creates economies of scope. This allows them to leverage R&D, manufacturing, and marketing resources across multiple product lines, presenting a formidable cost and offering barrier to potential new entrants who lack this integrated efficiency.

Nordson's robust portfolio, boasting over 95 global patents, creates significant barriers for new competitors. These proprietary technologies, often deeply integrated into their specialized equipment, are not easily replicated. The company's emphasis on differentiated product solutions further solidifies its market position, making it challenging for newcomers to offer comparable value or performance.

Access to Distribution Channels

Gaining access to effective distribution channels presents a significant barrier for new entrants looking to compete with established players like Nordson. Nordson leverages its direct global sales force and deep-rooted customer relationships across a wide array of critical applications and diverse end markets. This established network makes it challenging for newcomers to secure the necessary channels to reach their target customers efficiently.

Nordson's established distribution infrastructure, built over years of operation, provides a critical advantage. For instance, in the semiconductor equipment market, where Nordson is a major player, securing shelf space or partnerships with key distributors can be a lengthy and capital-intensive process. New entrants often struggle to replicate the reach and reliability of these existing networks.

The difficulty for new entrants is further amplified by the specialized nature of many of Nordson's markets. These often require tailored sales approaches and technical support, which are best delivered through established, knowledgeable channels. In 2024, the trend towards consolidation among distributors in some of Nordson's key industries means fewer independent channels are available, further concentrating power and increasing the entry hurdle.

- Established Global Sales Network: Nordson's direct sales force provides unparalleled market penetration.

- Deep Customer Relationships: Long-standing partnerships across diverse end markets are difficult to replicate.

- Specialized Market Needs: Niche applications require tailored distribution and support, favoring incumbents.

- Industry Consolidation: Fewer independent distributors in 2024 increase the difficulty for new entrants to gain access.

Government Policy and Regulatory Barriers

Government policies and regulatory frameworks present a significant threat of new entrants for Nordson, especially within its medical and electronics segments. Navigating complex compliance requirements, obtaining necessary certifications, and adhering to stringent industry standards can be costly and time-consuming for newcomers. For instance, in the medical device sector, the U.S. Food and Drug Administration (FDA) approval process for new products can take years and involve substantial investment, acting as a formidable barrier.

Furthermore, specific regional regulations and international trade policies can create additional hurdles. Companies looking to enter Nordson's markets must invest heavily in understanding and complying with diverse legal and technical specifications. In 2024, the global regulatory landscape continued to evolve, with increased scrutiny on product safety and environmental impact, particularly in advanced manufacturing and healthcare technologies where Nordson operates.

- Regulatory Compliance Costs: New entrants face substantial expenses related to product testing, validation, and ongoing compliance with standards like ISO 13485 for medical devices.

- Certification Hurdles: Obtaining certifications, such as UL listing for electrical safety or CE marking for the European market, requires significant effort and investment.

- Intellectual Property Protection: Strong patent protection held by incumbents like Nordson can deter new entrants who may face infringement risks.

- Government Subsidies and Incentives: Conversely, government support for established domestic players in strategic industries can also disadvantage new international entrants.

The threat of new entrants for Nordson is generally low due to significant barriers. High capital requirements for R&D, manufacturing, and specialized equipment, coupled with strong patent portfolios and established distribution networks, make entry costly and difficult. Furthermore, navigating complex regulatory landscapes and compliance requirements adds another layer of challenge for potential competitors entering Nordson's precision technology solutions markets.

Nordson's competitive advantages, including economies of scale and scope derived from its extensive product lines and global operations, present a substantial cost hurdle for newcomers. For example, in 2024, the semiconductor manufacturing equipment sector, where Nordson is a key supplier, saw continued investment in advanced facilities, reinforcing the need for deep pockets to even consider entry.

The company's intellectual property, with over 95 global patents, and its differentiated product offerings create a technological moat that is hard for new firms to breach. This focus on specialized, high-performance solutions means that imitation is difficult and costly, requiring significant innovation and investment from any potential entrant.

Accessing established distribution channels and customer relationships is a critical barrier. Nordson's direct sales force and long-standing partnerships across diverse end markets, from electronics to medical, are not easily replicated. In 2024, industry consolidation among distributors in some of Nordson's key sectors further tightened access, making it harder for new entrants to secure the necessary market reach.

| Barrier Type | Description | Impact on New Entrants | Nordson's Advantage |

|---|---|---|---|

| Capital Requirements | High R&D, manufacturing, and equipment costs. | Significant financial hurdle. | Leverages existing infrastructure and scale. |

| Intellectual Property | Extensive patent portfolio (95+ global patents). | Deters imitation and requires significant innovation. | Proprietary technologies create a competitive edge. |

| Distribution Channels | Established global sales force and customer relationships. | Difficult to gain market access and replicate reach. | Deep market penetration and customer loyalty. |

| Regulatory Compliance | Complex certifications and industry standards. | Costly and time-consuming to navigate. | Experienced in meeting and exceeding regulatory demands. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Nordson leverages a comprehensive mix of data, including Nordson's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Gartner. This ensures a robust understanding of competitive dynamics.