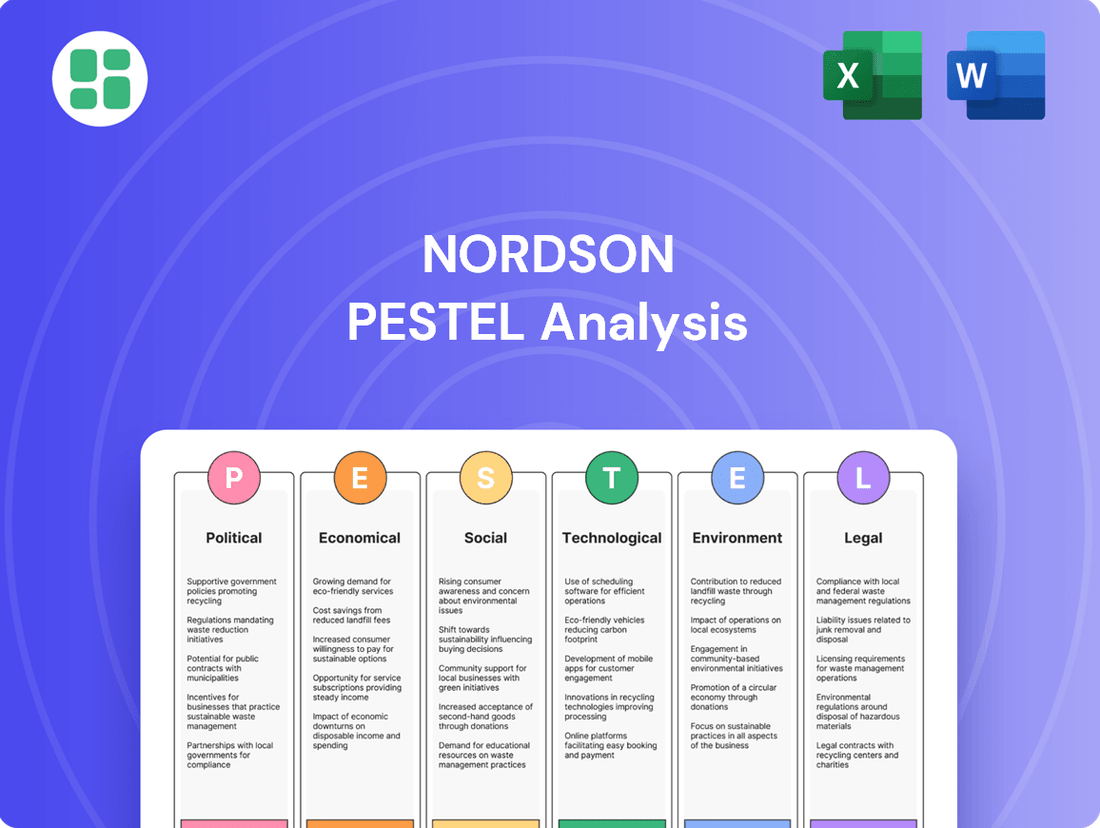

Nordson PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nordson Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal factors shaping Nordson's trajectory. Our PESTLE analysis provides a comprehensive overview, equipping you with the foresight needed to navigate market complexities. Don't just react to change—anticipate it. Purchase the full analysis now for actionable intelligence.

Political factors

Changes in international trade agreements and tariffs directly influence Nordson's global operations. For instance, the USMCA, replacing NAFTA, aims to reshape North American trade dynamics, potentially impacting Nordson's manufacturing and distribution networks in the region. Similarly, ongoing trade discussions and potential tariff adjustments between major economies like the US and China could affect the cost of components and the competitiveness of Nordson's products in those markets.

Nordson operates in sectors like medical and electronics, which are heavily regulated. For instance, the U.S. Food and Drug Administration (FDA) oversees medical device manufacturing, with new regulations often introduced to enhance patient safety. In 2024, there was a continued focus on cybersecurity for connected medical devices, impacting how Nordson's equipment integrates into healthcare systems.

Stricter government rules on product safety, manufacturing quality, and the materials used can force Nordson to adapt its product designs and production methods. For example, evolving environmental regulations, such as those concerning hazardous substances in electronics, might require Nordson to re-evaluate its material sourcing and manufacturing processes to meet compliance by 2025.

Staying compliant with these changing regulations is essential for Nordson to access markets and continue its operations. Failure to adapt can lead to significant fines or market exclusion, impacting revenue streams. For example, in the EU, the Medical Device Regulation (MDR) continues to impose rigorous compliance requirements, with ongoing updates affecting device manufacturers.

Geopolitical stability is a significant concern for Nordson. Political instability in key sourcing regions, such as parts of Southeast Asia where Nordson has manufacturing facilities, can lead to supply chain disruptions. For instance, in 2024, several countries in this region experienced heightened political tensions, which, while not directly impacting Nordson's operations at the time, highlighted the potential for such events to affect material availability and lead times.

Furthermore, conflicts or political unrest in markets where Nordson sells its products, like certain emerging economies, can dampen customer demand. For example, a slowdown in industrial activity due to political uncertainty in a specific European market in early 2025 could directly impact Nordson's sales figures for its precision dispensing equipment in that area.

To counter these risks, Nordson's strategy of maintaining a diversified supply chain across multiple continents and a broad market presence helps to mitigate the impact of localized geopolitical instability. This approach ensures that disruptions in one region do not cripple overall operations or revenue streams.

Government Spending and Infrastructure Projects

Government spending on infrastructure and manufacturing modernization is a key political factor influencing Nordson. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in late 2021, allocates significant funds towards upgrading roads, bridges, and public transit, which could indirectly boost demand for Nordson's industrial coatings and adhesives used in construction and maintenance. Furthermore, government initiatives aimed at reshoring manufacturing and bolstering domestic production, particularly in sectors like semiconductors and advanced electronics, directly benefit Nordson by increasing the need for their high-precision dispensing equipment.

Public funding for specific industries presents direct growth avenues. In 2024, many governments are prioritizing investments in renewable energy technologies and the expansion of healthcare infrastructure. These sectors frequently rely on advanced materials and sophisticated manufacturing processes where Nordson's solutions, such as those for solar panel assembly or medical device production, are essential. For example, the Inflation Reduction Act in the U.S. includes substantial tax credits and incentives for clean energy manufacturing, potentially driving demand for specialized application systems.

- Infrastructure Investment: The U.S. Infrastructure Investment and Jobs Act has allocated over $1.2 trillion, with a significant portion directed towards infrastructure upgrades, potentially increasing demand for industrial coatings and adhesives.

- Manufacturing Modernization: Government programs supporting advanced manufacturing and reshoring initiatives, such as those seen in the U.S. CHIPS and Science Act ($280 billion), directly benefit suppliers of precision manufacturing equipment like Nordson.

- Industry-Specific Funding: Increased government investment in renewable energy and healthcare sectors, driven by policies like the Inflation Reduction Act, creates new markets for Nordson's application technologies in solar, battery, and medical device manufacturing.

Intellectual Property Protection Laws

Intellectual property protection is a cornerstone for Nordson, a company heavily reliant on its proprietary technologies. The strength and enforcement of patent and trademark laws globally directly impact Nordson's ability to shield its innovations. For instance, in 2023, the World Intellectual Property Organization (WIPO) reported a 3.5% increase in international patent filings, highlighting the growing importance of IP in global commerce.

Robust IP frameworks allow Nordson to maintain its competitive edge by preventing rivals from easily replicating its advanced solutions. This protection is vital for recouping significant investments in research and development. Without strong safeguards, the risk of counterfeiting and unauthorized use of Nordson's technology increases, potentially leading to substantial revenue losses and diminished market share.

- Global IP Filings: WIPO data shows a consistent rise in international patent applications, underscoring the increasing value placed on innovation protection.

- R&D Investment: Nordson's commitment to innovation requires strong IP to justify its substantial R&D expenditures, which exceeded $250 million in fiscal year 2023.

- Market Impact: Weak IP enforcement in key markets can lead to an estimated 10-15% loss in potential revenue for technology-driven companies due to unauthorized replication.

- Competitive Landscape: Nordson operates in sectors where technological differentiation is paramount; effective IP protection is a critical enabler of its market leadership.

Government policies on trade, such as tariffs and trade agreements like the USMCA, directly influence Nordson's global supply chain and market access. For example, ongoing trade tensions between major economic blocs can impact the cost of raw materials and finished goods, affecting Nordson's pricing strategies and competitiveness in key markets throughout 2024 and into 2025.

Regulatory environments, particularly in sectors like medical devices and electronics, necessitate continuous adaptation by Nordson. Stricter regulations concerning product safety, cybersecurity for connected devices, and environmental compliance, such as the EU's Medical Device Regulation, require ongoing investment in compliance and product development to meet evolving standards by 2025.

Government spending on infrastructure and manufacturing modernization, exemplified by initiatives like the U.S. Infrastructure Investment and Jobs Act, creates opportunities for Nordson by increasing demand for its industrial coatings and adhesives. Furthermore, government support for reshoring and advanced manufacturing, such as through the CHIPS and Science Act, directly boosts demand for Nordson's precision dispensing equipment.

What is included in the product

This Nordson PESTLE analysis meticulously examines the impact of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting opportunities and threats derived from current market and regulatory landscapes.

The Nordson PESTLE analysis acts as a pain point reliever by providing a structured framework to proactively identify and address potential external challenges, thereby reducing the anxiety and uncertainty associated with unforeseen market shifts.

Economic factors

Global economic growth is a key driver for Nordson, as it directly impacts customer spending on manufacturing equipment. Strong growth in 2024, projected by the IMF to be around 3.2%, generally translates to higher capital expenditures by Nordson's clients in sectors like electronics and packaging. Conversely, economic slowdowns or recessions can lead to reduced investment and dampen sales for Nordson's solutions.

Fluctuations in the prices of raw materials and electronic components directly affect Nordson's cost of goods sold and profit margins. For instance, the cost of specialty metals and semiconductors, crucial for their dispensing and spraying equipment, experienced significant volatility throughout 2024. Increased demand in the automotive and consumer electronics sectors, coupled with lingering supply chain issues from 2023, pushed component prices higher for many manufacturers, including those supplying Nordson.

Supply chain disruptions, such as those seen with rare earth minerals in early 2025, can lead to price volatility for essential materials. These disruptions can create shortages and drive up costs for manufacturers relying on these inputs. Nordson's ability to navigate these price swings is heavily dependent on its procurement strategies and the strength of its supplier relationships, which allow for better negotiation and inventory management.

Currency exchange rate volatility significantly impacts Nordson's global operations. As a company generating a substantial portion of its revenue internationally, fluctuations in currency values directly affect its reported earnings when translated back into U.S. dollars. For instance, a stronger U.S. dollar in 2024 could make Nordson's specialized equipment, like its semiconductor manufacturing tools, pricier for overseas customers, potentially dampening demand.

Conversely, a weaker dollar can provide a tailwind for international sales, increasing the value of foreign earnings when repatriated. Nordson actively manages this risk through various hedging strategies, aiming to stabilize its financial results against unpredictable currency movements. In the first quarter of 2025, for example, the company noted that foreign currency headwinds had a modest negative impact on its reported sales growth.

Interest Rates and Access to Capital

Changes in interest rates directly affect Nordson's cost of borrowing for crucial investments like research and development, strategic acquisitions, or expanding manufacturing capabilities. For instance, if the Federal Reserve maintains a hawkish stance, increasing the federal funds rate, Nordson's future debt issuances will likely carry higher interest expenses, potentially impacting profitability. This also extends to customers; elevated borrowing costs can dampen their appetite for capital expenditures on new equipment, thereby slowing Nordson's sales growth.

Access to capital remains a critical determinant for both Nordson and its clientele, influencing the pace of investment and expansion. In 2024, the cost of capital for many industrial companies has been influenced by a dynamic interest rate environment. For example, the average yield on investment-grade corporate bonds, a key benchmark for corporate borrowing costs, has seen fluctuations. This directly impacts Nordson's ability to finance its operations and growth initiatives, as well as its customers' capacity to purchase their products.

- Interest Rate Impact: Higher interest rates increase Nordson's borrowing costs, affecting capital allocation for R&D and acquisitions.

- Customer Demand: Rising rates can deter customers from investing in new equipment, potentially reducing Nordson's sales volumes.

- Capital Accessibility: Affordable capital is vital for Nordson's investment cycles and its customers' purchasing power.

- Market Conditions: In 2024, the cost of corporate debt has been volatile, directly influencing Nordson's financing and customer investment decisions.

Industry-Specific Market Demand

Demand within Nordson's core markets, including packaging, electronics, medical, and general industrial, is directly tied to distinct economic trends. For example, the burgeoning e-commerce sector significantly fuels the need for advanced packaging technologies, while innovation in medical devices and healthcare services propels demand in that segment. This strategic diversification across multiple industries helps Nordson buffer against potential economic slowdowns affecting any single sector.

In 2024, the global packaging market, a key Nordson segment, was projected to reach approximately $1.1 trillion, with e-commerce growth being a primary driver. Similarly, the medical device market, valued at over $500 billion in 2024, continues its upward trajectory, supported by an aging global population and increased healthcare spending. The electronics industry also shows resilience, with demand for semiconductors and advanced electronic components remaining robust, underpinning Nordson's position.

- Packaging: E-commerce expansion continues to drive demand for efficient and sustainable packaging solutions.

- Electronics: Advancements in consumer electronics and industrial automation support demand for precision dispensing systems.

- Medical: Growth in healthcare technology and medical device manufacturing boosts the need for specialized equipment.

- General Industrial: Broad economic activity and manufacturing output directly influence demand in this diverse sector.

Global economic growth significantly impacts Nordson's sales, as clients increase capital expenditures during periods of expansion. For instance, the IMF's projection of 3.2% global growth in 2024 supports higher spending on manufacturing equipment. Conversely, economic downturns can curtail customer investment, directly affecting Nordson's revenue streams.

Preview the Actual Deliverable

Nordson PESTLE Analysis

The preview shown here is the exact Nordson PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same Nordson PESTLE Analysis document you’ll download after payment.

Sociological factors

Global workforce demographics are shifting, with developed nations experiencing an aging population, potentially leading to a smaller pool of younger workers for companies like Nordson. Conversely, some emerging markets boast a growing, younger workforce, presenting opportunities for talent acquisition. For instance, in 2024, the global median age continued to rise, while countries like India saw a significant youth bulge, impacting labor availability and skill sets.

Nordson's reliance on skilled labor, particularly engineers and technicians, is paramount for its advanced manufacturing processes and product innovation. The availability of these specialized professionals directly influences Nordson's operational efficiency and its capacity to develop cutting-edge solutions. Reports in early 2025 indicated ongoing shortages of skilled manufacturing labor in key North American and European markets.

To address these demographic and skill-related challenges, Nordson's investment in training and development programs is a critical strategy. By upskilling its existing workforce and nurturing new talent, the company can bridge skill gaps and ensure it has the necessary expertise to drive future growth and maintain its competitive edge in the market.

Consumer preferences are shifting, with a notable increase in demand for eco-friendly packaging. This trend impacts Nordson's clients, who are manufacturers, pushing them to adopt more sustainable materials and production methods. For instance, the global market for sustainable packaging was valued at approximately $273.1 billion in 2023 and is projected to grow significantly.

Furthermore, lifestyle changes, such as the growing popularity of wearable technology and the miniaturization of electronics, create new opportunities and challenges. Nordson's adhesive dispensing and dispensing systems must evolve to support the precise application of materials required for these smaller, more intricate devices. The global semiconductor market, a key sector for Nordson, saw substantial growth in 2024, driven by demand for advanced chips used in these devices.

Societal focus on health, safety, and environmental (HSE) matters is significantly reshaping manufacturing. Nordson's clients are increasingly demanding solutions that not only boost efficiency but also adhere to stricter HSE regulations, driving demand for Nordson's advanced dispensing and processing technologies that can improve worker safety and minimize waste. For instance, the global chemical industry, a key market for Nordson, is facing heightened scrutiny regarding emissions and worker exposure, pushing for automation and precision that Nordson's equipment provides.

Labor Relations and Unionization Trends

Nordson's operations are influenced by labor relations and unionization trends, which can directly impact costs and flexibility. For instance, regions with strong union presence or evolving labor laws might see increased wages and benefits, affecting Nordson's overall operational expenses. In 2023, union election wins in the US saw a notable increase, with unions winning 57% of elections held, up from 54% in 2022, according to the National Labor Relations Board (NLRB) data.

Changes in labor legislation, such as minimum wage adjustments or new regulations on working conditions, can also reshape Nordson's approach to employee management and compensation. The company's ability to maintain positive employee relations is crucial for ensuring consistent productivity and operational stability across its global manufacturing sites.

Key considerations for Nordson include:

- Impact of Unionization: The prevalence of unions in Nordson's key manufacturing regions can influence wage negotiations, benefit packages, and work rules, potentially increasing labor costs.

- Legislative Changes: Evolving labor laws, such as those related to collective bargaining or worker protections, require Nordson to adapt its HR policies and practices.

- Employee Relations: Proactive engagement with employees and fostering a positive work environment are vital for mitigating labor disputes and maintaining high productivity.

Global Urbanization and Industrialization

The ongoing global shift towards urbanization and industrialization, particularly in emerging economies, presents significant growth avenues for Nordson's industrial solutions. As nations invest heavily in building their manufacturing infrastructure, the demand for advanced dispensing and application technologies, like those Nordson offers, is on the rise. For example, by the end of 2023, over 60% of the world's population resided in urban areas, a figure projected to climb higher, fueling the need for efficient, high-volume production processes that rely on precision equipment.

This demographic and economic transformation directly translates into increased opportunities for Nordson. Countries focusing on developing their industrial capabilities require sophisticated machinery for sectors ranging from electronics assembly to automotive manufacturing. This trend is supported by data showing significant foreign direct investment in manufacturing sectors in regions like Southeast Asia and India during 2024, indicating a strong commitment to industrial expansion.

- Urban Population Growth: Global urban population is expected to reach 68% by 2050, driving demand for manufactured goods.

- Industrial Output Increase: Emerging markets are projected to see a continued rise in industrial production, boosting demand for Nordson's equipment.

- Manufacturing Investment: Significant FDI in manufacturing sectors in key emerging markets signals robust growth potential.

- Technological Adoption: Developing nations are increasingly adopting advanced manufacturing technologies to improve efficiency and quality.

Societal values are increasingly prioritizing sustainability and ethical production, influencing consumer choices and corporate responsibility. This trend pressures Nordson's clients to adopt greener manufacturing processes, which in turn drives demand for Nordson's equipment that can facilitate waste reduction and material efficiency. For example, consumer surveys in 2024 consistently showed a growing preference for products from environmentally conscious brands.

The growing emphasis on corporate social responsibility (CSR) means companies like Nordson are expected to demonstrate commitment to fair labor practices and community engagement. This societal expectation impacts brand reputation and can influence investment decisions. In 2023, companies with strong ESG (Environmental, Social, and Governance) scores generally outperformed those with weaker scores, highlighting the financial relevance of societal expectations.

The increasing awareness and demand for health and safety in the workplace also shape manufacturing operations. Nordson's solutions that enhance worker safety, such as automated dispensing systems that reduce manual handling of chemicals, are becoming more critical. The global industrial safety market was valued at over $50 billion in 2024, reflecting this heightened focus.

Technological factors

The ongoing advancements in automation and robotics are fundamentally reshaping manufacturing, directly influencing the demand for Nordson's precision dispensing equipment. Companies are increasingly investing in automated solutions to boost output and accuracy, with global industrial robotics market revenue projected to reach $80 billion by 2028, a significant jump from previous years.

Nordson's ability to integrate sophisticated automation features into its dispensing systems offers a clear value proposition to customers seeking enhanced productivity. For instance, their dispensing robots can achieve placement accuracies of +/- 50 micrometers, a critical factor in high-tech manufacturing.

Staying at the forefront of these technological shifts is paramount for Nordson's competitive edge. The company's own R&D spending in 2023 was over $200 million, a portion of which is dedicated to developing next-generation automated dispensing solutions.

The manufacturing sector's embrace of Industry 4.0, integrating technologies like the Internet of Things (IoT), artificial intelligence (AI), and big data analytics, creates significant avenues for Nordson. These advancements enable the development of more intelligent, interconnected dispensing systems. For instance, the global smart manufacturing market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating a strong demand for the very solutions Nordson can offer.

By leveraging these digital capabilities, Nordson can enhance its product portfolio with features such as predictive maintenance, leading to reduced downtime for customers, and real-time process control, which boosts efficiency and quality. This integration allows for optimized performance across various applications, from electronics assembly to medical device manufacturing, directly addressing the evolving needs of a digitally-driven industrial landscape.

Breakthroughs in material science, like novel adhesives and advanced polymers, are reshaping manufacturing processes. For instance, the development of high-performance, bio-compatible adhesives is opening new avenues in medical device assembly, a key market for Nordson. This necessitates continuous adaptation of dispensing equipment to precisely handle these new substances, ensuring compatibility with evolving industry standards.

Nordson's systems must be engineered to manage materials with increasingly complex properties, such as extreme temperature resistance or enhanced conductivity. The demand for lighter, stronger composite materials in the automotive sector, for example, requires dispensing equipment capable of accurate application of specialized resins and bonding agents. This ongoing evolution in material capabilities directly impacts the design and functionality of Nordson's product portfolio.

Research and Development Investment

Nordson's commitment to innovation is evident in its consistent R&D investment, a crucial element for maintaining technological leadership. This focus allows the company to develop cutting-edge dispensing solutions and enhance its existing product portfolio. For instance, in fiscal year 2023, Nordson reported $454.5 million in R&D expenses, a notable increase from $427.1 million in fiscal year 2022, underscoring their dedication to future growth and technological advancement.

These investments are strategically directed towards creating new dispensing technologies and exploring novel applications, particularly within high-growth sectors. By continuously improving their offerings and venturing into emerging markets, Nordson ensures it can effectively address evolving customer demands and solidify its competitive edge.

- R&D Investment Growth: Nordson's R&D spending increased by approximately 6.4% from FY2022 to FY2023.

- Focus Areas: Development of new dispensing technologies and applications in emerging markets.

- Strategic Importance: Essential for maintaining technological leadership and meeting evolving customer needs.

- Competitive Advantage: R&D efforts enable Nordson to stay ahead of competitors in the advanced dispensing solutions market.

Miniaturization and Precision Manufacturing

The relentless drive for smaller, more powerful electronic components and sophisticated medical devices directly fuels the demand for advanced dispensing and application technologies. This miniaturization trend means that manufacturers need increasingly precise ways to apply adhesives, coatings, and other materials at microscopic levels. Nordson's expertise in micro-dispensing and ultra-fine coating application is therefore a significant advantage in these rapidly expanding markets.

For instance, the semiconductor industry, a major driver of miniaturization, relies heavily on precision dispensing for processes like wafer-level packaging and underfill applications. In 2024, the global semiconductor market is projected to reach over $600 billion, with continued growth expected in advanced packaging technologies that demand sub-micron precision. Similarly, the medical device sector, with its increasing use of implantable sensors and minimally invasive tools, requires equally high levels of accuracy in material application. The global medical device market was valued at approximately $575 billion in 2023 and is anticipated to grow steadily.

Nordson's continued investment in precision engineering is not just about meeting current needs but anticipating future ones. As devices become even smaller and more complex, the ability to control material placement with extreme accuracy will become paramount. This innovation is key to maintaining market leadership and enabling breakthroughs in fields like advanced electronics, diagnostics, and personalized medicine.

- Market Demand: Miniaturization in electronics and medical devices creates a direct need for precision dispensing, with the semiconductor market alone exceeding $600 billion in 2024.

- Nordson's Strength: Expertise in micro-dispensing and ultra-fine coatings positions Nordson to serve these high-growth, precision-critical sectors.

- Future Relevance: Ongoing innovation in precision engineering is vital for Nordson to remain competitive as devices continue to shrink and advance.

Technological advancements, particularly in automation and AI, are fundamentally reshaping manufacturing, driving demand for Nordson's precision dispensing solutions. The company's investment in R&D, exceeding $454 million in fiscal year 2023, directly supports the development of these advanced systems, ensuring they meet the evolving needs of sectors like electronics and medical devices.

Nordson's systems are designed for high-precision applications, with capabilities like +/- 50 micrometer accuracy, essential for industries embracing Industry 4.0. The global smart manufacturing market, valued around $30 billion in 2023, highlights the significant opportunity for Nordson's interconnected and intelligent dispensing technologies.

The trend towards miniaturization in electronics and medical devices further emphasizes the need for Nordson's micro-dispensing expertise. With the semiconductor market projected to exceed $600 billion in 2024, Nordson's ability to deliver ultra-fine material application is critical for its competitive positioning.

| Key Technological Trend | Impact on Nordson | Supporting Data (2023-2024 Estimates) |

| Automation & Robotics | Increased demand for automated dispensing systems | Global industrial robotics market projected to reach $80 billion by 2028 |

| Industry 4.0 (IoT, AI) | Opportunities for intelligent, connected dispensing solutions | Global smart manufacturing market valued at ~$30 billion in 2023 |

| Miniaturization | Need for high-precision micro-dispensing capabilities | Semiconductor market projected to exceed $600 billion in 2024 |

| R&D Investment | Enables development of next-generation technologies | Nordson R&D spending: $454.5 million in FY2023 |

Legal factors

Nordson faces significant legal hurdles due to product liability and safety regulations, especially in its medical and industrial sectors. For instance, in 2023, the medical device industry saw a rise in product liability claims, with settlements often reaching millions. Ensuring their precision technology is defect-free and compliant with standards like ISO 13485 for medical devices is paramount to avoid costly lawsuits and protect brand reputation.

Compliance isn't a one-time event; it's a continuous commitment. The company must actively monitor evolving safety standards and regulatory changes globally. Failure to adapt can lead to recalls, fines, and damage to customer trust, impacting sales and market share. This proactive approach is vital for sustained operational integrity and financial stability.

Nordson's commitment to intellectual property (IP) law compliance is paramount, encompassing patents, trademarks, and trade secrets. This adherence is vital for both protecting its own groundbreaking innovations and respecting the IP rights of competitors, thereby mitigating the risk of expensive legal battles and preserving its competitive advantage. For instance, in 2023, the company continued its global strategy of actively monitoring and enforcing its IP portfolio to maintain its technological leadership.

Nordson must navigate a complex web of Environmental, Health, and Safety (EHS) regulations across its global manufacturing sites. These rules govern everything from waste disposal and chemical management to workplace safety, directly impacting operational procedures and costs. For instance, in 2024, stricter emissions standards in several key European markets necessitate ongoing investment in pollution control technologies.

Compliance is non-negotiable, as violations can result in significant financial penalties and severe reputational damage. Nordson's commitment to EHS is reflected in its sustainability reports, which detail efforts to minimize environmental impact and ensure worker well-being. The company's 2024 sustainability initiatives include a target to reduce hazardous waste generation by 10% compared to 2023 levels.

International Trade and Export Controls

Nordson's extensive global footprint necessitates meticulous compliance with a web of international trade regulations, encompassing export controls, customs procedures, and economic sanctions. The company’s ability to efficiently manage the import and export of its specialized equipment and components across diverse international markets is critical for maintaining robust supply chains and securing market access. For instance, in 2023, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) continued to enforce stringent export control measures, impacting the movement of advanced technologies, which could affect Nordson’s product distribution. Failure to adhere to these complex requirements can lead to substantial financial penalties, reputational damage, and the imposition of trade restrictions, directly impacting Nordson's operational continuity and profitability.

Navigating these legal frameworks involves:

- Export Control Compliance: Ensuring all shipments of controlled technologies and goods meet the requirements of countries of origin and destination, such as those managed by the Wassenaar Arrangement.

- Customs Duties and Tariffs: Accurately classifying products and managing duties and tariffs to prevent delays and unexpected costs, as seen with ongoing tariff adjustments in global trade negotiations.

- Sanctions Screening: Implementing rigorous processes to screen customers and transactions against international sanctions lists to avoid engaging with prohibited entities.

Data Privacy and Cybersecurity Laws

Nordson's increasing reliance on digital technologies and interconnected products means strict adherence to data privacy regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is paramount. Failure to comply can result in significant fines; for instance, GDPR violations can lead to penalties of up to 4% of global annual revenue or €20 million, whichever is higher. Ensuring customer and operational data is shielded from cyber threats and handled lawfully is not just about legal obligations but also about preserving stakeholder trust.

Cybersecurity is no longer an optional add-on but a core operational necessity for Nordson. The global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial risk associated with security breaches. Implementing robust cybersecurity measures is therefore essential to safeguard sensitive information and maintain business continuity.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- CCPA Fines: Civil penalties can range from $2,500 to $7,500 per violation.

- Global Cybercrime Costs: Projected to reach $10.5 trillion annually by 2025.

Nordson must navigate evolving product liability laws, particularly in its high-tech sectors like medical devices and semiconductors, where defects can lead to substantial claims. For example, the medical device industry saw significant settlements in 2023, underscoring the need for rigorous quality control and compliance with standards like ISO 13485.

Continuous adaptation to global safety regulations and standards is crucial, as non-compliance can trigger costly product recalls, hefty fines, and severe reputational damage. This commitment to regulatory alignment ensures operational integrity and safeguards financial performance.

Protecting its intellectual property through patents, trademarks, and trade secrets is a legal imperative for Nordson, essential for maintaining its technological edge and avoiding costly infringement disputes. The company's active enforcement of its IP portfolio in 2023 reflects this strategic focus.

Environmental factors

The increasing global focus on sustainability and circular economy principles directly impacts Nordson's business. Customers are actively looking for ways to reduce waste and use materials more efficiently, pushing for solutions that support these goals.

Nordson has an opportunity to differentiate itself by developing dispensing and application technologies that are more environmentally conscious. For example, in 2024, the demand for sustainable packaging solutions, a key market for Nordson, saw a significant uptick, with a projected growth rate of 5-7% annually through 2028.

By offering products that enhance material recyclability and reduce energy consumption in manufacturing processes, Nordson can align with these evolving customer demands and gain a competitive advantage in the market.

The availability and cost of essential raw materials for Nordson's advanced technology products are increasingly shaped by environmental concerns and growing resource scarcity. For instance, the global demand for critical minerals used in electronics, a key sector for Nordson, has seen price volatility. Copper prices, crucial for many components, experienced fluctuations in 2024, influenced by mining output and geopolitical factors impacting supply chains.

Furthermore, there's mounting pressure on manufacturers like Nordson to integrate recycled or sustainably sourced materials into their product lines. This shift can influence product design and necessitate adjustments in manufacturing processes to meet evolving environmental standards and consumer expectations. For example, the push for circular economy principles in the electronics industry, gaining traction in 2024, encourages the use of post-consumer recycled plastics and metals.

To navigate these environmental challenges, Nordson can mitigate risks by diversifying its supplier base and actively exploring alternative materials. This strategic approach ensures greater resilience against supply chain disruptions and potential price shocks. The company's ongoing efforts in supply chain optimization, including supplier relationship management and material innovation, are vital in maintaining competitive advantage amidst these environmental pressures.

Nordson's operations, from manufacturing plants to product usage, inherently contribute to energy consumption and carbon emissions. The company's global footprint means a significant demand for power, impacting its overall environmental impact. For example, in fiscal year 2023, Nordson reported its Scope 1 and Scope 2 greenhouse gas emissions, a key metric for understanding its carbon footprint.

Growing pressure from regulators and stakeholders to decarbonize is a major environmental factor. This trend is pushing companies like Nordson to invest in more energy-efficient technologies and explore renewable energy sources for their facilities. Failure to adapt could lead to increased operational costs and reputational damage.

Conversely, developing products that help customers reduce their own energy consumption offers a strategic opportunity. Innovations in areas like advanced coating systems or dispensing technologies can lead to significant energy savings for Nordson's clients, creating a dual benefit of environmental responsibility and market differentiation.

Waste Management and Pollution Control

Nordson faces increasing scrutiny over its environmental footprint, particularly concerning waste management and pollution control. Stringent regulations across its global operations, from the United States to Europe and Asia, mandate responsible disposal of industrial waste and the minimization of emissions into air and water. For instance, the European Union's Waste Framework Directive and national regulations like the Clean Air Act in the US impose strict limits on pollutants and require detailed reporting on waste streams. Failure to comply can result in significant fines and reputational damage. In 2023, companies in the industrial manufacturing sector faced an average of $1.5 million in fines for environmental violations, underscoring the financial risks associated with non-adherence.

The company's commitment to sustainability is tested by the need to manage hazardous materials used in its advanced manufacturing processes, such as those in semiconductor and electronics production. Nordson must invest in advanced treatment technologies and safe handling protocols to meet evolving environmental standards, which often require continuous upgrades. For example, new regulations on per- and polyfluoroalkyl substances (PFAS) are impacting industries that utilize these chemicals, demanding research into safer alternatives and more effective containment methods. By proactively addressing these challenges, Nordson aims to not only avoid penalties but also enhance its brand image as an environmentally conscious corporation.

Key considerations for Nordson include:

- Compliance Costs: Ongoing investment in pollution control equipment and waste treatment processes to meet evolving regulatory standards.

- Supply Chain Impact: Ensuring suppliers also adhere to environmental regulations, particularly regarding hazardous materials and waste disposal.

- Reputational Risk: Potential negative publicity and loss of customer trust stemming from environmental incidents or non-compliance.

- Innovation Opportunities: Developing more sustainable manufacturing processes and products to gain a competitive advantage and meet growing market demand for eco-friendly solutions.

Climate Change Impacts and Adaptation

The escalating impacts of climate change, including more frequent extreme weather events, pose a significant threat to Nordson's global operations. These disruptions can affect everything from sourcing raw materials to delivering finished products, potentially impacting manufacturing uptime and customer access in vulnerable areas. For instance, a severe drought in a key agricultural region could affect the supply of certain materials used in Nordson's products, while increased flooding in another area might disrupt logistics networks.

Nordson must proactively assess and address these climate-related risks. Developing robust adaptation strategies is crucial for maintaining business continuity and resilience. This includes investing in infrastructure that can withstand extreme weather and diversifying its geographic footprint to mitigate reliance on any single region susceptible to climate impacts. The company's commitment to sustainability, as highlighted in its 2023 ESG report, underscores the growing importance of these environmental considerations.

- Supply Chain Vulnerability: Extreme weather events, such as hurricanes and floods, can cause significant disruptions to Nordson's global supply chains, impacting material availability and transportation.

- Operational Resilience: Manufacturing facilities located in climate-vulnerable regions may face increased risks of downtime due to severe weather, necessitating investments in resilient infrastructure and contingency planning.

- Market Demand Shifts: Changing climate patterns can influence customer demand for certain products or technologies, requiring Nordson to adapt its product development and market strategies.

- Adaptation Investment: Proactive investment in adaptation measures, such as diversified sourcing and enhanced logistics, is essential for mitigating climate-related financial risks and ensuring long-term operational stability.

Nordson's environmental performance is increasingly scrutinized, driving demand for sustainable solutions in its key markets. The company's commitment to reducing its operational footprint, including greenhouse gas emissions, is a critical factor for stakeholders. For instance, Nordson's fiscal year 2023 ESG report detailed its Scope 1 and 2 emissions, highlighting areas for improvement.

The push for circular economy principles and the use of recycled materials are reshaping customer expectations and product development. In 2024, the market for sustainable packaging, a significant area for Nordson, continued its growth trajectory, with projections indicating a 5-7% annual increase through 2028. This trend necessitates innovation in dispensing and application technologies that facilitate material efficiency and recyclability.

Nordson faces regulatory pressures regarding waste management and pollution control across its global operations. Compliance with stringent standards, such as those outlined in the EU's Waste Framework Directive and the US Clean Air Act, requires continuous investment in advanced treatment technologies and safe handling protocols. Non-compliance risks substantial financial penalties, with industrial manufacturers facing average fines of $1.5 million for environmental violations in 2023.

Climate change impacts, including extreme weather events, pose risks to Nordson's supply chains and operational continuity. The company must invest in resilient infrastructure and diversified sourcing to mitigate these disruptions. For example, fluctuations in critical mineral prices, like copper, influenced by supply chain factors in 2024, underscore the vulnerability of raw material availability to geopolitical and environmental events.

| Environmental Factor | Impact on Nordson | Key Data/Trend (2023-2025) |

|---|---|---|

| Sustainability Demand | Increased customer preference for eco-friendly solutions | Sustainable packaging market growth: 5-7% annually (projected through 2028) |

| Regulatory Compliance | Need for investment in pollution control and waste management | Average fines for environmental violations in manufacturing: ~$1.5 million (2023) |

| Climate Change Risks | Supply chain disruptions and operational vulnerabilities | Price volatility in critical minerals (e.g., copper) due to supply chain pressures (2024) |

| Carbon Footprint | Pressure to reduce energy consumption and emissions | Nordson's Scope 1 & 2 emissions reported in FY2023 ESG report |

PESTLE Analysis Data Sources

Our Nordson PESTLE Analysis draws from a robust blend of data, including official government reports, reputable financial news outlets, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Nordson.