Nordson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nordson Bundle

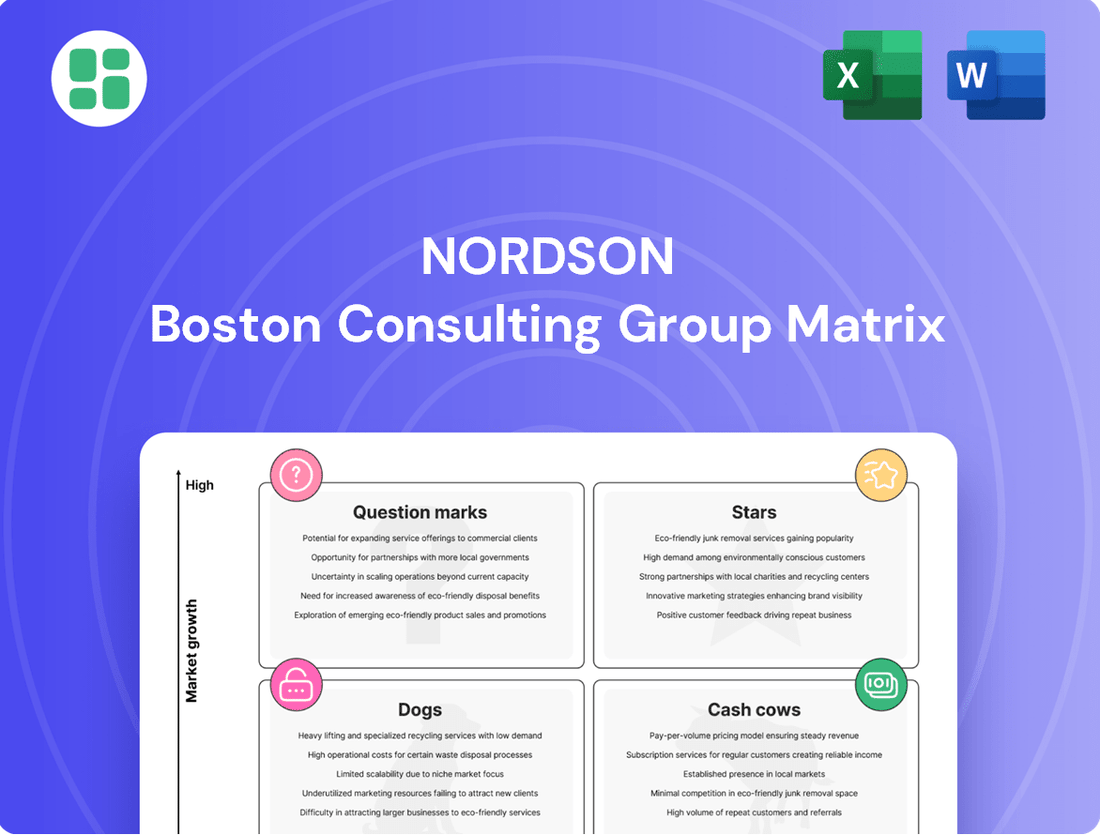

Unlock the strategic potential of this company's product portfolio with a clear understanding of its BCG Matrix. See which products are poised for growth (Stars), generating consistent revenue (Cash Cows), lagging behind (Dogs), or require careful evaluation (Question Marks).

This glimpse into the BCG Matrix is just the beginning of unlocking actionable insights. Purchase the full report to receive a comprehensive breakdown, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategy.

Stars

Nordson's Medical and Fluid Solutions segment, particularly its proprietary medical fluid components, is a key growth driver, bolstered by the strategic acquisition of Atrion in May 2024. This segment is capitalizing on the rising demand for single-use medical consumables, which offer predictable, recurring revenue.

The integration of Atrion has notably broadened Nordson's reach within infusion therapies and drug delivery systems. This expansion is directly contributing to the segment's robust sales figures, solidifying Nordson's leadership in a rapidly expanding market.

Nordson's acquisition of ARAG Group in August 2023 marked a significant strategic move into the precision agriculture sector. This expansion into dispensing systems for agriculture leverages a high-growth market, with the global precision agriculture market projected to reach $15.7 billion by 2025, growing at a CAGR of 12.8%.

These advanced dispensing technologies are designed to enhance efficiency and minimize waste in agricultural practices, a key driver for adoption in a sector increasingly focused on sustainability and cost optimization. Nordson's investment in this area reflects a commitment to capitalizing on the substantial growth potential offered by these innovative agricultural solutions.

Nordson's Electronics Test & Inspection Solutions, a key component of their Advanced Technology Solutions segment, is a clear star in the BCG matrix. This area, particularly in semiconductor test and inspection, is experiencing robust organic growth and demonstrates significant market leadership.

The company's strategic investments in automation, artificial intelligence, and cutting-edge memory technologies are directly fueling demand for their specialized product offerings. These advancements position Nordson to capitalize on the evolving needs of the electronics industry.

Further strengthening its star status, Nordson launched the Nordson Quadra Pro manual x-ray system in 2024, alongside expanding key partnerships. These moves solidify its presence in the rapidly expanding electronics market, indicating continued strong performance.

Packaging Dispensing Systems

Nordson's Packaging Dispensing Systems are a strong performer within the company's portfolio, fitting the description of a 'Cash Cow' in the BCG Matrix. These systems consistently contribute to the Industrial Precision Solutions segment with steady growth and market dominance.

The demand for these dispensing systems remains robust, particularly in the consumer non-durable goods sector, where they are essential for efficient and precise application. Nordson benefits from significant competitive advantages in this niche, ensuring sustained performance.

- Market Position: High market share in a mature, low-growth packaging market.

- Performance: Generates substantial, stable cash flow for Nordson.

- Strategic Importance: Critical for consumer non-durable goods, benefiting from predictable demand.

- Financial Contribution: Supports other business units through its consistent profitability.

Nonwovens Product Lines

Nordson's nonwovens product lines, a key component of its Industrial Precision Solutions segment, have demonstrated robust and steady growth, significantly bolstering the company's overall financial health. These advanced technologies are indispensable for the production of consumer non-durables, particularly in the hygiene sector, where Nordson commands a dominant market share.

The company's strategic and ongoing investments in these nonwovens technologies are crucial for maintaining its leadership status and ensuring sustained cash flow generation. For instance, Nordson's commitment to innovation in adhesive dispensing systems for disposable hygiene products, a primary application for their nonwovens solutions, continues to drive demand. In 2023, Nordson reported that its Industrial Solutions segment, which includes nonwovens, saw a substantial increase in sales, reflecting the strong market appetite for these essential manufacturing components.

- Consistent Growth: Nonwovens product lines are a reliable contributor to Nordson's revenue, showcasing steady expansion.

- Market Leadership: Strong positioning in hygiene and other consumer non-durable markets ensures consistent demand.

- Strategic Investment: Continued R&D and capital allocation reinforce Nordson's competitive edge and cash-generating capabilities.

- 2023 Performance: The Industrial Solutions segment, heavily featuring nonwovens, experienced notable sales growth, underscoring the segment's importance.

Nordson's Electronics Test & Inspection Solutions are a prime example of a 'Star' in the BCG matrix. This segment, especially within semiconductor testing and inspection, is experiencing significant organic growth and holds a leading market position. Strategic investments in automation and advanced memory technologies are directly fueling demand for their specialized offerings, positioning Nordson to meet the evolving needs of the electronics industry.

The company's launch of the Nordson Quadra Pro manual x-ray system in 2024 and the expansion of key partnerships further solidify its star status in the rapidly growing electronics market. This indicates a trajectory of continued strong performance and market leadership.

Nordson's Medical and Fluid Solutions segment, particularly its proprietary medical fluid components, is another strong contender for a 'Star' designation. The acquisition of Atrion in May 2024 has broadened its reach in infusion therapies and drug delivery systems. This segment is capitalizing on the increasing demand for single-use medical consumables, which provide predictable, recurring revenue streams.

The integration of Atrion has directly contributed to robust sales figures, reinforcing Nordson's leadership in a dynamic and expanding market. This segment's growth is a key driver for the company's overall performance.

| Segment | BCG Category | Key Growth Drivers | Market Position | Financial Data (Illustrative) |

|---|---|---|---|---|

| Electronics Test & Inspection Solutions | Star | Semiconductor demand, automation, AI, advanced memory technologies | Market Leader | Strong organic growth, significant revenue contribution |

| Medical and Fluid Solutions | Star | Single-use medical consumables, infusion therapies, drug delivery systems | Leading | Robust sales growth, driven by acquisitions and market trends |

What is included in the product

The Nordson BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

Clear visualization of Nordson's portfolio, simplifying strategic decisions.

Cash Cows

Nordson's core industrial adhesive dispensing systems represent a classic Cash Cow within the Boston Consulting Group (BCG) matrix. These systems operate in a mature market characterized by low growth, yet they are essential components across a wide array of manufacturing processes.

These established product lines are the bedrock of Nordson's profitability, consistently generating high-profit margins and robust cash flow. For instance, in fiscal year 2023, Nordson reported that its Industrial Solutions segment, which heavily features these dispensing systems, saw sales growth, indicating sustained demand even in mature markets.

The inherent stability of this business is further amplified by a loyal, established customer base. Recurring revenue streams from replacement parts and consumables, critical for the ongoing operation of these systems, ensure a predictable and reliable income generator for the company.

Nordson's Industrial Coating Systems, despite some recent organic sales softness, hold a commanding market share within a well-established industrial landscape. These systems are critical components in manufacturing, consistently producing substantial cash flow thanks to their dominant market presence and operational efficiency. For example, in fiscal year 2023, Nordson reported that its Industrial Technologies segment, which includes industrial coatings, saw net sales of $2.01 billion, underscoring the segment's significant contribution to overall revenue.

The strategy for these product lines centers on preserving their strong market standing and enhancing operational effectiveness rather than pursuing rapid expansion. This approach ensures continued profitability and stability, making them a reliable source of capital for the company. The mature nature of the industrial coatings market means that innovation is often incremental, focusing on efficiency gains and specialized applications, which aligns with Nordson's steady investment philosophy in this area.

Nordson's polymer processing systems are foundational to their business, operating in established markets where the company commands a significant presence. These systems are essential for industries like plastics manufacturing, consistently generating robust revenue streams. For instance, in fiscal year 2023, Nordson's Industrial Technologies segment, which includes many polymer processing solutions, saw revenue of $2.5 billion, demonstrating its substantial contribution.

Despite some softness in demand observed in early 2025, these product lines are characterized by their stability and ability to generate substantial cash flow. This consistent cash generation is vital, enabling Nordson to allocate capital towards more dynamic, high-growth opportunities within its portfolio. The segment's operating profit margin in FY23 was a healthy 22.5%, underscoring its efficiency and cash-generating power.

Fluid Management Solutions (General Industrial)

Nordson's Fluid Management Solutions for general industrial applications are a classic example of a Cash Cow within the BCG Matrix. This segment operates in a mature market, meaning growth is slow, but Nordson's strong market share ensures consistent profitability. These established product lines, like dispensing equipment for automotive manufacturing or electronics assembly, reliably generate substantial cash flow with relatively low reinvestment needs.

The dependable cash generation from these industrial fluid management systems is crucial for Nordson's overall financial health. For instance, in fiscal year 2023, Nordson reported total revenue of $6.1 billion, with their Industrial Technologies segment, which includes many of these fluid management solutions, contributing significantly. This segment's operating profit margin often remains robust, underscoring the efficient cash-generating capabilities of these mature offerings.

- Mature Market Dominance: Nordson's industrial fluid management solutions benefit from established customer relationships and brand recognition in sectors like automotive, aerospace, and general manufacturing.

- Consistent Cash Generation: These products require minimal marketing support due to their strong market position, allowing them to generate surplus cash that can fund other business areas.

- Low Reinvestment Needs: Unlike high-growth segments, these mature product lines typically require less capital for research and development or aggressive expansion, maximizing their cash-generating efficiency.

- Strategic Funding Source: The cash generated acts as a vital internal funding source, supporting Nordson's investments in high-potential areas such as medical technology or new market entries.

Legacy Dispensing Technologies

Nordson's legacy dispensing technologies represent a significant portion of its established business. These products, often serving mature industries, benefit from Nordson's strong market positions, ensuring consistent revenue streams. For instance, their adhesive dispensing systems, a core legacy area, continue to see demand in sectors like automotive and electronics manufacturing, where reliability is paramount.

These mature market products are characterized by low growth rates but high profitability due to Nordson's established market share and operational efficiencies. The long lifecycles of these technologies, coupled with consistent demand for replacement parts and servicing, contribute substantially to Nordson's overall financial stability and cash generation. In 2024, Nordson reported that its Industrial Solutions segment, which heavily features these legacy technologies, continued to be a strong contributor to overall revenue and profitability.

- Dominant Market Share: Nordson holds leading positions in the markets for many of its legacy dispensing technologies.

- Stable Cash Flows: Mature markets with low growth but high market share generate predictable and reliable cash inflows.

- Aftermarket Revenue: Significant revenue is derived from ongoing demand for parts and service for these long-lasting products.

- Profitability Contribution: These technologies are key drivers of Nordson's overall profitability, supporting investment in newer growth areas.

Nordson's industrial adhesive dispensing systems are prime examples of Cash Cows. These systems operate in mature, low-growth markets but benefit from Nordson's strong market share, ensuring consistent profitability and robust cash flow generation. For instance, in fiscal year 2023, Nordson's Industrial Technologies segment, which includes these systems, reported net sales of $2.01 billion, with a healthy operating profit margin of 22.5%.

The stability of these product lines is further bolstered by a loyal customer base and recurring revenue from parts and consumables. This predictability makes them a reliable source of capital, allowing Nordson to fund investments in higher-growth areas. The company's strategy focuses on maintaining market leadership and operational efficiency rather than aggressive expansion for these established offerings.

Nordson's polymer processing systems also fit the Cash Cow profile. Despite some market softness in early 2025, these systems, essential for plastics manufacturing, continue to generate substantial cash flow. In fiscal year 2023, the Industrial Technologies segment, encompassing these solutions, generated $2.5 billion in revenue, highlighting their significant contribution to the company's financial stability.

These mature product lines require minimal reinvestment, maximizing their cash-generating efficiency. The consistent cash flow from these systems is vital, providing Nordson with the financial flexibility to pursue strategic growth initiatives in other segments, such as medical technology.

| Nordson Segment | BCG Category | FY2023 Revenue (Approx.) | FY2023 Operating Margin (Approx.) | Key Characteristics |

| Industrial Technologies (includes Adhesive Dispensing, Polymer Processing, Industrial Coating) | Cash Cow | $4.51 Billion (Industrial Technologies segment) | 22.5% (Industrial Technologies segment) | Mature markets, high market share, stable cash flow, low reinvestment needs |

What You’re Viewing Is Included

Nordson BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully polished report you will receive immediately after completing your purchase. This means no watermarks, no placeholder text, and no altered content—just the comprehensive, professionally formatted strategic tool ready for your immediate application. You can trust that the insights and structure presented here are precisely what you will download, enabling you to seamlessly integrate this powerful analysis into your business planning and decision-making processes.

Dogs

Nordson's medical interventional solutions segment is currently navigating headwinds, with organic sales experiencing decreases in fiscal 2024 and projected for Q1 2025. This downturn is attributed to lower demand and customer destocking trends, signaling a challenging period for this product line within an otherwise expanding medical market.

The company has acknowledged these difficulties, even mentioning a strategic rationalization of certain medical contract manufacturing programs. This suggests a focus on optimizing operations and potentially divesting from less profitable or underperforming areas within this specialized sector.

Certain segments within Nordson's Advanced Technology Solutions, particularly those tied to cyclical electronics like semiconductors, have experienced notable weakness. In 2024, for instance, the semiconductor industry faced a downturn, impacting sales for companies supplying specialized equipment.

While Nordson maintains strong market positions in many electronics sectors, specific product lines heavily reliant on the semiconductor cycle’s ups and downs have shown lower organic sales. During these cyclical troughs, these particular areas might be characterized as question marks, potentially exhibiting slower growth and a reduced market share until the broader market conditions rebound or if they consistently lag behind.

While Nordson actively pursues growth through acquisitions, certain acquired product lines might falter, especially if integration is challenging or market dynamics turn unfavorable. These could become question marks if they don't align with the company's higher-value growth objectives.

Nordson's strategic approach involves divesting product lines that deviate from its core competencies or fail to meet return expectations. Such underperforming segments are prime candidates for divestiture if they struggle to capture adequate market share, even within their respective growth markets.

Outdated Industrial System Components

Outdated industrial system components, especially those with diminishing demand in areas like industrial coatings or polymer processing, can be categorized as Dogs within the Nordson BCG Matrix. These products typically hold a small slice of a market that isn't growing much, and they don't add much to the company's profits. For instance, if a specific type of older coating application equipment sees its market shrink by an estimated 5% annually due to newer, more efficient technologies, and Nordson's share in that niche is only 2%, it would fit this profile.

Investing further in these low-growth, low-share areas without a clear path to revitalization is generally not a sound strategy. It's more effective to reallocate resources to more promising segments.

- Low Market Share: Components with a market share below 3% in their respective stagnant sub-segments.

- Declining Demand: Products facing an annual market contraction of over 4% due to technological obsolescence or shifts in industry needs.

- Minimal Profit Contribution: Business units in this category contributing less than 1% to overall company operating profit.

- Resource Drain: Continued R&D or marketing spend on these items without a demonstrable return on investment.

Niche Legacy Products with Limited Innovation

Nordson might possess niche legacy products within its diverse industrial segments. These offerings often cater to highly specialized, low-growth markets where their market share is modest and innovation has slowed considerably. Such products, while potentially breaking even, divert valuable resources that could be reinvested in more promising growth areas.

These "Dog" category products, common in large, diversified industrial conglomerates, may struggle to achieve significant market penetration or revenue growth. For instance, a company like Nordson, with its broad portfolio, could have older, specialized dispensing equipment lines that serve very specific, mature industrial processes.

- Niche Market Focus: Products operating in highly specialized, low-growth industrial applications.

- Limited Innovation: Minimal investment in research and development for these legacy offerings.

- Low Market Share: Difficulty in capturing significant market share due to maturity or competition.

- Resource Drain: Potential for these products to consume capital and management attention without substantial returns, possibly just breaking even.

Products in Nordson's "Dogs" category are those with low market share in slow-growing or declining industries. These often include legacy industrial system components where demand is waning due to technological advancements. For example, older dispensing systems for specific, mature industrial processes might fit this description, potentially contributing minimally to profits while consuming resources.

These "Dogs" typically exhibit low revenue growth and minimal profit margins, often just breaking even. Identifying and managing these segments is crucial for resource allocation, allowing Nordson to focus investment on higher-potential "Stars" and "Question Marks."

In 2024, Nordson's medical interventional solutions faced organic sales decreases, partly due to lower demand and customer destocking, indicating a challenging period for certain product lines that might be considered "Dogs" if they also possess low market share in a slow-growth medical sub-segment.

Similarly, segments within Advanced Technology Solutions tied to cyclical electronics, like older semiconductor equipment lines with declining demand, could also be classified as Dogs if their market share is small and the overall market is contracting.

| Category | Nordson Example | Market Characteristics | Strategic Implication |

|---|---|---|---|

| Dogs | Legacy industrial coating equipment | Low market share, declining demand (e.g., market shrinking 5% annually) | Divestiture or minimal investment; focus on resource reallocation |

| Dogs | Older specialized dispensing systems | Niche, low-growth industrial applications, limited innovation | Potential resource drain; aim for break-even or divestment |

| Dogs | Certain medical contract manufacturing programs | Lower demand, customer destocking, strategic rationalization | Focus on optimization, potential divestiture if market share is low and growth is negative |

Question Marks

Following its acquisition of Atrion, Nordson is strategically expanding into high-growth medical sectors such as infusion therapies and advanced drug delivery systems. This move diversifies Nordson's medical portfolio beyond its traditional strengths, aiming to capture new market opportunities.

While the broader medical device market presents significant growth potential, some of these newly integrated product lines may initially hold a low market share as Nordson works to establish its presence and brand recognition. These emerging technologies represent potential future 'Stars' within the BCG matrix.

Significant investment and focused strategic development are crucial for these new ventures to gain traction and market share. For instance, the infusion therapy market alone was projected to reach over $30 billion globally by 2024, indicating a substantial opportunity for Nordson to capitalize on.

Nordson's advanced dispensing technologies are indeed vital for the burgeoning new energy sector, particularly in manufacturing solar panels and batteries. These high-growth markets present significant opportunities for dispensing solutions that are still developing, where Nordson may not yet hold a commanding market position.

Capturing market share in these nascent areas demands substantial investment in research and development. For instance, the global battery market was projected to reach over $200 billion by 2023, with continued strong growth anticipated. Similarly, the solar energy sector continues its expansion, with global solar power capacity expected to exceed 1,500 GW by 2025.

Nordson's expansion in precision agriculture beyond its current ARAG focus would likely place these new ventures in the question marks quadrant of the BCG matrix. This means they'd be entering a high-growth market with a low existing market share.

For instance, exploring novel sensor technologies for soil health monitoring or advanced drone-based application systems for specific crop inputs would represent such an expansion. These areas are experiencing rapid technological advancement and increasing adoption rates within the agricultural sector.

The global precision agriculture market was valued at approximately $7.5 billion in 2023 and is projected to reach over $15 billion by 2028, indicating a strong growth trajectory. Nordson would need significant investment to establish a foothold and capture market share in these emerging segments.

New Frontier Materials Dispensing

New frontier materials dispensing for Nordson would fall into the Question Mark category of the BCG Matrix. This signifies areas where Nordson is developing innovative solutions for dispensing novel or specialized materials, such as advanced polymers and fluids, targeting emerging industrial applications. The market for these materials is experiencing growth, but Nordson's current market share or penetration is relatively low, presenting a high-risk, high-reward scenario.

These new dispensing technologies are crucial for industries like advanced electronics, additive manufacturing, and specialized coatings, which are seeing significant investment and expansion. For instance, the global additive manufacturing market, a key area for novel material dispensing, was projected to reach approximately $30 billion in 2024, with continued strong growth expected.

- High Growth Potential: Markets for new materials, like those in aerospace and medical devices, are expanding rapidly, offering substantial revenue opportunities.

- Low Market Share: Nordson's presence in dispensing these specific new materials is still developing, meaning there's ample room for market capture.

- Investment Required: Significant R&D and market development investment is necessary to establish a strong foothold in these nascent markets.

- Strategic Importance: Success in these areas can position Nordson as a leader in future material handling technologies, driving long-term competitive advantage.

Digitalization and AI-Enhanced Solutions

Nordson's strategic focus on digitalization and AI is driving innovation across its product portfolio. The company is actively investing in these advanced technologies to create more intelligent and efficient solutions for its customers.

These advancements are particularly evident in areas where the market is experiencing rapid evolution, and Nordson's emerging offerings are designed to capitalize on these trends. For instance, solutions incorporating AI for predictive maintenance or process optimization are being developed for rapidly growing segments.

- Digitalization Investments: Nordson is channeling resources into digital technologies to improve product functionality and customer experience.

- AI for Optimization: The company is exploring AI applications for enhanced process control and predictive capabilities in its equipment.

- Market Responsiveness: These investments are aimed at addressing the needs of fast-moving markets where advanced connectivity and intelligence are becoming standard.

- R&D Focus: Significant research and development efforts are dedicated to establishing Nordson's leadership in these nascent, high-growth areas.

Nordson's ventures into new frontier materials dispensing and advanced digitalization/AI solutions represent classic "Question Marks" in the BCG matrix. These are high-growth market opportunities where Nordson is still establishing its presence and market share, requiring significant investment to mature.

The company's expansion into areas like precision agriculture, beyond its existing ARAG focus, also places these new initiatives in the Question Mark quadrant. These are high-growth markets with low existing market share for Nordson, necessitating substantial investment for market penetration.

These Question Mark businesses are critical for Nordson's future growth, as they target rapidly expanding sectors like new energy, advanced electronics, and additive manufacturing. Success here could transform them into future Stars, driving significant long-term value.

The strategic importance of these Question Marks cannot be overstated, as they represent Nordson's commitment to innovation and capturing emerging market trends, despite the inherent risks associated with low market share in high-growth environments.

| Nordson Business Area | BCG Category | Market Growth | Nordson Market Share | Investment Need |

|---|---|---|---|---|

| Infusion Therapies & Drug Delivery | Question Mark | High | Low | High |

| New Energy Sector Dispensing | Question Mark | High | Low | High |

| Precision Agriculture (New Segments) | Question Mark | High | Low | High |

| New Frontier Materials Dispensing | Question Mark | High | Low | High |

| Digitalization & AI Solutions | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages financial disclosures, market growth data, and competitive analysis to provide a clear strategic overview.