NextEra Energy Partners SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NextEra Energy Partners Bundle

NextEra Energy Partners leverages its strong position in renewable energy, benefiting from stable cash flows and a supportive regulatory environment. However, it faces challenges like rising interest rates and potential project execution risks.

Want the full story behind NextEra Energy Partners' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

NextEra Energy Partners (NEP) benefits immensely from its formation by NextEra Energy, Inc., a global leader in clean energy. This connection grants NEP preferential access to a steady stream of high-quality, long-term contracted renewable energy projects, primarily wind and solar. In 2023, NextEra Energy, Inc. reported approximately $28.3 billion in revenue, showcasing the financial strength that underpins NEP's operations and development.

NextEra Energy Partners (NEP) boasts a robust portfolio centered around contracted clean energy assets, including wind and solar generation, complemented by natural gas pipelines. This diversification is a key strength, providing a stable foundation for its operations.

The majority of NEP's revenue streams are secured by long-term contracts, typically with investment-grade counterparties. For instance, as of the first quarter of 2024, NEP had approximately 10,000 megawatts of contracted renewable energy projects in operation, ensuring predictable cash flows essential for distributions.

This long-term contracted nature of its assets significantly de-risks its business model, offering a high degree of revenue visibility. The focus on renewables also positions NEP favorably within the growing global energy transition market, aligning with increasing demand for sustainable energy solutions.

NextEra Energy Partners is designed to provide unitholders with stable and predictable cash distributions, a key draw for investors seeking reliable income. This predictability is largely thanks to the long-term contracts the company holds for its energy assets, ensuring consistent revenue streams. The partnership has consistently reaffirmed its expectation to grow these distributions annually.

Strategic Focus on Renewable Energy Growth and Repowering

NextEra Energy Partners (NEP) has a clear strategy centered on acquiring, managing, and owning contracted clean energy assets, with a strong emphasis on renewable energy. This focus positions the company to capitalize on the growing demand for sustainable power sources.

A key element of their growth is the active pursuit of repowering initiatives for existing wind farms. For instance, in 2023, NEP completed the repowering of its Shady Point Wind Energy Center, which is expected to increase its generating capacity. This strategy enhances the efficiency and output of their current portfolio, reducing the immediate need for new acquisitions to drive distribution growth.

- Strategic Acquisition and Ownership: NEP focuses on acquiring, managing, and owning contracted clean energy assets, primarily in renewables.

- Repowering Initiatives: The company actively repowers its wind farms, replacing older turbines with newer, more efficient models to boost power generation.

- Organic Growth Driver: This repowering strategy serves as a significant organic growth lever, lessening reliance on external acquisitions for distribution increases.

Diversified Asset Base and Geographic Footprint

NextEra Energy Partners (NEP) boasts a robust and diversified asset base, encompassing a significant mix of wind, solar, and natural gas pipeline assets spread across numerous U.S. states. This geographic and technological diversification is a key strength, offering considerable resilience against region-specific operational disruptions or adverse regulatory changes. For instance, as of early 2024, NEP's portfolio included approximately 6,200 megawatts (MW) of contracted renewable energy projects, primarily wind and solar, alongside its natural gas pipeline business.

This broad operational footprint significantly mitigates risks that could arise from over-reliance on a single energy source or a concentrated geographic area. Furthermore, NEP has strategically expanded its ownership and development of battery storage assets, a move that further diversifies its clean energy offerings and enhances its ability to provide grid reliability services. This ongoing expansion into storage solutions, which saw significant investment in 2023 and continued into 2024, strengthens its position in the evolving energy landscape.

The company's commitment to diversification is evident in its project pipeline and acquisitions. For example, NEP's 2023 acquisitions and development activities continued to broaden its exposure to different renewable technologies and regions, solidifying its position as a diversified energy infrastructure owner and operator. This strategic approach ensures a more stable and predictable revenue stream, less susceptible to the volatility of any single market segment.

NextEra Energy Partners (NEP) leverages its relationship with NextEra Energy, Inc., a major player in clean energy, to secure a consistent flow of high-quality, long-term contracted renewable energy projects, primarily wind and solar. This strategic advantage ensures predictable revenue streams, a critical strength for investor distributions. The company's robust portfolio, as of early 2024, included approximately 6,200 megawatts of contracted renewable energy projects, alongside its natural gas pipeline operations, demonstrating significant scale and diversification.

NEP's strength lies in its focus on contracted assets, with the majority of its revenue secured by long-term agreements with creditworthy counterparties. This contractual framework, as seen with its roughly 10,000 megawatts of contracted renewable energy projects in operation by Q1 2024, provides substantial revenue visibility and de-risks its business model. The company's commitment to growing distributions annually further enhances its appeal to income-focused investors.

The strategic repowering of existing wind farms, such as the Shady Point Wind Energy Center in 2023, represents a key organic growth driver for NEP. This initiative enhances the efficiency and output of its current assets, reducing the immediate need for external acquisitions to fuel distribution growth. This proactive approach to asset optimization strengthens its competitive position within the expanding clean energy sector.

| Strength | Description | Supporting Data (as of early 2024) |

| Sponsorship and Project Pipeline | Beneficial relationship with NextEra Energy, Inc. providing access to high-quality, contracted renewable energy projects. | NextEra Energy, Inc. reported ~$28.3 billion in revenue for 2023. |

| Contracted Asset Base | Majority of revenue secured by long-term contracts with investment-grade counterparties, ensuring stable cash flows. | Approximately 10,000 MW of contracted renewable energy projects in operation (Q1 2024). |

| Diversified Portfolio | Mix of wind, solar, and natural gas pipeline assets across various U.S. states mitigates region-specific risks. | Approximately 6,200 MW of contracted renewable energy projects (wind and solar) in operation. |

| Organic Growth Initiatives | Repowering of existing wind farms enhances efficiency and output, serving as an organic growth lever. | Completed repowering of Shady Point Wind Energy Center in 2023. |

What is included in the product

This SWOT analysis explores NextEra Energy Partners's strong market position and growth potential, while also identifying potential operational challenges and competitive threats.

Uncovers critical opportunities and mitigates potential threats, offering a clear roadmap to navigate NextEra Energy Partners' complex market landscape.

Weaknesses

NextEra Energy Partners (NEP) faces a significant weakness in its sensitivity to interest rate fluctuations. As a limited partnership heavily reliant on capital markets for expansion and debt refinancing, rising interest rates directly impact its cost of capital. For instance, if NEP needs to secure new debt in a higher rate environment, its borrowing costs will increase, potentially hindering its capacity to fund new projects or refinance existing obligations efficiently.

This sensitivity to interest rates can directly affect NEP's ability to maintain or grow its cash distributions to unitholders. Higher financing costs mean less available cash flow for distribution, which is a key attraction for investors in partnerships like NEP. For example, in early 2024, the Federal Reserve maintained its benchmark interest rate at elevated levels, underscoring the ongoing risk for companies with substantial debt loads like NEP.

Recent analyst reports and company communications have signaled a significant distribution cut for NextEra Energy Partners, potentially around 50%. This adjustment is largely driven by escalating cost of capital and the necessity to manage convertible equity portfolio financing. Such a reduction could notably diminish investor confidence and the overall appeal of the partnership's units.

NextEra Energy Partners (NEP) has heavily leaned on its parent company, NextEra Energy Resources (NEER), for asset drop-downs to fuel its growth. This strategy, while effective, creates a significant dependency, as NEP's pipeline of new projects is largely dictated by NEER's development activities.

This reliance means NEP's financial health and its ability to increase distributions are intrinsically tied to NEER's performance and its willingness to sell assets. NEER's right of first refusal on potential acquisitions further solidifies this dependence, making NEER's operational success and contractual obligations paramount to NEP's continued expansion.

High Payout Ratio and Equity Funding Needs

NextEra Energy Partners (NEP) faces a significant challenge with its high dividend payout ratio, projected to hover in the mid-90s through 2026. This leaves minimal financial flexibility to absorb unforeseen costs or operational disruptions.

While NEP's strategy is to defer equity issuance until 2027, the persistent need for external capital to strengthen its financial standing and support future expansion is a considerable risk, especially if borrowing expenses continue to be high.

- High Payout Ratio: NEP's dividend payout ratio is expected to remain in the mid-90s through 2026, indicating limited retained earnings for reinvestment or unexpected events.

- Equity Funding Dependency: The long-term requirement for equity infusions to bolster the balance sheet and fund growth projects is a key concern, particularly in an environment of elevated capital costs.

Exposure to Commodity Price and Weather Risks

While NextEra Energy Partners (NEP) primarily operates contracted assets, its natural gas pipeline segment still carries some exposure to commodity price fluctuations. This means that significant swings in natural gas prices could impact the profitability of these specific operations, even with contractual agreements in place.

Furthermore, NEP's renewable energy portfolio, which includes wind and solar farms, is inherently susceptible to weather patterns. Fluctuations in wind speeds and solar irradiance directly affect energy generation output. For instance, a prolonged period of low wind or cloud cover can reduce the electricity produced by their wind and solar facilities, impacting revenue streams.

Severe weather events pose a material risk to NEP's overall business, financial health, and operational results. Such events can lead to unexpected downtime for their assets or significantly curtail their energy production. In 2023, for example, extreme weather events across North America caused disruptions for many energy infrastructure companies, highlighting the potential impact on operations and financial performance.

- Commodity Price Sensitivity: Natural gas pipeline assets introduce a degree of exposure to volatile natural gas market prices.

- Weather Dependency: Renewable energy generation is directly tied to wind and solar resource availability, which can vary significantly.

- Operational Disruptions: Severe weather events can cause unplanned outages and reduce energy output, negatively impacting financial results.

NextEra Energy Partners' (NEP) substantial reliance on debt financing makes it highly vulnerable to rising interest rates. For example, as of Q1 2024, NEP's weighted average cost of debt was around 5.5%, and any increase in this rate for future borrowings or refinancing directly impacts its profitability and ability to distribute cash. This sensitivity limits its financial flexibility and can hinder the funding of new projects.

The partnership's strategy of deferring equity issuance until 2027, coupled with a projected dividend payout ratio in the mid-90s through 2026, leaves minimal room for error. This means NEP has limited retained earnings to cover unexpected costs or operational disruptions, increasing its risk profile, especially if capital costs remain elevated.

NEP's growth is significantly tied to asset drop-downs from its parent, NextEra Energy Resources (NEER). This dependence means NEP's expansion and distribution growth are largely dictated by NEER's development pipeline and willingness to sell assets, creating a concentration risk.

The partnership's natural gas pipeline segment exposes it to commodity price volatility, and its renewable assets are subject to weather-related generation fluctuations. For instance, a 10% drop in natural gas prices could impact segment profitability, while lower-than-average wind speeds in a given quarter could reduce renewable energy output and cash available for distribution.

Preview Before You Purchase

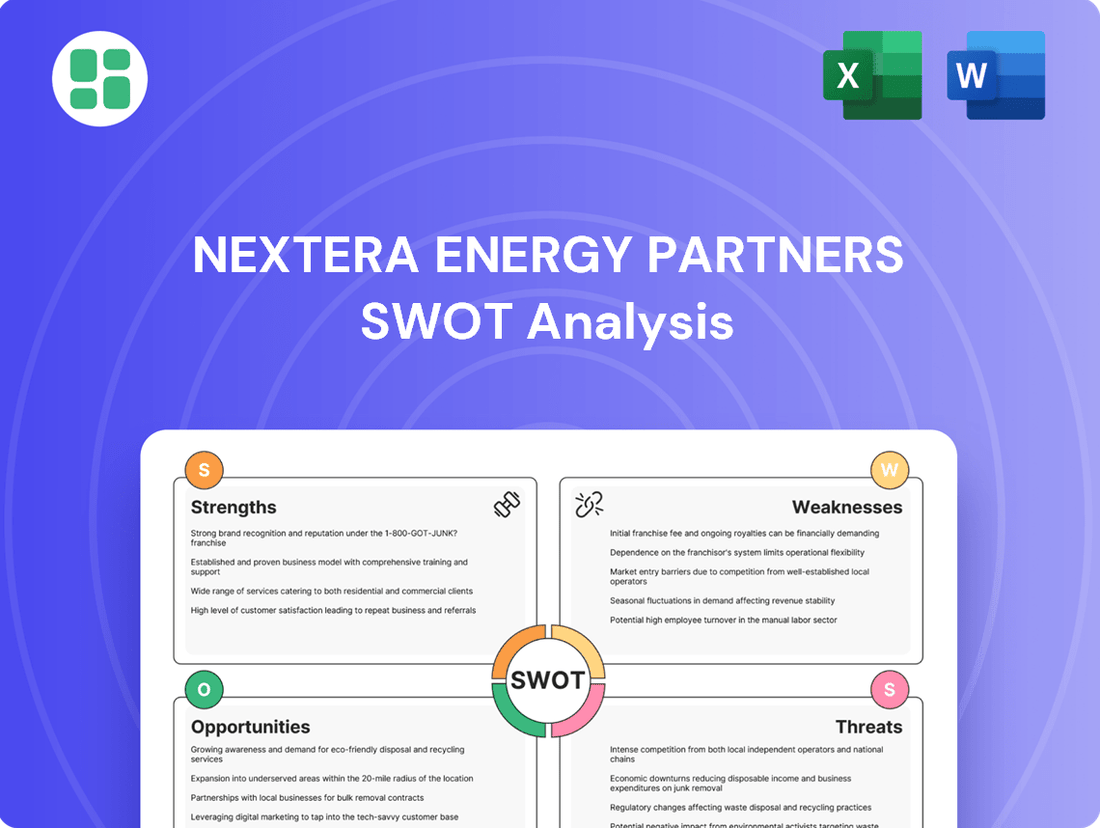

NextEra Energy Partners SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of NextEra Energy Partners' Strengths, Weaknesses, Opportunities, and Threats. The full, detailed report is available immediately after purchase.

Opportunities

The demand for clean energy is experiencing robust growth throughout the U.S. economy, fueled by increasing environmental awareness and a concerted effort toward decarbonization. This presents a substantial avenue for NextEra Energy Partners (NEP) to broaden its existing portfolio of renewable energy assets, including wind, solar, and battery storage facilities.

NEP is strategically positioned to leverage this significant market opportunity. For instance, in 2023, the U.S. saw renewable energy sources, particularly solar and wind, account for a growing share of new electricity-generating capacity additions. This trend is projected to continue, with forecasts indicating further expansion in renewable energy deployment through 2024 and 2025, directly benefiting companies like NEP that specialize in these technologies.

NextEra Energy Resources, the parent company, is actively growing its clean energy portfolio, consistently adding gigawatts of new renewable energy and energy storage projects. This robust organic growth is a significant opportunity for NextEra Energy Partners (NEP) to expand its own generating capacity and revenue streams.

NEP can capitalize on this expansion through potential future drop-down acquisitions from NextEra Energy Resources. In 2024, NextEra Energy Resources announced plans to add approximately 10.3 GW of new clean energy projects to its development pipeline, many of which could eventually be acquired by NEP, further bolstering its asset base and cash flows.

Government policies and incentives are a major tailwind for NextEra Energy Partners (NEP). For instance, the Inflation Reduction Act (IRA) of 2022, which extends and enhances tax credits like the Investment Tax Credit (ITC) and Production Tax Credit (PTC), is a game-changer for renewable energy developers. These credits can significantly boost the profitability of NEP's wind and solar projects, making them more attractive investments.

These supportive policies not only drive U.S. economic growth by stimulating investment in clean energy infrastructure but also contribute to lower energy prices for consumers. This creates a more favorable operating environment for companies like NEP, enabling them to secure more projects and deliver stable, predictable cash flows to investors. The IRA alone is projected to add hundreds of gigawatts of renewable capacity by 2030, directly benefiting NEP's growth pipeline.

Repowering Existing Wind Assets

NextEra Energy Partners (NEP) is actively pursuing a strategic initiative to repower a significant portion of its existing wind energy portfolio. This involves upgrading older turbines with newer, more efficient technology. By doing so, NEP anticipates a substantial increase in both the efficiency and overall energy output from these established assets. This approach is a key driver for organic growth, allowing NEP to enhance its existing infrastructure rather than solely relying on new acquisitions.

The repowering strategy is designed to deliver attractive cash available for distribution (CAFD) yields, making it a financially sound growth avenue. This focus on improving existing assets reduces the immediate pressure to secure external acquisitions to meet its projected growth targets. For instance, NEP has indicated plans to repower approximately 1,000 MW of its wind portfolio through 2026, a move expected to boost generation by roughly 20% for those specific sites.

- Increased Efficiency: Newer turbine technology offers higher capacity factors and better performance in varying wind conditions.

- Enhanced Output: Repowering is projected to increase the energy production from these wind farms, potentially by up to 20% per site.

- Attractive Yields: The investment in repowering is expected to generate strong cash available for distribution (CAFD) yields, supporting partnership distributions.

- Reduced Acquisition Need: This organic growth strategy lessens the reliance on external acquisitions to achieve expansion goals.

Potential for Improved Cost of Capital

NextEra Energy Partners (NEP) is actively exploring various avenues to reduce its cost of capital, a crucial move given its upcoming convertible equity portfolio financing needs. This strategic focus is driven by the need to manage financial obligations effectively and position the company for sustained growth.

Successfully implementing these capital structure optimization strategies could lead to tangible benefits for NEP. Lower financing costs directly translate to improved profitability and greater financial flexibility, enabling the company to pursue new investment opportunities and potentially increase distributions to unitholders.

For instance, as of the first quarter of 2024, NEP reported a weighted average cost of capital (WACC) that it aims to bring down. While specific target figures are not publicly disclosed, industry benchmarks suggest that a reduction of even 50-100 basis points could significantly impact future project economics and overall valuation.

- Evaluating Refinancing Options: NEP is assessing opportunities to refinance existing debt at more favorable rates, potentially taking advantage of a more stable interest rate environment in 2024-2025.

- Optimizing Equity Structure: The partnership is also considering adjustments to its equity mix, which could include issuing new equity at attractive valuations or optimizing its existing convertible security terms.

- Strategic Asset Sales: In some cases, the sale of non-core or mature assets could generate capital to pay down more expensive debt, thereby lowering the overall cost of capital.

The robust demand for clean energy in the U.S. presents a significant opportunity for NextEra Energy Partners (NEP) to expand its renewable asset portfolio. This growth is underpinned by government policies like the Inflation Reduction Act, which provides substantial tax credits, enhancing project profitability. Furthermore, NEP's strategic repowering of existing wind assets offers a pathway for organic growth and improved cash flows.

Threats

Persistent high interest rates are a significant hurdle for NextEra Energy Partners (NEP). This directly increases the cost of borrowing money and raising capital through equity. For a company like NEP, which relies heavily on financing for its infrastructure projects, this can make new developments more expensive and harder to fund.

The impact extends to NEP's ability to manage its existing debt and its plans to grow the cash distributions it pays to investors. For instance, if NEP needs to refinance its debt at higher rates, its interest expenses will rise, potentially squeezing profits and limiting future investment capacity. This trend is evident in the broader market, where the Federal Reserve's benchmark interest rate has remained elevated throughout 2024, impacting borrowing costs across industries.

Changes in government policy, particularly regarding renewable energy subsidies or mandates, pose a significant threat to NextEra Energy Partners' (NEP) business model. For instance, the Inflation Reduction Act (IRA) of 2022 extended crucial tax credits for renewable energy projects, providing a degree of stability. However, any future modifications or expirations of these incentives could directly impact NEP's project economics and future investment decisions.

Political rhetoric and potential policy shifts, such as discussions around limiting new wind power plant construction, introduce considerable uncertainty for NEP. While specific federal proposals for such restrictions haven't materialized into widespread policy in 2024, the ongoing debate can create a challenging environment for securing permits and financing for new wind energy developments, a core component of NEP's growth strategy.

The clean energy sector is experiencing a surge in competition, with established regulated utility holding companies, agile independent power producers, and well-capitalized private equity funds all actively pursuing new project development and acquisitions. This intensified rivalry can drive up the cost of acquiring new clean energy assets, potentially impacting NextEra Energy Partners' (NEP) growth strategy.

Furthermore, increased competition may exert downward pressure on the contract terms for new power purchase agreements (PPAs), which are crucial for NEP's revenue stability. For instance, in 2024, the average PPA price for solar projects has seen some moderation in certain markets due to this competitive landscape, a trend NEP will need to navigate carefully to maintain its projected distribution growth.

Weather Conditions and Climate-Related Risks

Weather conditions present a significant threat to NextEra Energy Partners (NEP). The very nature of their renewable energy portfolio, heavily reliant on wind and solar, means output is directly tied to variable weather patterns. This variability can lead to fluctuations in energy generation and, consequently, impact predictable cash flows. For instance, periods of lower-than-average wind speeds or excessive cloud cover directly translate to reduced electricity production and revenue.

Beyond operational variability, severe weather events pose a direct physical risk to NEP's assets. Extreme storms, hurricanes, or other natural disasters can cause substantial damage to wind turbines, solar panels, and associated infrastructure. While insurance coverage is in place, the potential for property damage, extended outages, and the associated financial losses, even after insurance payouts, represents a considerable threat to financial stability and operational continuity.

The increasing frequency and intensity of climate-related events, as observed globally and in regions where NEP operates, amplify these risks. For example, the heightened risk of hurricanes along the Gulf Coast or increased drought conditions impacting solar potential in certain areas necessitates robust risk management strategies. These environmental shifts can lead to higher insurance premiums, increased maintenance costs, and potential disruptions to long-term project performance, impacting the partnership's ability to meet its financial projections.

- Variable Renewable Output: NEP's wind and solar assets are inherently exposed to fluctuations in wind speeds and solar irradiance, directly affecting energy generation and revenue streams.

- Physical Asset Damage: Severe weather events like hurricanes, hailstorms, or extreme temperatures can cause direct physical damage to turbines and solar panels, leading to costly repairs and downtime.

- Insurance Gaps and Costs: While insured, significant weather events can result in deductibles, uncovered losses, and increased future insurance premiums, impacting profitability.

- Climate Change Impact: Long-term shifts in weather patterns due to climate change could alter the resource availability (wind, sun) at NEP's project sites, potentially reducing efficiency and cash flow.

Uncertainty Regarding Future Distributions and Financial Structure

NextEra Energy Partners (NEP) faces significant threats due to ongoing uncertainty surrounding its future distribution policy. This lack of clarity impacts how the company plans to manage its convertible equity portfolio financing obligations, a crucial aspect of its long-term financial health.

This ambiguity has directly influenced analyst sentiment, with a prevailing 'Hold' consensus reflecting caution. Such uncertainty can easily translate into negative market sentiment, potentially leading to increased volatility in NEP's unit price as investors await concrete plans.

- Analyst Consensus: As of late 2024, a significant portion of analysts maintained a 'Hold' rating on NEP, indicating investor apprehension regarding its distribution stability and financial strategy.

- Convertible Equity Concerns: The specific terms and future management of NEP's convertible equity portfolio present a complex financial challenge, with potential impacts on dilution and cash flow.

- Market Volatility Risk: Any perceived missteps or continued lack of transparency in communicating future financial plans could trigger further downward pressure on NEP's unit price, exacerbating existing volatility.

The competitive landscape in the clean energy sector presents a substantial threat, as intensified rivalry can drive up acquisition costs for new projects and potentially weaken terms for vital power purchase agreements. For instance, in 2024, the average PPA price for solar projects saw some moderation due to this competition, a trend that could impact NEP's revenue stability and growth projections.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from NextEra Energy Partners' official financial filings, comprehensive market research reports, and insights from leading industry analysts to ensure a thorough and accurate assessment.