NextEra Energy Partners Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NextEra Energy Partners Bundle

Unlock the strategic blueprint of NextEra Energy Partners's thriving business model. This comprehensive Business Model Canvas details their customer segments, value propositions, and key revenue streams, offering a clear picture of their success in the renewable energy sector. Discover how they leverage partnerships and manage costs to maintain their market leadership.

Partnerships

NextEra Energy, Inc. serves as the foundational partner for NextEra Energy Partners (NEP), having established the entity itself. This crucial relationship grants NEP access to a substantial pipeline of renewable energy projects and the extensive operational expertise of its parent company, which is vital for NEP's expansion and efficient asset management. In 2023, NextEra Energy's significant investments in clean energy infrastructure directly benefited NEP's growth trajectory.

Energy off-takers, primarily utilities and large corporations, are the cornerstone of NextEra Energy Partners' (NEP) revenue generation. These entities purchase the clean energy produced by NEP's wind and solar farms. For instance, NEP has secured long-term agreements with major utility companies across the United States, ensuring a consistent demand for its renewable output.

The foundation of NEP's business model rests on long-term power purchase agreements (PPAs) with creditworthy off-takers. These PPAs provide stable and predictable cash flows, crucial for investor confidence and operational stability. As of early 2024, a significant portion of NEP's contracted cash flows are backed by these agreements, often extending for 15 years or more.

These extended contract durations are vital as they shield NEP from the volatility of wholesale electricity market prices. By locking in prices for their energy output, NEP minimizes its exposure to market fluctuations, thereby enhancing the predictability of its financial performance and supporting its dividend growth strategy.

NextEra Energy Partners (NEP) relies heavily on partnerships with top-tier equipment manufacturers and suppliers. These collaborations are essential for sourcing high-quality, dependable, and efficient clean energy technology, such as wind turbines, solar panels, and battery storage systems.

These strategic alliances guarantee NEP's access to the cutting-edge equipment needed to construct and maintain its diverse portfolio of generation assets. This includes securing components for both new development projects and the crucial repowering of existing facilities, ensuring continued operational excellence and technological advancement.

Financial Institutions and Lenders

NextEra Energy Partners (NEP) actively cultivates relationships with a diverse array of financial institutions and lenders. These partnerships are critical for securing the necessary debt financing to fuel its ambitious growth agenda. For instance, NEP frequently utilizes revolving credit facilities and term loans from major banks to fund its ongoing project development and acquisitions.

Access to capital markets is another cornerstone of NEP's financial strategy, enabling it to raise funds through the issuance of various debt instruments. These relationships are vital for maintaining a healthy capital structure and ensuring the consistent payment of distributions to its unitholders. As of early 2024, NEP's ability to access diverse funding sources underscores the strength of these financial partnerships.

- Debt Financing: Partnerships with banks and financial institutions provide NEP with essential credit facilities and loans for project development and acquisitions.

- Capital Markets Access: Relationships with investment banks facilitate the issuance of debt securities, crucial for managing its capital structure and funding growth.

- Strategic Importance: These financial partnerships are indispensable for NEP to achieve its expansion objectives and meet its targeted distribution growth.

Landowners and Local Communities

NextEra Energy Partners relies heavily on securing land rights and fostering positive relationships with landowners and local communities. These partnerships are absolutely crucial for the successful siting, development, and continued operation of their wind and solar energy projects. For instance, in 2024, the company continued to navigate complex land agreements across its diverse portfolio, ensuring access for construction and maintenance.

These collaborations are not just about access; they are fundamental to smooth project development and minimizing operational disruptions. By maintaining strong ties, NextEra Energy Partners can often preemptively address concerns, leading to more efficient project timelines. This community engagement also underpins the long-term social license to operate, which is vital for sustained energy generation.

- Securing Land Access: Essential for the physical placement and operation of renewable energy infrastructure.

- Community Relations: Building trust and maintaining positive engagement to ensure project acceptance and longevity.

- Operational Continuity: Partnerships help prevent disruptions and facilitate necessary maintenance and upgrades.

- Long-Term Sustainability: Strong community ties contribute to the overall social license and ongoing success of projects.

NextEra Energy Partners (NEP) leverages strategic alliances with leading clean energy technology providers to ensure access to high-quality wind turbines, solar panels, and battery storage systems. These partnerships are critical for both new project construction and the essential repowering of existing assets, guaranteeing operational efficiency and technological advancement.

NEP also relies on a robust network of financial institutions and capital markets to fund its substantial growth initiatives. These relationships provide access to vital debt financing, including credit facilities and loans, as well as enabling the issuance of debt securities to maintain a healthy capital structure and support distribution growth. As of early 2024, NEP's ability to secure diverse funding sources highlights the strength of these financial partnerships.

Furthermore, securing land rights through agreements with landowners and maintaining positive relationships with local communities are fundamental to NEP's operations. These collaborations are vital for the successful siting, development, and ongoing operation of its renewable energy projects, ensuring project acceptance and operational continuity.

| Key Partnership Type | Description | Strategic Importance | 2024 Relevance |

|---|---|---|---|

| NextEra Energy, Inc. | Parent company providing project pipeline and operational expertise. | Foundation for growth and asset management. | Continued access to development projects. |

| Energy Off-takers (Utilities, Corporations) | Customers purchasing clean energy. | Revenue generation through long-term Power Purchase Agreements (PPAs). | Stable, predictable cash flows from contracted assets. |

| Equipment Manufacturers & Suppliers | Providers of wind turbines, solar panels, and storage systems. | Ensuring access to cutting-edge, reliable technology. | Facilitating new project builds and repowering efforts. |

| Financial Institutions & Capital Markets | Banks, lenders, and investment entities. | Providing debt financing and capital for expansion. | Crucial for funding acquisitions and maintaining capital structure. |

| Landowners & Local Communities | Entities granting land access and stakeholders in project areas. | Enabling project siting, development, and operational continuity. | Essential for social license and preventing development disruptions. |

What is included in the product

NextEra Energy Partners' business model focuses on acquiring, owning, and operating contracted clean energy projects, primarily wind and solar, with long-term power purchase agreements. This strategy leverages stable, predictable cash flows from these assets to generate returns for unitholders and fund future growth.

NextEra Energy Partners' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their renewable energy infrastructure strategy, enabling quick identification of how they address the market's need for stable, long-term clean energy solutions.

This Business Model Canvas effectively relieves pain points by offering a digestible, shareable format that clarifies NextEra Energy Partners' strategy for investors and stakeholders, simplifying complex financial and operational structures into an easily understood single page.

Activities

A crucial activity for NextEra Energy Partners is the identification, evaluation, and acquisition of clean energy projects. This primarily involves wind and solar generation assets, alongside natural gas pipelines, all secured by long-term contracts.

The partnership actively seeks out assets developed by its parent company, NextEra Energy, Inc., as well as those from third-party developers. This diverse sourcing strategy underpins its focus on generating stable, predictable cash flows over extended periods.

In 2023, NextEra Energy Partners completed the acquisition of a portfolio of contracted clean energy projects, further demonstrating its commitment to expanding its renewable energy footprint and diversifying its asset base.

NextEra Energy Partners (NEP) actively manages, operates, and maintains its extensive portfolio of renewable energy and natural gas pipeline assets. This hands-on approach is fundamental to ensuring each project performs at its peak, delivering reliable energy and maximizing financial returns.

In 2024, NEP's commitment to efficient operations is underscored by its focus on optimizing energy output from its wind and solar farms. This diligent O&M strategy directly contributes to the predictable and stable cash flows that are a hallmark of NEP's business model, supporting its dividend growth objectives.

Financing and capital management for NextEra Energy Partners (NEP) centers on securing funds for growth, primarily through debt and equity. In 2024, NEP continued to leverage its access to capital markets to finance its expanding portfolio of clean energy assets. This includes managing existing debt, such as its revolving credit facility, and issuing new debt to fund acquisitions and development projects.

Optimizing its capital structure is key to NEP's strategy. By balancing debt and equity, the partnership aims to lower its cost of capital and enhance its ability to generate predictable cash distributions for its unitholders. This financial discipline is crucial for supporting NEP's ambitious growth plans, including the acquisition of new renewable energy projects and the repowering of existing facilities.

Contract Negotiation and Management

Contract negotiation and management are foundational to NextEra Energy Partners' (NEP) operational success. The partnership focuses on securing and overseeing long-term power purchase agreements (PPAs) and natural gas transportation contracts. These agreements are crucial for ensuring predictable income and mitigating risks associated with market volatility.

These contracts are typically established with counterparties possessing strong credit ratings, which provides a high degree of revenue certainty. For instance, in 2023, NEP's contracted cash flows provided significant stability, with a substantial portion of its revenue underpinned by these long-term agreements.

- Long-Term PPAs: Securing agreements that lock in electricity prices for extended periods, often 15-20 years.

- Natural Gas Transportation: Managing contracts for the reliable transport of natural gas, essential for its pipeline assets.

- Counterparty Risk Mitigation: Prioritizing contracts with financially sound entities to ensure payment reliability.

- Revenue Stability: These contracts are the primary driver of NEP's predictable and stable revenue streams.

Regulatory Compliance and Risk Management

NextEra Energy Partners' key activities heavily involve ensuring strict adherence to a complex web of energy regulations, environmental standards, and financial reporting mandates. This ongoing commitment is fundamental to maintaining operational legitimacy and investor confidence.

Proactive risk management is also a cornerstone. This includes meticulously assessing potential impacts from weather events, which can significantly affect renewable energy generation, and identifying and mitigating various operational risks to safeguard asset value and ensure uninterrupted business continuity.

- Regulatory Adherence: NextEra Energy Partners (NEP) actively monitors and complies with evolving federal, state, and local energy regulations, including those from the Federal Energy Regulatory Commission (FERC) and environmental protection agencies.

- Environmental Stewardship: The company prioritizes meeting and exceeding environmental standards related to emissions, land use, and wildlife protection across its renewable energy portfolio, which includes solar and wind farms.

- Financial Reporting Integrity: NEP maintains rigorous internal controls and processes to ensure accurate and timely financial reporting, meeting requirements set by the Securities and Exchange Commission (SEC) and other financial oversight bodies.

- Risk Mitigation Strategies: In 2023, NEP continued to implement strategies to manage risks associated with weather variability, commodity price fluctuations, and operational performance, aiming to protect its contracted cash flows and asset integrity.

NextEra Energy Partners' key activities revolve around the strategic acquisition and efficient operation of clean energy infrastructure, primarily wind and solar farms, complemented by natural gas pipelines. These assets are secured by long-term contracts, ensuring predictable revenue streams.

The partnership actively manages its portfolio, focusing on optimizing energy output and maintaining asset integrity to deliver reliable energy and maximize financial returns. This operational focus is crucial for supporting its growth objectives and consistent cash flow generation.

Financing and capital management are central, involving securing funds through debt and equity to fuel acquisitions and development. In 2024, NEP continued to leverage capital markets, managing its debt and issuing new instruments to support its expanding asset base and growth strategy.

Contract negotiation and management, particularly for long-term Power Purchase Agreements (PPAs) and natural gas transportation contracts, are vital for revenue certainty and risk mitigation. These agreements, often with creditworthy counterparties, underpin NEP's stable income.

Adherence to regulations, environmental standards, and robust risk management strategies are fundamental to NEP's operations, ensuring legitimacy and investor confidence. This includes managing risks from weather and operational performance.

| Key Activity | Description | 2024 Focus/Data Point |

| Project Acquisition | Identifying, evaluating, and acquiring clean energy and pipeline assets. | Continued expansion of contracted clean energy portfolio. |

| Operations & Maintenance | Managing and operating renewable energy and natural gas pipeline assets. | Optimizing energy output from wind and solar farms for predictable cash flows. |

| Financing & Capital Management | Securing funds for growth through debt and equity. | Leveraging capital markets to finance asset expansion and manage debt. |

| Contract Management | Securing and overseeing long-term PPAs and natural gas transportation contracts. | Ensuring revenue certainty through agreements with strong counterparties. |

| Regulatory & Risk Management | Adhering to regulations and managing operational and financial risks. | Mitigating weather-related risks and ensuring compliance with environmental standards. |

What You See Is What You Get

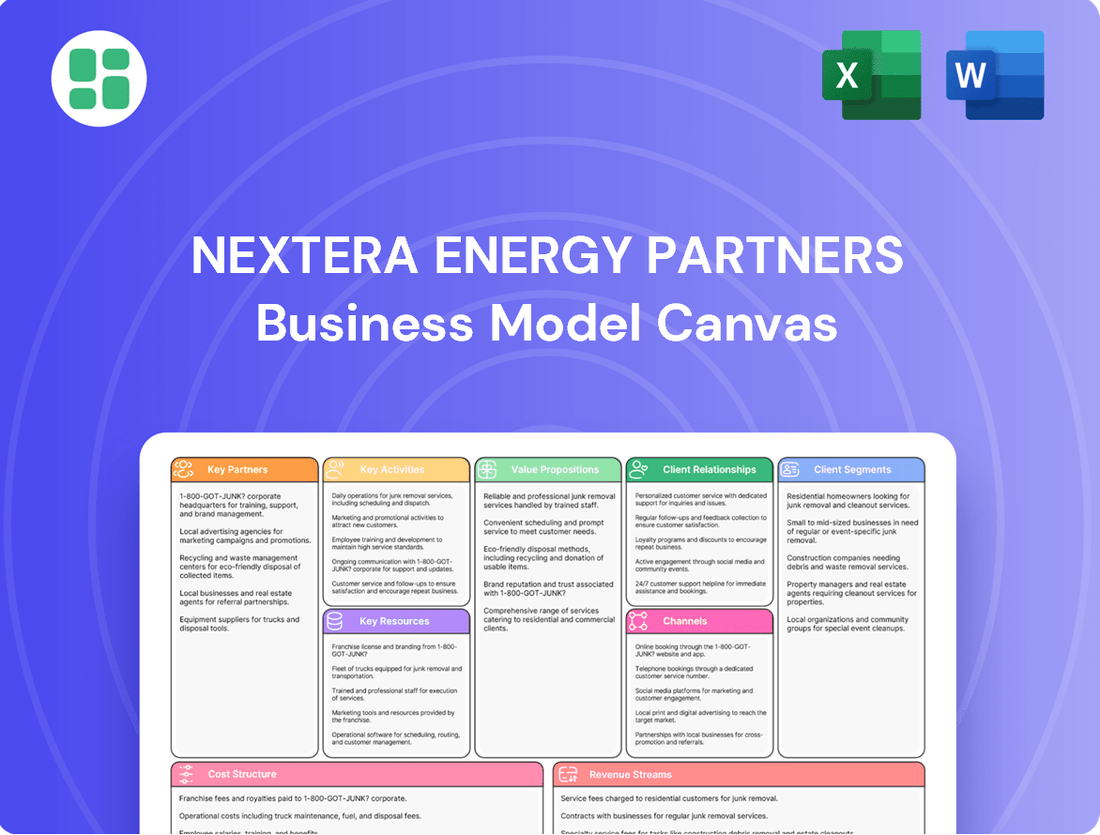

Business Model Canvas

This preview offers a direct look at the NextEra Energy Partners Business Model Canvas, showcasing the exact structure and content you will receive upon purchase. You are seeing a genuine section of the final document, not a generic sample or mockup. Once your order is complete, you will gain full access to this same professionally prepared and ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

NextEra Energy Partners (NEP) boasts a substantial portfolio of contracted clean energy assets, primarily consisting of wind and solar generation facilities. These projects are the bedrock of NEP's operations, providing the physical capacity that generates revenue. As of the first quarter of 2024, NEP's contracted renewable energy portfolio included approximately 7.3 gigawatts of generation capacity.

Long-term Power Purchase Agreements (PPAs) and natural gas transportation contracts are foundational to NextEra Energy Partners' (NEP) business model, acting as crucial intangible assets. These agreements provide a bedrock of predictable and stable cash flows, significantly mitigating revenue volatility.

For instance, as of the first quarter of 2024, NEP's contracted portfolio of renewable energy projects, primarily wind and solar, had an average remaining contract life of approximately 13 years. This long-term visibility into revenue streams makes NEP's distributions to unitholders more attractive and reliable.

NextEra Energy Partners (NEP) relies heavily on a highly skilled workforce for managing its diverse portfolio of clean energy assets. This human capital is crucial for everything from day-to-day operations and maintenance to the intricate development of new renewable energy projects.

The expertise within NEP spans critical areas such as advanced renewable energy technologies, sophisticated financial management, and navigating complex regulatory environments. A significant advantage for NEP is its ability to leverage the extensive talent pool and operational experience of its sponsor, NextEra Energy, Inc., a leader in the energy sector.

In 2024, NextEra Energy, Inc. reported a significant investment in its workforce development programs, aiming to enhance skills in areas like grid modernization and battery storage integration, directly benefiting NEP's operational capabilities and future growth strategies.

Access to Capital and Financial Flexibility

NextEra Energy Partners' ability to efficiently access capital through both debt and equity markets is a critical resource. This financial agility allows them to fund significant growth opportunities, such as acquiring new renewable energy projects or investing in the repowering of existing assets. For example, in 2024, the company continued to leverage its strong credit ratings to secure favorable financing for its expansion plans.

Strong financial policies further bolster this access to capital, providing a stable foundation for operations and strategic investments. This financial flexibility is paramount for NextEra Energy Partners, enabling them to pursue growth initiatives and maintain their commitment to making consistent distributions to unitholders.

- Efficient Capital Raising: Demonstrated ability to tap into debt and equity markets.

- Financial Strength: Supported by robust financial policies and creditworthiness.

- Growth Funding: Facilitates acquisitions and organic growth, including repowering projects.

- Distribution Capacity: Ensures the ability to provide returns to investors.

Intellectual Property and Technology

NextEra Energy Partners (NEP) leverages intellectual property and advanced technologies through its acquired renewable energy assets. While NEP itself is not a primary technology developer, it benefits from innovations like high-efficiency wind turbine designs and advanced solar panel technologies. These embedded technologies are crucial for maximizing energy production and ensuring operational efficiency across its portfolio.

The integration of proprietary technologies, such as GE's Haliade-X wind turbines or First Solar's Series 6 thin-film solar modules, directly impacts NEP's performance. For instance, the Haliade-X turbine, with its 12 MW capacity, represents a significant advancement in wind power generation, leading to higher capacity factors and thus increased revenue potential for NEP. Similarly, advancements in solar panel efficiency contribute to greater energy output per square meter, optimizing land use and overall project economics.

- Technological Integration: NEP acquires assets incorporating cutting-edge turbine and solar panel designs, enhancing energy capture and output.

- Operational Efficiency: Advanced technologies contribute to reduced downtime and optimized performance, lowering operating expenses.

- Competitive Advantage: Access to and deployment of leading technologies allows NEP to maintain a competitive edge in the renewable energy market.

NextEra Energy Partners' (NEP) key resources are its substantial portfolio of contracted clean energy assets, primarily wind and solar farms. These physical assets, totaling approximately 7.3 gigawatts of generation capacity as of Q1 2024, are the direct source of revenue. The company also leverages long-term power purchase agreements (PPAs) and transportation contracts, which are vital intangible assets providing predictable cash flows, with an average remaining contract life of about 13 years in Q1 2024. Furthermore, NEP's ability to access capital efficiently through debt and equity markets, supported by strong financial policies and creditworthiness, is crucial for funding growth and distributions.

| Key Resource | Description | Relevance to NEP |

| Contracted Clean Energy Assets | Approximately 7.3 GW of wind and solar generation capacity (as of Q1 2024). | Forms the physical basis for revenue generation. |

| Long-Term Contracts (PPAs) | Average remaining contract life of ~13 years (as of Q1 2024). | Ensures stable and predictable cash flows, mitigating revenue risk. |

| Access to Capital | Demonstrated ability to raise debt and equity efficiently. | Enables funding for acquisitions, project development, and distributions. |

| Skilled Workforce & Sponsor Support | Expertise in renewable energy operations, finance, and regulatory navigation; leverage of NextEra Energy, Inc.'s talent. | Drives operational efficiency and strategic growth initiatives. |

| Intellectual Property & Technology | Acquisition of assets with advanced technologies (e.g., GE Haliade-X turbines, First Solar Series 6 modules). | Maximizes energy production, enhances operational efficiency, and provides a competitive edge. |

Value Propositions

NextEra Energy Partners (NEP) provides unitholders with a strong value proposition centered on stable and predictable cash distributions. These distributions are underpinned by long-term agreements with counterparties that possess high credit quality, offering a reliable income stream for investors.

This emphasis on consistent returns makes NEP a particularly appealing option for individuals and institutions prioritizing income generation from their investments. For instance, NEP has a history of growing its cash distributions, aiming for a compound annual growth rate of 12-15% through 2026, demonstrating its commitment to returning capital to unitholders.

NextEra Energy Partners (NEP) offers a compelling value proposition for investors prioritizing environmental, social, and governance (ESG) alignment. Its pure-play focus on contracted clean energy assets directly addresses the increasing demand from stakeholders looking to integrate sustainability into their investment strategies.

This focus is particularly attractive as the global investment community increasingly shifts capital towards environmentally responsible ventures. For instance, NEP's portfolio, as of early 2024, predominantly consists of wind and solar projects, assets at the forefront of the clean energy transition, directly supporting decarbonization goals.

NextEra Energy Partners (NEP) offers utility and corporate customers a dependable and steady stream of clean electricity and natural gas transportation. These services are crucial for off-takers to maintain their operations and meet ambitious sustainability targets.

The backbone of this reliability is NEP's portfolio of long-term contracts, which provide energy security and predictable operational costs. For instance, in 2023, NEP's contracted renewable energy projects, primarily wind and solar, generated a substantial amount of clean power, underpinning its value proposition.

Diversified Portfolio of High-Quality Assets

NextEra Energy Partners (NEP) boasts a robust and varied collection of energy infrastructure assets. This includes a significant presence in both renewable energy, specifically wind and solar power, as well as stable natural gas pipelines. This mix is crucial for stability.

This strategic diversification across different energy sectors and geographies significantly reduces NEP's exposure to the volatility of any single market or resource. For instance, a downturn in solar power prices might be offset by strong performance in their natural gas pipeline segment.

The benefits of this diversified approach are clear. It bolsters the overall stability of NEP's cash flows and minimizes risks tied to specific regional economic conditions or even unpredictable weather patterns that can impact renewable generation. As of the first quarter of 2024, NEP's portfolio comprised approximately 7.3 GW of contracted renewable energy capacity and over 10,000 miles of natural gas pipelines.

- Wind Power: A substantial portion of NEP's renewable capacity comes from wind farms, providing consistent energy generation.

- Solar Power: The company also holds a growing portfolio of solar energy projects, contributing to a cleaner energy mix.

- Natural Gas Pipelines: NEP operates a large network of natural gas pipelines, offering stable, fee-based revenue streams.

- Geographic Spread: Assets are located across various regions in the United States, mitigating localized economic or regulatory risks.

Leveraging NextEra Energy's Expertise

NextEra Energy Partners (NEP) benefits immensely from its relationship with its parent company, NextEra Energy, Inc., a titan in clean energy. This affiliation grants NEP privileged access to a substantial pipeline of renewable energy projects, ensuring a steady stream of growth opportunities. In 2023, NextEra Energy, Inc. reported a net income of $5.7 billion, underscoring its financial strength and capacity to support NEP's expansion.

Furthermore, NEP inherits operational best practices honed by NextEra Energy, Inc., a company recognized for its efficiency and reliability in managing large-scale energy infrastructure. This includes leveraging advanced technologies and proven methodologies for project development and asset management, contributing to NEP's consistent performance.

The strong brand reputation of NextEra Energy, Inc. in the clean energy sector also translates into significant advantages for NEP. This established trust and recognition within the industry facilitate easier access to capital, favorable contract negotiations, and stronger relationships with customers and stakeholders.

- Access to Development Pipeline: NEP can tap into NextEra Energy's extensive portfolio of planned renewable energy projects.

- Operational Excellence: Benefiting from proven operational strategies and management expertise.

- Brand Recognition: Leveraging a well-established and respected brand in the clean energy market.

- Financial Synergies: Potential for shared resources and financial support from a larger, financially robust entity.

NextEra Energy Partners (NEP) offers investors a compelling value proposition through its commitment to stable and growing cash distributions, supported by long-term, high-quality contracts. This predictable income stream is enhanced by a target of 12-15% annual distribution growth through 2026. Furthermore, NEP's focus on contracted clean energy assets aligns with the growing demand for ESG-friendly investments, with its portfolio primarily consisting of wind and solar projects as of early 2024.

| Value Proposition | Key Features | Supporting Data/Facts |

|---|---|---|

| Stable & Growing Cash Distributions | Long-term, high-quality contracts provide predictable cash flows. | Targeting 12-15% annual distribution growth through 2026. |

| ESG Alignment | Pure-play focus on contracted clean energy assets. | Portfolio predominantly wind and solar projects (early 2024). |

| Reliable Clean Energy Supply | Dependable electricity and natural gas transportation for customers. | Utilizes long-term contracts for energy security and cost predictability. |

| Diversified Infrastructure Portfolio | Mix of renewable energy (wind, solar) and natural gas pipelines. | Approximately 7.3 GW of contracted renewables and 10,000+ miles of pipelines (Q1 2024). |

| Strong Parent Company Relationship | Access to NextEra Energy's development pipeline and operational expertise. | Leverages NextEra Energy's $5.7 billion net income (2023) and brand reputation. |

Customer Relationships

NextEra Energy Partners primarily secures its revenue through long-term, fixed-price contracts with established utilities and corporate customers. These agreements, often spanning 15 to 25 years, provide predictable cash flows and a stable foundation for the business.

These contractual relationships are formal, defined by the specific terms of Power Purchase Agreements (PPAs). This structure minimizes customer churn and ensures a consistent demand for the clean energy generated.

For instance, in 2024, NextEra Energy Partners continued to leverage these stable contractual arrangements, with a significant portion of its revenue underpinned by these long-duration agreements, highlighting the reliability of its customer base.

NextEra Energy Partners (NEP) cultivates robust investor relations through a commitment to transparency. This includes providing detailed financial reports, hosting quarterly earnings calls, and delivering comprehensive investor presentations. For instance, in 2024, NEP continued its practice of regular updates, aiming to keep unitholders fully informed about operational performance and its progress towards distribution growth targets.

NextEra Energy Partners (NEP) likely utilizes dedicated account management for its key energy off-takers, ensuring seamless contract execution and proactive issue resolution. This personalized approach is crucial for maintaining high service levels and reinforcing long-term relationships.

By assigning specific teams or individuals to manage these vital relationships, NEP can effectively address operational concerns and foster a collaborative environment. This focus on client retention is a cornerstone of their customer relationship strategy.

For instance, in 2023, NEP reported that its contracted cash flows provided significant visibility, with approximately 97% of its EBITDA expected to be covered by long-term contracts. This high contract coverage underscores the importance of these dedicated relationships.

Community Engagement and Stakeholder Management

NextEra Energy Partners actively cultivates strong ties with local communities, landowners, and regulatory agencies. This focus is essential for securing the social license to operate and for facilitating the development of new renewable energy projects. Proactive engagement and a commitment to addressing local concerns are cornerstones of this strategy.

In 2024, the company continued its emphasis on community outreach. For instance, initiatives aimed at local economic development often accompany project construction, creating jobs and supporting local businesses. NextEra Energy Partners understands that transparent communication and responsiveness to stakeholder feedback are vital for long-term project success and maintaining trust.

- Community Investment: In 2024, NextEra Energy Partners continued to invest in community programs, focusing on education and environmental stewardship in areas where its projects are located.

- Landowner Relations: The company maintains direct relationships with landowners, ensuring clear communication regarding project operations and lease agreements, fostering mutual benefit.

- Regulatory Engagement: Proactive engagement with federal, state, and local regulatory bodies is ongoing to ensure compliance and to facilitate the permitting process for new developments.

- Stakeholder Feedback: Mechanisms are in place to gather and address feedback from all stakeholders, demonstrating a commitment to responsive and collaborative operations.

Analyst and Media Engagement

NextEra Energy Partners (NEP) actively cultivates relationships with financial analysts and media outlets. This engagement is crucial for transparently communicating its business strategy, operational performance, and future growth plans. By providing clear and consistent information, NEP aims to foster a deeper understanding of its value proposition among key stakeholders.

This proactive communication strategy is designed to maintain and enhance market confidence. For instance, in 2024, NEP's investor relations team conducted numerous calls and presentations with financial analysts, addressing inquiries about its renewable energy portfolio and distribution growth initiatives. These interactions are vital for ensuring that the market accurately values NEP’s assets and growth trajectory.

- Analyst Briefings: Regular meetings with financial analysts to discuss quarterly earnings, project pipelines, and strategic outlook.

- Media Relations: Issuing press releases and responding to media inquiries to manage public perception and disseminate key company news.

- Investor Conferences: Participation in industry and financial conferences to broaden reach and engage with a wider investor base.

- Transparency: Commitment to providing timely and accurate financial and operational data to support informed investment decisions.

NextEra Energy Partners' customer relationships are primarily built on long-term, fixed-price contracts, ensuring stable revenue streams. These formal Power Purchase Agreements (PPAs) minimize customer churn and guarantee consistent demand for their clean energy output.

Beyond direct customers, NEP cultivates strong relationships with investors through transparency and regular communication, including detailed financial reports and earnings calls. In 2024, this commitment continued, keeping unitholders informed about performance and distribution growth.

The company also prioritizes community engagement and landowner relations, essential for project development and social license to operate. Proactive communication and addressing local concerns are key. For instance, in 2024, community initiatives often accompanied project construction, boosting local economies.

NEP actively manages relationships with financial analysts and media to communicate its strategy and performance, fostering market confidence. In 2024, numerous analyst calls and presentations were held to discuss the renewable portfolio and growth plans.

| Relationship Type | Key Activities | 2024 Focus/Data Point |

|---|---|---|

| Contracted Customers | Long-term PPAs, dedicated account management | High percentage of revenue secured by contracts, ensuring predictable cash flows. |

| Investors/Unitholders | Financial reporting, earnings calls, investor presentations | Continued transparency and regular updates on performance and distribution growth targets. |

| Communities & Landowners | Local outreach, economic development initiatives, clear communication on operations | Emphasis on community investment in education and environmental stewardship. |

| Financial Analysts & Media | Analyst briefings, press releases, conference participation | Proactive communication of strategy and performance to enhance market confidence. |

Channels

NextEra Energy Partners (NEP) primarily relies on direct sales for its energy and pipeline services. This involves engaging directly with potential customers, such as utility companies, large corporations, and other significant energy users.

The core of these direct sales efforts is the negotiation of long-term contracts, most notably Power Purchase Agreements (PPAs). These agreements are crucial for NEP's revenue stability and predictable cash flows, often spanning 15 to 20 years.

For instance, in 2023, NEP secured several key contracts. One notable deal involved a PPA for a solar project in Texas, contributing to its growing renewable energy portfolio and demonstrating the effectiveness of its direct negotiation strategy with corporate off-takers.

NextEra Energy Partners' investor relations website acts as a vital hub, delivering essential documents like annual reports, SEC filings, and press releases. This digital platform ensures transparency and accessibility for both existing and potential investors seeking detailed financial information.

In 2024, NextEra Energy Partners continued to emphasize its commitment to clear communication through this channel. The website provided access to quarterly earnings calls and presentations, offering insights into the partnership's performance and strategic outlook.

Financial Reporting and SEC Filings are crucial for NextEra Energy Partners, serving as the primary conduit for transparently sharing financial health and operational performance with investors and the public. These official documents, including the annual 10-K and quarterly 10-Q reports filed with the Securities and Exchange Commission (SEC), offer a deep dive into the company's revenue, expenses, assets, liabilities, and cash flows. For instance, NextEra Energy Partners' 2023 10-K filing detailed a total revenue of $1.4 billion and a net income of $521 million, providing stakeholders with essential data for valuation and strategic assessment.

Earnings Calls and Investor Conferences

NextEra Energy Partners (NEP) leverages earnings conference calls and investor conferences as crucial communication channels. These events allow senior management to directly engage with the financial community, presenting financial results, detailing strategic advancements, and addressing inquiries from analysts and investors.

These interactions are vital for transparency and building investor confidence. For instance, in their Q1 2024 earnings call, NEP highlighted strong performance driven by their contracted renewable energy portfolio and provided updated guidance for the year. Participation in conferences like the Wolfe Research Utilities, Power & Clean Energy Conference offers further opportunities to articulate their long-term growth strategy and capital allocation plans.

- Direct Communication: Earnings calls offer a platform for real-time dialogue between NEP leadership and stakeholders.

- Strategic Updates: Management uses these forums to share progress on project development and operational achievements.

- Investor Engagement: Participation in investor conferences broadens reach and allows for in-depth discussions on NEP's business model and outlook.

- Transparency: These channels are key to providing clarity on financial performance and future expectations.

Public Relations and Media Outlets

NextEra Energy Partners actively manages its public relations by issuing press releases to announce crucial company developments, such as new project completions or financial results. This strategy aims to keep investors, stakeholders, and the general public informed about the company's progress and strategic direction.

Engagement with financial and industry media outlets is a cornerstone of their communication. By proactively sharing information and responding to inquiries, they cultivate a positive media presence, which is vital for maintaining investor confidence and a strong corporate reputation.

In 2024, NextEra Energy Partners continued to emphasize transparency and consistent communication regarding its renewable energy projects. For instance, the company often highlights the successful commissioning of new solar and wind farms, such as the recent completion of the Golden Coyote wind farm in West Texas, which added 200 MW of clean energy capacity.

- Press Releases: Used to announce significant corporate news, including financial performance and project milestones.

- Media Engagement: Cultivating relationships with financial and industry journalists to ensure accurate reporting and positive coverage.

- Information Dissemination: Communicating key messages about growth, sustainability, and operational achievements to a wide audience.

- Reputation Management: Building and maintaining a strong corporate image through consistent and transparent communication efforts.

NextEra Energy Partners utilizes its investor relations website as a primary channel for disseminating crucial financial and operational information. This platform provides direct access to annual reports, SEC filings, and press releases, ensuring transparency for stakeholders. In 2024, the website continued to be a key resource for quarterly earnings calls and presentations, offering insights into the partnership's performance and strategic direction.

The company also leverages earnings conference calls and investor conferences to directly engage with the financial community. These events allow for the presentation of financial results, strategic updates, and direct Q&A sessions with analysts and investors. For example, participation in industry conferences in 2024 provided a platform to discuss NEP's growth strategy and capital allocation, reinforcing investor confidence.

Press releases and media engagement are vital for communicating significant company developments, such as new project completions or financial results. This proactive approach keeps investors and the public informed about NEP's progress and strategic direction. In 2024, announcements often highlighted the successful commissioning of renewable energy projects, such as the Golden Coyote wind farm, adding significant clean energy capacity.

| Channel | Purpose | 2023/2024 Highlight |

|---|---|---|

| Investor Relations Website | Information dissemination (reports, filings, calls) | Access to Q1 2024 earnings presentations |

| Earnings Calls & Investor Conferences | Direct engagement, strategic updates | Discussion of 2024 guidance and growth strategy |

| Press Releases & Media Engagement | Announcing developments, managing reputation | Highlighting new project completions like Golden Coyote wind farm |

Customer Segments

Income-Focused Unitholders/Investors are individuals and institutions prioritizing steady, reliable cash flow and long-term growth. They are drawn to NextEra Energy Partners' (NEP) business model because of its foundation in contracted, revenue-generating assets, which underpins consistent dividend payouts.

These investors value NEP's history of stable distributions, often viewing it as a key component of their portfolio for generating income. For instance, NEP has demonstrated a commitment to increasing its distributions, with a projected annualized distribution per unit growth rate of 5-7% through at least 2026, a key draw for this segment.

ESG-focused investors are a significant customer segment for NextEra Energy Partners (NEP). They are attracted to NEP's substantial portfolio of renewable energy assets, including wind and solar power generation facilities, which directly align with their investment mandates for environmental impact.

In 2024, NEP's commitment to sustainability, evidenced by its growing renewable energy footprint, makes it an appealing choice for these investors. For instance, NextEra Energy, NEP's parent company, has consistently invested billions in clean energy projects, with NEP benefiting from this strategic focus.

NextEra Energy Partners' key customer segment comprises large utilities, municipalities, and corporations that rely on consistent, long-term energy supply. These off-takers are particularly interested in the renewable energy sources NEP provides, such as solar and wind power. For instance, in 2023, NEP's portfolio of contracted renewable generation assets, primarily wind and solar, provided a significant portion of their revenue, demonstrating the strong demand from these entities for clean energy solutions.

Financial Analysts and Portfolio Managers

Financial analysts and portfolio managers are key to NextEra Energy Partners' (NEP) success, even though they don't directly use its energy. Their role is to assess NEP's financial health and growth potential, influencing whether investors buy or sell its units. For instance, in 2024, analysts closely watched NEP's ability to maintain its distribution growth targets, which are critical for attracting income-focused investors.

These professionals need detailed financial reports and clear operational updates to perform their valuations. They scrutinize metrics like adjusted EBITDA and distributable cash flow to understand NEP's earnings power and its capacity to fund future projects and distributions. In the first quarter of 2024, NEP reported adjusted EBITDA of $653 million, a figure that analysts would use to gauge performance against expectations.

Their analysis directly impacts NEP's cost of capital and its ability to raise funds for expansion. A positive assessment from influential financial analysts can lead to increased demand for NEP's units, potentially lowering borrowing costs and facilitating strategic acquisitions. For example, NEP's 2024 guidance on project pipelines, which projected the addition of approximately 2,200-3,100 MW of solar and wind projects, was a focal point for these stakeholders.

- Data Needs: Require detailed financial statements, operational performance metrics, and forward-looking guidance.

- Valuation Focus: Analyze adjusted EBITDA, distributable cash flow, and distribution growth sustainability.

- Influence: Their buy/sell recommendations significantly impact unit prices and capital access.

- Key 2024 Metrics: Monitoring project pipeline additions and the ability to meet distribution targets.

Energy Consumers (Indirectly)

NextEra Energy Partners' (NEP) energy consumers, though indirect customers, represent a crucial segment. These are the homes and businesses that ultimately utilize the clean electricity produced by NEP's portfolio of wind and solar projects. In 2024, the demand for reliable and increasingly green energy continues to grow, making this segment vital for NEP's revenue streams.

While these end-users don't directly contract with NEP, their consumption patterns and the broader energy market dynamics directly influence NEP's financial performance. The partnership's success hinges on its ability to supply power reliably to utilities and other entities that then deliver it to these end consumers.

- End-Use Beneficiaries: Millions of households and businesses across various regions benefit from the clean energy supplied by NEP's assets.

- Demand Drivers: Economic activity, population growth, and increasing environmental consciousness fuel the demand for the electricity NEP generates.

- Grid Integration: NEP's infrastructure connects to the broader electricity grid, ensuring that the power generated reaches a wide array of end-use consumers.

NextEra Energy Partners (NEP) serves a diverse set of customers. These include large entities like utilities, municipalities, and corporations seeking stable, long-term energy supplies, particularly from renewable sources. Additionally, income-focused investors and ESG-conscious investors are key segments, attracted by NEP's reliable cash flow and its significant renewable energy portfolio.

Financial analysts and portfolio managers, while not direct energy consumers, play a critical role by evaluating NEP's financial performance and growth prospects, thereby influencing investor sentiment and capital access. Finally, the ultimate beneficiaries are the millions of households and businesses that consume the clean electricity generated by NEP's assets, driven by growing demand for reliable, green energy.

| Customer Segment | Key Motivations | 2024 Relevance/Data |

|---|---|---|

| Utilities, Municipalities, Corporations | Long-term, reliable energy supply; renewable energy sources | NEP's portfolio of contracted renewable generation assets is a primary revenue driver. |

| Income-Focused Investors | Steady cash flow, long-term growth, reliable distributions | Projected 5-7% annualized distribution per unit growth through 2026. |

| ESG-Focused Investors | Environmental impact, renewable energy portfolio | Growing renewable energy footprint, billions invested by parent company in clean energy. |

| Financial Analysts/Portfolio Managers | Financial health, growth potential, valuation | Monitoring project pipelines (e.g., 2,200-3,100 MW solar/wind guidance) and distribution targets. |

| End-Use Consumers (Indirect) | Reliable, green energy | Demand for clean electricity fuels NEP's revenue streams; grid integration ensures supply. |

Cost Structure

Operations and Maintenance (O&M) costs are a substantial component of NextEra Energy Partners' business model, directly impacting profitability. These expenses cover the day-to-day running and upkeep of their renewable energy assets, including wind farms and solar facilities, as well as their natural gas pipeline infrastructure.

For 2024, NextEra Energy Partners has a significant commitment to O&M, which includes regular servicing of wind turbines and solar panels to ensure optimal energy generation. This also encompasses necessary repairs to maintain the integrity and efficiency of their natural gas pipelines. Staffing for these operational facilities is also a key O&M expenditure.

NextEra Energy Partners incurs significant costs in acquiring and developing its clean energy assets. These expenses cover the entire lifecycle from initial project identification and rigorous evaluation to the final integration into their operational portfolio. For instance, in 2024, the company continued to invest in expanding its renewable energy footprint, which inherently includes these upfront acquisition and development expenditures.

These costs are not limited to new project acquisitions; they also encompass capital expenditures for enhancing existing infrastructure. A prime example is the repowering of older wind facilities, a strategic move to boost efficiency and extend asset life. Such initiatives require substantial investment in new turbine technology and related infrastructure, directly impacting the acquisition and development cost line item.

Debt servicing and financing costs are a significant component of NextEra Energy Partners' (NEP) cost structure, reflecting its strategy of leveraging debt to fuel acquisitions and expansion. Interest expenses on its substantial debt obligations, including loans and bonds, are a primary outflow. For instance, NEP reported interest expense of $546 million in 2023, highlighting the financial commitment associated with its growth capital.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for NextEra Energy Partners encompass the essential corporate functions that keep the business running smoothly. This includes costs like executive compensation, salaries for administrative support staff, legal fees, accounting services, and other overhead necessary for managing the entire partnership's operations.

For NextEra Energy Partners, G&A is a critical component of its cost structure, ensuring efficient oversight and compliance across its diverse portfolio of renewable energy projects. These costs are fundamental to maintaining the corporate infrastructure that supports the partnership's strategic direction and operational execution.

- Executive Salaries & Benefits: Compensation for senior leadership driving the company's strategy.

- Administrative Staff Costs: Salaries and benefits for personnel in HR, finance, and legal departments.

- Legal & Compliance: Expenses related to legal counsel, regulatory filings, and adherence to industry standards.

- Accounting & Audit Fees: Costs associated with financial reporting, internal controls, and external audits.

Asset Depreciation and Amortization

Asset depreciation and amortization represent significant non-cash expenses for NextEra Energy Partners. These costs reflect the gradual decline in the value of their vast renewable energy infrastructure, such as wind turbines and solar panels, as well as the amortization of any intangible assets acquired. For instance, in 2023, NextEra Energy Partners reported approximately $1.2 billion in depreciation and amortization expenses, a key component impacting their net income.

While these are not actual cash outflows in a given period, they are crucial for accurate financial reporting. Depreciation reduces the book value of assets over time, and amortization does the same for intangible assets. This accounting treatment is essential for matching expenses with the revenue generated by these assets throughout their operational lifespan, providing a more realistic picture of profitability.

- Depreciation of Physical Assets: This includes the wear and tear on solar arrays, wind turbines, and transmission infrastructure.

- Amortization of Intangible Assets: This relates to the expensing of costs associated with acquired intangible assets, such as long-term power purchase agreements.

- Impact on Earnings: Depreciation and amortization reduce reported net income, even though no cash leaves the company for these specific items in the current period.

- Financial Statement Relevance: These non-cash expenses are vital for calculating taxable income and understanding the true economic performance of the partnership's assets.

NextEra Energy Partners' cost structure is dominated by Operations and Maintenance (O&M) and debt servicing. In 2023, the company reported $546 million in interest expense, underscoring the significant cost of financing its growth. Depreciation and amortization also represent a substantial non-cash expense, totaling approximately $1.2 billion in 2023, reflecting the wear and tear on its extensive renewable energy assets.

| Cost Category | 2023 Expense (Millions) | Key Components |

|---|---|---|

| Operations & Maintenance (O&M) | Not Explicitly Itemized Separately | Wind turbine servicing, solar panel upkeep, pipeline maintenance, staffing |

| Debt Servicing (Interest Expense) | $546 | Interest on loans and bonds |

| Depreciation & Amortization | $1,200 (Approximate) | Wear on turbines, solar arrays, transmission infrastructure; amortization of intangibles |

Revenue Streams

NextEra Energy Partners (NEP) primarily generates revenue through long-term Power Purchase Agreements (PPAs). These contracts involve selling electricity from their wind and solar farms to reliable buyers, often utilities, at set prices that can increase over time. This structure ensures very stable and predictable cash flows for the company.

As of the first quarter of 2024, NEP had a portfolio of contracted renewable energy projects with a capacity of approximately 7.3 gigawatts. This extensive base of contracted assets underpins the reliability of its revenue streams, with the majority of its cash flows secured by these PPAs, providing a solid foundation for financial performance.

Natural Gas Pipeline Fees represent a significant revenue stream for NextEra Energy Partners, derived from long-term contracts for transporting natural gas. These fees are structured primarily around volume-based charges or capacity reservation fees, ensuring a predictable and stable income flow.

In 2024, NextEra Energy Partners' pipeline segment, which includes its natural gas gathering and transportation assets, is expected to contribute substantially to its overall financial performance. The stability of these fee-based contracts offers a strong foundation for the partnership's revenue generation, insulating it from the direct volatility of natural gas commodity prices.

Capacity payments are a crucial revenue stream for NextEra Energy Partners (NEP) in certain markets. These payments are essentially a fee for ensuring that generation capacity is available, irrespective of whether that capacity is actively producing energy at any given moment.

This arrangement significantly bolsters the stability and predictability of NEP's financial performance. For instance, in 2023, capacity payments contributed to the overall reliability of NEP's cash flows, providing a consistent income base that is less susceptible to fluctuations in energy prices or output variations.

Renewable Energy Credits (RECs) Sales

NextEra Energy Partners generates revenue through the sale of Renewable Energy Credits (RECs), which represent the environmental benefits of clean energy production. These credits are sold to entities looking to meet their renewable energy obligations or sustainability goals, often through long-term contracts or on the open market.

In 2023, NextEra Energy Partners' revenue from REC sales and similar environmental attributes was a significant component of its overall earnings. For instance, the company's financial reports often detail the contribution of these credits to their cash available for distribution.

- REC Sales: Revenue from selling RECs and other environmental attributes tied to clean energy output.

- Contractual Arrangements: Revenue is often secured through long-term agreements with purchasers.

- Market Mechanisms: Proceeds also depend on prevailing market prices for environmental attributes.

- Contribution to Earnings: REC sales directly support the partnership's financial performance and distributions.

Asset Repowering and Enhancements

Asset repowering and enhancements at NextEra Energy Partners (NEP) are a strategic investment that transforms operational costs into future revenue drivers. By upgrading older wind turbines or solar panels, NEP can significantly boost energy production and extend the operational lifespan of its existing contracted assets. This directly translates into increased contracted revenue potential over the long term.

For instance, NEP has actively pursued repowering projects. In 2023, they completed repowering of approximately 200 MW of wind assets, which is expected to add around $10 million to $15 million in annual Adjusted EBITDA. These projects are designed to capture more wind, thereby generating more electricity and fulfilling existing power purchase agreements (PPAs) more robustly, or even securing new ones.

- Increased Energy Output: Repowering can boost energy generation by 10-20% or more from existing sites.

- Extended Asset Life: Modernizing components can add 10-15 years to an asset's operational life.

- Enhanced Contractual Revenue: Higher output and extended life directly increase the value of existing PPAs.

- Improved Efficiency: Newer technologies reduce downtime and maintenance costs, further boosting net revenue.

NextEra Energy Partners (NEP) diversifies its revenue through multiple streams, primarily anchored by long-term contracts. These include electricity sales from its renewable energy portfolio, natural gas pipeline transportation fees, and capacity payments for ensuring generation availability.

In 2024, NEP's contracted renewable energy portfolio, spanning approximately 7.3 gigawatts as of Q1 2024, continues to be a cornerstone of its revenue. The natural gas pipeline segment also provides stable, fee-based income, insulated from commodity price swings.

Furthermore, NEP capitalizes on selling Renewable Energy Credits (RECs) and benefits from asset repowering initiatives. For instance, repowering projects completed in 2023 are projected to add between $10 million to $15 million annually in Adjusted EBITDA by enhancing energy output and extending asset life.

| Revenue Stream | Primary Mechanism | 2023/2024 Relevance |

|---|---|---|

| Power Purchase Agreements (PPAs) | Long-term sale of electricity at fixed or escalating prices | Core revenue, ~7.3 GW contracted capacity as of Q1 2024 |

| Natural Gas Pipeline Fees | Volume-based charges or capacity reservations | Significant contributor, stable fee-based income |

| Capacity Payments | Fees for ensuring generation capacity availability | Bolsters financial stability, consistent income base |

| REC Sales | Sale of environmental attributes from clean energy | Significant component of earnings, supports distributions |

| Asset Repowering | Increased energy output and extended asset life | Projected $10-$15M annual EBITDA increase from 2023 repowering |

Business Model Canvas Data Sources

The NextEra Energy Partners Business Model Canvas is built using financial disclosures, investor reports, and industry analysis. These sources provide a comprehensive view of the company's operations, market position, and strategic direction.