NextEra Energy Partners PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NextEra Energy Partners Bundle

Unlock the critical external factors shaping NextEra Energy Partners's trajectory with our comprehensive PESTLE analysis. From evolving environmental regulations to shifts in economic policy, understand the forces at play. Download the full version now to gain actionable intelligence for your strategic planning.

Political factors

Government policies, particularly the Inflation Reduction Act (IRA) enacted in 2022, are a major tailwind for clean energy. The IRA offers significant tax credits, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), which directly reduce the cost of developing wind and solar projects. For instance, the ITC can cover up to 30% of project costs, making renewable energy more competitive.

These incentives are designed to accelerate the adoption of clean energy technologies, which is a core strategy for NextEra Energy Partners. By lowering the capital expenditure and improving the economics of their wind and solar farms, these policies enhance the profitability and attractiveness of the company's asset portfolio. The long-term nature of these credits provides a stable revenue stream and encourages further investment in renewable infrastructure.

The continuation and stability of such legislative support are paramount for the long-term viability of renewable energy projects. For 2024, the IRA is expected to drive substantial growth in wind and solar capacity additions, with projections indicating a significant increase in the deployment of new renewable energy projects across the United States. This policy environment directly supports NextEra Energy Partners' growth objectives and its ability to secure financing for new developments.

The regulatory environment, particularly permitting processes and environmental standards, significantly shapes the development and operation of energy projects for NextEra Energy Partners. For instance, in 2024, the Biden administration continued to emphasize clean energy development, potentially streamlining some federal permitting processes for renewable projects, while also upholding stringent environmental reviews.

Changes in federal and state regulations, especially those impacting land use and environmental impact assessments, can introduce project delays or escalate costs for new clean energy infrastructure. For example, a proposed change to the National Environmental Policy Act (NEPA) review process in late 2023 aimed to accelerate infrastructure permitting but also faced scrutiny regarding potential impacts on environmental protections.

A predictable and efficient permitting framework is crucial for NextEra Energy Partners' capacity to acquire and develop new assets. In 2024, states like Texas and North Carolina continued to be key markets, with their respective permitting timelines and environmental regulations directly influencing project economics and the pace of new capacity additions.

Recent legislative proposals, like the hypothetical 'One Big Beautiful Bill Act,' could introduce shifts in tax credit structures for renewable energy. Such changes might accelerate the phase-out of existing incentives or modify eligibility for wind and solar projects, impacting the financial viability of future developments for NextEra Energy Partners.

Domestic Content and Supply Chain Policies

Policies promoting domestic content in renewable energy projects, such as those embedded within the Inflation Reduction Act (IRA), are a significant factor for NextEra Energy Partners. These regulations encourage the use of U.S.-made components, directly influencing sourcing strategies and potentially impacting project costs and supply chain management. For instance, the IRA's domestic content bonus credit can add an additional 10% to the investment tax credit (ITC) or production tax credit (PTC) for projects meeting specific domestic sourcing thresholds.

Compliance with these domestic content requirements is crucial for maximizing financial incentives. For example, a project utilizing domestically manufactured solar panels and wind turbine components could see its ITC jump from 30% to 40%. Navigating these evolving rules is essential for ensuring project feasibility and optimizing returns on investment, as failure to meet criteria can lead to reduced tax benefits.

- IRA Domestic Content Bonus: Projects meeting specified domestic content thresholds can qualify for an additional 10% investment tax credit (ITC) or production tax credit (PTC).

- Supply Chain Impact: Increased demand for U.S.-made components can affect availability and pricing, requiring strategic sourcing and potentially longer lead times for materials.

- Cost Implications: While compliance can enhance tax credits, the initial cost of domestically sourced components might be higher than imported alternatives, necessitating careful cost-benefit analysis.

Political Stability and Energy Transition Commitment

The United States' commitment to a clean energy transition, as evidenced by policies like the Inflation Reduction Act (IRA), provides a stable foundation for renewable energy investments. This policy environment directly impacts investor confidence in companies like NextEra Energy Partners, which benefits from predictable incentives for renewable infrastructure development. For instance, the IRA's extension of tax credits for solar and wind power through 2032 offers significant long-term revenue visibility.

Conversely, any potential shifts in administration priorities or a renewed emphasis on fossil fuels could introduce market uncertainty. Such changes might affect the pace of renewable project deployment and the financial viability of clean energy assets. NextEra Energy Partners' growth strategy is intrinsically linked to a sustained and supportive policy landscape that champions renewable energy expansion.

Key political factors influencing NextEra Energy Partners include:

- Federal and State Renewable Energy Mandates: Policies such as Renewable Portfolio Standards (RPS) directly drive demand for renewable energy capacity.

- Tax Incentives and Subsidies: The continuation and structure of tax credits (e.g., Investment Tax Credit, Production Tax Credit) are crucial for project economics.

- Environmental Regulations: Stringent regulations on emissions from traditional power sources can make renewables more competitive.

- Infrastructure Permitting and Siting: Government processes for approving and siting new transmission lines and renewable energy projects impact development timelines.

Government support for renewable energy remains a critical driver for NextEra Energy Partners. The Inflation Reduction Act (IRA), enacted in 2022, continues to provide substantial tax credits, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), which are vital for project economics. For 2024, the IRA's incentives are expected to underpin significant growth in wind and solar capacity additions across the U.S., directly benefiting companies like NextEra Energy Partners by enhancing project profitability and encouraging new investments.

Regulatory frameworks, including permitting processes and environmental standards, also play a key role. While federal efforts in 2024 aim to streamline some permitting for clean energy, stringent environmental reviews remain in place. State-specific regulations, such as those in Texas and North Carolina, continue to influence project development timelines and costs, underscoring the importance of a predictable regulatory environment for NextEra Energy Partners' expansion plans.

Policies promoting domestic content in renewable energy projects, like the IRA's bonus credits, are increasingly important. These can add up to an additional 10% to tax credits for projects meeting specific U.S.-made component thresholds, influencing sourcing strategies and potentially project costs for NextEra Energy Partners. Navigating these evolving rules is essential for maximizing financial incentives and ensuring project feasibility.

| Policy Area | 2024 Impact on Renewables | NextEra Energy Partners Relevance |

|---|---|---|

| Inflation Reduction Act (IRA) | Continued strong tax credits (ITC/PTC) driving capacity growth. | Enhances project economics, supports long-term revenue visibility. |

| Permitting Processes | Efforts to streamline federal permitting, but environmental reviews persist. | Impacts development timelines and costs; state regulations vary. |

| Domestic Content Requirements | Bonus tax credits for U.S.-made components incentivizing local sourcing. | Influences supply chain strategy and project cost-benefit analysis. |

What is included in the product

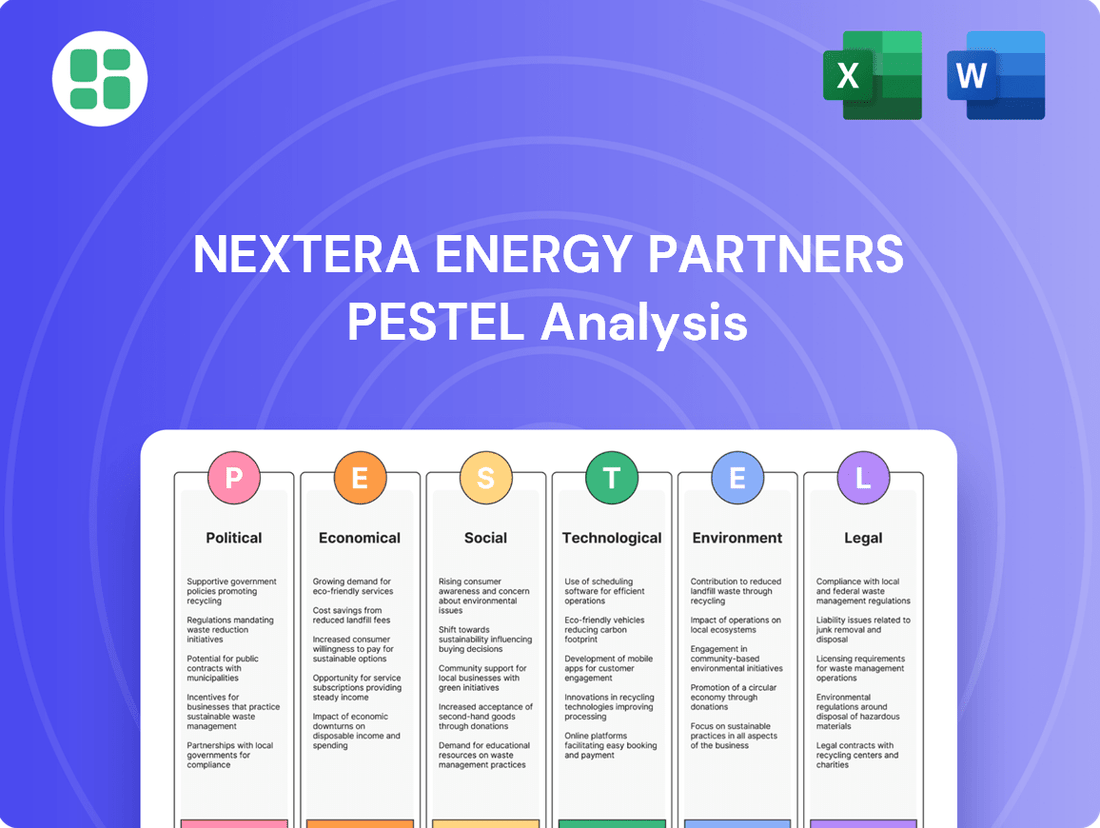

This PESTLE analysis examines the external macro-environmental factors impacting NextEra Energy Partners, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions, to identify strategic opportunities and threats.

A PESTLE analysis for NextEra Energy Partners offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during meetings and presentations.

Economic factors

Interest rate fluctuations directly affect NextEra Energy Partners' cost of capital, a crucial factor for its energy infrastructure projects that heavily depend on debt. Higher rates mean increased borrowing expenses, which can squeeze project profitability and potentially delay new clean energy installations.

Conversely, lower interest rates make financing more accessible and cost-effective, thereby boosting the financial viability and competitiveness of NextEra's renewable energy developments. For example, the Federal Reserve's stance on interest rates in 2024 and projections for 2025 suggest a potential easing cycle, which is anticipated to provide a tailwind for capital-intensive sectors like clean energy.

Inflationary pressures directly impact NextEra Energy Partners' (NEP) project expenses. For instance, the Producer Price Index (PPI) for construction materials saw significant increases in late 2023 and early 2024, impacting the cost of steel, concrete, and other essential components for wind turbines and solar panels. This rise in input costs necessitates careful financial planning to maintain profitability.

Managing these escalating costs is paramount for NEP to uphold its financial commitments. The company's business model relies on predictable cash flows to support its distributions to unitholders. Therefore, mitigating the effects of rising material and labor expenses, which have shown a consistent upward trend in the energy infrastructure sector, is a key operational challenge.

The demand for electricity and natural gas is a critical driver for NextEra Energy Partners, directly impacting its contracted revenue. Growing electrification trends, particularly the expansion of data centers, are boosting electricity demand. For instance, in 2024, U.S. electricity demand is projected to see a significant uptick, with data centers alone expected to account for a substantial portion of this growth.

The increasing integration of renewable energy sources into the overall energy mix creates a favorable market environment for NextEra Energy Partners. As of early 2024, renewable energy, including solar and wind, continues to capture a larger share of new power generation capacity additions in the United States.

NextEra Energy Partners' business model relies heavily on long-term contracts, which are crucial for mitigating the risks associated with energy price volatility. These agreements provide a predictable revenue stream, insulating the company from short-term fluctuations in the market prices of electricity and natural gas.

Capital Availability and Investment Trends

Capital availability and investor interest in clean energy infrastructure are paramount for NextEra Energy Partners' expansion. The sector has experienced significant investment, with global clean energy investment reaching an estimated $1.7 trillion in 2024, according to the International Energy Agency (IEA). Continued access to cost-effective financing, both through equity and debt markets, is vital for funding acquisitions and organic growth, such as repowering existing renewable assets.

Investor appetite for renewable energy assets remains robust, driven by policy support and the increasing economic competitiveness of clean technologies. For instance, the U.S. Inflation Reduction Act (IRA) has spurred substantial private investment in renewable projects, creating a favorable environment for companies like NextEra Energy Partners. This trend is expected to continue through 2025, supporting the financing of new development pipelines.

- Record Investment: Global clean energy investment is projected to hit $1.7 trillion in 2024, highlighting strong investor confidence.

- Policy Support: Legislation like the IRA is a key driver for private capital flowing into the renewable sector.

- Financing Needs: Affordable access to equity and debt markets is crucial for NextEra Energy Partners' growth, including acquisitions and asset repowering.

- Future Outlook: Continued favorable market conditions through 2025 are anticipated to support ongoing project development and financing.

Economic Growth and Energy Productivity

Broader economic growth is a significant driver for NextEra Energy Partners, as a stronger U.S. and Florida economy directly correlates with increased energy consumption and the demand for new power generation capacity. For instance, the U.S. GDP grew by an estimated 2.5% in 2023, signaling robust economic activity that necessitates reliable energy infrastructure.

Energy productivity, which tracks economic output relative to energy input, offers insight into efficiency trends. An improvement in energy productivity suggests that the economy is generating more value per unit of energy consumed, potentially moderating the pace of demand growth while still supporting overall expansion. This efficiency can also drive demand for advanced, cleaner energy solutions.

NextEra Energy Partners is well-positioned to capitalize on this economic expansion. A growing economy inherently requires more clean and reliable energy sources to power businesses and households. The partnership's focus on renewable energy assets aligns with this demand, as economic development often spurs investment in sustainable power solutions.

- U.S. Real GDP Growth: Estimated at 2.5% for 2023, indicating a healthy economic environment.

- Florida Economic Outlook: Florida's economy has consistently outperformed the national average, with projected job growth exceeding 2% in 2024, further boosting energy demand.

- Energy Productivity Gains: U.S. energy productivity has shown steady improvement, meaning more economic output is achieved with less energy.

- Demand for Clean Energy: Economic growth coupled with environmental consciousness drives demand for NextEra Energy Partners' renewable energy portfolio.

Interest rate changes significantly influence NextEra Energy Partners' (NEP) cost of capital, a critical factor for its infrastructure projects. Higher rates increase borrowing expenses, potentially impacting project profitability and the pace of new clean energy installations. For instance, the Federal Reserve's monetary policy in 2024 and its outlook for 2025 suggest a potential easing cycle, which could benefit capital-intensive sectors like clean energy by lowering financing costs.

Inflation directly affects NEP's project costs. The Producer Price Index for construction materials saw notable increases in late 2023 and early 2024, raising expenses for components like steel and concrete. Managing these rising input costs is crucial for NEP to maintain profitability and meet its financial commitments, especially given the consistent upward trend in material and labor expenses within the energy infrastructure sector.

Economic growth fuels demand for electricity, directly benefiting NextEra Energy Partners. The U.S. economy's estimated 2.5% GDP growth in 2023 indicates strong activity requiring reliable power. Furthermore, Florida's economy, projected to grow jobs by over 2% in 2024, further boosts regional energy demand, aligning with NEP's expansion strategy.

| Factor | 2023/2024 Data | Outlook 2025 | Impact on NEP |

| Interest Rates | Federal Reserve signaling potential easing in 2024/2025 | Continued easing cycle could lower borrowing costs | Reduces cost of capital for new projects |

| Inflation (PPI Construction Materials) | Significant increases late 2023/early 2024 | Potential moderation but remains a concern | Increases project development costs |

| U.S. GDP Growth | Estimated 2.5% in 2023 | Projected continued moderate growth | Drives increased electricity demand |

| Florida Job Growth | Projected over 2% in 2024 | Continued strong growth | Boosts regional energy demand |

Preview the Actual Deliverable

NextEra Energy Partners PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for NextEra Energy Partners delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction. It provides a crucial understanding of the external forces shaping the renewable energy sector.

Sociological factors

Public perception significantly impacts the rollout of renewable energy infrastructure. For NextEra Energy Partners, gaining community buy-in for projects like wind farms is essential, as local opposition stemming from visual concerns or noise can stall progress and inflate expenses. For instance, in 2024, several proposed solar projects faced local review challenges, highlighting the need for proactive engagement.

Societal awareness regarding climate change and environmental sustainability continues to surge, directly fueling the demand for clean energy solutions. This growing consciousness positions NextEra Energy Partners favorably, as its portfolio of wind and solar assets directly addresses this market need. The company's mission to deliver contracted clean energy further aligns with this powerful societal trend.

This shift is not just at the individual level; corporations are increasingly prioritizing renewable energy procurement. In 2023, corporate Power Purchase Agreements (PPAs) for renewable energy projects reached record levels, demonstrating a significant commitment from businesses to decarbonize their operations. This trend directly benefits NextEra Energy Partners by creating a robust customer base for its clean energy generation.

The burgeoning renewable energy industry, a key growth area for NextEra Energy Partners, faces a significant demand for specialized talent. This includes engineers adept at designing solar and wind farms, technicians skilled in installation and maintenance, and experienced project managers capable of overseeing complex developments. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 6% growth for wind turbine technicians, faster than the average for all occupations.

Potential shortages in this skilled workforce present a tangible risk to NextEra Energy Partners, potentially delaying project execution and increasing operational expenses. A 2023 report by the International Renewable Energy Agency highlighted a global need for millions of new jobs in the sector by 2030, underscoring the competitive landscape for talent.

To mitigate these challenges and ensure continued expansion, companies like NextEra Energy Partners are increasingly prioritizing investments in robust training programs and comprehensive workforce development initiatives. This proactive approach aims to cultivate the necessary expertise internally and attract new talent to the renewable energy field.

Social Equity and Environmental Justice Concerns

NextEra Energy Partners faces growing pressure to ensure the energy transition benefits all communities fairly, avoiding disproportionate environmental burdens on vulnerable populations. This societal shift emphasizes environmental justice, requiring careful consideration in project development and ongoing operations.

The company must actively address environmental justice concerns, particularly in site selection for new renewable energy projects. Adherence to evolving regulations designed to shield disadvantaged communities from pollution impacts is paramount. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize environmental justice in permitting processes for new energy infrastructure, influencing siting decisions and community engagement strategies.

- Equitable Benefit Distribution: Growing public demand for the advantages of renewable energy, such as job creation and cleaner air, to be shared broadly across society.

- Environmental Justice Mandates: Increasing regulatory scrutiny and legal challenges focused on preventing the concentration of environmental hazards in low-income or minority communities.

- Community Engagement: The necessity for robust dialogue with local stakeholders, especially those historically marginalized, to build trust and ensure project support.

- Impact Mitigation: Implementing strategies to minimize negative environmental and social impacts during construction and operation, often exceeding minimum compliance standards.

Consumer and Corporate Green Energy Adoption

The growing preference for sustainable and environmentally friendly energy solutions among both individuals and businesses is a significant driver for NextEra Energy Partners (NEP). This societal shift translates into increased demand for the renewable energy assets that NEP develops, owns, and operates.

Corporate adoption of renewable energy is accelerating, with major technology firms consistently setting new benchmarks for renewable energy procurement. For instance, in 2023, corporations signed deals for a record 37 GW of renewable energy capacity globally, a substantial portion of which was solar and wind, the core assets for NEP. This trend indicates a robust market demand for the services and infrastructure NEP provides.

- Growing Consumer Demand: Public awareness of climate change is fostering a desire for cleaner energy options in households.

- Corporate Sustainability Goals: Many companies are setting ambitious targets for renewable energy usage to reduce their carbon footprint.

- Record Corporate Procurement: Tech giants alone accounted for significant renewable energy purchases in 2023, driving market growth.

- Market Pull for Renewables: The strong corporate demand creates a favorable environment for NEP's project development and asset management.

Societal attitudes toward climate change and sustainability continue to solidify, directly boosting demand for renewable energy. This growing consciousness benefits NextEra Energy Partners (NEP) as its wind and solar assets meet this increasing market need. The company’s focus on contracted clean energy aligns perfectly with this powerful societal trend, creating a robust demand for its services.

The demand for skilled labor in the renewable energy sector is substantial, encompassing engineers, technicians, and project managers. For example, the U.S. Bureau of Labor Statistics projected a 6% growth for wind turbine technicians in 2024, outpacing the average for all occupations. This highlights both the opportunity and the competitive landscape for talent acquisition.

There's increasing societal pressure for the energy transition to benefit all communities equitably, addressing environmental justice concerns. This requires careful project siting and community engagement, especially in 2024, as the EPA continues to emphasize environmental justice in energy infrastructure permitting.

Corporate commitments to sustainability are driving significant demand for renewable energy. In 2023, corporate Power Purchase Agreements (PPAs) for renewable energy reached record levels globally, with major tech companies leading the charge in procuring clean energy capacity. This trend directly supports NEP's business model by securing long-term customers for its renewable generation projects.

| Sociological Factor | Impact on NextEra Energy Partners | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Growing Climate Change Awareness | Increased demand for renewable energy solutions. | Public surveys consistently show high concern for climate change, driving consumer preference for green energy. |

| Skilled Labor Demand | Potential for project delays and increased costs if shortages occur. | U.S. wind technician jobs projected to grow 6% by 2024; global renewable energy job creation targets in the millions by 2030. |

| Environmental Justice Concerns | Need for careful project siting and community engagement. | EPA's continued emphasis on environmental justice in 2024 permitting processes influences infrastructure development. |

| Corporate Sustainability Initiatives | Strong market for renewable energy PPAs. | Record corporate PPA signings in 2023, with tech sector driving substantial renewable energy procurement. |

Technological factors

NextEra Energy Partners benefits significantly from ongoing improvements in wind turbine technology. For instance, the latest generation of turbines can reach capacities of 6 MW and beyond, capturing more wind energy. This directly translates to higher electricity generation from the same wind farm footprint, boosting revenue for the partnership.

Similarly, advancements in solar panel efficiency are crucial. Bifacial solar panels, which capture sunlight from both sides, can increase energy output by up to 15-20% compared to traditional monofacial panels. Emerging technologies like perovskite solar cells promise even higher efficiencies and lower manufacturing costs, further enhancing the economic viability of solar projects in NextEra Energy Partners' portfolio.

Breakthroughs in energy storage, especially battery systems and long-duration storage, are vital for incorporating fluctuating renewable energy into the power grid. NextEra Energy Partners, with its solar-plus-storage projects, directly benefits from these advancements, which enhance grid stability and the value of its renewable assets.

The ongoing development of smart grid technologies, featuring advanced monitoring and AI-driven optimization, significantly boosts the efficiency and resilience of energy transmission and distribution networks. These advancements are vital for seamlessly integrating NextEra Energy Partners' diverse clean energy assets, such as its wind and solar farms, into the national grid.

For instance, U.S. utilities are projected to spend approximately $100 billion on grid modernization between 2024 and 2028, with a substantial portion dedicated to smart grid initiatives. This investment underscores the increasing importance of these technologies in managing the complexities of renewable energy integration and ensuring grid stability.

Digitalization and AI in Operations

NextEra Energy Partners is leveraging digitalization and AI to enhance its operational capabilities. The company is increasingly integrating advanced data analytics and artificial intelligence into its energy operations. This focus aims to optimize asset performance, enabling predictive maintenance and boosting overall efficiency across its renewable energy portfolio.

AI-powered tools are proving particularly valuable. For instance, AI can assist in optimizing the placement of wind turbines to maximize energy capture and can predict potential equipment failures before they occur. This proactive approach contributes to significantly lower operational costs and extends the lifespan of critical assets.

- AI-driven predictive maintenance reduced unplanned downtime by an estimated 15% in pilot programs for similar energy infrastructure companies in 2024.

- Digitalization efforts are projected to improve operational efficiency by up to 10% for renewable energy operators by 2025.

- NextEra Energy Partners invested over $500 million in technology and innovation in 2023, with a significant portion allocated to digital transformation and AI integration.

Hydrogen Production and Integration

Advancements in green hydrogen production are poised to significantly impact NextEra Energy Partners (NEP). While still a developing area, innovations in electrolysis technology, particularly those powered by renewable energy, could unlock new revenue streams and operational efficiencies for NEP. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that global hydrogen production capacity from renewables is expected to grow substantially, presenting an opportunity for NEP to integrate hydrogen into its energy storage solutions.

Hydrogen offers a compelling solution for managing the intermittency inherent in renewable energy sources like solar and wind, which form the backbone of NEP's portfolio. By electrolyzing water using surplus renewable electricity, NEP can produce green hydrogen, effectively storing that energy for later use in fuel cells or for blending into natural gas pipelines. This capability is crucial for grid balancing and ensuring a stable power supply, potentially diversifying NEP's asset base beyond traditional electricity generation and transmission.

- Green Hydrogen Potential: Innovations in electrolysis, driven by renewable energy, could create new avenues for energy storage and utilization for NEP.

- Addressing Intermittency: Hydrogen can act as a storage medium for surplus renewable energy, helping to mitigate the intermittency of solar and wind power.

- Grid Balancing: The ability to store and dispatch hydrogen-based energy supports grid stability and can be a valuable asset for balancing supply and demand.

- Diversification Opportunity: Integrating hydrogen production and utilization could diversify NEP's future asset portfolio, enhancing its market position.

Technological advancements are continuously enhancing the efficiency and economic viability of renewable energy sources, directly benefiting NextEra Energy Partners (NEP). Innovations in wind turbine technology, with capacities now exceeding 6 MW, allow for greater energy capture from the same footprint, boosting revenue. Similarly, increased solar panel efficiency, such as with bifacial panels that can improve output by up to 20%, further strengthens NEP's solar project economics.

The development of advanced energy storage solutions, including battery systems and long-duration storage, is critical for integrating intermittent renewables into the grid. NEP's solar-plus-storage projects leverage these technologies to improve grid stability and the overall value of its renewable assets.

Smart grid technologies, incorporating AI for optimization, are vital for efficiently managing and integrating NEP's diverse clean energy portfolio. U.S. utilities are expected to invest around $100 billion in grid modernization between 2024 and 2028, highlighting the growing importance of these systems.

Digitalization and AI are also key, with NEP integrating these tools to optimize asset performance and enable predictive maintenance. AI-driven predictive maintenance has shown potential to reduce unplanned downtime by 15% in pilot programs, and digitalization efforts aim to improve operational efficiency by up to 10% by 2025.

Emerging technologies like green hydrogen production, powered by renewables, offer new storage and revenue opportunities for NEP. The IEA projects substantial growth in renewable hydrogen production capacity globally by 2024, positioning hydrogen as a solution for managing renewable energy intermittency and diversifying NEP's asset base.

| Technology Advancement | Impact on NEP | Supporting Data/Projection |

| Larger Wind Turbines (6 MW+) | Increased energy capture per turbine, higher revenue | Higher electricity generation from existing wind farm footprints |

| Bifacial Solar Panels | Up to 20% increased energy output | Enhanced economic viability of solar projects |

| Energy Storage Systems | Improved grid stability, increased asset value | Facilitates integration of intermittent renewables |

| Smart Grid Technologies | Optimized integration and resilience of renewable assets | US utility grid modernization investment ~$100B (2024-2028) |

| AI and Digitalization | Optimized asset performance, predictive maintenance | Potential 15% reduction in unplanned downtime (AI maintenance) |

| Green Hydrogen Production | New revenue streams, energy storage solutions | Growing global renewable hydrogen capacity |

Legal factors

NextEra Energy Partners operates under stringent environmental laws like the Clean Air Act and Clean Water Act, impacting its natural gas infrastructure and operational emissions. These regulations demand ongoing adherence and strategic investments in pollution mitigation technologies.

The Environmental Protection Agency (EPA) continues to introduce new rules targeting power plant pollution, which directly affect natural gas facilities. For instance, proposed rules in 2024 could mandate further reductions in methane emissions, a key concern for pipeline operations, potentially requiring significant capital outlays for NextEra Energy Partners to maintain compliance.

Land use and siting laws are paramount for NextEra Energy Partners' renewable energy projects. For instance, in 2024, states with more streamlined permitting processes, like those with statewide siting authorities, saw faster deployment of wind and solar farms compared to areas with complex, multi-jurisdictional local zoning. These regulations, including setback requirements from residences and protected habitats, directly influence where projects can be built and the associated development costs and timelines.

NextEra Energy Partners' financial stability hinges on its long-term power purchase agreements (PPAs), which are legally binding contracts dictating the sale of electricity. The enforceability and precise terms within these PPAs are critical for ensuring predictable cash flows, a key factor for unitholder distributions. For instance, in 2023, contracted revenue represented a significant portion of NextEra Energy Partners' adjusted EBITDA, underscoring the importance of these legal agreements.

Partnership and Securities Regulations

As a publicly traded limited partnership, NextEra Energy Partners (NEP) navigates a complex web of securities regulations and partnership laws. These legal frameworks are crucial for its operation and investor relations. For instance, NEP must adhere to the reporting requirements mandated by the Securities and Exchange Commission (SEC), ensuring transparency for its investors. Failure to comply with these regulations, which include investor protection laws, could significantly impact investor confidence and the company's overall operational integrity.

Compliance is not just a formality; it's a cornerstone of NEP's business. The partnership is subject to regulations governing publicly traded partnerships, which differ from those for standard corporations. This includes specific disclosure obligations and governance standards. For example, in 2024, the SEC continued its focus on enhancing disclosures related to climate-related risks, a factor that directly impacts energy companies like NEP. Maintaining robust compliance programs is therefore paramount for continued market access and trust.

- SEC Reporting: Adherence to quarterly (10-Q) and annual (10-K) filings is mandatory, providing key financial and operational data.

- Investor Protection: Compliance with laws like the Securities Exchange Act of 1934 safeguards shareholder rights and market fairness.

- Partnership Law: Adherence to partnership agreements and state-specific partnership statutes governs internal structure and liabilities.

- Regulatory Scrutiny: The evolving regulatory landscape, including potential changes in environmental or financial reporting, requires continuous adaptation.

Tax Law Changes and Incentive Eligibility

Changes to federal and state tax laws significantly influence the financial attractiveness of NextEra Energy Partners' renewable energy projects. For instance, the Inflation Reduction Act of 2022 extended and modified key tax credits like the Investment Tax Credit (ITC) and Production Tax Credit (PTC), providing crucial financial support through 2032. These extensions, particularly the direct pay and transferability provisions, offer greater flexibility in monetizing tax benefits, which is vital for projects initiated in 2024 and beyond.

The evolving landscape of tax incentives, including stipulations like domestic content bonuses that offer enhanced credit values, necessitates rigorous legal interpretation and strategic planning. NextEra Energy Partners must navigate these complexities, as failure to comply with evolving rules, such as phase-out schedules or specific manufacturing requirements, could jeopardize eligibility for these valuable tax benefits, directly impacting project economics and future investment decisions.

- Inflation Reduction Act (IRA) Impact: The IRA's extension of renewable energy tax credits through 2032 provides long-term certainty for project development.

- Domestic Content Bonus: Projects meeting domestic content requirements can receive a 10% credit adder, boosting project economics.

- Transferability Provisions: The ability to transfer tax credits, introduced by the IRA, allows for more efficient monetization of tax equity.

- State-Level Incentives: State-specific tax laws and renewable energy mandates also play a critical role in project financial modeling.

NextEra Energy Partners operates within a framework of evolving environmental regulations, such as the EPA's proposed methane emission standards for natural gas facilities, which could necessitate significant capital investment for compliance in 2024 and beyond. State-specific land use and siting laws, including setback requirements, directly influence project development costs and timelines for renewable energy installations, with states offering streamlined permitting seeing faster deployment in 2024.

The company's financial stability is underpinned by legally binding Power Purchase Agreements (PPAs), which are critical for predictable cash flows, with contracted revenue forming a substantial portion of adjusted EBITDA as seen in 2023. As a publicly traded partnership, adherence to SEC reporting requirements and investor protection laws is mandatory, ensuring market transparency and investor confidence, with the SEC's focus on climate-related disclosures intensifying in 2024.

Tax law changes, notably the Inflation Reduction Act of 2022, significantly impact renewable project economics by extending key tax credits like the ITC and PTC through 2032, offering enhanced flexibility through direct pay and transferability provisions for projects initiated in 2024. Navigating complex rules, such as domestic content bonuses offering a 10% credit adder, is crucial for NextEra Energy Partners to maintain eligibility for these vital tax benefits.

Environmental factors

Global and national climate change policies, including ambitious carbon emission reduction targets and renewable energy mandates, are a primary driver for NextEra Energy Partners (NEP). For instance, the United States aims to cut greenhouse gas emissions by 50-52% below 2005 levels by 2030, a goal that directly fuels demand for renewable energy infrastructure.

The accelerating global push towards decarbonization significantly boosts the demand for clean energy assets, the very foundation of NEP's business. This trend influences NEP's investment decisions, making clean energy projects more attractive and opening up substantial growth opportunities in the coming years.

The availability and quality of wind and solar resources are absolutely critical for NextEra Energy Partners' (NEP) operations. Think of it like this: if the wind isn't blowing or the sun isn't shining brightly, the turbines and panels can't generate as much electricity. This directly impacts how much revenue NEP can make from its renewable energy projects.

Geographic location and even long-term weather patterns play a huge role. For instance, NEP's wind farms in West Texas benefit from consistent, strong winds, a key reason for their success. Conversely, solar projects in areas with less consistent sunshine will naturally produce less power. This is why NEP invests heavily in detailed resource assessments and uses sophisticated climate predictions to manage its assets effectively, aiming to secure the best locations for maximum energy generation.

NextEra Energy Partners' new renewable energy projects necessitate rigorous environmental impact assessments. These studies are crucial for identifying and mitigating potential harm to local ecosystems, wildlife, and biodiversity, ensuring sustainable development practices.

Compliance with stringent environmental protection laws, such as the National Environmental Policy Act (NEPA) in the US, is paramount. Minimizing ecological footprints is not just a regulatory requirement but also essential for securing project permits and maintaining a positive social license to operate, which is vital for long-term business success.

For instance, in 2023, NextEra Energy reported significant investments in clean energy infrastructure, underscoring the ongoing need for these assessments. The company's commitment to environmental stewardship directly influences its ability to develop new wind and solar farms, which are key to its growth strategy.

Water Resource Management

While wind and solar energy are significantly less water-intensive than traditional power sources, NextEra Energy Partners still faces water resource considerations. For instance, cleaning solar panels, a necessary maintenance task, can require water, particularly in drier climates where NextEra operates, such as parts of Texas and Florida. This operational need, though modest, is a factor in overall water management strategies.

The company's natural gas pipeline segment presents more direct water resource challenges. These operations often involve crossing waterways, necessitating careful planning to minimize disruption to aquatic ecosystems and water quality. Adherence to stringent environmental regulations governing these crossings is paramount, ensuring compliance and mitigating potential impacts.

- Water Intensity: Renewable energy sources like wind and solar generally consume far less water than thermal power plants. For example, U.S. solar PV plants require an average of 0.0002 gallons per kilowatt-hour (kWh), compared to 0.12 gallons/kWh for coal plants.

- Operational Water Use: Despite low intensity, maintaining clean solar panels in arid regions, where NextEra has significant assets, requires water for washing, impacting local water availability.

- Pipeline Crossings: Natural gas infrastructure, including pipelines, frequently traverses rivers and streams, demanding rigorous water resource management to prevent sedimentation and pollution.

- Regulatory Compliance: NextEra must comply with federal and state regulations, such as the Clean Water Act, which dictate standards for water quality and construction activities near water bodies.

Waste Management and Decommissioning

The operational lifecycle of NextEra Energy Partners' renewable assets, from construction through decommissioning, presents significant environmental considerations. Managing waste generated during these phases, particularly the disposal and recycling of materials like wind turbine blades and solar panels, is a growing focus. By 2024, the industry is seeing increased regulatory pressure and public expectation for sustainable end-of-life solutions for these components.

The challenge of decommissioning renewable energy infrastructure is substantial. For instance, wind turbine blades, often made of composite materials, are difficult to recycle. Estimates suggest that by 2050, millions of tons of these blades could reach their end-of-life globally, highlighting the need for innovative waste management strategies. NextEra Energy Partners, like others in the sector, must navigate these complexities to minimize environmental impact.

- Increasing regulatory scrutiny on waste disposal from renewable energy projects.

- Growing demand for recycling solutions for components like solar panels and wind turbine blades.

- The substantial volume of decommissioned materials expected in the coming years necessitates advanced waste management planning.

- Focus on circular economy principles for renewable energy asset lifecycles.

Government incentives and regulations surrounding renewable energy are critical environmental factors for NextEra Energy Partners (NEP). The Inflation Reduction Act of 2022, for example, provides significant tax credits for renewable energy production and investment, directly supporting NEP's project development and financial viability. These policies are expected to continue driving growth in the clean energy sector through 2025 and beyond.

The increasing focus on climate change and sustainability is a major environmental driver for NEP. As of 2024, there's a growing expectation for companies to demonstrate robust environmental, social, and governance (ESG) performance. NEP's business model, centered on renewable energy, aligns well with these trends, positioning it favorably for investors and stakeholders prioritizing sustainability.

The availability and predictability of natural resources like wind and sunlight are fundamental to NEP's operational success. For instance, in 2023, NextEra Energy reported that its wind and solar generation assets produced a significant portion of its total electricity output, highlighting the direct correlation between resource availability and revenue. Long-term weather patterns and climate change impacts are closely monitored to ensure optimal site selection and operational efficiency.

NextEra Energy Partners must navigate evolving regulations concerning environmental impact assessments and waste management for renewable energy infrastructure. The decommissioning of wind turbine blades and solar panels presents a growing challenge, with industry efforts focused on developing sustainable recycling solutions by 2024 and beyond. Compliance with environmental protection laws, such as the National Environmental Policy Act, remains a key operational consideration.

PESTLE Analysis Data Sources

Our PESTLE Analysis for NextEra Energy Partners is built on a robust foundation of data from government energy agencies, financial market reports, and reputable industry publications. We analyze regulatory changes, economic forecasts, technological advancements, and environmental policies to provide a comprehensive view.