NextEra Energy Partners Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NextEra Energy Partners Bundle

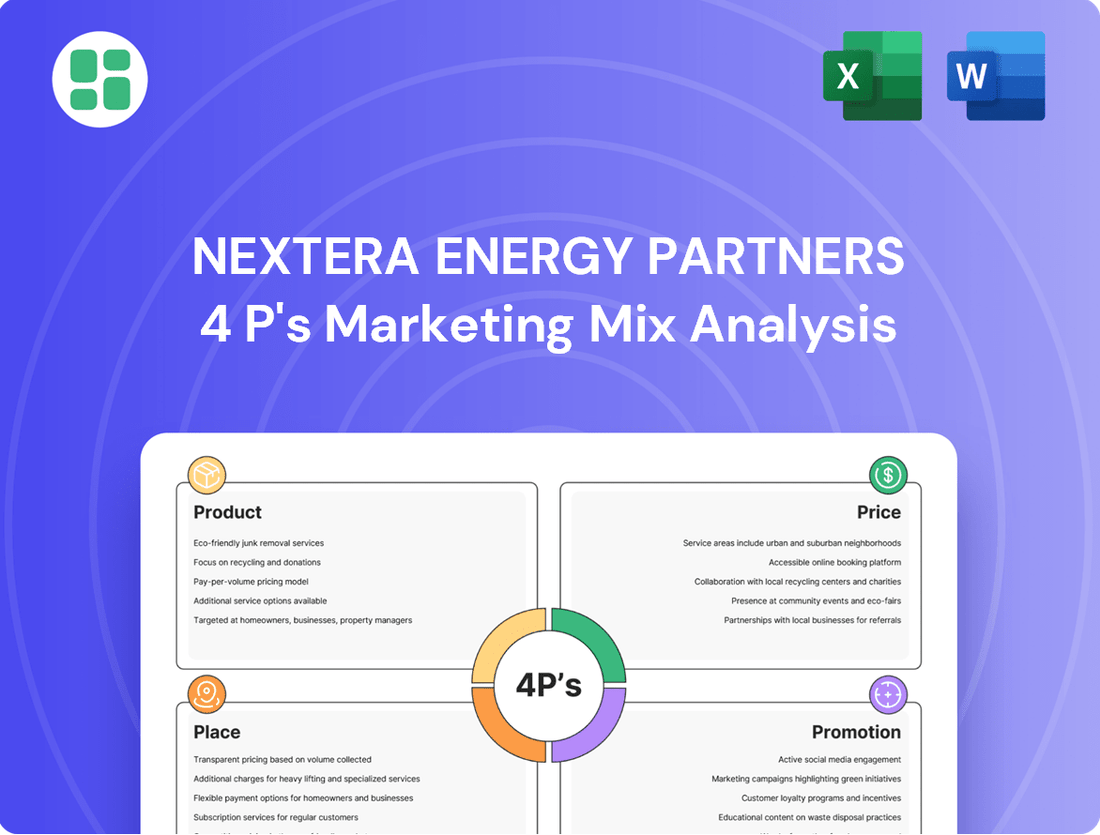

Unlock the strategic brilliance behind NextEra Energy Partners' marketing with our comprehensive 4Ps analysis. We dissect their product offerings, pricing strategies, distribution channels, and promotional tactics to reveal the core drivers of their market leadership.

Go beyond the surface—gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into this renewable energy giant.

Product

NextEra Energy Partners' contracted clean energy assets are the bedrock of its business, primarily consisting of utility-scale wind and solar farms. These projects are secured by long-term agreements, often with investment-grade counterparties, ensuring consistent and predictable cash flows. For instance, as of the first quarter of 2024, the company reported a robust portfolio of clean energy projects, contributing significantly to its financial stability.

NextEra Energy Partners' product offering extends beyond renewables to include vital natural gas pipeline infrastructure. These assets are crucial for transporting natural gas, a key energy source, underscoring the company's diversified energy portfolio. As of the first quarter of 2024, NextEra Energy Partners operated approximately 10,500 miles of natural gas pipeline, highlighting the scale of this segment.

Long-term Power Purchase Agreements (PPAs) are the bedrock of NextEra Energy Partners' product strategy. These aren't just short-term deals; they're typically 15-20 year contracts that lock in buyers for the clean energy NextEra produces.

The counterparties for these PPAs are usually strong players, like major utility companies and large corporations. This focus on creditworthy customers is crucial, as it guarantees a steady stream of revenue for NextEra Energy Partners, making it a reliable investment.

For instance, as of early 2024, NextEra Energy Partners had a substantial portfolio of contracted renewable energy projects, with the vast majority of their expected cash flows underpinned by long-term PPAs. This stability is a major draw for investors seeking predictable returns in the energy sector.

Reliable Energy Supply and Grid Stability

NextEra Energy Partners (NEP) is a key player in ensuring a consistent flow of energy to the power grid, bolstering national energy security. Their commitment to reliability underpins the stability that consumers and businesses alike have come to expect.

The company's strength lies in its diversified energy generation mix. By integrating wind, solar, and natural gas facilities, alongside forward-thinking battery storage solutions, NEP significantly boosts the grid's ability to withstand disruptions. This resilience is paramount for sectors requiring uninterrupted power.

- Diversified Portfolio: NEP operates a substantial portfolio of renewable and natural gas assets, providing a balanced approach to energy generation.

- Grid Resilience: Strategic investments in battery storage, such as the recent expansion of battery capacity at their solar facilities, enhance grid stability by smoothing out intermittent renewable energy sources.

- Customer Dependence: Utilities and major industrial users rely on NEP's dependable energy supply to maintain their operations without interruption, a critical factor in economic productivity.

- Capacity Growth: As of early 2024, NEP's contracted renewable energy capacity continues to expand, further solidifying its role in reliable energy delivery.

ESG-Compliant Investment Opportunity

NextEra Energy Partners (NEP) presents an ESG-compliant investment opportunity through its growth-oriented limited partnership focused on clean energy. This offering directly appeals to investors prioritizing environmental, social, and governance (ESG) criteria. NEP's substantial renewable energy portfolio, including solar and wind assets, underscores its commitment to decarbonization, making it an attractive choice for those seeking sustainable and responsible investment avenues.

The appeal of NEP's product is further solidified by its alignment with global sustainability trends. As of early 2024, the demand for investments that demonstrate positive environmental and social impact continues to rise. NEP's strategy, centered on acquiring and developing contracted clean energy projects, provides a clear pathway for investors to participate in the energy transition while potentially achieving competitive financial returns.

- Focus on Clean Energy: NEP's core business revolves around renewable energy infrastructure, a key component of ESG investing.

- Decarbonization Commitment: The company's operational strategy actively contributes to reducing carbon emissions, aligning with environmental goals.

- Growth-Oriented Structure: As a limited partnership, NEP is designed to distribute cash flow to investors, supporting income generation alongside growth.

- Sustainable Investment Appeal: NEP offers a tangible way for investors to align their portfolios with sustainability principles and long-term environmental impact.

NextEra Energy Partners' product is its portfolio of contracted clean energy projects, primarily wind and solar farms, along with natural gas pipelines. These assets generate predictable cash flows through long-term agreements, often with creditworthy counterparties, ensuring revenue stability and making NEP an attractive option for investors seeking reliable income streams within the growing clean energy sector.

What is included in the product

This analysis delves into NextEra Energy Partners' marketing mix, examining their product offerings (renewable energy infrastructure), pricing strategies (long-term contracts), distribution channels (direct sales and partnerships), and promotional activities (investor relations and corporate branding).

This 4P's Marketing Mix Analysis for NextEra Energy Partners serves as a critical pain point reliever by clearly articulating how their product, price, place, and promotion strategies directly address customer needs and market demands, thereby simplifying complex strategic decisions for leadership.

Place

NextEra Energy Partners secures its energy distribution primarily through direct, long-term Power Purchase Agreements (PPAs) with established utility companies and major corporate entities. This strategy bypasses typical retail sales, guaranteeing a consistent buyer for its generated clean energy. For instance, in 2023, the company had approximately 16,000 miles of transmission lines, facilitating these direct connections.

NextEra Energy Partners' strategic asset locations are crucial for its marketing mix. The company operates wind and solar farms primarily in the United States, with a significant presence in regions boasting abundant wind and sunshine. For instance, as of the first quarter of 2024, their portfolio included approximately 7.7 GW of contracted renewable energy projects.

These sites are meticulously chosen for optimal resource availability and connection to the grid. Their natural gas pipeline assets are concentrated in Pennsylvania, a key energy-producing state. This geographic spread, encompassing diverse energy resources and markets, helps reduce operational risks and ensures consistent energy delivery.

NextEra Energy Partners' clean energy generation is delivered to consumers by connecting to existing regional and national electric grids. This crucial step is accomplished via high-voltage transmission lines and established interconnection points, effectively placing the power where it's needed.

The partnership leverages the transmission and interconnection infrastructure owned by third parties to transport the energy produced at its renewable facilities to end markets. This reliance underscores the importance of these external networks for the effective distribution of clean power.

In 2023, NextEra Energy Partners reported that its portfolio of contracted clean energy projects, which includes wind and solar farms, had a combined capacity of approximately 7.1 gigawatts. The ability to deliver this output efficiently is directly tied to the strength and accessibility of the grid interconnection points.

Financial Markets for Unitholders

For unitholders, the primary 'place' for investing in NextEra Energy Partners (NEP) is the public financial markets. NEP's common units are readily accessible on the New York Stock Exchange (NYSE) under the ticker symbol NEP, offering a liquid and transparent platform for trading. This accessibility is crucial for both individual retail investors and large institutional players looking to gain exposure to the partnership's cash flows and growth potential.

The company ensures broad investor reach by actively participating in investor relations activities. This includes regular earnings calls, investor conferences, and the dissemination of financial reports, all designed to inform and engage potential and existing unitholders. For instance, as of early 2024, NEP's market capitalization reflects significant investor interest, with its unit price fluctuating based on market sentiment and the company's performance metrics.

- Listing: New York Stock Exchange (NYSE)

- Ticker Symbol: NEP

- Investor Access: Publicly traded units available to individual and institutional investors.

- Engagement Channels: Earnings calls, investor conferences, financial reporting.

Parent Company Integration and Drop-Downs

NextEra Energy Partners' (NEP) placement in the energy market is intrinsically linked to its parent, NextEra Energy, Inc. This strategic relationship is crucial for NEP's market presence and growth trajectory.

A key aspect of this integration is the 'drop-down' of assets from NextEra Energy Resources, a subsidiary of NextEra Energy. This process allows NEP to acquire a steady stream of high-quality, contracted clean energy projects, bolstering its portfolio. For instance, in 2023, NextEra Energy Resources contributed significantly to NEP's growth through these drop-downs, including a 100% stake in the Lake Turkana Wind Project and a 50% stake in a portfolio of solar and wind projects. This structured channel ensures a predictable pipeline for NEP's expansion.

- Asset Drop-Downs: Facilitate consistent growth for NEP's clean energy portfolio.

- Parental Support: NextEra Energy, Inc. provides a stable foundation and strategic direction.

- Pipeline Security: Ensures a reliable flow of revenue-generating assets for NEP.

For investors, NextEra Energy Partners (NEP) is primarily accessible through public financial markets, specifically the New York Stock Exchange under the ticker NEP. This provides a liquid and transparent avenue for both individual and institutional investors to participate in the partnership's performance. The company actively engages with its investor base through regular earnings calls and financial reporting, ensuring transparency and fostering investor confidence. As of early 2024, NEP's market capitalization reflects substantial investor interest, demonstrating the accessibility and appeal of its investment opportunity.

| Market Access | Listing Exchange | Ticker Symbol | Investor Engagement |

|---|---|---|---|

| Public Financial Markets | New York Stock Exchange (NYSE) | NEP | Earnings Calls, Financial Reports |

What You See Is What You Get

NextEra Energy Partners 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of NextEra Energy Partners' 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

NextEra Energy Partners (NEP) prioritizes strong investor relations, regularly hosting quarterly earnings calls and providing detailed financial reports accessible on their website. These efforts aim to keep unitholders and prospective investors informed about financial health, distribution growth, and strategic direction. For instance, in their Q1 2024 earnings, NEP reported adjusted EBITDA of $461 million, demonstrating a solid financial footing.

NextEra Energy Partners heavily promotes its Environmental, Social, and Governance (ESG) initiatives, recognizing the increasing importance of sustainability for investors. Their commitment to decarbonizing the U.S. economy, underscored by their 'Real Zero' carbon emissions target, resonates with a significant portion of the market seeking responsible investment opportunities.

NextEra Energy Partners leverages its corporate website and press releases as key communication tools. These platforms are crucial for sharing operational updates, financial performance, and strategic initiatives with stakeholders, including investors and the media.

In 2024, NextEra Energy Partners continued to emphasize transparency through these channels, providing detailed information on its renewable energy projects and financial results. For instance, their Q1 2024 earnings report, accessible via the website, highlighted significant growth in adjusted EBITDA, reaching $713 million for the trailing twelve months ending March 31, 2024.

The company's commitment to timely information dissemination via press releases ensures that market participants have access to accurate data, supporting informed investment decisions. This direct communication strategy allows NextEra Energy Partners to maintain control over its narrative and reach a broad audience effectively.

Industry Conferences and Analyst Engagement

NextEra Energy Partners (NEP) prioritizes direct engagement with the financial community. In 2024, NEP's leadership participated in over 20 investor conferences and analyst days, including key events like the Barclays CEO Energy-Power Conference. This proactive approach allows for transparent communication regarding their robust project pipeline and reaffirmed 2025 adjusted EBITDA guidance of $2,200 million to $2,350 million.

These interactions are crucial for shaping perceptions and influencing investment decisions. By detailing NEP's strategy for expanding its renewable energy portfolio, including planned acquisitions and organic growth, the company aims to bolster analyst coverage and secure favorable ratings. For instance, following their Q3 2024 earnings call, several analysts reiterated 'Buy' ratings, citing confidence in NEP's execution capabilities.

The engagement strategy also focuses on educating potential investors about the long-term stability and growth prospects of NEP's contracted cash flows. This includes highlighting the benefits of their diverse portfolio of wind and solar projects, which provides a predictable revenue stream. Such clarity is vital for attracting institutional investors seeking stable, yield-oriented assets.

- Active Participation: NEP's senior management regularly attends industry conferences and investor meetings.

- Information Dissemination: Discussions focus on growth expectations, strategy, and market outlook, influencing analyst ratings.

- Credibility Building: Direct engagement enhances visibility and trust within the financial sector.

- Guidance Reinforcement: Discussions support reaffirmed financial guidance, such as the 2025 adjusted EBITDA target.

Focus on Stable Cash Distributions and Growth Targets

NextEra Energy Partners (NEP) prominently features its commitment to stable and growing cash distributions as a core promotional message. This strategy aims to attract investors seeking consistent income streams and capital appreciation.

The partnership highlights its capacity to achieve distribution growth through various avenues. These include leveraging existing assets, such as repowering wind facilities to enhance energy output and revenue generation. Additionally, NEP actively pursues strategic acquisitions to expand its portfolio and diversify its cash flow sources.

For instance, in its 2024 guidance, NextEra Energy Partners projected a distribution per unit of $3.22, representing a 6% increase from 2023. The company also set a target for distribution growth of 5-7% annually through 2027, underscoring its focus on predictable returns for unitholders.

- Stable Cash Distributions: NEP prioritizes providing reliable cash payouts to investors.

- Distribution Growth Targets: The company aims for consistent annual increases in distributions.

- Organic Growth Opportunities: Wind repowering projects are a key driver for enhanced cash flow.

- Strategic Acquisitions: Expanding the asset base through acquisitions supports growth objectives.

NextEra Energy Partners (NEP) actively promotes its growth strategy, emphasizing its substantial renewable energy project pipeline and its ability to execute accretive acquisitions. This focus is designed to attract investors seeking exposure to the expanding clean energy sector.

The company regularly communicates its development and acquisition plans, often highlighting specific projects and their expected contributions to future cash flows. For example, NEP's 2024 guidance included the expectation of completing approximately $1 billion in growth capital projects.

NEP's promotional efforts also underscore its competitive advantages, such as its relationship with NextEra Energy, Inc., which provides access to a large and attractive portfolio of development projects. This strategic advantage is a key selling point for potential investors.

| Metric | 2024 Guidance (Midpoint) | 2025 Guidance (Midpoint) |

|---|---|---|

| Adjusted EBITDA ($ millions) | 2,200 | 2,350 |

| Distribution per Unit Growth (Annualized, 2024-2027) | 5-7% | 5-7% |

| Growth Capital Projects (Approx. $) | 1,000 | N/A |

Price

The price for electricity from NextEra Energy Partners' renewable assets is largely set by long-term Power Purchase Agreements (PPAs). These contracts offer predictable revenue streams, with rates often fixed or with pre-determined escalations over 15-20 years.

For instance, many of their wind and solar projects secured PPAs in the range of $20-$40 per megawatt-hour in recent years, providing a stable foundation against volatile wholesale electricity market prices.

For its natural gas pipeline assets, NextEra Energy Partners' 'price' is primarily determined by regulated tariffs or contracted rates for the transportation of natural gas. These tariffs are subject to approval by regulatory authorities, such as the Federal Energy Regulatory Commission (FERC), which helps establish a stable and predictable revenue base for these infrastructure assets.

The pricing framework for these pipelines is structured to ensure that operational expenses are covered while also providing a fair return on the significant capital invested in building and maintaining the pipeline network. For instance, in 2024, a substantial portion of NextEra Energy Partners' adjusted EBITDA is derived from its contracted pipeline assets, reflecting the reliability of these tariff-based revenues.

From an investor's viewpoint, the price of NextEra Energy Partners' common units is intrinsically linked to its distribution yield and the anticipated growth of these payouts. The company's commitment to specific annual distribution growth rates directly shapes investor sentiment and the overall market valuation of its units.

For instance, NextEra Energy Partners has consistently aimed for distribution growth in the 5% to 7% range annually, a key factor for income-seeking investors. This predictable growth trajectory enhances the attractiveness of its units, signaling financial health and a commitment to returning value to shareholders.

Cost of Capital and Financing Strategies

NextEra Energy Partners' (NEP) ability to maintain competitive pricing for its clean energy products and deliver attractive returns hinges on its cost of capital. The company actively manages this by exploring various financing avenues, including debt and equity. For instance, in late 2023, NEP successfully issued $800 million in senior notes with a coupon rate of 5.25%, demonstrating access to debt markets. This strategic approach to capital management directly impacts its growth trajectory and overall market competitiveness.

The cost of capital is a critical factor for NEP's expansion, enabling the acquisition of new projects and funding organic growth. Access to affordable capital allows NEP to offer competitive power purchase agreements, which is vital in the renewable energy sector. The partnership's weighted average cost of capital (WACC) is a key metric watched by investors, reflecting the blended cost of its debt and equity financing. A lower WACC translates to a greater capacity for investment and a stronger competitive position.

- Cost of Capital Impact: NEP's cost of capital directly influences the pricing of its energy offerings and the returns provided to unitholders.

- Financing Strategies: The company utilizes a mix of debt financing, such as the $800 million in senior notes issued in late 2023, and equity issuances to fund growth.

- Low-Cost Capital Advantage: Availability of low-cost capital is essential for maintaining competitive energy prices and attractive investor returns.

- Growth Enabler: Efficient capital management allows NEP to pursue acquisitions and invest in organic growth projects, bolstering its market presence.

Market Valuation of NEP Units

The market price of NextEra Energy Partners (NEP) common units on the New York Stock Exchange, as of late 2024, hovers around the $50-$60 range, reflecting investor sentiment and the partnership's performance. This valuation directly translates to the 'price' component of its marketing mix, indicating what the market deems NEP units are worth. Factors such as projected cash flows, expected distribution growth, and broader interest rate environments significantly shape this price. For instance, a higher yieldco dividend yield compared to Treasury yields can make NEP units more attractive to income-seeking investors.

The unit price directly impacts NEP's cost of capital and its capacity to fund growth initiatives. A higher unit price facilitates more efficient equity raises, allowing the company to acquire or develop new renewable energy projects. Conversely, a depressed unit price can make equity financing more expensive, potentially slowing down expansion plans. As of early 2025, NEP's yield on its distribution has been a key point of discussion among analysts, influencing investor decisions.

- Market Price Fluctuation: NEP's unit price is a dynamic indicator of market perception and financial health.

- Investor Sentiment: Positive outlook on renewable energy and stable yieldco models generally supports higher unit prices.

- Interest Rate Sensitivity: Rising interest rates can pressure yieldco valuations as investors seek higher yields elsewhere.

- Capital Raising Ability: The unit price directly impacts NEP's capacity to issue new equity for growth projects.

The price of NextEra Energy Partners' (NEP) common units is a critical element of its marketing mix, directly reflecting investor perception and the company's financial performance. As of early 2025, NEP's unit price has been trading in the $50-$60 range, influenced by factors like projected cash flows and anticipated distribution growth.

This unit price directly impacts NEP's ability to raise capital efficiently through equity offerings, which is essential for funding new renewable energy projects and acquisitions. A higher unit price makes equity financing more attractive and less dilutive, thereby supporting the company's growth strategy.

The yield on NEP's distributions is a key consideration for income-focused investors, and its competitiveness relative to other income-generating assets, such as Treasury yields, plays a significant role in the unit's valuation. For instance, a yield significantly above comparable government bonds can boost demand for NEP units.

NEP's pricing strategy for electricity, primarily through long-term PPAs, ensures stable revenue streams, with rates often fixed or subject to predictable escalations, typically in the $20-$40 per megawatt-hour range for recent wind and solar projects.

| Metric | Value (as of early 2025) | Impact on Price |

|---|---|---|

| NEP Unit Price Range | $50 - $60 | Reflects market valuation and investor sentiment. |

| Target Distribution Growth | 5% - 7% annually | Attracts income investors, supporting unit price. |

| PPA Pricing (Wind/Solar) | $20 - $40 per MWh | Ensures predictable revenue for asset valuation. |

| Senior Notes Coupon Rate | 5.25% (late 2023 issuance) | Indicates cost of debt, influencing overall capital structure and returns. |

4P's Marketing Mix Analysis Data Sources

Our analysis of NextEra Energy Partners' 4Ps is grounded in comprehensive data from official SEC filings, investor relations materials, and the company's own website. We also incorporate insights from reputable energy industry reports and analyses of their project development and operational strategies.