NextEra Energy Partners Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NextEra Energy Partners Bundle

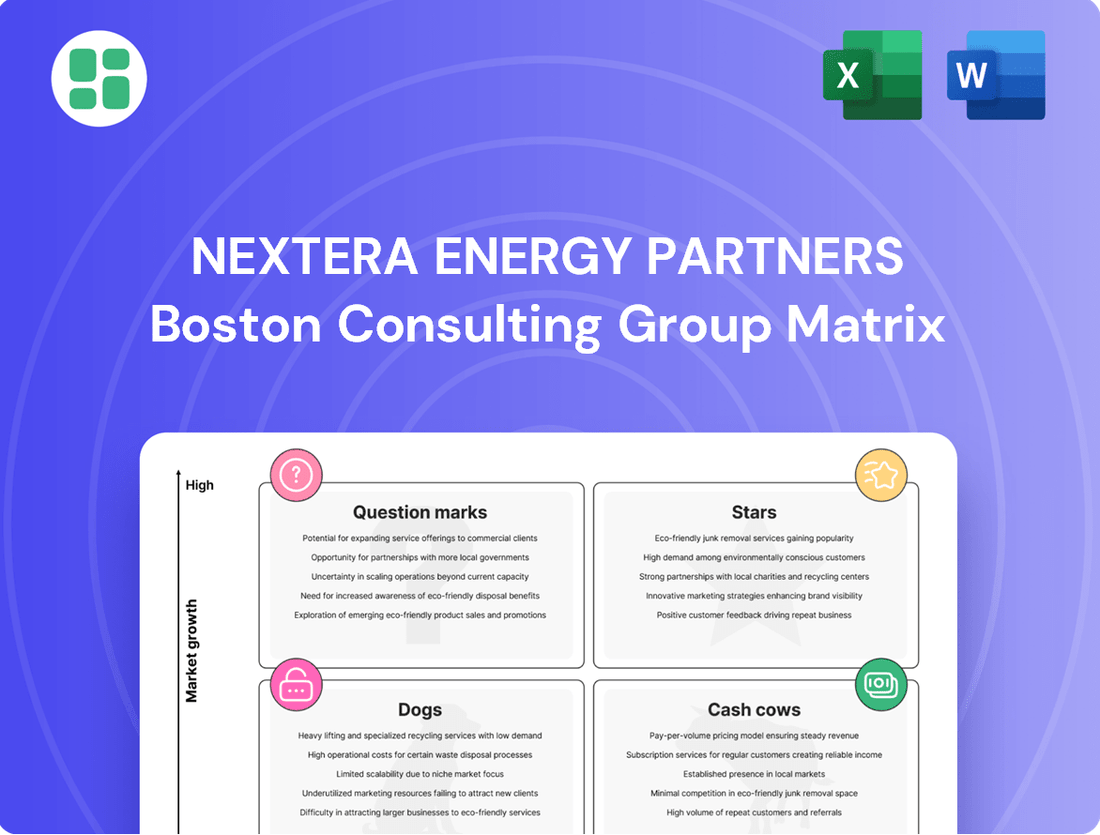

Curious about NextEra Energy Partners' strategic positioning? Our BCG Matrix analysis reveals a dynamic portfolio, highlighting key growth drivers and areas for optimization. Understand where its renewable energy assets and contracted generation stand in terms of market share and growth potential.

This preview offers a glimpse into NextEra Energy Partners' market standing. For a comprehensive understanding of its Stars, Cash Cows, Dogs, and Question Marks, and to unlock actionable strategies, purchase the full BCG Matrix report.

Stars

NextEra Energy Partners is strategically repowering its existing wind farms, a move designed to boost both the capacity and efficiency of these mature assets. This process involves replacing older turbines with cutting-edge technology, essentially generating new power from established locations, which is crucial in an expanding renewable energy sector.

The company has set ambitious goals, planning to repower around 1.3 gigawatts of wind projects by 2026. As of April 2024, approximately 1,085 megawatts of this total had already been announced, demonstrating tangible progress in this growth-focused initiative.

New solar-plus-storage projects are a significant star for NextEra Energy Partners (NEP). The market for renewable energy paired with storage is booming, with demand for reliable, dispatchable clean power growing rapidly. In 2024, NEP continued to expand its portfolio of these integrated solutions, recognizing their critical role in meeting evolving energy needs.

NextEra Energy Partners (NEP) strategically focuses on acquiring contracted clean energy assets, particularly in areas with strong renewable energy demand and favorable regulations. This approach is key to its growth.

While NEP isn't anticipating needing an acquisition in 2024 to hit its distribution growth goals, its relationship with NextEra Energy Resources (NEER) is a significant advantage. NEER, a global leader in renewable energy generation, provides NEP with a consistent pipeline of potential projects.

This access to NEER's development pipeline, which includes projects like the recently announced acquisition of a portfolio of wind and solar assets from NEER in late 2023, ensures NEP can pursue high-growth opportunities as they emerge. For instance, NEP's 2023 acquisitions from NEER contributed to its adjusted EBITDA growth, underscoring the importance of this strategic relationship.

Investment in Stand-Alone Battery Storage

Stand-alone battery storage projects represent a burgeoning high-growth sector in clean energy, essential for grid stability as renewable sources like solar and wind become more prevalent. NextEra Energy Partners' (NEP) investment in this area signals a strategic push into a market with substantial expansion opportunities and a chance to build considerable market share.

These battery assets are crucial for grid reliability, smoothing out the intermittent nature of renewables and enhancing the overall value of clean energy generation. For instance, by 2024, the U.S. Energy Information Administration (EIA) reported that battery storage capacity connected to the grid was projected to reach approximately 16 gigawatts, a significant increase from previous years, highlighting the rapid growth NEP is tapping into.

- Growth Potential: Stand-alone battery storage is a key growth area, driven by the need for grid flexibility with increasing renewable penetration.

- Strategic Importance: NEP's investment positions it to capture significant market share in this developing segment.

- Grid Services: These projects offer vital grid services, ensuring reliability and optimizing renewable energy output.

- Market Expansion: The U.S. battery storage capacity is rapidly expanding, with projections indicating substantial growth through 2024 and beyond, offering a fertile ground for NEP's investments.

Geographic Expansion in Untapped Renewable Markets

Geographic expansion into untapped renewable markets presents a significant opportunity for NextEra Energy Partners (NEP) to cultivate future stars. While its current focus is the U.S., identifying regions with robust renewable potential, supportive policies, and increasing energy demand, such as parts of Latin America or Southeast Asia, could unlock substantial growth. For instance, countries like Brazil, with its abundant solar and wind resources and a growing commitment to clean energy, offer a promising avenue. In 2024, Brazil continued to see significant investment in renewable energy projects, with solar power capacity expected to reach over 35 GW by the end of the year, and wind power exceeding 30 GW. This aligns with NEP's core competencies and could allow them to replicate their successful U.S. market entry strategy.

By strategically entering these nascent renewable markets, NEP can establish an early competitive advantage. This proactive approach allows for the acquisition of prime development sites and the formation of key partnerships before the markets become saturated. Consider the growing demand for renewable energy in emerging economies, driven by both environmental concerns and the need for reliable power. For example, in 2024, several Southeast Asian nations, including Vietnam and the Philippines, announced ambitious targets for renewable energy integration, with Vietnam alone aiming for 30% of its electricity to come from renewables by 2030. NEP's expertise in developing and operating large-scale wind and solar facilities makes it well-positioned to capitalize on these opportunities.

- Leveraging Policy Support: Targeting regions with clear government incentives and renewable energy mandates, such as feed-in tariffs or tax credits, can de-risk new market entries.

- Resource Assessment: Thoroughly evaluating wind speeds and solar irradiance in potential new territories ensures the viability of NEP's core project types.

- Demand Growth Alignment: Focusing on markets with projected increases in electricity consumption, particularly where renewables can displace fossil fuels, offers a strong demand-side driver.

- Early Market Share: Establishing a presence in markets with low current renewable penetration allows NEP to capture significant market share as demand grows.

New solar-plus-storage projects are a significant star for NextEra Energy Partners (NEP). The market for renewable energy paired with storage is booming, with demand for reliable, dispatchable clean power growing rapidly. In 2024, NEP continued to expand its portfolio of these integrated solutions, recognizing their critical role in meeting evolving energy needs.

Stand-alone battery storage projects represent a burgeoning high-growth sector in clean energy, essential for grid stability as renewable sources like solar and wind become more prevalent. NextEra Energy Partners' (NEP) investment in this area signals a strategic push into a market with substantial expansion opportunities and a chance to build considerable market share. By 2024, the U.S. Energy Information Administration (EIA) reported that battery storage capacity connected to the grid was projected to reach approximately 16 gigawatts, a significant increase from previous years, highlighting the rapid growth NEP is tapping into.

Geographic expansion into untapped renewable markets presents a significant opportunity for NextEra Energy Partners (NEP) to cultivate future stars. For instance, in 2024, Brazil continued to see significant investment in renewable energy projects, with solar power capacity expected to reach over 35 GW by the end of the year, and wind power exceeding 30 GW. NEP's expertise in developing and operating large-scale wind and solar facilities makes it well-positioned to capitalize on these opportunities.

| Star Category | Key Drivers | NEP's Strategic Focus | 2024 Market Insight |

|---|---|---|---|

| Solar-Plus-Storage | Growing demand for dispatchable clean power | Expanding integrated renewable and storage portfolio | Continued portfolio growth and project development |

| Stand-alone Battery Storage | Grid stability, renewable integration, market expansion | Investing in high-growth battery storage sector | U.S. grid-connected battery capacity projected around 16 GW |

| Geographic Expansion (e.g., Brazil) | Untapped renewable potential, supportive policies, energy demand | Entering new markets with strong renewable resources | Brazil's solar capacity >35 GW, wind capacity >30 GW (2024 est.) |

What is included in the product

This BCG Matrix analysis offers tailored insights into NextEra Energy Partners' portfolio, highlighting which units to invest in or divest.

The NextEra Energy Partners BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

NextEra Energy Partners' (NEP) mature, long-term contracted wind assets are classic cash cows. These established wind farms benefit from high market share in mature wind regions, providing a steady stream of predictable income thanks to their long-term power purchase agreements (PPAs).

As of September 30, 2024, NEP's portfolio of renewable energy and pipeline projects boasted a weighted average remaining contract term of roughly 13 years. This extended contract duration ensures consistent and reliable revenue generation from these wind assets, solidifying their cash cow status.

NextEra Energy Partners' (NEP) established solar generation facilities function as prime cash cows, much like their wind counterparts. These operational solar farms benefit from long-term power purchase agreements, ensuring stable and predictable revenue streams. In 2023, NEP reported that its contracted renewable energy portfolio, which includes a significant solar component, had a weighted average remaining contract term of approximately 13 years, highlighting the long-term revenue visibility.

These solar assets typically require minimal additional capital for continued operations, allowing them to generate substantial cash available for distribution to unitholders. Their established presence and efficient operations in key markets contribute to a high market share. The consistent performance of these facilities is a cornerstone of NEP's strategy to provide reliable distributions.

NextEra Energy Partners' (NEP) natural gas pipeline assets in Pennsylvania, although a smaller segment of its overall holdings, operate as cash cows. These assets are crucial for transporting natural gas, delivering steady and reliable cash flow. For instance, in the first quarter of 2024, NEP reported that its natural gas pipeline segment contributed significantly to its adjusted EBITDA, demonstrating its consistent revenue generation capabilities.

These pipelines are situated in a mature infrastructure market, offering stable, contracted revenue streams. While growth prospects are limited, their high reliability makes them dependable cash generators for the partnership. This stability is key to NEP's financial model, allowing for consistent distributions to unitholders.

NEP's strategic direction involves a shift towards a 100% renewable energy portfolio by 2025. This overarching goal implies that the Pennsylvania natural gas pipeline assets are currently being managed primarily for cash generation, with a potential future divestment on the horizon. This approach allows NEP to maximize the value of these existing assets while pursuing its renewable energy transition.

Fully Deleveraged Project-Level Assets

NextEra Energy Partners' (NEP) portfolio includes fully deleveraged project-level assets, which are essentially cash cows. These are projects that have either paid off all their debt or have very little debt remaining. This means they don't need to spend much money on debt payments.

Because these assets require less capital for debt servicing, they generate substantial free cash flow. This increased cash flow can then be distributed to unitholders, making them attractive investments. The stability of these income streams is further enhanced by the long-term, contracted nature of the underlying energy projects.

- Significant Free Cash Flow Generation: Fully deleveraged assets convert a larger portion of their revenue into free cash flow due to minimal debt servicing costs.

- Reliable Income Stream: Long-term, stable contracts for electricity generation provide predictable revenue, underpinning their cash cow status.

- Distribution Potential: The strong free cash flow allows for consistent and potentially growing distributions to investors.

Assets with Favorable Tax Equity Structures

Certain renewable energy projects within NextEra Energy Partners' (NEP) portfolio are classified as cash cows due to their favorable tax equity structures. These arrangements often involve significant upfront capital infusions or ongoing tax benefits, which substantially boost project economics and, consequently, their cash-generating capacity.

These projects, especially those that have been operational for some time and continue to leverage legacy tax incentives, are crucial for NEP. They provide a stable and predictable influx of cash, reinforcing the company's financial foundation.

- Tax Equity Benefits: These structures can significantly reduce a project's effective cost of capital.

- Predictable Cash Flow: Older projects with established tax benefits offer a reliable income stream.

- Contribution to NEP: Such assets are vital for funding growth initiatives and distributions.

NextEra Energy Partners' (NEP) mature wind and solar assets, underpinned by long-term power purchase agreements, function as robust cash cows. These established projects, with weighted average remaining contract terms of approximately 13 years as of late 2024, generate predictable and stable revenue streams. Their operational efficiency and established market presence minimize the need for significant capital reinvestment, allowing them to produce substantial free cash flow available for distributions to unitholders.

| Asset Type | Key Characteristic | Cash Flow Driver | Example Data (as of Q3 2024) |

|---|---|---|---|

| Wind Farms | Long-term PPAs, Mature Markets | Predictable Revenue, Low Reinvestment | Weighted Avg. Contract Life: ~13 Years |

| Solar Farms | Long-term PPAs, Established Operations | Stable Income, Minimal Operating Costs | Significant contribution to Adjusted EBITDA |

| Natural Gas Pipelines (PA) | Mature Infrastructure, Contracted Revenue | Reliable Cash Flow, Limited Growth | Consistent segment contribution to Adjusted EBITDA |

| Fully Deleveraged Assets | Low/No Debt | Maximized Free Cash Flow, High Distribution Potential | Reduced debt servicing costs enhance distributable cash |

Full Transparency, Always

NextEra Energy Partners BCG Matrix

The NextEra Energy Partners BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase, ensuring no surprises and complete readiness for your strategic planning.

This comprehensive BCG Matrix analysis of NextEra Energy Partners is the exact document you will download, offering a clear, actionable framework for evaluating their business segments without any watermarks or demo content.

What you see is the actual, professionally designed BCG Matrix for NextEra Energy Partners that you will own upon purchase, providing a robust tool for assessing their portfolio's growth potential and market share.

The preview accurately represents the final BCG Matrix report for NextEra Energy Partners that will be delivered to you, meticulously crafted for strategic insight and immediate application in your business decisions.

Dogs

Some older wind or solar projects within NextEra Energy Partners' (NEP) portfolio could be considered 'Dogs' if they are situated in less dynamic markets and are not meeting energy production targets or are incurring higher operational expenses. These assets might exhibit reduced capacity factors, encounter curtailment problems, or have contracts nearing expiration that are difficult to renegotiate on favorable terms.

For instance, while NEP's overall portfolio is robust, any specific older projects facing these challenges would naturally fall into the 'Dog' category. This could mean they are consuming capital without generating substantial returns, impacting overall portfolio efficiency. As of the first quarter of 2024, NEP reported a strong operational performance across its renewable assets, but the possibility of individual underperforming older projects remains a consideration in portfolio management.

Non-core, small-scale legacy assets within NextEra Energy Partners (NEP) represent older, smaller energy generation facilities that may no longer align with the company's strategic focus on large-scale, contracted clean energy projects. These might include older wind or solar farms with limited remaining operational life or smaller, less efficient conventional power assets.

For instance, if NEP still holds a portfolio of distributed generation assets or older transmission lines acquired in the past, these could fall into this category. Such assets often exhibit lower growth potential and might require significant capital for upgrades or maintenance, potentially diverting resources from more promising growth areas. By 2024, NEP's strategy has heavily emphasized expanding its portfolio of utility-scale renewable projects, making these smaller, legacy assets less of a priority.

Projects with contracts nearing expiration, especially those unlikely to be renewed at favorable rates, represent a significant concern for NextEra Energy Partners (NEP). These assets, potentially facing lower revenue growth and the risk of non-renewal, could become cash traps, only breaking even.

The ability of NEP to successfully extend, renew, or replace these expiring contracts at attractive terms is a critical risk factor. For instance, if a substantial portion of their contracted revenue base faces unfavorable renewal prospects, it could directly impact future cash flows and dividend sustainability.

Divested Texas Natural Gas Pipeline Portfolio

NextEra Energy Partners (NEP) divested its Texas natural gas pipeline portfolio for $1.815 billion. This strategic move aligns with NEP's classification of these assets as 'Dogs' within its current BCG Matrix context. The sale reflects a deliberate pivot towards a 100% renewable energy focus by 2025.

The divestment was also driven by the need to manage convertible equity portfolio financing (CEPF) obligations. These pipelines, while generating cash, were viewed as non-core with limited future growth potential for NEP. This action allowed NEP to escape potential capital traps and reorient its business strategy.

- Divestment Value: $1.815 billion received for the Texas natural gas pipeline portfolio.

- Strategic Rationale: Transition to a 100% renewable energy company by 2025.

- Financial Consideration: Addressing convertible equity portfolio financing (CEPF) obligations.

- BCG Classification: Assets deemed 'Dogs' due to limited future growth prospects for NEP.

Assets Facing Significant Regulatory Headwinds

Assets within NextEra Energy Partners (NEP) facing significant regulatory headwinds can be categorized as Dogs in a BCG Matrix analysis. These are assets, irrespective of their underlying technology, that encounter substantial and ongoing regulatory challenges or policy shifts which diminish their profitability and future growth prospects. For instance, changes in government incentives or subsidies for renewable energy projects, a core area for NEP, could materially and adversely impact operational performance. In 2024, the renewable energy sector continued to navigate evolving policy landscapes, with some regions seeing adjustments to tax credits or renewable portfolio standards that create uncertainty.

Such situations often result in a diminished market share or declining profitability, even within markets that are otherwise expanding. These assets become less desirable for long-term investment due to the persistent uncertainty and potential for negative financial impacts. For example, a specific solar farm project might experience reduced revenue streams if a state decides to phase out or significantly alter net metering policies, a crucial component for its economic viability. This regulatory risk can overshadow the asset's operational efficiency and market demand.

- Regulatory Uncertainty: Assets exposed to unpredictable changes in environmental regulations, tax policies, or energy market rules.

- Subsidy Dependence: Projects heavily reliant on government incentives that are subject to reduction or elimination.

- Policy Shifts: Investments in technologies or regions where government policy is actively moving against their favor.

- Impact on Profitability: These factors can lead to lower-than-expected cash flows and hinder the asset's ability to generate consistent returns.

NextEra Energy Partners (NEP) has strategically divested its Texas natural gas pipeline portfolio for $1.815 billion. This move clearly aligns with classifying these assets as 'Dogs' within its BCG Matrix, reflecting a deliberate pivot towards a 100% renewable energy focus by 2025.

These pipelines, though cash-generating, were deemed non-core with limited future growth potential for NEP, allowing the company to avoid potential capital traps and reorient its strategy. The divestment also helped address convertible equity portfolio financing obligations.

This action highlights NEP's commitment to streamlining its portfolio and focusing resources on high-growth renewable energy projects. By shedding these 'Dog' assets, NEP positions itself for greater efficiency and enhanced future returns in its core business.

| Asset Category | BCG Classification | Strategic Action | Rationale | Key Financials (2024 Context) |

|---|---|---|---|---|

| Texas Natural Gas Pipelines | Dogs | Divested | Non-core, limited growth, capital trap avoidance | $1.815 billion divestment value; addressed CEPF obligations |

| Older Renewable Projects (specific cases) | Dogs | Potential optimization or sale | Lower capacity factors, higher O&M, expiring contracts | Focus on improving efficiency of remaining portfolio |

| Legacy Small-Scale Assets | Dogs | De-prioritized, potential divestment | Not aligned with utility-scale renewable focus, lower growth | Shifted capital towards large-scale projects |

Question Marks

While not currently listed as a direct asset for NextEra Energy Partners (NEP), its sponsor, NextEra Energy, is actively engaged in the burgeoning green hydrogen sector. If NEP were to allocate capital towards early-stage green hydrogen production facilities, these would likely be classified as question marks within the BCG matrix.

The green hydrogen market presents a compelling high-growth opportunity, but its current market share remains low. This is primarily due to the nascent stage of the technology and the significant associated costs. For instance, in 2024, the global green hydrogen market was valued at approximately $2.5 billion, with projections indicating substantial growth, but it still represents a small fraction of the overall energy market.

Investing in these early-stage projects would necessitate considerable capital expenditure to achieve scalability and establish a dominant market position. The returns on such investments are currently uncertain, reflecting the inherent risks associated with developing and commercializing a new energy technology. The cost of producing green hydrogen, for example, can range from $3 to $8 per kilogram, a figure that needs to decrease significantly for widespread adoption.

Investing in pilot or demonstration projects for emerging clean energy technologies like advanced geothermal or ocean energy would position these as Question Marks for NextEra Energy Partners. These ventures tap into high-growth potential markets but currently hold minimal market share, necessitating significant capital for R&D and scaling.

The inherent uncertainty in their success means these projects could either transform into Stars with substantial investment or decline into Dogs if they fail to gain traction. For instance, the global ocean energy market, while projected to reach $5.7 billion by 2030, still faces technological and cost challenges, mirroring the risk profile of a Question Mark.

Entering new international renewable energy markets, where NextEra Energy Partners (NEP) currently has no operations, would position it as a Question Mark in the BCG matrix. These markets often present substantial growth potential, driven by increasing demand for clean energy and supportive government policies. For instance, by mid-2024, many European nations were accelerating their renewable energy targets, creating attractive new opportunities.

However, NEP would enter these markets with a nascent market share, facing established competitors and potentially navigating complex regulatory environments. The initial investment required to build infrastructure, secure project pipelines, and establish brand recognition could be considerable. For example, developing a new wind farm in a European country might require hundreds of millions of dollars in upfront capital, a significant outlay for a new entrant.

Aggressive Expansion into Untested Energy Storage Applications

Aggressive expansion into untested energy storage applications, such as commercial-scale flow batteries or compressed air energy storage, would position NextEra Energy Partners (NEP) in a high-growth, but high-risk segment. While these technologies promise significant market potential, their commercial viability and widespread adoption are still in early stages. This means NEP would likely face low initial market share coupled with substantial investment requirements, characteristic of a question mark in the BCG matrix.

The global long-duration energy storage market is projected to reach hundreds of billions of dollars by the early 2030s, but current penetration rates for technologies beyond lithium-ion are modest. For instance, while flow batteries offer advantages for grid-scale applications, their upfront costs and efficiency compared to established technologies remain a hurdle. Compressed air energy storage (CAES) also faces geographical limitations and high capital expenditures for new projects.

- High Growth Potential: Emerging storage technologies cater to a growing demand for grid stability and renewable energy integration, offering substantial future revenue streams.

- Unproven Commercial Viability: Many advanced storage solutions are still maturing, with uncertainties surrounding their long-term operational costs, reliability, and scalability.

- Significant Investment Risk: Ventures into these nascent markets require considerable capital outlay with no guarantee of market acceptance or profitability, aligning with the high risk of question mark assets.

- Low Initial Market Share: As a first mover or early adopter in these less developed segments, NEP would likely capture only a small fraction of the market initially.

Repowering Projects with Uncertain Performance Upside

Repowering projects for NextEra Energy Partners, while generally falling into the Star category due to the growing renewable energy market, can face challenges. If a specific repowering project experiences uncertain performance gains or incurs higher-than-expected costs, it could be classified as a Question Mark.

These situations arise when the projected increase in energy output or cost savings from the repowering effort doesn't materialize as anticipated. This can be due to unforeseen technical complexities during the upgrade or escalating equipment and installation expenses. For instance, if a project aiming for a 15% efficiency boost only achieves 5% due to turbine compatibility issues, its future cash flow projections would be significantly impacted.

- Uncertainty in Performance Upside: Projects where the actual energy output improvement post-repowering is not guaranteed, potentially falling short of initial projections.

- Higher-Than-Anticipated Costs: Instances where the capital expenditure for repowering significantly exceeds the budget, impacting the project's profitability and return on investment.

- Market Share of Improved Capacity: The project might be in a growing market for renewable energy upgrades, but its specific share of this 'improved capacity' could be lower than expected due to these performance or cost issues.

- Strategic Evaluation Needed: Such projects require careful analysis to determine if continued investment is warranted or if divestment is a more prudent strategy if performance targets are not met.

Question Marks for NextEra Energy Partners (NEP) represent investments in high-growth potential areas where the company currently holds a low market share. These ventures require substantial capital and carry inherent risks, making their future success uncertain. For example, NEP's potential involvement in emerging energy storage technologies or new international renewable energy markets would fit this classification.

The green hydrogen sector, while experiencing rapid growth, remains a nascent market with significant cost barriers. In 2024, its global market value was around $2.5 billion, a small fraction of the overall energy landscape, highlighting its Question Mark status. Similarly, advanced geothermal or ocean energy projects, despite their high growth potential, face technological hurdles and require considerable R&D investment.

Entering new international renewable energy markets by mid-2024 presented NEP with significant growth prospects but also low initial market share and substantial upfront capital needs, typical of a Question Mark. The global long-duration energy storage market, projected for massive growth, also features technologies with modest current penetration rates, demanding significant investment for competitive positioning.

Even repowering projects can become Question Marks if performance gains are uncertain or costs escalate beyond projections, impacting their viability. These situations demand careful strategic evaluation to determine the best path forward.

BCG Matrix Data Sources

Our NextEra Energy Partners BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.