Nabors SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nabors Bundle

Nabors' robust operational efficiency and extensive fleet are clear strengths, but rising energy prices present a significant opportunity they can leverage. However, the company faces challenges with technological adoption and a competitive market landscape.

Want the full story behind Nabors' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Nabors Industries Ltd. boasts a formidable global presence, operating in over 20 countries with one of the world's largest land-based drilling rig fleets. This extensive international footprint, particularly strong in regions like the Middle East and Latin America, significantly diversifies its revenue streams and acts as a crucial hedge against localized market downturns. For instance, Nabors secured new rig contracts in Argentina, Colombia, and Kuwait during 2024, reinforcing its commitment to international growth and market penetration.

Nabors stands out as a leader in energy technology, excelling in drilling, engineering, automation, data science, and manufacturing. This deep technological expertise allows them to offer cutting-edge solutions across the energy sector.

The company's dedication to innovation is clearly demonstrated through products like SmartDRILL® automation and RigCLOUD. Furthermore, their forward-thinking approach is visible in their energy transition offerings, such as the PowerTAP modules designed for electrification, highlighting their commitment to a sustainable future.

These technological advancements directly translate into tangible benefits for operations. They significantly boost efficiency, minimize environmental footprints, and elevate safety protocols, solidifying Nabors' position as a frontrunner in the industry.

Nabors' strategic partnership with Saudi Aramco through their joint venture, SANAD, is a cornerstone strength. This collaboration allows Nabors to directly support its major customer’s ambitious expansion initiatives, including the construction of new rigs, ensuring sustained demand for its services.

The SANAD venture is designed to deliver long-term contract stability and a robust return on Nabors' invested capital. This strategic alignment is projected to significantly boost Nabors' EBITDA contributions and generate substantial cash flow, underscoring the immense value derived from these key collaborations.

Comprehensive Service Offerings

Nabors Industries distinguishes itself with a broad spectrum of services that extend well beyond traditional land-based drilling rigs. The company provides essential rig equipment, advanced drilling instrumentation software, specialized directional drilling services, and innovative performance tools and technologies. This integrated approach allows Nabors to offer a complete drilling solution, optimizing operations for clients globally across both land and offshore environments.

This comprehensive service portfolio is a significant strength, enabling Nabors to capture more value from each project and offer tailored solutions. For instance, in 2023, Nabors reported that its integrated solutions, which bundle rig services with advanced technologies, contributed significantly to improved customer drilling efficiency. The company's focus on technology integration, including its proprietary drilling optimization software, aims to reduce non-productive time and enhance overall wellbore quality, a key differentiator in a competitive market.

- Integrated Drilling Solutions: Offering a full suite from rigs to software and directional services.

- Technological Advancement: Development and deployment of proprietary performance tools and instrumentation.

- Global Reach: Ability to cater to diverse drilling needs across land and offshore operations worldwide.

- Operational Optimization: Focus on enhancing drilling efficiency and reducing downtime for clients.

Focus on Sustainability and Decarbonization

Nabors demonstrates a significant commitment to sustainability and decarbonization, a key strength in today's energy landscape. The company is actively pursuing initiatives aimed at reducing its carbon footprint, including the electrification of drilling rigs and investments in advanced technologies. For instance, their Red Zone Robotics (RZR and RZR-Lite) systems not only boost operational efficiency and safety but also contribute to minimizing environmental impact.

This strategic focus on sustainability aligns Nabors with the accelerating global energy transition. By prioritizing emissions reduction and integrating cleaner energy solutions, the company is positioning itself for long-term viability and a stronger market reputation. This proactive approach is crucial as stakeholders increasingly demand environmentally responsible operations from energy service providers.

Nabors' dedication to these principles is reflected in tangible progress:

- Electrification of Rigs: Nabors is actively working to power its rigs with electricity, reducing reliance on diesel engines and lowering direct emissions.

- Advanced Robotics: Investments in systems like RZR and RZR-Lite enhance operational precision, leading to less waste and improved energy utilization.

- Alignment with ESG Goals: The company's sustainability efforts directly support Environmental, Social, and Governance (ESG) objectives, making it more attractive to investors and partners focused on responsible energy development.

Nabors' extensive global footprint, operating in over 20 countries, provides significant revenue diversification and resilience against regional market volatility. Its advanced technological capabilities, particularly in automation and data science, position it as an industry leader in providing efficient and safe drilling solutions.

What is included in the product

Analyzes Nabors’s competitive position through key internal and external factors, detailing its strengths in advanced drilling technology and market share, while also identifying weaknesses in debt levels and opportunities in energy transition services, alongside threats from commodity price volatility and regulatory changes.

Offers a clear, actionable framework to identify and address critical operational challenges in the oil and gas sector.

Weaknesses

Nabors' reliance on the oil and gas industry makes it inherently vulnerable to the wild swings in commodity prices. These prices are a rollercoaster, influenced by everything from global supply and demand to international politics and new government rules. When oil and gas prices drop, it directly hits Nabors' bottom line, reducing drilling activity, revenue, and overall profits.

The impact of this volatility was clearly seen in 2024. With West Texas Intermediate (WTI) crude oil prices facing pressure and natural gas prices hitting historic lows, the economic incentive for companies to launch new drilling projects significantly diminished. This directly affected Nabors' operational tempo and financial performance.

Nabors Industries faces substantial capital expenditure demands, notably for its newbuild initiatives, such as those conducted through the SANAD joint venture. These significant investments are a key weakness, as they require substantial upfront capital.

For the years 2025 and 2026, S&P projects annual capital expenditures to range between $725 million and $775 million. This level of spending directly impacts the company's ability to generate free cash flow, potentially compressing it significantly.

The necessity for such heavy investment can constrain Nabors' financial flexibility. This, in turn, could lead to periods of negative free operating cash flow, making it harder to pursue other strategic opportunities or return capital to shareholders.

Nabors faces significant headwinds in the U.S. Lower 48 market, where declining daily rig margins and rising operational costs are a persistent issue. This is exacerbated by high churn rates and fluctuating activity levels, leading to operational inefficiencies. For instance, while leading-edge rig pricing remained stable, the average U.S. rig count saw a decrease in 2024, signaling weaker demand and heightened competition.

High Debt Levels and Refinancing Risks

Nabors carries a substantial debt burden, with long-term debt standing at approximately $2.69 billion as of March 2025. This level of indebtedness presents a significant weakness, as it can strain cash flow and limit financial flexibility.

The company faces heightened refinancing risk, a concern highlighted by S&P Global Ratings' revision of Nabors' outlook to negative. This outlook adjustment specifically points to the challenges associated with maturing debt, including $700 million in notes due in May 2027 and $390 million in notes due in January 2028.

The ability to successfully refinance these upcoming maturities at favorable terms is crucial for Nabors' financial stability. A failure to do so could lead to significant liquidity constraints, potentially impacting the company's operational capacity and future investment plans.

- Significant Debt Load: Nabors' long-term debt reached roughly $2.69 billion by March 2025.

- Refinancing Concerns: S&P Global Ratings has flagged increased refinancing risk, impacting Nabors' outlook.

- Key Maturities: Major debt maturities include $700 million in May 2027 and $390 million in January 2028.

- Liquidity Risk: Unfavorable refinancing could result in liquidity challenges for the company.

Geopolitical and Regulatory Risks

Geopolitical shifts and evolving regulatory landscapes present significant challenges for Nabors. For instance, the suspension of operations in Russia due to geopolitical events directly impacted the company's international segment. Tariff uncertainties and broader impacts on the global economy can also create unpredictable headwinds, affecting Nabors' financial performance and strategic planning.

These external factors can lead to disruptions in supply chains, increased operating costs, and a more volatile demand for drilling services. The company's exposure to various international markets means it must constantly adapt to changing political climates and trade policies, which can influence capital expenditure decisions by clients.

- Geopolitical Events: Nabors' withdrawal from Russia in response to the 2022 invasion of Ukraine led to the write-down of assets and a reduction in its international rig fleet.

- Regulatory Changes: Evolving environmental regulations in key operating regions could necessitate additional capital investment in emissions control technology for its rig fleet.

- Trade Policy: Increased tariffs on imported equipment or materials could raise Nabors' operational costs, impacting its cost competitiveness.

- Sanctions: Expanded U.S. sanctions on certain countries could further limit Nabors' ability to operate or secure new contracts in those regions.

Nabors' significant debt load, with long-term debt around $2.69 billion as of March 2025, limits financial flexibility and strains cash flow. This is compounded by refinancing risks, as highlighted by S&P Global Ratings' negative outlook, particularly concerning $700 million in notes due May 2027 and $390 million in January 2028. Failure to secure favorable refinancing could lead to liquidity issues, impacting operations and future investments.

| Debt Item | Amount (USD Billions) | Maturity |

|---|---|---|

| Long-Term Debt (as of March 2025) | 2.69 | N/A |

| Notes Due | 0.70 | May 2027 |

| Notes Due | 0.39 | January 2028 |

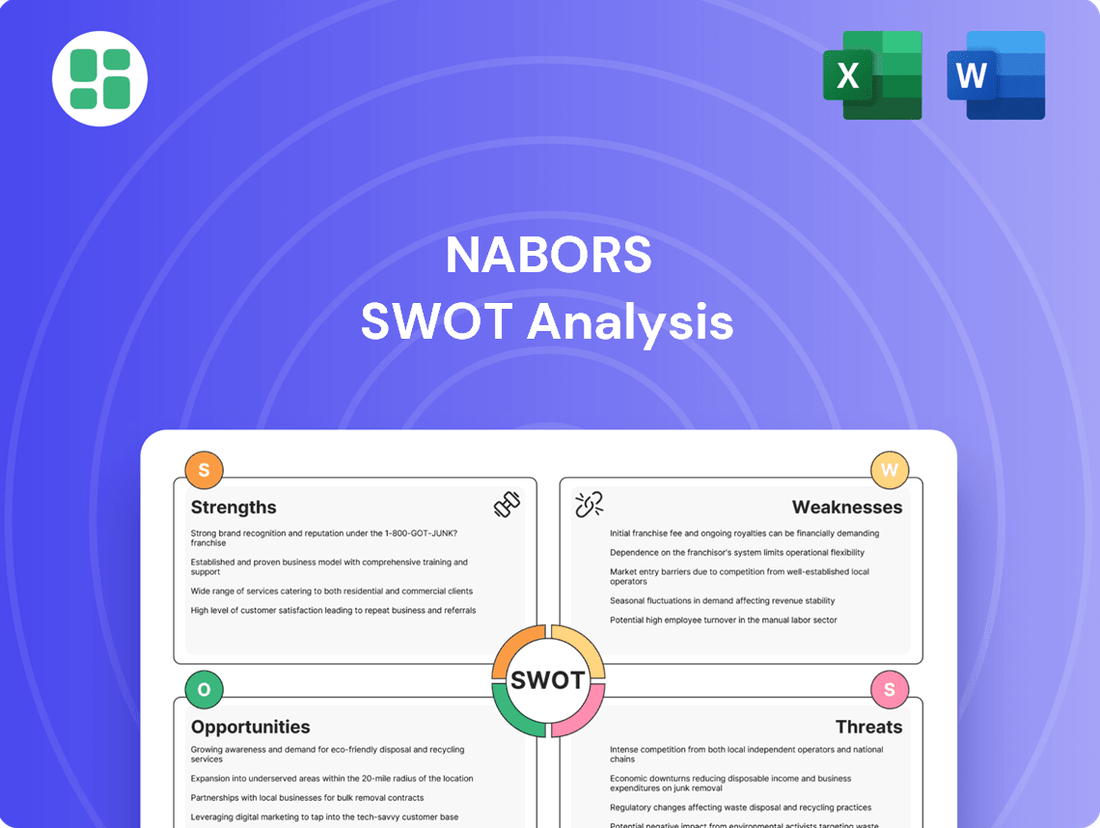

Preview Before You Purchase

Nabors SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Nabors SWOT analysis, offering a clear snapshot of its strategic positioning.

The content below is pulled directly from the final Nabors SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights into their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Nabors sees substantial growth opportunities by expanding its operations in key international markets. Regions such as Saudi Arabia, Argentina, Colombia, Kuwait, and Algeria are particularly attractive for further rig deployment.

The company is strategically positioning itself to capitalize on these international prospects. Nabors intends to deploy additional rigs in these areas, building upon existing contracts and actively seeking new business awards to fuel this expansion.

This international push is anticipated to yield significant financial benefits. The expansion is projected to result in higher profit margins, effectively counterbalancing any potential headwinds or slowdowns experienced in the U.S. domestic market.

The increasing integration of automation, artificial intelligence (AI), and smart technologies within the oil and gas sector represents a significant opportunity for Nabors. These advancements enable real-time operational monitoring, drive down expenses, boost overall efficiency, and elevate safety standards. By embracing these innovations, Nabors can deliver superior, state-of-the-art solutions to its clientele, thereby solidifying its competitive advantage in the market.

The global market for AI in the oil and gas industry is experiencing robust expansion. Projections indicate continued growth, with some analyses suggesting the market could reach billions of dollars by the mid-2020s, driven by the demand for optimized production and predictive maintenance. Nabors' investment in these technologies positions it to capitalize on this expanding market, offering enhanced drilling services that meet the evolving needs of energy producers.

Nabors is well-positioned to benefit from the global shift towards decarbonization. The company's ongoing investments in energy efficiency and emissions reduction technologies are directly aligned with the growing demand for sustainable energy solutions. For example, Nabors' commitment to reducing its operational greenhouse gas emissions by 25% by 2025 compared to a 2017 baseline provides a tangible measure of its progress in this area.

The company's strategic focus on expanding into geothermal energy and electrification of its rig fleet presents significant growth opportunities. These initiatives not only cater to the increasing market for low-carbon energy sources but also open up new revenue streams and business models. Nabors' successful pilot projects in geothermal drilling, demonstrating improved efficiency and reduced environmental impact, underscore the viability of these new ventures.

Acquisition Synergies and Integration

The acquisition of Parker Wellbore is a significant opportunity for Nabors, projected to yield substantial cost synergies. Nabors anticipates realizing $40 million in cost synergies by 2025, a testament to the strategic integration of operations. This move is poised to strengthen Nabors' Drilling Solutions segment and elevate its standing in the energy technology landscape.

The integration of Parker Wellbore's capabilities opens doors for a broader spectrum of services and increased market penetration. This strategic alignment allows Nabors to leverage combined expertise and resources, fostering innovation and competitive advantage in the evolving energy sector.

- Cost Synergies: Nabors expects to achieve $40 million in cost synergies in 2025 following the Parker Wellbore acquisition.

- Segment Enhancement: The acquisition bolsters the Drilling Solutions segment, improving Nabors' competitive position.

- Market Expansion: This integration provides opportunities for expanded service offerings and a wider market reach in energy technology.

Increased Demand for Natural Gas Drilling

The global appetite for natural gas is on the rise, creating a significant opportunity for companies like Nabors. This surge is largely fueled by expanding liquefied natural gas (LNG) export markets and the ever-increasing power needs of data centers. For instance, in 2024, global LNG trade reached record levels, with projections indicating continued growth through 2025 as new export facilities come online.

This favorable market dynamic is underscored by major players. Saudi Aramco, a key energy producer, is strategically increasing its investment in natural gas development, signaling a broader industry trend. Nabors itself has secured newbuild awards for rigs specifically designed for gas drilling, demonstrating their preparedness to capitalize on this demand. These awards position Nabors to benefit from the anticipated increase in drilling activity throughout 2024 and into 2025.

The opportunity for increased natural gas drilling can be summarized as follows:

- Growing Global Demand: Natural gas consumption is expanding, driven by its role as a cleaner-burning fuel and its increasing use in power generation and industrial processes.

- LNG Export Expansion: Significant investments in new LNG export terminals globally are creating a robust demand for natural gas supply, necessitating increased upstream drilling.

- Data Center Power Needs: The rapid growth of the data center industry requires substantial and reliable power, with natural gas often serving as a primary or backup energy source.

- Industry Investment Trends: Major energy companies, like Saudi Aramco, are prioritizing natural gas, while Nabors' recent rig awards for gas-capable equipment highlight the industry's focus on this sector.

Nabors is strategically expanding its international presence, targeting growth in markets like Saudi Arabia and Argentina, with plans to deploy additional rigs to capitalize on existing and new contracts. This global push is expected to enhance profit margins, providing a counterbalance to potential U.S. market fluctuations.

The company is embracing technological advancements, integrating AI and automation to improve drilling efficiency, reduce costs, and elevate safety standards. This focus on smart technologies positions Nabors to offer superior solutions in a market where AI in oil and gas is projected for significant growth through 2025.

Nabors is also aligning with the global decarbonization trend by investing in energy efficiency and emissions reduction, aiming for a 25% reduction in greenhouse gas emissions by 2025 from a 2017 baseline. Furthermore, the company is exploring new revenue streams through geothermal energy and rig electrification, with successful pilot projects already demonstrating viability.

The acquisition of Parker Wellbore is a key opportunity, projected to deliver $40 million in cost synergies by 2025, strengthening Nabors' Drilling Solutions segment and expanding its market reach in energy technology.

The increasing global demand for natural gas, driven by LNG exports and data center power needs, presents a significant opportunity. Nabors' recent rig awards for gas drilling underscore its readiness to meet this growing demand through 2024 and 2025.

| Opportunity Area | Key Driver | Projected Impact |

|---|---|---|

| International Expansion | Targeted rig deployment in Saudi Arabia, Argentina | Enhanced profit margins, U.S. market counterbalance |

| Technology Integration | AI, automation in drilling | Improved efficiency, cost reduction, safety elevation |

| Decarbonization & New Energy | Emissions reduction, geothermal, electrification | Alignment with sustainability trends, new revenue streams |

| Parker Wellbore Acquisition | Cost synergies, segment enhancement | $40M cost synergies by 2025, stronger market position |

| Natural Gas Demand | LNG exports, data center growth | Increased drilling activity, new rig awards |

Threats

The most significant challenge Nabors faces is the unpredictable nature of oil and gas prices. When prices drop, exploration and production companies tend to cut back on spending, directly impacting Nabors' demand for drilling services.

For example, during periods of low oil prices, such as those seen in late 2023 and early 2024, drilling activity often slows. This directly translates to lower rig utilization for Nabors, impacting revenue and profitability. The International Energy Agency (IEA) projected in their November 2023 oil market report that while demand was expected to grow, price volatility remained a key concern for the industry's investment outlook.

The oilfield services sector is notoriously competitive, with Nabors facing significant pressure from numerous players, especially in the U.S. Lower 48 market where drilling capacity often outstrips demand. This intense competition translates into downward pressure on day rates and rig utilization, directly impacting Nabors' revenue streams and profitability.

A significant headwind for Nabors is the projected slowdown in upstream capital spending. S&P Global anticipates a 5% to 10% contraction in U.S. upstream capital expenditures for 2025. This directly translates to reduced demand for the drilling services Nabors provides.

This cautious spending by oil and gas operators, driven by fluctuating commodity prices and ongoing industry consolidation, presents a substantial threat to Nabors' business, particularly its domestic market segment.

Regulatory Changes and Environmental Policies

Increasing regulatory scrutiny and evolving environmental policies, particularly those targeting carbon emissions, present a significant threat. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine methane emission standards for oil and natural gas operations, which could necessitate costly upgrades to Nabors' fleet and operational procedures. These evolving regulations can lead to higher compliance costs and operational complexities.

A rapid energy transition away from fossil fuels poses a long-term demand risk for traditional oil and gas drilling services. While the International Energy Agency (IEA) projects continued, albeit moderating, demand for oil and gas through 2030, the pace of renewable energy adoption and technological advancements in alternative energy sources could accelerate this decline sooner than anticipated. This shift could reduce the need for Nabors' core services.

- Stricter Emissions Standards: New or enhanced regulations on methane and CO2 emissions may require significant capital investment in Nabors' rig fleet for compliance.

- Carbon Pricing Mechanisms: The implementation or expansion of carbon taxes or cap-and-trade systems could increase operating expenses for companies involved in fossil fuel extraction.

- Shifting Investor Sentiment: Growing investor focus on Environmental, Social, and Governance (ESG) factors may lead to reduced capital availability for companies heavily reliant on traditional drilling.

- Accelerated Energy Transition: A faster-than-expected shift to renewable energy sources could materially impact the long-term demand for oil and gas, affecting Nabors' market size.

Geopolitical Instability and Sanctions

Geopolitical instability, particularly the ongoing conflict in Eastern Europe and subsequent sanctions, poses a significant threat to Nabors Industries. For instance, the company has had to navigate the complexities of operating in regions affected by sanctions, which can lead to operational disruptions and financial penalties. These geopolitical events introduce considerable uncertainty into the business environment, potentially impacting Nabors' ability to secure and execute contracts in affected areas.

The imposition of international sanctions can directly hinder Nabors' operations. This can manifest as the suspension of activities in certain markets, as seen with the impact of sanctions on operations in Russia. Such disruptions not only halt revenue generation but can also lead to the loss of existing contracts and make it challenging to enter or maintain a presence in key regions, directly affecting the company's global reach and profitability.

The financial ramifications of geopolitical instability and sanctions can be substantial. Nabors may face direct financial penalties or incur significant costs to comply with evolving sanctions regimes. Furthermore, the broader economic impact of geopolitical tensions, such as fluctuating energy prices and supply chain disruptions, can indirectly affect demand for drilling services, creating a challenging operating landscape.

- Sanctions Impact: Nabors has had to manage operations impacted by sanctions, particularly those affecting regions like Russia, leading to operational challenges.

- Contractual Uncertainty: Geopolitical events create uncertainty around contract continuity and the ability to secure new business in affected territories.

- Regional Limitations: Sanctions can restrict Nabors' operational footprint, limiting its ability to serve clients in strategically important markets.

- Financial Penalties: Non-compliance with sanctions or the costs associated with navigating them can result in direct financial penalties and increased operational expenses.

Intense competition, particularly in the U.S. Lower 48, exerts downward pressure on day rates and rig utilization, directly impacting Nabors' revenue. The projected contraction in U.S. upstream capital expenditures for 2025, estimated by S&P Global to be between 5% and 10%, signifies reduced demand for Nabors' core services. Furthermore, evolving environmental regulations and the long-term risk of an accelerated energy transition away from fossil fuels present significant headwinds, potentially requiring costly fleet upgrades and diminishing the overall market for traditional drilling.

SWOT Analysis Data Sources

This Nabors SWOT analysis is built upon a foundation of robust data, including their official financial filings, comprehensive market intelligence reports, and insights from industry experts. These sources provide a well-rounded view of the company's operational landscape and strategic positioning.