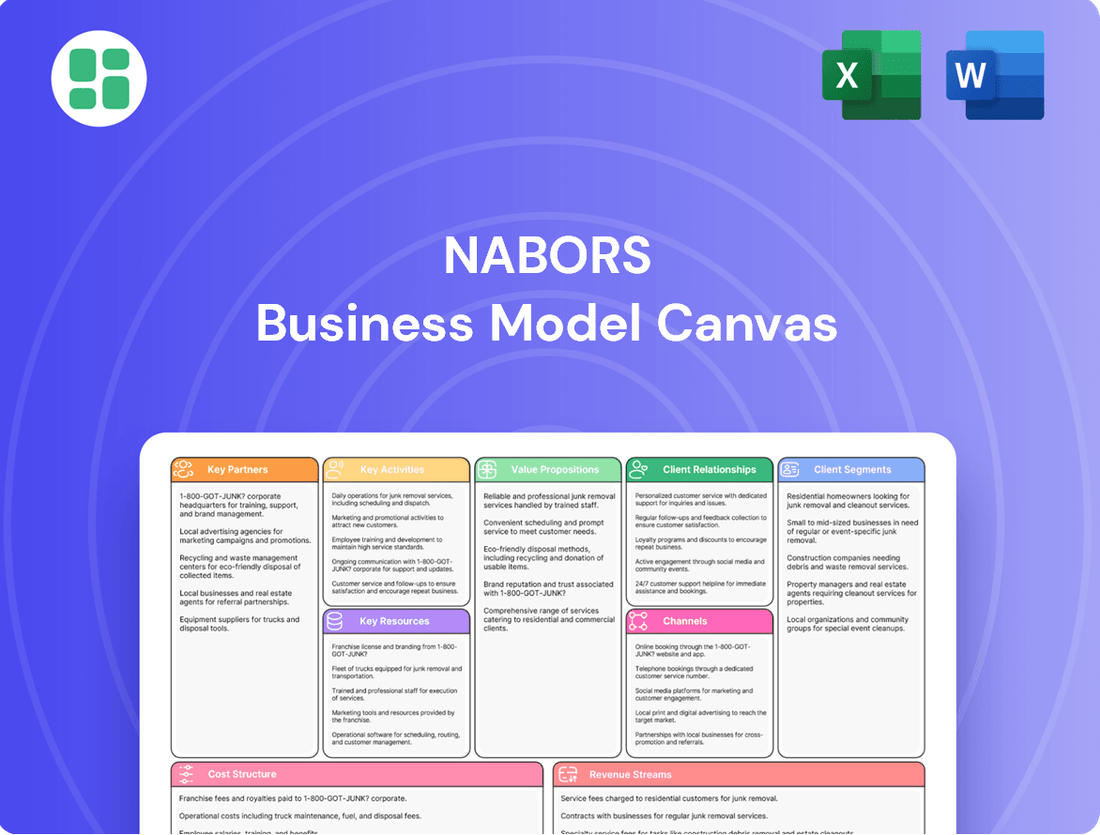

Nabors Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nabors Bundle

Unlock the strategic brilliance behind Nabors's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market success.

Discover the intricate workings of Nabors's business model, from their core activities to their cost structure. This in-depth canvas is your key to understanding how they deliver value and maintain a competitive edge.

Ready to gain a competitive advantage? Download the full Nabors Business Model Canvas to see exactly how they structure their value proposition, key partnerships, and channels. It's the perfect tool for strategic analysis and inspiration.

Partnerships

Nabors' strategic alliance with Saudi Aramco, through its SANAD joint venture, is a cornerstone of its business model. This partnership is set to introduce 50 new rigs over a decade, significantly boosting Nabors' operational capacity and market presence in a crucial international region.

This collaboration provides Nabors with a substantial foundation of long-term contracts, securing a predictable and stable revenue stream. The SANAD venture is a key growth engine, with projections indicating a doubling of its contribution to adjusted EBITDA between 2024 and 2025, underscoring its financial importance.

Nabors actively partners with leading technology providers such as SLB and Corva AI to drive the widespread adoption of drilling automation. These alliances are crucial for accelerating Nabors' digital transformation initiatives within the drilling sector.

These collaborations focus on integrating Nabors' proprietary SmartROS® rig operating system with its partners' advanced platforms. The goal is to significantly boost well construction performance and overall operational efficiency.

A key development in 2025 was the expansion of the strategic alliance with Corva AI, announced in April. This move underscores Nabors' commitment to rapidly advancing digital innovation in its operations.

Nabors relies on strategic acquisition and integration partners to expand its operational capabilities and market reach. A prime example is the successful acquisition of Parker Wellbore, finalized in March 2025, which brought valuable complementary businesses like Quail Tools and additional drilling rigs into Nabors' fold.

This integration is projected to unlock substantial cost synergies and bolster free cash flow generation for Nabors. The merger received shareholder approval in the fourth quarter of 2024, paving the way for its completion in the first quarter of 2025.

Equipment and Service Providers

Nabors relies on key partnerships with equipment and service providers to enhance its drilling operations. Collaborations with companies like KCF Technologies are crucial for implementing advanced predictive maintenance on drilling rigs. This partnership directly contributes to improved operational uptime and efficiency, benefiting mutual customers by reducing unexpected downtime.

Another significant partnership is with Halliburton. Together, Nabors and Halliburton have demonstrated the potential of integrated digital solutions by achieving fully automated surface and subsurface drilling operations in Oman. This showcases a commitment to leveraging technology for more streamlined and efficient drilling processes.

- KCF Technologies: Enhances predictive maintenance for drilling rigs, boosting operational uptime.

- Halliburton: Achieved fully automated drilling operations in Oman, highlighting digital solution integration.

Energy Transition Initiative Partners

Nabors actively partners with geothermal innovators such as Sage Geosystems. This collaboration is key to developing and deploying advanced geothermal drilling technologies, a significant step in Nabors' energy transition strategy.

The company is also exploring opportunities in the burgeoning hydrogen sector. These explorations signal Nabors' commitment to diversifying its energy portfolio beyond conventional oil and gas operations.

These strategic alliances are fundamental to Nabors' objective of advancing its lower-carbon energy solutions. By working with pioneers in geothermal and hydrogen, Nabors aims to build a more sustainable and diversified business model.

- Geothermal Advancement: Partnerships like the one with Sage Geosystems are critical for Nabors to leverage cutting-edge drilling techniques for geothermal energy projects, aiming to unlock new revenue streams.

- Hydrogen Exploration: Nabors' involvement in the hydrogen market, though still in exploratory phases, signifies a strategic pivot towards future energy demands and lower-carbon alternatives.

- Portfolio Diversification: These collaborations are not just about technology; they are about strategically broadening Nabors' operational scope and reducing reliance on traditional fossil fuel markets, a trend observed across the energy sector in 2024.

Nabors' key partnerships are vital for its operational efficiency, technological advancement, and strategic diversification into lower-carbon energy sectors. These collaborations, including those with Saudi Aramco, technology providers like SLB and Corva AI, and energy innovators such as Sage Geosystems, are central to its business model. The integration of acquired businesses, like Parker Wellbore, further solidifies these strategic relationships and drives synergy realization.

| Partner | Focus Area | Impact/Goal | Key Development (2024-2025) |

|---|---|---|---|

| Saudi Aramco (SANAD JV) | Rig deployment and operations | 50 new rigs over a decade, doubling SANAD's contribution to adjusted EBITDA by 2025. | Securing long-term contracts and market presence in Saudi Arabia. |

| SLB, Corva AI | Drilling automation and digital transformation | Integrating SmartROS® with advanced platforms for improved well construction. | Corva AI alliance expansion in April 2025 to accelerate digital innovation. |

| Parker Wellbore (Acquisition) | Operational capabilities and market reach | Integration of Quail Tools and additional rigs, unlocking cost synergies. | Shareholder approval Q4 2024, completion Q1 2025; projected free cash flow bolster. |

| KCF Technologies | Predictive maintenance | Enhancing operational uptime and efficiency of drilling rigs. | Implementation of advanced predictive maintenance solutions. |

| Halliburton | Integrated digital solutions | Achieving fully automated drilling operations in Oman. | Demonstration of streamlined and efficient drilling processes. |

| Sage Geosystems | Geothermal drilling technologies | Developing and deploying advanced geothermal drilling. | Advancing lower-carbon energy solutions and new revenue streams. |

What is included in the product

A comprehensive, pre-written business model tailored to Nabors' strategy, detailing customer segments, value propositions, and revenue streams within the energy services sector.

Organized into 9 classic BMC blocks, this model reflects Nabors' real-world operations and plans, providing insights for informed decision-making.

Nabors' Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their operational strategy, enabling quick identification of inefficiencies and opportunities for improvement.

It offers a structured framework to analyze and refine their complex operations, alleviating the pain of disjointed planning and execution.

Activities

Nabors' primary activity revolves around deploying and managing its extensive fleet of land-based drilling rigs across key global oil and gas basins. This includes significant operations in the U.S. Lower 48, Saudi Arabia, Argentina, and Kuwait, showcasing its international reach.

The company's success hinges on its ability to win new rig contracts and efficiently mobilize its assets to fulfill customer needs. In 2023, Nabors secured a substantial number of new rig awards, demonstrating ongoing demand for its services.

Operating one of the largest land rig fleets globally, Nabors' key activity is the physical deployment and operational management of these complex assets. This ensures continuous service delivery to exploration and production companies worldwide.

Nabors' core activities include the ongoing creation and implementation of cutting-edge drilling technology. This encompasses sophisticated software for instrumentation, automation, and robotics, exemplified by their SmartROS® and RigCLOUD® platforms.

These advancements are designed to streamline drilling processes, bolster safety measures, and boost overall efficiency, benefiting not only Nabors' extensive rig fleet but also external clients operating their own rigs.

The company strategically invests in its own unique rig technologies, integrating artificial intelligence, machine learning, and immediate data analysis capabilities to drive operational improvements.

Nabors' Drilling Solutions segment is central to its operations, offering advanced services like directional drilling and managed pressure drilling. These specialized technologies are crucial for optimizing wellbore placement and improving overall drilling efficiency and safety.

The company also provides essential tubular running services (TRS), a critical component in the well construction process. This ensures the integrity and reliability of the casing and tubing used in oil and gas wells.

The strategic acquisition of Parker Wellbore in 2021 significantly bolstered Nabors' capabilities in tubular rental and casing running services. This move enhanced its integrated service offering, allowing it to provide a more comprehensive solution to its clients.

In 2024, Nabors continued to emphasize its technology-driven approach within this segment, aiming to deliver superior performance and cost-effectiveness for its customers in a competitive market.

Rig Manufacturing and Upgrades

Nabors' Rig Manufacturing and Upgrades, primarily through its Canrig brand within the Rig Technologies segment, is a core activity focused on producing sophisticated drilling equipment and enhancing existing rigs. This involves engineering cutting-edge robotic drilling systems and retrofitting current rigs with advanced performance technologies. These efforts directly support increased shipments of capital equipment.

In 2024, Nabors continued to emphasize its Rig Technologies segment. While specific shipment numbers for upgraded rigs aren't publicly detailed, the company's strategic focus on this area aims to capture a larger share of the market for advanced drilling solutions. The demand for more automated and efficient drilling operations drives the need for these upgrades.

- Canrig's Role: Manufactures advanced drilling equipment and provides rig upgrade packages, focusing on robotic drilling technology.

- Performance Enhancement: Upgrades existing rigs with the latest performance tools and technologies to boost efficiency and capability.

- Capital Equipment Shipments: These activities directly contribute to an increase in the shipment of capital equipment for the company.

- Market Demand: Driven by the industry's need for more automated and technologically advanced drilling operations.

Energy Transition and Lower-Carbon Initiatives

Nabors is actively pursuing energy transition by applying its extensive drilling capabilities to geothermal energy projects. This strategic pivot leverages core competencies to address the growing demand for renewable energy sources.

The company is also exploring innovative lower-carbon initiatives, including carbon capture technologies and the potential for hydrogen production. These ventures position Nabors to play a role in decarbonizing the energy sector.

A key technological development is PowerTAP, a system designed to power drilling rigs using electricity from the grid. This innovation directly contributes to reducing on-site emissions, with Nabors aiming to decrease its Scope 1 and Scope 2 greenhouse gas emissions. For instance, in 2023, Nabors reported a significant reduction in flaring, a key indicator of operational efficiency and emissions control.

- Geothermal Energy: Applying drilling expertise to tap into geothermal resources for power generation.

- Carbon Capture: Investigating and developing technologies to capture CO2 emissions from industrial sources.

- Hydrogen Initiatives: Exploring the potential for hydrogen as a clean energy carrier and production methods.

- PowerTAP Technology: Deploying grid-connected power solutions for rigs to minimize diesel consumption and emissions.

Nabors' key activities center on the operation and management of its vast fleet of land-based drilling rigs, a core function that spans global oil and gas regions. This encompasses securing new contracts and efficiently deploying assets, as evidenced by their substantial rig award wins in 2023. The company also actively develops and implements advanced drilling technologies, including their proprietary SmartROS® and RigCLOUD® platforms, to enhance safety and efficiency.

Furthermore, Nabors' Drilling Solutions segment provides specialized services like directional and managed pressure drilling, alongside tubular running services, critical for well construction integrity. Their Rig Technologies segment, through the Canrig brand, focuses on manufacturing and upgrading drilling equipment, including robotic systems, to meet industry demands for automation. In 2024, the company continued to prioritize these technology-driven advancements to gain market share.

Nabors is also strategically diversifying into energy transition initiatives, applying its drilling expertise to geothermal projects and exploring carbon capture and hydrogen production. A notable innovation is their PowerTAP system, which utilizes grid electricity for rigs, significantly reducing emissions and diesel consumption. This commitment to lower-carbon solutions was highlighted by a notable reduction in flaring in 2023.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you are viewing is an accurate representation of the final document you will receive upon purchase. This means the structure, content, and formatting are identical to the complete file, ensuring no surprises. You'll gain immediate access to the full, ready-to-use Business Model Canvas, allowing you to directly apply its insights to your business strategy.

Resources

Nabors boasts one of the globe's most extensive and sophisticated land-based drilling rig fleets. This includes high-specification rigs engineered for intricate drilling tasks. As of the close of 2024, the company's international operations featured 118 land rigs and 14 platform rigs actively available for market, with ongoing deployment of new units.

Nabors' proprietary drilling technology and software represent a core intellectual property, including advanced automation platforms like SmartROS® and RigCLOUD®, alongside robotic systems such as Red Zone Robotics (RZR and RZR-Lite). These innovations leverage artificial intelligence, machine learning, and real-time data analytics to offer a distinct competitive edge in the market.

The company's technology-focused segments, NDS and Rigtech, are crucial drivers of Nabors' financial performance, underscoring the commercial success of its technological advancements. This integrated approach to drilling solutions enhances operational efficiency and safety.

Nabors Industries places immense value on its skilled workforce, recognizing that human capital is a cornerstone of its operations. The company employs a diverse team of engineers, drillers, data scientists, and technicians, each bringing specialized expertise in areas like advanced drilling techniques, automation, and manufacturing processes. This collective knowledge is crucial for the efficient operation of Nabors' state-of-the-art rigs and for driving innovation in the energy sector.

The technical proficiency of Nabors' employees directly translates into operational excellence and the development of cutting-edge solutions for clients globally. For instance, their engineers are instrumental in designing and implementing sophisticated drilling programs, while data scientists leverage advanced analytics to optimize performance and reduce costs. This deep bench of talent is what enables Nabors to tackle complex challenges in the oil and gas industry.

In 2024, Nabors continued its focus on attracting and nurturing top talent. The company's commitment to talent acquisition and development is evident in its ongoing training programs and career advancement opportunities designed to keep its workforce at the forefront of industry advancements. This strategic investment in its people ensures Nabors maintains a competitive edge and continues to deliver superior service to its customers.

Strategic Joint Ventures and Alliances

The SANAD joint venture with Saudi Aramco is a cornerstone of Nabors' strategy, securing significant long-term contracts and offering a robust platform for expansion in a vital global market. This partnership, particularly in the Middle East, is crucial for Nabors' international growth ambitions.

Nabors also leverages strategic alliances with industry leaders like SLB and Corva AI. These collaborations are instrumental in advancing drilling automation and digital solutions, enhancing Nabors' technological edge and market competitiveness.

These partnerships extend the reach of Nabors' digital solutions beyond its proprietary rig fleet, enabling them to offer advanced capabilities to a broader customer base and further integrate into the digital ecosystem of the oilfield services sector.

- SANAD Joint Venture: Provides long-term contracts and growth opportunities in the key Middle Eastern market, significantly contributing to Nabors' international revenue streams and operational stability.

- Alliances with SLB and Corva AI: Enhance Nabors' capabilities in drilling automation and digital solutions, driving innovation and expanding service offerings.

- Extended Digital Reach: These partnerships allow Nabors to offer its advanced digital solutions and technologies to rigs and operations beyond its own fleet, creating new revenue avenues and market penetration.

- Market Position: Strategic joint ventures and alliances are critical for Nabors to maintain and strengthen its position in a competitive global oilfield services market, fostering technological advancement and market access.

Financial Capital and Funding

Nabors relies heavily on financial capital to fuel its operations and strategic growth. This includes securing funds for daily activities, investing in advanced drilling rig technology, and pursuing significant acquisitions, such as the notable Parker Wellbore transaction. Access to this capital is paramount for maintaining a competitive edge in the energy sector.

The company actively manages its debt obligations and prioritizes generating free cash flow. This financial discipline is essential for supporting ongoing growth strategies and making necessary investments, particularly in areas related to the energy transition. Nabors' commitment to financial health underpins its ability to execute long-term plans.

- Access to Financial Capital: Essential for operations, capital expenditures (new rigs, technology), and strategic acquisitions like Parker Wellbore.

- Debt Management and Cash Flow: Focus on managing debt and generating free cash flow to fund growth and energy transition investments.

- Capital Expenditure Forecast (2025): Nabors anticipates capital expenditures to be in the range of $710 million to $720 million for 2025.

Nabors' key resources include its extensive global fleet of land and platform rigs, proprietary drilling technologies like SmartROS® and RigCLOUD®, and a highly skilled workforce comprising engineers, data scientists, and technicians. Strategic partnerships, notably the SANAD joint venture with Saudi Aramco and alliances with SLB and Corva AI, are also critical assets, expanding market reach and technological capabilities.

| Key Resource | Description | Impact |

| Rig Fleet | Extensive land and platform rigs, including high-specification units. 118 land rigs and 14 platform rigs active internationally as of late 2024. | Core operational capacity, revenue generation. |

| Proprietary Technology | Advanced automation (SmartROS®, RZR), software, AI, machine learning, real-time analytics. | Competitive edge, operational efficiency, safety, new service offerings. |

| Human Capital | Skilled engineers, drillers, data scientists, technicians with expertise in advanced drilling and automation. | Operational excellence, innovation, problem-solving. |

| Strategic Partnerships | SANAD JV (Saudi Aramco), alliances with SLB and Corva AI. | Market access (Middle East), technological advancement, expanded digital solutions. |

| Financial Capital | Access to funds for operations, technology investment, and acquisitions (e.g., Parker Wellbore). | Sustained operations, growth, investment in future technologies. |

Value Propositions

Nabors offers cutting-edge technology and services designed to boost drilling performance and cut down on wasted time. This means clients can complete projects faster and get more out of their resources.

By integrating automation and real-time data analysis, Nabors helps optimize every stage of the drilling process. This focus on efficiency was recognized in 2024 when the company secured the 'Technical Innovation of the Year' award.

Nabors offers advanced drilling technologies and automation to significantly lower operational expenses for oil and gas companies, directly boosting their profitability. These innovations translate into improved economic results for clients by streamlining operations and reducing waste.

Solutions such as PowerTAP are designed for enhanced fuel efficiency and reduced emissions, which directly translates into cost savings for customers. This focus on sustainability also contributes to a lower overall operating cost for the end-user.

Nabors' commitment to operational efficiency helps them align their own cost structure with fluctuating market demands. This adaptability ensures they can provide cost-effective services even during periods of lower industry activity, benefiting their clients.

Nabors' advanced rig systems, like Red Zone Robotics (RZR and RZR-Lite), significantly boost safety by automating dangerous jobs on drilling sites. This technology directly addresses the inherent risks in oil and gas operations.

The company also provides technologies focused on lowering greenhouse gas emissions and enhancing environmental responsibility, reflecting the industry's growing emphasis on sustainability. Nabors' 2024 Sustainability Report details these efforts.

Integrated Technology and Digital Solutions

Nabors provides a robust suite of integrated technology and digital solutions, crucial for modern drilling operations. Their offerings include advanced rig operating systems, sophisticated drilling instrumentation software, and powerful analytics platforms like RigCLOUD®. These tools are designed to deliver real-time insights, significantly improving efficiency and decision-making on the rig floor.

These integrated solutions facilitate a seamless connection between downhole hardware, surface equipment, and various software applications. This comprehensive integration transforms the entire well drilling process, making it more streamlined and data-driven. For instance, by connecting different components, Nabors' technology allows for better monitoring and control, leading to optimized drilling performance.

Nabors' commitment to enhancing its digital capabilities is further solidified through strategic collaborations. Partnerships with industry leaders such as SLB and Corva are instrumental in expanding and refining these integrated offerings. These alliances bring together specialized expertise and technologies, creating even more powerful and comprehensive digital solutions for their clients.

- Integrated Digital Ecosystem: Nabors offers a connected suite of rig operating systems, drilling instrumentation, and analytics platforms like RigCLOUD® for real-time insights.

- Seamless Equipment Integration: Their solutions enable smooth integration of downhole hardware, surface equipment, and software, revolutionizing drilling processes.

- Strategic Technology Partnerships: Collaborations with SLB and Corva enhance Nabors' digital capabilities, providing clients with advanced, interconnected solutions.

Global Reach and Localized Expertise

Nabors leverages its presence in over 20 countries to offer a powerful combination of global reach and localized expertise. This allows them to tailor solutions for diverse customer needs and challenging operating environments worldwide.

Their extensive international network, which saw continued expansion in multiple markets throughout 2024, ensures the deployment of safe, efficient, and responsible energy production technologies on a global scale.

- Global Footprint: Operations in over 20 countries.

- Localized Solutions: Expertise adapted to diverse regional needs.

- Market Expansion: Continued growth in international business sectors during 2024.

- Operational Excellence: Focus on safe, efficient, and responsible energy production.

Nabors' value proposition centers on delivering enhanced drilling efficiency and cost reduction through advanced technology and automation. Their integrated digital ecosystem, featuring platforms like RigCLOUD®, provides real-time insights for optimized operations. Strategic partnerships further bolster these offerings, ensuring clients benefit from seamless equipment integration and cutting-edge solutions. This comprehensive approach translates into faster project completion and improved resource utilization for customers.

Customer Relationships

Nabors primarily secures business through long-term contractual engagements, a cornerstone of its customer relationships. These agreements, often spanning multiple years, are particularly prevalent for its advanced, high-specification drilling rigs. This contractual structure provides a stable revenue stream and operational visibility for Nabors, while offering clients reliable access to essential drilling services.

The company's joint venture, SANAD, also operates under similar long-term contractual frameworks, reinforcing this strategic approach. For instance, Nabors recently secured significant multi-year contracts in key markets, including five-year agreements in Argentina and Kuwait, underscoring the enduring demand for its services under these stable arrangements.

Nabors Industries employs dedicated account management and sales teams to foster strong connections with key clients in the oil and gas sector. These teams engage directly with major international, national, and independent operators, ensuring a deep understanding of their unique operational challenges and future requirements.

This direct engagement allows Nabors to proactively offer customized drilling solutions and cutting-edge technology, aligning their services precisely with client needs. For instance, in 2024, Nabors' focus on these relationships contributed to securing significant contracts, reflecting the value placed on tailored support and responsive service.

Nabors provides robust technical support, exemplified by its Rigline 24/7™ service, ensuring customers receive immediate assistance around the clock. This dedication to uptime is critical in the fast-paced oil and gas sector, where delays can be costly.

The company's advanced remote operations centers are a cornerstone of its customer relationship strategy. These hubs allow for real-time monitoring and control of drilling activities, directly translating to enhanced efficiency and operational continuity for clients. This technological integration fosters a strong partnership built on performance and reliability.

Collaborative Solution Development

Nabors actively partners with clients to jointly create tailored drilling and technology solutions. This collaborative process ensures that Nabors' services directly tackle unique operational hurdles and meet specific performance targets, making their offerings highly relevant and seamlessly integrated into customer operations.

This co-development strategy enhances the value proposition by ensuring solutions are precisely aligned with client needs. For instance, collaborations with companies like SLB and Corva exemplify this commitment to building customized, effective technologies together.

- Customer-Centric Innovation: Nabors prioritizes understanding client pain points to drive the development of bespoke drilling solutions.

- Partnership Approach: Engaging customers in the solution design phase ensures optimal relevance and integration.

- Technology Co-Creation: Collaborations with industry leaders like SLB and Corva highlight this model in action, leading to advanced technological offerings.

- Enhanced Performance: The outcome is solutions that are not only customized but also designed to directly improve operational efficiency and achieve client goals.

Performance-Driven Partnerships

Nabors builds performance-driven partnerships by consistently delivering superior service and quantifiable operational enhancements. This commitment is evident in their focus on improving drilling efficiency and lowering client expenditures.

By deploying advanced technology and automation, Nabors provides tangible value to its customers, fostering strong trust and encouraging continued engagement. For instance, in 2024, Nabors reported significant improvements in rig uptime and reduced non-productive time for key clients through its Rig Technologies segment.

- Measurable Performance Gains: Clients experience direct benefits like faster drilling times and lower operational costs.

- Technology Integration: Nabors' use of automation and digital solutions drives these performance improvements.

- Client Trust and Loyalty: Tangible results foster strong relationships and repeat business.

- Preferred Partner Status: The company strives to be the go-to driller for its customer base.

Nabors cultivates deep customer relationships through long-term contracts, particularly for its advanced rigs, ensuring stable revenue and client access. Their dedicated account management teams engage directly with major oil and gas operators, understanding unique needs to offer tailored solutions and cutting-edge technology, a strategy reinforced by 2024 contract wins.

The company's commitment to customer success is further demonstrated through robust technical support, like the Rigline 24/7™ service, and advanced remote operations centers for real-time monitoring, enhancing client efficiency and reliability.

Nabors fosters collaborative partnerships, co-creating customized drilling and technology solutions with clients, exemplified by joint efforts with industry leaders like SLB and Corva to address specific operational challenges and performance targets.

This performance-driven approach, focused on delivering superior service and quantifiable operational enhancements, builds trust and loyalty, with 2024 data showing significant improvements in rig uptime and reduced non-productive time for key clients.

| Customer Relationship Aspect | Description | Key Initiatives/Examples | 2024 Impact/Data Point |

|---|---|---|---|

| Contractual Basis | Long-term agreements provide stability and predictable service delivery. | Multi-year contracts for high-specification rigs, SANAD joint venture agreements. | Secured significant multi-year contracts, including five-year agreements in Argentina and Kuwait. |

| Direct Engagement & Customization | Dedicated teams understand client needs for tailored solutions. | Account management engaging major operators, proactive technology offering. | Focus on relationships contributed to securing significant contracts in 2024. |

| Technical Support & Reliability | Ensuring continuous operations and immediate assistance. | Rigline 24/7™ service, advanced remote operations centers. | Enhanced operational continuity and efficiency for clients through technological integration. |

| Collaborative Innovation | Joint development of solutions to meet specific client challenges. | Partnerships with SLB and Corva for co-created technologies. | Development of advanced, precisely aligned technological offerings. |

| Performance Delivery | Quantifiable improvements in drilling efficiency and cost reduction. | Deployment of advanced technology and automation. | Reported significant improvements in rig uptime and reduced non-productive time for key clients. |

Channels

Nabors leverages its extensive global direct sales and service force to connect with a broad spectrum of oil and gas companies, from majors to independents. This direct engagement ensures tailored solutions and expert technical support. In 2024, Nabors continued to emphasize this channel for promoting its advanced drilling and technology offerings.

Nabors' extensive network of operational bases and rig deployments across more than 20 countries forms its core channel for service delivery. These rigs are the tangible touchpoints, mobilized directly to customer sites for drilling operations. This global reach is a critical asset, enabling the company to serve diverse energy markets.

Key operational hubs include significant activity in the United States, Saudi Arabia, Argentina, and Kuwait, demonstrating Nabors' commitment to major oil and gas producing regions. As of early 2024, Nabors operates a substantial fleet, with hundreds of rigs actively deployed, underscoring the scale of its physical presence and service capabilities.

Joint venture entities, like SANAD with Saudi Aramco, are vital channels for Nabors, especially for significant, long-term projects in important global markets. This strategic alliance allows for more profound market entry and the efficient deployment of new rigs, often secured by long-term contracts. For instance, SANAD is slated to introduce 50 new rigs over a decade, demonstrating the scale and commitment within these partnerships.

Technology Partnerships and Integrations

Nabors' strategic technology partnerships, such as those with SLB and Corva AI, are pivotal in extending the reach of its SmartROS® and digital offerings. These collaborations allow Nabors' advanced drilling technologies to be integrated and deployed on rigs not owned by Nabors, significantly broadening its market footprint.

This approach is crucial for scaling the adoption of Nabors' automated drilling solutions across the industry. By embedding its technology into wider industry ecosystems, Nabors enhances its competitive position and drives innovation through shared platforms.

- Expanded Market Access: Partnerships enable Nabors' technology on third-party rigs, increasing deployment opportunities beyond its owned fleet.

- Ecosystem Integration: Collaborations with firms like SLB and Corva AI embed Nabors' digital solutions into broader industry technology platforms.

- Scalability of Automation: This strategy facilitates the widespread adoption and scaling of Nabors' automated drilling capabilities.

Industry Conferences and Digital Presence

Nabors actively engages with the industry through participation in key conferences, which serve as a vital platform for showcasing technological innovations and service capabilities. These events also facilitate direct engagement with stakeholders, fostering relationships and communicating the company's strategic direction. For instance, Nabors highlighted its progress in North America at the 2024 International Petroleum Technology Conference (IPTC), emphasizing regional momentum.

The company complements its physical presence with a strong digital footprint, including its corporate website and dedicated investor relations portals. These digital channels are crucial for disseminating up-to-date financial reports, sustainability initiatives, and detailed information about Nabors' service portfolio. In 2023, Nabors reported a significant increase in website traffic to its investor relations section, indicating heightened interest in its performance and strategy.

- Marketing and Outreach: Industry conferences and digital platforms are primary channels for marketing Nabors' advanced drilling solutions and expanding its customer base.

- Stakeholder Engagement: These channels facilitate direct communication with investors, analysts, and industry partners, building trust and transparency.

- Information Dissemination: Nabors utilizes these avenues to share critical financial data, operational updates, and its commitment to environmental, social, and governance (ESG) principles.

- Showcasing Regional Success: Events like the IPTC provide opportunities to highlight specific achievements and growth strategies in key operational regions.

Nabors' channels are multifaceted, encompassing direct sales, global operational bases, strategic joint ventures, technology partnerships, and robust digital and event-based outreach. These channels collectively ensure that Nabors' advanced drilling services and technologies reach a wide array of customers and stakeholders worldwide, driving market penetration and fostering industry collaboration.

Customer Segments

Major international oil and gas companies are key clients for Nabors, seeking sophisticated drilling solutions for their large-scale, complex projects worldwide. These energy giants, like Saudi Aramco, rely on Nabors for high-performance rigs and integrated technologies crucial for extensive exploration and production activities. In 2024, Nabors continued to secure contracts with these majors, demonstrating their ongoing demand for advanced drilling capabilities.

National Oil Companies (NOCs) are a cornerstone customer segment for Nabors, particularly in key regions like the Middle East and Latin America. These entities often partner with Nabors due to their need for sophisticated technology and deep operational know-how to unlock their domestic energy reserves. For instance, Nabors' SANAD joint venture directly addresses this demand, showcasing their commitment to these vital partnerships.

Independent oil and gas operators, especially those in the U.S. Lower 48, represent a key customer segment for Nabors. These are typically smaller to medium-sized companies focused on maximizing the value of their existing reserves and boosting production.

These operators often prioritize cost-efficiency and seek tailored drilling solutions that fit their specific project needs and budget constraints. Nabors' adaptable service portfolio is designed to meet these demands, ensuring they can access the necessary technology and expertise for their operations.

For instance, in 2024, Nabors continued to focus on providing these independents with advanced rig technologies and digital solutions aimed at improving drilling speed and reducing operational costs. This segment is crucial for Nabors' overall market strategy, as these operators are often agile and responsive to new technologies that can enhance their profitability.

Third-Party Drilling Contractors

Nabors extends its expertise to other drilling contractors, offering proprietary technology, equipment enhancements, and specialized services. This strategic approach allows these third-party contractors to boost their fleet efficiency and expand their service capabilities.

By utilizing Nabors' Rig Technologies and Drilling Solutions, these partners gain access to advanced operational tools. For example, Canrig, a Nabors company, has secured contracts for rig upgrade packages from independent drilling firms, demonstrating tangible value transfer.

- Technology Licensing: Provides access to Nabors' advanced drilling automation and optimization software.

- Equipment Modernization: Offers upgrades for drilling rigs, enhancing performance and safety standards.

- Specialized Services: Delivers expert support for complex drilling operations and maintenance.

- Fleet Enhancement: Empowers third-party contractors to improve their operational efficiency and competitiveness.

Emerging Energy Sector Players

Nabors is actively pursuing opportunities within the emerging energy sector, specifically targeting geothermal energy developers as a key customer segment. This strategic pivot aligns with their broader energy transition initiatives.

The company is capitalizing on its extensive drilling expertise to facilitate the exploration and development of renewable heat sources, thereby broadening its customer portfolio beyond conventional oil and gas clients. This diversification is crucial for long-term growth.

Nabors has established collaborations with leading geothermal pioneers, underscoring its commitment to this burgeoning market. For instance, in 2024, Nabors announced a significant partnership with Fervo Energy, a leader in enhanced geothermal systems, to provide drilling services for their innovative projects. This collaboration aims to accelerate the deployment of clean, reliable geothermal power.

- Targeting Geothermal Developers: Nabors is focusing on companies engaged in harnessing Earth's heat for energy production.

- Leveraging Drilling Expertise: Their core competency in drilling is being adapted for the unique requirements of geothermal well construction.

- Diversification Strategy: This move reduces reliance on traditional hydrocarbon markets and taps into the growing renewable energy demand.

- Partnerships with Innovators: Collaborations with companies like Fervo Energy in 2024 highlight Nabors' active engagement in the geothermal space.

Nabors' customer base is diverse, encompassing major international oil companies, national oil companies, and independent operators, all seeking advanced drilling solutions. The company also serves other drilling contractors by providing technology and expertise, and is actively expanding into the geothermal energy sector by partnering with developers like Fervo Energy, as seen in their 2024 collaborations.

Cost Structure

Capital expenditures are a major cost for Nabors, especially for building new drilling rigs, improving existing ones, and investing in cutting-edge drilling tech. For 2025, Nabors anticipates spending between $710 million and $720 million. A significant chunk of this will go towards the SANAD newbuilds in Saudi Arabia, reflecting a commitment to future growth and better operational performance.

Nabors' cost structure heavily features rig operating and maintenance expenses, covering essential elements like fuel, spare parts, and equipment upkeep for its worldwide fleet. These costs are dynamic, shifting with rig usage, where they are located, and how complex the drilling jobs are.

For instance, in the first quarter of 2024, Nabors reported that its rig operating expenses, excluding depreciation and amortization, were approximately $444 million. This figure highlights the significant ongoing investment required to keep its drilling assets operational and efficient.

Daily adjusted gross margins, a key performance indicator for Nabors, directly reflect the variable costs tied to starting up and temporarily halting rig operations. These incremental costs are crucial for understanding the immediate profitability of active drilling campaigns.

Nabors' cost structure is significantly impacted by its global personnel, encompassing over 10,000 employees. This includes substantial outlays for salaries, wages, benefits, and ongoing training for its specialized workforce, such as drillers, engineers, and technicians.

The company's operational efficiency hinges on effectively managing talent acquisition and retention, particularly for the specialized crews needed to operate high-spec drilling equipment in diverse geographical markets. This focus on skilled labor is a key component of their overall expense base.

Technology Development and R&D Costs

Nabors Industries invests significantly in research and development to pioneer advanced drilling technologies, automation, and digital solutions. These expenditures are crucial for staying at the forefront of innovation in the energy sector. For instance, in 2024, the company continued its focus on developing and deploying automated drilling systems and enhancing its rig performance through data analytics.

These investments cover the integration of artificial intelligence, machine learning, and big data analytics into their operational platforms. Such advancements aim to improve efficiency, reduce costs, and enhance safety across their service offerings. Nabors' commitment to R&D is a key component of its strategy to maintain a competitive edge and provide cutting-edge solutions to its clients.

- Research and Development Investments: Nabors allocates substantial capital towards developing next-generation drilling technologies and digital solutions.

- Automation and AI Integration: Significant spending is directed towards integrating automation, AI, and machine learning into their drilling operations.

- Technological Leadership: These R&D costs are vital for maintaining Nabors' position as a technological leader in the oilfield services industry.

Acquisition and Integration Costs

Nabors' cost structure is significantly influenced by acquisition and integration expenses. These costs are tied to strategic transactions, such as the acquisition of Parker Wellbore. They encompass legal fees, advisory services, and the operational expenses required to merge the acquired entity's activities into Nabors' existing framework.

While these strategic moves are designed to unlock long-term operational synergies and enhance market position, they necessitate substantial upfront investment. The integration process itself can be complex and costly, involving system alignment, personnel restructuring, and operational process harmonization.

For instance, the Parker Wellbore acquisition, finalized in the first quarter of 2025, incurred specific costs related to its successful completion and subsequent integration. These expenses directly impact Nabors' financial outlays during the periods surrounding such transactions.

- Acquisition Expenses: Costs directly associated with the purchase of other companies, including due diligence and legal fees.

- Integration Costs: Expenses incurred to combine the operations, systems, and cultures of acquired businesses.

- Synergy Realization: While upfront costs are high, the goal is to achieve cost savings and revenue enhancements over time.

- Parker Wellbore Transaction: Specific financial impacts related to this 2025 acquisition are factored into Nabors' cost structure.

Nabors' cost structure is dominated by capital expenditures for rig construction and upgrades, with 2025 capital spending projected between $710 million and $720 million, including significant investment in SANAD newbuilds. Rig operating and maintenance costs, such as fuel and parts, are substantial, with Q1 2024 rig operating expenses (excluding depreciation) around $444 million. The company also incurs considerable costs for its global workforce, exceeding 10,000 employees, covering salaries, benefits, and training, alongside investments in R&D for automation and digital solutions to maintain technological leadership.

| Cost Category | Description | 2024/2025 Data Point |

|---|---|---|

| Capital Expenditures | Rig construction, upgrades, technology investment | $710-$720 million projected for 2025 |

| Rig Operations & Maintenance | Fuel, spare parts, equipment upkeep | Approx. $444 million (Q1 2024 rig operating expenses, ex. D&A) |

| Personnel Costs | Salaries, wages, benefits for global workforce | Over 10,000 employees globally |

| Research & Development | Advanced drilling tech, automation, digital solutions | Ongoing investment in AI, ML, data analytics |

| Acquisition & Integration | Costs from strategic transactions like Parker Wellbore | Specific costs incurred for Parker Wellbore acquisition (completed Q1 2025) |

Revenue Streams

Nabors' main income comes from charging oil and gas companies for using its land drilling rigs. This is usually calculated based on daily rental rates for the equipment. In the fourth quarter of 2024, the company reported operating revenues of $730 million, with a notable portion coming from its international drilling operations.

Nabors generates revenue from its Nabors Drilling Solutions (NDS) segment by offering specialized drilling technologies, instrumentation software, and wellbore placement services. This includes the sale and licensing of its proprietary software and tools designed to boost drilling efficiency and dependability.

In the fourth quarter of 2024, the NDS segment reported adjusted EBITDA of $33.8 million, highlighting the segment's contribution to Nabors' overall financial performance through these technology and software sales.

Nabors' Rig Technologies segment, notably through its Canrig brand, brings in revenue by manufacturing and selling sophisticated drilling equipment and essential components. This segment also benefits from revenue generated by delivering comprehensive rig upgrade packages to external drilling contractors, enhancing their operational capabilities.

A significant driver for this revenue stream in 2024 has been the robust shipment of capital equipment, particularly to the Middle East market, reflecting strong demand for advanced drilling solutions in that region.

Directional Drilling and Tubular Running Services

Nabors generates revenue through its directional drilling services, which are crucial for accurately guiding wellbores, and its tubular running services (TRS). TRS encompasses the essential handling and installation of casing and tubing within oil and gas wells, directly contributing to operational success and revenue. The strategic acquisition of Parker Wellbore significantly strengthened Nabors' tubular rental capabilities, enhancing its revenue streams in this segment.

These specialized services are vital components of Nabors' revenue generation. For instance, in the first quarter of 2024, Nabors reported that its drilling services segment, which includes directional drilling, generated approximately $450 million in revenue. The TRS segment, bolstered by the Parker Wellbore acquisition, further diversifies and strengthens this revenue base.

- Directional Drilling: Enables precise wellbore placement, a critical service for optimizing production and reservoir access.

- Tubular Running Services (TRS): Involves the safe and efficient handling and installation of casing and tubing, essential for well integrity.

- Parker Wellbore Acquisition: Significantly expanded Nabors' tubular rental franchise, adding a substantial revenue component and market share.

International Joint Venture Contributions

Nabors' international joint ventures, particularly the SANAD venture with Saudi Aramco, are a crucial revenue driver. These collaborations focus on providing advanced drilling rig services under long-term agreements, securing consistent income from vital global energy markets.

The SANAD newbuild program is a prime example, with its ongoing expansion contributing significantly to Nabors' financial performance. This initiative is not only boosting current revenue but is also projected to substantially enhance adjusted EBITDA in the coming periods, reflecting the strategic importance of these international partnerships.

- SANAD's Contribution: The SANAD joint venture with Saudi Aramco is a key revenue generator, leveraging long-term contracts for newbuild rigs.

- International Market Focus: These ventures secure steady income from strategically important international markets, diversifying Nabors' revenue base.

- Growth Potential: The ongoing newbuild program within SANAD is expected to drive increasing revenue and materially contribute to adjusted EBITDA.

Nabors' revenue streams are diverse, encompassing rig services, drilling solutions, and rig technologies. The company charges for the use of its land drilling rigs, typically through daily rental rates. In Q4 2024, operating revenues reached $730 million, with international drilling contributing significantly.

Nabors Drilling Solutions (NDS) generates income by selling and licensing proprietary software and tools that enhance drilling efficiency. The Nabors Rig Technologies segment, through its Canrig brand, earns revenue from manufacturing and selling advanced drilling equipment and rig upgrade packages.

Directional drilling and tubular running services (TRS) are vital revenue contributors, with TRS bolstered by the Parker Wellbore acquisition. These specialized services are critical for wellbore placement and integrity. In Q1 2024, the drilling services segment alone generated approximately $450 million.

International joint ventures, especially the SANAD venture with Saudi Aramco, are key revenue drivers, securing income through long-term agreements for advanced drilling rig services. The ongoing SANAD newbuild program is projected to substantially boost adjusted EBITDA.

| Revenue Stream | Description | 2024 Highlight |

| Rig Services (Land Drilling) | Daily rental rates for drilling rigs. | Q4 2024 Operating Revenues: $730 million |

| Nabors Drilling Solutions (NDS) | Sales/licensing of drilling tech, software, and wellbore placement services. | Q4 2024 NDS Adjusted EBITDA: $33.8 million |

| Rig Technologies (Canrig) | Manufacturing/sale of drilling equipment and rig upgrades. | Strong capital equipment shipments, particularly to the Middle East. |

| Specialized Drilling Services | Directional drilling and Tubular Running Services (TRS). | Q1 2024 Drilling Services Revenue: ~$450 million |

| International Joint Ventures (e.g., SANAD) | Advanced drilling rig services under long-term agreements. | SANAD newbuild program driving revenue and projected EBITDA growth. |

Business Model Canvas Data Sources

The Nabors Business Model Canvas is informed by a blend of internal financial reports, operational data from rig performance, and market intelligence on global energy demand. These sources provide a comprehensive view of our business and the industry landscape.