Nabors PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nabors Bundle

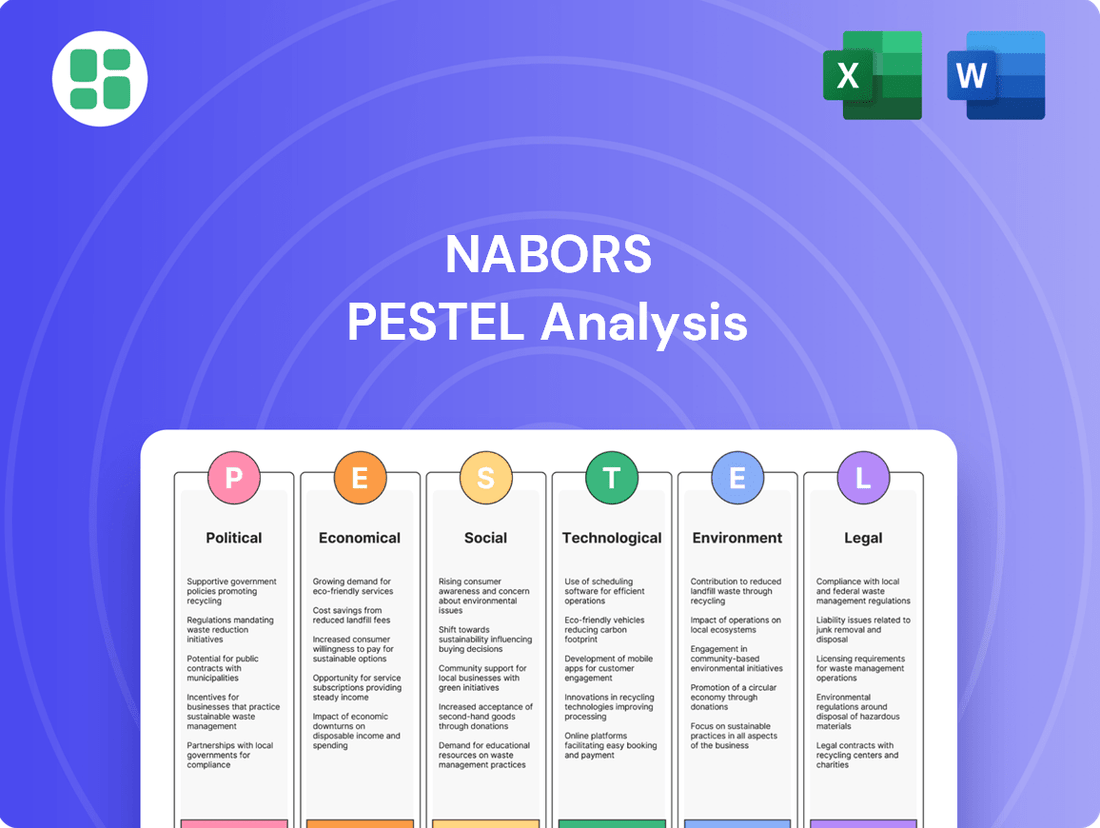

Navigate the complex external forces shaping Nabors's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Gain a strategic advantage by leveraging these expert-level insights to refine your market approach. Download the full version now for actionable intelligence.

Political factors

Government energy policies, particularly those concerning oil and gas exploration and production, are crucial for Nabors. Regulations around permitting, leasing, and operational restrictions directly influence the company's capacity to secure drilling contracts and grow its land-based operations. For instance, in 2023, the U.S. Bureau of Land Management continued to manage oil and gas leasing, with a focus on balancing energy development with environmental considerations, impacting where and how Nabors can deploy its rigs.

Shifts in political administrations can significantly alter the landscape for companies like Nabors. A hypothetical scenario where a new U.S. administration adopts more permissive policies towards domestic energy development could unlock substantial new opportunities for onshore drilling. This would likely translate into increased demand for Nabors' rig fleet and services, potentially boosting revenue streams and market share in the coming years.

Global geopolitical events, such as the ongoing conflict in Ukraine and tensions in the Middle East, inject considerable volatility into the oil and gas sector. These situations can directly impact energy prices and demand, influencing Nabors' operational environment.

Nabors, with its extensive international footprint, faces direct consequences from sanctions and regional instability. For instance, the company had to wind down its operations in Russia following the 2022 invasion of Ukraine, highlighting the tangible impact of geopolitical shifts on its business.

Regional instabilities can disrupt drilling activities and critical supply chains, leading to increased operational costs and project delays. In 2023, the Brent crude oil price fluctuated significantly, at times exceeding $90 per barrel, underscoring the market's sensitivity to geopolitical risks.

International trade policies and the imposition of tariffs directly influence Nabors' operational costs. For instance, if tariffs are placed on specialized drilling equipment imported from countries like China or Germany, Nabors' expenses for acquiring new technology or replacement parts will rise. This can impact their ability to offer competitive pricing for drilling services globally.

Government incentives for energy transition

Government incentives aimed at accelerating the energy transition, such as tax credits for renewable energy projects and carbon capture technologies, can indirectly impact Nabors by shifting investment away from traditional oil and gas exploration. For instance, the Inflation Reduction Act of 2022 in the United States offers significant incentives for clean energy, potentially altering the long-term demand for drilling services.

Nabors itself is actively participating in the energy transition, investing in solutions like geothermal drilling and carbon capture, utilization, and storage (CCUS) services. This strategic pivot is a direct response to global governmental pushes for lower-carbon energy sources and aims to diversify its revenue streams.

The evolving policy landscape, including potential carbon pricing mechanisms and stricter emissions regulations, will continue to shape the demand for fossil fuel extraction. Nabors' ability to adapt its service offerings to align with these governmental directives will be crucial for its sustained growth and relevance in the coming years.

International relations and sanctions

International relations and sanctions significantly shape Nabors' operational landscape. The imposition of sanctions on key oil-producing nations directly curtails market access and can force a withdrawal from lucrative regions. For instance, Nabors suspended its operations in Russia following international sanctions, impacting its revenue streams from that area. This highlights the need for agile strategic planning to navigate geopolitical shifts and their financial repercussions.

These political decisions necessitate careful risk assessment and contingency planning. Nabors' experience in Russia, where it ceased operations in 2022 due to sanctions, serves as a clear example of how geopolitical events can abruptly alter business operations. Such disruptions can lead to write-downs and force a reallocation of resources to more stable markets. The company's ability to adapt to these evolving international dynamics is crucial for maintaining its global presence and profitability.

The ongoing geopolitical tensions and potential for new sanctions regimes mean that Nabors must continuously monitor the global political climate. For example, tensions in the Middle East or potential sanctions on Iran could create similar challenges. The company’s financial reports often include disclosures regarding the impact of geopolitical risks on its operations and financial condition, underscoring the materiality of these factors.

- Market Access Limitation: Sanctions can block Nabors from operating in countries rich in oil and gas resources, reducing potential revenue.

- Operational Suspension: Geopolitical events, like those leading to the suspension of Nabors' Russian operations in 2022, can halt business activities.

- Revenue Impact: The inability to operate in sanctioned regions directly affects Nabors' top-line performance and regional diversification.

- Strategic Realignment: Companies must be prepared to shift capital and resources to unaffected or less risky markets in response to sanctions.

Government energy policies significantly influence Nabors' operations, dictating leasing, permitting, and environmental regulations that affect drilling activities. For instance, the U.S. government's approach to oil and gas leasing, balancing development with environmental concerns, directly impacts where Nabors can deploy its rigs. Shifts in political administrations can lead to more favorable or restrictive policies, influencing demand for Nabors' services.

Geopolitical events create market volatility, impacting energy prices and demand for drilling services. Nabors' international presence means it's directly affected by sanctions and regional instability, as seen with its withdrawal from Russia in 2022 due to sanctions. These factors necessitate agile strategic planning and risk management.

International trade policies, including tariffs on imported equipment, can increase Nabors' operational costs. Furthermore, government incentives for renewable energy, like those in the U.S. Inflation Reduction Act of 2022, can steer investment away from traditional oil and gas, potentially altering long-term demand for drilling. Nabors is responding by investing in geothermal and carbon capture services to align with these evolving governmental priorities.

The political landscape continues to evolve, with potential carbon pricing and stricter emissions regulations shaping the demand for fossil fuel extraction. Nabors' ability to adapt its offerings to comply with governmental directives is crucial for its future growth and relevance in the energy sector.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Nabors, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within Nabors' operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Economic factors

Global oil and gas price volatility significantly impacts Nabors' upstream clients, directly affecting their capital expenditure. For instance, during 2024, fluctuating crude oil prices, often trading within a range of $75-$90 per barrel, influenced exploration and production budgets. This directly translates to demand for Nabors' drilling rigs and services; higher, stable prices encourage increased drilling activity, while sharp declines can lead to rig count reductions and compressed profit margins for Nabors.

Exploration and production (E&P) companies' capital expenditure (CapEx) is a direct driver of demand for drilling services, impacting companies like Nabors. In 2024, E&P CapEx is projected to see a moderate increase, with many companies prioritizing returns and efficiency over aggressive expansion, though specific basin activity remains strong.

Increased investment, especially in prolific areas such as the Permian Basin, signals a healthier market for Nabors' offerings. For instance, major E&P players in the Permian have maintained or slightly increased their 2024 drilling budgets, anticipating continued demand for oil and gas, which directly translates to more work for drilling contractors.

Global economic growth is a primary driver for energy demand, directly impacting the oil and gas sector. A robust global economy typically translates to higher energy consumption, which in turn fuels the need for increased drilling and exploration activities. For Nabors, this means that a healthy economic environment generally supports greater demand for its rig services and technology.

In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a stable rate that supports continued energy consumption. This sustained demand is crucial for companies like Nabors, as it underpins the need for efficient and advanced drilling solutions to meet market requirements.

Interest rates and access to capital

Fluctuations in interest rates directly impact Nabors' cost of capital and the willingness of its clients to invest in new drilling projects. For instance, if benchmark interest rates like the Federal Funds Rate rise, Nabors' borrowing costs for new equipment or operational expansion will likely increase, potentially affecting profitability. This was evident in early 2024 as markets anticipated potential rate hikes, influencing capital expenditure decisions across the energy sector.

Access to affordable capital is paramount for Nabors, especially considering significant investments like its 2024 Parker Wellbore merger. The availability and cost of debt and equity financing directly influence Nabors' ability to fund such strategic moves and maintain its operational fleet. In 2023, Nabors successfully refinanced a portion of its debt, demonstrating the importance of favorable credit market conditions.

- Interest Rate Impact: Higher interest rates increase Nabors' debt servicing costs and can dampen client demand for drilling services due to increased project financing expenses.

- Capital Access for Growth: The ability to secure capital at competitive rates is vital for funding Nabors' fleet modernization and pursuing strategic growth opportunities, such as mergers and acquisitions.

- 2024 Merger Context: The Parker Wellbore merger highlights the critical need for robust access to capital, with financing terms heavily influenced by prevailing interest rate environments.

- Market Sensitivity: Nabors' financial health and investment capacity are sensitive to shifts in the broader economic climate, particularly changes in monetary policy and credit availability.

Currency exchange rate fluctuations

Nabors Industries, as a global operator, is significantly exposed to the volatility of currency exchange rates. Fluctuations in the value of currencies where Nabors conducts business directly affect the translation of its international revenues and expenses into its reporting currency, typically the US dollar. For instance, a stronger US dollar can reduce the reported value of foreign earnings, impacting overall financial performance.

These shifts can materially alter the profitability of international contracts. If a contract is denominated in a currency that weakens against the US dollar, the revenue received will be less valuable when converted, potentially eroding profit margins. Conversely, a strengthening foreign currency can boost reported profits, but this is often offset by increased costs for imported goods or services. As of the first quarter of 2024, Nabors reported that approximately 40% of its revenue was generated outside the United States, highlighting the substantial impact currency movements can have on its financial statements.

- Global Operations Exposure: Nabors' international presence means its financial results are directly influenced by changes in foreign currency values.

- Profitability Impact: Adverse currency movements can decrease the value of international earnings and make contracts less profitable.

- Revenue Translation: For example, if the Brazilian Real weakens against the US Dollar, Nabors' revenue earned in Brazil will translate to fewer US Dollars.

- 2024 Revenue Split: In Q1 2024, Nabors noted that around 40% of its revenue originated from international markets, underscoring the significance of currency risk management.

Global economic growth is a key driver for energy demand, directly influencing Nabors' business. A robust economy generally means higher energy consumption, leading to increased drilling and exploration activities. For instance, the IMF projected global growth at 3.2% for 2024, a stable rate supporting continued energy demand and, consequently, demand for Nabors' services.

Oil and gas price volatility significantly impacts Nabors' clients' capital expenditure. In 2024, crude oil prices, often fluctuating between $75-$90 per barrel, directly affected exploration and production budgets, influencing the demand for Nabors' drilling rigs. Higher, stable prices encourage more drilling, while sharp declines can lead to reduced rig counts and squeezed profit margins.

Interest rates affect Nabors' cost of capital and clients' investment decisions. Higher rates increase borrowing costs for Nabors and can make projects more expensive for clients. This was a consideration in early 2024 as markets anticipated potential rate changes, impacting capital expenditure decisions across the energy sector.

Nabors' international operations expose it to currency exchange rate fluctuations. About 40% of Nabors' revenue was generated outside the US as of Q1 2024, meaning shifts in foreign currency values can materially impact reported earnings and contract profitability.

Preview the Actual Deliverable

Nabors PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Nabors PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Nabors' strategic landscape.

Sociological factors

Growing public awareness of climate change is significantly impacting the energy sector. Surveys in 2024 indicate a strong majority of consumers are concerned about environmental issues, directly influencing investment trends. This heightened awareness translates into substantial pressure on companies like Nabors from ESG-focused investors who prioritize sustainability and reduced emissions.

The demand for fossil fuels is increasingly scrutinized, pushing drilling companies to adopt more environmentally responsible operational practices. Nabors, like its peers, faces the challenge of demonstrating a genuine commitment to sustainability. For instance, in 2024, many energy firms reported increased capital allocation towards carbon capture technologies and methane emission reduction strategies to appease these investor concerns.

The oil and gas sector, including drilling services like those Nabors provides, is grappling with attracting and keeping skilled workers. This is partly due to the industry's boom-and-bust cycles, which make careers seem less stable, and also because of evolving perceptions about the industry's future. In 2023, for instance, reports indicated a persistent shortage of experienced rig personnel across North America.

Nabors must proactively tackle potential labor gaps. This involves ensuring a steady supply of well-trained professionals capable of operating advanced drilling technologies, a critical need as the company continues to invest in automation and digital solutions. The demand for specialized skills in areas like directional drilling and data analytics remains high.

Nabors Industries prioritizes strong community ties to maintain its social license to operate, a critical factor in energy services. In 2024, the company continued its focus on local engagement, aiming to create shared value. This includes offering employment opportunities, with a significant portion of Nabors' workforce drawn from the communities where it operates, fostering goodwill and operational continuity.

Addressing community concerns proactively is key. Nabors actively works to minimize environmental impacts and operational disruptions, understanding that local acceptance is vital for long-term success. For example, by investing in local infrastructure or supporting community development projects, Nabors aims to build trust and ensure its operations are viewed as beneficial by residents.

Health and safety standards and reputation

Societal expectations for robust health and safety standards are critical in industries like oil and gas drilling, where inherent risks are high. Nabors, as a major player, faces intense scrutiny regarding its safety performance, directly impacting its public image and ability to secure contracts. A strong safety record is not just a regulatory requirement but a fundamental aspect of its social license to operate.

Nabors' reputation and the continuity of its operations are intrinsically linked to its adherence to rigorous safety protocols. Incidents, even minor ones, can lead to significant reputational damage, increased regulatory oversight, and potential operational disruptions. For instance, in 2023, the oil and gas industry saw a continued focus on reducing lost-time injury frequency rates, with many companies reporting rates below 1.0 per 200,000 hours worked, a benchmark Nabors strives to meet or exceed.

- Societal Demand: Public and employee demand for safe working environments in hazardous industries is non-negotiable.

- Reputational Risk: Safety incidents can severely damage Nabors' brand and stakeholder trust.

- Operational Continuity: Maintaining high safety standards is essential to avoid work stoppages and regulatory penalties.

- Industry Benchmarks: Nabors actively monitors and aims to outperform industry safety metrics, such as lost-time injury frequency rates, which in 2024 continued to be a key performance indicator.

Demand for energy efficiency and sustainable practices

Societal pressure is mounting for energy companies to prioritize efficiency and sustainability. Investors and customers alike are vocal about expecting energy service providers to adopt greener practices. Nabors is responding to this by investing in technologies designed to streamline drilling processes and minimize their environmental impact, directly addressing these growing societal demands.

This shift is reflected in market trends. For instance, the global market for energy-efficient building technologies was projected to reach over $300 billion by 2024, indicating a broad societal push for sustainability across sectors. Nabors' commitment to optimizing operations, such as their advancements in automated drilling systems, helps reduce fuel consumption and emissions, aligning with this powerful societal expectation for a reduced environmental footprint.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions. Nabors' focus on reducing its carbon intensity is a key aspect of meeting investor expectations for responsible operations.

- Customer Preferences: Clients in the energy sector are also seeking partners who demonstrate a commitment to sustainability, influencing contract awards and business relationships.

- Technological Alignment: Nabors' investments in areas like advanced rig automation and data analytics directly contribute to operational efficiency, which in turn lowers energy consumption and waste.

- Regulatory Foresight: By proactively adopting sustainable practices, Nabors positions itself favorably in anticipation of potentially stricter environmental regulations in the future.

Public perception of the oil and gas industry significantly influences Nabors' operational environment and talent acquisition. Growing awareness of climate change, evidenced by surveys in 2024 showing strong public concern, pushes companies towards sustainable practices. This societal shift pressures Nabors to demonstrate environmental responsibility, impacting investor confidence and attracting talent.

The demand for skilled labor in the oil and gas sector remains a challenge, exacerbated by industry volatility and evolving career perceptions. In 2023, a shortage of experienced rig personnel was reported across North America. Nabors must invest in training and development to secure professionals for advanced drilling technologies, particularly in areas like directional drilling and data analytics.

Nabors' social license to operate hinges on strong community relations and a commitment to safety. In 2024, the company continued to prioritize local engagement and minimize operational impacts to foster goodwill. The industry benchmark for lost-time injury frequency rates, a key safety metric, remained a focus, with many companies aiming for rates below 1.0 per 200,000 hours worked, a standard Nabors actively pursues.

| Societal Factor | Impact on Nabors | 2023-2024 Data/Trend |

|---|---|---|

| Environmental Awareness | Increased pressure for sustainable operations, influencing investment and public perception. | Majority of consumers concerned about climate change (2024 surveys). |

| Labor Market Dynamics | Challenges in attracting and retaining skilled workers due to industry perception and skill demand. | Reported shortage of experienced rig personnel in North America (2023). |

| Health & Safety Expectations | Critical for reputation and operational continuity; incidents lead to reputational damage and regulatory scrutiny. | Focus on reducing lost-time injury frequency rates, with industry benchmarks below 1.0 per 200,000 hours worked. |

Technological factors

Nabors is at the forefront of integrating advanced drilling automation and digitalization, a key technological factor. This transformation allows for real-time monitoring, predictive analytics, and significantly improved safety in drilling operations.

The company's RigCLOUD platform exemplifies this commitment, offering a centralized hub for operational data. Furthermore, strategic partnerships with AI specialists like Corva are accelerating the development and deployment of cutting-edge solutions, enhancing efficiency and performance.

Innovation in drilling techniques, like extended reach and horizontal drilling, is fueling demand for more sophisticated rig capabilities. Nabors needs to keep its fleet and services cutting-edge to keep up.

For instance, the adoption of advanced drilling methods in North American unconventional plays is a key driver. Nabors' investment in technologies that support these operations, such as their advanced hydraulic fracturing services, directly addresses this trend. In 2024, Nabors reported that its Rig Technologies segment saw increased activity driven by demand for higher-spec rigs, reflecting this technological shift.

Nabors is actively integrating AI and data analytics to boost its operational efficiency. This technology helps optimize drilling parameters, leading to better performance. For instance, in 2023, Nabors reported a significant increase in drilling speed on certain wells by leveraging advanced analytics, though specific percentage figures remain proprietary.

The company's strategy includes forming alliances and developing internal capabilities to harness AI. A key focus is using AI for predictive maintenance, which anticipates equipment failures before they occur, minimizing downtime. Nabors also aims to gain real-time operational insights, allowing for quicker adjustments and improved decision-making in the field.

Innovations in rig design and energy efficiency

Innovations in rig design are significantly enhancing mobility and power efficiency, a key area for companies like Nabors. These advancements are crucial for reducing operational costs and minimizing environmental impact. Nabors' strategic focus on modernizing its fleet and investing in newbuilds directly addresses these technological shifts, aiming to provide clients with more competitive and sustainable drilling services.

Nabors' commitment to incorporating these innovations is evident in its fleet modernization efforts. For instance, their SmartRigs are designed for increased automation and efficiency, leading to reduced non-productive time. The company's ongoing investment in new rig technologies reflects a proactive approach to meeting evolving industry demands for cleaner and more effective drilling operations.

- Enhanced Mobility: New rig designs feature lighter materials and modular components for quicker deployment and relocation, reducing rig-up/rig-down times.

- Power Efficiency: Advanced power management systems and hybrid power solutions are being integrated to lower fuel consumption, with some rigs achieving up to a 15% reduction in energy usage.

- Environmental Footprint: Innovations include closed-loop mud systems and emission control technologies, contributing to a significant decrease in surface disturbance and air pollution.

- Automation and Digitalization: Nabors is incorporating advanced automation and remote operating capabilities, improving safety and operational precision.

Cybersecurity threats and data protection

As Nabors continues to integrate digital technologies into its drilling operations, cybersecurity threats and data protection become paramount. The increasing reliance on interconnected systems for real-time monitoring and control of complex machinery heightens the vulnerability to cyberattacks. Protecting sensitive client data, proprietary operational algorithms, and the integrity of industrial control systems is a significant technological hurdle.

In 2024, the oil and gas sector, in general, faced escalating cybersecurity risks, with incidents often targeting operational technology (OT) environments. Nabors, like its peers, must invest heavily in advanced threat detection, prevention, and response mechanisms to safeguard its digital infrastructure. The potential financial and reputational damage from a successful breach underscores the critical nature of these technological challenges.

- Digitalization Risk: Increased connectivity in drilling operations expands the attack surface for cyber threats.

- Data Protection Imperative: Safeguarding client information and proprietary operational data is a core technological challenge.

- Operational Control Systems: Protecting the integrity of systems that manage drilling machinery is vital to prevent disruptions.

- Industry Trend: The oil and gas sector is a prime target for cyberattacks, necessitating robust security investments.

Nabors is heavily investing in technological advancements to enhance drilling efficiency and safety. This includes the integration of AI and advanced analytics for real-time monitoring and predictive maintenance, as seen with their RigCLOUD platform and collaborations with AI specialists.

Innovations in rig design are focusing on improved mobility, power efficiency, and reduced environmental impact. Nabors' fleet modernization, including their SmartRigs, directly addresses the industry's demand for more capable and sustainable drilling solutions.

The company's adoption of advanced drilling techniques, such as extended reach and horizontal drilling, necessitates sophisticated rig capabilities, a trend that drove increased activity in Nabors' Rig Technologies segment in 2024.

However, the increased digitalization of operations also presents significant cybersecurity challenges, requiring substantial investment in threat detection and prevention to protect sensitive data and operational control systems.

Legal factors

Nabors faces increasing pressure from stringent environmental regulations, including proposed EPA methane emission standards expected to impact operational costs significantly in 2024 and 2025. State-level restrictions on drilling near sensitive ecological zones also add complexity and potential delays to project timelines.

Compliance with these evolving rules is not just a matter of avoiding penalties, which can run into millions of dollars, but is essential for maintaining the necessary permits to operate. Failure to adapt could lead to operational disruptions and reputational damage.

Occupational health and safety (OHS) standards are paramount in the drilling sector, a field inherently fraught with significant risks. Nabors, like all companies in this industry, must adhere strictly to both national and international OHS regulations to safeguard its employees and mitigate potential legal repercussions.

In 2023, the International Association of Oil & Gas Producers (IOGP) reported a total recordable injury frequency rate (TRIFR) of 0.78 per million hours worked across its member companies, highlighting the industry's focus on safety performance. Non-compliance with these stringent OHS requirements can lead to substantial fines, operational shutdowns, and severe damage to reputation, impacting Nabors' ability to secure contracts and attract talent.

Nabors Industries operates under a multitude of complex contractual agreements with its diverse clientele, primarily oil and gas exploration companies. These contracts meticulously outline the scope of services, performance benchmarks, and crucially, the liabilities each party assumes. For instance, in 2023, Nabors reported significant revenue tied to these drilling and rig service contracts, with any disputes or renegotiations directly impacting financial performance and operational continuity.

Anti-trust and competition laws

Nabors Industries' strategic moves, like its 2023 acquisition of Parker Wellbore for approximately $1.2 billion, are closely scrutinized under anti-trust and competition laws across the globe. These regulations are vital for ensuring fair market practices and preventing monopolistic tendencies, impacting Nabors' ability to consolidate its market position and pursue further strategic growth initiatives.

Navigating these legal frameworks is essential for Nabors to secure regulatory approval for significant transactions. For instance, the successful integration of Parker Wellbore required compliance with merger control regulations in multiple jurisdictions, demonstrating the pervasive influence of competition law on the company's expansion strategies.

- Merger Scrutiny: Nabors' acquisition of Parker Wellbore in 2023, valued at around $1.2 billion, underwent anti-trust reviews in key markets.

- Market Consolidation: Compliance with competition laws is critical for Nabors to achieve its goals of market consolidation and enhanced operational efficiencies.

- Global Compliance: The company must adhere to varying anti-trust regulations in the numerous countries where it operates, impacting its M&A activities.

- Strategic Growth: Failure to comply with these laws could impede Nabors' ability to execute future growth strategies and acquisitions.

Intellectual property rights

Intellectual property rights are crucial for Nabors, a company heavily invested in developing proprietary drilling instrumentation software and performance tools. Protecting these innovations through patents and other legal mechanisms is vital for maintaining its competitive advantage in the energy technology sector. For instance, in 2024, Nabors continued to secure patents for its advanced downhole measurement technologies, safeguarding its unique software algorithms and hardware designs.

The company's commitment to IP protection ensures that its significant research and development expenditures translate into sustainable market leadership. By legally securing its technological advancements, Nabors can prevent competitors from replicating its innovations, thereby preserving its market share and profitability. This strategic focus on intellectual property underpins its ability to offer differentiated solutions and command premium pricing in the energy services market.

Nabors Industries must navigate a complex web of international and domestic laws governing its operations, from environmental compliance to labor standards. The company's 2023 acquisition of Parker Wellbore for approximately $1.2 billion, for example, required extensive antitrust review across multiple jurisdictions, highlighting the legal hurdles in market consolidation.

Adherence to stringent safety regulations, such as those promoted by the IOGP with a reported TRIFR of 0.78 per million hours worked in 2023, is critical to avoid substantial fines and operational shutdowns. Furthermore, protecting its intellectual property, including advanced downhole measurement technologies patented in 2024, is key to maintaining its competitive edge.

The company's contractual agreements, which generated significant revenue in 2023, are subject to legal interpretation and potential disputes, directly impacting financial performance. Staying abreast of evolving environmental regulations, like proposed EPA methane emission standards for 2024-2025, is also essential for operational continuity and permit adherence.

Environmental factors

Global and national climate change policies, such as the Paris Agreement's goal to limit warming to 1.5°C and the increasing number of countries setting net-zero emission targets by 2050, directly impact the long-term demand for fossil fuels. These policies also necessitate stricter operational standards for drilling companies. For instance, the European Union's Fit for 55 package aims to cut emissions by 55% by 2030 compared to 1990 levels, influencing energy markets worldwide.

Nabors is actively responding to these evolving environmental regulations and market shifts. The company is investing in and developing lower-carbon technologies and exploring energy transition initiatives. This includes advancements in their rig technologies to reduce emissions and exploring opportunities in geothermal drilling and carbon capture, utilization, and storage (CCUS) projects, reflecting a strategic pivot towards a more sustainable energy future.

Drilling operations are water-intensive, and managing the resulting wastewater is a growing concern, with regulations becoming more stringent. Nabors, like other companies in the sector, must navigate these rules, which cover everything from how water is sourced to how it's treated and ultimately disposed of. This is crucial not only for environmental stewardship but also for keeping operational costs in check.

For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize the importance of responsible wastewater management in the oil and gas industry, with potential for updated guidelines impacting discharge permits. Companies are investing in advanced water treatment technologies to meet these evolving standards, aiming to reduce their water footprint and avoid penalties associated with non-compliance.

Nabors' land-based drilling operations, including rigs and support infrastructure, directly impact land use and raise significant biodiversity protection concerns. This physical footprint necessitates careful planning to minimize habitat disruption and ecological damage.

Navigating stringent environmental regulations and evolving stakeholder expectations regarding responsible land management is crucial for Nabors. For instance, in 2024, the company continues to focus on implementing best practices for site reclamation and minimizing its operational footprint across its North American and international land rig segments.

Waste management and disposal of drilling fluids

Proper management and disposal of drilling fluids, cuttings, and other operational waste are critical environmental considerations for Nabors, directly impacting regulatory compliance and operational costs. Failure to adhere to strict waste management protocols can lead to significant fines and reputational damage, as environmental laws mandate the prevention of pollution.

Nabors must navigate a complex web of regulations governing the handling and disposal of these materials. For instance, in the United States, the Environmental Protection Agency (EPA) sets standards under acts like the Resource Conservation and Recovery Act (RCRA) for hazardous waste. In 2024, the oil and gas industry continued to face scrutiny over its environmental footprint, with increasing emphasis on sustainable practices and circular economy principles in waste management.

- Regulatory Compliance: Adherence to national and local environmental laws for waste disposal is paramount.

- Pollution Prevention: Implementing robust protocols to prevent soil, water, and air contamination from drilling byproducts.

- Cost Management: Efficient waste management strategies can reduce disposal fees and potential remediation expenses.

- Technological Advancements: Investing in and utilizing advanced technologies for waste treatment and recycling can improve environmental performance.

Transition to lower-carbon energy sources

Nabors Industries faces significant environmental pressures stemming from the global transition to lower-carbon energy sources. This shift, driven by climate change concerns and policy initiatives, directly impacts the demand for oil and gas drilling services, which form the core of Nabors' business. For instance, the International Energy Agency (IEA) projected in its 2024 scenarios that while oil demand might plateau, the pace of transition could accelerate, potentially impacting drilling activity sooner than anticipated.

This evolving energy landscape presents a dual challenge and opportunity for Nabors. While a sustained reduction in fossil fuel extraction could decrease long-term demand for their traditional drilling rigs and services, it simultaneously creates a compelling need for the company to adapt. Nabors is actively exploring investments in energy transition technologies and services, such as carbon capture, utilization, and storage (CCUS) and geothermal drilling, to diversify its revenue streams and align with a lower-carbon future.

The company's strategic pivot is crucial for its long-term viability. By leveraging its existing expertise in complex drilling operations, Nabors aims to capitalize on emerging markets within the energy transition. For example, the global CCUS market is projected to grow substantially, with estimates suggesting it could reach hundreds of billions of dollars annually by 2030, according to various industry analyses from 2024. This presents a tangible area for Nabors to apply its technological capabilities.

- Global Energy Transition: The worldwide move towards renewables and reduced carbon emissions directly influences demand for traditional oil and gas drilling.

- Market Volatility: Policy changes and technological advancements in green energy can create unpredictable shifts in the demand for Nabors' core services.

- Investment in New Technologies: Nabors is investing in areas like CCUS and geothermal energy to adapt to the changing energy landscape and secure future revenue.

- Strategic Diversification: The company's ability to successfully transition its business model will be key to navigating the environmental factors impacting the energy sector.

Global climate policies, like the push for net-zero emissions by 2050, directly affect the demand for fossil fuels, influencing drilling activity. Stricter regulations, such as the EU's Fit for 55 package aiming for a 55% emission cut by 2030, necessitate cleaner operational standards for companies like Nabors.

Nabors is actively adapting by investing in lower-carbon technologies and exploring energy transition initiatives, including advancements in rig emissions reduction and opportunities in geothermal drilling and CCUS projects.

Water management is a growing environmental concern, with increasingly stringent regulations on sourcing, treatment, and disposal of wastewater from drilling operations. For example, the U.S. EPA continued to emphasize responsible wastewater management in 2023, potentially leading to updated guidelines.

Nabors' operations impact land use and biodiversity, requiring careful planning to minimize habitat disruption. The company focuses on best practices for site reclamation and reducing its operational footprint, as seen in its 2024 efforts across its land rig segments.

Proper waste management of drilling fluids and cuttings is critical for regulatory compliance and cost control, with potential fines for non-compliance. In 2024, the industry faced continued scrutiny on its environmental footprint, emphasizing sustainable practices.

| Environmental Factor | Impact on Nabors | Nabors' Response/Strategy |

|---|---|---|

| Climate Change Policies | Reduced demand for fossil fuels, stricter operational standards. | Investing in lower-carbon tech, exploring geothermal and CCUS. |

| Water Management | Increased regulatory scrutiny and costs for wastewater disposal. | Implementing advanced water treatment technologies. |

| Land Use and Biodiversity | Need to minimize habitat disruption and ecological damage. | Focus on site reclamation and reducing operational footprint. |

| Waste Management | Strict regulations on drilling byproducts, potential fines. | Adhering to EPA standards (e.g., RCRA), exploring circular economy principles. |

PESTLE Analysis Data Sources

Our Nabors PESTLE analysis is meticulously constructed using data from official government publications, reputable financial institutions, and leading industry research firms. This ensures a comprehensive understanding of political stability, economic trends, and technological advancements impacting the energy sector.