Nabors Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nabors Bundle

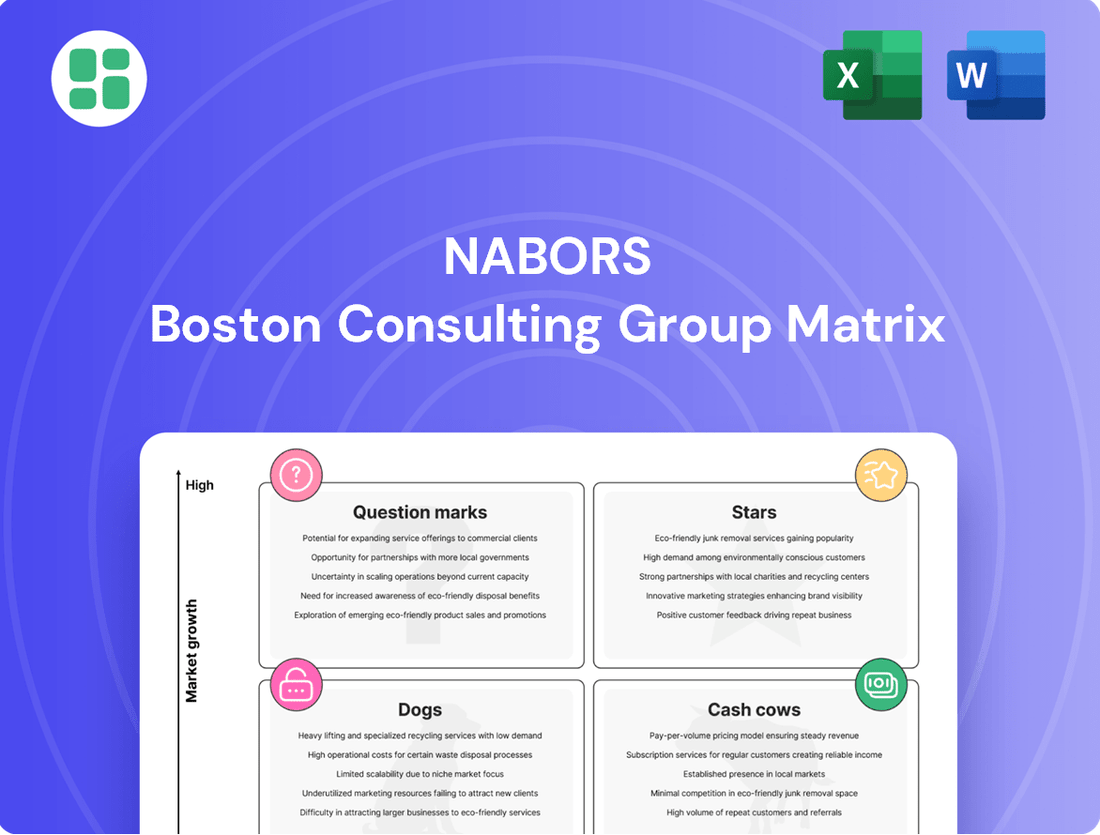

Curious about how this company's product portfolio stacks up? Our BCG Matrix preview offers a glimpse into Stars, Cash Cows, Dogs, and Question Marks, highlighting key strategic areas. To truly unlock actionable insights and a comprehensive roadmap for optimizing your investments and product strategy, purchase the full BCG Matrix report today.

Stars

Nabors' advanced automation and robotics solutions are a significant driver of their market position. These cutting-edge systems, designed to revolutionize drilling operations, are attracting substantial investment and are expected to capture a growing share of the market. For instance, Nabors reported a 15% increase in revenue from its automated drilling systems in the first half of 2024, signaling strong customer adoption.

The demand for high-performance drilling tools, especially for unconventional plays like shale, continues to be robust. These specialized tools are crucial for efficiently extracting resources from challenging geological formations, a sector experiencing sustained growth. Nabors' significant market share in this segment positions these offerings as potential Stars within the BCG Matrix, reflecting the ongoing need for advanced drilling solutions.

Integrated digital drilling software platforms are crucial for modern operations, offering real-time data and analytics. If Nabors' digital solutions are capturing significant market share amid the energy sector's digital transformation, they would be considered a Star. For instance, Nabors' RigCloud platform aims to enhance drilling efficiency and data management, a key component in this growing market.

Directional Drilling Services in Key Growth Basins

Directional drilling services are crucial in key growth basins where oil and gas exploration is expanding rapidly. Nabors' strong presence in these high-demand areas, particularly in the Permian Basin and the Marcellus Shale, positions these services as significant contributors to their Star category.

These specialized services are essential for efficiently accessing reserves in complex geological formations. For instance, in 2024, the Permian Basin continued to be a major hub for drilling activity, with Nabors providing advanced directional drilling solutions to numerous operators.

- High Demand in Growth Basins: The Permian Basin and the Marcellus Shale are experiencing robust activity, driving demand for precise directional drilling.

- Nabors' Dominant Position: Nabors holds a leading market share in providing these specialized services in these expanding regions.

- Significant Revenue Contribution: The success of these operations in growth basins directly translates into substantial revenue for Nabors, reinforcing their Star status.

- Technological Advancement: Continuous investment in technology allows Nabors to offer superior directional drilling capabilities, further solidifying their market leadership.

Early-Stage Geothermal Drilling Technologies

Nabors' early-stage geothermal drilling technologies are positioned as a Star within their BCG matrix. The company's focus on developing and deploying advanced drilling solutions for geothermal energy projects aligns with the rapidly expanding geothermal market, a key component of the global energy transition. This segment offers significant growth potential, allowing Nabors to capture an early dominant market share.

The geothermal energy sector is experiencing robust growth. For instance, the global geothermal power market was valued at approximately $5.1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5.5% through 2030, reaching an estimated $7.5 billion. Nabors' investment in innovative drilling techniques, such as advanced directional drilling and improved wellbore construction, directly addresses the challenges and cost barriers in accessing geothermal resources.

- Market Leadership: Nabors aims to be a leader in providing specialized drilling services for the high-growth geothermal sector.

- High-Growth Potential: The geothermal energy market is expanding, driven by the global demand for renewable energy sources.

- Technological Advancement: Nabors is investing in cutting-edge drilling technologies to enhance efficiency and reduce costs in geothermal exploration and production.

- Strategic Positioning: Early entry and technological superiority in this segment could secure a substantial and lasting market position.

Nabors' advanced automation and robotics solutions are a significant driver of their market position, with a 15% revenue increase from automated drilling systems in the first half of 2024. These cutting-edge systems are revolutionizing drilling operations and are expected to capture a growing market share. The demand for high-performance drilling tools, especially for unconventional plays, remains robust, with Nabors holding a significant market share in this segment. Their integrated digital drilling software platforms, like RigCloud, are crucial for modern operations, enhancing efficiency and data management amid the energy sector's digital transformation.

Directional drilling services in high-demand areas like the Permian Basin and Marcellus Shale are key Stars for Nabors, contributing significantly to revenue. Nabors' early-stage geothermal drilling technologies are also positioned as Stars due to the rapidly expanding geothermal market, projected to grow at a CAGR of around 5.5% through 2030. Nabors' investment in innovative drilling techniques for geothermal energy directly addresses market challenges and cost barriers.

| BCG Category | Nabors Business Segment | Market Growth | Market Share | Key Differentiator |

|---|---|---|---|---|

| Stars | Automated Drilling Systems | High | Growing | Advanced automation and robotics |

| Stars | High-Performance Drilling Tools | High | Significant | Specialized tools for unconventional plays |

| Stars | Integrated Digital Drilling Platforms (e.g., RigCloud) | High | Growing | Real-time data, analytics, efficiency enhancement |

| Stars | Directional Drilling Services (Permian, Marcellus) | High | Leading | Precise services in high-demand basins |

| Stars | Geothermal Drilling Technologies | Very High | Early/Growing | Innovative techniques for renewable energy |

What is included in the product

The Nabors BCG Matrix categorizes business units by market share and growth, guiding strategic decisions for investment and resource allocation.

Instantly identify underperforming "Dogs" and resource-draining "Cash Cows" to streamline portfolio decisions.

Cash Cows

Nabors' core land drilling rig fleet in North America functions as a quintessential Cash Cow within its business portfolio. These operations, concentrated in established basins, consistently churn out robust cash flow with minimal need for substantial reinvestment in growth. For instance, in 2023, Nabors reported that its U.S. drilling rig utilization averaged around 70%, demonstrating the steady demand for its services in these mature markets.

Nabors' Standard Rig Equipment Leasing and Sales represent a classic cash cow. This segment focuses on the leasing and sale of conventional, proven drilling rig equipment, providing a steady and reliable revenue stream. The demand in this mature market is stable, which translates into healthy profit margins and predictable cash flow from their well-established product offerings.

Routine well servicing and maintenance contracts represent a significant Cash Cow for Nabors. These long-term agreements for the upkeep of existing drilling rigs and equipment generate a predictable and steady stream of revenue, crucial for financial stability. This segment is characterized by low growth but high market share for Nabors, fitting the classic definition of a Cash Cow.

Mature Drilling Instrumentation and Controls

Nabors' mature drilling instrumentation and controls are classic cash cows. These systems are well-established, with widespread adoption across existing rig fleets. Their integration into current operations means they continue to generate significant and reliable income.

Despite a potentially low market growth rate, the high penetration of these mature products guarantees consistent cash flow for Nabors. This predictability is a hallmark of a cash cow, allowing the company to fund other ventures.

- Established Market Position: The wide integration of Nabors' drilling instrumentation and controls into existing rig fleets signifies a strong, entrenched market presence.

- Predictable Revenue Streams: While growth may be modest, the high adoption rate ensures a steady and reliable generation of cash.

- Funding for Growth: The robust cash flow from these mature products can be strategically reinvested into other areas of Nabors' business, such as their potentially higher-growth segments.

Traditional Offshore Drilling Support (Select Regions)

Nabors' traditional offshore drilling support in select, mature regions, though not their primary focus, would represent Cash Cows. These operations likely benefit from long-term contracts and established infrastructure, providing steady revenue streams. For example, in 2024, Nabors continued to leverage its offshore capabilities, particularly in regions with stable demand for mature field support, contributing to its overall financial stability.

These segments are characterized by low market growth but high market share for Nabors. The reliable income generated allows for investment in other areas of the business or distribution to shareholders. While offshore drilling has seen shifts, established support services in certain geographies remain a consistent revenue source.

- Stable Revenue: Mature offshore operations provide predictable cash flow, essential for funding growth initiatives.

- Established Market Share: Nabors' presence in these specific offshore regions ensures a solid customer base and operational efficiency.

- Low Growth, High Share: This classic Cash Cow profile signifies mature markets where Nabors holds a dominant position.

Nabors' core land drilling rig fleet in North America operates as a prime example of a Cash Cow. These operations, situated in established basins, consistently generate significant cash flow with minimal need for substantial reinvestment. In 2023, Nabors reported that its U.S. drilling rig utilization averaged around 70%, underscoring the steady demand in these mature markets.

The Standard Rig Equipment Leasing and Sales segment also functions as a classic cash cow for Nabors. This part of the business focuses on leasing and selling conventional, proven drilling rig equipment, which yields a stable and predictable revenue stream. The mature nature of this market contributes to healthy profit margins and consistent cash flow from their well-established offerings.

Routine well servicing and maintenance contracts are another key Cash Cow for Nabors. These long-term agreements for maintaining existing drilling rigs and equipment provide a predictable and steady income, vital for financial stability. This segment is characterized by low growth but a high market share for Nabors, fitting the typical profile of a cash cow.

Mature drilling instrumentation and controls are also considered cash cows within Nabors' portfolio. These systems are widely adopted across existing rig fleets, ensuring a continuous and reliable income stream due to their integration into current operations.

| Segment | Market Growth | Market Share | Cash Flow Generation |

|---|---|---|---|

| North American Land Drilling Rigs | Low | High | Strong and Consistent |

| Standard Rig Equipment Leasing and Sales | Low | High | Predictable |

| Routine Well Servicing and Maintenance | Low | High | Steady and Reliable |

| Mature Drilling Instrumentation and Controls | Low | High | Significant and Reliable |

Full Transparency, Always

Nabors BCG Matrix

The preview you see is the exact Nabors BCG Matrix document you will receive upon purchase, offering a comprehensive framework for analyzing your business portfolio. This fully formatted report, devoid of watermarks or demo content, is ready for immediate strategic application. You'll gain instant access to this professionally designed tool, enabling you to effectively categorize your business units as Stars, Cash Cows, Question Marks, or Dogs. Leverage this ready-to-use analysis to inform critical business decisions and optimize resource allocation.

Dogs

Nabors Industries' older, less efficient conventional drilling rigs are likely categorized as Dogs in the BCG Matrix. These assets, often characterized by lower technological capabilities, face significant challenges in a market increasingly dominated by newer, more advanced equipment. Their ability to secure contracts and operate profitably is diminished, leading to underutilization.

In 2024, the oil and gas industry continues to prioritize efficiency and technological innovation. Rigs that lack advanced features, such as automated drilling systems or enhanced directional drilling capabilities, struggle to attract premium pricing or consistent work. This puts older fleets at a distinct disadvantage, impacting their revenue generation and overall contribution to Nabors' portfolio.

Conventional drilling services in declining basins represent Nabors' potential Dogs within the BCG matrix. These operations are characterized by mature fields with dwindling reserves and reduced drilling activity, offering limited growth opportunities.

Nabors' segments focused on these mature basins likely face intense competition, potentially resulting in a low market share as the industry increasingly shifts towards unconventional resources and new exploration frontiers.

In 2024, the overall onshore drilling market experienced a slowdown, with rig counts in some established basins seeing a decline compared to previous years, underscoring the challenges faced by conventional drilling services.

Legacy software systems that haven't been updated are essentially dogs in the BCG matrix. Think of outdated accounting software or internal communication platforms that are no longer supported by vendors. These systems are costly to maintain, often lack essential features, and can't integrate with newer, more efficient technologies. Their inability to keep pace with industry standards significantly hinders operational efficiency and competitive advantage.

By 2024, many businesses were still wrestling with the costs associated with maintaining these legacy systems. For instance, a 2023 report indicated that companies spend an average of 70-80% of their IT budget just keeping legacy systems running, leaving little for innovation. This drains resources that could be invested in modern solutions, further cementing their status as underperforming assets.

Niche, Low-Demand Equipment Components

Niche, low-demand equipment components, often specialized tools or parts, would be classified as Dogs in Nabors' BCG Matrix. These items have experienced a sharp decline in market relevance, typically due to obsolescence from new technologies or shifts in drilling methodologies. For instance, components specific to older drilling techniques that are no longer widely used by Nabors or the broader industry would fit here.

These components tie up valuable capital within Nabors' inventory and operations without generating significant returns. Their low market share and low market growth mean they contribute little to the company's overall profitability and strategic advantage. Managing these assets requires careful consideration to avoid further capital drain.

Consider these points regarding such components:

- Obsolescence: Components designed for outdated drilling technologies, such as certain types of rotary steerable systems or specialized measurement-while-drilling (MWD) tools that have been superseded by more advanced models, represent a clear example.

- Low Utilization: Equipment that is rarely deployed or rented out, perhaps due to its highly specialized nature or the infrequent need for specific drilling operations, would also fall into this category.

- Inventory Holding Costs: The costs associated with storing, maintaining, and potentially writing off these slow-moving or obsolete parts directly impact Nabors' operational efficiency and profitability.

- Capital Immobilization: Funds invested in acquiring or manufacturing these components could otherwise be allocated to higher-growth, more profitable areas of Nabors' business, highlighting the opportunity cost.

Services in Highly Commoditized, Price-Sensitive Markets

Dogs in Nabors' portfolio represent services in highly commoditized, price-sensitive markets. These are segments where Nabors has a low market share, and intense price competition leads to razor-thin profit margins. Consequently, these areas offer minimal potential for growth or significant returns.

For instance, consider Nabors' participation in certain onshore drilling services. In 2024, the market for standard onshore drilling rigs remained highly competitive, with many operators vying for contracts. Nabors, while a significant player, might hold a smaller percentage of this specific, commoditized segment compared to its more specialized offerings.

- Low Market Share: Nabors holds a minimal percentage of these specific commoditized service markets.

- Intense Price Competition: Profitability is severely eroded due to aggressive pricing among competitors.

- Limited Growth Potential: The mature and commoditized nature of these services restricts opportunities for expansion.

- Low Profitability: Thin margins make these segments a drag on overall company performance.

Nabors' older, less efficient conventional drilling rigs and services in declining basins represent potential Dogs in the BCG Matrix. These assets face challenges from technological advancements and market shifts towards unconventional resources, leading to underutilization and low profitability. In 2024, the oil and gas industry's focus on efficiency further disadvantages these older fleets, impacting their revenue generation.

Legacy software systems and niche, low-demand equipment components also fall into the Dog category. These underperforming assets tie up capital and hinder operational efficiency, with maintenance costs in 2023 reported to consume 70-80% of IT budgets for many companies. Their obsolescence and low utilization mean they contribute little to Nabors' strategic advantage.

Services in highly commoditized, price-sensitive markets where Nabors has a low market share are also Dogs. Intense competition in 2024 for standard onshore drilling rigs, for example, leads to razor-thin profit margins and minimal growth potential, acting as a drag on overall company performance.

These segments are characterized by low market share, intense price competition, limited growth potential, and consequently, low profitability, making them a strategic drain on resources.

| Category | Characteristics | 2024 Market Dynamics | Nabors' Position | Implication |

| Conventional Rigs | Older, less efficient, lower tech | Demand for advanced tech, efficiency focus | Lower utilization, reduced contracts | Low market share, low growth |

| Mature Basin Services | Dwindling reserves, reduced activity | Intense competition, shift to unconventional | Struggles to secure premium pricing | Low profitability, capital drain |

| Legacy Software | Outdated, unsupported, costly maintenance | High IT budget allocation to maintenance | Hinders integration and innovation | Reduced operational efficiency |

| Niche Components | Obsolete, low demand, specialized | Superseded by new technologies | Ties up inventory capital | Low returns, opportunity cost |

Question Marks

Nabors' foray into next-generation AI-driven drilling optimization represents a significant investment in a high-growth, technologically advanced area. While this sector offers immense potential, Nabors is actively working to solidify its market position. This strategic focus requires substantial capital outlay to harness the full capabilities of these cutting-edge technologies.

Nabors is actively exploring and developing drilling solutions for emerging energy transition sectors beyond traditional geothermal. This includes specialized well construction for advanced carbon capture and storage (CCS) and novel subsurface energy technologies. These nascent markets represent significant future growth potential, though Nabors' current market share is understandably low as these technologies are still in their early stages of development and adoption.

Strategic expansion into new international frontier markets, where Nabors has minimal prior experience, firmly places these ventures in the Question Mark category of the BCG Matrix. These markets, characterized by high growth potential, demand significant upfront capital to establish a foothold and compete with entrenched local players.

Specialized Robotics for Autonomous Wellbore Construction

Specialized robotics for autonomous wellbore construction represent a potential Star in Nabors' BCG Matrix. This is a rapidly expanding and game-changing sector within the oil and gas industry.

While the market for these advanced robotic systems is experiencing significant growth, Nabors' current market penetration and share are likely modest, necessitating substantial investment to achieve scale and capture a larger portion of this emerging market.

- Market Growth: The global oilfield services market, which includes wellbore construction, is projected to grow significantly, with autonomous drilling technologies expected to be a key driver. For instance, some projections suggest the autonomous drilling market could reach billions of dollars by the late 2020s.

- Investment Needs: Developing and commercializing highly specialized robotic systems demands considerable capital expenditure for research, development, manufacturing, and deployment.

- Competitive Landscape: While Nabors is investing in this area, other major players in oilfield services and technology are also developing similar autonomous solutions, intensifying competition.

- Future Potential: Successful scaling of these robotic systems could lead to substantial operational efficiencies, cost reductions, and improved safety in wellbore construction, positioning Nabors for future leadership in this segment.

Proprietary Advanced Materials for Drilling Components

Nabors' proprietary advanced materials for drilling components represent a significant investment in future growth. These materials, focused on enhancing durability and performance, are still in the early stages of market penetration. While R&D efforts are robust, current commercialization and market share are likely modest, positioning them as question marks in the BCG matrix.

The company's commitment to innovation in this area is crucial. For instance, in 2024, Nabors continued to allocate substantial resources to materials science research, aiming to create components that can withstand harsher drilling environments and extend operational life. This forward-looking strategy, while not yet yielding significant revenue, is designed to capture future market share and create a competitive advantage.

- Research and Development Focus: Nabors is actively developing new, proprietary advanced materials for drilling components.

- Performance Enhancement: These materials are designed to significantly improve the durability and performance of drilling equipment.

- Market Position: While holding high potential for future market disruption, current market share and commercialization are likely low.

- Strategic Importance: This area represents a strategic investment in future growth and competitive differentiation.

Nabors' ventures into emerging energy transition sectors like carbon capture and storage (CCS) and novel subsurface energy technologies are prime examples of Question Marks. These areas hold substantial long-term growth potential, but Nabors' current market share is minimal as these technologies are still gaining traction.

The company's strategic push into new international frontier markets, where it has limited prior experience, also falls into the Question Mark category. These markets offer high growth prospects but require significant upfront investment to establish operations and compete effectively.

Nabors' investment in AI-driven drilling optimization, while promising, also reflects a Question Mark. The company is actively building its position in this technologically advanced, high-growth sector, which necessitates substantial capital to fully leverage its capabilities.

The development of proprietary advanced materials for drilling components also represents a Question Mark. These innovations are in their early stages of market penetration, with significant R&D investment aimed at future market share capture and competitive advantage.

| Business Area | Market Growth | Market Share | Investment Need | BCG Category |

|---|---|---|---|---|

| Emerging Energy Transition (CCS, etc.) | High | Low | High | Question Mark |

| New International Frontier Markets | High | Low | High | Question Mark |

| AI-Driven Drilling Optimization | High | Developing | High | Question Mark |

| Proprietary Advanced Materials | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of internal financial performance data, external market research, and competitor analysis to provide a robust strategic overview.