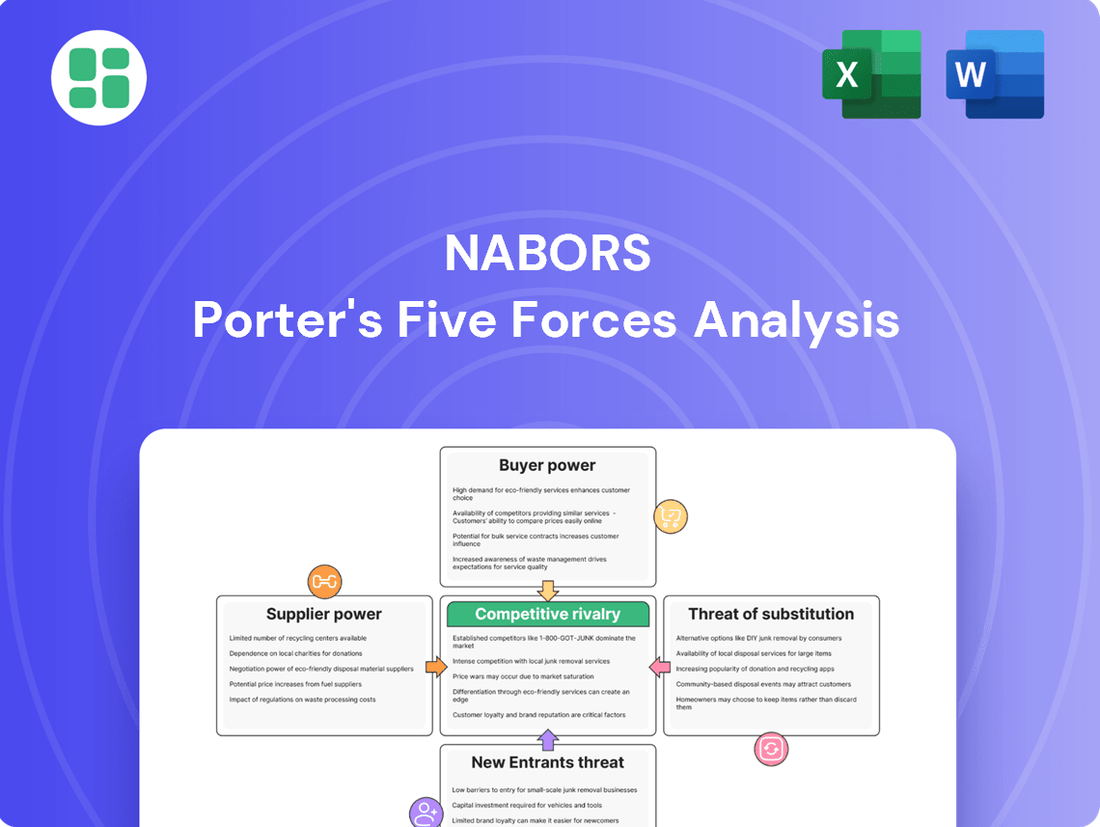

Nabors Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nabors Bundle

Nabors's competitive landscape is shaped by the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players. Understanding these forces is crucial for navigating the oil and gas drilling services sector.

The complete report reveals the real forces shaping Nabors’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Nabors Industries relies heavily on specialized manufacturers for advanced drilling rigs, critical components, and proprietary software. These suppliers often wield substantial bargaining power due to the unique, high-cost nature of their cutting-edge automation and digital solutions, which are essential for Nabors' operations.

The acquisition of Parker Wellbore in 2022, for instance, aimed to bolster Nabors' internal capabilities, particularly in tubular rental and casing services, potentially mitigating some reliance on external specialized providers and their associated pricing leverage.

The oil and gas drilling sector, including companies like Nabors, relies heavily on a specialized and skilled workforce. This includes engineers, experienced rig operators, and essential maintenance technicians. The demand for these professionals often outstrips supply, particularly for those with niche technical abilities.

A scarcity of this highly trained labor directly impacts operational costs. Companies may face increased wage demands and higher expenses for recruitment and retention, effectively increasing the bargaining power of these skilled employees. For instance, in 2024, reports indicated a persistent shortage of experienced rig crews in several key North American basins, leading to upward pressure on daily rates.

To mitigate this, Nabors, like its peers, must prioritize robust talent acquisition and development programs. Investing in training, apprenticeships, and competitive compensation packages is crucial for securing the necessary expertise to maintain efficient and safe drilling operations.

Suppliers of critical raw materials, such as the specialized chemicals used in drilling fluids or the steel essential for constructing drilling rigs, can wield significant influence over Nabors. This power intensifies when these suppliers are few in number or when the prices of their materials are prone to unpredictable swings. For instance, in 2024, the global price of steel experienced fluctuations due to ongoing geopolitical tensions and production adjustments, directly impacting the cost of Nabors' rig building and maintenance.

Proprietary Software and Digital Solutions

Nabors' increasing reliance on proprietary software and digital solutions, such as AI and real-time data analytics for its drilling operations, grants significant bargaining power to specialized technology providers. These suppliers, particularly those with unique or patented intellectual property, can dictate terms and pricing due to the critical nature of their offerings. For instance, in 2024, the demand for advanced operational software in the energy sector saw a notable increase, allowing key providers to negotiate favorable contracts.

This dependence creates a potential vulnerability for Nabors, as these specialized providers can leverage their technological edge to influence contract terms and costs. The effectiveness of Nabors' internal development and strategic collaborations will be crucial in mitigating this supplier power.

- Technological Dependence: Nabors' integration of AI, machine learning, and real-time data analytics into its rigs and services heightens its reliance on specialized software and digital solution providers.

- Supplier Leverage: Providers with unique or patented technologies can command higher prices and influence contract terms, impacting Nabors' operational costs.

- Mitigation Strategies: Nabors' internal technology development and collaborative efforts are key to reducing this supplier bargaining power.

Energy and Fuel Providers

The bargaining power of energy and fuel providers is a significant factor for Nabors. Drilling rigs are inherently energy-intensive, consuming large amounts of diesel fuel and, as the industry moves forward, electricity. This reliance means that increases in fuel prices or disruptions in energy supply chains can directly and substantially inflate Nabors' operating costs.

For instance, in 2024, global diesel prices experienced volatility, impacting transportation and operational expenses across many industries, including oil and gas services. Nabors' strategic initiatives to enhance rig electrification and improve overall energy efficiency are designed to mitigate this supplier power by reducing their dependence on traditional fuel sources and their susceptibility to price swings.

- Energy Intensity: Nabors' drilling operations require substantial diesel and electricity, making them vulnerable to energy price fluctuations.

- Cost Impact: Fluctuations in fuel prices directly affect Nabors' operating expenses, impacting profitability.

- Mitigation Strategies: The company is actively pursuing electrification and energy efficiency to lessen its reliance on energy suppliers.

Nabors' reliance on specialized technology providers for AI and data analytics grants these suppliers significant leverage. Companies with unique intellectual property can dictate terms and pricing, directly impacting Nabors' operational costs and efficiency. For example, in 2024, the demand for advanced energy sector software increased, allowing key providers to negotiate more favorable contracts.

The bargaining power of raw material suppliers, particularly for specialized steel and drilling fluids, also affects Nabors. Limited suppliers or volatile material prices, such as the steel price fluctuations seen in 2024 due to geopolitical factors, can increase Nabors' construction and maintenance expenses.

Furthermore, the scarcity of skilled labor, including experienced rig operators and technicians, empowers employees and specialized recruitment firms. In 2024, shortages in key North American basins led to increased wage demands, raising Nabors' operational costs.

| Supplier Type | Key Dependencies | 2024 Impact Example | Mitigation Efforts |

|---|---|---|---|

| Technology Providers | AI, data analytics, proprietary software | Increased software contract costs due to high demand | Internal development, strategic collaborations |

| Raw Material Suppliers | Specialized steel, drilling fluid chemicals | Steel price volatility impacting rig costs | Supply chain diversification, long-term contracts |

| Skilled Labor | Rig operators, engineers, technicians | Higher wages due to labor shortages | Talent acquisition, training programs, retention incentives |

What is included in the product

This analysis examines the competitive forces impacting Nabors, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the oil and gas drilling industry.

Quickly identify and address competitive threats with a visual, easy-to-understand breakdown of each Porter's Five Forces, eliminating the guesswork in strategic planning.

Customers Bargaining Power

The oil and gas exploration and production (E&P) sector, which forms Nabors' core customer base, has experienced substantial consolidation. This trend is particularly evident in crucial areas like the Permian Basin, where the number of independent E&P companies has dwindled.

This consolidation directly impacts Nabors by reducing the pool of potential clients. Consequently, the larger, surviving E&P firms wield increased bargaining power. They can leverage this position to negotiate more favorable terms for drilling contracts and daily rates, putting downward pressure on Nabors' revenue and profit margins.

Nabors' customers, primarily exploration and production (E&P) companies, wield significant bargaining power when commodity prices like crude oil and natural gas are volatile. When energy prices slump, E&P firms slash their capital expenditures, directly impacting demand for drilling services. This reduced demand leads to lower rig utilization rates for Nabors, forcing them to accept lower day rates to secure contracts.

Despite a growing global need for land drilling rigs, some areas, notably the U.S. Lower 48, have seen a surplus of rigs, leading to low utilization. This oversupply means customers have more choices, strengthening their bargaining power, especially for standard, less complex rigs.

Technological Advancements and Efficiency Demands

Exploration and Production (E&P) companies are pushing for rigs that drill faster, deeper, and with a smaller environmental footprint, driven by technological advancements. Nabors' commitment to smart technologies and automation allows them to meet these evolving efficiency demands. However, this technological leap also empowers customers, as they can leverage these innovations to negotiate for superior performance and more competitive pricing, thereby increasing their bargaining power.

The drive for efficiency directly impacts pricing leverage. For instance, Nabors reported in their 2023 annual report that their investments in automated drilling systems and advanced data analytics are designed to reduce non-productive time, a key metric for E&P companies. This reduction in downtime translates to cost savings for the customer, giving them more room to negotiate rates for Nabors' services. The ability of E&P firms to secure more efficient drilling operations means they can exert greater pressure on rig providers for better terms.

- Efficiency Demands: E&P companies require rigs capable of faster, deeper, and more environmentally friendly drilling.

- Nabors' Response: Nabors invests in smart technologies, automation, and robotics to meet these efficiency needs.

- Customer Leverage: These technological advancements enable customers to negotiate for better performance and pricing.

- Impact on Bargaining Power: Increased customer demand for efficiency amplifies their ability to bargain for favorable contract terms.

Long-term Contracts and Strategic Partnerships

Long-term contracts, while beneficial for revenue predictability, can shift bargaining power towards customers, especially when dealing with major players. For instance, Nabors' joint venture with Saudi Aramco, SANAD, exemplifies this. Saudi Aramco's significant scale and commitment to long-term drilling services through this partnership allow them to negotiate terms that favor their operational needs and cost structures.

These strategic alliances highlight a dynamic where consistent, large-scale demand from customers like Saudi Aramco grants them considerable influence. This influence is a direct result of their ability to commit to extended periods of service, ensuring a stable revenue stream for Nabors but also enabling customers to secure favorable pricing and operational conditions.

The bargaining power of customers in this context is further underscored by:

- Customer Concentration: A few large customers can represent a substantial portion of a company's revenue, giving them leverage.

- Switching Costs: While high for Nabors to acquire new customers, customers might face costs in switching drilling service providers if they are deeply integrated into Nabors' operations.

- Volume Commitments: The sheer volume of services required by major clients like those in the Middle East allows them to demand better terms.

- Joint Venture Dynamics: Partnerships like SANAD inherently involve shared decision-making, where customer needs and influence are significant factors in contract terms.

Nabors' customers, primarily large exploration and production (E&P) companies, possess significant bargaining power. This is amplified by industry consolidation, leading to fewer, larger clients who can negotiate more favorable terms and lower day rates, especially during periods of low oil and gas prices. The drive for drilling efficiency also empowers customers, as they can leverage Nabors' technological advancements to secure better performance and pricing.

In 2023, Nabors noted that its U.S. drilling rig utilization averaged around 66%, indicating a degree of customer choice and leverage. Customers also benefit from Nabors' investments in automation and smart technologies, which reduce non-productive time and translate to cost savings, further strengthening their negotiating position.

| Factor | Impact on Bargaining Power | Example/Data Point |

| Industry Consolidation | Increases customer power | Fewer, larger E&P companies in regions like the Permian Basin. |

| Commodity Price Volatility | Increases customer power during downturns | Low oil prices in 2023 led to reduced E&P capital expenditures. |

| Technological Demands | Increases customer power | Customers negotiate for faster, deeper, and more efficient drilling. |

| Rig Utilization | Increases customer power when low | U.S. Lower 48 utilization averaged ~66% in 2023. |

What You See Is What You Get

Nabors Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Nabors' competitive landscape through a detailed Porter's Five Forces analysis, covering the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

The land drilling rig market is intensely competitive, with Nabors facing formidable rivals such as Helmerich & Payne, Patterson-UTI Energy, and Ensign Energy Services. This landscape is further complicated by the presence of many smaller, regional drilling contractors, particularly in certain international arenas, which amplifies the competitive pressure.

The drilling industry demands significant investment in rigs, leading to substantial fixed costs for companies like Nabors. These high costs necessitate keeping rigs busy to spread the expense, creating pressure to secure contracts even at lower margins. For instance, in 2024, the average U.S. land rig utilization hovered around 70-75%, a figure that, while improved from prior years, still means a considerable portion of assets are idle, amplifying the impact of fixed costs.

The oil and gas drilling sector is intensely competitive, with technological innovation acting as a primary battleground. Companies like Nabors are pouring resources into developing and deploying advanced technologies, including sophisticated automation, comprehensive digitalization, and cutting-edge performance monitoring tools. This drive for differentiation is crucial, as competitors are also heavily invested in their own proprietary innovations. For instance, Nabors reported significant progress in its Rig Technologies segment in 2024, driven by the adoption of its automated drilling systems, which aim to enhance efficiency and safety.

Geographical Market Dynamics

Competitive intensity in the oil and gas drilling sector significantly shifts based on geography. For instance, the U.S. Lower 48 market experienced a notable downturn in day rates, a trend exacerbated by increased industry consolidation. This contrasts with regions like the Middle East and certain Asian markets, which present more favorable growth prospects.

Nabors Industries' extensive global footprint is a key strategic asset, enabling the company to adapt to these varying regional dynamics. This international presence, however, also means navigating a complex mosaic of competitive landscapes, each with its own unique pressures and opportunities.

- U.S. Lower 48: Declining day rates and consolidation indicate heightened competition.

- Middle East & Asia: Emerging growth potential suggests a different competitive intensity.

- Nabors' Global Strategy: Leverages its presence to manage diverse regional competitive pressures.

Mergers and Acquisitions Activity

The oil and gas drilling sector has experienced notable consolidation through mergers and acquisitions. A prime example is Nabors Industries' acquisition of Parker Wellbore, a move designed to bolster market share and broaden its service capabilities. This strategic consolidation, while reducing the number of smaller players, can lead to the emergence of larger, more dominant competitors.

This trend of industry consolidation is driven by the pursuit of economies of scale and enhanced operational efficiencies. Companies aim to achieve cost synergies through integrated operations and expanded service portfolios. For instance, in 2023, Nabors reported that the Parker Wellbore acquisition was expected to generate approximately $50 million in annual run-rate cost synergies within 18-24 months.

- Industry Consolidation: Significant M&A activity, like Nabors' acquisition of Parker Wellbore, aims to consolidate market share and expand service offerings.

- Synergies and Competition: Such deals seek cost synergies, potentially reducing direct competitors but also creating larger, more formidable rivals.

- Strategic Rationale: The primary drivers include achieving economies of scale and improving operational efficiencies in a competitive landscape.

- Financial Impact: Nabors projected $50 million in annual run-rate cost synergies from the Parker Wellbore acquisition, highlighting the financial motivations behind these transactions.

Nabors faces intense rivalry from major players like Helmerich & Payne and Patterson-UTI, alongside numerous smaller regional contractors, particularly in international markets. High fixed costs associated with drilling rigs compel companies to maintain high utilization rates, often leading to competitive pricing. Technological innovation is a key differentiator, with companies investing heavily in automation and digitalization to gain an edge. For example, Nabors' Rig Technologies segment saw growth in 2024 due to its automated drilling systems.

| Competitor | 2024 Estimated Revenue (USD Billions) | Key Differentiator |

|---|---|---|

| Helmerich & Payne | ~3.0 | Advanced drilling technology, strong U.S. land presence |

| Patterson-UTI Energy | ~2.5 | Integrated services, large rig fleet |

| Ensign Energy Services | ~1.5 | International presence, specialized drilling services |

SSubstitutes Threaten

The global shift towards renewable energy sources, such as solar and wind power, presents a significant threat of substitution for Nabors Industries. As nations and corporations increasingly invest in decarbonization efforts, the long-term demand for oil and gas exploration and production services, Nabors' primary market, is expected to face pressure. For instance, by 2024, the International Energy Agency reported that renewable energy sources accounted for a substantial portion of new power generation capacity globally, a trend that is projected to continue and accelerate.

Advancements in extraction technologies pose a significant threat of substitutes for traditional oil and gas drilling services. New methods, like advanced hydraulic fracturing or in-situ recovery techniques, could reduce the reliance on conventional drilling. For instance, innovations in geothermal energy extraction or even synthetic fuel production could offer alternative energy sources, indirectly impacting demand for oil and gas extraction.

The increasing focus on optimizing production from existing oil and gas wells presents a significant threat of substitutes for Nabors. Advanced completion techniques, enhanced oil recovery (EOR) methods, and re-fracking are enabling exploration and production (E&P) companies to extract more value from their current assets, potentially reducing the demand for new drilling services.

This trend means E&P companies may redirect capital towards maximizing output from existing wells rather than contracting for new rig services. For instance, in 2024, the global EOR market was projected to reach over $250 billion, indicating substantial investment in extending the life and productivity of mature fields, which directly impacts the need for new well drilling.

Development of Non-Hydrocarbon Energy Storage

The development of non-hydrocarbon energy storage presents a significant threat of substitutes to Nabors' core drilling services. While not a direct replacement for the physical act of drilling, advancements in technologies like advanced battery systems and hydrogen fuel cells are steadily reducing the global reliance on fossil fuels for energy generation and transportation. This shift directly impacts the demand for new oil and gas exploration and production activities, which are the primary drivers for Nabors' business.

Consider the rapid growth in renewable energy adoption. By the end of 2023, global renewable energy capacity additions reached an estimated 510 gigawatts (GW), a 50% increase compared to 2022, as reported by the International Energy Agency (IEA). This expansion, coupled with improving energy storage solutions, means less investment will be channeled into traditional hydrocarbon extraction. Consequently, the market for drilling services faces a long-term erosion of demand as the world transitions to cleaner energy sources.

- Reduced Demand for Exploration: As renewable energy sources become more efficient and cost-effective, the imperative to discover and extract new oil and gas reserves diminishes.

- Shifting Investment Priorities: Capital is increasingly flowing towards renewable energy infrastructure and storage solutions, diverting funds that might otherwise be used for oil and gas exploration.

- Policy and Regulatory Support: Governments worldwide are implementing policies and offering incentives to promote clean energy adoption and penalize fossil fuel use, further accelerating the shift away from hydrocarbons.

- Technological Advancements: Innovations in battery technology, such as solid-state batteries, promise higher energy density and faster charging, making them increasingly viable alternatives for transportation and grid-scale storage.

Changes in Global Energy Consumption Patterns

Long-term shifts in global energy consumption, like the rise of electric vehicles (EVs) and greater industrial energy efficiency, directly threaten demand for traditional oil and gas. For instance, by the end of 2023, global EV sales surpassed 13.6 million units, a significant increase from previous years, indicating a growing preference for alternatives to gasoline-powered vehicles.

These macro trends represent fundamental substitutes for hydrocarbon-based energy sources. As more countries and corporations commit to decarbonization goals, the reliance on oil and gas is expected to decline, impacting companies like Nabors, which provides drilling and rig services primarily for the oil and gas sector.

The International Energy Agency (IEA) projects that oil demand for road transport could peak and begin to decline in the coming years, driven by EV adoption and fuel efficiency improvements. This structural change in energy demand creates a potent substitute threat, potentially reducing the market size and profitability for oilfield service providers.

- Reduced Demand for Transportation Fuels: The increasing adoption of electric vehicles is a direct substitute for gasoline and diesel, impacting the demand for the very resources Nabors' clients extract.

- Energy Efficiency Improvements: Across industries, a focus on efficiency means less overall energy is consumed, lessening the need for new extraction projects.

- Growth of Renewable Energy Sources: While not a direct substitute for all oil and gas uses, the expanding role of solar, wind, and other renewables in the energy mix offers alternative power generation, potentially displacing fossil fuels.

- Government Policies and Regulations: Climate change initiatives and mandates favoring cleaner energy sources further accelerate the shift away from traditional hydrocarbons.

The increasing viability of alternative energy sources and technologies directly substitutes for the demand for oil and gas exploration, a core Nabors business. As renewable energy capacity grows and energy storage solutions improve, the need for new fossil fuel extraction projects diminishes. This trend is supported by data showing substantial global investment in renewables, signaling a long-term shift away from hydrocarbons.

For instance, by the end of 2023, global renewable energy capacity additions reached an estimated 510 gigawatts (GW), a 50% increase compared to 2022, according to the International Energy Agency (IEA). This expansion, coupled with advancements in energy storage, means less capital will be directed towards traditional hydrocarbon extraction, thereby reducing the market for drilling services.

| Trend | Impact on Nabors | Supporting Data (2023/2024 Estimates) |

| Renewable Energy Growth | Decreased demand for new oil and gas exploration | Global renewable capacity additions up 50% in 2023 (IEA) |

| Electric Vehicle Adoption | Reduced demand for transportation fuels | Global EV sales surpassed 13.6 million units by end of 2023 |

| Energy Efficiency Improvements | Lower overall energy consumption, less need for new extraction | Ongoing focus across industries to optimize energy use |

| Advanced Extraction/Storage | Potential for alternative energy sources | Global EOR market projected over $250 billion in 2024 |

Entrants Threaten

The land drilling rig industry is inherently capital-intensive. Companies like Nabors must invest heavily in acquiring, maintaining, and technologically upgrading their fleets of specialized drilling rigs and associated equipment. This substantial upfront financial commitment creates a significant barrier for new players looking to enter the market.

The operational demands of advanced drilling technology, including sophisticated software and deep expertise, present a significant barrier to entry. Nabors, for instance, invests heavily in maintaining and upgrading its fleet of technologically advanced rigs, a capital-intensive undertaking that requires specialized knowledge to operate efficiently and safely.

Established customer relationships present a significant barrier for new entrants. Nabors, for instance, benefits from deep-seated ties with major exploration and production (E&P) companies, often cemented by multi-year agreements and strategic alliances like its joint venture with Saudi Aramco, SANAD. These long-standing partnerships are built on trust and proven performance, making it exceptionally difficult for newcomers to gain traction and secure substantial contracts against such entrenched players.

Regulatory Hurdles and Environmental Standards

The oil and gas sector, including companies like Nabors, is heavily burdened by rigorous environmental regulations and safety standards. New companies entering this market must navigate complex permitting processes and substantial compliance costs, particularly those related to reducing emissions and adopting sustainable operational practices. For instance, in 2024, the US Environmental Protection Agency continued to enforce stricter methane emission standards for oil and gas facilities, requiring significant investments in leak detection and repair technologies.

These regulatory barriers act as a substantial deterrent to new entrants. The capital expenditure required to meet these evolving standards, coupled with the uncertainty of future regulatory changes, makes market entry particularly challenging. Companies must demonstrate a commitment to environmental stewardship and safety, which can be a significant hurdle for startups or smaller firms lacking established compliance frameworks and the financial capacity to absorb these costs.

- Compliance Costs: New entrants face substantial upfront and ongoing costs to meet environmental and safety regulations.

- Permitting Complexity: Obtaining necessary permits can be a lengthy and intricate process, delaying market entry.

- Technological Investment: Adhering to standards often necessitates investment in advanced technologies for emissions control and safety monitoring.

- Reputational Risk: Failure to comply can lead to significant fines and damage a new entrant's reputation in a highly scrutinized industry.

Access to Funding and Financing

New entrants in the oilfield services sector face significant hurdles in accessing capital. The industry’s inherent cyclicality and substantial capital expenditure requirements make financing a critical barrier. For instance, in 2024, the average capital expenditure for oil and gas companies globally remained robust, with many focusing on efficiency and technology upgrades, demanding substantial upfront investment that new players struggle to match.

Established companies benefit from existing relationships with financial institutions and a history of successful project execution. This translates into easier access to credit lines and more favorable loan terms compared to nascent competitors. In 2023, major oilfield service providers reported strong balance sheets, enabling them to secure financing at lower interest rates, a distinct advantage over newcomers seeking initial funding.

- High Capital Requirements: The cost of acquiring and maintaining specialized drilling rigs, equipment, and technology is immense, often running into hundreds of millions of dollars for a modern fleet.

- Cyclical Industry Nature: Oil price volatility directly impacts demand for services, making lenders cautious about extending credit to unproven entities during downturns.

- Established Financial Relationships: Incumbent firms leverage long-standing ties with banks and capital markets, securing financing more readily and at better rates.

- Proven Track Records: Existing companies can demonstrate a history of operational success and financial stability, which is crucial for attracting investment and loans.

The threat of new entrants in the land drilling rig industry is currently moderate, primarily due to the substantial capital investment required to acquire and maintain modern drilling fleets. Additionally, stringent environmental regulations, like those concerning methane emissions enforced in 2024, necessitate significant technological upgrades and compliance costs, posing a considerable barrier for newcomers. Established customer relationships and the need for proven operational track records further solidify the position of incumbents like Nabors.

Porter's Five Forces Analysis Data Sources

Our Nabors Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Nabors' own investor relations website, SEC filings, and industry-specific trade publications to assess competitive pressures.