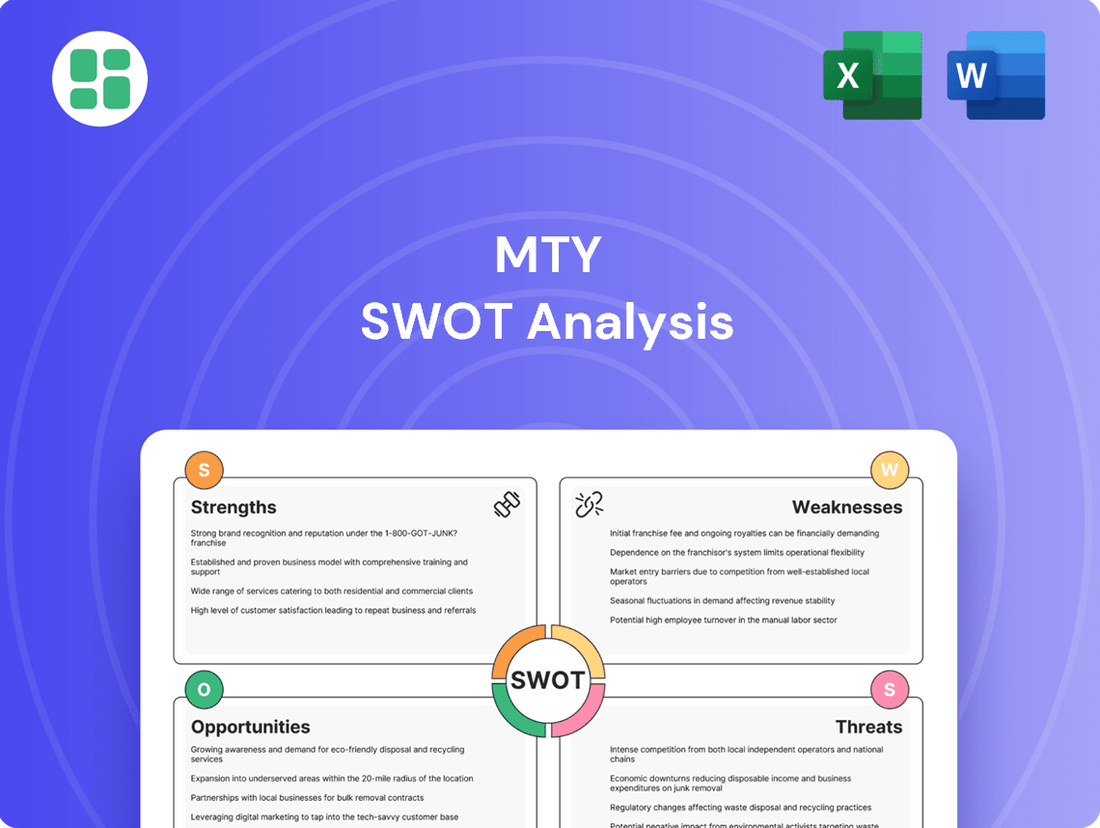

MTY SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MTY Bundle

MTY's current SWOT analysis reveals a company with strong brand recognition and a diverse portfolio, but also highlights potential challenges in market saturation and evolving consumer preferences.

Want to understand the full depth of MTY's competitive advantages and potential vulnerabilities? Purchase the complete SWOT analysis to unlock actionable strategies and detailed market insights, empowering your investment decisions.

Strengths

MTY Food Group's strength lies in its extensive brand portfolio, encompassing over 80 quick-service and casual dining restaurants. This vast selection spans diverse cuisines, from Thai to Mexican, ensuring a wide appeal to different consumer tastes.

This significant diversification is a key advantage, as it prevents over-reliance on any single restaurant concept. For instance, MTY's portfolio includes well-established brands like Thai Express and Mucho Burrito, which contribute to a stable revenue stream even if one segment of the market experiences a slowdown.

The broad range of offerings acts as a buffer against economic volatility and shifts in consumer preferences. By catering to various dining occasions and tastes, MTY Food Group can maintain resilience, as demonstrated by its ability to navigate the challenges faced by the food service industry in recent years, with system-wide sales reaching $1.6 billion in fiscal 2023.

MTY Food Group's strength lies in its robust franchise model, an asset-light strategy that significantly reduces capital expenditure and operational risks. This approach allows the company to generate high-margin royalty fees and consistent cash flow, as evidenced by its strong financial performance in recent years. For instance, in 2023, MTY's royalty and franchise fee revenue represented a substantial portion of its total income, underscoring the model's profitability.

This franchising structure also leverages the entrepreneurial spirit of independent operators, fostering organic network expansion and driving overall system sales growth. By minimizing its direct investment in physical stores, MTY can more effectively allocate capital towards brand development, marketing, and strategic acquisitions, further solidifying its market position.

MTY Food Group consistently demonstrates strong operating and free cash flow generation, a testament to its efficient business model. For instance, in the first quarter of 2024, MTY reported a significant increase in cash flow from operations, providing a solid foundation for its financial strategies.

This robust cash flow allows MTY to actively manage its balance sheet by reducing long-term debt and simultaneously rewarding shareholders. The company's share repurchase programs and consistent dividend payments, which saw a notable increase in their quarterly dividend in late 2023, underscore its commitment to returning value to its investors.

Strategic Acquisitions and Organic Growth Initiatives

MTY Food Group has a proven track record of strategic acquisitions, a cornerstone of its growth and brand diversification over its 45-year history. This approach has consistently expanded its market presence and portfolio.

Complementing its acquisition strategy, MTY is actively pursuing organic growth. This involves opening new locations and enhancing the performance of its existing restaurants.

These combined efforts are yielding tangible results. In 2023, MTY achieved net positive location growth for the first time in ten years, with a total of 7,246 locations globally by the end of the year. This growth was driven by 176 new openings, offset by 102 closures.

- Strategic Acquisitions: MTY's history is marked by successful acquisitions, significantly contributing to its brand portfolio and market share.

- Organic Growth Focus: The company is investing in expanding its footprint through new store openings and improving the performance of existing units.

- Net Positive Location Growth: For the first time in a decade, MTY reported net positive location growth in 2023, with 7,246 total locations worldwide.

- Expansion Metrics: The company added 176 new locations in 2023 while closing 102, demonstrating a net increase in its operational base.

Focus on Digital Sales and Operational Efficiency

MTY Food Group is making significant strides in its digital transformation, with a clear focus on boosting digital sales. In the first quarter of 2024, digital sales represented 15.8% of total sales, a notable increase from 12.5% in the same period of 2023. This growth highlights the company's successful investment in online platforms and delivery services, enhancing customer accessibility and convenience.

The company is also aggressively pursuing operational efficiency through several key initiatives. Cost control measures and strategic restructuring are already in place, designed to streamline operations and improve profitability. A major undertaking for 2025 is the rollout of a new Enterprise Resource Planning (ERP) system. This advanced system is expected to further optimize supply chain management, inventory control, and overall business processes, contributing to a more agile and cost-effective operation.

- Digital sales grew to 15.8% of total sales in Q1 2024, up from 12.5% in Q1 2023.

- Ongoing cost control measures and restructuring are in effect.

- A new ERP system is scheduled for implementation in 2025 to enhance operational efficiency.

- These digital and operational improvements are geared towards enhancing customer experience and supporting long-term growth.

MTY Food Group's extensive brand portfolio, exceeding 80 quick-service and casual dining concepts, offers significant diversification across various cuisines. This broad appeal, exemplified by brands like Thai Express and Mucho Burrito, provides resilience against market fluctuations and changing consumer preferences, contributing to system-wide sales of $1.6 billion in fiscal 2023.

The company's asset-light franchise model is a key strength, generating high-margin royalties and consistent cash flow with reduced capital expenditure. This model, which saw royalty and franchise fee revenue form a substantial part of its income in 2023, enables efficient capital allocation towards brand development and strategic growth.

MTY demonstrates strong cash flow generation, with Q1 2024 showing a significant increase in cash flow from operations. This financial health supports debt reduction and shareholder returns, including a notable dividend increase in late 2023.

The company's strategic acquisition history, spanning 45 years, has consistently expanded its brand offerings and market reach. This is complemented by a renewed focus on organic growth, leading to a net positive location increase in 2023, with 7,246 global locations achieved through 176 new openings against 102 closures.

MTY is actively enhancing its digital presence, with digital sales climbing to 15.8% of total sales in Q1 2024, up from 12.5% in Q1 2023. Furthermore, a new ERP system is slated for 2025 implementation to boost operational efficiency and supply chain management.

| Metric | 2023 (Fiscal Year) | Q1 2024 (Fiscal Year) |

|---|---|---|

| System-Wide Sales | $1.6 billion | N/A |

| Total Locations | 7,246 | N/A |

| New Locations Opened | 176 | N/A |

| Locations Closed | 102 | N/A |

| Digital Sales % of Total Sales | N/A | 15.8% |

What is included in the product

Delivers a strategic overview of MTY's internal capabilities and external market landscape.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities for growth.

Weaknesses

A significant portion of MTY Food Group's restaurant portfolio, around 60% as of early 2024, is concentrated in shopping malls and food courts. This reliance makes the company particularly susceptible to fluctuations in consumer foot traffic within these specific retail environments. Changes in shopping habits, such as the ongoing shift towards e-commerce, can directly reduce the number of people visiting these locations, impacting sales for MTY's brands and their franchisees.

The vulnerability of mall-based locations was highlighted by a notable dip in mall traffic during the early 2020s, a trend that, while recovering, still presents a risk. If consumer preference continues to move away from traditional brick-and-mortar retail, MTY's revenue streams tied to these venues could face sustained pressure. This concentration also means that growth opportunities in areas without significant mall presence might be limited.

While MTY's franchising model generally thrives, its corporate-owned restaurant segment has encountered headwinds. This directly managed sector has seen a downturn in EBITDA and thinner profit margins, signaling operational strains. For instance, in the fiscal year ending November 30, 2023, MTY reported impairment charges of $10.5 million related to underperforming corporate stores, highlighting the difficulties in optimizing these locations.

These performance issues within the corporate segment necessitate a focused strategic review. The company needs to address the root causes of these declines to enhance profitability and mitigate the inherent operational risks associated with direct ownership. A potential recalibration of this segment could involve divesting underperforming assets or implementing more aggressive turnaround strategies.

MTY Food Group's balance sheet reflects a significant reliance on leverage, with substantial long-term debt obligations. As of the first quarter of 2024, MTY reported total debt of $679.3 million, a slight decrease from $685.2 million in the prior year, indicating ongoing debt management efforts.

While MTY has demonstrated a capacity to service its debt through strong cash flows, the high debt levels inherently introduce financial risks. A challenging economic climate or increasing interest rates, as seen with the Bank of Canada's policy rate holding at 5.00% in early 2024, could strain the company's ability to manage these obligations and potentially impact its capacity for future strategic investments or acquisitions.

Vulnerability to Macroeconomic Headwinds and Consumer Caution

MTY Food Group's performance is closely tied to the overall economic climate, making it vulnerable to macroeconomic headwinds. Factors like high inflation and tighter consumer budgets can significantly impact discretionary spending, which directly affects the restaurant industry. For instance, MTY has observed weakening U.S. sales and a decline in same-store sales in certain markets, a clear signal of this economic sensitivity.

The restaurant sector often acts as a bellwether for consumer confidence. As discretionary spending tightens, consumers tend to cut back on dining out, leading to reduced traffic and sales for establishments like those in MTY's portfolio. This cautious consumer behavior, driven by economic uncertainty, presents a notable weakness for the company's growth prospects.

- Inflationary Pressures: Rising costs for ingredients and labor can squeeze profit margins if not passed on to consumers, who are already budget-conscious.

- Consumer Spending Habits: A shift towards value-oriented options or a reduction in dining frequency directly impacts revenue streams for quick-service and casual dining brands.

- Economic Downturn Sensitivity: As a discretionary sector, the restaurant industry is often one of the first to feel the impact of an economic slowdown or recessionary fears.

Geographic Disparity in Performance

MTY Food Group faces a significant weakness in its geographic performance disparity. While its Canadian operations have demonstrated resilience, the U.S. segment has struggled, particularly with corporate-owned stores experiencing declining same-store sales and profitability. For instance, in the first quarter of fiscal 2024, MTY reported that its U.S. segment's adjusted EBITDA margin was 14.8%, a notable drop from the 19.2% seen in the same period of fiscal 2023, indicating a clear underperformance compared to its Canadian counterparts.

This imbalance suggests that MTY's strategies are not yielding consistent results across its key markets. The divergence points to potential issues in market penetration, brand appeal, or operational execution within the United States that need to be addressed.

- Canadian Market Strength: MTY's Canadian operations continue to be a stable performer, contributing significantly to overall revenue and profitability.

- U.S. Market Challenges: The U.S. segment, especially corporate stores, has shown a downward trend in key performance indicators like same-store sales and profitability.

- Profitability Gap: The U.S. segment's lower profitability margins in early fiscal 2024 compared to the previous year highlight the severity of the performance gap.

- Strategic Implication: This geographic imbalance necessitates focused strategic interventions to revitalize the U.S. market and ensure more uniform growth across the company.

MTY's significant reliance on mall-based locations, representing about 60% of its portfolio in early 2024, makes it vulnerable to declining foot traffic due to e-commerce growth. This concentration limits expansion into non-mall areas and exposes the company to shifts in consumer retail habits.

The corporate-owned store segment has faced profitability challenges, with reported impairment charges of $10.5 million in fiscal 2023 for underperforming locations. This indicates operational inefficiencies that need strategic attention to improve margins and mitigate risks associated with direct ownership.

MTY carries substantial debt, totaling $679.3 million in Q1 2024. While manageable with current cash flows, high leverage introduces financial risk, especially if interest rates rise or the economic climate deteriorates, potentially hindering future investments.

The company's performance is highly sensitive to economic downturns, as discretionary spending on dining out decreases during periods of inflation and consumer budget tightening. This was evident in weakening U.S. sales and declining same-store sales in certain markets in early 2024.

Geographic performance is uneven, with the U.S. segment showing underperformance. In Q1 fiscal 2024, the U.S. adjusted EBITDA margin dropped to 14.8% from 19.2% in the prior year, highlighting a profitability gap compared to its stronger Canadian operations.

Full Version Awaits

MTY SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

MTY Food Group's strategy heavily relies on acquiring new restaurant brands to fuel its growth. This approach has been a consistent theme, with the company actively seeking opportunities to integrate complementary concepts into its existing portfolio. For instance, in 2023, MTY completed the acquisition of a significant number of locations, further solidifying its market position.

The company's disciplined approach to acquisitions means it targets deals where valuations are attractive and the new brands can benefit from MTY's operational expertise. This focus on accretive acquisitions is a primary driver for expanding its market presence and brand diversity, as seen in its consistent track record of integrating new chains effectively.

MTY's continued investment in digital sales channels, such as online ordering and delivery, is a prime opportunity for growth. In 2024, the company saw substantial increases in digital transactions across its brands, with some reporting over 30% of sales coming through these platforms. This trend is expected to accelerate.

The planned rollout of a new ERP system in 2025 is a critical step to capitalize on technology. This upgrade aims to streamline back-end operations, improve inventory management, and provide richer data for decision-making, potentially leading to cost savings and better resource allocation.

Further technological adoption can enhance customer engagement through personalized marketing and loyalty programs. By leveraging data analytics, MTY can optimize menu development and tailor promotions, driving repeat business and increasing average check sizes, a strategy that proved effective for many QSRs in 2024.

MTY Food Group is strategically pursuing organic growth by opening new locations for its established brands. This includes expanding into various formats like street-front restaurants and non-traditional venues, aiming for positive unit growth despite market dynamics.

The company's commitment to a robust pipeline of new openings, coupled with careful management of store closures, underscores its intention to broaden its market presence. For instance, MTY reported a net increase of 20 locations in the first quarter of fiscal 2024, ending November 30, 2023, highlighting this expansionary strategy.

International Market Expansion

MTY Food Group has a significant opportunity to grow by expanding its reach beyond Canada and the United States. This international market expansion can be strategically pursued through master franchise agreements, allowing for a more scalable entry into new territories.

Developing a more robust international presence offers several key advantages. It diversifies MTY's revenue streams, making the company less susceptible to fluctuations in any single market. Furthermore, tapping into new consumer bases can unlock substantial growth potential, as demonstrated by the global appeal of many quick-service restaurant concepts.

This strategic move also serves to reduce the company's reliance on North American economic conditions. As of the first quarter of 2024, MTY's international operations accounted for a notable portion of its revenue, with continued growth in regions like Europe and Asia presenting a clear avenue for future development.

- Diversified Revenue: International expansion reduces dependence on the Canadian and U.S. markets.

- New Market Access: Tapping into global consumer demand offers significant growth potential.

- Scalable Growth: Master franchise agreements provide an efficient model for international rollout.

- Reduced Economic Risk: A broader geographic footprint mitigates the impact of regional economic downturns.

Optimizing Corporate Store Portfolio and Franchise Conversion

MTY Food Group faces challenges with its corporate-owned stores, creating an avenue to optimize this portfolio. A key strategy involves converting underperforming corporate locations into franchised units. This aligns perfectly with MTY's preference for an asset-light model, which can significantly boost overall profitability by reducing direct operational costs and capital expenditure.

This strategic shift can lead to improved financial performance. For instance, by focusing resources on the most profitable corporate stores and either divesting or franchising the less productive ones, MTY can enhance its overall profit margins. This approach allows for a more efficient allocation of capital and management attention.

- Portfolio Optimization: Convert underperforming corporate stores to franchised units to align with MTY's asset-light strategy.

- Profitability Enhancement: Focus on high-performing corporate stores and franchise or divest underperforming locations to boost margins.

- Strategic Alignment: This move supports MTY's broader goal of expanding its franchised network and reducing direct operational overhead.

MTY's digital sales channels present a significant growth opportunity, with many brands reporting over 30% of sales from online and delivery platforms in 2024. The company's planned ERP system upgrade in 2025 is poised to streamline operations and enhance data-driven decision-making, further capitalizing on technology. Enhanced customer engagement through personalized marketing and loyalty programs, leveraging data analytics, can drive repeat business and increase average check sizes, a trend observed across the QSR sector in 2024.

MTY is actively pursuing organic growth by opening new locations, aiming for positive unit growth across its brands. For example, the company reported a net increase of 20 locations in the first quarter of fiscal 2024, ending November 30, 2023, demonstrating its commitment to expanding its physical footprint. This includes exploring various formats like street-front restaurants and non-traditional venues to broaden market presence.

Expanding internationally offers MTY a chance to diversify revenue streams and reduce reliance on North American markets, as international operations already contribute a notable portion of revenue as of Q1 2024. Utilizing master franchise agreements can facilitate scalable entry into new territories, unlocking substantial growth potential by tapping into global consumer demand. This strategic move helps mitigate risks associated with regional economic downturns.

Optimizing its corporate-owned store portfolio by converting underperforming locations to franchised units aligns with MTY's asset-light strategy and can significantly boost profitability. This focus on high-performing corporate stores, while franchising or divesting less productive ones, allows for more efficient capital allocation and management attention, enhancing overall profit margins.

Threats

The quick-service and casual dining landscape is incredibly crowded. MTY operates in a space where established brands and emerging concepts constantly compete for consumer attention and dollars. This means MTY is up against not just other franchisors, but also independent eateries and even non-traditional food providers.

This fierce competition can really squeeze margins. For MTY, it often translates into needing to spend more on advertising and promotions to stand out. Furthermore, keeping customers loyal becomes a significant challenge when there are so many alternatives readily available.

The restaurant sector, including MTY Food Group, is feeling the pinch from escalating input costs. Inflation is driving up the price of everything from ingredients to wages, creating a challenging environment. For instance, in 2024, the Consumer Price Index (CPI) for food away from home in Canada saw a notable increase, impacting restaurant operating expenses significantly.

These rising prime costs directly affect profit margins. Both MTY's corporate-owned locations and its franchisees face pressure to absorb these increases or pass them on to customers through higher menu prices. This delicate balancing act is crucial, as price hikes could potentially lead to reduced customer traffic and sales volume.

MTY's success hinges on its capacity to navigate these inflationary headwinds. Efficient cost management strategies and careful pricing decisions are paramount to maintaining profitability without alienating its customer base. The company's ability to adapt quickly to these economic shifts will be a key determinant of its performance in the coming periods.

Economic uncertainties, such as the possibility of recessions or prolonged high inflation, can significantly curb consumer spending on non-essential items like dining out. This directly affects MTY's system-wide sales and overall profitability across its diverse brand portfolio.

For instance, during periods of economic slowdown, consumers often prioritize essential goods and services, leading to reduced traffic at restaurants. MTY's reliance on discretionary spending makes it vulnerable to these shifts, impacting revenue streams.

The company's financial performance is therefore sensitive to economic cycles, posing a persistent threat to its revenue stability. For example, while MTY reported strong growth in fiscal year 2023, continued economic headwinds in 2024 and 2025 could temper these gains.

Geopolitical Risks and Trade Tariffs

Geopolitical tensions and trade tariffs, especially those originating from the U.S. impacting Canadian imports, pose a significant threat to MTY's supply chain and can drive up the cost of goods. Even though MTY largely sources within Canada, tariffs on key ingredients or essential equipment could still lead to higher operating expenses. For example, in 2023, the U.S. maintained tariffs on various steel and aluminum products, which could indirectly affect the cost of restaurant equipment or packaging materials sourced from or manufactured using these materials.

The dynamic nature of international trade policies creates an environment of uncertainty, potentially introducing financial headwinds for MTY. These shifts can disrupt established sourcing agreements and necessitate costly adjustments to supply chain management.

- Supply Chain Disruption: Tariffs can increase the cost of imported ingredients or equipment, impacting MTY's cost of goods sold.

- Increased Operational Costs: Unexpected tariff implementations can lead to higher expenses for franchisees and the parent company.

- Uncertainty in Planning: Fluctuating trade policies make long-term financial forecasting and strategic sourcing more challenging.

- Competitive Disadvantage: If competitors have more resilient supply chains or are less reliant on affected imports, MTY could face a competitive disadvantage.

Brand Image and Reputation Risks

MTY Food Group's extensive portfolio of over 90 brands presents a significant threat to its brand image and reputation. Maintaining consistent quality and positive consumer perception across such a diverse range of restaurants is a constant challenge. A single incident, such as a food safety recall or a widely publicized dispute with a franchisee, could rapidly tarnish the reputation of multiple MTY brands simultaneously, impacting consumer trust and sales across its vast network. For example, in 2024, reports of supply chain disruptions affecting certain popular fast-casual chains highlighted the interconnectedness of MTY's brand management.

The potential for negative publicity to spread rapidly through social media and news outlets poses a substantial risk. MTY's ability to effectively manage and respond to crises across its many concepts is critical. Failure to do so could lead to widespread damage to consumer confidence, affecting not just the directly implicated brand but also others within the MTY umbrella. The company's 2024 annual report noted increased investment in digital reputation management tools to mitigate these risks.

Ensuring consistent operational standards and quality control across all franchised and corporate-owned locations is an ongoing operational threat. Variations in food preparation, customer service, or cleanliness can lead to disparate brand experiences, undermining the overall MTY brand equity. MTY's 2025 strategic plan emphasizes enhanced franchisee training and auditing protocols to address these consistency concerns.

- Brand Dilution: Over-expansion or inconsistent brand messaging across MTY's diverse portfolio could dilute the unique appeal of individual concepts.

- Reputational Contagion: Negative news regarding one MTY brand, such as a foodborne illness outbreak, can quickly spill over and negatively impact consumer perception of other MTY-owned restaurants.

- Franchisee Relations: Strained relationships with franchisees, potentially stemming from operational disputes or perceived lack of support, can lead to public criticism and damage brand reputation.

- Supply Chain Vulnerabilities: Disruptions in the supply chain for key ingredients, as seen in early 2024 affecting certain dairy suppliers, can impact product quality and availability, leading to customer dissatisfaction and reputational harm.

Intense competition from numerous established and emerging brands puts pressure on MTY's market share and requires significant marketing investment to maintain visibility. This crowded environment makes customer loyalty a constant challenge, as consumers have abundant dining choices. For instance, in 2024, the Canadian restaurant industry saw continued growth in new outlets, intensifying this competitive landscape.

Rising inflation significantly impacts MTY's cost of goods sold and operational expenses, affecting profit margins for both the parent company and its franchisees. In 2024, food inflation in Canada remained a key concern, with the average cost of groceries increasing by approximately 5-7% year-over-year, directly translating to higher ingredient costs for restaurants.

Economic downturns and potential recessions pose a threat to MTY's revenue, as consumers tend to reduce discretionary spending on dining out during uncertain economic periods. While MTY demonstrated resilience in 2023, forecasts for 2024 and 2025 suggest a cautious economic outlook, which could temper consumer spending.

Geopolitical events and trade policies can disrupt MTY's supply chain, leading to increased costs for ingredients and equipment. For example, tariffs on imported goods, even indirectly, can inflate operational expenses, as seen with the continued volatility in global trade relations throughout 2023 and into 2024.

SWOT Analysis Data Sources

This MTY SWOT analysis is built on a foundation of robust data, drawing from official financial reports, comprehensive market intelligence, and expert industry analysis to ensure a thorough and actionable strategic overview.