MTY Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MTY Bundle

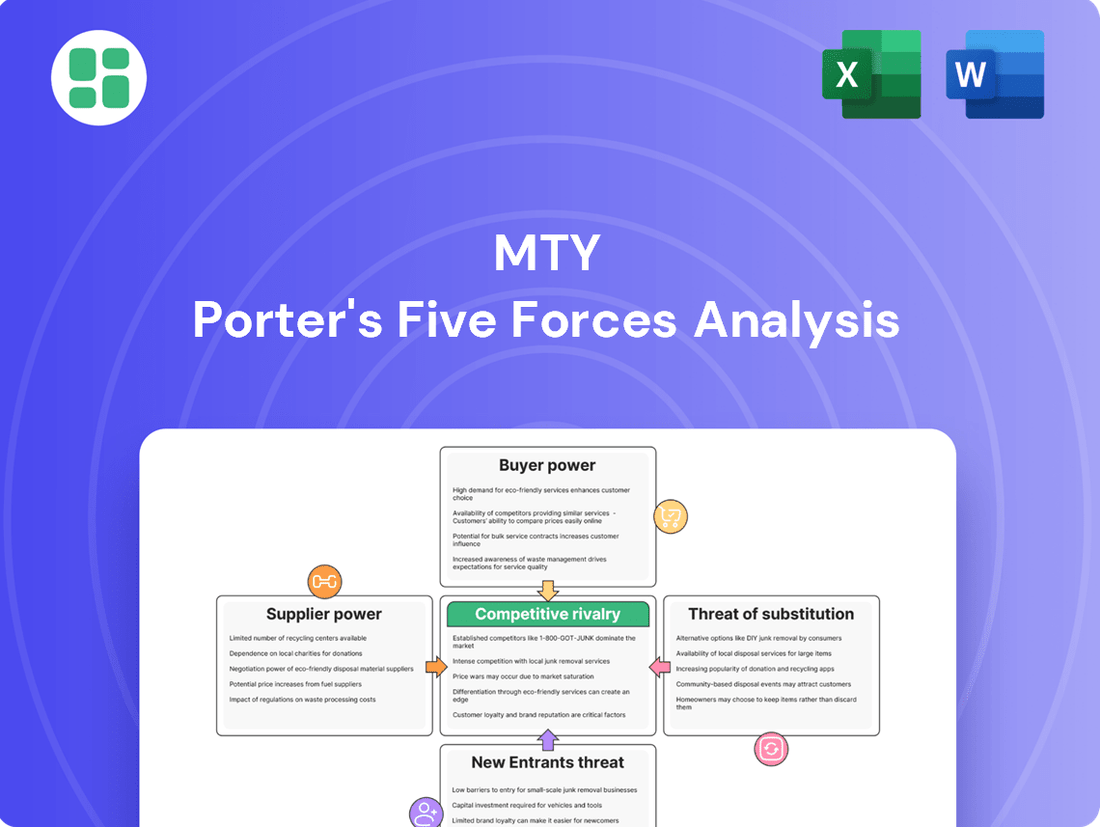

Understanding the competitive landscape is crucial for any business, and MTY is no exception. Our Porter's Five Forces analysis delves into the critical factors influencing MTY's market, from buyer power to the threat of new entrants.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore MTY’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

MTY Food Group's strength lies in its vast network of over 80 brands and numerous locations, which translates to a highly fragmented supplier base. This broad supplier pool, encompassing everything from fresh produce to specialized kitchen equipment, significantly reduces the bargaining power of any individual supplier.

With such a diverse range of suppliers available, MTY can easily switch providers if terms become unfavorable. This competition among suppliers allows MTY to negotiate advantageous pricing and payment terms, leveraging its substantial purchasing volume across its entire brand portfolio and geographic reach.

MTY Food Group's diversified sourcing strategy is a key factor in managing supplier bargaining power. With operations spanning Canada, the US, and international markets, MTY leverages its multi-brand portfolio to spread procurement across various suppliers and regions.

This broad geographic and brand reach allows MTY to pivot sourcing if one supplier or region faces issues, such as price hikes or disruptions. For instance, if a key ingredient becomes more expensive in one area, MTY can often secure it from an alternative supplier in another location, lessening the impact of any single supplier's leverage.

In 2024, MTY Food Group continued to expand its franchise network, operating over 7,000 locations. This scale reinforces its ability to negotiate favorable terms with suppliers due to the sheer volume of goods purchased across its diverse brands.

While MTY Food Group's significant purchasing volume gives it considerable leverage, the critical need for consistent quality and strict adherence to food safety standards can empower certain specialized suppliers. This is particularly true for those providing unique ingredients or proprietary recipes essential to MTY's diverse brand portfolio. For instance, a supplier of a signature sauce for one of MTY's popular brands might hold more sway than a bulk supplier of generic produce.

Potential for Backward Integration

MTY Food Group's ownership of a food processing plant and a distribution center offers a strategic advantage by allowing for a degree of backward integration. This capability directly influences the bargaining power of suppliers by reducing MTY's dependence on external parties for essential components and logistics. For instance, in 2023, MTY's internal processing and distribution likely supported a significant portion of its supply chain needs, lessening the impact of supplier price hikes.

This internal capacity not only insulates MTY from some supplier pressures but also provides valuable insights into the true costs associated with production and distribution. By understanding these internal costs, MTY is better positioned to negotiate with external suppliers, as they can more accurately assess the fairness of pricing and terms. This transparency strengthens their hand at the bargaining table.

- Backward Integration: MTY's food processing plant and distribution center reduce reliance on external suppliers.

- Cost Insight: Internal operations provide data to strengthen negotiation positions with suppliers.

- Reduced Dependence: Lessening reliance on outside services enhances MTY's bargaining power.

Impact of Commodity Price Volatility

The bargaining power of suppliers for MTY Food Group is significantly influenced by commodity price volatility. Many of MTY's key ingredients, such as meat, grains, and dairy products, are subject to global price fluctuations. For instance, the FAO Food Price Index, a measure of the monthly change in international prices of a basket of food commodities, experienced notable swings throughout 2024, with certain categories like dairy seeing upward pressure due to supply chain disruptions and increased demand.

While MTY's considerable scale provides some leverage in negotiating with suppliers, sustained and sharp increases in these commodity prices can eventually lead to higher input costs. This directly impacts MTY's profit margins if these increased costs cannot be effectively passed on to consumers through pricing adjustments or mitigated through strategic hedging practices. For example, a prolonged period of high beef prices in late 2024 could squeeze margins for MTY's burger-focused brands if not managed proactively.

- Commodity Price Sensitivity: MTY's cost of goods sold is directly linked to volatile global commodity markets for essential ingredients.

- Impact on Margins: Significant and sustained commodity price hikes can erode MTY's profitability if cost increases aren't offset.

- Mitigation Strategies: Effective pricing strategies and financial hedging are crucial for managing supplier cost pressures.

- Scale as a Buffer: MTY's size offers some negotiating power, but it doesn't completely insulate it from market-wide cost increases.

MTY Food Group's extensive network of over 8,000 locations across more than 80 brands significantly dilutes supplier bargaining power by creating a fragmented supplier base. This vast scale allows MTY to easily switch suppliers if terms are unfavorable, leveraging its substantial purchasing volume to negotiate advantageous pricing and payment terms across its diverse portfolio. For instance, in 2024, MTY's continued expansion reinforced its ability to negotiate favorable terms due to the sheer volume of goods purchased.

While MTY's scale provides leverage, specialized suppliers of unique ingredients or proprietary recipes can still hold considerable influence, as seen with suppliers of signature sauces. Furthermore, commodity price volatility for key ingredients like meat and grains, as reflected in global indices throughout 2024, can impact MTY's input costs, necessitating proactive cost management and hedging strategies to protect profit margins.

| Factor | MTY's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Supplier Base Fragmentation | Highly fragmented due to over 8,000 locations and 80+ brands | Lowers bargaining power; MTY can easily switch providers. |

| Purchasing Volume | Substantial and growing, reinforced by 2024 expansion | Increases MTY's negotiation leverage. |

| Specialized Suppliers | Certain suppliers of unique ingredients have more influence | Can increase bargaining power for specific inputs. |

| Commodity Price Volatility | Sensitive to global price swings for key ingredients (e.g., meat, grains) | Can increase supplier power if prices rise sharply and consistently. |

What is included in the product

MTY Porter's Five Forces Analysis dissects the competitive landscape by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the restaurant industry, specifically for MTY Food Group.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

MTY Food Group's customers, particularly those frequenting quick-service and casual dining establishments, wield considerable bargaining power. The sheer abundance of dining choices, with over a million restaurants operating in the United States and a vast array of options in Canada, means consumers have little incentive to remain loyal if unsatisfied.

This high degree of customer choice translates directly into low switching costs for MTY's end consumers. A diner can easily move from one restaurant to another if they find a better price, a higher quality meal, or a more appealing dining experience elsewhere, putting pressure on MTY to maintain competitive offerings.

MTY Food Group's core business relies on franchising, meaning its franchisees are its direct customers. These operators, while contractually obligated, hold sway due to their direct impact on MTY's revenue and brand presence. Their collective profitability is paramount for MTY's continued growth and operational success.

Franchisees can exert influence through various channels. They participate in purchasing cooperatives, which can negotiate better terms, and their feedback often shapes brand standards and operational procedures. In situations where the franchise model proves consistently unprofitable, franchisees possess the ultimate leverage of choosing not to renew their agreements, a significant consideration for MTY's long-term stability.

Consumers, particularly in the quick-service and casual dining sectors, demonstrate significant price sensitivity. This means they are very aware of prices and actively look for good deals, a behavior that has been further emphasized by rising inflation in 2024 and continuing into 2025. This puts pressure on companies like MTY Food Group to keep their prices competitive, making it tough to fully pass on any increased operating costs to customers.

Evolving Consumer Preferences

Customer preferences are in constant flux, with a notable surge in demand for healthier food choices, plant-based options, and environmentally sustainable practices. The convenience of digital ordering and delivery also plays a significant role in consumer decisions.

MTY Food Group must remain highly adaptable, continuously refining its extensive brand portfolio and menu selections to align with these evolving consumer expectations. Failing to do so could result in a loss of market share to competitors that are quicker to embrace emerging trends.

For instance, in 2024, the plant-based food market continued its robust growth, with projections indicating a global market size exceeding $160 billion by 2030, highlighting the financial imperative for MTY to integrate more such offerings. Similarly, consumer surveys in late 2023 and early 2024 revealed that over 60% of diners consider sustainability when choosing a restaurant.

- Growing demand for plant-based options: The plant-based sector is a key area of evolving consumer preference.

- Emphasis on health and wellness: Consumers are increasingly seeking nutritious and wholesome food choices.

- Digital convenience is paramount: Seamless online ordering and efficient delivery services are now expected.

- Sustainability as a decision factor: Environmentally conscious practices influence where consumers choose to dine.

Digitalization and Delivery Platforms

The proliferation of digital ordering, mobile apps, and third-party delivery platforms significantly bolsters customer bargaining power. This digital shift allows consumers to effortlessly compare prices, menus, and reviews across numerous restaurants, driving down switching costs and increasing price sensitivity. For instance, in 2024, the food delivery market continued its robust growth, with platforms like Uber Eats and DoorDash facilitating millions of transactions daily, giving customers unprecedented choice and leverage.

MTY's reliance on these platforms, while crucial for market access, creates a dynamic where MTY must either share a portion of its revenue through commission fees or absorb these costs, directly impacting its profit margins. This dependence means that the terms set by these powerful intermediaries can directly influence MTY's profitability and operational flexibility.

- Increased Customer Choice: Digital platforms provide consumers with a vast array of dining options at their fingertips, intensifying competition among restaurants.

- Price Transparency: Easy comparison of prices and promotions across multiple platforms forces restaurants to be more competitive, potentially squeezing margins.

- Platform Dependency: MTY's integration with these delivery services, while necessary for reach, subjects the company to platform fees and commission structures that can be substantial. In 2023, average commission rates for major delivery platforms ranged from 15% to 30%, a significant cost for restaurants.

Customers of MTY Food Group, especially end consumers, possess substantial bargaining power due to the vast number of dining alternatives available, making loyalty a challenge if experiences are subpar.

This ease of switching means MTY must continually offer competitive pricing and quality, as consumers can readily opt for other restaurants without significant cost or inconvenience.

The increasing reliance on digital platforms further amplifies this power, enabling effortless price and menu comparisons, which in turn pressures MTY to maintain aggressive pricing strategies, especially in light of 2024 inflation trends impacting consumer spending.

Franchisees, as MTY's direct customers, also wield significant influence through purchasing cooperatives and their critical role in brand representation, with the ultimate leverage of not renewing contracts if profitability is consistently lacking.

| Factor | Impact on MTY | Supporting Data/Trend (as of 2024) |

| Abundance of Choice | Lowers switching costs for end consumers | Over 1 million restaurants in the US; vast Canadian options |

| Price Sensitivity | Pressures MTY to maintain competitive pricing | Inflationary pressures in 2024 increased consumer focus on value |

| Digital Platforms | Increases price transparency and convenience | Millions of daily transactions via delivery apps; average commission rates 15-30% in 2023 |

| Franchisee Power | Influences operational standards and profitability | Franchisees can impact brand presence and renewal decisions |

What You See Is What You Get

MTY Porter's Five Forces Analysis

This preview shows the exact MTY Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape for MTY Food Group. You'll gain a comprehensive understanding of the industry's bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use and strategic planning.

Rivalry Among Competitors

The quick-service and casual dining restaurant sectors in Canada and the US are incredibly competitive and fragmented. This means there are tons of businesses, from small local spots to big international brands, all vying for customers.

MTY Food Group operates within this crowded landscape, where success often means taking market share from rivals. This dynamic can lead to some pretty aggressive business tactics as companies try to stand out.

For instance, in 2024, the Canadian quick-service restaurant market alone is valued at over CAD 30 billion, with hundreds of brands competing. This sheer volume of players intensifies the rivalry.

MTY Food Group's extensive brand portfolio, encompassing over 80 diverse banners, is a significant factor in its competitive rivalry. This broad offering allows MTY to cater to a wide array of consumer tastes and price sensitivities, from quick-service to casual dining. For instance, MTY's 2023 financial report highlighted continued growth across its various segments, demonstrating the strength derived from this diversified approach.

The company's aggressive acquisition strategy further amplifies its competitive stance. By strategically acquiring complementary brands, MTY consolidates market share and expands its geographic reach. This approach intensifies rivalry by presenting a formidable, multi-faceted competitor against more specialized or smaller restaurant chains. However, managing such a vast and varied portfolio also presents challenges in maintaining brand consistency and operational efficiency against highly focused rivals.

Consumer price sensitivity and market saturation frequently trigger intense price wars and promotional battles within the restaurant industry. MTY must strategically navigate these dynamics, balancing aggressive customer acquisition tactics with the need to maintain healthy profit margins. For instance, the average cost of a fast-food meal in Canada saw an increase of over 7% in 2023 compared to the previous year, highlighting the pressure on both consumers and operators.

Innovation in Menu and Technology

Competitors in the restaurant industry are relentlessly pushing the boundaries of innovation. This includes introducing novel menu items, catering to growing demands for healthier choices, and embracing technological advancements. For instance, many chains are implementing AI-powered kiosks and sophisticated digital ordering platforms, alongside optimizing efficient delivery systems. MTY Food Group must actively participate in this innovation race to maintain its competitive edge and attract today's consumers who value convenience and tailored experiences.

The drive for innovation is evident in the market. By mid-2024, a significant portion of quick-service restaurants had already integrated or were in the process of upgrading their digital ordering capabilities. Companies that fail to adapt risk losing market share to more agile competitors. MTY's ability to stay ahead of these trends, particularly in areas like personalized digital menus and streamlined order fulfillment, will be crucial for its sustained growth and appeal.

- Menu Diversification: Competitors are expanding offerings to include plant-based options, gluten-free choices, and globally inspired flavors, reflecting evolving consumer preferences.

- Technological Integration: AI-driven personalization in ordering, loyalty programs, and kitchen automation are becoming standard, enhancing efficiency and customer engagement.

- Delivery Optimization: Advanced logistics and partnerships with third-party delivery services are critical for reaching a wider customer base and ensuring timely service.

Geographic and Format Competition

MTY Food Group's competitive landscape is significantly shaped by geographic variations and the diverse formats through which it operates. For instance, competition in the Canadian market, MTY's home base, differs from the pressures encountered in the United States. This geographic segmentation necessitates distinct strategic approaches for each region.

The company navigates varied competitive intensity across its different operating formats. These include traditional food courts, prominent street-front locations, and non-traditional venues such as airports or universities. Each format presents unique competitive challenges and opportunities, requiring MTY to adapt its strategies accordingly.

A notable shift in the industry is the move away from enclosed mall food courts towards more visible street-front locations. This trend directly impacts competitive dynamics, as MTY must contend with a different set of rivals and consumer expectations in these more accessible settings. For example, in 2024, many quick-service restaurant chains continued to expand their street-front presence, increasing direct competition for foot traffic and brand visibility.

- Geographic Nuances: Competition intensity for MTY varies significantly between Canada and the US, requiring tailored market penetration and operational strategies.

- Format Diversification: MTY operates across multiple formats including food courts, street fronts, and non-traditional locations, each facing distinct competitive pressures.

- Location Shift Impact: The industry trend favoring street-front locations over traditional mall food courts alters the competitive landscape, demanding greater focus on visibility and accessibility.

- 2024 Market Trends: In 2024, the expansion of quick-service restaurants into street-front locations intensified competition for prime real estate and customer engagement.

The restaurant industry is densely populated, with numerous players constantly vying for customer attention. This intense rivalry means MTY Food Group must continually innovate and adapt to maintain its market position. The sheer number of brands, from global giants to local eateries, creates a dynamic environment where aggressive strategies are common.

Price wars and aggressive promotions are frequent tactics employed by competitors to capture market share. In 2023, the average cost of a fast-food meal in Canada rose by over 7%, illustrating the financial pressures and the need for strategic pricing. MTY must balance attracting customers with ensuring profitability amidst these competitive pressures.

Innovation is a key battleground, with companies introducing new menu items, healthier options, and advanced technology like AI-powered kiosks. By mid-2024, many quick-service restaurants had upgraded their digital ordering systems, highlighting the critical need for MTY to stay technologically current and offer personalized customer experiences.

| Competitive Factor | Description | Impact on MTY | 2024 Data Point |

| Market Fragmentation | Numerous small and large players compete across various segments. | Requires MTY to differentiate its extensive brand portfolio. | Canadian QSR market valued over CAD 30 billion. |

| Price Sensitivity | Consumers are often influenced by price, leading to promotional battles. | MTY must manage pricing strategies to remain competitive while maintaining margins. | Fast-food meal costs increased >7% in Canada in 2023. |

| Innovation Race | Competitors introduce new menus, healthier options, and technology. | MTY needs to invest in menu development and digital advancements to retain customers. | Many QSRs upgraded digital ordering by mid-2024. |

SSubstitutes Threaten

Home cooking and meal preparation present a significant threat of substitution for restaurants. In 2024, with ongoing economic considerations and a heightened consumer interest in health and personalized culinary experiences, many individuals are opting to prepare meals at home. This trend is further bolstered by the increasing availability and convenience of grocery stores offering a wide array of ingredients and the growing popularity of meal kit delivery services, which simplify the cooking process.

Consumers increasingly turn to alternatives beyond traditional restaurants, such as ready-to-eat meals from grocery stores, convenience stores, and specialty food markets. These channels provide a spectrum of convenience and price points, directly challenging quick-service and casual dining establishments. For instance, the ready-to-eat meal market in Canada saw significant growth, with sales reaching approximately $3.4 billion in 2023, highlighting a strong consumer shift towards these substitute options.

The rise of meal delivery services presents a significant threat of substitutes for MTY Food Group. While MTY leverages these platforms, the sheer volume of options available to consumers, including home-based food businesses and virtual kitchens, intensifies competition. These substitutes often bypass traditional restaurant overheads, allowing for potentially lower price points or unique offerings that can draw customers away.

Shift to Healthier and Plant-Based Diets

The increasing consumer demand for healthier options, including plant-based and whole foods, poses a significant threat. If MTY's brands lag in adapting their menus to these evolving preferences, customers might seek out specialized health food stores or prepare meals at home, bypassing MTY's establishments. This shift is not just a fad; it's a fundamental change in consumer priorities.

For instance, the plant-based food market has seen substantial growth. In 2023, the global plant-based food market was valued at approximately $37.5 billion and is projected to reach over $100 billion by 2030, indicating a strong and sustained trend. This suggests that consumers are actively seeking alternatives that align with health and ethical considerations.

- Growing Health Consciousness: Consumers are increasingly aware of the link between diet and health, driving demand for nutritious and minimally processed foods.

- Rise of Plant-Based Eating: The adoption of vegetarian, vegan, and flexitarian diets is accelerating, creating a market for plant-forward menu options.

- Functional Foods Trend: Foods with added health benefits, such as probiotics or antioxidants, are gaining popularity, offering new avenues for competitors.

- Consumer Preference for Customization: Consumers are looking for options that cater to specific dietary needs and preferences, which can be more readily met by specialized outlets or home cooking.

Changing Lifestyles and Work Habits

Shifting lifestyles, especially the rise of remote work, directly impact dining habits. As more people work from home, the demand for traditional lunch services in business districts may decrease, forcing restaurant chains like those under MTY to rethink their offerings. For instance, a significant portion of the workforce continuing hybrid or fully remote arrangements in 2024 means fewer spontaneous lunch purchases.

This trend creates a threat from substitutes that cater to new consumption patterns. Instead of quick lunches at office-adjacent eateries, consumers might opt for home-cooked meals or more elaborate dinner deliveries. MTY's brands must therefore adapt, perhaps by enhancing their dinner takeout and delivery capabilities or focusing on family-oriented meal solutions, which represent a substitute for individual, on-the-go dining experiences.

- Remote Work Impact: The continued prevalence of remote and hybrid work models in 2024 reduces the need for daily office lunches, a key revenue stream for many quick-service restaurants.

- Shift in Demand: Consumers are increasingly prioritizing convenience and at-home dining, making delivered meals and family meal kits substitutes for traditional dine-in or quick lunch options.

- Adaptation Necessity: MTY's brands face pressure to pivot offerings towards dinner delivery and takeout to capture evolving consumer preferences, thereby mitigating the threat from these substitutes.

The threat of substitutes for MTY Food Group is substantial, encompassing home cooking, ready-to-eat meals from grocery stores, and the burgeoning meal delivery sector. In 2024, economic pressures and a desire for personalized, healthy eating continue to drive consumers towards preparing meals at home, a trend amplified by convenient meal kits. The Canadian ready-to-eat meal market alone reached approximately $3.4 billion in 2023, underscoring this shift.

Furthermore, the increasing consumer focus on health and plant-based diets presents a significant challenge. The global plant-based food market, valued at around $37.5 billion in 2023, is projected to exceed $100 billion by 2030, indicating a strong demand for alternatives that MTY's brands must address. The rise of remote work also redirects demand from office lunches to home-based or delivered meals, necessitating strategic adaptation by MTY.

| Substitute Category | Key Drivers | 2023/2024 Relevance |

|---|---|---|

| Home Cooking | Cost savings, health control, personalization | Continued strong trend due to economic factors |

| Grocery Ready-to-Eat Meals | Convenience, variety, price points | Canadian market ~$3.4 billion in 2023 |

| Meal Delivery Services | Convenience, access to diverse options | Intensified competition from virtual kitchens and home businesses |

| Health-Focused Alternatives | Health consciousness, plant-based diets | Global plant-based market ~$37.5 billion in 2023 |

| Remote Work Impact | Shift from office lunches to home dining | Reduced demand for traditional quick-service lunch options |

Entrants Threaten

While a single quick-service restaurant might appear approachable, building a diversified portfolio and franchise network akin to MTY's demands significant capital. This includes substantial investment in brand development, establishing robust infrastructure, and extensive marketing efforts. For instance, in 2023, MTY Food Group reported revenues of CAD $793.7 million, showcasing the scale of operations that new entrants would need to match.

The sheer operational complexity of managing over 80 distinct brands and thousands of locations globally presents a formidable barrier. New entrants would face immense challenges in replicating MTY's established supply chains, training programs, and franchise support systems. This intricate operational structure, honed over years, creates a significant hurdle for any potential large-scale competitor aiming to enter the market.

MTY Food Group benefits from strong brand recognition across its diverse portfolio of restaurants, a key factor in cultivating customer loyalty. This established trust makes it difficult for newcomers to capture market share. For example, MTY's brands like Thai Express and Country Style have a long-standing presence and loyal customer base, making it challenging for a new Thai or breakfast concept to gain immediate traction without substantial marketing efforts.

Established players like MTY benefit significantly from economies of scale in sourcing and distribution. Their massive purchasing volumes allow them to negotiate lower prices for ingredients and supplies, a key advantage in the food service industry.

In 2024, MTY Food Group's robust supply chain, built on years of expansion, likely translates to substantial cost savings. For instance, if MTY procures a staple ingredient like chicken at a 10% lower cost per pound than a new entrant due to volume, this creates an immediate competitive pricing disadvantage for the newcomer.

New entrants, without this established scale, will inevitably face higher per-unit costs. This makes it challenging to compete on price with established brands and achieve comparable profit margins, especially in a market where consumers are often price-sensitive.

Regulatory Hurdles and Compliance

The restaurant sector faces substantial regulatory challenges that act as a barrier to new entrants. Compliance with stringent health codes, food safety standards, and licensing requirements, such as obtaining liquor licenses, demands considerable investment in both time and capital. For instance, in 2024, the average cost to obtain a liquor license can range from several hundred to tens of thousands of dollars, depending on the jurisdiction and type of license. This complexity and expense can deter potential new players from entering the market.

Navigating these regulatory landscapes requires specialized knowledge and resources. New businesses must allocate significant funds towards legal counsel, training, and operational adjustments to meet all mandates. Failure to comply can result in hefty fines or even closure, making adherence a critical initial hurdle. In 2023, the U.S. Food and Drug Administration reported over 5,000 food safety violations, highlighting the strict enforcement of these standards.

- Health and Safety Regulations: Strict adherence to food preparation, storage, and sanitation guidelines is mandatory, often requiring specialized equipment and staff training.

- Licensing and Permits: Obtaining necessary business licenses, food service permits, and potentially liquor licenses involves a complex application process and associated fees.

- Zoning and Land Use: Restaurants must comply with local zoning laws, which can restrict where establishments can operate and dictate operating hours.

- Labor Laws: Compliance with minimum wage, overtime, and employee benefit regulations adds to operational costs and complexity.

Franchise Network Development

Building a strong franchise network, a cornerstone of MTY Food Group's strategy, demands considerable expertise in operations, marketing, and franchisee support. This is a substantial hurdle for potential new entrants aiming to replicate MTY's success. MTY's established franchise system and its proven ability to attract and retain successful operators create a significant barrier to entry.

New players would need to invest heavily in developing an equally attractive franchise offering, a process that is time-consuming and capital-intensive. MTY's existing scale and brand recognition provide a competitive advantage that is difficult for newcomers to overcome. For instance, as of the first quarter of 2024, MTY operated over 7,000 locations across its diverse brand portfolio, showcasing the depth and breadth of its established network.

- Extensive Experience Required: Developing a successful franchise model necessitates deep operational knowledge and proven brand management capabilities, which new entrants lack.

- Proven Operational Model: MTY's standardized processes and supply chain efficiencies offer a significant advantage that is hard for new entrants to replicate quickly.

- Attracting and Supporting Operators: The ability to recruit, train, and provide ongoing support to franchisees is critical, and MTY has a well-honed system for this.

- Significant Capital Investment: New entrants face substantial upfront costs to build a comparable franchise infrastructure and brand presence.

The threat of new entrants in the quick-service restaurant sector, particularly for a large, diversified operator like MTY Food Group, is moderated by several significant barriers. High capital requirements for brand building, infrastructure, and marketing, coupled with the operational complexity of managing numerous brands and a global supply chain, deter many potential competitors. MTY's established brand recognition and loyal customer base further solidify its market position, making it difficult for newcomers to gain immediate traction.

Porter's Five Forces Analysis Data Sources

Our MTY Porter's Five Forces analysis is built upon a robust foundation of data from company annual reports, industry-specific market research, and publicly available financial filings. This ensures a comprehensive understanding of competitive intensity and market dynamics.