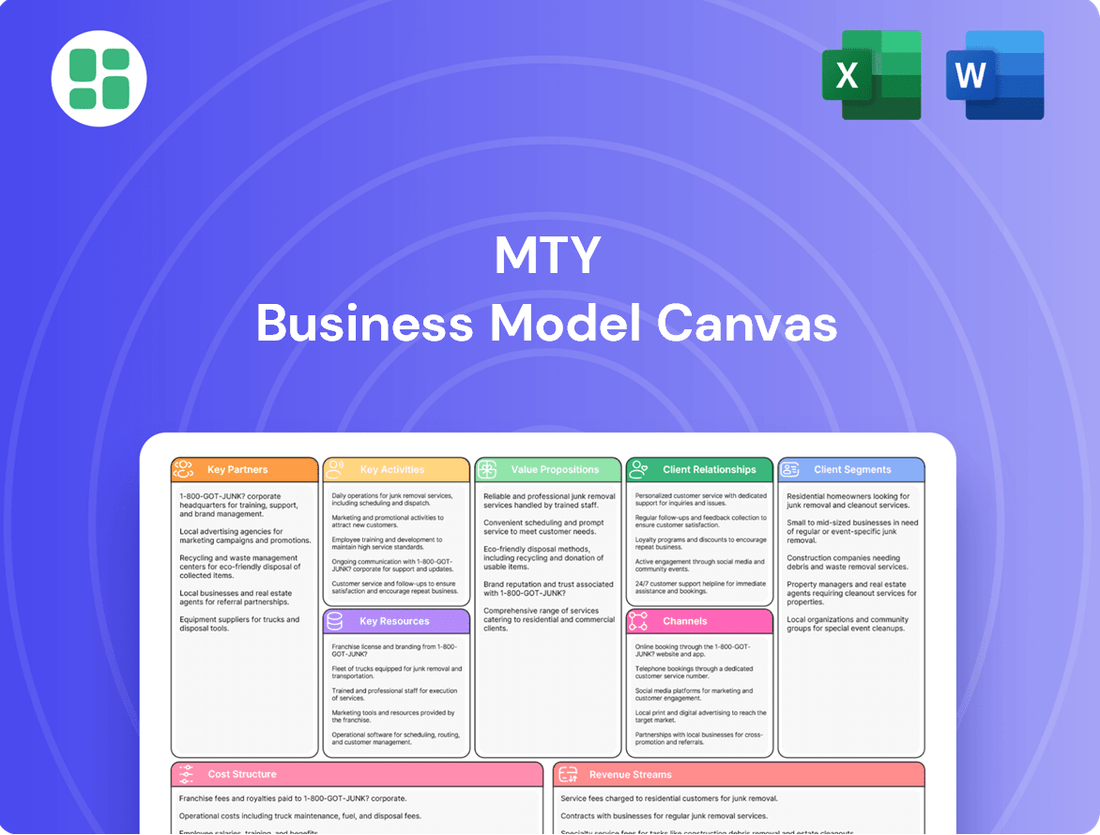

MTY Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MTY Bundle

Curious about the engine driving MTY's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Unlock the full blueprint to understand how MTY consistently delivers value and achieves its strategic goals.

Partnerships

MTY's core business model thrives on its vast network of independent franchisees, who are instrumental in operating its diverse portfolio of restaurant brands. These partnerships are the engine for expanding brand presence and maintaining operational consistency across various high-traffic venues like food courts, shopping malls, and airports.

In 2024, MTY's commitment to supporting its franchisees remained strong, providing them with a well-established business model and ongoing operational assistance. This symbiotic relationship allows MTY to scale efficiently while franchisees benefit from proven systems and brand recognition.

MTY Food Group strategically partners with a diverse range of suppliers for food, beverages, and essential restaurant equipment. These alliances are crucial for maintaining consistent quality and cost-efficiency across their extensive brand portfolio. For instance, in 2023, MTY’s robust supply chain management contributed to its overall operational efficiency, a key factor in its continued growth.

MTY Food Group's success hinges on strong relationships with landlords and property developers. These partnerships are crucial for securing prime locations in high-traffic commercial venues, which is MTY's primary strategy. For instance, in 2024, MTY continued to leverage these relationships to open new restaurants and expand existing brands, directly contributing to its growth in the number of operational locations.

Technology and Digital Platform Providers

MTY Food Group actively collaborates with technology and digital platform providers to bolster its online presence and operational capabilities. These partnerships are crucial for enhancing digital sales channels and improving the overall customer experience across its diverse brand portfolio.

Key collaborations involve providers of online ordering systems and third-party delivery platforms, which are vital for reaching a wider customer base and facilitating convenient food delivery. Additionally, MTY partners for the implementation of robust enterprise resource planning (ERP) systems. These systems streamline back-end operations, from inventory management to financial reporting, thereby boosting overall efficiency and cost control. As of 2024, digital sales continue to represent a significant and growing portion of MTY's total revenue, underscoring the importance of these technological alliances.

- Online Ordering & Delivery Platforms: Partnerships with companies like SkipTheDishes, Uber Eats, and DoorDash are essential for expanding digital reach and sales volume.

- Point-of-Sale (POS) and Digital Menu Solutions: Collaborations with POS providers ensure seamless integration of ordering and payment systems, often including digital menu capabilities.

- ERP and Data Analytics Providers: Strategic alliances with ERP vendors help optimize supply chain, inventory, and financial management, providing valuable data insights.

- Customer Relationship Management (CRM) Systems: Partnerships for CRM tools enable MTY to better understand customer preferences and personalize marketing efforts, driving loyalty and repeat business.

Acquired Brands and Their Management Teams

MTY's growth hinges on acquiring restaurant brands, necessitating strong partnerships with their existing management teams. These collaborations are vital for seamless integration and capitalizing on established market presence and operational know-how. MTY's acquisition strategy has been a consistent driver of its expansion.

These partnerships allow MTY to leverage the unique expertise and brand equity of acquired companies, fostering a diversified portfolio. For instance, MTY's acquisition of Firehouse Subs in 2021, a significant move, brought with it a seasoned management team experienced in franchise operations and brand development.

The success of these key partnerships is evident in MTY's financial performance. As of the first quarter of 2024, MTY reported a revenue of $222.6 million, a notable increase, reflecting the successful integration and performance of its acquired brands and their management structures.

- Acquisition Integration: Partnerships with acquired brand management teams facilitate the smooth integration of new concepts into MTY's operational framework.

- Leveraging Expertise: These collaborations allow MTY to tap into the specialized market knowledge and operational skills of the acquired entities' leadership.

- Brand Portfolio Growth: MTY's strategic acquisitions, supported by these partnerships, have consistently expanded its diverse restaurant brand portfolio.

- Performance Impact: The effective management of these partnerships contributes directly to MTY's overall financial growth and market position, as seen in its Q1 2024 revenue figures.

MTY's key partnerships extend to crucial suppliers for food, beverages, and equipment, ensuring quality and cost-effectiveness across its brands. These alliances are vital for maintaining consistent product standards and managing operational expenses effectively.

In 2024, MTY continued to strengthen its supplier relationships, focusing on reliable sourcing to support its extensive network of restaurants. This focus on supply chain efficiency is a cornerstone of their operational strategy, directly impacting profitability and customer satisfaction.

Furthermore, MTY actively engages with landlords and property developers to secure prime locations, a fundamental aspect of their growth strategy. These collaborations are instrumental in placing their brands in high-traffic areas, maximizing visibility and customer access.

What is included in the product

A structured framework outlining MTY's core business components, from customer relationships to revenue streams, enabling strategic analysis and operational clarity.

The MTY Business Model Canvas effectively alleviates the pain of fragmented strategic thinking by providing a structured, visual framework to map out all key business elements, ensuring clarity and alignment.

Activities

Franchise development and management are core to MTY's strategy, focusing on attracting and supporting new franchisees while overseeing existing agreements. This includes rigorous recruitment processes and providing ongoing operational support to ensure brand consistency across its vast network.

MTY's extensive franchisee network, which comprises the overwhelming majority of its locations, relies on the company for brand standards adherence and operational guidance. This symbiotic relationship is crucial for maintaining the integrity and growth of its diverse portfolio of brands.

As of the first quarter of 2024, MTY Food Group operated a total of 7,154 locations globally, with a significant portion being franchised. This demonstrates the scale and success of their franchise development and management model in driving widespread brand presence.

MTY Food Group actively manages its extensive portfolio of over 80 brands, ensuring each concept remains relevant and appealing to a diverse consumer base. This involves strategic brand development, targeted marketing campaigns, and continuous menu innovation to adapt to evolving tastes and industry trends.

In 2024, MTY's commitment to innovation is evident in its ongoing efforts to refresh existing menus and introduce new offerings across its quick-service and casual dining segments. For instance, the company has focused on integrating healthier options and plant-based alternatives, reflecting a significant consumer shift observed in market research throughout the year.

MTY Food Group's supply chain optimization and procurement are central to its operations. This involves meticulously managing the journey of ingredients from sourcing to final distribution for all its diverse restaurant brands. The company's substantial scale allows it to negotiate favorable terms with suppliers, driving cost efficiencies and ensuring a steady supply of high-quality products to its franchised and corporate locations.

Strategic supplier relationships are a cornerstone of MTY's procurement strategy. By fostering strong partnerships, MTY can secure consistent product availability and maintain stringent quality standards across its extensive network. For instance, in 2024, MTY continued to refine its supplier agreements to enhance resilience and cost-effectiveness, a critical factor given the fluctuating global commodity markets.

Corporate Restaurant Operations

While MTY Food Group is predominantly a franchisor, a key activity involves managing its corporate-owned restaurant locations, especially within the casual dining sector. These operations are crucial for direct oversight of day-to-day activities. This includes ensuring excellent customer service, effective staff management, and executing local marketing initiatives. These company-run stores often act as innovation hubs, testing new menu items or operational efficiencies before broader rollout. As of the first quarter of 2024, MTY reported a significant number of franchised locations, but the corporate-owned segment remains a vital component of their strategy.

The management of these corporate restaurants is hands-on, focusing on the granular details that drive success. This encompasses everything from inventory control and food preparation standards to maintaining a welcoming atmosphere for patrons. For instance, in 2023, MTY's focus on operational excellence in its corporate stores contributed to overall brand consistency across its portfolio. These locations are not just revenue generators but also crucial feedback loops for refining the business model.

- Operational Management: Direct oversight of daily restaurant functions including staffing, inventory, and customer experience in corporate locations.

- Innovation Hub: Utilizing corporate stores to pilot new menu items, marketing strategies, and operational improvements.

- Brand Consistency: Ensuring high standards are met in company-owned outlets to reinforce brand image and customer loyalty.

- Financial Performance: Driving profitability and efficiency at the store level, contributing directly to MTY's consolidated financial results.

Financial Management and Strategic Acquisitions

MTY Food Group's key activities revolve around meticulous financial management and strategic growth through acquisitions. This includes rigorous financial planning, efficient debt management, and judicious capital allocation to support its expanding network of brands. The company actively seeks and integrates strategic acquisitions, a core driver for broadening its brand portfolio and increasing its market presence.

A significant aspect of MTY's financial strategy is its commitment to generating robust free cash flows. This financial strength enables the company to pursue disciplined capital strategies, such as share buybacks, which benefit shareholders. For instance, in the first quarter of 2024, MTY reported adjusted EBITDA of $76.1 million, demonstrating its operational efficiency and cash-generating capabilities.

- Financial Planning & Debt Management: MTY prioritizes sound financial planning and maintains a strong focus on managing its debt effectively to support growth initiatives.

- Capital Allocation & Share Buybacks: The company strategically allocates capital, utilizing free cash flows for initiatives like share buybacks, as seen in its ongoing commitment to shareholder value.

- Strategic Acquisitions: Actively pursuing and integrating acquisitions is a central activity, crucial for expanding MTY's brand portfolio and enhancing its market footprint.

- Free Cash Flow Generation: MTY consistently focuses on generating strong free cash flows, underpinning its financial stability and capacity for strategic investments.

MTY's key activities encompass the comprehensive management of its vast franchise network, ensuring brand consistency and providing ongoing support. This includes rigorous franchisee recruitment and the continuous development and innovation of its diverse brand portfolio, with over 80 brands under its umbrella. The company also focuses on optimizing its supply chain and forging strategic supplier relationships to ensure cost-efficiency and product quality across all locations.

Furthermore, MTY actively manages its corporate-owned restaurants, using them as testing grounds for new initiatives and to maintain direct oversight of operations. This hands-on approach in company-owned stores ensures adherence to brand standards and contributes to overall customer satisfaction. The company's financial management is equally critical, with a strong emphasis on generating free cash flow, managing debt, and pursuing strategic acquisitions to fuel its expansion and enhance shareholder value.

| Key Activity | Description | 2024 Data/Context |

|---|---|---|

| Franchise Development & Management | Attracting, onboarding, and supporting franchisees; ensuring brand standards. | Operated 7,154 locations globally as of Q1 2024, predominantly franchised. |

| Brand Portfolio Management & Innovation | Managing over 80 brands, refreshing menus, and introducing new offerings. | Focus on healthier options and plant-based alternatives in 2024 menu development. |

| Supply Chain & Procurement | Optimizing ingredient sourcing and distribution; negotiating supplier terms. | Refining supplier agreements in 2024 for resilience and cost-effectiveness. |

| Corporate Restaurant Operations | Direct management of company-owned stores for operational excellence and testing. | Corporate stores serve as innovation hubs for new menu items and efficiencies. |

| Financial Management & Acquisitions | Financial planning, debt management, capital allocation, and pursuing acquisitions. | Reported $76.1 million adjusted EBITDA in Q1 2024; active pursuit of acquisitions. |

Full Document Unlocks After Purchase

Business Model Canvas

The MTY Business Model Canvas preview you are viewing is an exact replica of the document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final deliverable. You'll get the complete, ready-to-use Business Model Canvas, identical to this preview, ensuring no surprises and immediate usability for your strategic planning.

Resources

MTY Food Group's extensive brand portfolio, encompassing over 80 quick-service and casual dining concepts, represents its most critical resource. This diverse collection of brands, including popular names like Thaï Express, Mucho Burrito, and Country Style, is the bedrock of its franchising success.

These brands are protected by significant intellectual property, including trademarks, proprietary recipes, and established operational methodologies. This IP is the engine driving MTY's ability to license its concepts to franchisees, allowing for rapid expansion and market penetration across various segments.

In 2024, MTY's strategic acquisition of Firenza Pizza in January further bolstered this portfolio, demonstrating a continued commitment to expanding its brand offerings and leveraging its intellectual property for growth. This constant evolution of its brand assets is key to maintaining its competitive edge.

MTY Food Group's extensive franchise network, encompassing thousands of locations, is a cornerstone of its business model. This vast network, managed through robust franchise agreements, ensures consistent revenue generation via royalties and franchise fees.

In fiscal year 2023, MTY Food Group reported system-wide sales of $4.4 billion, with a significant portion flowing back to the company through franchise fees and royalties. This demonstrates the power of their established network in achieving broad market reach without requiring substantial upfront capital investment from MTY itself.

MTY Food Group's experienced management team and operational expertise are cornerstones of its success. This human capital, encompassing skilled culinary professionals and dedicated franchise support staff, is crucial for navigating the complexities of multi-brand management and fostering strong franchise relationships.

In 2024, MTY continued to leverage this expertise to drive strategic growth across its diverse portfolio. The company's ability to adapt and innovate within the dynamic restaurant industry is directly attributable to the deep operational knowledge held by its leadership and support teams.

Digital Infrastructure and Technology

MTY Food Group's digital infrastructure and technology are critical resources, with significant investments in online ordering systems, mobile apps, and a new enterprise resource planning (ERP) system. These platforms are designed to elevate the customer experience and streamline operations across its diverse brand portfolio.

The company's commitment to technology directly fuels digital sales growth. For instance, in the first quarter of 2024, MTY reported a notable increase in digital sales, driven by these enhanced platforms, contributing to overall revenue performance.

- Digital Platforms: Online ordering, mobile apps, and loyalty programs are key to customer engagement and sales.

- Operational Efficiency: A new ERP system is being implemented to improve back-end processes, inventory management, and data analytics.

- Data Analytics: Technology enables better understanding of customer behavior and sales trends to inform strategic decisions.

- Scalability: Digital infrastructure supports the expansion of existing brands and the integration of new acquisitions.

Financial Capital and Strong Cash Flows

MTY Food Group's access to financial capital, including its substantial cash reserves and available credit lines, is a cornerstone of its business model. This financial muscle allows MTY to not only maintain its day-to-day operations smoothly but also to strategically manage its debt obligations and pursue opportunities for growth. The company's ability to generate robust free cash flows is particularly vital, providing the financial flexibility needed for various strategic initiatives.

This financial strength directly fuels MTY's capacity for:

- Operational Stability: Ensuring consistent funding for all business activities, from franchise support to supply chain management.

- Debt Management: Facilitating timely repayment of existing loans and maintaining a healthy credit profile.

- Shareholder Returns: Enabling share repurchase programs, which can enhance shareholder value.

- Strategic Acquisitions: Providing the necessary capital to identify and integrate new brands and concepts, a key driver of MTY's expansion strategy.

For instance, as of the first quarter of 2024, MTY reported a strong financial position, with cash and cash equivalents of approximately $135 million. This liquidity, combined with its consistent free cash flow generation, underscores its ability to execute its growth plans and navigate market dynamics effectively.

MTY's brand portfolio, intellectual property, and franchise network are its core assets. The company's digital platforms and strong financial capital further enable its strategic growth and operational stability.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Brand Portfolio & IP | Over 80 QSR/casual dining brands, protected by trademarks and proprietary know-how. | Acquisition of Firenza Pizza in January 2024 expanded offerings. |

| Franchise Network | Thousands of locations generating royalties and fees. | System-wide sales reached $4.4 billion in fiscal 2023. |

| Management & Expertise | Skilled professionals driving multi-brand management and franchise relations. | Continued leveraging of expertise for strategic growth in 2024. |

| Digital Platforms | Online ordering, mobile apps, and new ERP system for customer experience and efficiency. | Notable increase in digital sales reported in Q1 2024. |

| Financial Capital | Cash reserves, credit lines, and free cash flow for operations and growth. | Cash and cash equivalents were approximately $135 million as of Q1 2024. |

Value Propositions

MTY offers franchisees a robust, proven business model and comprehensive support, significantly de-risking their venture. This includes established brand recognition, a clear operational blueprint, and continuous training, allowing franchisees to focus on growth rather than initial setup challenges.

Franchisees gain access to MTY's substantial collective purchasing power, leading to better supply costs. Furthermore, MTY's centralized marketing initiatives drive customer traffic to individual locations, directly contributing to franchisee profitability and expansion opportunities.

Consumers gain access to a broad spectrum of culinary experiences through MTY's diverse brand portfolio. This includes everything from quick-service options to more relaxed casual dining, covering a wide array of cuisines to satisfy various palates. For instance, MTY's brands like Sarpino's Pizzeria and Villa Madina offer distinct tastes, catering to different cravings.

The convenience factor is significant, with MTY's restaurants strategically located in high-traffic areas such as food courts and shopping malls. This accessibility makes it easy for consumers to grab a meal or enjoy a dining experience without extensive travel. In 2024, MTY continued to expand its footprint, aiming to be present where consumers live, work, and shop.

MTY Food Group offers commercial landlords a significant value proposition by providing a curated selection of established and reliable tenants. These tenants introduce diverse and popular food concepts, directly contributing to increased foot traffic and overall appeal for properties like shopping malls and airport terminals. For instance, MTY's portfolio includes well-known brands that consistently draw customers, thereby boosting the revenue potential for landlords.

The company's multi-brand strategy is particularly beneficial, allowing landlords to cater to a wide range of consumer preferences within a single development. This approach effectively fills various culinary niches, preventing market saturation and creating a more dynamic dining environment. By consolidating multiple successful food concepts under one umbrella, MTY simplifies leasing for landlords and enhances the tenant mix, making their properties more attractive to a broader customer base.

For Suppliers: Large Volume and Consistent Demand

Suppliers partnering with MTY Food Group benefit significantly from the company's substantial purchasing volume. This scale translates into consistent, high-volume orders across MTY's extensive restaurant network, providing a reliable revenue stream and minimizing the risk of fluctuating demand.

This consistent demand fosters efficient supply chain operations and allows suppliers to plan production and logistics more effectively. MTY's commitment to stable partnerships encourages long-term relationships, creating a mutually beneficial ecosystem where suppliers can thrive.

- Large Scale Purchasing: MTY's vast network of over 90 brands and more than 7,000 locations generates significant purchasing power, offering suppliers high-volume opportunities.

- Consistent Demand: The diversified and widespread nature of MTY's brands ensures a steady and predictable demand for goods and services, providing stability for suppliers.

- Operational Efficiency: This consistent, large-scale demand enables suppliers to optimize their production schedules and logistics, leading to greater efficiency and cost savings.

- Long-Term Partnerships: MTY's business model encourages enduring relationships with its suppliers, fostering trust and mutual growth within the supply chain.

For Investors: Stable Revenue and Growth Potential

MTY's value proposition for investors centers on its ability to deliver both predictable income and opportunities for capital appreciation. The company generates stable revenue through its franchise model, which includes recurring royalties and initial franchise fees. This provides a consistent income base, even in varying economic conditions.

Beyond this stability, MTY actively pursues growth. This expansion comes from adding new locations organically and, crucially, through strategic acquisitions of complementary restaurant brands. This dual approach allows for both steady, incremental growth and the potential for significant leaps in revenue and market share.

Further enhancing investor appeal is MTY's commitment to sound financial practices. The company prioritizes disciplined capital allocation and focuses on generating strong free cash flow. For instance, as of the first quarter of 2024, MTY reported a robust free cash flow generation, underscoring its operational efficiency and ability to return value to shareholders.

- Stable Revenue Streams: Primarily from royalties and franchise fees, offering predictability.

- Growth Potential: Driven by strategic acquisitions and organic expansion of its brand portfolio.

- Financial Discipline: Focus on free cash flow generation and efficient capital management.

- Diversified Portfolio: Ownership of numerous well-established brands mitigates risk.

MTY offers franchisees a proven, low-risk path to restaurant ownership with extensive support. This includes established brand recognition, operational guidance, and ongoing training, allowing franchisees to concentrate on business growth and customer satisfaction.

Franchisees benefit from MTY's collective buying power, securing favorable supply costs and leveraging centralized marketing efforts that drive customer traffic. This dual advantage directly boosts franchisee profitability and supports their expansion initiatives.

MTY's diverse brand portfolio provides consumers with a wide array of culinary choices, from quick bites to sit-down meals, catering to varied tastes and preferences. Brands like Sarpino's Pizzeria and Villa Madina exemplify this broad appeal.

Conveniently located in high-traffic areas such as malls and food courts, MTY restaurants offer easy accessibility for consumers. The company’s 2024 expansion efforts further solidify its presence where customers live, work, and shop.

Customer Relationships

MTY Food Group actively nurtures its franchisee relationships through specialized support teams, consistent communication channels, and robust training initiatives. This commitment ensures franchisees are well-equipped and aligned with MTY's brand vision.

Operational guidance, marketing support, and performance tracking are key components of MTY's franchisee engagement strategy. For instance, in 2024, MTY continued to invest in digital tools to streamline communication and provide real-time performance analytics to its network, aiming to enhance franchisee profitability and brand consistency across its diverse portfolio of brands.

MTY Food Group manages consumer relationships by ensuring consistent quality across its diverse brand portfolio, from quick-service restaurants to casual dining. This focus on reliability builds trust and encourages repeat business, a key factor in retaining customers in a competitive market.

Efficient service delivery is paramount, with MTY aiming for speed and accuracy in order fulfillment. For instance, in 2024, many of their brands continued to invest in streamlined kitchen operations and front-of-house processes to minimize wait times, directly impacting customer satisfaction.

Furthermore, MTY leverages digital platforms and feedback systems to actively engage with consumers. This includes online ordering apps and social media channels where customer preferences are monitored, allowing for agile responses to market trends and direct improvements to the dining experience.

MTY Food Group's strategic partnerships are cemented through formal agreements with crucial suppliers, distributors, and landlords. These aren't just transactional relationships; they involve ongoing collaboration and regular reviews to ensure mutual benefit and operational efficiency.

For instance, in 2024, MTY continued to leverage its strong supplier network, which is vital for maintaining consistent quality and cost-effectiveness across its diverse franchise portfolio. Negotiations on terms and joint problem-solving sessions are standard practice to navigate market fluctuations and optimize supply chain performance.

These carefully managed relationships are fundamental to MTY's business model, ensuring access to essential resources and favorable operating conditions. The company actively works to maintain these collaborations, recognizing their direct impact on profitability and brand consistency.

Investor Relations and Transparency

MTY Food Group prioritizes building investor trust through consistent and open communication. This includes detailed financial reporting, live quarterly earnings calls, and annual general meetings where key performance indicators and future strategies are discussed. For instance, in their Q1 2024 earnings report, MTY highlighted a revenue increase of 10.5% year-over-year, demonstrating solid operational performance that underpins investor confidence.

- Transparent Financial Reporting: MTY provides regular, detailed financial statements, ensuring investors have a clear understanding of the company's performance and financial health.

- Proactive Investor Communication: Quarterly earnings calls and annual general meetings serve as crucial platforms for MTY to share updates on strategic initiatives, capital allocation, and overall financial results, fostering an informed investor base.

- Building Confidence: This commitment to transparency and regular dialogue is fundamental to maintaining and strengthening investor confidence in MTY's long-term growth prospects.

Brand Community Building

MTY Food Group actively fosters brand communities, particularly for its popular franchises. For instance, brands like Thaï Express and Cultures often leverage social media platforms to engage customers, sharing new menu items and running interactive contests. This direct interaction builds a sense of belonging and encourages repeat business.

Local store-level initiatives also play a crucial role. Many MTY brands participate in community events or offer localized promotions, strengthening ties with their immediate customer base. This grassroots approach is vital for building loyalty in diverse markets.

- Social Media Engagement: MTY brands utilize platforms like Instagram and Facebook for direct customer interaction, sharing updates and running campaigns.

- Local Event Participation: Franchises frequently engage in local community events, enhancing brand visibility and customer connection.

- Customer Feedback Loops: Through these channels, MTY gathers valuable direct feedback, which informs menu development and operational improvements across its portfolio.

MTY Food Group cultivates strong relationships with its franchisees through dedicated support, clear communication, and comprehensive training programs. This ensures alignment with brand standards and operational excellence across its network.

In 2024, MTY continued to enhance its franchisee support by investing in digital platforms that streamline communication and provide real-time performance analytics. This focus aids in boosting franchisee profitability and maintaining brand consistency.

The company also prioritizes consumer loyalty by ensuring consistent product quality and efficient service across its diverse brand portfolio, from quick-service to casual dining. MTY actively engages consumers through digital channels and feedback systems, allowing for agile responses to market trends and direct improvements to the customer experience.

| Relationship Type | Key Engagement Strategies | 2024 Focus/Data Point |

|---|---|---|

| Franchisee | Specialized support teams, consistent communication, robust training, operational guidance, marketing support, performance tracking. | Investment in digital tools for streamlined communication and real-time performance analytics. |

| Consumer | Consistent quality, efficient service, digital platforms (apps, social media), feedback systems. | Continued investment in streamlined kitchen and front-of-house processes to minimize wait times. |

Channels

MTY's franchised restaurant locations are the core of its customer relationships, serving as the primary touchpoint for delivering its quick-service and casual dining offerings. These outlets are strategically situated in bustling environments like food courts, shopping centers, and busy street fronts, ensuring consistent consumer access.

As of the first quarter of 2024, MTY operated a vast network of 6,994 franchised locations globally, a testament to the effectiveness of this channel. For example, in fiscal year 2023, the company reported system-wide sales exceeding CAD 2.3 billion, with a significant portion generated through these physical restaurant sites.

Corporate-owned locations, though fewer in number, are crucial for MTY Food Group. These sites act as direct revenue generators and are instrumental in piloting new menu items, store designs, and operational efficiencies. This hands-on approach allows for rapid refinement before scaling to the franchise network.

In 2024, MTY Food Group operated a significant number of corporate stores across its diverse brand portfolio. These locations are vital for understanding direct consumer feedback and testing the viability of new concepts, contributing to the overall strategic development and innovation pipeline.

MTY Food Group actively utilizes online ordering systems, both their own and through popular third-party delivery platforms, to cater to the growing demand for convenient, off-premise dining. This strategic digital presence allows them to connect with a wider customer base.

In 2024, the trend of digital ordering continued to be a dominant force in the restaurant industry, with a significant percentage of consumers preferring to order food online. MTY's investment in these channels directly addresses this consumer behavior, driving substantial revenue.

Partnerships with major delivery services are crucial for MTY, expanding their reach and offering customers a seamless experience. These collaborations are vital for capturing market share in the competitive food service landscape.

Franchise Sales and Development Teams

MTY's franchise sales and development teams are the engine for network expansion, actively seeking and onboarding new franchisees. These teams leverage a multi-channel approach to attract potential partners.

Key channels include direct outreach by dedicated sales personnel, the corporate website serving as a primary information hub, and participation in industry trade shows and expos. These efforts are vital for communicating MTY's brand strength and the benefits of becoming a franchisee.

In 2024, MTY continued its aggressive growth strategy, with franchise sales teams playing a pivotal role. The company's commitment to expanding its footprint across North America and internationally relies heavily on the effectiveness of these development units.

- Dedicated Franchise Sales Teams: Directly engage prospective franchisees, manage the application process, and provide support throughout the onboarding journey.

- Corporate Website: Serves as a digital storefront, offering detailed information on franchise opportunities, brand portfolio, and the application process.

- Industry Events and Trade Shows: Provide platforms for MTY to showcase its brands, network with potential franchisees, and generate leads.

Marketing and Advertising Campaigns

MTY Food Group leverages a multi-faceted approach to marketing and advertising, utilizing a blend of traditional media, digital marketing, and in-store promotions to reach a broad consumer base. These efforts are crucial for building brand recognition and driving customer traffic to their extensive network of franchised and corporate-owned restaurants.

In 2024, MTY continued to invest in digital channels, recognizing their effectiveness in targeted advertising and customer engagement. This includes social media campaigns, search engine marketing, and partnerships with food delivery platforms, which are vital for reaching younger demographics and facilitating convenient ordering.

The company also emphasizes in-store promotions and local marketing initiatives to foster community connection and encourage repeat business. These often include seasonal offers, loyalty programs, and collaborations with local events, directly impacting foot traffic and sales at individual locations.

- Digital Marketing: Significant investment in social media, SEM, and delivery platform partnerships to enhance online visibility and customer acquisition.

- Traditional Media: Continued use of television, radio, and print advertising for broader brand awareness, particularly for established brands.

- In-Store Promotions: Focus on localized campaigns, loyalty programs, and seasonal offers to drive repeat business and increase average transaction value.

- Brand-Specific Strategies: Tailored marketing plans for each of MTY's diverse brands, acknowledging their unique target audiences and market positioning.

MTY's channels extend beyond physical restaurants to encompass digital ordering and strategic partnerships. Online platforms and third-party delivery services are increasingly vital, capturing a significant share of consumer transactions and expanding the group's market reach. These digital avenues are crucial for meeting evolving customer preferences for convenience.

In 2024, MTY Food Group continued to leverage its digital presence, with online orders and delivery services forming a substantial portion of its revenue stream. The company's investment in these channels reflects the broader industry trend towards off-premise dining, which saw continued growth throughout the year.

Furthermore, MTY's franchise development efforts are a key channel for expansion. Dedicated sales teams, the corporate website, and industry events are utilized to attract and onboard new franchisees, driving the growth of its brand portfolio across new and existing markets.

Customer Segments

Independent Franchisees are the backbone of MTY's expansion, representing entrepreneurs and business operators who invest capital and operational expertise into MTY's diverse portfolio of brands. These individuals are drawn to MTY's established reputation and proven success in the quick-service and casual dining sectors, seeking a reliable framework for building their own businesses.

These franchisees are motivated by the prospect of leveraging strong brand recognition and a well-defined operational model to achieve profitability. MTY's support system, encompassing training, marketing, and supply chain management, is a key draw, reducing the inherent risks of starting a new venture.

In 2024, MTY's franchise model continued to demonstrate its appeal, with a significant portion of its revenue generated through its franchised locations. This segment is crucial for MTY's growth strategy, allowing for rapid market penetration without the direct capital investment required for corporate-owned stores.

MTY Food Group's diverse end consumers represent a broad spectrum of individuals and families seeking convenient, quality quick-service and casual dining options. This vast customer base frequents a variety of locations, from bustling food courts and shopping malls to busy airports and accessible street-front establishments.

These consumers are drawn to MTY's brands for their diverse culinary offerings and varied price points, catering to a wide range of tastes and budgets. For instance, in 2024, the quick-service restaurant (QSR) sector continued its strong performance, with consumers increasingly prioritizing value and convenience, trends MTY is well-positioned to address across its portfolio.

Commercial property owners and developers, including those managing shopping malls, airports, and office buildings, are key customers. They are actively seeking stable and desirable restaurant tenants to boost their property's appeal and secure consistent rental income streams. In 2024, the retail property sector, for instance, continued to see demand for diverse F&B offerings to drive foot traffic.

Institutional and Individual Investors

Institutional and individual investors form a crucial customer segment for MTY Food Group. These stakeholders closely monitor MTY's financial health, strategic direction, and shareholder returns. They are actively seeking detailed financial reports, growth projections, and information on dividend policies to guide their investment choices.

For instance, in the first quarter of 2024, MTY reported a revenue of $176.1 million, a 5.4% increase compared to the same period in 2023, demonstrating consistent growth that appeals to investors. The company's commitment to returning value to shareholders is often reflected in its dividend payouts, which are a key consideration for this segment.

- Financial Performance: Investors analyze MTY's revenue, profitability, and cash flow to assess its operational efficiency and market position.

- Growth Strategies: The segment evaluates MTY's expansion plans, including acquisitions and organic growth, to understand future earning potential.

- Dividend Payouts: Shareholders are particularly interested in dividend history and future prospects as a measure of income generation and company stability.

- Market Data: Information such as MTY's stock performance and industry comparables is vital for making informed investment decisions.

Wholesale and Retail Partners

MTY Food Group's wholesale and retail partners are crucial for extending its brand reach beyond traditional restaurant settings. These partners acquire MTY's food products for distribution through various channels, including grocery stores and other retail outlets. This segment is particularly vital for brands that have successfully established a retail presence, allowing MTY to tap into consumer purchasing habits outside of dine-in or take-out experiences.

In 2024, MTY continued to leverage these partnerships to diversify its revenue streams. For instance, the company's focus on ready-to-eat meals and frozen food items available in supermarkets directly benefits from these wholesale and retail relationships. This strategy allows MTY to capture a broader market share, reaching consumers who may not frequent their restaurant locations but are loyal to their product quality and brand recognition.

- Wholesale Distributors: Businesses buying MTY products in bulk for onward sale to retailers.

- Retailers: Grocery stores, convenience stores, and other outlets stocking MTY branded food items for direct consumer purchase.

- Private Label Opportunities: Collaborations with retailers to produce MTY-developed products under the retailer's own brand.

- Growth in Retail Channels: MTY's expansion into the retail space, as evidenced by their product placements in major Canadian grocery chains, contributing to overall sales growth.

MTY's customer segments are diverse, ranging from independent franchisees who invest in and operate MTY brands to the end consumers who enjoy the food. Property owners seeking desirable tenants and investors looking for financial returns also represent key segments.

Furthermore, wholesale and retail partners are vital for expanding MTY's product reach into grocery stores and other retail environments. This multi-faceted approach allows MTY to cater to various stakeholders and market channels.

In 2024, MTY's performance highlights the strength of these relationships, with continued growth in franchised locations and successful retail product placements. For example, MTY reported a revenue of $176.1 million in Q1 2024, showcasing the economic vitality driven by these customer segments.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Independent Franchisees | Entrepreneurs seeking proven business models and brand recognition. | Backbone of expansion, driving market penetration. |

| End Consumers | Individuals and families seeking convenient, quality dining options. | Drive demand across a diverse portfolio of brands. |

| Commercial Property Owners | Seeking stable tenants to enhance property appeal and income. | Essential for securing prime locations in malls, airports, etc. |

| Investors | Seeking financial performance, growth strategies, and shareholder returns. | Monitor revenue growth (e.g., $176.1M in Q1 2024) and dividend policies. |

| Wholesale & Retail Partners | Distributors and retailers stocking MTY branded food products. | Crucial for expanding brand reach into grocery and convenience channels. |

Cost Structure

MTY Food Group invests heavily in its extensive franchisee network, a significant cost driver. This involves providing continuous support, comprehensive training programs, and crucial operational guidance to ensure brand consistency and efficiency across over 900 locations as of early 2024. These costs cover field support personnel and the development of training materials.

MTY Food Group invests significantly in building and promoting its diverse brand portfolio, which necessitates substantial marketing and advertising expenses. These expenditures are crucial for keeping MTY's brands top-of-mind, drawing in new customers, and successfully introducing fresh menu offerings or entirely new restaurant concepts.

For the fiscal year 2023, MTY Food Group reported selling, general, and administrative expenses of $237.7 million, a portion of which directly relates to these brand development and marketing efforts, underscoring the scale of investment in maintaining and growing its market presence.

General and Administrative (G&A) expenses for MTY Food Group, as a franchisor and operator of numerous brands, encompass essential corporate functions. These include executive and administrative salaries, legal and accounting services, and other costs supporting the overall infrastructure and strategic management of the company. For instance, in 2023, MTY's G&A expenses were reported at $77.5 million, reflecting the significant investment in managing its diverse portfolio of restaurants.

Acquisition and Integration Costs

Acquisition and integration costs are a significant component of MTY Food Group's business model, reflecting their aggressive growth-by-acquisition strategy. These expenses encompass thorough due diligence, legal and advisory fees, and the operational costs associated with merging new brands into MTY's established framework. For instance, in the fiscal year ending September 30, 2023, MTY reported acquisition-related expenses, including integration costs, which are a direct manifestation of these expenditures.

These costs are crucial for MTY's expansion, allowing them to broaden their brand portfolio and market reach. The process involves careful evaluation of potential targets and substantial investment to ensure seamless integration, which is vital for realizing the full value of each acquisition. Without managing these costs effectively, the strategic benefits of acquiring new businesses could be diminished.

- Due Diligence: Costs incurred for investigating the financial, legal, and operational health of target companies before acquisition.

- Legal and Advisory Fees: Expenses paid to lawyers, accountants, and consultants involved in structuring and executing acquisition deals.

- Integration Expenses: Costs related to merging IT systems, supply chains, marketing efforts, and administrative functions of acquired businesses.

- Brand Portfolio Expansion: These costs directly contribute to MTY's ability to grow its diverse range of restaurant brands.

Corporate Store Operating Costs

For its corporate-owned locations, MTY Food Group incurs significant direct operating costs. These include essential expenses like rent for prime retail spaces, labor costs for staff at these outlets, the cost of goods sold (food and beverages), and utility expenses such as electricity and water. These are the day-to-day expenditures necessary to keep the stores running.

MTY is actively managing its portfolio to enhance profitability. A key strategy involves the divestment of certain corporate casual dining stores. This move is specifically targeting locations that have demonstrated lower profit margins, aiming to streamline operations and improve the overall financial performance of the company's corporate-owned segment.

- Rent: A substantial fixed cost for physical store locations.

- Labor: Wages and benefits for store employees, a variable but significant expense.

- Food Costs: The direct cost of ingredients and menu items, subject to market fluctuations.

- Utilities: Expenses for electricity, gas, water, and waste disposal.

MTY Food Group's cost structure is heavily influenced by its franchise support system, marketing initiatives, and administrative overhead. The company also bears direct operating costs for its corporate-owned locations and incurs substantial expenses related to its acquisition strategy. These elements collectively define the financial backbone of MTY's business model.

| Cost Category | Description | 2023 Financial Data (Approximate) |

|---|---|---|

| Franchisee Support | Training, operational guidance, field support personnel | Significant investment in over 900 locations |

| Marketing & Advertising | Brand promotion, new customer acquisition, menu introductions | Part of SG&A expenses |

| General & Administrative (G&A) | Executive salaries, legal, accounting, corporate infrastructure | $77.5 million |

| Acquisition & Integration | Due diligence, legal fees, merging new brands | Reported acquisition-related expenses |

| Direct Operating Costs (Corporate) | Rent, labor, food costs, utilities for owned locations | Variable based on location performance |

Revenue Streams

MTY's core revenue generation hinges on franchise royalties, a consistent income stream derived from franchisees paying a percentage of their gross sales. This model ensures MTY benefits directly from the success of its branded locations.

In 2024, MTY's robust franchise network continued to be the bedrock of its financial performance. These royalty payments, a fundamental aspect of the MTY business model, provide a predictable and scalable revenue source, reflecting the ongoing value MTY delivers through its established brands and operational support.

Initial franchise fees represent a crucial, albeit non-recurring, revenue source for MTY Food Group. These fees are collected from new franchisees as they sign agreements to open MTY-branded restaurants, directly funding new unit development and expansion efforts.

For instance, in 2023, MTY’s franchise fees contributed to its overall growth strategy. While specific figures for franchise fees alone are often bundled within broader revenue categories, the company's consistent expansion, with over 7,000 locations as of early 2024, highlights the importance of this initial capital infusion from new partners.

Revenue from corporate-owned restaurants forms a direct sales channel for MTY Food Group. These locations, managed internally, generate income from the sale of food and beverages to consumers. This segment is a core component of the company's overall financial performance.

In the first quarter of 2024, MTY Food Group reported total system-wide sales of $1,465.1 million. While this figure encompasses all brands, corporate-owned stores are a significant contributor to this top-line number, reflecting the direct operational success of these outlets.

Food Processing, Distribution, and Retail Sales

MTY Food Group's revenue streams extend beyond just restaurant operations. They also generate income from their food processing and distribution activities, which supply essential ingredients and products to their extensive network of restaurants. This vertical integration helps control costs and ensures product quality across their brands.

Furthermore, MTY capitalizes on retail sales of select branded products through channels that are separate from their core restaurant offerings. This diversification taps into broader consumer markets and leverages the brand recognition built within their restaurant portfolio. For instance, in 2024, MTY continued to explore and expand these non-restaurant retail avenues, contributing to overall revenue growth.

- Food Processing & Distribution: Supplying ingredients and products to MTY's restaurant network.

- Retail Sales: Selling branded products through channels outside of their restaurants.

- Growth Potential: This segment has demonstrated capacity for expansion and increased revenue generation.

Other Fees and Contributions

MTY Food Group's revenue streams extend beyond royalties and initial franchise fees to include various other contributions from its franchisees. These ancillary fees help support the overall brand and provide essential services, contributing to a more robust and unified operational framework.

These other fees can encompass several key areas. For instance, franchisees often contribute to national or regional marketing funds, which MTY manages to execute broad advertising campaigns and promotional activities. Additionally, when a franchise location changes hands, a transfer fee is typically levied. Miscellaneous fees for specific services, such as operational support, training programs, or technology platforms provided by MTY to its franchisees, also form part of this revenue category.

For example, MTY Food Group's consolidated financial statements often detail these various income sources. In fiscal year 2023, the company reported significant revenue from these other fee structures, underscoring their importance to the overall business model.

- Marketing Contributions: Fees paid by franchisees to support brand-wide advertising and promotional efforts.

- Transfer Fees: Charges incurred when a franchise ownership is transferred to a new party.

- Service Fees: Payments for operational support, training, technology, and other services provided by MTY to its franchisees.

- Other Miscellaneous Income: Revenue generated from various other arrangements or services offered to franchisees or related entities.

MTY Food Group's diverse revenue streams are anchored by franchise royalties, which are a percentage of gross sales from its extensive franchisee network. This model provides a stable and scalable income. In 2024, the company's performance was significantly bolstered by these predictable royalty payments, reflecting the ongoing strength of its brands and operational support systems.

Initial franchise fees represent a key, though one-time, revenue source, funding new restaurant development. The company's continued expansion, evidenced by its presence in over 7,000 locations by early 2024, underscores the importance of these fees in driving growth. Corporate-owned restaurants also contribute directly through food and beverage sales, forming a core part of MTY's overall financial performance, with system-wide sales reaching $1,465.1 million in Q1 2024.

Beyond core restaurant operations, MTY generates revenue from food processing and distribution, ensuring quality and cost control for its network. Additionally, retail sales of branded products through non-restaurant channels offer a diversification strategy, leveraging brand recognition to tap into broader consumer markets. These segments saw continued expansion and revenue contribution in 2024.

Ancillary fees from franchisees, including contributions to marketing funds, transfer fees, and service fees for operational support and training, further diversify MTY's revenue. These fees are crucial for maintaining brand consistency and providing value-added services. Fiscal year 2023 financial statements highlighted the significant contribution of these various fee structures.

| Revenue Stream | Description | 2024 Relevance |

| Franchise Royalties | Percentage of gross sales from franchisees | Core, predictable income |

| Initial Franchise Fees | One-time fees for new franchise agreements | Funds new unit development |

| Corporate-Owned Restaurants | Direct sales from company-managed locations | Significant contributor to system-wide sales |

| Food Processing & Distribution | Supplying ingredients to restaurant network | Cost control and quality assurance |

| Retail Sales | Selling branded products outside restaurants | Diversification and brand leverage |

| Ancillary Franchisee Fees | Marketing, transfer, and service fees | Supports brand and operations |

Business Model Canvas Data Sources

The MTY Business Model Canvas is meticulously constructed using a blend of internal financial reports, comprehensive market research, and customer feedback data. These diverse sources ensure a holistic and accurate representation of the business's strategic framework.