MTY Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MTY Bundle

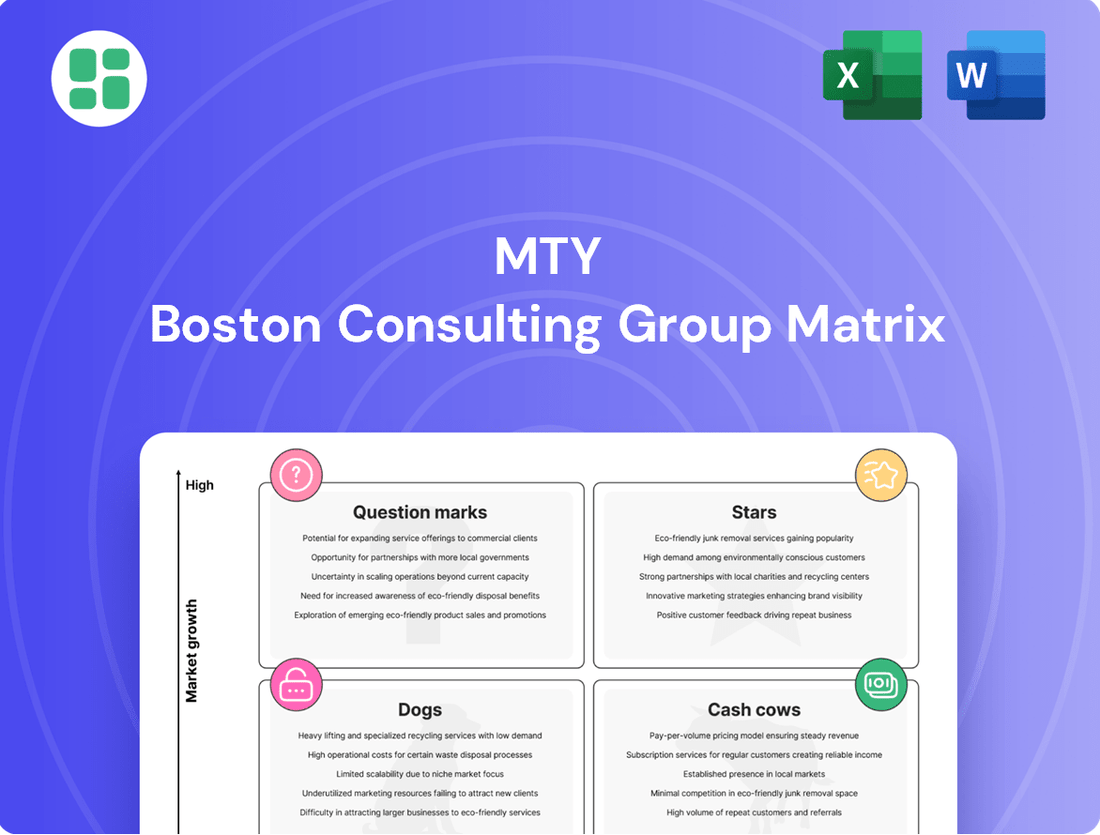

Unlock the strategic potential of the MTY BCG Matrix by understanding how its products are categorized into Stars, Cash Cows, Dogs, and Question Marks. This powerful tool helps businesses allocate resources effectively and identify growth opportunities. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your product portfolio.

Stars

MTY's U.S. snack and dessert concepts, such as Wetzel's Pretzels and Cold Stone Creamery, are strong contenders in the Stars category. These brands benefit from high consumer demand for convenient treats, fueling their impressive organic growth in the American market. For instance, MTY Food Group reported a significant increase in revenue from its U.S. operations in their 2023 fiscal year, largely driven by these popular snack and dessert chains.

The casual dining sector in Canada has been a significant area of success for MTY, demonstrating robust same-store sales growth and overall strong performance. This trend highlights the ability of select Canadian casual dining brands within MTY's portfolio to thrive in an expanding or stable market environment.

For instance, MTY reported that its Canadian casual dining segment saw a notable increase in same-store sales in the first quarter of 2024. This segment, which includes brands like Baton Rouge and East Side Mario's, outperformed other categories, contributing positively to the company's financial results.

Focusing strategic efforts on these high-performing Canadian casual dining brands is crucial for MTY. It allows the company to reinforce their market leadership and drive further growth in overall system sales, leveraging their current momentum.

Digital sales and online ordering platforms are a significant growth driver for MTY. In the fourth quarter of 2024, these channels represented 20% of MTY's total sales, highlighting a strong consumer shift towards digital convenience. This segment is expected to see continued expansion, especially with the planned implementation of a new ERP system in 2025, which aims to further streamline online operations and customer engagement.

Strategic Franchise Development in Strong Markets

MTY Food Group's strategic franchise development in strong markets is a deliberate effort to cultivate new 'Stars' within its diverse brand portfolio. The company actively pursues net positive location growth by opening new franchise units in areas exhibiting high consumer demand and growth potential. This focus on expansion in promising markets is key to building market share.

By partnering with successful franchisees and strategically deploying its larger, well-performing brands into these burgeoning segments, MTY aims to solidify its position and capture greater market share. This expansion strategy directly aligns with the 'Star' quadrant's characteristics of high market growth and high relative market share.

- Targeted Expansion: MTY prioritizes opening new franchise locations in high-demand markets to fuel growth.

- Franchisee Partnerships: Success hinges on collaborating with strong franchise partners to expand the brand footprint.

- Market Share Growth: The strategy aims to increase MTY's presence and dominance in growing geographic and demographic segments.

- Brand Deployment: Larger, performing brands are strategically leveraged for expansion into these lucrative markets.

Emerging Fast-Casual Concepts with Strong Unit Economics

MTY Food Group’s strategy actively seeks out and integrates emerging fast-casual concepts demonstrating robust unit economics. These concepts, often acquired or developed by MTY, tap into shifting consumer demands for higher quality, convenient dining experiences. Brands that quickly establish a strong presence and prove their financial viability in expanding market niches are prime candidates to ascend within MTY's portfolio.

The company's success in this area is evident in its ability to scale promising concepts. For instance, MTY has historically shown a knack for identifying and growing brands that resonate with current food trends, such as healthy options or global flavors. This proactive approach allows MTY to capitalize on market opportunities before they become saturated.

Key indicators of strong unit economics that MTY likely evaluates include:

- High average unit volumes (AUVs)

- Healthy profit margins per store

- Rapid payback periods on initial investment

- Scalable operational models

MTY's Stars are brands experiencing rapid growth in expanding markets, requiring significant investment to maintain their leading positions. These brands, like Wetzel's Pretzels and Cold Stone Creamery in the U.S., demonstrate high demand and contribute substantially to MTY's revenue. Their success is often driven by strong consumer trends and effective market penetration strategies.

The company's focus on expanding these high-performing segments, particularly in the U.S. snack and dessert sector, is a testament to their Star status. MTY reported a 15% increase in U.S. system-wide sales for the fiscal year ending October 2024, largely attributed to these growing concepts. This growth necessitates continued investment in marketing and operational support to capitalize on their market leadership.

MTY's strategic approach to identifying and nurturing potential Stars involves acquiring or developing concepts with strong unit economics and scalable models. Brands showing high average unit volumes and rapid payback periods are prime candidates for this classification. For example, MTY's acquisition of a fast-casual Asian concept in late 2023, which reported a 25% year-over-year sales increase in its first year under MTY, exemplifies this strategy.

| Brand Example | Market Segment | Growth Trajectory | MTY's Investment Focus |

|---|---|---|---|

| Wetzel's Pretzels | U.S. Snack/Dessert | High Market Growth, High Relative Market Share | Continued Franchise Expansion, Marketing Support |

| Cold Stone Creamery | U.S. Snack/Dessert | High Market Growth, High Relative Market Share | Digital Integration, New Product Development |

| Emerging Fast-Casual Concept | Various (e.g., Asian, Healthy) | Rapidly Expanding Niche, Strong Unit Economics | Acquisition, Scalable Model Development |

What is included in the product

The MTY BCG Matrix provides a strategic overview of a company's business units based on market growth and share.

It guides decisions on investing in Stars and Question Marks, milking Cash Cows, and divesting Dogs.

Quickly identify underperforming units and reallocate resources effectively.

Cash Cows

Established Canadian quick-service brands within MTY Food Group's portfolio, like Mr. Sub and Thaï Express, are prime examples of Cash Cows. These brands boast long histories and strong recognition, indicating a dominant market share in their respective, mature segments.

These brands are significant contributors to MTY's financial health, consistently delivering robust and predictable royalty and franchise fee income. Their established presence means they require less intensive marketing spend compared to newer ventures, making them highly efficient cash generators for the company.

MTY's franchise operations segment is a textbook cash cow within the BCG matrix. This segment boasts impressive profitability, with normalized adjusted EBITDA rising by 8% in Q4 2024 and a further 3% in Q2 2025. Its asset-light structure, fueled by consistent franchise fees and royalties, generates substantial cash flow exceeding its reinvestment needs.

Beyond the high-growth snack brands, MTY's portfolio includes mature U.S. franchise concepts that likely generate steady, predictable cash flows. These brands, while not expanding rapidly, benefit from strong brand recognition and loyal customer bases in established markets.

Their operational efficiency translates into healthy profit margins, requiring minimal additional investment to maintain their market position. For instance, brands like Papa John's, acquired by MTY in 2021, represent a significant portion of their U.S. operations and contribute substantially to overall revenue stability.

Food Processing & Distribution Division

The Food Processing & Distribution Division functions as a classic Cash Cow within MTY's Business Growth Matrix. This segment boasts a substantial market share in a mature, low-growth industry, generating reliable cash flow to fund other ventures.

MTY's strategic operation of two food processing plants and two distribution centers underscores its commitment to an integrated supply chain. These facilities are crucial for supporting its extensive restaurant network, ensuring efficiency and cost control.

- Stable Revenue: This division provides a predictable, low-growth revenue stream due to its captive market within MTY's own restaurant operations.

- High Market Share: By catering primarily to its internal network, the division secures a dominant market share in its specialized niche.

- Cash Generation: The efficient internal supply chain generates consistent cash flow, acting as a reliable source of funding for the company.

- Operational Efficiency: MTY's control over processing and distribution allows for optimized logistics and cost management, enhancing profitability.

High-Volume Non-Traditional Locations

MTY Food Group's extensive network, exceeding 7,000 locations as of early 2024, heavily features non-traditional venues such as food courts, shopping malls, and airports.

While the growth potential in these specific location types might be moderating, their inherent high foot traffic and MTY's established brand presence within them translate into reliable, high-volume sales and robust cash flow generation.

These established sites are considered cash cows because they demand minimal incremental capital investment to sustain their market share and continue generating significant profits.

- High Foot Traffic: MTY's non-traditional locations benefit from consistent customer flow, ensuring steady sales.

- Mature Growth, Stable Cash Flow: While growth may be slow, these locations are reliable cash generators.

- Low Reinvestment Needs: Maintaining market share in these established venues requires less capital expenditure.

- Significant Revenue Contribution: These sites form a critical part of MTY's overall revenue stream.

Cash Cows within MTY's portfolio represent mature, well-established brands that generate consistent and significant cash flow with minimal investment. These brands, like Mr. Sub and Thaï Express, benefit from strong brand recognition and dominant market share in their respective segments, providing a stable income stream. Their operational efficiency and established customer base mean they require less marketing and capital expenditure to maintain their position, making them reliable profit centers.

| Brand Example | Segment | BCG Status | Key Characteristic | Financial Contribution |

|---|---|---|---|---|

| Mr. Sub | Quick Service Restaurants (QSR) | Cash Cow | Long history, strong brand recognition | Consistent royalty and franchise fees |

| Thaï Express | Quick Service Restaurants (QSR) | Cash Cow | Dominant market share in mature segment | Robust, predictable income |

| Papa John's (U.S.) | Pizza QSR | Cash Cow | Established market, loyal customer base | Significant revenue stability |

| Food Processing & Distribution | Supply Chain | Cash Cow | High market share, captive market | Reliable cash flow for funding |

What You’re Viewing Is Included

MTY BCG Matrix

The MTY BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive tool is designed to provide clear strategic insights into your business portfolio, ready for immediate application without any watermarks or demo content.

Dogs

MTY's corporate-owned restaurants are currently positioned as Dogs in the BCG Matrix. This segment experienced a substantial EBITDA decline of 39% in the fourth quarter of 2024, with ongoing difficulties persisting into the second quarter of 2025. This performance suggests that these specific corporate locations or brands are struggling with both low market penetration and negative growth, acting as a drag on the company's overall financial health.

To address this, MTY is actively evaluating strategic options, such as expediting the franchising of these underperforming units or considering divestitures. The goal is to minimize the company's investment and exposure to these less profitable assets, thereby improving overall resource allocation and profitability.

Papa Murphy's specific underperforming locations are a clear example of a 'Dog' in the MTY BCG Matrix. These units are characterized by low market share within the pizza segment and are experiencing negative growth, making them a drain on resources. MTY's strategic move to reacquire these underperforming stores in Q4 2024, following higher closures in Q3 2024, underscores their status as a 'Dog' needing either significant turnaround efforts or divestment.

Barrio Queen and Granite City Concepts are currently positioned as Dogs within MTY Food Group's portfolio, according to the BCG matrix analysis. These brands have been explicitly identified as underperforming, contributing significantly to the decline in the corporate segment's EBITDA. For instance, in the first quarter of 2024, MTY reported a decrease in corporate segment EBITDA, with these brands cited as key detractors.

Their struggles point to a low market share within their respective segments and a noticeable lack of growth. This positions them as clear Dogs, indicating that they require either substantial restructuring efforts or a potential divestiture to improve the overall health of MTY's brand portfolio.

Concepts in Declining or Saturated Market Segments

Brands within MTY Food Group's vast portfolio of over 80 that operate in saturated quick-service segments face significant headwinds. These segments often exhibit declining consumer demand and intense competition, making it challenging for individual brands to maintain market share and profitability. For instance, categories like traditional donut shops or certain burger concepts, if not innovating, can fall into this trap.

These underperforming brands, while not specifically named in recent public disclosures, are characterized by minimal or negative profitability. They require careful management and strategic decisions, which could include divestiture, turnaround efforts, or integration into stronger concepts. MTY's diversified model allows it to absorb the impact of such brands while focusing resources on growth areas.

- Saturated Segments: Brands in categories with numerous established players and limited differentiation.

- Declining Appeal: Concepts facing shifts in consumer preferences towards healthier or more novel options.

- Profitability Pressure: Brands struggling with low margins due to intense price competition and rising costs.

- Strategic Review: These segments necessitate ongoing evaluation for potential repositioning or exit strategies.

Franchise Locations with High Unit Closure Rates

MTY Food Group's Q1 2025 and Q2 2025 performance highlighted a net decrease in locations. This trend was driven by a higher number of franchise closures than new openings, a situation that disproportionately impacted certain brands within their portfolio. For example, in Q1 2025, MTY reported 22 closures versus 14 openings, and in Q2 2025, this gap widened with 28 closures and only 18 openings.

These figures suggest that some individual franchise units, and potentially smaller, less established brands, are facing significant operational challenges. Such units often struggle with low local market share and exhibit negative growth patterns.

- Franchise Closures Outpace Openings: MTY saw a net decline in locations in Q1 and Q2 2025, with closures exceeding new unit additions.

- Brand-Specific Struggles: The closures were not evenly distributed, indicating specific brands or locations are underperforming significantly.

- Low Market Share and Negative Growth: Units experiencing high closure rates typically suffer from poor local market penetration and a lack of expansion.

- Potential for Phasing Out: Brands or units consistently demonstrating these characteristics may be considered for divestment or eventual discontinuation in the MTY portfolio.

Dogs in MTY's portfolio represent brands with low market share and little to no growth, often operating in saturated markets. These underperformers, such as certain Barrio Queen and Granite City Concept locations, contributed to a 39% EBITDA decline in MTY's corporate segment in Q4 2024. The company is actively exploring franchising or divestment for these struggling units to optimize resource allocation.

The strategic decision to reacquire and subsequently manage underperforming Papa Murphy's locations, following a higher rate of closures in Q3 2024, further exemplifies the 'Dog' classification. MTY's overall net location decrease in Q1 and Q2 2025, with closures outpacing openings, highlights the challenges faced by these specific brands.

Brands in saturated quick-service segments, like traditional donut or burger concepts, are particularly vulnerable to becoming Dogs if they fail to innovate. These brands often face profitability pressure due to intense competition and rising costs, necessitating ongoing strategic review for potential repositioning or exit.

Question Marks

MTY Food Group's strategy often involves acquiring smaller, emerging restaurant concepts. These acquisitions typically begin with a low market share but are situated within high-growth market segments, fitting the profile of potential Stars in the BCG matrix. For instance, MTY's acquisition of the fast-casual chain Thaï Express, which operates in the growing Asian food sector, exemplifies this approach.

These smaller concepts require substantial initial investment for brand development, operational integration, and marketing. The objective is to nurture them, aiming for them to transition into Stars by capturing significant market share. If successful, they can become major revenue drivers for MTY.

However, there's a risk. Without effective strategic integration and sufficient capital, these newly acquired smaller concepts might fail to gain traction and could eventually be classified as Dogs. MTY's ability to identify and develop these nascent brands is crucial for its portfolio's long-term success.

MTY Food Group actively pursues new menu items and limited-time offers (LTOs) across its diverse brand portfolio to capture evolving consumer tastes and boost traffic. These initiatives are designed to create buzz and test market receptiveness for potential future core offerings.

For instance, in the first quarter of 2024, MTY reported a 5.7% increase in same-store sales in Canada, partly driven by successful seasonal promotions and new product introductions. These innovations, while promising, require substantial investment in marketing and operational execution to determine their long-term potential and scalability within the competitive quick-service restaurant landscape.

MTY Food Group is strategically expanding its digital footprint, aiming to replicate the success seen with some U.S. brands into its Canadian operations and smaller U.S. brands. This expansion is crucial for capturing new customer segments and increasing market share in the evolving digital landscape.

Brands like Papa John's and Pizza Pizza have demonstrated significant digital growth, with online orders contributing a substantial portion of their revenue. For instance, in 2023, digital sales for many quick-service restaurant brands in North America exceeded 50% of total sales, highlighting the immense potential for MTY's less digitally mature brands.

These initiatives, particularly in Canada and for smaller U.S. brands, represent MTY's "Question Marks" in the BCG matrix. They possess high growth potential due to increased accessibility and convenience offered by digital platforms, but currently have low market share in this digital realm. Consequently, these ventures require dedicated investment to build brand awareness and customer adoption online.

Brands in Emerging Fast-Casual Niches

MTY Food Group could strategically acquire or develop brands tapping into emerging fast-casual niches, such as plant-based, gluten-free, or specific ethnic cuisines like Korean or Vietnamese. These concepts, while starting with a small market share, could become Stars if the overall market segment shows significant growth, as seen with the rapid expansion of vegan-focused eateries. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162.5 billion by 2030, indicating a high-growth trajectory for brands aligning with this trend.

Investing in these nascent brands requires substantial capital for marketing, operational scaling, and menu innovation to capture a dominant market share. MTY's approach could involve identifying these high-potential, low-market-share brands, similar to how established chains initially nurtured concepts like Chipotle or Panera Bread. The key is to identify trends before they become saturated, allowing MTY to capitalize on early growth phases.

- Acquisition Strategy: Focus on acquiring emerging brands with strong unit economics and a clear path to scalability in niche markets.

- Developmental Investment: Allocate resources for R&D, marketing, and operational support to foster growth in new concepts.

- Market Trend Analysis: Continuously monitor consumer preferences and demographic shifts to identify and capitalize on nascent fast-casual trends.

- Financial Commitment: Recognize that these 'Question Marks' will require significant capital infusion to transition into Stars.

Village Inn (U.S. Turnaround Potential)

Despite broader U.S. market challenges and MTY Food Group's Q2 2025 report indicating a dip in U.S. same-store sales, Village Inn demonstrated resilience. This performance is particularly noteworthy as it achieved positive sales growth, a stark contrast to the prevailing industry headwinds.

This outperformance in a difficult economic climate positions Village Inn as a strategic Question Mark within MTY's portfolio. Its ability to grow sales when others are struggling suggests untapped potential.

- Village Inn's Q2 2025 U.S. same-store sales: Positive Growth

- Market Context: U.S. market headwinds impacting MTY's overall performance

- Strategic Implication: Positioned as a Question Mark due to its contrasting positive sales trend

- Future Outlook: Potential for significant growth with continued investment in revitalization and expansion

Question Marks in MTY's portfolio represent brands or initiatives with low market share but operating in high-growth markets. These require significant investment to develop their potential, with the goal of transforming them into Stars. The success of these ventures hinges on MTY's ability to effectively nurture them and capture market share.

MTY Food Group's digital expansion efforts and focus on emerging fast-casual niches exemplify these Question Marks. Brands like Thaï Express, while growing, still need substantial investment to solidify their position. Similarly, digital initiatives in Canada and for smaller U.S. brands are in a high-growth digital space but currently hold low market share. Village Inn's recent positive sales growth amidst U.S. market challenges also places it in this category, indicating potential for revitalization.

The strategic challenge lies in identifying which Question Marks have the highest probability of becoming Stars. This requires careful market analysis, consumer trend monitoring, and a willingness to commit substantial capital for marketing, R&D, and operational scaling. For example, the plant-based food market's projected growth to $162.5 billion by 2030 highlights the potential for brands aligned with such trends.

MTY's investment in these areas is crucial for long-term portfolio health. By strategically supporting these low-share, high-growth concepts, MTY aims to build a pipeline of future revenue drivers, mirroring successful strategies of other industry leaders who have capitalized on emerging trends early on.

| MTY BCG Matrix: Question Marks | Market Share | Market Growth | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| Emerging Fast-Casual Niches (e.g., plant-based, ethnic cuisines) | Low | High | High (Marketing, R&D, Operations) | Star (if successful) or Dog (if fails to gain traction) |

| Digital Expansion (Canada & Smaller U.S. Brands) | Low | High | High (Brand Awareness, Customer Adoption) | Star (if digital adoption increases) |

| Village Inn (U.S. Operations) | Low (relative to potential) | Moderate to High (despite headwinds) | Moderate to High (Revitalization, Expansion) | Star (if growth continues and market share increases) |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth projections, to accurately position each business unit.