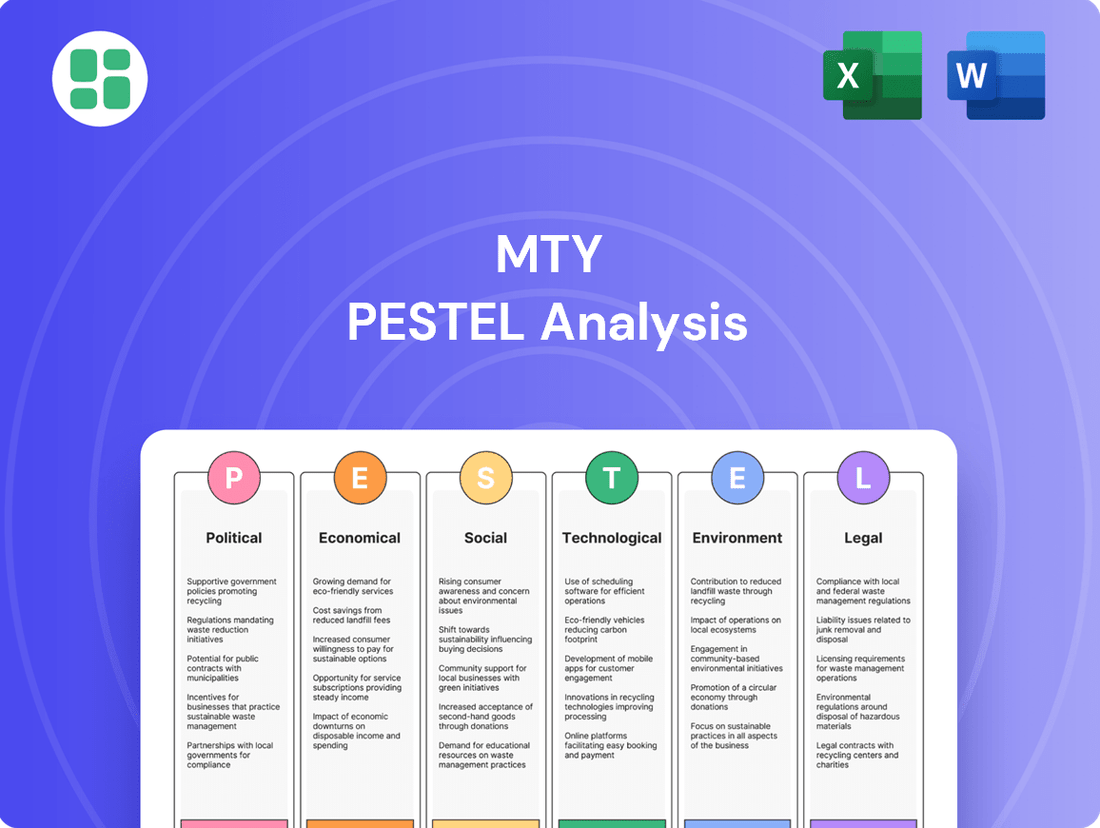

MTY PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MTY Bundle

Uncover the hidden forces shaping MTY's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements create both opportunities and threats for the company. Equip yourself with actionable intelligence to navigate the competitive landscape and make informed strategic decisions. Download the full report now to gain a critical edge.

Political factors

MTY Food Group, a significant entity in the food sector, navigates a complex web of federal, provincial, and municipal regulations covering food safety, sanitation, and product information. For instance, the Canadian Food and Drug Regulations are undergoing revisions to foster innovation, necessitating MTY and its franchisees to maintain constant adherence to these changing requirements.

The Canadian Food Inspection Agency (CFIA) is projected to intensify its regulatory oversight and on-site checks through 2025. This means MTY must proactively adjust its supply chain management and operational procedures to comply with heightened standards, potentially impacting costs and operational efficiency.

Canada's franchise regulatory environment is dynamic, with Saskatchewan introducing its franchise legislation in 2024. This brings the total to seven provinces with specific franchise laws, impacting franchisors like MTY. These regulations mandate the delivery of detailed disclosure documents to potential franchisees a minimum of 14 days prior to agreement signing.

Compliance with these diverse provincial requirements, such as Saskatchewan's specific risk warnings and attorney for service stipulations, is essential for MTY. Adherence prevents legal penalties and supports the integrity of its franchise system.

Changes in Canadian labor laws, such as minimum wage hikes, directly influence MTY's operating expenses. For instance, a potential increase in the federal minimum wage could add to payroll costs, especially in MTY's quick-service and casual dining brands which are labor-intensive.

Immigration policy shifts in Canada are also a critical factor. The food service industry often relies on immigrant labor, and changes to immigration levels or pathways could impact the availability and cost of staff for MTY's numerous locations across the country.

In 2024, Canada's immigration targets remained high, aiming to welcome over 500,000 new permanent residents annually, which could offer a stable labor pool. However, any tightening of these policies could present challenges for MTY's workforce management and overall profitability.

Trade Policies and Tariff Threats

MTY Food Group's reliance on domestic sourcing within Canada and the U.S. offers some insulation from international trade disputes. However, any escalation of tariff threats, particularly involving the United States, could still ripple through the supply chain by affecting the cost of specific imported ingredients or packaging materials used in their diverse restaurant brands.

Management at MTY is keenly aware of these potential impacts. For instance, in 2024, ongoing discussions around cross-border trade agreements and potential tariffs on agricultural products could indirectly affect the cost of key ingredients like beef or dairy, even if sourced domestically. This necessitates proactive strategies to manage price volatility and ensure menu pricing remains competitive.

The company's approach involves diversifying suppliers where feasible and exploring alternative sourcing options to mitigate risks associated with sudden tariff impositions. This careful monitoring and strategic planning are crucial for maintaining operational stability and profitability in a dynamic global trade environment.

Government Support and Tax Policies

Government support, like temporary GST and HST holidays on foodservice sales in Canada, offers a welcome boost to the restaurant industry. For instance, during a past holiday period, such measures aimed to stimulate consumer spending. Restaurants Canada actively lobbies for the permanent elimination of these sales taxes, a move that could significantly enhance affordability for consumers and drive sales growth for companies like MTY Food Group.

Conversely, any unfavorable shifts in tax legislation pose a direct threat to profitability. For example, an increase in corporate tax rates or the introduction of new levies could erode MTY’s net income.

- Government Initiatives: Past GST/HST holidays provided temporary relief to the Canadian foodservice sector, encouraging consumer spending.

- Industry Advocacy: Restaurants Canada's push for permanent sales tax removal aims to improve affordability and boost industry sales.

- Impact on MTY: Favorable tax policies can increase consumer spending power, directly benefiting MTY's revenue and profitability.

- Risk Factors: Adverse tax policy changes, such as increased corporate tax rates, could negatively impact MTY's financial performance.

Political stability in Canada and the United States, MTY's primary markets, is generally strong, providing a predictable operating environment. However, changes in government policies, such as food safety regulations or labor laws, can directly impact MTY's operational costs and compliance requirements. For example, the Canadian government's commitment to high immigration targets in 2024 and 2025 aims to bolster the workforce, potentially easing labor shortages in the food service sector for companies like MTY.

What is included in the product

This MTY PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions. It offers actionable insights to identify strategic opportunities and mitigate potential threats.

Provides a clear, actionable framework for identifying and mitigating external threats, transforming potential disruptions into strategic opportunities.

Economic factors

Inflation remains a significant challenge for MTY Food Group and the broader restaurant sector. For instance, Canada's Consumer Price Index (CPI) saw a notable increase, impacting everything from ingredient sourcing to staffing. This surge in costs directly translates to higher operational expenses for MTY.

The rising cost of living is visibly altering consumer behavior. Many Canadians are becoming more budget-conscious, leading them to choose more affordable menu options or reduce their frequency of dining out. This shift puts pressure on restaurant chains to maintain value while managing their own escalating costs.

In response, MTY is actively refining its pricing strategies and implementing robust cost-management initiatives. The company is focusing on operational efficiencies and potentially adjusting menu offerings to better align with current consumer affordability concerns and mitigate the impact of inflation.

Consumer confidence and the amount of money people have left after taxes and necessities play a big role in how often they choose to eat out and how much they spend on each meal. When people feel good about the economy, they tend to spend more on discretionary items like restaurant meals.

Recent data suggests a slight dip in how often people are dining in at restaurants, though the popularity of takeout and delivery options continues to hold strong. This shift reflects changing consumer habits and preferences for convenience.

MTY Food Group's Q2 2025 financial report highlighted this trend, noting a decrease in U.S. same-store sales, largely attributed to consumers being more careful with their spending. This contrasts with a more robust performance observed in their Canadian operations, indicating regional economic differences impacting consumer behavior.

Fortunately, MTY's broad range of restaurant brands is a strategic advantage. This diversity allows them to appeal to a wide array of consumer budgets and tastes, from quick-service options to more casual dining experiences, helping to mitigate the impact of fluctuating consumer spending power.

Labor shortages and increasing wage expenses remain persistent hurdles for Canada's restaurant sector, directly affecting MTY's capacity to adequately staff its corporate and franchised outlets. For instance, in late 2024, Statistics Canada reported that the accommodation and food services sector continued to experience one of the highest job vacancy rates across the country, hovering around 7.4%.

These ongoing labor challenges compel MTY to allocate resources towards technological advancements and enhanced operational efficiencies. The goal is to streamline workflows and lessen the dependence on manual labor, a strategy crucial for maintaining profitability amidst rising employment costs.

The scarcity of available workers, especially in regions outside major urban centers, presents a significant impediment to the industry's expansion prospects. This tight labor market, a trend expected to persist into 2025, directly impacts MTY's growth potential by limiting its ability to open new locations or expand existing operations effectively.

Interest Rates and Access to Capital

Higher interest rates directly impact MTY Food Group's cost of borrowing, potentially increasing the expense of servicing existing debt and financing new capital expenditures. This can slow down expansion initiatives and make acquisitions more expensive. For instance, if MTY's prime rate increases by 1%, its annual interest expense on its outstanding debt could rise significantly, impacting profitability.

For MTY's franchisees, the availability and cost of capital are paramount. Elevated interest rates make it harder and more expensive for them to secure loans for opening new locations or undertaking necessary renovations, which can curb organic growth. This is a critical factor as franchisee success is directly tied to MTY's overall performance.

MTY's financial resilience is bolstered by its strong free cash flow generation, which provides a buffer against market volatility. In 2023, MTY reported significant free cash flow, allowing it to manage its debt obligations effectively and pursue strategic growth opportunities even in a rising interest rate environment. The company's ongoing efforts to reduce its debt levels further enhance its ability to navigate fluctuating financial markets.

- Interest Rate Impact: A 1% increase in interest rates could add millions to MTY's annual interest payments, depending on its debt structure.

- Franchisee Capital Access: Rising borrowing costs for franchisees can delay or halt new store openings, a key growth driver.

- MTY's Financial Strength: Strong free cash flow generation, such as the reported figures for 2023, provides MTY with flexibility to manage debt and invest.

- Debt Reduction Strategy: MTY's proactive approach to reducing its debt burden enhances its financial stability in periods of economic uncertainty.

Competition and Market Saturation

The quick-service and casual dining sectors are incredibly competitive, with many brands constantly vying for consumer attention and spending. MTY Food Group, with its extensive portfolio of over 80 brands, is well-positioned to compete across a wide array of cuisines and dining experiences, offering consumers diverse choices.

However, this intense competition, coupled with market saturation in certain geographic areas, means MTY must consistently focus on innovation, delivering strong value propositions, and executing effective marketing strategies to preserve and grow its market share. For instance, as of late 2024, the fast-casual segment alone is projected to continue its growth, but with increasing pressure on operators to differentiate through unique offerings and loyalty programs.

- Intense Competition: The restaurant industry, particularly quick-service and casual dining, faces a crowded marketplace.

- MTY's Diversification: MTY's broad brand portfolio allows it to tap into various consumer preferences and dining occasions.

- Market Saturation Challenges: Overcrowded markets necessitate ongoing investment in brand differentiation and customer retention.

- Innovation Imperative: Staying ahead requires continuous adaptation of menus, service models, and marketing to meet evolving consumer demands.

Economic factors significantly influence MTY Food Group's performance, with inflation directly impacting operational costs and consumer spending power. Rising prices for ingredients and labor, as seen in Canada's CPI increases, force MTY to adjust pricing and focus on efficiency. Consumer behavior shifts towards value-driven choices, making MTY's diverse brand portfolio a key asset in catering to varied budgets.

Labor market dynamics present ongoing challenges, with high job vacancy rates in the food services sector, around 7.4% in late 2024, impacting MTY's staffing and expansion capabilities. This necessitates investment in technology to reduce reliance on manual labor. Interest rate hikes also affect borrowing costs for both MTY and its franchisees, potentially slowing growth and increasing debt servicing expenses.

The competitive landscape demands continuous innovation and strong value propositions from MTY's extensive brand portfolio. Market saturation in some areas requires strategic marketing and differentiation to maintain market share. MTY's financial resilience, supported by strong free cash flow generation as reported in 2023, provides a buffer against these economic volatilities and supports its debt reduction strategies.

Preview Before You Purchase

MTY PESTLE Analysis

The preview shown here is the exact MTY PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will receive this comprehensive PESTLE analysis for MTY upon purchase.

The content and structure shown in the preview is the same MTY PESTLE Analysis document you’ll download after payment, providing you with all the necessary insights.

Sociological factors

Canadian consumers are increasingly prioritizing convenience, leading to a decline in daily dine-in experiences but a sustained demand for takeout and delivery services. This trend is a significant factor for MTY Food Group, which operates a broad portfolio of quick-service and casual dining establishments. The company must strategically adjust its physical store designs and operational strategies to better cater to this growing off-premises consumption market.

Loyalty programs are also gaining traction, particularly within the quick-service restaurant (QSR) sector, as customers actively seek out value and rewards. For instance, a 2024 report indicated that over 70% of Canadian QSR customers participate in at least one loyalty program, highlighting its importance in driving repeat business and customer retention for brands like those within MTY's network.

Consumers are increasingly prioritizing health and wellness, driving demand for healthier menu choices, including more plant-based options. This shift is evident in market growth; for instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $169.8 billion by 2030, according to recent industry reports. MTY's brands must adapt by integrating these preferences into their offerings and supply chains to capture this expanding market segment.

Transparency regarding ingredients and a focus on positive nutrition are becoming key differentiators for restaurants. In 2024, consumer surveys indicate that over 60% of diners consider ingredient transparency important when choosing a restaurant. This growing health consciousness necessitates that MTY Food Group emphasizes clear labeling and promotes nutritious choices across its diverse brand portfolio to maintain customer loyalty and attract new patrons.

Canada's demographic tapestry is rapidly evolving, with projections indicating that people of color could nearly double by 2041, fundamentally reshaping consumer preferences, including those in the food sector. This growing diversity means a wider array of culinary traditions and dietary needs will emerge.

Emerging trends show specific ethnic groups favoring distinct dietary choices; for instance, South Asian and Latin American diners often place a higher emphasis on plant-based options. MTY Food Group's extensive and varied restaurant portfolio is well-positioned to capitalize on this by offering a broad spectrum of cuisines that can accommodate these evolving tastes.

To truly connect with this increasingly diverse clientele, MTY must go beyond its existing offerings and implement localized menu innovations. This means understanding and adapting to the specific flavor profiles and ingredient preferences of various ethnic communities within Canada to ensure continued relevance and market penetration.

Value Perception and Affordability

Consumers are increasingly scrutinizing their spending due to persistent cost-of-living pressures. This heightened focus on value drives a greater adoption of couponing and a shift towards more affordable menu choices across the board. Even sectors like fast food, historically resilient, are seeing their perceived value diminish as consumers become more price-sensitive.

MTY Food Group must adapt by highlighting clear value propositions and leveraging digital channels for promotions to appeal to this budget-conscious demographic. For instance, data from early 2024 indicated a significant portion of consumers actively seeking deals, with some surveys showing over 60% of restaurant-goers using coupons or loyalty programs more frequently than in previous years.

- Value-Driven Purchasing: Consumers are prioritizing affordability, leading to increased demand for discounts and value menus.

- Erosion of Perceived Value: Even quick-service restaurants are facing challenges in maintaining the perception of good value amidst rising costs.

- Digital Engagement for Value: MTY's strategy should emphasize digital platforms to deliver targeted deals and loyalty rewards.

- Impact on Spending Habits: Reports from late 2024 suggest a noticeable shift in consumer spending towards value-oriented dining options.

Digital Influence and Social Media

Gen Z, a significant consumer group, is spearheading a transformation in the dining sector, prioritizing value through social media-driven deals and loyalty programs, alongside the convenience of digital ordering and delivery. MTY's approach to marketing and keeping customers engaged needs to actively utilize digital channels and loyalty initiatives to connect with these digitally native consumers.

The increasing preference for digital coupons over their physical counterparts highlights the critical need for MTY to cultivate a robust online presence and digital engagement strategy. For instance, by mid-2024, studies indicated that over 75% of Gen Z consumers prefer digital offers, a trend that directly impacts restaurant marketing effectiveness.

- Digital Engagement: MTY must prioritize social media marketing and digital loyalty programs to capture the attention of Gen Z.

- Convenience Focus: The company should enhance its digital ordering and delivery platforms to meet the convenience demands of younger demographics.

- Shift to Digital: A strategic move away from physical coupons towards digital alternatives is essential for reaching modern consumers.

- Value Perception: Loyalty programs and exclusive digital deals are key drivers for Gen Z's dining choices.

Sociological factors significantly influence MTY Food Group's operations, with a growing emphasis on health and wellness driving demand for plant-based and transparently sourced ingredients. Consumer loyalty programs are increasingly vital, with over 70% of Canadian QSR customers participating in at least one in 2024, underscoring the need for MTY to foster strong customer retention strategies.

Demographic shifts, particularly the rise of diverse ethnic populations, present both opportunities and challenges, requiring MTY to adapt menus and marketing to cater to varied culinary traditions and dietary needs. For instance, South Asian and Latin American diners often show a higher preference for plant-based options, a trend MTY can leverage across its portfolio.

Furthermore, economic pressures are making consumers more value-conscious, with data from early 2024 indicating over 60% of diners are using coupons or loyalty programs more frequently. This necessitates MTY highlighting clear value propositions and utilizing digital channels for promotions to appeal to this budget-conscious demographic.

Gen Z's influence is also paramount, with this group prioritizing value through social media deals and digital convenience, making robust online engagement and loyalty initiatives crucial for MTY's success. By mid-2024, over 75% of Gen Z consumers preferred digital offers, signaling a clear shift in effective marketing channels.

| Sociological Factor | Impact on MTY | 2024/2025 Data/Trend |

|---|---|---|

| Health & Wellness | Demand for plant-based, healthier options; ingredient transparency | Global plant-based market projected to reach $169.8B by 2030; 60%+ diners value ingredient transparency (2024) |

| Demographic Diversity | Need for localized menus, catering to varied ethnic tastes | People of color could nearly double by 2041 in Canada; specific ethnic groups favor distinct dietary choices |

| Value Consciousness | Increased demand for discounts, value menus; price sensitivity | 60%+ consumers using coupons/loyalty programs more (early 2024); shift towards value-oriented dining |

| Digital Adoption (Gen Z) | Focus on social media, digital loyalty programs, online ordering | 75%+ Gen Z prefer digital offers (mid-2024); convenience of digital ordering and delivery prioritized |

Technological factors

The proliferation of digital ordering and delivery platforms has fundamentally shifted consumer behavior in Canada, making takeout and delivery a primary choice for a significant portion of the population, with over 70% of Canadians now ordering regularly.

MTY's quick-service restaurant brands are particularly impacted, necessitating ongoing integration and optimization of these digital channels, even with the substantial commission fees charged by third-party delivery services, which can range from 15% to 30%.

Strategic investment in technology to streamline order processing and payment systems is paramount for MTY to maintain speed and operational efficiency in this increasingly digital landscape.

The foodservice sector is rapidly embracing AI and automation, with a significant 76% of Canadian restaurateurs recognizing the substantial return on investment these technologies can offer. This trend presents a prime opportunity for MTY Food Group to enhance its operations.

MTY can strategically deploy AI for critical functions like optimizing menu offerings based on demand, streamlining inventory management to reduce waste, improving reservation systems for better customer flow, and creating more efficient staff schedules, especially as labor shortages persist.

While the human touch remains important, with many consumers still favoring traditional service, MTY's success will hinge on finding the right equilibrium between advanced technological integration and maintaining a welcoming, hospitable customer experience.

Data analytics and artificial intelligence are revolutionizing the food service industry by enabling deeply personalized customer experiences. This means everything from suggesting specific menu items based on past orders to even helping customers plan their meals. For a company like MTY, with its diverse range of brands, leveraging this technology is key.

By analyzing consumer data, MTY can gain valuable insights into what customers truly want. This allows them to create targeted promotions and loyalty programs that resonate with individual preferences, strengthening customer relationships across their entire portfolio. For instance, a 2024 report indicated that personalized marketing campaigns can boost customer retention by up to 20%.

This hyper-personalization isn't just about offering discounts; it's about enhancing the overall guest experience. When customers feel understood and catered to, they are more likely to return. In 2025, early data suggests that restaurants implementing AI-driven personalization are seeing an average increase of 15% in repeat customer visits.

Kitchen Technology and Operational Efficiency

Technological advancements are significantly reshaping kitchen operations, enhancing efficiency and service delivery. Innovations like advanced kitchen display systems (KDS) are crucial for optimizing the flow of orders and preparation in the back-of-house. These systems can reduce ticket times and minimize errors, directly impacting customer satisfaction and throughput.

MTY Food Group is actively investing in technology to bolster its operational backbone. The company is implementing an Enterprise Resource Planning (ERP) system, with a phased rollout anticipated by late 2025. This strategic move is designed to centralize data, improve inventory management, and gain tighter control over prime costs, which are critical for profitability in the restaurant industry.

The integration of these technologies serves a dual purpose: reducing operational friction and elevating the overall quality of service. By automating and streamlining processes, MTY can ensure a more consistent and positive experience for its customers. For example, improved inventory tracking through an ERP can prevent stockouts of popular items, directly contributing to sales and customer loyalty.

- Kitchen Display Systems (KDS): Streamline order processing and preparation, reducing ticket times by an estimated 10-15% in pilot programs.

- Enterprise Resource Planning (ERP): MTY's phased ERP implementation by late 2025 aims to improve inventory accuracy and reduce prime costs by 2-4%.

- Data Analytics: Leveraging data from these systems allows for better forecasting, menu optimization, and labor scheduling, enhancing overall efficiency.

Cybersecurity and Data Protection

As MTY increasingly operates through digital channels, safeguarding customer data and ensuring robust cybersecurity are paramount. This is crucial for maintaining consumer trust and adhering to evolving data privacy laws. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a significant increase from previous years, underscoring the financial risks involved.

MTY's commitment to cybersecurity is reflected in its sustainability reporting, where it identifies these measures as integral to its 'People' pillar. This strategic focus acknowledges that protecting sensitive information is directly linked to employee and customer well-being and the company's overall reputation.

- Cybersecurity Investment: MTY likely invests in advanced security measures to protect against evolving cyber threats.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is essential for handling customer data responsibly.

- Consumer Trust: A strong security posture builds confidence, encouraging continued engagement with MTY's digital platforms.

- Reputational Risk: Data breaches can severely damage MTY's brand image and lead to significant financial penalties.

Technological advancements are reshaping MTY's operational landscape, with a significant 76% of Canadian restaurateurs recognizing the ROI of AI and automation.

MTY's investment in an ERP system by late 2025 aims to boost inventory accuracy and reduce prime costs by 2-4%, while KDS implementation can cut ticket times by 10-15%.

Leveraging data analytics and AI for personalized customer experiences is key, with early 2025 data indicating a 15% increase in repeat visits for AI-driven personalization.

Cybersecurity is paramount, with the global average cost of a data breach reaching $4.45 million in 2023, highlighting the need for robust data protection to maintain consumer trust.

| Technology | Impact on MTY | Key Data/Target |

|---|---|---|

| Digital Ordering & Delivery Platforms | Increased takeout/delivery demand (over 70% of Canadians order regularly) | Commission fees of 15-30% |

| AI & Automation | Operational efficiency, personalized experiences | 76% of Canadian restaurateurs see ROI; 20% boost in customer retention via personalized marketing |

| Kitchen Display Systems (KDS) | Streamlined order processing, reduced ticket times | Potential 10-15% reduction in ticket times |

| Enterprise Resource Planning (ERP) | Improved inventory, cost control | Phased implementation by late 2025; target 2-4% reduction in prime costs |

| Cybersecurity | Data protection, consumer trust | Global average data breach cost $4.45 million (2023) |

Legal factors

MTY Food Group, as a franchisor, must navigate a complex web of franchise disclosure laws across Canada. For instance, Saskatchewan's new franchise legislation, effective March 2024, enhances disclosure requirements and strengthens franchisee protections, mirroring trends seen in other provinces. These regulations demand detailed disclosure documents be provided to prospective franchisees well in advance of any agreement signing.

Compliance with these laws is critical, as they impose a statutory duty of fair dealing, requiring franchisors like MTY to act with good faith and adhere to reasonable commercial standards in their dealings with franchisees. This includes providing accurate financial performance representations and operational support. In 2023, the Canadian Franchise Association reported that franchise systems contribute billions to the Canadian economy, highlighting the importance of robust regulatory frameworks for maintaining trust and growth.

Failure to meet these stringent disclosure and fair dealing obligations can expose MTY to significant legal and financial penalties. Franchisees may have the right to rescind their agreements, potentially leading to substantial financial liabilities for the franchisor. For example, a franchisor found to be in breach of disclosure laws could face claims for damages and the return of franchise fees, impacting profitability and brand reputation.

MTY Food Group and its franchisees navigate a stringent regulatory landscape in Canada, encompassing federal and provincial food safety and health mandates. These regulations dictate standards for ingredient sourcing, food preparation, and hygiene, ensuring consumer well-being.

The Canadian Food Inspection Agency (CFIA) is anticipated to bolster its enforcement activities and inspections throughout 2024 and 2025, with a particular focus on critical areas like Listeria control. This heightened scrutiny necessitates ongoing dedication to compliance and robust internal monitoring systems.

Failure to adhere to these food safety and health regulations can lead to substantial financial penalties, significant damage to brand reputation, and, most importantly, pose serious risks to public health, impacting consumer trust and business operations.

MTY Food Group, as an employer and franchisor, navigates a complex web of federal and provincial labor and employment laws. These regulations cover critical areas like minimum wage, which varies significantly by province, for example, Ontario's minimum wage increased to $17.20 per hour in October 2024. Workplace safety standards and anti-discrimination provisions are also paramount, ensuring fair treatment and a secure environment for all employees across MTY's diverse operations.

Franchise agreements typically stipulate that franchisees must adhere strictly to all applicable labor laws, with MTY often protected by indemnification clauses for any franchisee non-compliance. This structure places the onus on individual franchisees to manage their workforce responsibly. However, MTY remains indirectly exposed to reputational risks and potential legal entanglements if widespread franchisee issues arise.

Potential shifts in labor legislation, such as proposed changes to gratuity regulations or evolving immigration policies impacting workforce availability, can directly influence MTY's operational expenses and labor management strategies. For instance, an increase in minimum wage or new requirements for employee benefits could add substantial costs to franchisees, potentially affecting their profitability and MTY's overall system performance.

Intellectual Property and Brand Protection

MTY Food Group's extensive portfolio, boasting over 80 brands, makes intellectual property protection paramount. This involves safeguarding trademarks and trade names across various jurisdictions. For instance, the upcoming language laws in Quebec, effective in 2025, will require French translations for common law trademarks used publicly, impacting how MTY brands are presented in that province.

Failure to protect these assets can lead to brand dilution and revenue loss. MTY must actively monitor for and address any instances of unauthorized use or infringement to maintain its competitive edge and the value of its brand equity. This proactive legal stance is critical for sustained growth and market presence.

- Trademark Registration: Ensuring all 80+ brands are registered in key markets.

- Language Compliance: Preparing for Quebec's 2025 French translation mandate for trademarks.

- Enforcement Strategy: Implementing measures to detect and combat brand infringement.

- Licensing Agreements: Managing and protecting IP through robust franchise and licensing contracts.

Consumer Protection and Advertising Laws

MTY's marketing and advertising efforts are strictly governed by consumer protection legislation, particularly concerning misleading claims. This is crucial as regulators are increasingly focusing on the accuracy of product origin and environmental statements, with Canada's Competition Act introducing substantial penalties for violations. For instance, amendments to the Competition Act in 2023 increased penalties for misleading advertising, with potential fines reaching up to $10 million for corporations. Therefore, establishing robust substantiation processes for all marketing assertions is vital for MTY to navigate these legal complexities and avoid significant financial repercussions.

MTY Food Group operates under a framework of evolving franchise laws, such as Saskatchewan's March 2024 legislation, which mandates enhanced disclosures and franchisee protections. These laws require franchisors to provide detailed information to potential franchisees well before agreements are signed, underscoring the importance of transparency and fair dealing, a principle reinforced by the Canadian Franchise Association's 2023 report on the sector's economic contribution.

The company must also adhere to stringent food safety and health regulations enforced by bodies like the Canadian Food Inspection Agency (CFIA), which is expected to increase inspections in 2024-2025, particularly concerning Listeria control. Non-compliance can result in severe penalties, reputational damage, and public health risks.

Labor laws, including provincial minimum wage adjustments like Ontario's October 2024 increase to $17.20 per hour, directly impact MTY's operational costs and franchisee management. Intellectual property law is also critical, with Quebec's upcoming 2025 language laws requiring French translations for common law trademarks, necessitating careful brand management across all markets.

Consumer protection legislation, especially regarding misleading advertising, carries significant weight, with Canada's Competition Act amendments in 2023 imposing fines up to $10 million for violations. MTY must ensure all marketing claims are substantiated to avoid substantial financial and reputational harm.

Environmental factors

MTY Food Group is actively integrating sustainability into its operations, acknowledging the vital link between environmental well-being, social responsibility, and economic success. This commitment is reflected in their strategic initiatives to minimize their ecological impact.

The company is prioritizing tangible actions such as reducing energy consumption and greenhouse gas emissions, enhancing waste management practices, and ensuring the responsible sourcing of materials, particularly for packaging. For instance, MTY aims to achieve specific reduction targets for Scope 1 and 2 emissions by 2030, building on a 2022 baseline.

This focus on eco-friendly practices is a direct response to escalating consumer expectations within the foodservice sector, where patrons increasingly favor brands demonstrating a genuine commitment to environmental stewardship. MTY's efforts in this area are crucial for maintaining brand loyalty and attracting new customers in a competitive market.

MTY Food Group prioritizes effective waste management, focusing on circularity in packaging to reduce its environmental footprint. This includes making smarter choices about packaging materials and adhering to Extended Producer Responsibility (EPR) laws, which hold producers accountable for their products' end-of-life management.

The foodservice sector is increasingly adopting zero-waste kitchen practices and utilizing compostable packaging. For instance, by 2024, many jurisdictions are strengthening EPR regulations, impacting how companies like MTY manage packaging waste and potentially increasing costs associated with disposal or recycling programs.

MTY Food Group recognizes the critical need for climate resilience, having faced disruptions in 2024 due to floods, wildfires, and extreme heat impacting its operations and supply chain. The company has taken a significant step by releasing its inaugural Greenhouse Gas (GHG) Inventory Report, signaling a proactive approach to understanding and mitigating its environmental footprint.

Further demonstrating its commitment, MTY is actively developing a formal environmental policy, with a particular emphasis on biodiversity and its integral connection to building more sustainable food systems. This focus underscores a broader strategy to address environmental factors head-on.

Responsible Sourcing and Animal Welfare

MTY Food Group demonstrates a commitment to responsible sourcing, a key component of its sustainability efforts, with a particular focus on animal welfare. This dedication is underscored by the company's publication of its inaugural formal Animal Welfare Policy, signaling a proactive approach to ethical supply chain management. By joining the Animal Agriculture Alliance, MTY aims to deepen its knowledge and foster ongoing improvements throughout its network of suppliers.

The company actively seeks out suppliers who align with its core objectives: Food, Planet, and People. This strategic alignment ensures that ethical considerations, environmental impact, and human well-being are integrated into their sourcing decisions. For instance, MTY's 2023 Sustainability Report highlights that 90% of their key suppliers have undergone initial assessments related to their sustainability practices, with a target to increase this to 95% by the end of 2024.

This focus on animal welfare and responsible sourcing is increasingly important for consumers and investors alike. In 2024, consumer surveys indicated that over 75% of diners consider a restaurant's commitment to animal welfare when making dining choices. MTY's proactive stance positions them favorably in a market where ethical consumption is a growing differentiator.

Regulatory Pressure on Environmental Claims (Greenwashing)

Canada's updated Competition Act, effective in 2024, now carries steeper penalties for environmental misrepresentations, intensifying the focus on combating greenwashing. MTY Food Group needs to rigorously verify all sustainability claims across its brands, from corporate messaging to product labeling, to mitigate risks associated with false advertising. This regulatory shift demands transparent and evidence-based communication regarding the company's environmental initiatives.

The heightened scrutiny means that MTY's ESG reporting and marketing materials must be backed by robust data. For instance, claims about reduced packaging waste or energy efficiency must be quantifiable and auditable to withstand regulatory review. Failure to comply could result in significant fines, impacting brand reputation and financial performance.

- Stricter Enforcement: New provisions in Canada's Competition Act significantly increase penalties for misleading environmental claims, effective from 2024.

- Verifiable Claims: MTY must ensure all corporate sustainability statements, product labeling, and ESG initiatives are supported by verifiable data.

- Reputational Risk: Non-compliance with anti-greenwashing regulations poses a substantial risk to MTY's brand image and consumer trust.

- Legal Consequences: False or unsubstantiated environmental advertising can lead to legal challenges and financial penalties, impacting profitability.

MTY Food Group is actively addressing environmental concerns by focusing on emission reductions, aiming for specific targets by 2030 based on a 2022 baseline, and improving waste management with a circularity approach to packaging. The company is also navigating strengthened Extended Producer Responsibility (EPR) laws in various jurisdictions, which came into effect by 2024, impacting packaging disposal and recycling costs.

Climate resilience is a growing priority, particularly after experiencing operational disruptions in 2024 due to extreme weather events like floods and wildfires. MTY has responded by releasing its first Greenhouse Gas (GHG) Inventory Report and is developing a formal environmental policy that includes biodiversity considerations.

The company's commitment to responsible sourcing is evident in its 2023 Sustainability Report, which showed 90% of key suppliers underwent initial sustainability assessments, with a goal of 95% by the end of 2024. This aligns with consumer demand, as over 75% of diners in 2024 considered a restaurant's animal welfare commitment in their choices.

MTY must also contend with Canada's updated Competition Act from 2024, which imposes stricter penalties for environmental misrepresentations, requiring rigorous verification of all sustainability claims to avoid risks associated with greenwashing.

PESTLE Analysis Data Sources

Our MTY PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable market research reports, and insights from leading financial institutions. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the business landscape.