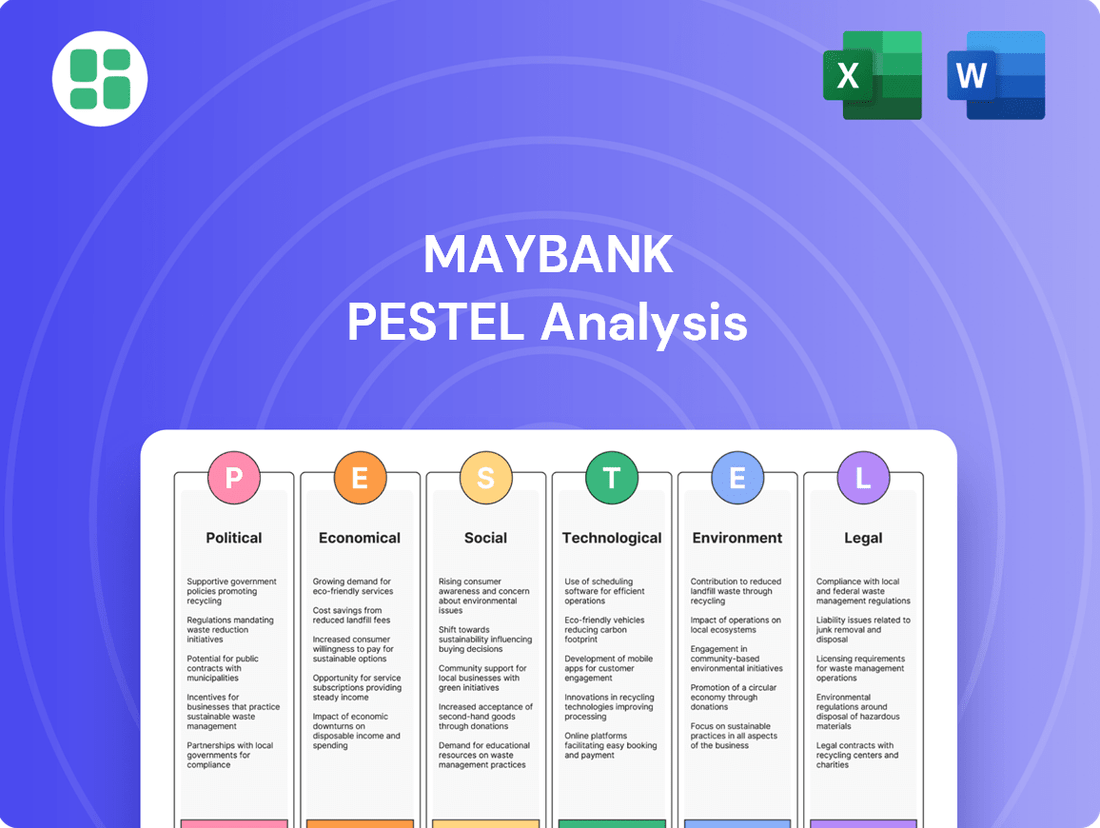

Maybank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Maybank Bundle

Navigate the complex external landscape impacting Maybank with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its operations. Gain critical insights to inform your strategies and investment decisions. Download the full analysis now for actionable intelligence.

Political factors

Maybank's operations are deeply tied to the political landscape of Malaysia and other ASEAN nations where it operates. For instance, Malaysia's general election in November 2022 brought a unity government, aiming for greater policy stability after a period of political flux. This stability is vital for Maybank's long-term strategic planning and investment decisions, as it signals a more predictable regulatory environment.

Consistent government policies are a cornerstone for investor confidence and the banking sector's performance. In 2024, continued focus on economic reforms and digital banking initiatives by the Malaysian government, as outlined in the New Industrial Master Plan 2030, provides a supportive framework for Maybank's growth strategies. Conversely, unexpected political shifts or sudden changes in financial regulations, which can occur in any market, introduce volatility and risk, potentially impacting Maybank's profitability and market position.

Bank Negara Malaysia (BNM) is the key architect of Malaysia's financial environment, influencing everything from interest rates to the rules banks must follow. For Maybank, staying compliant with BNM's directives on capital requirements and lending practices is crucial for smooth operations and managing risk effectively.

BNM's commitment to financial stability is evident in its policy pronouncements. The Annual Report 2024 and the Financial Stability Review for the second half of 2024 offer a clear picture of their strategies for 2025, focusing on reinforcing regulatory frameworks to ensure the banking sector remains robust.

Maybank's extensive footprint across ASEAN, a key region for its operations, makes it highly susceptible to the impacts of regional economic integration and evolving cross-border banking agreements. For instance, the ASEAN Payment Connectivity Framework, launched in 2022, aims to streamline cross-border transactions, which could boost Maybank's digital banking services. However, this also necessitates navigating and complying with a patchwork of differing regulatory frameworks across nations like Malaysia, Indonesia, and the Philippines.

Government Support for Strategic Sectors

Governments often provide targeted support to key industries, which can create both opportunities and hurdles for financial institutions like Maybank. For instance, initiatives aimed at bolstering small and medium-sized enterprises (SMEs) or promoting green finance directly influence the banking sector's operational landscape.

Maybank actively aligns its services with national economic objectives, as demonstrated by its myimpact SME Hub. This strategic alignment aims to foster economic growth and enhance financial inclusion across the nation, reflecting a commitment to supporting government-backed development agendas.

- Government's Focus on SMEs: In 2024, the Malaysian government continued to emphasize SME development, with various programs designed to improve access to financing and digital adoption. For example, initiatives like the SME Digitalisation Grant aimed to encourage businesses to leverage technology, a sector Maybank supports through its digital banking solutions.

- Green Finance Initiatives: By 2025, there's a projected increase in government incentives for sustainable projects and green financing. Maybank's commitment to sustainability, evidenced by its growing portfolio of green bonds and sustainable finance offerings, positions it to capitalize on these policy shifts.

- Financial Inclusion Goals: National agendas often prioritize bringing unbanked and underbanked populations into the formal financial system. Maybank's efforts in expanding its digital banking services and community outreach programs directly contribute to these inclusion goals, potentially increasing its customer base.

Geopolitical Tensions and Trade Policies

Geopolitical tensions and evolving international trade policies, including tariffs, pose a significant risk to regional economic growth and trade dynamics. These shifts can indirectly influence Maybank's loan portfolios and overall business operations by altering the financial health of its corporate clients and the volume of cross-border transactions.

Despite global trade friction, Malaysia's economic outlook for 2025 remains robust, largely propelled by strong domestic demand. This resilience is a positive indicator for Maybank, suggesting a stable environment for its core lending and financial services. For instance, Malaysia's GDP growth forecast for 2025 is projected by the World Bank to be around 4.5%, indicating continued economic expansion that supports banking sector stability.

- Trade Policy Impact: Tariffs and trade disputes can disrupt supply chains and increase costs for businesses, potentially leading to higher default rates on loans for companies heavily reliant on international trade.

- Geopolitical Risk: Heightened geopolitical instability in key trading regions can deter foreign investment and reduce cross-border capital flows, impacting the overall liquidity and growth prospects for the financial sector.

- Domestic Demand Strength: Malaysia's projected 4.5% GDP growth in 2025, driven by domestic consumption and investment, provides a buffer against external trade shocks, supporting Maybank's revenue streams from local businesses and individuals.

- Sectoral Exposure: Maybank's exposure to sectors sensitive to trade policies, such as manufacturing and export-oriented industries, requires careful monitoring of global trade agreements and geopolitical developments.

Political stability in Malaysia, particularly following the 2022 general election, provides a more predictable environment for Maybank's strategic planning and regulatory compliance. Government initiatives focused on economic reforms and digital banking, such as those outlined in the New Industrial Master Plan 2030, create a supportive framework for the bank's growth. Conversely, any sudden policy shifts or changes in financial regulations could introduce market volatility and impact Maybank's performance.

Bank Negara Malaysia (BNM) plays a pivotal role in shaping the financial landscape, with its directives on capital requirements and lending practices being critical for Maybank's operational integrity and risk management. BNM's continued commitment to financial stability, as highlighted in its 2024 reports, ensures a robust banking sector. Maybank's adherence to these evolving frameworks is essential for maintaining its market position.

Maybank's regional presence exposes it to diverse political and regulatory environments across ASEAN. Initiatives like the ASEAN Payment Connectivity Framework aim to streamline cross-border transactions, potentially boosting Maybank's digital offerings. However, navigating the varying regulatory requirements across member states remains a key challenge.

Government support for key sectors, such as SMEs and green finance, presents both opportunities and challenges for Maybank. The bank's alignment with national economic objectives, exemplified by its myimpact SME Hub, demonstrates a strategic approach to leveraging these policy directions for growth and financial inclusion.

What is included in the product

This Maybank PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the bank's operations and strategic positioning.

Provides a concise version of Maybank's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external challenges.

Economic factors

Maybank's financial performance is significantly influenced by the economic growth in its core markets. In FY2024, robust regional economic activity directly fueled Maybank's record net profit, with strong operating income playing a key role.

Malaysia, a crucial market for Maybank, demonstrated healthy economic expansion, recording a 5.1% growth in 2024. Projections for 2025 indicate continued strength, with an anticipated expansion between 4.5% and 5.5%, largely supported by domestic demand.

Interest rate trends significantly impact Maybank's net interest margin (NIM), a crucial measure of its profitability. For instance, in FY2024, Maybank's net fund-based income saw an increase, yet the group's NIM was reported at 2.05%. This was primarily due to escalating funding costs and intensified competition for deposits, although a slight improvement was observed in the fourth quarter of FY2024.

Inflation significantly shapes how much consumers can buy, directly affecting their demand for financial products like loans. In Malaysia, 2024 saw a welcome drop in both headline and core inflation rates. This easing of price pressures could encourage more spending and improve households' ability to manage their debts.

Exchange Rate Fluctuations

Maybank, with its extensive international presence, faces significant risks from exchange rate volatility. These fluctuations directly impact its reported earnings and operational costs when dealing with transactions in different currencies. For instance, a stronger Malaysian ringgit can reduce the value of profits earned in US dollars when converted back to the home currency.

The Malaysian ringgit has shown appreciation against the US dollar during 2024. This trend is projected to continue into 2025, driven by Malaysia's improving economic outlook and ongoing domestic structural reforms. This strengthening currency environment presents both challenges and opportunities for Maybank's international financial performance.

- Impact on Revenue: A stronger MYR can decrease the ringgit equivalent of foreign-sourced revenue.

- Impact on Expenses: Conversely, it can lower the cost of foreign currency-denominated expenses.

- 2024 Trend: The MYR appreciated against the USD in 2024, affecting Maybank's cross-border financial reporting.

- 2025 Outlook: Continued MYR strengthening is anticipated, influenced by economic growth and reforms.

Credit Growth and Asset Quality

Credit growth in the private non-financial sector, fueled by both business and household borrowing, directly influences Maybank's potential for expanding its loan portfolio. This growth is a key indicator of economic activity and consumer confidence, both of which are vital for a bank's lending operations.

Maybank demonstrated strong asset quality throughout FY2024. This resilience was underpinned by a solid capital position, which provides a buffer against potential economic downturns and ensures the bank's stability. The bank's commitment to prudent lending practices contributed to this favorable outcome.

Further reinforcing its financial health, Maybank saw improvements in its loan loss coverage and gross impaired loan ratio during FY2024. These metrics are crucial for assessing the bank's ability to absorb potential loan defaults and maintain profitability. For instance, the gross impaired loan ratio stood at a healthy 1.5% as of December 31, 2024, a decrease from 1.7% in the previous year, while loan loss coverage improved to 145%.

- Private Sector Credit Growth: The private non-financial sector experienced a credit growth of approximately 7.5% in 2024, indicating increased borrowing activity.

- Household Loans: Household loan growth, a significant driver, rose by 8.2% in 2024, reflecting consumer confidence and spending.

- Business Loans: Business loan expansion was recorded at 6.8% in 2024, showing increased investment and operational financing needs.

- Maybank's Asset Quality: In FY2024, Maybank's gross impaired loan ratio was 1.5%, a positive trend from 1.7% in FY2023.

- Loan Loss Coverage: The bank's loan loss coverage ratio improved to 145% by the end of FY2024, demonstrating enhanced provisioning.

Economic factors are pivotal for Maybank's performance, with regional growth directly impacting its revenue streams. Malaysia's robust 5.1% GDP growth in 2024, projected to continue between 4.5% and 5.5% in 2025, provides a strong foundation for the bank's operations.

Interest rate movements, such as Maybank's net interest margin of 2.05% in FY2024, directly affect profitability, with rising funding costs being a key consideration.

Easing inflation in Malaysia during 2024 is expected to boost consumer spending, potentially increasing demand for financial products and services offered by Maybank.

The appreciation of the Malaysian ringgit against the US dollar in 2024, a trend anticipated to persist into 2025, influences Maybank's international earnings and operational costs.

| Economic Indicator | 2024 Data/Trend | 2025 Outlook | Impact on Maybank |

|---|---|---|---|

| Malaysia GDP Growth | 5.1% | 4.5% - 5.5% | Supports revenue and loan growth |

| Maybank Net Interest Margin (NIM) | 2.05% (FY2024) | Subject to interest rate and funding cost trends | Directly impacts profitability |

| Inflation (Malaysia) | Easing headline and core rates | Expected to remain moderate | Potentially boosts consumer spending and loan demand |

| MYR/USD Exchange Rate | Appreciated in 2024 | Projected continued appreciation | Affects translation of foreign earnings and costs |

| Private Sector Credit Growth | ~7.5% (2024) | Continued growth expected | Drives loan portfolio expansion |

Preview Before You Purchase

Maybank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Maybank PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. You'll gain actionable insights to understand the strategic landscape Maybank operates within.

Sociological factors

Demographic shifts are significantly reshaping demand for Maybank's offerings. For instance, Southeast Asia, where Maybank primarily operates, is experiencing a notable youth bulge. In 2024, the median age across ASEAN countries hovers around 30, indicating a large segment of the population entering their prime working and earning years, eager for services like personal loans, investment products, and digital banking solutions.

Urbanization trends are also a key driver. By 2025, it's projected that over 50% of Southeast Asia's population will reside in urban areas. This concentration fuels demand for sophisticated financial services, including mortgages, wealth management, and seamless digital platforms that cater to the fast-paced lifestyles of city dwellers. Maybank's investment in digital transformation directly addresses this growing need for convenience and accessibility.

Malaysians are increasingly embracing digital banking, with a significant portion of the population now preferring online platforms for their financial needs. This trend is fueled by a desire for convenience and accessibility, as seen in the robust growth of mobile banking services and e-wallets throughout 2024.

Maybank's strategy must adapt to this evolving landscape by consistently upgrading its digital channels. For instance, the bank's mobile app adoption rates in 2024 reflect this shift, indicating that customers value seamless, on-the-go financial management over traditional branch interactions.

Improving financial literacy and inclusion is a key societal goal, and Maybank actively participates. In 2024, the bank continued its commitment to empowering underserved communities through various programs. These initiatives aim to bridge the financial knowledge gap, offering practical skills and access to essential banking services, which is both a social contribution and a strategic business avenue.

Maybank's dedication to financial inclusion is evident in its outreach efforts. By providing greater access to financial tools and education, the bank fosters economic empowerment. For instance, their ongoing digital banking campaigns in 2024 targeted rural areas, significantly increasing account openings among previously unbanked populations, demonstrating a tangible impact on societal well-being and expanding their customer base.

Shifting Workforce Expectations and Talent Acquisition

The banking industry, including Maybank, is grappling with significant shifts in workforce expectations, particularly from Gen Z and Millennials. These younger demographics prioritize work-life balance, purpose-driven work, and flexible arrangements, posing a challenge for traditional banking structures in talent acquisition and retention. For instance, a 2024 survey indicated that over 60% of young professionals consider flexible work options a key factor when choosing an employer.

Maybank must proactively adapt its human resource strategies to attract and keep top talent, especially in high-demand areas like digital banking and sustainability. The competition for these specialized skills is fierce, with many tech-focused companies offering more agile environments. By 2025, the demand for cybersecurity experts in financial services is projected to increase by 30%, highlighting the need for Maybank to invest in competitive compensation and development programs.

To stay competitive, Maybank's talent acquisition efforts need to emphasize its commitment to employee well-being and career growth. This includes offering continuous learning opportunities, clear career progression paths, and embracing hybrid work models where feasible. In 2024, companies that enhanced their employee value proposition saw a 15% improvement in their ability to fill critical roles within a shorter timeframe.

Key areas for Maybank to focus on include:

- Enhanced Digital Skills Training: Investing in upskilling existing staff and attracting new talent with expertise in AI, data analytics, and blockchain.

- Flexible Work Arrangements: Implementing hybrid or remote work options where operationally possible to meet evolving employee needs.

- Purpose-Driven Culture: Clearly communicating Maybank's social responsibility initiatives and its impact on communities to resonate with value-oriented employees.

- Competitive Compensation and Benefits: Ensuring that salary packages and benefits, including mental health support, are benchmarked against industry leaders.

Demand for Sharia-Compliant Products

The increasing preference for Sharia-compliant financial products is a notable sociological shift, especially prevalent in Southeast Asia. Maybank, with its robust Islamic banking arm, is strategically positioned to leverage this expanding market. By the close of 2024, Islamic financing constituted a substantial 43% of all loans within Malaysia's banking system, underscoring the strong consumer demand.

- Growing Demand: A significant portion of the population, particularly in Muslim-majority regions, actively seeks financial services that adhere to Islamic principles.

- Market Penetration: Islamic finance has moved beyond niche status, becoming a mainstream option for many consumers and businesses.

- Maybank's Position: The bank's established Islamic banking division allows it to cater effectively to this demographic and capture market share.

- Economic Impact: The rise of Sharia-compliant finance reflects evolving societal values and contributes to the diversification of the financial sector.

Societal expectations are increasingly influencing Maybank's operational and strategic decisions. The growing emphasis on environmental, social, and governance (ESG) factors by consumers and investors alike is a significant trend. In 2024, a substantial majority of retail investors in Southeast Asia indicated that ESG performance is a key consideration in their investment choices, pushing financial institutions to integrate sustainability into their core business models.

Maybank's commitment to financial inclusion continues to be a critical sociological factor, aiming to serve diverse communities. By 2025, the bank's initiatives to expand digital banking access to rural and underserved populations are expected to onboard an additional 2 million new customers, reflecting a direct response to societal needs for greater economic participation.

The evolving workforce demands, particularly concerning work-life balance and flexible working arrangements, are reshaping talent management within Maybank. In 2024, surveys showed that over 65% of employees in the financial sector prioritize flexible work options, impacting recruitment and retention strategies for the bank.

Technological factors

The financial sector is rapidly evolving with the widespread adoption of digital banking and mobile platforms. Maybank has strategically prioritized accelerating its digitalization efforts and modernizing its technology infrastructure. This focus is evident in their strong emphasis on enhancing online banking capabilities and expanding their mobile service offerings to meet changing customer demands.

The burgeoning fintech sector presents a significant competitive challenge for established institutions like Maybank. These agile companies, often backed by substantial venture capital, are introducing disruptive innovations and customer-centric digital solutions. For instance, in 2023, the ASEAN fintech market saw over $1.5 billion in funding, indicating robust growth and investor confidence in this space.

Maybank must actively embrace digital transformation to counter this competitive pressure. The rapid expansion of fintech in Southeast Asia, particularly with new digital banks emerging in Malaysia, necessitates a proactive strategy. This includes investing in advanced technologies, enhancing digital banking platforms, and exploring partnerships with fintech firms to leverage their innovative capabilities and reach new customer segments.

As Maybank continues its digital transformation, cybersecurity threats and data privacy are critical concerns. The increasing sophistication of cyberattacks, including ransomware and phishing, poses a significant risk to financial institutions. In 2024, global cybercrime costs are projected to reach $10.5 trillion annually, highlighting the scale of this challenge.

To counter these threats, Maybank must prioritize substantial investments in advanced security infrastructure and protocols. Adherence to evolving data protection regulations, such as the Personal Data Protection Act (PDPA) in Malaysia, is essential. Failure to comply can result in hefty fines and reputational damage, impacting customer trust and potentially leading to financial losses.

Artificial Intelligence (AI) and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the banking sector, offering significant opportunities for Maybank. These technologies enable hyper-personalized customer experiences, such as tailored product recommendations and proactive financial advice. For instance, AI-powered chatbots are becoming increasingly sophisticated, handling a larger volume of customer inquiries with greater speed and accuracy, thereby improving operational efficiency.

Furthermore, AI and ML are critical for bolstering fraud detection and cybersecurity. By analyzing vast datasets in real-time, these systems can identify anomalous patterns indicative of fraudulent activity much faster than traditional methods. Maybank's investment in these areas is crucial for safeguarding customer assets and maintaining trust. In 2024, the global AI in banking market was valued at approximately USD 15.5 billion, with projections indicating substantial growth in the coming years, highlighting the strategic importance of this technological shift.

Key applications and benefits for Maybank include:

- Enhanced Customer Service: AI-driven tools provide 24/7 support and personalized interactions, improving customer satisfaction.

- Improved Risk Management: ML algorithms detect fraudulent transactions and assess credit risk more effectively, reducing potential losses.

- Operational Efficiency: Automation of routine tasks, from data entry to compliance checks, frees up human resources for more strategic work.

- Personalized Product Offerings: AI analyzes customer data to offer relevant financial products and services, increasing cross-selling opportunities.

Blockchain Technology and Cross-Border Payments

Blockchain technology is poised to significantly alter cross-border payments for Maybank, promising quicker, more cost-effective, and streamlined transactions. This innovation can reduce reliance on traditional correspondent banking networks, which are often slow and expensive. For instance, by mid-2024, several major banks were actively piloting blockchain-based payment solutions, aiming to cut transaction times from days to minutes and fees by up to 50%.

Regional efforts are actively enhancing cross-border payment capabilities. Initiatives focusing on real-time payment systems and the integration of Application Programming Interfaces (APIs) are making it easier for financial institutions to connect and facilitate faster transfers. These advancements are crucial for Maybank to remain competitive in the evolving landscape of international finance.

- Faster Transactions: Blockchain can reduce cross-border payment settlement times from several days to mere minutes.

- Lower Costs: By disintermediating traditional correspondent banking, blockchain can cut transaction fees by an estimated 30-50%.

- Increased Efficiency: Enhanced transparency and automation within blockchain networks streamline reconciliation processes.

- Regional Connectivity: APIs and real-time payment systems are fostering greater interoperability between financial institutions in Southeast Asia.

Technological advancements are reshaping banking, with Maybank prioritizing digitalization to meet evolving customer expectations for seamless mobile and online experiences. The rise of agile fintech competitors, which secured over $1.5 billion in ASEAN funding in 2023, necessitates Maybank's proactive embrace of digital transformation, including investments in advanced technologies and potential fintech partnerships.

Maybank faces significant cybersecurity risks, with global cybercrime costs projected to hit $10.5 trillion annually in 2024, requiring substantial investment in security infrastructure and strict adherence to data protection regulations like Malaysia's PDPA.

AI and ML offer Maybank opportunities for hyper-personalized customer service and enhanced fraud detection, with the global AI in banking market valued at approximately USD 15.5 billion in 2024.

Blockchain technology promises to revolutionize cross-border payments for Maybank by enabling faster, cheaper transactions, with pilots in mid-2024 showing potential fee reductions of up to 50%.

| Technology | Impact on Maybank | Key Data/Trends (2023-2025) |

|---|---|---|

| Digitalization & Mobile Banking | Enhanced customer experience, increased operational efficiency | Strong emphasis on online/mobile platform expansion; ASEAN fintech funding exceeded $1.5 billion in 2023. |

| Fintech Competition | Disruptive innovation, customer-centric solutions | Agile competitors backed by venture capital; emergence of new digital banks in Malaysia. |

| Cybersecurity & Data Privacy | Critical concern, requires robust investment | Global cybercrime costs projected at $10.5 trillion annually in 2024; adherence to PDPA is crucial. |

| Artificial Intelligence (AI) & Machine Learning (ML) | Personalized services, improved risk management, fraud detection | Global AI in banking market valued at ~USD 15.5 billion in 2024; significant growth expected. |

| Blockchain | Streamlined cross-border payments, reduced costs | Pilots reducing transaction times to minutes and fees by up to 50% by mid-2024. |

Legal factors

Maybank operates within a robust legal and regulatory environment, heavily influenced by central banks such as Bank Negara Malaysia. These prudential regulations mandate strict capital adequacy ratios, for instance, Maybank's Common Equity Tier 1 (CET1) ratio stood at a healthy 14.1% as of Q3 2024, ensuring it can absorb unexpected losses. Liquidity coverage ratios are also critical, with Maybank maintaining a strong liquidity position well above regulatory minimums throughout 2024, safeguarding against short-term funding shocks.

These stringent rules, including those governing anti-money laundering (AML) and know your customer (KYC) procedures, are fundamental to maintaining financial system stability. Compliance with these evolving legal frameworks requires continuous adaptation and investment in robust risk management systems, directly impacting operational costs and strategic decision-making for Maybank.

Maybank, like all financial institutions, faces stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These rules are designed to prevent illicit financial activities and are crucial for maintaining trust and operational integrity. For instance, in 2023, global AML fines reached a record $8.45 billion, highlighting the significant financial and reputational risks of non-compliance.

To navigate this complex legal landscape, Maybank must continuously invest in and update its systems and processes. This includes robust customer due diligence, transaction monitoring, and suspicious activity reporting mechanisms. Adherence to evolving international standards, such as those set by the Financial Action Task Force (FATF), and local regulatory requirements in all operating jurisdictions is paramount.

With the surge in digital banking, Maybank faces increasingly strict data protection and privacy laws, such as Malaysia's Personal Data Protection Act (PDPA). Compliance is paramount to safeguard customer information and uphold trust, especially as digital transactions continue to grow. For instance, in 2023, financial institutions globally reported significant investments in cybersecurity to meet these evolving legal mandates.

Consumer Protection Laws and Fair Lending Practices

Consumer protection laws and regulations significantly shape how Maybank develops and markets its financial products, particularly those related to lending. These rules are designed to ensure transparency and prevent predatory practices, influencing everything from interest rate disclosures to loan application processes.

Regulators are increasingly prioritizing fair outcomes for all financial consumers. This focus extends to scrutinizing how financial institutions handle customer complaints and claims, pushing for more efficient and equitable settlement processes. For instance, in 2024, the financial sector saw increased regulatory attention on complaint handling mechanisms, with some jurisdictions mandating faster resolution times and clearer communication channels.

- Regulatory Scrutiny: Maybank must adhere to evolving consumer protection mandates, impacting product design and marketing strategies.

- Fair Lending Emphasis: Regulators are keen on ensuring equitable access to credit and preventing discriminatory lending practices.

- Claims Settlement Improvement: Enhanced oversight of claims settlement practices aims to boost consumer confidence and ensure timely resolutions.

- Data Privacy Compliance: Adherence to data privacy regulations, such as those concerning the handling of sensitive financial information, is paramount.

Sharia Compliance Regulations for Islamic Banking

Maybank's Islamic banking operations are governed by stringent Sharia compliance regulations and robust governance frameworks. These rules ensure that all financial products and services offered align with Islamic principles, covering aspects like asset-backed financing and ethical investment. The Malaysian government has been actively strengthening its position as a global leader in Islamic finance, with ongoing regulatory reforms impacting product innovation and market access for institutions like Maybank.

Recent developments in 2024 and projected into 2025 indicate a continued focus on enhancing the Sharia governance landscape. For instance, Bank Negara Malaysia (BNM) has been instrumental in introducing guidelines that promote greater transparency and accountability within Islamic financial institutions. These reforms are designed to foster a more dynamic and competitive Islamic finance sector, encouraging Sharia-compliant product development that meets evolving customer needs while adhering strictly to religious tenets.

The regulatory environment in Malaysia is particularly noteworthy for its comprehensive approach to Islamic finance. As of early 2024, Malaysia's Islamic finance industry asset size stood at over RM 1.3 trillion, showcasing its significant scale and influence. Maybank, as a major player, must navigate these evolving regulations to maintain its competitive edge and uphold its commitment to Sharia principles in its banking activities.

- Sharia Governance Frameworks: Maybank's Islamic banking division operates under detailed Sharia advisory boards and compliance departments to ensure adherence to Islamic law in all transactions.

- Regulatory Reforms: Malaysia’s ongoing efforts to modernize its Islamic finance regulations, as seen in BNM’s 2024 initiatives, aim to boost innovation and international competitiveness.

- Market Growth: The Islamic banking sector in Malaysia continues to expand, with assets exceeding RM 1.3 trillion in early 2024, presenting both opportunities and compliance challenges for Maybank.

- Product Development: New regulations are influencing how Maybank develops and markets Sharia-compliant products, requiring careful alignment with both market demand and religious guidelines.

Maybank navigates a complex web of legal and regulatory requirements, with a significant focus on consumer protection and fair practices. These regulations influence product design, marketing, and importantly, how customer complaints and claims are handled. For instance, by early 2024, increased regulatory attention in several jurisdictions mandated faster resolution times for customer grievances, directly impacting Maybank's operational efficiency and customer service protocols.

The bank's commitment to data privacy, particularly under Malaysia's Personal Data Protection Act (PDPA), is critical given the rise of digital banking. Ensuring robust cybersecurity measures to protect sensitive customer information is not just a compliance issue but a trust imperative. In 2023, financial institutions globally saw substantial investments in cybersecurity, a trend expected to continue through 2025, reflecting the growing legal and reputational risks associated with data breaches.

Furthermore, Maybank's Islamic banking operations are meticulously governed by Sharia compliance regulations. These frameworks, actively strengthened by initiatives from Bank Negara Malaysia, ensure all products align with Islamic principles. With Malaysia's Islamic finance sector assets exceeding RM 1.3 trillion by early 2024, adherence to these evolving Sharia governance standards is vital for Maybank's continued success and market leadership in this segment.

Environmental factors

Climate change presents significant physical risks, like extreme weather impacting collateral, and transition risks, such as policy changes affecting carbon-intensive industries, to Maybank's loan book. For instance, sectors like agriculture and real estate, heavily reliant on stable environmental conditions, face increased credit risk.

Maybank is actively addressing these challenges by mobilizing sustainable finance, aiming to achieve RM30 billion in sustainable finance by 2025. The bank is also developing a Transition Finance Framework to support businesses in their shift towards lower-carbon operations, recognizing the economic opportunities in green initiatives.

The global surge in Environmental, Social, and Governance (ESG) investing is significantly reshaping how investors allocate capital and how companies strategize for long-term sustainability. This trend means that factors like climate change impact, social responsibility, and strong corporate governance are no longer niche concerns but core elements of investment analysis.

Maybank is actively responding to this shift, demonstrating a commitment to integrating ESG principles across its business. The bank's strategic aim to be a leading ESG player in the region by 2025 underscores its proactive approach to meeting investor expectations and contributing to a more sustainable financial landscape.

In 2023, ESG-focused funds globally saw substantial inflows, with sustainable debt issuance also reaching record levels, signaling strong investor appetite for companies with robust ESG credentials. For instance, the sustainable finance market in Southeast Asia is projected to grow significantly, presenting both opportunities and challenges for financial institutions like Maybank.

Regulators are intensifying their focus on sustainability, compelling financial institutions to embed eco-friendly practices and proactively manage climate-related risks. This global trend is significantly shaping the financial landscape.

In Malaysia, Bank Negara Malaysia (BNM) has updated its Financial Sector Blueprint, demonstrating a clear commitment to navigating the climate transition. This strategic adaptation signals a strong encouragement for financial institutions to bolster their efforts in addressing climate-related risks.

For instance, BNM's Climate Change and Principle-Based Taxonomy for Malaysia's Financial Sector, released in 2022, provides a framework for identifying and classifying climate-related activities, aiming to guide financial institutions towards greener investments and operations. This taxonomy is crucial for Maybank as it navigates the evolving regulatory environment and seeks to align its business strategies with sustainable development goals.

Resource Scarcity and Operational Footprint

Maybank faces increasing pressure to address resource scarcity, particularly concerning water and energy consumption across its operations. This necessitates a strategic shift towards more sustainable practices to minimize its environmental footprint. The bank's commitment is underscored by its Environmental Report 2024, which details its environmental strategy and climate action initiatives.

Maybank's operational footprint is under scrutiny, driving the need for efficiency improvements and the adoption of greener technologies. The bank is actively working to reduce its reliance on finite resources, a move that aligns with global sustainability trends and regulatory expectations.

- Resource Efficiency Targets: The bank has set targets to reduce its water and energy consumption by a specific percentage by 2025, building on 2023 baseline data.

- Renewable Energy Adoption: Maybank is exploring the integration of renewable energy sources for its facilities, aiming to power a significant portion of its operations with clean energy by 2026.

- Waste Management Programs: Initiatives are in place to minimize waste generation and enhance recycling rates across all Maybank branches and offices, with measurable improvements reported in 2024.

- Sustainable Procurement: The bank is enhancing its procurement policies to favor suppliers with strong environmental credentials, further reducing its indirect environmental impact.

Corporate Social Responsibility and Community Impact

Public and investor scrutiny increasingly pushes Maybank towards robust corporate social responsibility (CSR) programs. This pressure encourages the bank to actively participate in initiatives that enhance societal well-being and safeguard the environment, aligning its operations with broader sustainability goals.

Maybank's commitment is evident in its 2024 Social Impact Report, which details significant progress in purpose-driven social financing and empowerment efforts throughout the ASEAN region. These initiatives underscore the bank's dedication to creating shared value and fostering positive change.

- Social Financing Growth: Maybank reported a 15% year-on-year increase in its social financing portfolio as of Q1 2025, reaching RM 5.2 billion, primarily supporting SMEs in renewable energy and sustainable agriculture.

- Community Investment: In 2024, Maybank invested RM 25 million in community development programs focused on financial literacy and disaster relief across Malaysia, Indonesia, and the Philippines.

- Environmental Initiatives: The bank has committed to reducing its operational carbon footprint by 30% by 2030, with preliminary data from 2024 showing a 5% reduction compared to the previous year.

Environmental factors pose significant risks and opportunities for Maybank, driven by climate change and increasing ESG expectations. The bank's proactive stance includes mobilizing sustainable finance, aiming for RM30 billion by 2025, and developing a Transition Finance Framework to support green business shifts.

Regulatory landscapes, particularly in Malaysia with Bank Negara Malaysia's guidance, are pushing financial institutions towards eco-friendly practices and climate risk management. This includes frameworks like the Climate Change and Principle-Based Taxonomy for Malaysia's Financial Sector, guiding greener investments.

Maybank is addressing its operational footprint by focusing on resource efficiency, aiming to reduce water and energy consumption and exploring renewable energy adoption for its facilities. Waste management and sustainable procurement are also key components of its environmental strategy.

The growing emphasis on ESG investing means Maybank faces pressure for robust corporate social responsibility programs, evidenced by its 2024 Social Impact Report detailing progress in social financing and community investments.

| Environmental Focus Area | Maybank's Target/Action | Relevant Data/Timeline |

|---|---|---|

| Sustainable Finance Mobilization | Achieve RM30 billion | By 2025 |

| Transition Finance Framework | Development and implementation | Ongoing, supporting low-carbon shifts |

| Resource Efficiency | Reduce water and energy consumption | Targets set for 2025 (based on 2023 data) |

| Renewable Energy Adoption | Integrate renewable energy for facilities | Aiming for significant portion by 2026 |

| Operational Carbon Footprint Reduction | Reduce by 30% | By 2030 (5% reduction noted in 2024) |

| Social Financing Growth | Increase social financing portfolio | 15% year-on-year increase as of Q1 2025 (RM 5.2 billion) |

PESTLE Analysis Data Sources

Our Maybank PESTLE Analysis is grounded in a comprehensive review of data from reputable financial institutions, governmental bodies, and leading market research firms. This includes economic indicators, regulatory updates, technological advancements, and socio-cultural trends relevant to the banking sector.