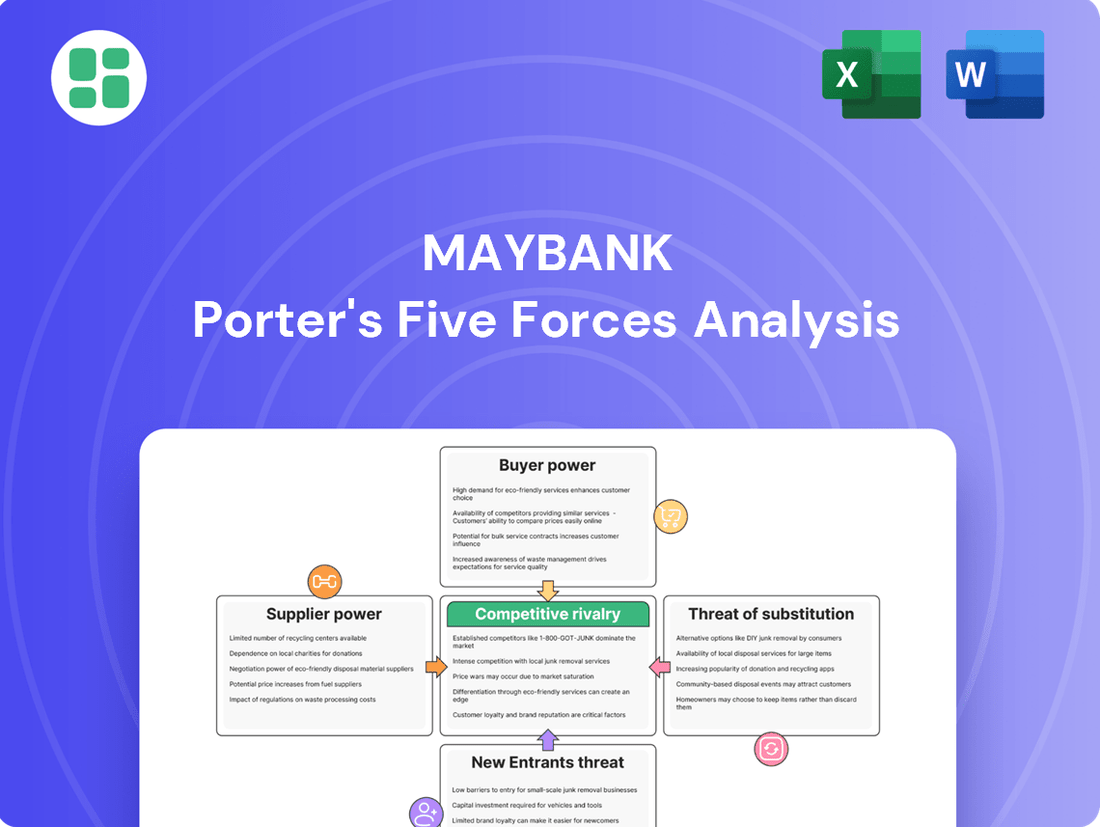

Maybank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Maybank Bundle

Maybank operates within a dynamic banking landscape, facing significant competitive pressures from rivals and the constant threat of new digital entrants. Understanding the bargaining power of its customers and the availability of substitute financial products is crucial for its strategic positioning.

The complete report reveals the real forces shaping Maybank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Maybank's reliance on technology and software for its core banking, digital services, and cybersecurity means technology providers hold significant sway. For highly specialized or mission-critical software, where switching costs are high, this bargaining power can range from moderate to high. For instance, in 2024, global IT spending in the financial services sector was projected to reach over $600 billion, highlighting the demand for such solutions and the leverage suppliers can wield.

Skilled human capital, especially in cutting-edge fields like technology, data analytics, and robust risk management, is a vital resource for Maybank. The limited availability of top-tier talent in the rapidly evolving financial technology landscape can significantly empower employees, driving up compensation and benefits. For instance, in 2024, the demand for AI specialists in banking saw salary increases of up to 20% in certain regions, reflecting this talent scarcity.

Maybank actively addresses this challenge by investing heavily in comprehensive talent development initiatives and cultivating a compelling employer brand. Their commitment to internal upskilling programs, which saw a 15% increase in participation in 2023, helps to build a pipeline of qualified professionals. This strategic approach aims to reduce reliance on external hiring for specialized roles, thereby moderating the bargaining power of suppliers of human capital.

Financial market infrastructure providers, like payment networks and data services, wield considerable bargaining power. Their services are critical for Maybank’s daily operations, from processing transactions to meeting regulatory requirements. High barriers to entry in this sector further solidify their strong position.

Maybank’s reliance on these essential services means that disruptions or price increases from infrastructure providers can directly impact its efficiency and profitability. For instance, the cost of transaction processing fees or access to real-time market data can be significant operational expenses.

While Maybank’s substantial size and its role in the broader financial system may grant it some negotiation leverage, the fundamental necessity and limited alternatives for these core services often tip the scales in favor of the suppliers.

Data and Information Providers

Data and information providers hold significant sway over Maybank, as access to precise, up-to-the-minute financial data, market intelligence, and credit information is absolutely crucial for the bank's strategic choices, how it manages risk, and the creation of new offerings. Providers with exclusive or proprietary datasets can leverage this to their advantage.

Maybank frequently counters this supplier power by entering into extended contracts and by actively diversifying its data acquisition channels, ensuring it is not overly reliant on any single source. For instance, in 2024, the global financial data market was valued at over $30 billion, highlighting the substantial investment banks make in this area.

- Critical Data Dependency: Maybank requires real-time financial data and market insights for everything from trading decisions to customer profiling, making these providers essential partners.

- Proprietary Data Advantage: Companies possessing unique datasets, such as specialized economic indicators or niche market trends, can command higher prices and dictate terms.

- Mitigation Strategies: Long-term agreements and a multi-vendor approach are key tactics Maybank employs to reduce its dependence and improve its negotiating position with data suppliers.

- Market Value of Information: The financial data industry's growth, projected to reach over $45 billion by 2028, underscores the increasing value and potential bargaining power of its key players.

Consulting and Professional Services

Maybank utilizes a range of consulting and professional services for areas like strategic planning, regulatory compliance, and specialized projects. The bargaining power of these suppliers is generally moderate, as the consulting industry is competitive, and Maybank can often leverage multiple firms. For instance, in 2024, the global consulting market was valued at over $300 billion, indicating a broad supplier base.

However, for highly niche expertise or services from top-tier firms, supplier power can increase. Maybank's internal capabilities in areas like risk management and digital transformation also serve to mitigate the reliance on external consultants for day-to-day operations, thereby tempering supplier influence.

- Supplier Specialization: The degree of specialization required for consulting services impacts supplier power; highly specialized skills command higher influence.

- Market Competition: A competitive consulting market, with numerous providers vying for business, generally limits the bargaining power of individual suppliers.

- Internal Capabilities: Maybank's internal expertise in various functions reduces its dependence on external consultants, thereby reducing supplier bargaining power.

- Reputation and Brand: Prestigious consulting firms with strong track records can exert greater influence due to their perceived value and demand.

The bargaining power of suppliers for Maybank is influenced by several key areas, including technology providers, skilled human capital, financial market infrastructure, and data providers. In 2024, the financial services sector's IT spending exceeded $600 billion, indicating the leverage technology suppliers hold, especially for specialized software with high switching costs.

The scarcity of top talent in areas like AI and data analytics in 2024 led to salary increases of up to 20% for specialists, highlighting the power of human capital suppliers. Maybank's investment in internal upskilling, with a 15% participation increase in 2023, aims to mitigate this.

Essential financial market infrastructure providers, such as payment networks, possess strong bargaining power due to high entry barriers and the critical nature of their services. Similarly, data providers with proprietary information can command significant influence; the global financial data market, valued over $30 billion in 2024, reflects this. Maybank counters this by diversifying data sources and using long-term contracts.

| Supplier Category | Influence Level (2024) | Key Factors | Maybank's Mitigation |

|---|---|---|---|

| Technology Providers | Moderate to High | Specialized software, high switching costs | Diversification, long-term contracts |

| Skilled Human Capital | High | Talent scarcity in tech/data | Internal upskilling, employer branding |

| Market Infrastructure | High | Critical services, high entry barriers | Negotiation leverage from scale |

| Data Providers | High | Proprietary/exclusive data | Multi-vendor approach, long-term agreements |

What is included in the product

This analysis of Maybank's competitive environment examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces for Maybank.

Customers Bargaining Power

Individual retail customers typically face low switching costs for everyday banking products such as savings and current accounts. This ease of movement, amplified by the growth of digital banking platforms, empowers them to readily compare financial institutions and switch providers, thereby enhancing their collective bargaining power. For instance, in 2023, the average customer retention rate for retail banks in Southeast Asia hovered around 85%, indicating a significant portion of customers were open to switching.

Small and Medium Enterprises (SMEs) typically hold moderate bargaining power. While they need specialized services, the rise of digital lending and fintech providers offers them greater choice. For instance, in 2024, the SME lending market saw significant growth in alternative financing, giving businesses more leverage.

Maybank counters this by focusing on building strong relationships through comprehensive business solutions and advisory services, like their myImpact SME Hub. This approach aims to differentiate Maybank beyond just transactional lending, fostering loyalty and reducing price sensitivity among its SME clientele.

Large corporations and institutional clients wield substantial bargaining power with Maybank. Their significant financial needs, encompassing large loans, investment banking, and treasury services, allow them to negotiate for customized terms and competitive pricing. For instance, in 2024, Maybank's corporate banking segment reported a substantial contribution to its overall revenue, highlighting the importance of these high-value relationships.

Digital Natives and Tech-Savvy Customers

Digital natives and tech-savvy customers, particularly younger demographics, are increasingly demanding seamless digital experiences, instant services, and mobile-first banking solutions. This segment's high expectations for digital innovation and their readiness to adopt new fintech offerings significantly amplify their bargaining power. They push traditional banks like Maybank to continuously improve their digital platforms and services to stay competitive.

Maybank's M25+ strategy directly addresses this by accelerating digitalization and prioritizing customer-centricity. This proactive approach aims to meet the evolving demands of these digitally empowered customers, thereby mitigating the increased bargaining power they represent. For instance, in 2024, Maybank continued to invest heavily in enhancing its digital banking capabilities, aiming to provide a superior user experience that retains and attracts these key customer segments.

- Digital Adoption Rates: Globally, smartphone penetration reached over 86% in 2024, with a significant portion of this user base actively engaging with mobile banking applications.

- Fintech Growth: The global fintech market size was projected to grow substantially throughout 2024, indicating a strong customer appetite for innovative financial solutions beyond traditional banking.

- Customer Expectations: Surveys in 2024 consistently showed that over 70% of banking customers preferred digital channels for most transactions and inquiries.

- Maybank's Digital Investments: Maybank's commitment to its M25+ strategy involved billions in digital transformation initiatives throughout 2024, focusing on app enhancements and new digital product launches.

Wealth Management Clients

Wealth management clients, particularly those in the high-net-worth (HNW) and ultra-high-net-worth (UHNW) segments, wield considerable bargaining power. This stems from their substantial assets under management and their demand for highly personalized and sophisticated investment advisory services. In 2024, the global HNW population continued to grow, with Asia Pacific showing particularly strong growth, indicating a significant client base with considerable leverage.

Maybank addresses this by focusing on differentiation through specialized expertise and a comprehensive suite of investment products. The bank emphasizes its commitment to sustainable and values-based investing, catering to the evolving preferences of these discerning clients. This strategic approach aims to retain and attract these powerful clients by offering tailored solutions that align with their financial goals and ethical considerations.

- Client Leverage: HNW and UHNW individuals manage significant wealth, giving them substantial influence over service providers.

- Service Demand: These clients require bespoke, high-touch wealth management and investment advice.

- Maybank's Strategy: Differentiation through specialized expertise, diverse product offerings, and a focus on ESG aligns with client expectations.

- Market Trends: Growth in HNW populations, especially in Asia Pacific, amplifies client bargaining power in 2024.

Individual retail customers possess low switching costs, especially with digital banking's rise, allowing easy comparison and provider changes. This collective power is significant, as evidenced by the 2023 Southeast Asian retail banking customer retention rate of around 85%.

SMEs, while needing specialized services, benefit from growing alternative financing options in 2024, increasing their leverage. Maybank counters this by fostering loyalty through comprehensive solutions and advisory services, like its myImpact SME Hub, to reduce price sensitivity.

Large corporations and institutional clients wield substantial bargaining power due to their significant financial needs, enabling negotiation for customized terms and competitive pricing. Maybank's corporate banking segment's substantial revenue contribution in 2024 underscores the importance of these high-value relationships.

| Customer Segment | Bargaining Power Level | Key Drivers | Maybank's Mitigation Strategy |

|---|---|---|---|

| Retail Customers | Low to Moderate | Low switching costs, digital access | Relationship building, digital enhancements |

| SMEs | Moderate | Increased financing options | Comprehensive solutions, advisory services |

| Large Corporations | High | Significant financial needs, negotiation leverage | Tailored services, competitive pricing |

Same Document Delivered

Maybank Porter's Five Forces Analysis

This preview showcases the complete Maybank Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the banking industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. This comprehensive analysis is ready for your immediate use, providing valuable insights into Maybank's strategic positioning.

Rivalry Among Competitors

The Malaysian banking landscape is a battleground, with formidable domestic players like Public Bank, CIMB, RHB, and Hong Leong Bank constantly vying for market share. This intense rivalry spills over into every aspect of their operations, from pricing strategies and product development to aggressive marketing campaigns.

This fierce competition directly pressures net interest margins (NIMs). Banks must offer attractive rates to capture and retain deposits, which in turn can squeeze profitability. For instance, in early 2024, average lending rates remained competitive, reflecting this ongoing deposit-gathering war.

Maybank, a major player in Southeast Asia, contends with significant competition from both regional and global banks. This rivalry isn't confined to Malaysia; it extends across key ASEAN markets like Singapore and Indonesia, where international banks often bring substantial capital and advanced technological capabilities. For instance, as of early 2024, major international banks operating in Singapore, a key hub, reported substantial asset growth, putting pressure on local players like Maybank to innovate and maintain market share.

The Malaysian banking landscape is seeing intensified rivalry with the emergence of new digital banks like GXBank, AEON Bank, and Boost Bank. These digital-first players, often supported by technology giants, are directly challenging established institutions like Maybank.

Fintech companies are also contributing to this competitive surge by offering specialized services such as digital payments, peer-to-peer lending, and wealth management. For instance, by the end of 2023, Malaysia had over 100 licensed e-wallets, indicating a highly fragmented and competitive digital payments sector.

These new entrants typically operate with lower overhead costs and utilize agile, technology-driven strategies to attract customers, particularly in segments that may be underserved by traditional banking models. This forces incumbents to innovate and enhance their digital offerings to remain competitive.

Product and Service Commoditization

Many standard banking products, like basic loans and deposits, have become largely commoditized. This means competition often boils down to price, putting pressure on profit margins. For instance, in 2024, the average interest rate spread for many retail banking products across Southeast Asia remained relatively tight, reflecting this intense price sensitivity.

To combat this, banks like Maybank actively seek differentiation. They aim to stand out through superior customer service, cutting-edge digital innovation, and the addition of valuable features that go beyond the basic offering. This strategy helps attract and, crucially, retain customers in a crowded market.

Maybank's strategic emphasis on enhancing the overall customer experience and leveraging its established leadership in Islamic banking are key components of its differentiation strategy. These efforts are designed to create distinct value propositions that set it apart from competitors, moving beyond mere price competition.

- Product Commoditization: Standard banking products like loans and deposits face intense price-based competition.

- Differentiation Strategies: Banks focus on customer service, digital innovation, and value-added features to attract and retain clients.

- Maybank's Approach: Prioritizing customer experience and Islamic banking leadership to create unique value.

- Market Reality (2024): Narrow interest rate spreads in Southeast Asia highlight the impact of commoditization on profitability.

Regulatory Landscape and Market Share

The regulatory environment significantly shapes competition among established players like Maybank. Stringent capital requirements and compliance mandates act as substantial barriers, influencing how banks operate and compete for market share. For instance, in 2024, banks operating in Southeast Asia, including those in Maybank's core markets, faced ongoing adjustments to Basel III endgame requirements, impacting their risk-weighted asset calculations and capital adequacy ratios.

Maybank actively navigates this landscape, leveraging its established presence to maintain a leading position. The bank's strategy focuses on expanding its reach in key growth markets and deepening its engagement in specific customer segments. As of the first half of 2024, Maybank reported a strong performance in its home market of Malaysia, with its retail banking segment continuing to drive significant revenue growth, underscoring its competitive strength within the regulated framework.

- Regulatory hurdles such as capital adequacy ratios and compliance costs create significant barriers to entry.

- These regulations directly influence the operational strategies and competitive dynamics among existing financial institutions.

- Maybank's competitive advantage is bolstered by its ability to adapt and thrive within these evolving regulatory frameworks.

- The bank's strategic focus on key markets and segments aims to solidify its market share amidst regulatory pressures.

Competitive rivalry in the Malaysian banking sector is intense, with established players like CIMB, RHB, and Public Bank constantly vying for market share. This competition extends to regional markets, where Maybank faces pressure from both local and international banks, particularly in hubs like Singapore. The emergence of digital banks and fintech firms further intensifies this rivalry, forcing incumbents to innovate and enhance their digital offerings. By early 2024, average lending rates remained competitive, reflecting the ongoing battle for deposits and a squeeze on profit margins.

| Competitor | Market Share (Malaysia, est. 2023) | Key Focus Areas |

|---|---|---|

| CIMB | ~15-20% | Digital banking, regional expansion |

| Public Bank | ~15-20% | Retail banking, strong customer loyalty |

| RHB | ~10-15% | Digital transformation, SME banking |

| Hong Leong Bank | ~8-12% | Digital innovation, wealth management |

| Maybank | ~20-25% | Digital leadership, Islamic banking, regional presence |

SSubstitutes Threaten

The proliferation of digital payment solutions and e-wallets presents a significant threat of substitutes for traditional banking services. Platforms like GrabPay, Touch 'n Go eWallet, and various online payment gateways offer increasingly seamless alternatives for everyday transactions, from retail purchases to bill payments, diminishing reliance on conventional bank transfers or even cash.

In 2024, the digital payment landscape in Malaysia continued its robust growth, with mobile wallet transactions projected to see a substantial increase. For instance, the total value of e-wallet transactions in Malaysia was anticipated to reach billions of US dollars, indicating a strong consumer shift towards these convenient, non-bank payment methods.

Maybank, recognizing this trend, has actively pursued strategies to counter this threat. This includes enhancing its own digital offerings, such as Maybank2u and MAE e-wallet, and forging partnerships to integrate its services with popular third-party digital payment platforms, ensuring it remains a competitive player in this evolving financial ecosystem.

Peer-to-peer (P2P) lending and crowdfunding platforms present a significant threat by offering alternative financing routes that bypass traditional banking. For instance, in 2023, the global P2P lending market was valued at approximately USD 100 billion and is projected to grow significantly, indicating a substantial shift in capital access for individuals and small to medium-sized enterprises (SMEs).

These digital platforms often boast quicker approval processes and more adaptable loan terms compared to conventional bank loans. This agility can attract borrowers, especially for smaller funding requirements, thereby directly impacting Maybank's existing loan portfolios and potentially diverting new business.

The rise of non-bank wealth management and investment platforms presents a significant threat. Online brokerage firms, robo-advisors, and direct investment platforms provide accessible, often lower-cost alternatives to traditional bank services. For instance, the global robo-advisor market was valued at approximately USD 6.3 billion in 2023 and is projected to grow substantially, indicating a strong shift towards these digital solutions.

These platforms attract customers with user-friendly interfaces, a wide range of investment options, and competitive fee structures, directly challenging Maybank's established position. In response, Maybank is actively enhancing its digital investment platforms and expanding its wealth management offerings to better meet the evolving needs of a diverse investor base, aiming to retain and attract clients in this competitive landscape.

Alternative Credit Providers

Alternative credit providers pose a significant threat to Maybank. Beyond peer-to-peer lending platforms, a growing number of non-bank financial institutions and specialized lenders, such as credit unions and microfinance organizations, offer diverse credit products. These entities often cater to niche markets or specific customer segments that may not be fully served by traditional banks, providing viable substitutes for conventional bank loans.

Maybank is actively addressing this competitive pressure. Recognizing the evolving landscape, the bank has adopted a strategy that includes forging partnerships with fintech lenders. This approach allows Maybank to expand its reach into areas where these alternative providers are strong and to leverage technology for more efficient credit delivery. For instance, in 2024, Maybank announced collaborations aimed at enhancing digital lending capabilities, signaling a proactive stance against the threat of substitutes.

- Growing Fintech Influence: The fintech sector continues to expand, offering innovative credit solutions that challenge traditional banking models.

- Niche Market Penetration: Specialized lenders effectively target underserved segments, presenting alternative financing options.

- Partnership Strategies: Maybank's collaborations with fintech firms aim to integrate new technologies and broaden customer access.

Emerging Technologies (e.g., Blockchain, Crypto)

Emerging technologies like blockchain and cryptocurrencies present a long-term threat of substitution for traditional banking services. These innovations offer alternative methods for transactions, value storage, and capital raising, potentially impacting Maybank's core functions. For instance, decentralized finance (DeFi) platforms, built on blockchain, are increasingly offering services like lending and borrowing, bypassing traditional intermediaries.

The potential for these technologies to disrupt established financial models is significant. While still in their nascent stages, blockchain and crypto could fundamentally alter how payments are processed and how individuals and businesses manage their finances. Maybank, like many financial institutions, actively monitors these advancements and investigates their potential integration or competitive implications, reflecting a broader industry trend towards digital transformation.

Consider the growing adoption of stablecoins, which aim to bridge the gap between traditional fiat currencies and cryptocurrencies, potentially offering a more efficient payment rail. For example, in 2024, the global stablecoin market capitalization reached hundreds of billions of dollars, indicating a tangible shift in transaction preferences for some segments of the economy. This growth underscores the evolving landscape and the need for established players to adapt.

- Blockchain's potential to disintermediate traditional financial processes.

- Cryptocurrencies offering alternative stores of value and mediums of exchange.

- DeFi platforms challenging conventional banking services like lending and borrowing.

- The growing market capitalization of stablecoins as a proxy for digital transaction adoption.

The threat of substitutes for Maybank is significant, primarily driven by the rapid evolution of digital payment solutions and alternative financing platforms. These substitutes offer convenience, speed, and often lower costs, directly challenging traditional banking services.

In 2024, the Malaysian digital payment market continued its expansion, with e-wallets experiencing substantial growth. This trend highlights a clear consumer preference shift away from conventional banking channels for everyday transactions, impacting transaction volumes for banks like Maybank.

Peer-to-peer lending and non-bank investment platforms also represent strong substitutes, providing accessible financing and wealth management alternatives. For example, the global robo-advisor market saw significant valuation in 2023, indicating a growing demand for these digital investment solutions that bypass traditional bank offerings.

Entrants Threaten

The banking sector, including institutions like Maybank, demands enormous capital to even begin operations. This isn't just about physical branches; it's about building robust IT systems, complying with strict financial regulations, and maintaining adequate capital reserves to absorb potential losses. For instance, in 2024, global banks continued to face pressure to bolster their capital ratios, with many needing to raise billions to meet evolving Basel III requirements.

These substantial financial prerequisites act as a formidable barrier. A new bank needs to demonstrate significant financial strength from day one, which deters many potential competitors. This high entry cost effectively limits the pool of viable new entrants, thereby reducing the immediate threat to established players like Maybank.

The financial sector, particularly banking, faces a significant threat from new entrants due to a strict regulatory landscape and demanding licensing requirements. Bodies like Bank Negara Malaysia (BNM) enforce stringent rules, including complex application processes and continuous oversight, making it difficult and time-consuming for new players to enter the market. For instance, obtaining a full banking license in Malaysia involves meeting substantial capital requirements and demonstrating robust risk management frameworks, which can be a substantial barrier for aspiring institutions.

Established banks like Maybank have cultivated deep customer loyalty over decades, built on trust and widespread branch networks. For instance, Maybank reported a customer base of over 22 million in 2023, a testament to this ingrained trust. New entrants find it incredibly difficult to replicate this established rapport and attract customers who are comfortable with their existing banking relationships.

Economies of Scale and Scope

Maybank's formidable presence, built on extensive operations and a deeply entrenched customer base, creates significant barriers for new entrants. Its diversified product portfolio, spanning consumer, business, and investment banking, allows for substantial economies of scale and scope. This means Maybank can spread its costs over a larger volume of business and offer a wider range of services more efficiently than a new player could hope to achieve initially.

Newcomers face the daunting task of replicating Maybank's cost efficiencies and comprehensive service capabilities. Achieving this requires a massive initial investment and considerable time to build the necessary infrastructure, brand recognition, and customer loyalty. For instance, as of the first quarter of 2024, Maybank reported a customer base exceeding 25 million across its global operations, a scale difficult for any new entrant to match quickly.

- Economies of Scale: Maybank's large operational footprint allows it to negotiate better terms with suppliers and spread fixed costs, leading to lower per-unit costs.

- Economies of Scope: Offering a wide array of financial products and services enables Maybank to cross-sell and leverage existing customer relationships, reducing marketing and distribution costs for new offerings.

- Customer Base: A large, loyal customer base provides a stable revenue stream and reduces the acquisition cost for new products, a significant advantage over startups.

- Investment Requirements: The capital needed to establish a comparable banking infrastructure, regulatory compliance, and technological capabilities is immense, deterring many potential entrants.

Digital Banks and Fintech Innovation

The threat of new entrants, particularly from digital banks and fintech innovators, remains a significant concern for established institutions like Maybank. These agile players often bypass the substantial capital and regulatory hurdles faced by traditional banks by focusing on digital-first strategies and leveraging technology to reduce operational costs. For instance, by mid-2024, the global fintech market was projected to reach over $3.5 trillion, demonstrating the scale of investment and potential disruption.

These new entrants are adept at acquiring customers through seamless digital experiences and often target underserved or niche market segments with specialized offerings. This approach allows them to gain traction without the extensive branch networks and legacy systems that burden incumbents. By mid-2024, digital-only banks in various markets were reporting significant customer growth, with some acquiring millions of users within a few years of launch.

- Digital Transformation Imperative: Maybank must continue to accelerate its digital transformation to compete with fintechs on customer experience and cost efficiency.

- Fintech Investment Trends: Global fintech funding in 2023 saw significant investment in areas like embedded finance and AI-driven banking solutions, highlighting areas of innovation to watch.

- Customer Acquisition Strategies: Fintechs' success in digital customer acquisition, often through mobile-first platforms, necessitates Maybank's focus on enhancing its own digital channels.

The threat of new entrants for Maybank is mitigated by substantial capital requirements and stringent regulatory hurdles, which demand significant upfront investment and adherence to complex compliance frameworks. These barriers, coupled with Maybank's established customer loyalty and economies of scale in operations and product offerings, make it challenging for new players to compete effectively. For instance, in 2024, global banks continued to focus on strengthening capital ratios, a trend that underscores the high financial barriers to entry in the banking sector.

| Barrier Type | Description | Impact on New Entrants | Maybank's Advantage | 2024 Context |

|---|---|---|---|---|

| Capital Requirements | High minimum capital needed to operate. | Deters many potential entrants. | Established capital base. | Ongoing pressure for banks to bolster capital ratios. |

| Regulatory Compliance | Complex licensing and ongoing oversight. | Time-consuming and costly to navigate. | Expertise and resources for compliance. | Strict rules from bodies like Bank Negara Malaysia. |

| Customer Loyalty & Brand Recognition | Deeply ingrained trust and established relationships. | Difficult to acquire customers from incumbents. | Over 25 million customers globally (Q1 2024). | Maybank's customer base exceeding 22 million in 2023. |

| Economies of Scale & Scope | Cost efficiencies from large operations and diverse offerings. | Challenging to match cost structure and product breadth. | Lower per-unit costs, cross-selling opportunities. | Enables competitive pricing and bundled services. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Maybank leverages data from Maybank's annual reports, investor presentations, and official press releases. We also incorporate insights from reputable financial news outlets, industry-specific publications, and market research reports to provide a comprehensive view of the competitive landscape.