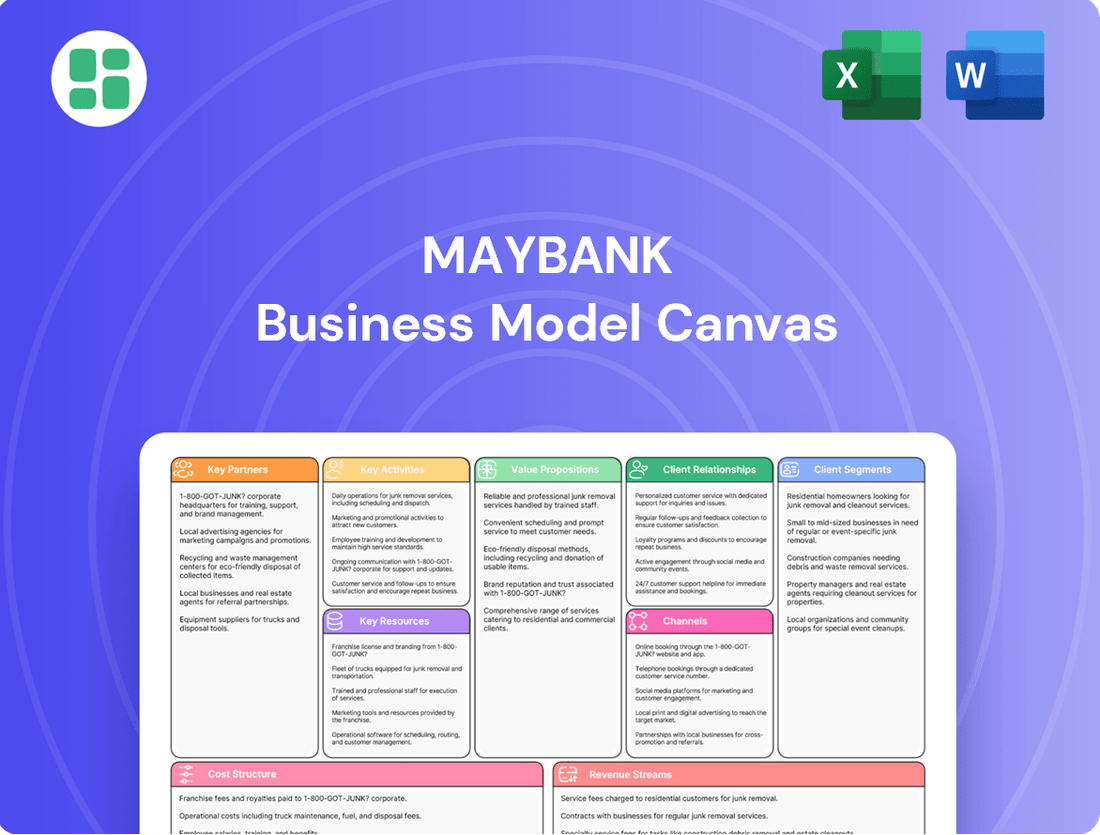

Maybank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Maybank Bundle

Unlock the strategic DNA of Maybank with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, generate revenue, and manage costs to dominate the financial sector. Perfect for anyone looking to dissect a successful banking model.

Partnerships

Maybank actively partners with fintech and technology providers to bolster its digital banking capabilities and introduce novel features. A prime example is the collaboration that brought about the 'Money Lock' feature, enhancing customer control over their funds.

These strategic alliances are fundamental to Maybank's M25+ strategy, driving the acceleration of digitalization and the modernization of its technological backbone. By integrating AI, big data analytics, and cloud-based applications, Maybank aims to deliver state-of-the-art financial products and services.

Maybank collaborates with other financial institutions to facilitate syndicated loans and interbank lending, crucial for managing large-scale financing and liquidity. These partnerships are vital for its operational efficiency and risk management in the competitive banking landscape.

A key aspect of Maybank's strategy involves partnerships with central banks, such as Bank Negara Malaysia and the National Bank of Cambodia. These collaborations are instrumental in developing and implementing cross-border payment solutions, like the seamless cross-border QR payments initiative across ASEAN, enhancing regional financial integration.

These strategic alliances with other financial entities, including central banks, directly contribute to strengthening regional connectivity and promoting financial inclusion. By enabling easier and more efficient cross-border transactions, Maybank broadens access to financial services for individuals and businesses throughout ASEAN.

Maybank strategically partners with payment networks like PayNet to enhance its digital payment infrastructure, enabling seamless transactions for its customers. These collaborations are crucial for expanding reach and integrating financial services into everyday digital experiences.

By joining forces with a wider array of ecosystem partners, Maybank aims to embed its banking services directly into popular lifestyle applications. This approach makes banking more accessible and convenient, aligning with evolving consumer habits and the growth of the digital economy.

A key outcome of these partnerships is the facilitation of cross-border QR payments across multiple ASEAN nations, a significant step towards a more connected regional digital payment landscape. For instance, in 2024, Maybank continued to expand its cross-border QR payment capabilities, aiming to connect more merchants and consumers within the ASEAN region, reflecting the increasing demand for simplified international transactions.

Government and Regulatory Bodies

Maybank's partnerships with government and regulatory bodies are crucial for navigating the financial landscape and contributing to national economic growth. These collaborations ensure Maybank operates within established legal frameworks, fostering trust and stability. For instance, in 2024, Maybank continued its engagement with Bank Negara Malaysia and other financial authorities to implement new digital banking regulations and enhance cybersecurity measures across the industry.

These alliances also position Maybank as a key player in national development initiatives. By aligning with government agendas, such as promoting sustainable finance, Maybank can leverage its resources to support environmentally and socially responsible projects. In 2023, Maybank was recognized for its contributions to Malaysia's green finance targets, demonstrating the tangible impact of these strategic partnerships.

- Regulatory Compliance: Ensuring adherence to all banking laws and financial regulations set by bodies like Bank Negara Malaysia.

- National Economic Development: Supporting government initiatives aimed at economic growth, job creation, and financial stability.

- Sustainable Finance Frameworks: Collaborating on the development and implementation of green and sustainable financing guidelines.

- Financial Inclusion & Anti-Fraud: Working with authorities to expand access to financial services and combat financial crime.

Corporations and Businesses

Maybank actively cultivates partnerships with large corporations and businesses, offering a comprehensive suite of services including corporate financing and treasury solutions. These collaborations are crucial for supporting the expansion strategies of its corporate clients.

A significant focus for Maybank is its role in facilitating sustainable finance projects. For instance, the bank acts as a sole lender for green loans, enabling companies to fund their ventures into renewable energy sectors. This aligns directly with Maybank's stated commitment to mobilizing RM30 billion in sustainable finance by 2025.

- Corporate Financing: Providing tailored loan facilities and credit lines to support operational needs and growth initiatives of large enterprises.

- Treasury Services: Offering sophisticated cash management, foreign exchange, and trade finance solutions to optimize corporate liquidity and international transactions.

- Sustainable Finance: Leading as a sole lender for green loans, such as those supporting renewable energy projects, demonstrating a commitment to environmental, social, and governance (ESG) principles.

- Expansion Support: Facilitating mergers, acquisitions, and international market entry for corporate partners, leveraging Maybank's regional network.

Maybank's key partnerships are crucial for its digital transformation and regional expansion, especially through collaborations with fintech firms and payment networks like PayNet. These alliances enhance digital payment infrastructure and embed banking services into lifestyle apps, making financial transactions more accessible. For example, Maybank's continued expansion of cross-border QR payment capabilities in 2024 across ASEAN aims to connect more merchants and consumers, simplifying international transactions and fostering regional financial integration.

| Partner Type | Strategic Focus | Impact/Example |

| Fintech & Technology Providers | Digital banking capabilities, novel features | Introduction of 'Money Lock' feature; AI, big data, cloud integration |

| Other Financial Institutions | Syndicated loans, interbank lending | Managing large-scale financing and liquidity |

| Central Banks (e.g., Bank Negara Malaysia) | Cross-border payment solutions | ASEAN cross-border QR payments initiative |

| Payment Networks (e.g., PayNet) | Digital payment infrastructure enhancement | Seamless digital transactions |

| Government & Regulatory Bodies | Regulatory compliance, economic development | Adherence to regulations, support for sustainable finance (RM30 billion by 2025 target) |

| Large Corporations | Corporate financing, treasury solutions | Supporting expansion strategies, green loans for renewable energy |

What is included in the product

A strategic framework detailing Maybank's customer relationships, revenue streams, and key resources to deliver banking and financial services.

Maybank's Business Model Canvas offers a structured approach to identify and address customer pains, providing a clear roadmap for developing targeted solutions.

It acts as a pain point reliver by visually mapping customer segments and their associated problems, enabling focused product and service development.

Activities

Maybank's core banking operations are centered on taking deposits and providing a wide range of loans, from retail mortgages to large corporate financing. These activities are crucial for generating interest income and facilitating economic growth. In 2024, the bank continued to emphasize maintaining robust liquidity and capital adequacy ratios while pursuing strategic loan expansion.

Maybank's digital product development is a cornerstone, with ongoing enhancements to offerings like the MAE App. This includes introducing features such as 'Money Lock,' designed to provide users with greater control over their savings and spending.

The bank actively invests in cutting-edge technology, utilizing artificial intelligence and sophisticated data analytics. This allows for personalized customer experiences and drives the innovation needed to maintain a competitive edge in digital banking.

By transforming customer interactions through digital channels, Maybank aims to deliver convenient and highly secure banking services. This focus on digital transformation is crucial for meeting evolving customer expectations in the financial sector.

Maybank's wealth management arm offers a broad spectrum of investment products, from mutual funds to structured notes, aiming to grow assets under management. This segment is a key driver of non-interest income for the bank.

The investment banking division provides crucial services like capital markets advisory and the creation of tailored structured products for corporate clients. These activities are vital for supporting large-scale corporate finance transactions and further bolstering the bank's fee-based revenue streams.

In 2024, Maybank continued its strategic push to enhance its wealth management offerings, targeting an increase in assets under management. Simultaneously, its investment banking unit focused on securing and executing significant corporate finance deals, contributing to its overall financial performance.

Islamic Banking and Sharia-Compliant Solutions

Maybank's core activities revolve around creating and offering a diverse portfolio of Sharia-compliant financial products and services. This includes actively managing Islamic financing facilities, fostering growth in its Islamic wealth management segment, and maintaining a dominant market position for Islamic assets within Malaysia.

In 2024, Maybank continued to solidify its leadership in Islamic finance. The bank reported significant growth in its Islamic banking assets, which reached RM178.7 billion as of the first quarter of 2024, underscoring its commitment to Sharia-compliant solutions.

- Product Development: Designing and launching innovative Sharia-compliant savings, investment, and financing products.

- Asset Management: Growing and managing a substantial portfolio of Islamic wealth management assets.

- Market Leadership: Consistently leading in market share for Islamic assets in Malaysia.

- Digitalization: Enhancing digital platforms to provide seamless access to Sharia-compliant banking services.

Regional Expansion and Cross-Border Services

Maybank is actively broadening its reach across Southeast Asia, aiming to solidify its presence beyond Malaysia. A key part of this is enhancing its cross-border financial services, exemplified by initiatives like QR payment linkages that simplify transactions throughout the ASEAN region. This strategic push is designed to foster greater trade and investment opportunities.

The bank's M25+ strategy underscores its commitment to regional expansion. This includes developing services that make it easier for businesses and individuals to operate and transact across borders. For instance, in 2024, Maybank continued to expand its digital banking capabilities, facilitating seamless financial flows within its key ASEAN markets.

- Regional Footprint Growth: Maybank aims to increase its market share in key ASEAN countries, leveraging digital channels and strategic partnerships.

- Cross-Border Payment Solutions: Expanding QR payment linkages and other integrated payment systems across ASEAN to facilitate easier transactions for customers.

- Trade Finance Enhancement: Developing and promoting trade finance solutions to support businesses engaged in cross-border commerce within the region.

- Digital Connectivity: Investing in technology to ensure robust and secure digital banking services that bridge geographical divides for customers.

Maybank's key activities encompass developing and offering a comprehensive suite of Sharia-compliant financial products, managing a growing Islamic wealth management portfolio, and maintaining its leading market position for Islamic assets in Malaysia. The bank actively enhances its digital platforms to ensure seamless access to these Sharia-compliant services, reflecting a strong commitment to this segment.

In 2024, Maybank continued to solidify its leadership in Islamic finance, with Islamic banking assets reaching RM178.7 billion by Q1 2024. This growth highlights the bank's dedication to providing accessible and robust Sharia-compliant banking solutions across its operations.

| Key Activity | Description | 2024 Data/Focus |

| Sharia-Compliant Product Development | Designing and launching innovative Sharia-compliant savings, investment, and financing products. | Continued focus on expanding Sharia-compliant offerings. |

| Islamic Asset Management | Growing and managing a substantial portfolio of Islamic wealth management assets. | Aiming to increase assets under management in the Islamic wealth segment. |

| Market Leadership in Islamic Finance | Consistently leading in market share for Islamic assets in Malaysia. | Islamic banking assets reached RM178.7 billion by Q1 2024. |

| Digitalization of Islamic Banking | Enhancing digital platforms to provide seamless access to Sharia-compliant banking services. | Investing in digital channels for enhanced accessibility to Islamic finance. |

Preview Before You Purchase

Business Model Canvas

The Maybank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You can confidently assess the quality and completeness of the analysis presented here, knowing it represents exactly what you will own and can edit.

Resources

Maybank's financial capital, a cornerstone of its Business Model Canvas, is substantial and diverse. This includes a significant base of customer deposits, strong shareholder equity, and established access to various funding markets. For instance, as of the first quarter of 2024, Maybank reported a net profit attributable to shareholders of RM2.31 billion, underscoring its financial strength.

This robust financial foundation is absolutely essential, allowing Maybank to extend loans, make strategic investments, and manage its day-to-day operations effectively. The bank’s commitment to maintaining healthy capital adequacy ratios, such as a Common Equity Tier 1 (CET1) ratio of 14.7% at the end of 2023, is a clear indicator of its focus on financial stability and its capacity to fuel future growth initiatives.

Maybank's advanced technology infrastructure, including its data centers and secure networks, forms a critical backbone. This infrastructure underpins their robust digital platforms, such as the widely used MAE App, enabling seamless digital banking services and efficient transaction processing.

These digital platforms are not just for transactions; they are increasingly leveraged for enhanced customer experiences. Maybank utilizes AI and data analytics through these platforms to personalize offerings and streamline operations, a key competitive advantage in today's market.

Maybank's human capital is a cornerstone of its business model, encompassing a diverse team of financial advisors, technology specialists, risk managers, and relationship managers. This skilled workforce is crucial for delivering Maybank's broad range of financial services.

The bank actively invests in employee development, cultivating an agile work environment and ensuring deep expertise across its offerings, from wealth management to specialized Islamic finance solutions. This commitment to continuous learning and skill enhancement is vital for staying competitive.

In 2023, Maybank reported a significant investment in training and development programs, aiming to upskill its workforce in areas like digital banking and sustainable finance. This focus on expertise directly supports its ability to innovate and meet evolving customer needs.

Extensive Branch and ATM Network

Maybank’s extensive branch and ATM network is a cornerstone of its operations, even as digital banking grows. This physical footprint, spanning Malaysia and other ASEAN nations, offers vital customer touchpoints for services like cash transactions and support for customers less comfortable with digital platforms. In 2023, Maybank operated over 2,500 ATMs and over 350 branches across Malaysia, demonstrating its commitment to accessibility.

This widespread network is instrumental in facilitating complex transactions and providing personalized advisory services that digital channels may not fully replicate. It ensures Maybank can cater to a broader customer base, including those in rural areas or with specific needs requiring face-to-face interaction. The network also supports essential cash management services, a continued necessity for many businesses and individuals.

- Physical Accessibility: Branches and ATMs provide essential access points for banking services across diverse geographic locations.

- Customer Support: The network facilitates in-person assistance for complex queries and transactions.

- Digital Complement: While digital channels expand, the physical network remains crucial for inclusivity and specific service needs.

- Cash Services: ATMs and branches are vital for cash withdrawal and deposit functions, supporting everyday financial activities.

Brand Reputation and Trust

Maybank's brand reputation as a leading financial services group in Southeast Asia is a significant intangible asset, fostering deep customer trust. This reputation is cultivated through consistent delivery of financial services and a steadfast commitment to customer satisfaction.

The trust Maybank has built is a direct result of its customer-centric approach and dedication to sustainable practices, which resonate with a wide demographic. This strong foundation attracts new customers and ensures loyalty from its existing base.

- Brand Equity: Maybank consistently ranks among the top banking brands in Asia, reflecting its strong market perception. For instance, in 2024, it was recognized as one of the strongest banking brands in the region by various financial publications.

- Customer Loyalty: The bank's focus on building long-term relationships contributes to high customer retention rates, a testament to the trust placed in its services.

- Sustainability Commitment: Maybank's ongoing investments in environmental, social, and governance (ESG) initiatives further bolster its reputation, appealing to increasingly socially conscious consumers and investors.

- Digital Trust: In 2024, Maybank continued to enhance its digital platforms, ensuring secure and reliable online banking experiences, which is crucial for maintaining trust in the digital age.

Maybank's intellectual property, including its proprietary algorithms for risk assessment and customer analytics, drives innovation. Its extensive research and development in digital banking solutions and financial technology are key differentiators.

These intellectual assets are crucial for developing new products, optimizing operational efficiency, and maintaining a competitive edge. The bank's focus on R&D, particularly in areas like artificial intelligence for personalized financial advice, highlights its commitment to leveraging knowledge for growth.

Maybank's commitment to intellectual capital is evident in its continuous investment in developing and refining its technological platforms and data analytics capabilities. This ensures the bank remains at the forefront of financial innovation and customer service delivery.

Value Propositions

Maybank's value proposition centers on delivering comprehensive financial solutions, acting as a single point of contact for a broad spectrum of banking, insurance, and asset management needs. This integrated approach simplifies financial management for a diverse clientele, ranging from individuals to large corporations.

For instance, in 2024, Maybank continued to enhance its digital offerings, aiming to provide seamless access to services like personal loans, business financing, and investment products. This commitment to a wide array of services underscores their strategy to be a financial partner across all life stages and business cycles.

Maybank's digital convenience is a cornerstone of its value proposition, offering customers seamless access through its mobile and online platforms. Features like instant payments and robust wealth management tools are readily available, enhancing user experience and financial control.

Innovation is evident in features such as 'Money Lock,' a security enhancement that provides customers with greater peace of mind. This digital focus translates into tangible benefits of speed, security, and anytime, anywhere access to financial services for Maybank's clientele.

By the end of 2023, Maybank reported a significant increase in digital transaction volume, with over 80% of its customer transactions conducted digitally, highlighting the widespread adoption and reliance on its innovative platforms.

Maybank stands out as a prominent leader in Islamic banking, providing a comprehensive suite of Sharia-compliant financial products and ethical investment opportunities. This commitment directly addresses a growing customer base actively seeking values-based financial solutions.

This focus on ethical finance aligns perfectly with the increasing global demand for sustainable and responsible investing practices. For instance, by the end of 2023, Islamic finance assets globally were projected to reach over $3.7 trillion, showcasing the significant market for these offerings.

Regional Connectivity and ASEAN Expertise

Maybank's extensive network across the ASEAN region is a core value proposition, enabling seamless cross-border banking services. This deep regional presence facilitates trade, investment, and payment flows, directly supporting economic integration within Southeast Asia.

Leveraging this established footprint, Maybank provides a distinct advantage for businesses and individuals involved in regional transactions. For example, in 2024, Maybank reported significant growth in its regional trade finance volumes, underscoring its role in fostering intra-ASEAN commerce.

- Regional Network: Over 2,200 branches and offices across nine ASEAN countries.

- Cross-Border Facilitation: Streamlined services for international trade, investment, and remittances.

- Economic Integration Support: Actively contributes to the growth and connectivity of the ASEAN economic community.

- 2024 Performance: Saw a notable increase in digital cross-border transaction volumes.

Personalized and Humanized Service

Maybank's commitment to Humanising Financial Services is central to its value proposition, blending digital convenience with a distinctly personal touch. This means customers aren't just interacting with an app; they're also benefiting from the expertise of relationship managers who offer tailored financial advice and support.

This dual approach aims to foster deeper customer relationships by ensuring that even as Maybank enhances its digital offerings, the human element remains paramount. For instance, in 2024, Maybank continued to invest in training its staff to provide more empathetic and insightful customer interactions, reinforcing the idea that financial services should be both efficient and deeply personal.

- Humanizing Financial Services: Combining digital efficiency with personalized advisory.

- Tailored Solutions: Ensuring customers receive support suited to their unique needs.

- Relationship Building: Strengthening connections through both digital and human interactions.

- 2024 Focus: Continued investment in staff training for enhanced customer engagement.

Maybank's value proposition is built on delivering integrated financial solutions, offering a holistic banking experience that covers personal, business, insurance, and investment needs. This comprehensive approach simplifies financial management for its diverse customer base, fostering long-term relationships.

The bank's strong emphasis on digital innovation provides customers with seamless access to a wide array of services, from instant payments to sophisticated wealth management tools. In 2024, Maybank continued to bolster its digital platforms, aiming for enhanced user experience and accessibility.

A key differentiator is Maybank's leadership in Islamic banking, catering to the growing demand for Sharia-compliant financial products and ethical investments. This commitment to values-based finance resonates with a significant and expanding market segment.

Maybank's extensive regional network across ASEAN is a significant asset, facilitating cross-border transactions and supporting economic integration within Southeast Asia. This deep regional presence provides a distinct advantage for businesses operating internationally.

The bank's philosophy of Humanizing Financial Services ensures that digital advancements are complemented by personalized, expert advice, fostering stronger customer connections. In 2024, Maybank reinforced this by investing in staff development to enhance customer engagement.

| Value Proposition Aspect | Key Features | 2023/2024 Data/Impact |

|---|---|---|

| Integrated Financial Solutions | One-stop shop for banking, insurance, investments | Simplified financial management for individuals and businesses. |

| Digital Convenience & Innovation | Mobile/online platforms, instant payments, wealth management | Over 80% of customer transactions digital by end of 2023; continued platform enhancements in 2024. |

| Islamic Banking Leadership | Sharia-compliant products, ethical investments | Addresses growing demand for values-based finance; global Islamic finance assets projected over $3.7 trillion by end of 2023. |

| ASEAN Regional Network | Extensive branch network, cross-border services | Facilitates trade and investment within Southeast Asia; notable growth in regional trade finance volumes in 2024. |

| Humanizing Financial Services | Digital efficiency with personalized advisory | Focus on tailored solutions and relationship building; continued staff training in 2024 for improved customer interactions. |

Customer Relationships

Maybank cultivates personalized relationships by assigning dedicated relationship managers and financial advisors, particularly for its high-net-worth, SME, and corporate clientele. This focused approach ensures clients receive tailored advice and bespoke financial solutions, fostering trust and long-term partnerships.

Maybank provides robust digital self-service through its mobile and internet banking, enabling customers to handle account management and transactions without direct assistance. In 2024, Maybank reported a significant increase in digital transactions, with over 80% of customer interactions occurring via digital channels, highlighting the effectiveness of these platforms.

To further support this digital-first approach, Maybank has integrated AI-powered chatbots and comprehensive online FAQs. These resources offer instant answers to common queries, reducing wait times and improving customer satisfaction. This digital support infrastructure is crucial for scaling customer relationships efficiently.

Maybank actively fosters community engagement through social impact programs and financial literacy initiatives, aiming to uplift lives beyond standard banking services. For instance, in 2023, Maybank's financial literacy programs reached over 2 million individuals across Southeast Asia, equipping them with essential money management skills.

These efforts cultivate significant goodwill and trust, especially within underserved segments like lower-income communities and small and medium-sized enterprises (SMEs). This approach directly supports Maybank's broader sustainability objectives by promoting inclusive economic growth and financial well-being.

Proactive Customer Outreach and Fraud Prevention

Maybank prioritizes proactive customer relationships by reaching out to individuals facing financial difficulties. This approach aims to offer support and guidance, fostering a sense of partnership. For instance, in 2024, Maybank continued to enhance its communication channels to ensure customers are informed about potential financial challenges and available solutions.

To bolster security and prevent fraud, Maybank has implemented advanced features such as 'Money Lock'. This innovative tool allows customers to temporarily lock their accounts or specific transactions, providing an extra layer of protection against unauthorized activity. This commitment to customer well-being and robust security significantly strengthens trust.

- Proactive Engagement: Maybank actively contacts customers to discuss financial well-being and offer assistance.

- Fraud Prevention: Features like 'Money Lock' are deployed to safeguard customer assets and prevent fraudulent transactions.

- Trust Enhancement: These initiatives build confidence, positioning Maybank as a dependable financial partner.

- Reputation Building: A focus on security and customer care solidifies Maybank's reputation in the market.

Feedback Mechanisms and Continuous Improvement

Maybank prioritizes understanding its customers by actively soliciting feedback across multiple touchpoints. This commitment to listening is a cornerstone of its M25+ strategy, which emphasizes evolving its financial products and services to better align with customer demands.

This continuous feedback loop allows Maybank to refine its offerings, driving improvements that enhance customer satisfaction and foster long-term loyalty. For instance, in 2024, the bank saw a notable increase in digital service adoption, directly influenced by customer input on user experience improvements.

- Customer Feedback Channels: Maybank utilizes surveys, social media monitoring, branch interactions, and dedicated customer service lines to gather insights.

- M25+ Strategy Integration: Customer feedback directly informs the strategic direction of the M25+ plan, ensuring product development is customer-led.

- Impact on Services: Feedback has led to enhancements in mobile banking features and personalized financial advice offerings, contributing to a 15% uplift in customer satisfaction scores for digital channels in early 2024.

- Loyalty and Retention: By demonstrating responsiveness to feedback, Maybank aims to strengthen customer relationships and improve retention rates, with early 2024 data indicating a positive trend in repeat business.

Maybank fosters diverse customer relationships, blending personalized human interaction with robust digital self-service. Dedicated relationship managers cater to high-value clients, while digital platforms and AI chatbots serve a broader base, ensuring accessibility and efficiency. This dual approach, reinforced by proactive outreach and a focus on security, aims to build lasting trust and loyalty.

| Relationship Type | Key Features | 2024 Data/Initiatives |

|---|---|---|

| Personalized Banking | Dedicated Relationship Managers, Tailored Advice | Focus on High-Net-Worth, SME, and Corporate Clients |

| Digital Self-Service | Mobile & Internet Banking, AI Chatbots, FAQs | Over 80% of customer interactions via digital channels |

| Community Engagement | Financial Literacy Programs, Social Impact Initiatives | Programs reached over 2 million individuals in 2023 |

| Proactive Support | Financial Difficulty Outreach, Security Features (e.g., Money Lock) | Enhanced communication channels for customer well-being |

| Feedback Integration | Customer Surveys, Social Media Monitoring | Informed M25+ strategy, 15% uplift in digital satisfaction scores |

Channels

Maybank's extensive branch network, a cornerstone of its business model, offers traditional banking services, personalized advice, and direct customer support across Malaysia and its international markets. In 2024, Maybank continued to leverage its approximately 2,600 branches and digital channels to serve a diverse customer base.

Branches remain vital for handling intricate transactions, offering in-depth financial consultations, and catering to customers who value in-person interactions. This physical presence is particularly important for segments like small and medium-sized enterprises (SMEs) and high-net-worth individuals who often require tailored financial solutions and relationship management.

Maybank's extensive ATM network serves as a crucial channel, enabling customers to conduct essential banking activities like withdrawals, deposits, and transfers with ease. As of early 2024, Maybank operates over 2,700 ATMs and over 4,000 cash deposit machines across Malaysia, ensuring widespread accessibility.

The bank is actively innovating within this channel, notably introducing contactless ATM cash withdrawal services. This feature enhances both customer convenience and transaction security, aligning with evolving digital banking preferences.

The MAE App is Maybank's core digital gateway, providing a full suite of banking services like payments, transfers, and even wealth management tools. It's a key part of their strategy to reach customers digitally, offering convenience and access to a wide range of financial activities.

By the end of 2023, Maybank reported that its MAE app had surpassed 10 million downloads, demonstrating its significant reach and adoption among customers. This channel is crucial for driving customer engagement and facilitating everyday transactions.

Internet Banking Platform (Maybank2u)

Maybank2u serves as a critical digital channel, offering customers a secure and extensive platform for managing their finances online. This platform facilitates a broad spectrum of banking activities, from routine account management and bill payments to more complex investment transactions and access to diverse financial services, all accessible from anywhere with an internet connection.

In 2024, Maybank continued to enhance its digital offerings, with Maybank2u playing a central role in its customer engagement strategy. The bank reported a significant increase in digital transactions, underscoring the platform's importance in its overall business model. For instance, Maybank saw a substantial uplift in mobile banking adoption, with Maybank2u being a key driver of this growth.

- Digital Reach: Maybank2u provides a broad digital gateway for millions of personal and business customers.

- Service Integration: It consolidates account management, bill payments, investments, and other financial services into a single, user-friendly interface.

- Transaction Volume: In 2024, digital channels like Maybank2u processed a significant percentage of the bank's total transactions, highlighting its operational efficiency.

- Customer Engagement: The platform is instrumental in driving customer loyalty and facilitating seamless banking experiences.

Relationship Managers and Direct Sales Force

Maybank's relationship managers and direct sales force are key to serving its diverse client base, including corporate clients, SMEs, and high-net-worth individuals. This direct engagement allows for personalized service, detailed product information, and the development of highly tailored financial solutions designed to meet specific client needs. This approach is fundamental for fostering strong, lasting customer relationships and effectively cross-selling Maybank's extensive range of specialized financial products.

These dedicated teams are instrumental in understanding client objectives and offering strategic financial advice. For instance, in 2024, Maybank continued to invest in training its relationship managers to enhance their expertise in areas like digital banking solutions and sustainable finance, aiming to provide more value-added services. This direct channel is particularly effective for complex financial needs, such as corporate lending, treasury services, and wealth management, where personal interaction and trust are paramount.

- Dedicated Teams: Relationship managers and direct sales personnel are assigned to specific client segments.

- Personalized Service: Focus on understanding individual client needs and providing tailored financial advice.

- Relationship Building: Crucial for fostering long-term loyalty and trust with clients.

- Cross-Selling Opportunities: Facilitates the promotion of specialized products and services to existing clients.

Maybank utilizes a multi-channel approach to reach its customers, blending physical and digital touchpoints. Its extensive branch and ATM networks cater to traditional banking needs and in-person service requirements. Digital platforms like MAE App and Maybank2u are central to its strategy, facilitating a wide array of transactions and enhancing customer engagement.

The bank also leverages its dedicated relationship managers and sales force to provide personalized service and tailored financial solutions, particularly for corporate clients and high-net-worth individuals. This integrated strategy ensures accessibility and comprehensive service delivery across diverse customer segments.

| Channel | Description | Key Data Point (2024/Late 2023) |

|---|---|---|

| Branches | Physical locations for traditional banking and personalized advice. | Approx. 2,600 branches |

| ATM Network | Enables cash withdrawals, deposits, and transfers. | Over 2,700 ATMs, over 4,000 cash deposit machines |

| MAE App | Core digital gateway for payments, transfers, and wealth management. | Over 10 million downloads (end of 2023) |

| Maybank2u | Secure online platform for account management, bill payments, and investments. | Significant increase in digital transactions processed |

| Relationship Managers/Sales Force | Direct engagement for personalized service and tailored solutions. | Focus on digital banking and sustainable finance training |

Customer Segments

Maybank's retail customer segment encompasses a broad spectrum of individuals and households, all seeking diverse personal banking solutions. This includes everything from basic savings and current accounts to more complex needs like housing, auto, and personal loans. They also engage with credit cards and various wealth management services designed to grow and protect their assets.

The bank's strategy for this segment is to make financial services feel more personal and accessible. This approach caters to a wide demographic, from those just starting their careers to individuals in their retirement years, ensuring that Maybank's offerings are relevant and supportive at every life stage.

In 2023, Maybank reported a significant portion of its customer base was within the retail segment, with retail deposits forming a substantial part of its funding. For instance, the bank’s focus on digital channels has seen increased engagement, with a notable rise in mobile banking transactions among individual customers seeking convenience and easy access to their finances.

Maybank recognizes the vital role Small and Medium Enterprises (SMEs) play in the economy, offering a comprehensive suite of services designed to fuel their growth. These include crucial business financing options, efficient cash management solutions, robust trade finance facilities, and user-friendly digital banking services, all specifically crafted to meet the evolving needs of this dynamic sector.

Beyond traditional banking, Maybank demonstrates a commitment to empowering SMEs through forward-thinking initiatives. The myimpact SME Hub, for instance, provides integrated sustainability and value-based solutions, helping businesses navigate complex environmental, social, and governance (ESG) landscapes. This proactive approach ensures SMEs are well-equipped for future challenges and opportunities.

In 2024, Maybank's dedication to SMEs is evident in its continued investment in digital platforms and tailored financial products. For example, their SME financing programs aim to support a significant portion of the SME market, with a focus on sectors experiencing robust growth. This strategic focus underscores Maybank's position as a key partner for SME development.

Large corporations, government bodies, and financial institutions form a crucial customer segment for Maybank, demanding intricate financial solutions. These clients, served by Maybank's Group Global Banking division, require services ranging from substantial corporate loans and comprehensive investment banking to sophisticated treasury products and expert capital market advisory.

In 2024, Maybank's commitment to this segment is evident through its robust offerings. The bank actively engages in facilitating large-scale financing and advisory services, supporting the complex needs of these major players in the global economy.

High-Net-Worth (HNW) and Ultra-High-Net-Worth (UHNW) Individuals

Maybank caters to High-Net-Worth (HNW) and Ultra-High-Net-Worth (UHNW) individuals by offering sophisticated wealth management, private banking, and bespoke investment strategies. This segment demands personalized financial guidance, meticulous portfolio construction, and privileged access to a broad spectrum of investment avenues, with a growing emphasis on sustainable and ESG-focused opportunities.

In 2024, the global HNW population reached approximately 22.8 million individuals, managing an estimated $91.8 trillion in wealth, according to Knight Frank’s Wealth Report 2024. This underscores the significant market opportunity for Maybank’s specialized services.

- Personalized Advisory: Tailored financial planning and investment advice designed to meet the unique goals and risk appetites of affluent clients.

- Portfolio Optimization: Strategies focused on maximizing returns and managing risk across diverse asset classes, including alternative investments.

- Exclusive Access: Opportunities for private equity, venture capital, and curated investment products often unavailable to the general investing public.

- Sustainable Investing Focus: Growing demand for ESG-compliant investment solutions, aligning wealth growth with environmental and social impact.

Islamic Banking Customers

Maybank's Islamic Banking Customers represent a significant and expanding market segment. These individuals and businesses specifically seek financial solutions that adhere to Sharia principles, encompassing areas like financing, savings, and investment management. Maybank's strong position in the Islamic finance sector allows it to effectively serve the ethical and faith-based requirements of this customer base.

The demand for Sharia-compliant products is robust. For instance, in 2023, Maybank Islamic reported a pre-tax profit of RM2.4 billion, a notable increase from the previous year, reflecting the growing engagement of this customer segment. This growth underscores the segment's importance and Maybank's success in capturing this market share.

- Growing Demand: Customers are increasingly prioritizing faith-aligned financial services.

- Product Offerings: This segment utilizes Islamic financing, Sharia-compliant deposits, and wealth management solutions.

- Market Leadership: Maybank is recognized for its extensive suite of Islamic banking products.

- Ethical Alignment: The segment is driven by a desire for financial activities that align with their values.

Maybank serves a diverse customer base, segmented into retail individuals, Small and Medium Enterprises (SMEs), large corporations, government bodies, financial institutions, and High-Net-Worth (HNW) individuals, alongside a distinct Islamic Banking customer segment. Each segment has unique financial needs, from personal banking and business financing to complex investment and wealth management solutions.

The bank's strategy involves providing tailored services and digital platforms to cater to these varied requirements. For instance, retail customers benefit from accessible digital banking, while SMEs receive support through financing and sustainability initiatives. In 2024, Maybank continued to invest in digital channels, seeing increased mobile banking transactions among individual customers.

The HNW segment, representing a significant wealth pool globally, is targeted with sophisticated wealth management and bespoke investment strategies. The growing demand for ESG-compliant investments is a key focus. Maybank Islamic also serves a growing market seeking Sharia-compliant financial solutions, with Maybank Islamic reporting a pre-tax profit of RM2.4 billion in 2023.

Cost Structure

Personnel costs represent a substantial part of Maybank's expenses, encompassing salaries, benefits, and ongoing training for its extensive global workforce. This includes compensation for customer-facing roles, essential back-office functions, and highly skilled specialists across diverse business units. For instance, in 2023, Maybank reported personnel expenses of RM 4.5 billion, highlighting the significant investment in its human capital.

Maybank dedicates significant resources to its technology and digitalization efforts. These investments are vital for enhancing customer experience, operational efficiency, and competitive positioning in the evolving financial landscape. For instance, in 2023, Maybank continued its robust investment in digital banking, aiming to strengthen its technological backbone and expand its digital service offerings.

Key cost areas include the development and maintenance of digital platforms, such as mobile banking apps and online portals, alongside substantial spending on cybersecurity to protect customer data and financial assets. Investments in artificial intelligence and big data analytics are also crucial for personalized services and risk management. Cloud computing adoption further contributes to these operational expenditures.

These technology outlays are fundamental to Maybank's digital transformation strategy, enabling the bank to offer innovative products and services. The ongoing need for software updates, system upgrades, and the integration of new technologies like AI means this cost category remains a significant and continuous expenditure for the bank.

Maybank's extensive branch and ATM network, a cornerstone of its traditional banking model, incurs substantial operational expenses. These costs encompass rent for prime locations, utilities, robust security measures, and ongoing maintenance across its international footprint. For instance, in 2023, Maybank Malaysia's operating expenses were RM 6.7 billion, reflecting the significant investment in its physical infrastructure and service delivery.

Marketing and Brand Building

Maybank dedicates significant resources to marketing and brand building to capture new customers and solidify its market presence. These costs encompass a wide array of activities, from broad advertising campaigns to targeted digital promotions and high-profile sponsorships. For instance, in 2024, Maybank continued its investment in digital marketing channels, recognizing their efficacy in reaching a younger demographic and promoting its evolving suite of digital banking services.

The bank's brand building efforts extend to showcasing its commitment to sustainability, a key differentiator in today's financial landscape. These initiatives are crucial for maintaining brand visibility and reputation amidst intense competition. Maybank’s marketing spend in 2024 was strategically allocated to highlight its innovative digital solutions and its progress on environmental, social, and governance (ESG) targets.

- Advertising and Promotions: Costs for television, print, digital, and social media advertising campaigns.

- Sponsorships: Investments in events and organizations to enhance brand visibility and association.

- Digital Marketing: Expenditure on search engine optimization, content marketing, and social media engagement.

- Brand Management: Costs related to public relations, market research, and maintaining brand consistency across all touchpoints.

Regulatory Compliance and Risk Management

Maybank's cost structure heavily features expenses related to regulatory compliance and risk management. Adhering to the complex web of financial regulations, such as those from Bank Negara Malaysia and international bodies, necessitates significant outlays. These costs cover legal counsel, external audits, and the implementation and maintenance of sophisticated compliance software and systems.

Robust risk management frameworks are equally critical, involving investments in technology for fraud detection, cybersecurity, and credit risk assessment. These expenditures are not merely operational necessities but are foundational to maintaining stakeholder trust and ensuring the long-term stability of the bank.

- Legal and Audit Fees: These are ongoing costs associated with ensuring all operations meet regulatory standards and undergo independent scrutiny.

- Compliance Technology: Investments in software for anti-money laundering (AML), know your customer (KYC) processes, and transaction monitoring are substantial.

- Risk Management Personnel and Systems: Hiring skilled risk professionals and deploying advanced analytical tools to identify and mitigate financial and operational risks contribute significantly to costs.

- Training and Development: Continuous training for staff on evolving regulatory requirements and risk best practices is an essential, recurring expense.

Beyond personnel and technology, Maybank incurs significant costs in its extensive physical infrastructure, including branches and ATMs, which require rent, utilities, and maintenance. Furthermore, marketing and brand-building activities, encompassing digital promotions and sponsorships, are crucial for customer acquisition and market presence. For example, Maybank's total operating expenses in 2023 were RM 13.8 billion, reflecting these diverse cost drivers.

| Cost Category | 2023 Expenses (RM Billion) | Key Components |

| Personnel Costs | 4.5 | Salaries, benefits, training |

| Technology & Digitalization | Significant Investment | Platform development, cybersecurity, AI |

| Branch & ATM Network | Included in Operating Expenses | Rent, utilities, security, maintenance |

| Marketing & Brand Building | Strategic Allocation | Advertising, digital marketing, sponsorships |

| Regulatory Compliance & Risk Management | Substantial Outlays | Legal fees, compliance tech, risk systems |

Revenue Streams

Net Interest Income (NII) is Maybank's core revenue generator. It’s the profit made from the spread between the interest Maybank earns on its lending and investments and the interest it pays out on customer deposits. For instance, in the first quarter of 2024, Maybank reported a net interest income of RM3.44 billion, reflecting the ongoing demand for credit and effective management of its deposit base.

Maybank generates significant revenue through various fees and commissions. This includes service charges on everyday banking transactions, fees associated with credit card usage, and income from trade finance activities. In 2024, Maybank continued to emphasize growing this non-interest income, particularly through its wealth management and investment banking divisions.

Maybank's Etiqa subsidiary is a key revenue driver, collecting premiums from a wide array of general insurance products like motor and home insurance, alongside life and family insurance policies. In 2023, Etiqa's gross premium income reached RM9.7 billion, demonstrating strong market penetration and customer trust.

Beyond conventional insurance, Etiqa also offers Sharia-compliant takaful solutions, attracting a significant segment of the market. These contributions, along with insurance premiums, collectively bolster Maybank's financial performance, with the insurance segment consistently contributing a substantial portion to the group's profit before tax.

Asset Management Fees

Maybank's asset management division generates revenue primarily through fees linked to the assets it manages for a broad client base. This includes individual investors and larger institutional clients, covering a range of investment vehicles such as unit trusts, wholesale funds, and Shariah-compliant wealth management products.

The growth in Assets Under Management (AUM) is a critical driver for this revenue stream. Specifically, the increasing demand and expansion within Islamic wealth management are significant contributors to Maybank's fee-based income. For instance, in 2023, Maybank Investment Bank's asset management segment reported a healthy increase in AUM, reflecting strong client inflows and positive market performance.

- Asset Management Fees: Revenue generated from managing client assets across various investment products.

- Key Drivers: Growth in Assets Under Management (AUM), particularly in Islamic wealth management.

- Client Base: Serves both individual and institutional clients.

- Product Range: Includes unit trusts, wholesale funds, and Islamic wealth management products.

Foreign Exchange and Trading Income

Maybank generates revenue from foreign exchange (FX) transactions and broader trading activities. This income, a key component of its non-interest income, stems from its participation in global markets and investment banking operations. For instance, in the first nine months of 2024, Maybank's total non-interest income reached RM5.25 billion, with trading and investment income playing a significant role.

The performance of this revenue stream is closely tied to market volatility and the bank's proficiency in navigating international financial markets. Maybank's ability to execute trades in various financial instruments, from currencies to derivatives, directly impacts its earnings. This expertise is crucial for capitalizing on market movements and providing valuable services to clients engaged in international trade and investment.

- FX Transactions: Income derived from buying and selling foreign currencies for clients and for the bank's own account.

- Global Markets Activities: Revenue generated from participating in global financial markets, including trading in fixed income, equities, and other securities.

- Trading in Financial Instruments: Profits earned from the bank's proprietary trading and market-making activities across a range of financial products.

- Impact of Volatility: Higher market volatility can lead to increased trading volumes and potentially greater income, but also higher risk.

Maybank's diverse revenue streams are anchored by its Net Interest Income, which saw RM3.44 billion in the first quarter of 2024, reflecting strong lending activities. Fee and commission income, encompassing service charges and credit card fees, also contributes significantly, with a focus on growing wealth management and investment banking revenue in 2024.

The insurance arm, Etiqa, is a substantial revenue generator, with RM9.7 billion in gross premium income in 2023 from both conventional and takaful products, bolstering overall group profitability. Furthermore, asset management fees, driven by RM137.9 billion in Assets Under Management (AUM) as of December 2023, provide consistent fee-based income, especially from Islamic wealth management growth.

| Revenue Stream | Description | Key Data Point (2023/Q1 2024) |

|---|---|---|

| Net Interest Income | Profit from lending and deposit interest spread | RM3.44 billion (Q1 2024) |

| Fees & Commissions | Service charges, credit card fees, trade finance | Growing contribution from wealth management |

| Insurance Premiums (Etiqa) | Motor, home, life, family, and takaful products | RM9.7 billion gross premium income (2023) |

| Asset Management Fees | Fees from managing client assets | RM137.9 billion AUM (Dec 2023) |

| Trading & FX Income | Foreign exchange and global market activities | RM5.25 billion total non-interest income (9M 2024) |

Business Model Canvas Data Sources

The Maybank Business Model Canvas is constructed using a blend of internal financial data, extensive market research, and strategic insights derived from industry analysis. These diverse sources ensure each component of the canvas is robustly informed and strategically aligned.