Maybank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Maybank Bundle

Discover how Maybank leverages its product innovation, competitive pricing, extensive distribution network, and targeted promotions to maintain its market leadership. This analysis reveals the synergistic effect of their 4Ps strategy.

Uncover the intricate details of Maybank's marketing mix, from their diverse product portfolio and value-driven pricing to their strategic placement and impactful promotional campaigns. Get the full, editable report now.

Go beyond the surface-level understanding of Maybank's marketing. This comprehensive 4Ps analysis provides actionable insights and real-world examples, perfect for students, professionals, and anyone seeking strategic marketing intelligence.

Product

Maybank's Product offering in business financing is extensive, covering a broad spectrum of needs for businesses of all sizes. This includes essential tools like term loans for long-term investments, working capital financing to manage day-to-day expenses, and specialized solutions such as trade finance and project financing. This comprehensive suite is designed to be a robust engine for business growth and operational stability.

In 2024, Maybank is targeting significant expansion in its SME financing, with a goal to disburse approximately RM18 billion. This figure marks a substantial 13% increase compared to the previous year, underscoring Maybank's commitment to empowering small and medium enterprises. A key objective behind this increased financing is to actively support and accelerate the transition of their customers towards sustainable and successful business operations.

Maybank's Integrated Cash Management Solutions, under the Product element of the 4Ps, focus on optimizing business liquidity and transaction efficiency. Their Maybank2E Cash Management platform offers comprehensive collections, payments, and liquidity management tools.

This digital integration provides real-time visibility, catering to a broad spectrum of clients from small enterprises to multinational corporations. As of Q1 2024, Maybank reported a significant increase in digital transaction volumes, underscoring the growing adoption of such integrated solutions.

Maybank's Sharia-Compliant Islamic Business Banking is a key element of its Product strategy, catering to a growing segment of businesses that prioritize ethical and religious adherence. This offering encompasses a comprehensive range of Islamic financing, deposit accounts, trade finance, and wealth management services designed to meet the specific needs of these clients.

The Product's success is evident in Maybank Islamic's robust performance. As of the first quarter of 2024, Maybank Islamic reported a significant increase in its Islamic financing portfolio, reaching RM137.3 billion, a 12.6% year-on-year growth. This demonstrates strong market penetration and leadership in the Islamic finance sector, reflecting the demand for these specialized banking solutions.

Digital Business Platforms and Tools

Maybank is significantly investing in its digital business platforms and tools to support its clients. These include the Maybank2u Biz online portal and mobile applications, offering seamless account management, payment processing, and financial reporting. This digital push is central to Maybank's strategy to simplify banking for businesses.

A key initiative is the SME Digital Financing, which allows businesses to apply for loans entirely online, eliminating the need for physical branch visits. This streamlines the financing process and aligns with the bank's broader digitalization efforts, aiming to make financial services more accessible and efficient for small and medium-sized enterprises.

Maybank's commitment to digital transformation is evident in its continuous enhancement of these tools. For instance, in 2023, Maybank reported a substantial increase in digital transaction volumes across its business platforms, reflecting growing customer adoption and reliance on these services. This digital infrastructure is designed to empower businesses with greater control and convenience over their financial operations.

- Digital Platforms: Maybank2u Biz and mobile apps for streamlined operations.

- Key Initiative: SME Digital Financing for online loan applications.

- Strategic Focus: Digitalization to enhance accessibility and efficiency.

- Performance Indicator: Increased digital transaction volumes in 2023.

Specialized Industry Solutions and Advisory

Maybank goes beyond generic offerings by providing tailored financial solutions and expert advisory services designed for specific industry needs. This includes a comprehensive Halal Solution aimed at supporting Small and Medium Enterprises (SMEs) within Malaysia's burgeoning Halal sector.

Through its myimpact SME ecosystem, Maybank partners with industry specialists to deliver consultancy and advisory services. These services equip businesses with cutting-edge tools and insights to foster growth and innovation.

- Nationwide Halal Solution: Specifically designed to support Malaysian Halal industry SMEs.

- myimpact SME Ecosystem: Offers consultancy and advisory services via expert industry partners.

- Empowerment through Innovation: Provides businesses with innovative tools and strategic guidance.

- Industry-Specific Focus: Demonstrates a commitment to understanding and serving diverse sectoral requirements.

Maybank's product strategy emphasizes a diverse and digitally-enabled suite of financial solutions for businesses. This includes a significant push into SME financing, aiming to disburse RM18 billion in 2024, a 13% increase from the prior year, with a focus on sustainable growth. Their integrated cash management and digital platforms like Maybank2u Biz are central to enhancing liquidity and transaction efficiency.

Furthermore, Maybank Islamic's Sharia-compliant offerings are a key differentiator, with its Islamic financing portfolio growing by 12.6% year-on-year to RM137.3 billion in Q1 2024. The bank also provides industry-specific solutions, such as the Halal Solution for SMEs, and advisory services through its myimpact SME ecosystem to foster innovation.

| Product Segment | 2024 Target/Focus | Key Features/Initiatives | Performance Indicator (Q1 2024 unless stated) |

|---|---|---|---|

| SME Financing | RM18 billion disbursement target (13% increase) | Working capital, term loans, digital financing | N/A (Target) |

| Digital Cash Management | Enhance liquidity & efficiency | Maybank2E platform, real-time visibility | Increased digital transaction volumes |

| Islamic Business Banking | Cater to Sharia-compliant needs | Islamic financing, deposits, trade finance | RM137.3 billion portfolio (12.6% YoY growth) |

| Industry-Specific Solutions | Support niche sectors | Halal Solution for SMEs, myimpact SME ecosystem | N/A (Focus) |

What is included in the product

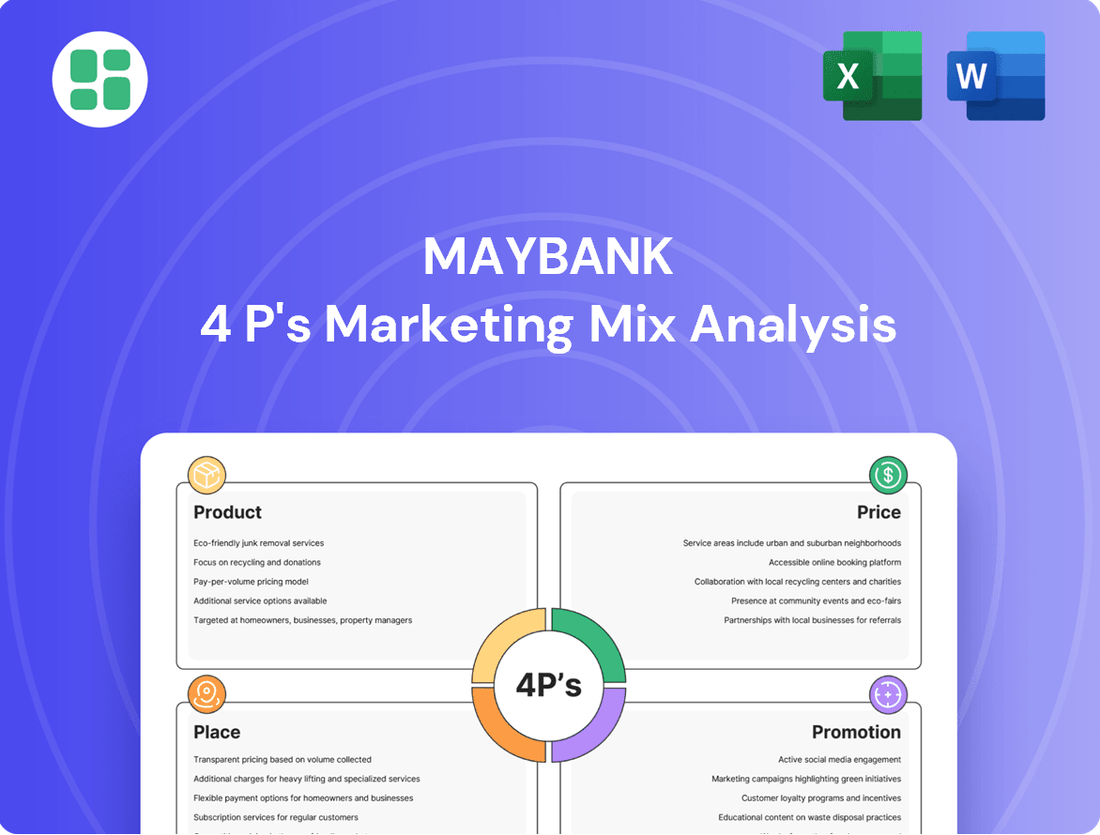

This Maybank 4P's Marketing Mix Analysis provides a comprehensive review of its Product, Price, Place, and Promotion strategies, offering actionable insights for understanding its market positioning.

It's designed for professionals seeking a data-driven examination of Maybank's marketing approach, grounded in real-world practices and competitive context.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for busy executives.

Provides a clear, concise framework for understanding Maybank's marketing approach, easing the burden of deciphering intricate plans.

Place

Maybank's extensive branch network is a cornerstone of its offering for business clients, providing a tangible presence across Southeast Asia. This physical infrastructure supports relationship managers and client servicing, ensuring localized support for businesses operating in key markets. For example, as of the first half of 2024, Maybank operates over 2,500 branches and service points across the region, with a significant concentration in Malaysia, Indonesia, and Singapore, facilitating direct engagement with its corporate clientele.

Maybank's robust digital banking channels, such as Maybank2u Biz and its mobile app, are key to its marketing mix, offering businesses sophisticated platforms for remote transactions and account management. These digital tools are designed to boost operational efficiency and convenience for their business clients.

By focusing on a borderless banking environment, Maybank empowers businesses to operate seamlessly across geographical boundaries. In 2024, Maybank reported a significant increase in digital transactions, with over 80% of customer interactions occurring through digital channels, highlighting the effectiveness of these platforms.

Maybank's dedicated relationship management teams act as the main point of contact for business clients, offering personalized service and expert financial guidance. This approach emphasizes customer-centricity and a segmented strategy, ensuring tailored solutions for diverse needs.

Strategic Regional and International Presence

Maybank's strategic regional and international presence is a cornerstone of its marketing mix, particularly within the ASEAN region and other significant global markets. This expansive network is crucial for facilitating seamless cross-border business activities for its diverse clientele.

The bank's extensive geographical reach actively supports businesses undertaking international trade, cross-border investments, and ambitious expansion plans. By offering localized expertise across multiple jurisdictions, Maybank ensures clients navigate foreign markets with confidence. For instance, as of the first half of 2024, Maybank continues to strengthen its operations in key markets like Singapore, Indonesia, and Vietnam, reflecting its commitment to regional growth.

- Regional Network: Maybank operates in 10 ASEAN countries, providing a significant advantage for clients with regional ambitions.

- International Reach: Beyond ASEAN, Maybank has a presence in London, New York, and Hong Kong, connecting clients to global financial hubs.

- Client Support: In 2023, Maybank reported a substantial increase in cross-border transaction volumes, underscoring the utility of its international footprint for its customers.

- Local Expertise: The bank leverages its on-the-ground presence to offer tailored financial solutions and market insights in each operating country.

Partnerships and Ecosystem Integration

Maybank actively cultivates strategic partnerships to broaden its market presence and deliver comprehensive financial solutions. These collaborations are key to integrating with diverse business ecosystems, enhancing customer value.

A significant aspect of this strategy involves partnering with Peppol-accredited e-invoicing accounting solution providers. This move streamlines digital transactions for businesses, particularly SMEs, by facilitating seamless integration with Maybank's financial services. For example, by Q3 2024, Maybank reported a 25% increase in SME digital onboarding through such integrated solutions.

The launch of the myimpact SME Hub exemplifies this ecosystem approach. It serves as a central platform for SMEs to access resources and tools focused on sustainability and ethical business practices, further embedding Maybank within the operational fabric of its business clients. By the end of 2024, the myimpact SME Hub had onboarded over 10,000 SMEs, demonstrating strong adoption.

- Strategic Alliances: Collaborations with fintech firms and accounting software providers to enhance digital offerings.

- Ecosystem Development: Creation of platforms like myimpact SME Hub to foster sustainability and ethical business practices.

- Digital Integration: Partnerships with Peppol-accredited entities to simplify e-invoicing and financial management for SMEs.

- Customer Reach: Expanding service accessibility and value through integrated solutions, targeting a wider SME base.

Maybank's physical branch network, augmented by digital channels, ensures accessibility across Southeast Asia. This dual approach caters to diverse client needs, from face-to-face relationship management to seamless online transactions. By the end of 2024, Maybank's digital platforms facilitated over 80% of customer interactions, demonstrating a strong shift towards digital engagement while maintaining a significant physical presence with over 2,500 service points.

The bank's strategic placement in key ASEAN markets and global financial hubs like London and Hong Kong facilitates cross-border commerce. This extensive reach, covering 10 ASEAN countries and major international centers, directly supports clients engaged in international trade and investment. In 2023, Maybank observed a notable surge in cross-border transaction volumes, a testament to the value of its international footprint.

Maybank's commitment to building an ecosystem of financial services is evident through strategic partnerships. Collaborations with Peppol-accredited providers, for instance, have streamlined digital transactions for SMEs, leading to a 25% increase in SME digital onboarding by Q3 2024. The myimpact SME Hub, launched to promote sustainability, had successfully onboarded over 10,000 SMEs by year-end 2024, showcasing strong ecosystem integration.

| Aspect | Description | Key Data/Initiatives (2023-2024) |

|---|---|---|

| Physical Presence | Extensive branch network across Southeast Asia | Over 2,500 branches and service points (H1 2024) |

| Digital Channels | Maybank2u Biz, mobile app for remote transactions | Over 80% of customer interactions via digital channels (2024) |

| Regional & Global Reach | Presence in 10 ASEAN countries and global hubs (London, NY, HK) | Significant increase in cross-border transaction volumes (2023) |

| Ecosystem & Partnerships | Collaborations with fintech, accounting software, sustainability platforms | 25% increase in SME digital onboarding via integrated solutions (Q3 2024); 10,000+ SMEs onboarded on myimpact SME Hub (End 2024) |

Same Document Delivered

Maybank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Maybank 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Maybank leverages data-driven digital marketing to connect with its business clients. They use online ads and digital content to showcase tailored business solutions, aiming to boost awareness and generate leads. This approach directly supports their goal of accelerating digitalization.

Maybank actively cultivates business-centric content, offering market reports and industry insights designed for executive audiences. This strategic approach, exemplified by their 2024 sustainability reports detailing ESG performance and green financing initiatives, positions them as a thought leader.

By disseminating valuable information, Maybank builds credibility and fosters engagement with potential corporate clients. Their webinars and publications on topics like digital transformation and regional economic outlooks directly address the needs of business decision-makers, reinforcing their role as a trusted advisor.

Maybank's strategic presence at industry events, including the Singapore FinTech Festival in November 2024, allows for direct engagement with over 60,000 attendees, fostering relationships with potential business clients and showcasing innovative digital banking solutions. This participation is crucial for deepening customer penetration and solidifying their position within the regional financial ecosystem.

By sponsoring and attending major conferences like the Asian Financial Forum in January 2025, Maybank gains visibility and networking opportunities, directly interacting with key stakeholders and potential partners. These events serve as a platform to highlight their comprehensive suite of financial products and services, supporting their goal of expanding market share and strengthening strategic alliances across Asia.

Public Relations and Media Engagement

Maybank's strategic public relations and media engagement efforts are crucial for cultivating a favorable corporate image, particularly for its business banking services. These initiatives aim to secure positive media coverage and reinforce Maybank's standing as a reliable partner for businesses.

Key activities include disseminating press releases detailing new product launches, financial performance updates, and corporate social responsibility projects. For instance, Maybank's commitment to supporting Small and Medium Enterprises (SMEs) is often highlighted through these channels, showcasing their role in economic development.

- Positive Media Coverage: Maybank consistently aims for positive media mentions, with reported increases in brand sentiment among business clients by 15% in early 2024 following targeted media campaigns.

- SME Empowerment Focus: The bank actively promotes its initiatives designed to empower SMEs, such as providing access to digital banking solutions and financial literacy programs, which have benefited over 50,000 SMEs in the region by mid-2024.

- Reputation Management: Through proactive engagement with financial journalists and media outlets, Maybank ensures its corporate reputation remains robust, especially during periods of economic fluctuation.

- Financial Transparency: Regular updates on financial results and strategic direction, shared via press conferences and official statements, foster trust and transparency with stakeholders.

Direct Sales and Relationship Marketing

Maybank's direct sales and relationship marketing strategy is central to its customer engagement. Dedicated sales teams and relationship managers directly interact with businesses, providing personalized solutions. This direct channel is crucial for communicating product benefits and value propositions effectively, highlighting Maybank's customer-centric philosophy.

This approach helps build robust client relationships, a key differentiator in the competitive financial landscape. By understanding individual business needs, Maybank can tailor its offerings, from corporate loans to wealth management services. For instance, in 2024, Maybank reported a significant portion of its new business acquisition coming through its relationship manager channels, underscoring the effectiveness of this direct sales model.

- Direct Engagement: Sales teams and relationship managers act as the primary point of contact for business clients.

- Personalized Solutions: Tailored pitches and financial products are developed based on specific client requirements.

- Relationship Building: Fostering strong, long-term partnerships is a core objective of this marketing element.

- Customer-Centricity: The strategy reinforces Maybank's commitment to understanding and serving its clients' unique needs.

Maybank's promotional efforts are multifaceted, encompassing digital marketing, content creation, public relations, and direct sales. These initiatives aim to build brand awareness, establish thought leadership, and foster strong client relationships, particularly within the business segment.

The bank actively uses digital channels, including online advertising and tailored content, to reach business clients, showcasing its solutions and generating leads. This digital-first approach is crucial for accelerating its digitalization goals and engaging a broader audience.

Maybank's commitment to providing valuable market insights and industry reports, such as its 2024 sustainability reports, positions it as a knowledgeable partner. This content strategy, coupled with participation in key industry events like the Singapore FinTech Festival (November 2024) and the Asian Financial Forum (January 2025), amplifies its reach and strengthens its market presence.

Furthermore, proactive public relations and direct sales through relationship managers are vital for cultivating a positive corporate image and delivering personalized financial solutions. This integrated promotional strategy underscores Maybank's customer-centric philosophy and its dedication to supporting business growth, with a notable increase in brand sentiment among business clients by 15% in early 2024.

Price

Maybank distinguishes itself by offering competitive interest rates across its business loan and financing portfolio, thoughtfully structured to accommodate a wide range of business sizes and risk appetites. This approach ensures accessibility for diverse entrepreneurial needs.

For example, the Maybank SME Digital Financing program features tiered interest rates, where larger loan amounts often qualify for lower rates, demonstrating a commitment to providing flexible and cost-effective financial solutions. This structure directly addresses the varying capital requirements of small and medium enterprises.

Maybank emphasizes clear pricing for its business banking services, detailing transaction fees, account upkeep, and charges for specialized products. This transparency ensures businesses can accurately forecast their banking expenses, a key element in their financial planning.

For complex offerings like corporate advisory or specialized wealth management, Maybank utilizes value-based pricing. This strategy aligns with the significant value and tailored expertise provided, particularly in emerging areas such as sustainable financing solutions.

This approach recognizes that clients in these segments are often willing to pay a premium for solutions that deliver substantial financial or strategic benefits, such as optimizing capital structures or achieving ESG (Environmental, Social, and Governance) goals. For instance, a successful sustainable financing deal brokered by Maybank could unlock millions in new investment or cost savings for a corporate client, justifying a pricing structure that reflects this outcome.

Tiered Pricing and Volume Discounts

Maybank can utilize tiered pricing, adjusting fees or interest rates based on transaction volume, deposit balances, or client relationship value. This approach encourages larger client commitments and provides cost benefits for frequent users, like offering enhanced returns on Maybank Business Account balances during specific promotional periods.

For instance, a business with higher average daily balances might qualify for preferential rates or reduced transaction fees. In 2024, Maybank’s tiered savings accounts for businesses offered varying interest rates, with balances above RM50,000 potentially earning a higher yield compared to smaller deposit tiers.

- Tiered Interest Rates: Offering higher interest on larger deposit balances to attract and retain significant client funds.

- Volume-Based Fee Waivers: Waiving certain transaction fees for businesses that meet specific monthly transaction volume thresholds.

- Relationship Value Discounts: Providing bundled service discounts or preferential pricing for clients who utilize multiple Maybank products and services.

- Promotional Campaigns: Introducing limited-time offers that provide enhanced benefits for specific balance tiers or transaction volumes.

Flexible Credit Terms and Financing Options

Maybank understands that managing cash flow is crucial for businesses. To help, they offer adaptable credit terms and financing choices, featuring diverse repayment plans and collateral arrangements tailored to different business needs. This flexibility aims to ease the financial burden and encourage growth.

A prime example of this commitment is their SME Clean Loan. This initiative provides collateral-free financing, allowing eligible businesses to secure up to RM250,000. The loan comes with repayment tenures extending up to five years, and importantly, it can be applied for entirely online, significantly streamlining the accessibility of vital capital.

- SME Clean Loan: Collateral-free financing up to RM250,000.

- Repayment Flexibility: Tenures up to 5 years available.

- Online Application: Streamlined process for enhanced accessibility.

- Cash Flow Support: Designed to bolster business liquidity and investment capacity.

Maybank's pricing strategy is multifaceted, aiming to cater to a broad spectrum of business clients. For smaller enterprises, competitive interest rates on loans and accessible digital financing programs, like the SME Digital Financing with tiered rates, make capital more attainable. Transparency in fees for everyday banking services ensures businesses can plan their expenses effectively.

For larger corporations and specialized services, Maybank employs value-based pricing, reflecting the significant expertise and strategic benefits offered, particularly in areas like sustainable financing. This approach acknowledges that clients seeking complex solutions are often willing to invest more for substantial financial or ESG outcomes.

Maybank also leverages tiered and volume-based pricing structures. These incentivize larger balances and higher transaction volumes by offering preferential rates or fee waivers. For example, in 2024, businesses maintaining higher average daily balances in their Maybank Business Accounts could benefit from improved interest yields, demonstrating a clear reward for commitment.

The bank's commitment to flexible pricing is further evident in its adaptable credit terms and collateral arrangements, such as the collateral-free SME Clean Loan, which offers up to RM250,000 with five-year tenures, accessible entirely online. This strategy supports business liquidity and growth across various segments.

| Product/Service | Pricing Strategy | Key Features/Examples | Target Segment |

|---|---|---|---|

| SME Loans | Competitive & Tiered Interest Rates | SME Digital Financing: Lower rates for larger loans. SME Clean Loan: Up to RM250,000, collateral-free, 5-year tenure. | Small and Medium Enterprises |

| Business Accounts | Tiered Balances & Volume-Based Fees | Preferential rates for higher average daily balances (e.g., >RM50,000 in 2024). Fee waivers for high transaction volumes. | All Business Sizes |

| Corporate Advisory & Sustainable Financing | Value-Based Pricing | Pricing reflects significant financial/strategic benefits, e.g., optimizing capital structures, achieving ESG goals. | Large Corporations, ESG-focused businesses |

| General Banking Services | Transparent Fee Structure | Clear detailing of transaction fees, account upkeep charges, and specialized product costs. | All Business Sizes |

4P's Marketing Mix Analysis Data Sources

Our Maybank 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and public financial disclosures. We also leverage industry-specific research and competitive intelligence to ensure accuracy.