Maybank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Maybank Bundle

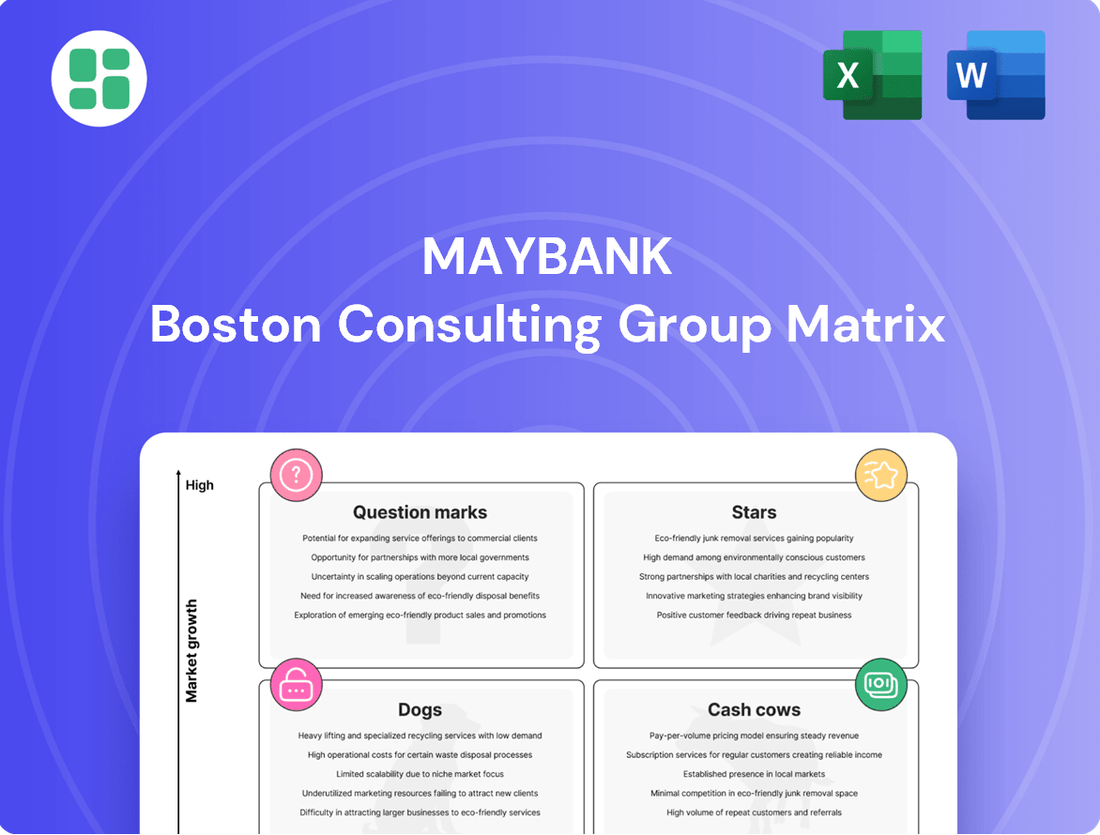

Discover how Maybank strategically categorizes its diverse product portfolio using the BCG Matrix. Understand which offerings are potential growth drivers (Stars), reliable income generators (Cash Cows), underperforming assets (Dogs), or ventures requiring careful consideration (Question Marks). Purchase the full report for a comprehensive analysis and actionable strategies to optimize Maybank's market position.

Stars

Maybank's digital banking, notably the MAE app, is a star performer in the BCG matrix, driven by robust user growth across ASEAN. As of early 2024, the bank reported over 9.9 million active digital customers, underscoring the significant traction of its digital offerings.

The MAE app's success is further evidenced by its strong digital sales penetration, a key indicator of its market leadership and customer engagement. This growth is crucial for Maybank's customer-centric approach and ongoing digitalization efforts.

Maybank's strategic expansion of cross-border QR payment services is a testament to its commitment to innovation and market dominance. This initiative not only strengthens the MAE app's position but also attracts a continuous stream of new users, solidifying its status as a high-growth, high-share product.

Maybank Islamic stands as a powerhouse, recognized as the largest Islamic bank in ASEAN and ranking among the top five globally by asset size. This dominant position highlights its substantial market share within a rapidly expanding financial sector.

In 2024, Maybank’s Islamic banking segment continued its impressive trajectory, with profit before tax and zakat showing robust growth. Islamic financing now represents a significant portion of Maybank Malaysia's overall loan portfolio, underscoring its strategic importance.

The bank's commitment to developing innovative Shariah-compliant products and its active participation in the burgeoning halal ecosystem point to substantial future growth opportunities and reinforce its market leadership.

Wealth Management at Maybank is positioned as a 'Super Growth' star, demonstrating robust expansion in total financial assets. In 2024, the bank reported a substantial increase in assets under management, reflecting strong client confidence and market traction.

This segment is a significant contributor to Maybank's non-interest income, highlighting its profitability and strategic importance. The bank's commitment to digital innovation, including AI-powered advisory services, is a key driver of this growth, attracting a growing base of high-net-worth individuals across Asia.

Cross-Border Digital Payment Solutions

Maybank's cross-border QR payment connectivity, spanning Malaysia, Singapore, Indonesia, Thailand, Cambodia, and China, is a key growth area. This expansion is crucial for capturing the increasing demand for international digital transactions within ASEAN and beyond.

The initiative has demonstrated robust growth, with transaction values and user adoption rates climbing steadily. For instance, in 2023, Maybank reported a significant increase in cross-border QR transactions, reflecting the growing reliance on digital payment solutions for regional commerce.

- Cross-Border QR Connectivity: Maybank's network connects consumers and businesses across Malaysia, Singapore, Indonesia, Thailand, Cambodia, and China, facilitating seamless international payments.

- Growth Metrics: The platform has experienced substantial year-over-year growth in transaction volume, with a notable surge in user adoption as more individuals and merchants embrace digital payments.

- Strategic Alignment: This initiative directly supports ASEAN's vision for greater digital payment integration, leveraging Maybank's extensive regional footprint and technological infrastructure.

- Market Opportunity: The growing e-commerce landscape and increasing intra-regional trade present a significant opportunity for Maybank to solidify its position in the cross-border digital payment market.

Sustainable Finance Solutions (ESG)

Sustainable Finance Solutions (ESG) represents a Stars category for Maybank, showcasing robust growth and market leadership. The bank has already mobilized over RM115.17 billion in sustainable finance, surpassing its 2025 goals significantly ahead of time.

This performance is fueled by strong global and regional ESG trends, positioning ESG as a high-growth market for Maybank. The bank is actively capturing market share through its comprehensive green and social financing programs and established frameworks.

- Market Leadership: Maybank is a recognized leader in sustainable finance mobilization.

- Exceeded Targets: Mobilized over RM115.17 billion, ahead of its 2025 goal.

- High-Growth Segment: Driven by increasing global and regional ESG focus.

- Strategic Initiatives: Leveraging green and social financing to build market share.

Maybank's digital banking, particularly the MAE app, is a standout star. By early 2024, it boasted over 9.9 million active digital users across ASEAN, a clear sign of its strong market share and rapid growth. This success is further amplified by its expanding cross-border QR payment network, connecting six countries and facilitating seamless international transactions, which saw significant growth in transaction values in 2023.

Maybank Islamic, as ASEAN's largest Islamic bank, is another star. In 2024, its profit before tax and zakat showed robust growth, with Islamic financing forming a substantial part of Maybank Malaysia's loan portfolio. Its leadership in Shariah-compliant products cements its position in a growing market.

Wealth Management is a 'Super Growth' star, with total financial assets expanding significantly in 2024, indicating strong client trust and market penetration. This segment's contribution to non-interest income is vital, driven by digital innovations like AI advisory services.

Sustainable Finance Solutions (ESG) is also a star, having mobilized over RM115.17 billion by early 2024, well ahead of its 2025 target. This achievement reflects Maybank's leadership in a high-growth sector, driven by global ESG trends and its comprehensive green and social financing programs.

| Business Segment | BCG Category | Key Performance Indicators (2024 Data unless specified) | Market Share/Growth |

|---|---|---|---|

| Digital Banking (MAE App) | Star | 9.9M+ active digital customers (early 2024); Growing cross-border QR transactions (significant increase in 2023) | High Growth, High Share |

| Maybank Islamic | Star | Largest Islamic bank in ASEAN; Robust profit growth (2024); Significant portion of loan portfolio | High Growth, High Share |

| Wealth Management | Star | Substantial increase in Assets Under Management (2024); Key contributor to non-interest income | High Growth, High Share |

| Sustainable Finance (ESG) | Star | Mobilized RM115.17B+ (ahead of 2025 goal); Strong growth driven by ESG trends | High Growth, High Share |

What is included in the product

Strategic overview of Maybank's portfolio, categorizing products by market share and growth.

The Maybank BCG Matrix provides a clear, one-page overview of business unit performance, relieving the pain of complex data analysis.

Cash Cows

Maybank holds a commanding position in Malaysia's retail deposit market, especially in Current Account and Savings Account (CASA) products. This segment is crucial, offering a reliable and cost-effective funding source for the bank's operations.

Despite generally slower growth rates for these established offerings, they are significant contributors to Maybank's net fund-based income. The substantial liquidity generated here is vital for financing the bank's more ambitious, high-growth ventures.

For instance, as of the first quarter of 2024, Maybank's total deposits stood at RM 673.4 billion, with CASA forming a substantial portion, underscoring its role as the bank's financial bedrock.

Conventional mortgage loans in Malaysia represent a significant cash cow for Maybank, Malaysia's largest financial services group. This segment, while mature, offers stable and consistent interest income, benefiting from strong collateralization and Maybank's established market dominance.

In 2024, the Malaysian housing market saw continued demand, with conventional mortgages forming the backbone of financing. Maybank's substantial market share in this area translates to a reliable revenue stream, requiring minimal incremental marketing spend due to its ingrained brand recognition and extensive branch network.

Maybank's SME Banking, built on decades of established relationships and an extensive network across Malaysia and key ASEAN nations, represents a significant cash cow. This deep-rooted presence ensures a steady revenue flow from traditional lending, transaction banking, and other core services for small and medium enterprises.

In 2024, Maybank continued to leverage this strong foundation, with its SME segment consistently contributing to the bank's overall profitability. For instance, Maybank's total loans to SMEs in Malaysia remained robust, reflecting the ongoing demand for financing and the bank's trusted position in supporting this vital economic sector.

Corporate Banking & Large Enterprise Loans

Maybank's Group Global Banking (GGB) segment, which handles corporate banking and large enterprise loans, is a clear cash cow. This division consistently generates substantial profit before tax, largely due to its stable net fund-based income.

The strength of GGB lies in its deep-rooted relationships with major corporate clients. These established connections provide a reliable and steady stream of revenue, even though the growth prospects might be more moderate compared to newer, faster-growing business areas.

- Stable Revenue: GGB's large enterprise loans offer predictable income.

- Profit Contribution: This segment is a significant driver of Maybank's overall profit before tax.

- Established Relationships: Long-term client ties ensure consistent business.

- Lower Growth, High Stability: While not a high-growth area, its stability makes it a valuable cash generator.

General Insurance & Takaful (Etiqa)

Etiqa, Maybank's insurance and takaful business, is a prime example of a Cash Cow within the BCG Matrix. It commands a leading market position in Malaysia's general insurance and takaful sector.

This segment benefits from a mature market, translating into consistent premium income and robust profit generation. Etiqa's high market share in a low-growth environment highlights its ability to leverage efficiency and an established brand presence to generate reliable cash flow.

- Market Position: Top tier in Malaysian General Insurance & Takaful.

- Market Growth: Mature, low-growth environment.

- Financial Contribution: Stable premium income and strong profit generation.

- Strategic Advantage: High market share, efficiency, and established presence.

Maybank's conventional mortgage loans represent a significant cash cow, offering stable and consistent interest income due to strong collateralization and established market dominance.

In 2024, continued demand in the Malaysian housing market bolstered this segment, with Maybank's substantial market share ensuring a reliable revenue stream requiring minimal incremental marketing.

The bank's SME Banking, built on decades of relationships and an extensive network, also acts as a cash cow, consistently contributing to profitability through traditional lending and transaction banking.

Maybank's Group Global Banking (GGB) segment, focusing on corporate banking, is another clear cash cow, generating substantial profit before tax from stable net fund-based income and deep-rooted client relationships.

Etiqa, Maybank's insurance and takaful business, is a prime example of a cash cow, commanding a leading market position in a mature, low-growth environment, translating into consistent premium income and robust profit generation.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| CASA Deposits | Cash Cow | Cost-effective funding, stable liquidity | Formed substantial portion of RM 673.4 billion total deposits (Q1 2024) |

| Conventional Mortgages | Cash Cow | Stable interest income, strong collateral | Benefited from continued demand in Malaysian housing market |

| SME Banking | Cash Cow | Steady revenue from lending and transactions | Robust contribution to overall profitability, strong loan book |

| Group Global Banking (GGB) | Cash Cow | Substantial profit, stable net fund-based income | Consistent profit before tax driven by corporate relationships |

| Etiqa (Insurance/Takaful) | Cash Cow | Leading market share, consistent premium income | Top tier in Malaysian General Insurance & Takaful; stable profit generation |

What You See Is What You Get

Maybank BCG Matrix

The Maybank BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no hidden watermarks or incomplete sections—just the comprehensive strategic analysis ready for your immediate use.

Rest assured, the Maybank BCG Matrix you see here is the final, unedited version you will download after completing your purchase. It’s a professionally crafted report designed to provide clear strategic insights into Maybank's business portfolio.

What you are previewing is the definitive Maybank BCG Matrix report that will be delivered to you once your purchase is confirmed. This ensures you receive a complete and ready-to-deploy strategic tool without any alterations.

The Maybank BCG Matrix document you are examining is precisely what you will obtain after your purchase. This preview guarantees that the final file is identical, offering a fully functional and professionally presented strategic framework.

Dogs

Certain traditional banking services, heavily reliant on physical branches and manual processes, are increasingly becoming dogs in the Maybank BCG Matrix. These services, such as manual cheque processing or in-branch fixed deposit account openings, are experiencing a sharp decline in customer preference as digital alternatives become more prevalent. For instance, while digital transactions surged, the volume of over-the-counter transactions at Maybank branches in Malaysia saw a noticeable dip in recent years, reflecting this shift.

Low-volume niche investment products, often found in the "Dogs" quadrant of the Maybank BCG Matrix, represent offerings with minimal market share and slow growth. These might include specialized funds focusing on obscure asset classes or unique investment strategies that haven't resonated with a broad investor base. For instance, a hypothetical emerging market frontier bond fund launched in 2022 might have attracted only $50 million in assets under management by mid-2024, significantly underperforming its peers and indicating a lack of market traction.

These products typically contribute little to overall revenue and can become a drain on resources due to ongoing maintenance, regulatory compliance, and marketing efforts. Consider a structured product designed for a very specific tax advantage that saw limited uptake; by 2023, its operational costs might have exceeded the minimal fees generated, making it a candidate for divestment or repositioning.

The challenge with these "Dogs" is to identify if they are truly obsolete or if a strategic pivot could unlock latent potential. For example, a niche commodity ETF that experienced a downturn due to supply chain disruptions in 2021 might see renewed interest if geopolitical events shift commodity prices favorably by late 2024, though its current market share remains low.

Legacy IT systems and infrastructure, while not products, can be categorized as dogs within Maybank's BCG Matrix. These systems are expensive to maintain, slow to update, and struggle to meet current digital needs.

In 2024, Maybank, like many financial institutions, likely faces significant OPEX and CAPEX tied to maintaining these older systems. For instance, global banks often spend upwards of 70% of their IT budgets on maintaining existing infrastructure, a figure that could well apply to Maybank's legacy assets, hindering investment in growth areas.

These outdated systems consume resources without driving new revenue or market share, acting as a drag on agility and innovation. This diverts capital that could otherwise be invested in developing new digital products or enhancing customer experience, ultimately impacting Maybank's competitive edge.

Traditional, Non-Digital Payment Methods

Traditional, non-digital payment methods, such as physical cheque processing and older interbank transfer systems, are increasingly being phased out. While they still see some usage, their market share is diminishing rapidly as consumers and businesses gravitate towards more efficient digital alternatives. For instance, cheque usage in many developed economies has seen a significant decline; in the UK, cheque volumes have fallen by over 90% in the last two decades.

These legacy systems often carry higher operational costs relative to their declining transaction volumes. This makes them less attractive investments for financial institutions looking to optimize efficiency and profitability.

- Shrinking Market Share: Non-digital payments are losing ground to faster, more convenient digital options.

- High Operational Costs: Maintaining physical infrastructure and manual processing for these methods is expensive.

- Declining Transaction Volumes: Fewer transactions are being processed through these older channels each year.

- Divestiture/Reduction Candidates: Financial institutions may consider reducing investment or divesting from these less profitable segments.

Underperforming Regional Niche Markets

Underperforming regional niche markets, particularly those outside Maybank's core ASEAN strengths, can be classified as dogs within the BCG matrix. These operations often exhibit low market share and limited growth potential, frequently due to intense local competition or challenging economic climates. For instance, a hypothetical small-scale banking operation in a less developed African nation might fit this description, struggling to gain traction against established local players and facing economic headwinds.

Such ventures may consume significant resources without yielding proportionate returns, necessitating careful strategic review. In 2024, many smaller financial institutions globally have found themselves in similar predicaments, with some reporting net interest margins below 1.5% in markets with less than 3% GDP growth, indicating a struggle for profitability.

- Low Market Share: Operations in niche regional markets often struggle to achieve significant market penetration compared to core markets.

- Limited Growth Prospects: Intense local competition or unfavorable economic conditions in these regions stifle growth opportunities.

- Resource Drain: These units may require disproportionate investment for minimal returns, impacting overall profitability.

- Strategic Review Candidates: Operations fitting this profile are prime candidates for divestment or a complete strategic overhaul.

Dogs in the Maybank BCG Matrix represent business units or products with low market share and low growth potential. These are often legacy offerings or ventures in niche markets that are not performing well. For example, Maybank's traditional remittance services, while still utilized, face intense competition from digital platforms and have seen their market share erode, showing low growth. In 2023, the global remittance market saw significant growth driven by digital channels, with fintech companies capturing a larger share, leaving traditional players like those in the dog quadrant struggling to keep pace.

These segments typically require significant resources for maintenance and compliance but generate minimal returns, acting as a drag on the overall portfolio. Consider the operational costs associated with maintaining a network of physical remittance agents in regions with declining demand; by mid-2024, these costs likely outweighed the revenue generated, a common characteristic of dog-category assets.

The strategic approach for dogs often involves either divestment or a complete overhaul to find a new niche or integrate with more promising offerings. For instance, if a particular legacy product has a very small, but loyal customer base, Maybank might explore migrating these customers to a digital platform rather than continuing to support the outdated product separately.

Identifying and managing these dog assets is crucial for optimizing resource allocation and focusing on growth areas. By streamlining or exiting these low-performing segments, Maybank can free up capital and management attention for its star and question mark products, thereby enhancing overall financial health and competitive positioning.

| Category | Market Share | Market Growth | Maybank Example | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Legacy remittance services, underperforming niche regional operations | Divest, liquidate, or seek turnaround strategy |

Question Marks

Maybank's strategic alliances with emerging FinTechs, particularly in blockchain and AI, are positioned as question marks in the BCG matrix. These ventures, while holding immense growth potential, currently exhibit a low market share. For instance, Maybank's 2024 investment in a blockchain-based cross-border payment solution aims to tap into a rapidly expanding market, yet its adoption is still in its nascent stages.

These partnerships demand substantial capital and dedicated development efforts to validate their business models and achieve scalability. The inherent uncertainty of their success, coupled with the possibility of significant future returns, characterizes their question mark status. By 2024, Maybank continued to explore these avenues, recognizing the transformative power of these technologies in reshaping financial services.

Maybank is strategically prioritizing digital SME lending for underserved segments, recognizing this as a high-growth area often overlooked by traditional banking. This focus aligns with expanding financial inclusion and capturing a significant market opportunity.

In 2024, Maybank aimed to significantly increase its digital loan disbursement to MSMEs, targeting a 15% year-on-year growth. While the potential is vast, with many SMEs still relying on informal credit sources, Maybank's current market share in these specific digital channels remains nascent, necessitating substantial investment to build scale and brand recognition.

Maybank's strategic move to establish an Islamic banking window in the Philippines exemplifies a new geographic market entry, targeting a region with significant untapped potential for Islamic finance. This expansion aligns with Maybank's broader strategy to diversify its offerings and tap into growing markets.

While the Philippines presents a promising growth avenue for Islamic finance, Maybank's presence in this nascent market segment is characterized by a low initial market share. This necessitates considerable investment in infrastructure, talent, and marketing to build brand recognition and secure a competitive foothold.

By 2024, the Islamic finance sector in Southeast Asia, including the Philippines, is projected to see continued expansion, driven by increasing demand for Sharia-compliant products. Maybank's investment in this new window is a calculated risk to capture future market share in this evolving financial landscape.

Hyper-Personalized AI/Data-Driven Products

Maybank's M25+ strategy emphasizes hyper-personalized AI/Data-Driven Products as a key growth area. These products leverage advanced analytics and artificial intelligence to anticipate and fulfill individual customer needs, aiming for early market penetration. Significant investment in data infrastructure and AI capabilities is crucial for scaling these offerings and capturing substantial market share.

These initiatives are in their nascent stages, requiring substantial upfront investment in data infrastructure and AI talent. For instance, in 2024, Maybank continued to invest heavily in its digital transformation, with a significant portion allocated to enhancing its data analytics and AI capabilities to support these personalized offerings. The bank aims to differentiate itself by offering tailored financial solutions, moving beyond traditional banking products.

- Early Stage Development: Hyper-personalized products are in the initial phases of market penetration, necessitating continued development and refinement.

- High Investment Needs: Significant capital is required for robust data infrastructure and advanced AI technologies to support these complex offerings.

- Customer Centricity Focus: The core objective is to anticipate and meet individual customer needs through data-driven insights, enhancing customer loyalty and engagement.

- Future Growth Potential: While currently requiring substantial investment, these products represent a high-growth potential for Maybank in the evolving financial landscape.

New Sustainable/Green Investment Products

New sustainable/green investment products, while part of a burgeoning market, might initially occupy a Question Mark position within the Maybank BCG Matrix. This is due to their high-growth potential being counterbalanced by currently low market adoption and brand recognition. For instance, the global sustainable investment market reached an estimated $35.3 trillion in assets under management by the end of 2022, demonstrating significant growth. However, specific, novel green financial instruments may not yet have the widespread appeal or understanding required to be considered Stars.

Maybank faces the challenge of nurturing these nascent products. Significant investment in market education and demand generation is crucial to shift them from Question Marks to potential Stars or Cash Cows. Without this strategic push, these innovative offerings risk remaining niche products with limited impact, despite the overall positive trajectory of sustainable finance.

- Market Growth: The sustainable finance sector is experiencing robust expansion, with global ESG assets projected to exceed $50 trillion by 2025.

- Low Adoption: Specific new green investment products, such as certain types of green bonds or ESG-linked derivatives, may have limited uptake initially due to unfamiliarity or complexity.

- Investment Required: Maybank must allocate resources towards educating both institutional and retail investors about the benefits and mechanics of these new products.

- Future Potential: Successful market development could see these products transition into Stars, generating substantial revenue as demand solidifies.

Maybank's ventures into emerging technologies like blockchain and AI for financial services are currently categorized as Question Marks. These initiatives, while promising substantial future growth, are in their early stages with limited market share. For instance, Maybank's 2024 investment in a blockchain-based payment system aims to capture a growing market, but its adoption is still developing.

These projects require significant capital and focused effort to prove their viability and achieve scale. Their uncertain outcomes, coupled with the potential for high future returns, define their Question Mark status. Maybank continued to explore these areas in 2024, recognizing their potential to transform financial services.

Maybank's focus on digital lending for underserved SMEs is a prime example of a Question Mark. While the market opportunity is substantial, with many SMEs still lacking access to formal credit, Maybank's current penetration in these specific digital channels is minimal. In 2024, the bank targeted a 15% year-on-year growth in digital loan disbursements to MSMEs, highlighting the investment needed to build scale and brand awareness in this segment.

The bank's expansion into the Philippines with an Islamic banking window also represents a Question Mark. This strategic move targets a region with significant untapped potential for Islamic finance, aligning with Maybank's diversification goals. However, its presence in this nascent market segment is characterized by a low initial market share, necessitating considerable investment in infrastructure and marketing to establish a competitive foothold.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Status |

| FinTech Alliances (Blockchain/AI) | High | Low | High | Question Mark |

| Digital SME Lending (Underserved Segments) | High | Low | High | Question Mark |

| Islamic Banking Window (Philippines) | High | Low | High | Question Mark |

| Hyper-Personalized AI/Data-Driven Products | High | Low | High | Question Mark |

| New Sustainable/Green Investment Products | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our Maybank BCG Matrix leverages comprehensive data, including internal financial statements, market share reports, and industry growth forecasts, to accurately position each business unit.