Lamprell SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lamprell Bundle

Lamprell's strategic position hinges on its specialized fabrication capabilities within the energy sector, but it also faces significant market volatility and competition. Understanding these dynamics is crucial for any stakeholder looking to navigate this complex industry.

Want the full story behind Lamprell's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Lamprell's nearly 50 years of experience have cemented a strong reputation for safely delivering complex engineering and fabrication projects, particularly in the offshore energy sector. This proven track record, which saw them complete significant projects like the construction of multiple jackup rigs for clients such as Rowan Companies in the past, fosters client confidence and positions them as a dependable partner.

Their specialized expertise covers a wide array of intricate structures, including jackup rigs, liftboats, and topsides, demonstrating a profound understanding of specialized fabrication processes. This deep technical knowledge is a significant asset, allowing them to tackle challenging and high-value projects that require niche skills.

Lamprell's strategic reorganization into dedicated Oil & Gas, Renewables, and Digital business units allows for targeted development and resource allocation. This diversification positions the company to benefit from both established oil and gas projects and the rapidly expanding renewables sector, reducing dependency on any single market. For instance, their ongoing work in offshore wind, including the development of a new serial production line for components, underscores this commitment to the energy transition.

Lamprell's strategic geographic presence, with primary fabrication yards in the UAE and facilities in Saudi Arabia via joint ventures, positions it advantageously within crucial energy-producing hubs. This proximity to key markets facilitates efficient project execution and reduces logistical costs.

Long-term partnerships with major clients, including Saudi Aramco and ADNOC Group, are a significant strength. The recent extension of these agreements in April 2025 underscores the enduring trust and provides Lamprell with a predictable, stable project pipeline, reinforcing its market standing in the Middle East.

Advanced Fabrication Capabilities and Technology Adoption

Lamprell's investment in advanced fabrication technology, such as automated high-capacity can rolling and robotic painting systems, significantly boosts its production efficiency. This technological edge enables the company to undertake serial production of complex, large-scale components, like wind turbine generator substructures, with greater speed and precision. For instance, in the fiscal year ending March 31, 2024, Lamprell reported a strong order backlog, partly driven by its capacity to handle sophisticated offshore wind projects.

The company's commitment to digital innovation, including the integration of AI, further refines its operational processes. This focus on smart manufacturing not only enhances productivity but also contributes to reduced waste and improved project delivery timelines. By leveraging these cutting-edge capabilities, Lamprell solidifies its position as a competitive player in the energy sector, particularly in the growing offshore wind market.

- Automated High-Capacity Can Rolling: Streamlines the production of cylindrical structures for offshore platforms.

- Robotic Welding and Painting: Enhances precision, speed, and safety in fabrication processes.

- AI Integration: Optimizes workflows, predictive maintenance, and overall project management.

- Non-Destructive Testing (NDT): Ensures the structural integrity and quality of fabricated components.

Robust Project Pipeline and Execution

Lamprell boasts a robust project pipeline, actively progressing numerous Engineering, Procurement, Construction, and Installation (EPCI) projects. These span both the oil and gas and burgeoning offshore wind sectors, with many expected to extend well into 2025 and beyond. This sustained activity underscores the company's capacity to manage complex, large-scale undertakings effectively.

The company's project execution prowess is evident in its successful track record. Key achievements include ongoing work for RWE's Norfolk Vanguard wind farm, a significant undertaking in the renewable energy space. Furthermore, Lamprell continues to deliver critical assets like jackup rigs, showcasing consistent operational efficiency and a commitment to meeting client demands in demanding markets.

Key project highlights and capabilities include:

- Active EPCI projects in oil & gas and offshore wind, extending into 2025.

- Successful delivery of multiple large-scale projects, demonstrating execution strength.

- Ongoing contributions to major offshore wind developments like RWE's Norfolk Vanguard.

- Continued production and delivery of essential jackup rigs for the energy sector.

Lamprell's extensive experience, spanning nearly five decades, has built a strong reputation for delivering complex engineering and fabrication projects, especially in the offshore energy sector. This proven history, including the construction of multiple jackup rigs for companies like Rowan Companies, instills client trust and positions them as a reliable partner.

The company's specialized knowledge covers a broad range of intricate structures such as jackup rigs, liftboats, and topsides, reflecting a deep understanding of specialized fabrication. This technical depth is a major asset, enabling them to undertake challenging, high-value projects requiring niche skills.

Lamprell's strategic division into Oil & Gas, Renewables, and Digital business units allows for focused growth and resource allocation. This diversification enables them to capitalize on both established oil and gas projects and the rapidly expanding renewables market, reducing reliance on any single sector. Their ongoing involvement in offshore wind, including a new serial production line for components, highlights this commitment to the energy transition.

Their strategic geographic footprint, with fabrication yards in the UAE and facilities in Saudi Arabia through joint ventures, places them advantageously within key energy production regions. This proximity to important markets streamlines project execution and lowers logistical expenses.

Long-standing relationships with major clients like Saudi Aramco and ADNOC Group represent a significant strength. The extension of these agreements in April 2025 reinforces the enduring trust and provides Lamprell with a stable, predictable project flow, solidifying its market position in the Middle East.

What is included in the product

Analyzes Lamprell’s competitive position through key internal and external factors, highlighting its strengths in offshore construction and opportunities in renewables, while acknowledging weaknesses in project execution and threats from market volatility.

Offers a clear, actionable framework to address Lamprell's operational challenges and market vulnerabilities.

Weaknesses

While Lamprell has pursued diversification, its fundamental operations remain deeply connected to the offshore energy sector. This inherent link means the company is quite exposed to the ups and downs of global oil and gas prices. When energy prices fall, clients often cut back on spending, leading to project postponements or outright cancellations, which directly hits Lamprell's income and ability to make a profit.

For example, periods of significant oil price decline have historically forced Lamprell to revise its profit predictions downwards. This vulnerability was evident when Brent crude prices dipped significantly in prior years, impacting new contract awards and the progression of existing projects within the sector, a trend that continues to pose a risk.

Lamprell's operations are inherently capital-intensive due to the specialized nature of fabricating large offshore structures and rigs. This demands substantial investment in fabrication yards, advanced machinery, and cutting-edge technology, creating a significant barrier to entry and ongoing operational cost. For example, the development and maintenance of specialized facilities for offshore wind turbine foundations or complex subsea structures require billions in capital outlay.

This high capital expenditure can place a considerable strain on financial resources, particularly when the market experiences downturns or when the company needs to adapt to emerging technologies, such as the fabrication of components for offshore renewable energy projects. Continuous reinvestment is crucial to maintain a competitive edge and meet evolving industry standards, which can be challenging during periods of reduced order intake or uncertain market demand.

Lamprell's involvement in large, intricate Engineering, Procurement, Construction, and Installation (EPCI) projects inherently exposes it to significant execution risks. These can manifest as unexpected cost escalations, delays in project timelines, and unforeseen technical hurdles that demand immediate and often costly solutions.

While Lamprell has demonstrated a commendable safety record, factors like labor productivity fluctuations and occasional equipment availability issues, which have impacted past projects, pose a threat to both profit margins and client relationships. Successfully navigating these challenges across a portfolio of concurrent projects is paramount for maintaining operational efficiency and market reputation.

Intense Competitive Landscape

Lamprell operates in a fiercely competitive fabrication and offshore contracting sector, facing numerous well-established global competitors. This intense rivalry often leads to downward pressure on pricing and contract negotiations, potentially impacting Lamprell's profitability and margins. For instance, in the offshore wind sector, major players like Siemens Gamesa Renewable Energy and Vestas, alongside numerous regional fabricators, create a crowded marketplace.

To navigate this, Lamprell must continually invest in technological advancements and operational efficiencies to maintain its competitive standing. The need to secure contracts in a market where other large entities like McDermott International and TechnipFMC are also active means that pricing power is often limited. This environment necessitates a sharp focus on cost management and project execution excellence to differentiate and secure lucrative deals.

The pressure to secure projects in this environment can affect Lamprell's ability to command premium pricing, directly impacting its profit margins. For example, the fluctuating demand for offshore oil and gas projects, coupled with the rise of renewable energy infrastructure, means that companies must be agile and cost-effective to win bids.

Dependency on Skilled Workforce Availability

Lamprell's operational success hinges on its substantial workforce, exceeding 6,000 individuals, who possess specialized fabrication and engineering skills. The company's reliance on this highly skilled talent pool presents a significant vulnerability. Any disruption in the availability of such expertise, or difficulties in retaining key personnel, could directly impede project execution schedules and compromise the quality of deliverables.

Attracting and retaining top-tier talent in a competitive global market remains a persistent hurdle for Lamprell, despite ongoing investment in training and development initiatives. This challenge is particularly acute in specialized sectors where demand for skilled labor often outstrips supply.

- Workforce Size: Lamprell employs over 6,000 individuals globally.

- Skill Dependency: Operations are heavily reliant on specialized fabrication and engineering expertise.

- Retention Challenges: Attracting and retaining skilled workers in a competitive international market is a significant weakness.

- Impact of Shortages: A deficit in skilled labor could lead to project delays and affect service quality.

Lamprell's heavy reliance on the volatile offshore energy sector makes it susceptible to fluctuations in oil and gas prices. When these prices drop, clients often scale back investments, leading to project delays or cancellations that directly impact Lamprell's revenue and profitability. This vulnerability was highlighted in past periods of significant oil price declines, which historically prompted downward revisions of profit forecasts and affected new contract awards.

The company's operations are capital-intensive, requiring substantial investment in specialized fabrication yards and advanced machinery. This high capital expenditure can strain financial resources, especially during market downturns or when adapting to new technologies like offshore renewable energy components. Continuous reinvestment is essential for competitiveness, posing a challenge during periods of reduced orders or uncertain demand.

Lamprell faces intense competition from numerous global fabricators and offshore contractors, which often leads to price pressures and reduced margins. In sectors like offshore wind, major players and regional fabricators create a crowded market, limiting pricing power. This necessitates a strong focus on cost management and project execution to secure lucrative deals.

The company's dependence on a large, highly skilled workforce presents a significant weakness. Disruptions in the availability of specialized fabrication and engineering expertise, or challenges in retaining key personnel, can impede project execution and compromise quality. Attracting and retaining top talent in a competitive global market remains a persistent hurdle, particularly in specialized sectors where skilled labor is in high demand.

| Weakness | Description | Impact |

|---|---|---|

| Sectoral Dependence | Heavy reliance on the offshore energy sector. | Vulnerability to oil and gas price volatility, impacting revenue and profitability. |

| Capital Intensity | High investment required for specialized facilities and machinery. | Financial strain during market downturns and challenges in adapting to new technologies. |

| Intense Competition | Facing numerous global competitors in fabrication and contracting. | Downward pressure on pricing, reduced profit margins, and limited pricing power. |

| Workforce Dependency | Reliance on a large, highly skilled workforce. | Risk of project delays and quality compromise due to labor availability or retention issues. |

What You See Is What You Get

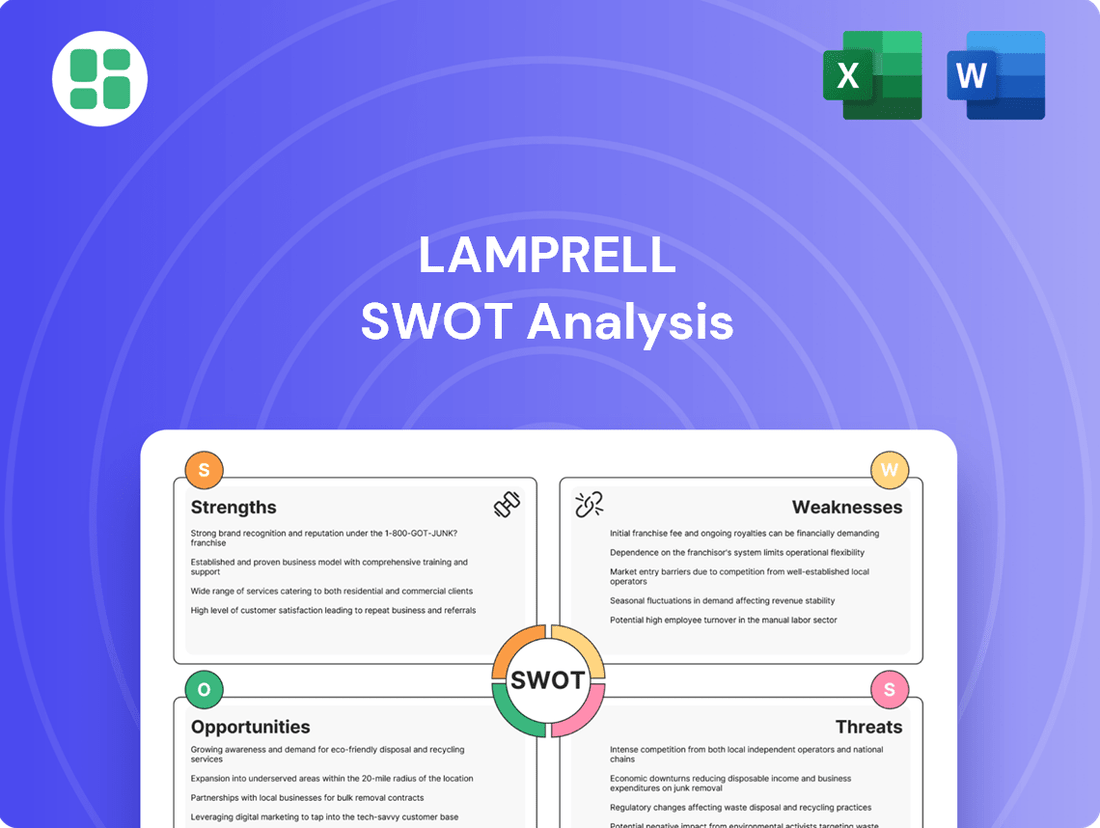

Lamprell SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’ll get the complete Lamprell SWOT analysis, offering a comprehensive overview of its strategic position.

Opportunities

The global drive for decarbonization, with offshore wind leading the charge, offers substantial growth avenues for Lamprell. The sector is projected to expand significantly, with global offshore wind capacity expected to reach over 300 GW by 2030, up from around 70 GW in 2023, according to various industry reports from late 2023 and early 2024.

Lamprell's strategic investments, such as their new serial production line for offshore wind components, position them to capitalize on this expansion. Securing contracts with prominent developers like RWE for substantial projects underscores their capability and growing footprint in this lucrative market.

Furthermore, the emerging commercialization of floating wind technology presents a long-term opportunity, opening up new geographical areas and project types that Lamprell can target, further solidifying their role in the evolving renewable energy landscape.

The global offshore rig and platform fleet is aging, creating a significant and continuous demand for refurbishment, upgrade, and maintenance services. This trend is expected to accelerate through 2024 and 2025 as older assets require significant attention to remain operational and compliant with evolving regulations.

Lamprell's established expertise in rig refurbishment and platform upgrades positions them favorably to capitalize on this growing market. These services offer a more stable and recurring revenue stream, less susceptible to the cyclical nature of new build orders, ensuring consistent work for their facilities and workforce.

For instance, the offshore drilling market saw a notable increase in rig utilization rates in late 2023 and early 2024, indicating a higher demand for operational assets that will inevitably require ongoing maintenance and potential upgrades. This sustained activity directly translates into opportunities for Lamprell's specialized service offerings.

Lamprell can capitalize on technological advancements by integrating digital innovation, artificial intelligence, and automation into its fabrication processes. This strategic move can significantly boost efficiency, drive down costs, and ultimately improve project delivery timelines, giving them a crucial edge in the competitive landscape.

The company's ongoing three-year IT initiative, coupled with the implementation of robotic systems for tasks such as painting and blasting, demonstrates a clear dedication to embracing these transformative technologies. These investments are expected to yield tangible benefits, enhancing operational capabilities and strengthening Lamprell's market position.

Geographic Market Expansion and Strategic Alliances

Lamprell can tap into burgeoning energy infrastructure markets outside its core Middle East presence. Regions like Southeast Asia and Africa present significant growth potential for offshore wind and oil and gas projects, offering Lamprell a chance to diversify its revenue streams and reduce reliance on a single geographic area. For instance, the Asia-Pacific region is projected to see substantial investment in offshore wind, with countries like Taiwan and Vietnam leading the charge.

Strategic alliances are key to unlocking these new markets. Lamprell's Memorandum of Understanding with Dong Fang Offshore for a new wind turbine installation vessel in the Asia-Pacific region exemplifies this strategy. Such partnerships can provide access to local expertise, established supply chains, and crucial regulatory navigation, thereby lowering the barriers to entry and accelerating market penetration. This collaborative approach can also lead to the development of new service capabilities tailored to specific regional demands.

- Geographic Diversification: Expanding beyond the Middle East into high-growth regions like Southeast Asia and Africa for offshore energy projects.

- Strategic Partnerships: Leveraging MoUs and joint ventures, such as the one with Dong Fang Offshore, to enter new markets and enhance service offerings.

- Market Entry Facilitation: Alliances provide access to local knowledge, supply chains, and regulatory understanding, smoothing the path into new territories.

- Service Expansion: Collaborations enable the development of specialized services catering to the unique needs of emerging energy infrastructure markets.

Commitment to Sustainability and ESG Initiatives

Lamprell's dedication to sustainability, including its net-zero emissions target by 2050 and community environmental programs, significantly bolsters its brand image. This focus is increasingly important for attracting both clients and investors who prioritize environmental, social, and governance (ESG) factors.

This commitment aligns with the growing global demand for sustainable practices, potentially opening up new project opportunities for Lamprell. Companies and governments are actively seeking partners with strong ESG credentials for energy transition and infrastructure projects.

- Enhanced Brand Reputation: A strong ESG commitment can differentiate Lamprell in a competitive market.

- Attracting Conscious Investors: Sustainable initiatives appeal to a growing pool of ESG-focused investment funds.

- Access to Green Projects: Alignment with global sustainability trends can unlock opportunities in renewable energy and decarbonization projects.

- Regulatory Alignment: Proactive environmental strategies can help Lamprell navigate evolving environmental regulations.

The global shift towards decarbonization, particularly in offshore wind, presents a significant growth area for Lamprell. Industry forecasts from late 2023 and early 2024 indicate a substantial rise in offshore wind capacity, projected to exceed 300 GW by 2030, a considerable increase from approximately 70 GW in 2023.

Lamprell's strategic investments, such as their new serial production line for offshore wind components, are well-positioned to capitalize on this expansion. Securing contracts with major developers like RWE for significant projects further solidifies their capabilities and growing presence in this expanding market.

The ongoing refurbishment and upgrade of aging offshore rigs and platforms represent a continuous demand for Lamprell's services through 2024 and 2025. This sustained activity, driven by the need for operational compliance and efficiency, translates directly into opportunities for Lamprell's specialized offerings, providing a more stable revenue stream.

Lamprell's integration of digital technologies, AI, and automation into its fabrication processes offers a pathway to enhanced efficiency and cost reduction. Their ongoing three-year IT initiative and adoption of robotic systems for tasks like painting and blasting underscore this commitment to technological advancement, aiming to improve project delivery and competitive positioning.

Expanding into new energy infrastructure markets in regions like Southeast Asia and Africa offers Lamprell diversification opportunities beyond its core Middle East operations. The Asia-Pacific region, in particular, is expected to see considerable investment in offshore wind, with countries like Taiwan and Vietnam leading the growth.

Strategic alliances, such as Lamprell's Memorandum of Understanding with Dong Fang Offshore for a new wind turbine installation vessel, are crucial for market entry. These partnerships facilitate access to local expertise, supply chains, and regulatory navigation, effectively reducing entry barriers and accelerating penetration into new territories.

Lamprell's commitment to sustainability and its net-zero emissions target by 2050 enhances its brand image, appealing to investors and clients prioritizing ESG factors. This alignment with global sustainability trends can unlock new project opportunities in renewable energy and decarbonization efforts.

Threats

Significant drops in oil and gas prices directly impact Lamprell's traditional oil and gas segment, which remains a substantial revenue driver. For instance, during periods of price volatility, such as the downturns experienced in 2020, clients often scale back exploration and production (E&P) activities. This leads to fewer new project awards and potential deferrals, directly affecting Lamprell's order book and overall revenue streams.

Global regulations and public scrutiny concerning climate change are intensifying, directly impacting industries like oil and gas. This trend could translate into more stringent operating requirements for companies such as Lamprell, potentially dampening investment in fossil fuel-related projects. For instance, the International Energy Agency's (IEA) Net Zero Emissions by 2050 scenario, updated in 2024, emphasizes a rapid phase-out of fossil fuels, suggesting a significant shift in market demand away from traditional energy sources.

These evolving environmental pressures may compel Lamprell to further adapt its service offerings, possibly requiring substantial investment in new technologies or a pivot towards renewable energy sectors. Such adaptations could also lead to increased compliance costs, particularly affecting its established oil and gas business segment, as companies face greater scrutiny and potential carbon pricing mechanisms in various jurisdictions.

Rapid advancements in energy technologies, such as novel offshore wind turbine designs or more efficient fabrication methods, pose a significant threat. Competitors embracing these innovations could make Lamprell's current processes less competitive or even obsolete.

While Lamprell invests in technology, a failure to adapt quickly to disruptive innovations, like advanced modular construction techniques or emerging alternative energy solutions, could lead to a substantial erosion of its market share. For instance, the growing demand for floating offshore wind platforms requires specialized fabrication capabilities that may not be part of Lamprell's current core offerings.

Geopolitical and Regional Instability

Lamprell's significant operational presence in the Middle East inherently exposes it to geopolitical risks. Regional conflicts or political instability can directly impact project execution, supply chain reliability, and even the safety of personnel. For instance, the ongoing tensions in the Red Sea, a critical shipping route for the region, have already led to increased shipping costs and delays for many companies operating in the energy sector, a challenge Lamprell likely navigates. This instability creates a volatile operating environment, making long-term project planning and investment decisions more complex.

Changes in government policies or regulations within the Middle Eastern countries where Lamprell operates can also pose a threat. Unexpected shifts in fiscal policies, local content requirements, or contract terms could negatively affect profitability and operational efficiency. The fluctuating political landscape means that the feasibility and safety of ongoing and future projects are constantly subject to external, unpredictable factors.

- Regional Conflicts: Increased risk of project delays or cancellations due to localized conflicts.

- Political Instability: Potential for sudden policy changes impacting contracts and operations.

- Supply Chain Disruptions: Geopolitical events can hinder the movement of materials and equipment, as seen with Red Sea shipping challenges impacting global trade routes.

- Safety Concerns: Ensuring the safety of employees and assets in politically sensitive regions requires robust security measures and contingency planning.

Supply Chain Disruptions and Cost Increases

Global supply chain vulnerabilities remain a significant concern for Lamprell. Shortages of key materials like specialized steel or critical components for offshore energy projects, coupled with a scarcity of skilled labor, can directly translate into higher operational costs and extended project timelines. For instance, the International Monetary Fund (IMF) projected global inflation to average 5.9% in 2024, impacting material and logistics expenses.

Inflationary pressures are particularly challenging for companies like Lamprell operating under fixed-price contracts. Rising costs for raw materials, energy, and transportation can significantly erode profit margins if not adequately managed or passed on to clients. This dynamic makes maintaining profitability on existing agreements a constant balancing act.

- Supply Chain Vulnerabilities: Continued geopolitical instability and the lingering effects of the pandemic have exposed weaknesses in global supply chains, leading to unpredictable availability and price fluctuations for essential project inputs.

- Inflationary Impact: Persistent inflation, with global average inflation projected at 4.5% for 2025 by the IMF, directly increases the cost of materials, equipment, and shipping, squeezing margins on fixed-price contracts.

- Labor Shortages: A global deficit in skilled labor, particularly in specialized engineering and fabrication roles required for offshore projects, can drive up wage costs and lead to project delays.

Intensifying global regulations and public scrutiny on climate change directly impact Lamprell's traditional oil and gas segment. The International Energy Agency's (IEA) Net Zero Emissions by 2050 scenario, updated in 2024, emphasizes a rapid phase-out of fossil fuels, suggesting a significant market shift away from traditional energy sources, potentially increasing compliance costs and requiring substantial investment in new technologies.

Rapid advancements in energy technologies, such as novel offshore wind turbine designs or more efficient fabrication methods, pose a significant threat. Competitors embracing these innovations could make Lamprell's current processes less competitive or even obsolete, particularly with the growing demand for specialized floating offshore wind platforms.

Lamprell's significant operational presence in the Middle East exposes it to geopolitical risks, including regional conflicts and political instability, which can impact project execution and supply chain reliability. The ongoing tensions in the Red Sea, for instance, have already led to increased shipping costs and delays for companies operating in the energy sector.

Global supply chain vulnerabilities, exacerbated by geopolitical instability and inflation, remain a significant concern. The International Monetary Fund (IMF) projected global inflation to average 5.9% in 2024, directly increasing the cost of materials, equipment, and shipping, squeezing margins on fixed-price contracts and potentially leading to project delays due to a deficit in skilled labor.

SWOT Analysis Data Sources

The data sources for this Lamprell SWOT analysis are primarily derived from their official financial reports, comprehensive industry publications, and expert market analysis to provide a robust and well-informed perspective.