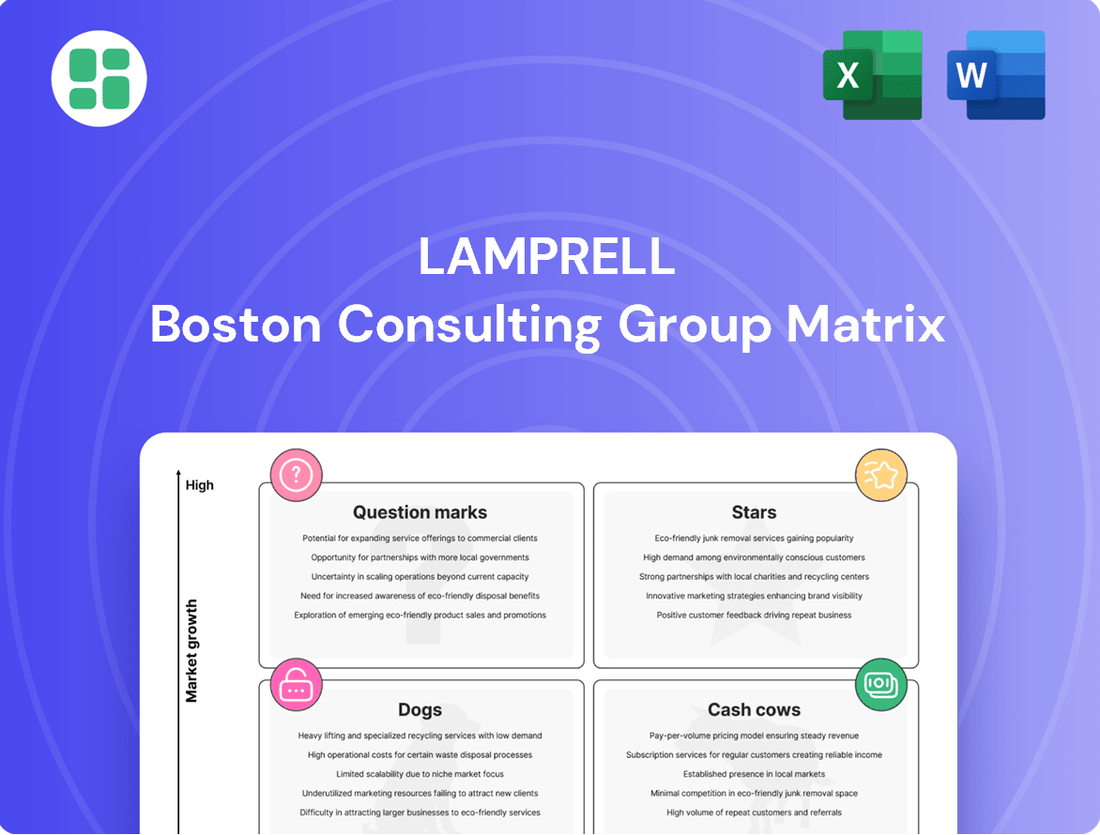

Lamprell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lamprell Bundle

Unlock Lamprell's strategic potential with our comprehensive BCG Matrix analysis. Discover which of their business units are poised for growth (Stars), generating consistent revenue (Cash Cows), underperforming (Dogs), or require further investment (Question Marks). This essential tool provides a clear roadmap for resource allocation and future business development.

Don't just guess Lamprell's market position; know it with our detailed BCG Matrix. Gain actionable insights into their product portfolio's performance and identify opportunities for strategic advantage. Purchase the full report to receive a complete quadrant breakdown and data-driven recommendations for optimizing Lamprell's business strategy.

Stars

Lamprell's offshore wind foundation fabrication unit, a key component of its business strategy, benefits from a dedicated serial production line established in 2023. This strategic investment allows for efficient manufacturing of critical components like transition pieces, essential for the burgeoning offshore wind sector.

The global offshore wind market is experiencing robust growth, with projections indicating continued expansion in the coming years. This presents a significant opportunity for Lamprell's fabrication services, positioning them within a high-growth segment of the renewable energy industry.

Lamprell's success in securing major offshore wind project wins, like the September 2024 contract with RWE for 184 transition pieces for the Norfolk Vanguard project, firmly places it in the Stars category of the BCG Matrix. This substantial order underscores Lamprell's capability to execute complex, high-value projects in a rapidly expanding market. These wins are critical for maintaining its competitive edge and driving future growth.

Lamprell's proven track record in renewables is a significant asset, particularly in the context of the BCG matrix, placing them firmly in the Stars category for this sector.

The successful completion of the Moray West project in Scotland during 2023-2024 exemplifies this strength. This project, involving the fabrication of 62 jacket foundations for wind turbines, highlights Lamprell's capability in executing complex offshore wind infrastructure. The successful delivery not only solidifies their reputation but also positions them favorably for securing future contracts in a rapidly expanding market.

Strategic Focus on Energy Transition

Lamprell is strategically reorganizing to place a strong emphasis on the energy transition, a move that directly addresses the global shift towards green energy sources. This includes the creation of a dedicated Renewables business unit.

This proactive strategy is designed to capitalize on the growing demand for renewable energy solutions and positions Lamprell to secure a larger share of this expanding market. The company's commitment to this sector is further evidenced by the substantial year-on-year growth observed in its renewables bid pipeline.

- Renewables Business Unit: Lamprell has established a dedicated unit to focus on the burgeoning renewables sector.

- Market Alignment: This strategic shift aligns with global trends favoring green energy and sustainability.

- Bid Pipeline Growth: The company has experienced significant increases in its bid pipeline for renewable energy projects.

- Investment Focus: The energy transition sector is characterized by substantial investment and supportive government policies.

Advanced Fabrication Capabilities

Lamprell's investment in automated high-capacity can rolling, welding, and non-destructive testing significantly bolsters its capabilities for serial production of large-scale wind turbine components. This technological advancement directly supports its position in the renewables sector.

These sophisticated manufacturing processes are crucial for Lamprell to efficiently meet the escalating volume demands of the expanding renewables market. For instance, in 2024, the company has focused on optimizing its production lines to handle increased order volumes for offshore wind structures.

This technological edge is a key differentiator, enabling Lamprell to maintain a competitive advantage and secure a strong market share in the demanding offshore wind fabrication industry.

- Automated High-Capacity Rolling: Enhances efficiency in producing large cylindrical components for wind turbines.

- Advanced Welding Techniques: Ensures structural integrity and speed in fabrication processes.

- Non-Destructive Testing (NDT): Guarantees the quality and reliability of manufactured components, crucial for safety and performance.

- Serial Production Focus: Aligns Lamprell's operations with the high-volume requirements of the growing renewable energy sector.

Lamprell's offshore wind business, particularly its fabrication of transition pieces, is a clear Star within the BCG Matrix. The significant September 2024 contract with RWE for 184 transition pieces for the Norfolk Vanguard project exemplifies this, showcasing Lamprell's capacity in a high-growth market. This aligns with the company's strategic reorganization to prioritize the energy transition, evidenced by a growing renewables bid pipeline.

The successful completion of the Moray West project in Scotland, involving 62 jacket foundations delivered in 2023-2024, further solidifies Lamprell's Star status. This project demonstrates their ability to handle complex, high-volume offshore wind infrastructure, supported by investments in automated manufacturing and advanced welding techniques. These capabilities are crucial for meeting the escalating demands of the expanding renewables sector.

| BCG Category | Lamprell's Offshore Wind Business | Market Growth | Relative Market Share |

|---|---|---|---|

| Star | High growth, high market share | Strong and expanding offshore wind market | Secured significant contracts and project wins |

What is included in the product

The Lamprell BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Clear visualization of Lamprell's business units, simplifying complex strategic decisions.

Cash Cows

Lamprell's extended Offshore Long-Term Agreement (LTA) with Saudi Aramco, renewed in April 2025, solidifies its position as a Cash Cow. This strategic collaboration, ongoing since 2018, guarantees a predictable and substantial revenue stream. The LTA allows Lamprell to secure significant EPCI and maintenance projects with reduced bidding friction, ensuring a consistent pipeline of work within a mature market.

Lamprell's established rig refurbishment services are a clear cash cow. Their long-standing expertise in refurbishing offshore jackup and land rigs positions them with a high market share in this mature segment, consistently generating strong cash flow.

While new rig construction can be cyclical, the ongoing need to maintain and upgrade the existing global fleet ensures a steady demand for refurbishment. This provides Lamprell with a reliable income stream, leveraging their existing infrastructure and deep technical experience. For example, in 2024, the offshore drilling market continued to see significant activity in rig upgrades and life extensions, a trend that directly benefits Lamprell's refurbishment division.

Traditional offshore EPCI projects in the Middle East represent Lamprell's established cash cows. The company is currently executing several significant offshore oil and gas development projects in this region, with project completions scheduled through 2025. These projects, which include the fabrication of production decks, jackets, and subsea cables, leverage Lamprell's core competencies and strong market position.

The Middle East continues to be a hub for sustained investment in oil and gas infrastructure, ensuring a predictable revenue stream from these ongoing EPCI contracts. Lamprell's Hamriyah facility is a key operational base for these activities, highlighting the strategic importance of this business segment. For example, in 2024, Lamprell secured new contracts for offshore wind projects in the North Sea, demonstrating its ability to diversify while maintaining its core EPCI strengths.

Joint Venture in IMI Yard

Lamprell's joint venture in the International Maritime Industries (IMI) yard in Saudi Arabia is a strategic move to secure its role in building new generation jackup rigs. This partnership is crucial for maintaining a strong presence in a vital regional market.

The collaboration guarantees a steady stream of substantial projects, allowing Lamprell to effectively utilize its fabrication skills within a beneficial alliance. This contributes significantly to holding a considerable market share in rig construction across the region.

- Strategic Location: The IMI yard's presence in Saudi Arabia positions Lamprell advantageously for regional projects.

- Project Pipeline: The joint venture ensures access to a consistent flow of jackup rig construction orders.

- Market Share: This partnership helps Lamprell maintain its competitive edge and market share in the rig building sector.

High Local Content and Regional Presence

Lamprell's significant regional presence in the UAE and Saudi Arabia, combined with high local content, acts as a powerful differentiator. This strong foothold allows them to effectively serve the Middle East's oil and gas industry, securing a competitive edge. Their strategically positioned facilities are key to efficient operations within these vital markets.

This deep integration into the regional economy, evidenced by their commitment to local content, aligns with national objectives and strengthens their project pipeline. For instance, Lamprell's focus on localizing supply chains contributes to the economic diversification goals of nations like Saudi Arabia, potentially leading to preferential treatment in contract awards.

- Regional Strength: Lamprell's operations are concentrated in the UAE and Saudi Arabia, key hubs for oil and gas development.

- Local Content Advantage: High local content scores enhance their appeal and compliance with nationalization mandates.

- Strategic Facilities: Their operational bases are optimally located to support regional projects efficiently.

Lamprell's established rig refurbishment services represent a significant cash cow, leveraging their deep expertise in a mature market segment. This business consistently generates strong cash flow due to high demand for life extensions and upgrades of the global offshore fleet. In 2024, the offshore drilling sector saw a notable increase in rig maintenance and refurbishment activities, directly benefiting Lamprell's consistent revenue stream from these services.

What You’re Viewing Is Included

Lamprell BCG Matrix

The Lamprell BCG Matrix preview you are viewing is the exact, fully completed document you will receive upon purchase. This means you're seeing the final analysis, ready for immediate strategic application without any alterations or watermarks. You can confidently assess its value knowing the purchased version will be identical and professionally formatted for your business planning needs.

Dogs

Outdated or niche rig designs, such as older jackup rigs that struggle to meet current depth or environmental requirements, often fall into the Dogs category. These assets may also include specialized land rig services that have seen demand decline due to technological advancements or shifts in exploration focus. For instance, a jackup rig built in the early 2000s with a maximum operating depth of 300 feet might be considered a Dog if the current market primarily demands units capable of operating at 400 feet or more.

These underperforming assets typically exhibit low utilization rates and require disproportionately high maintenance costs, significantly impacting profitability. In 2024, the average utilization rate for older, less capable jackup rigs in certain offshore regions has been reported to be as low as 40%, compared to over 80% for modern rigs. This low demand and high operational expenditure make them a drain on resources.

Highly commoditized ancillary services, such as basic offshore logistics or routine maintenance, often find themselves in the Dogs quadrant of the BCG matrix. These are typically small, non-specialized contracting services that face fierce price competition and consequently offer very low profit margins. For instance, in 2024, the global offshore support vessel market experienced significant overcapacity, driving day rates down for standard services, with some segments seeing profit margins shrink to single digits.

These services, by their very nature, lack a distinct competitive edge. They operate in a crowded market where differentiation is minimal, making it difficult to capture substantial market share in a slow-growing or stagnant segment. Companies relying heavily on these commoditized offerings might find their growth prospects limited. For example, a report from early 2024 indicated that companies solely focused on general offshore crew transfer services struggled to achieve more than 2-3% annual revenue growth.

Consequently, any significant investment in these areas would likely yield poor returns and could even dilute overall company profitability. It's often more prudent for businesses to divest or minimize their exposure to such low-margin, high-competition offerings. In 2023, several smaller offshore service providers were acquired or consolidated as they couldn't sustain operations solely on these commoditized ancillary services.

Underperforming legacy assets, such as older fabrication facilities or equipment, represent a significant challenge for companies like Lamprell. These assets often struggle to adapt to emerging technologies, particularly in the burgeoning renewables sector, and may also exhibit lower efficiency for contemporary oil and gas projects.

The continued maintenance of these legacy assets can lead to substantial operational costs without yielding proportional revenue or market share gains. For instance, if an older facility requires extensive upgrades to meet new environmental standards for offshore wind projects, the investment might outweigh the potential returns compared to newer, purpose-built facilities.

Strategic considerations for these underperforming assets typically involve divestment or repurposing. In 2024, many energy infrastructure companies are actively reviewing their asset portfolios, seeking to shed less productive units to free up capital for more growth-oriented ventures. This aligns with a broader industry trend of optimizing operational footprints for greater efficiency and adaptability.

Segments with Declining Regional Demand

Within the oil and gas sector, Lamprell might face declining regional demand in specific sub-segments where its market share is already low and the downturn appears structural rather than cyclical. For instance, certain types of specialized offshore platform fabrication for mature, non-producing regions could fall into this category. These areas are characterized by fewer new project announcements and intense bidding from a shrinking pool of competitors, leading to compressed margins.

Consider the market for smaller, legacy offshore platform modules in regions like the North Sea, where significant decommissioning activity is underway and new greenfield projects are scarce. Lamprell's involvement in such niche segments, if its market share is not dominant, would see demand consistently shrink. For example, in 2024, the global offshore oil and gas construction market faced headwinds, with some analysts noting a slowdown in traditional fabrication projects in established basins.

- Shrinking Niche Markets: Focus on specialized fabrication for mature offshore fields where demand for new builds is declining structurally.

- Low Market Share Impact: Lamprell's position in these shrinking segments exacerbates the challenge, making it harder to maintain volume.

- Increased Competition: Reduced bidding opportunities lead to heightened competition among fewer players, pressuring profitability.

- Example Scenario: Legacy platform module fabrication for decommissioning-heavy regions like the North Sea, experiencing a long-term demand contraction.

Services Not Aligned with Energy Transition

Services or product lines exclusively tied to legacy fossil fuel extraction methods, without a clear pivot towards supporting the energy transition, risk becoming question marks in the evolving market. As the global shift accelerates, segments unable to adapt or diversify their offerings could face prolonged periods of low growth and diminishing market share.

Lamprell's traditional strength in oil and gas services, while substantial, presents a potential challenge if these specific capabilities cannot be repurposed or leveraged for emerging new energy solutions. For instance, if a significant portion of their revenue in 2024 remains tied to conventional offshore oil platform maintenance without a clear strategy for offshore wind or hydrogen infrastructure, it would fall into this category. The International Energy Agency (IEA) reported in 2024 that investment in clean energy technologies continues to surge, highlighting the growing gap for businesses not aligning with this trend.

- Legacy Oil & Gas Services: Lamprell's historical focus on offshore oil and gas infrastructure construction and maintenance, if not adaptable to renewable energy projects, could become a question mark.

- Limited Diversification: Segments of their business that lack a clear pathway to integrate with or support the energy transition, such as specialized drilling equipment for traditional wells, may struggle.

- Market Erosion Risk: Without strategic diversification, these non-transition-aligned services could see declining demand as global energy markets increasingly favor renewables.

Dogs in Lamprell's context represent business units or assets with low market share in slow-growing or declining industries. These are often older, less efficient assets or services that struggle to compete with newer technologies or market demands. Their continued operation typically drains resources with minimal return on investment.

For example, older jackup rigs built to shallower depths, with limited operational capabilities, often fall into the Dog category. In 2024, the demand for such rigs in many established offshore basins has significantly decreased, leading to low utilization rates, sometimes below 50%, and making their operation unprofitable without substantial investment or divestment.

Highly commoditized ancillary services, such as basic offshore logistics or routine maintenance, also fit the Dog profile. These services face intense price competition, resulting in very thin profit margins. In 2024, the oversupply in certain offshore support vessel segments meant that profit margins for standard services could shrink to single digits.

These underperforming segments typically require significant capital for maintenance or upgrades but offer little prospect for growth or substantial market share gains. Many companies in 2023 and 2024 have been divesting or consolidating these types of operations to focus on more profitable and growth-oriented areas.

Question Marks

Lamprell's emerging digital solutions, encompassing areas like asset integrity platforms and adaptive robotic welding, are positioned within a high-growth market. This segment is experiencing rapid technological advancement and increasing demand across various industries. For instance, the global industrial automation market, which includes many of these digital solutions, was projected to reach USD 306.7 billion by 2024, highlighting the significant potential.

While the market for these specialized digital services is expanding, Lamprell's current market share may be relatively modest compared to established technology giants. This is typical for companies introducing innovative solutions into a dynamic landscape. Successfully capturing a larger share will likely require substantial investment to demonstrate the unique value proposition and achieve scalable deployment of their offerings.

While Lamprell has a history with fixed offshore wind foundations, the floating offshore wind sector is a burgeoning, high-potential market. This segment is poised for significant growth, offering Lamprell a substantial opportunity to establish a strong future presence.

Currently, Lamprell's share of the floating offshore wind components market may be modest. However, the rapid expansion of this industry presents a prime chance for the company to gain significant market penetration and capture future demand.

Strategic investments in floating offshore wind components could position Lamprell to capitalize on this growth, potentially transforming this segment into a future 'Star' within its portfolio. For instance, by 2030, the global floating offshore wind market is projected to reach over 16 GW, with Europe leading the charge, indicating a substantial opportunity for component suppliers.

Ventures into new, high-growth geographical markets where Lamprell currently has a limited presence and low market share would be classified as Question Marks in the BCG Matrix. These expansions, for example, entering the burgeoning offshore wind sector in Southeast Asia, carry high investment requirements and risks but offer significant growth potential if successful. Lamprell's 2024 strategic focus on diversifying its project pipeline beyond traditional oil and gas markets directly aligns with this classification, as it necessitates substantial market entry strategies and resource allocation to establish a foothold.

Advanced Modularization for Onshore Renewables

Developing advanced modularization for onshore renewables, like solar farms or green hydrogen facilities, presents a significant opportunity for Lamprell. This is a nascent market where their current share is minimal, but the growth potential is substantial. Lamprell's existing fabrication capabilities could be strategically adapted to this sector, requiring focused investment to establish a strong foothold and demonstrate scalable solutions.

The global renewable energy market is expanding rapidly. For instance, the International Energy Agency (IEA) reported in 2024 that solar PV capacity additions reached a record 320 GW in 2023, a 30% increase from 2022. This trend highlights the increasing demand for efficient and scalable construction methods. Modularization can streamline project timelines and reduce costs, making it an attractive proposition for developers.

- Market Growth: The onshore renewable energy sector, particularly in areas like green hydrogen, is projected for significant expansion, creating demand for innovative construction approaches.

- Leveraging Expertise: Lamprell can adapt its established fabrication skills to produce standardized, high-quality modules for renewable energy infrastructure.

- Investment Needs: Successfully entering this market will necessitate strategic capital allocation for research, development, and scaling of modularization techniques.

- Competitive Landscape: The market for integrated modular solutions is still maturing, offering a window for Lamprell to establish a competitive advantage.

Specialized Decommissioning Services for Offshore Assets

The decommissioning of offshore assets presents a significant growth opportunity, fueled by increasing environmental mandates and the aging of existing infrastructure. In 2024, the global offshore decommissioning market was valued at an estimated $50 billion and is projected to expand at a compound annual growth rate (CAGR) of 6.5% through 2030, reaching over $72 billion. Lamprell's potential entry into this sector positions it as a Question Mark within the BCG matrix.

Lamprell's current market share in specialized decommissioning services is likely nascent, requiring substantial investment in new capabilities and strategic alliances to compete effectively. The company would need to develop expertise in areas such as platform removal, subsea infrastructure abandonment, and waste management.

- Market Growth: The global offshore decommissioning market is projected to grow from approximately $50 billion in 2024 to over $72 billion by 2030, with a CAGR of 6.5%.

- Regulatory Drivers: Stricter environmental regulations worldwide are a primary catalyst for increased decommissioning activity.

- Capability Development: Lamprell would need to invest in specialized equipment and skilled personnel for tasks like heavy lifting, cutting, and environmentally sound disposal.

- Strategic Partnerships: Collaborating with established decommissioning service providers or technology firms could accelerate Lamprell's market entry and capability acquisition.

Question Marks represent business areas with low market share in high-growth industries. Lamprell's ventures into new geographical markets, such as Southeast Asia's offshore wind sector, and its potential entry into specialized offshore asset decommissioning, exemplify this category. These areas demand significant investment and carry inherent risks, but they also offer substantial future growth potential if Lamprell can successfully establish a strong market presence.

| Business Area | Market Growth Potential | Current Market Share | Investment Requirement | Strategic Focus |

|---|---|---|---|---|

| Southeast Asia Offshore Wind | High | Low | High | Market Entry & Development |

| Offshore Asset Decommissioning | High | Low | High | Capability Building & Partnerships |

| Onshore Renewables Modularization | High | Low | High | Adaptation of Fabrication Skills |

BCG Matrix Data Sources

Our Lamprell BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable, high-impact insights.